This is the thirty-fifth in a series of posts about war tax resistance as it was reported in back issues of The Mennonite. Today we finish off the 1980s.

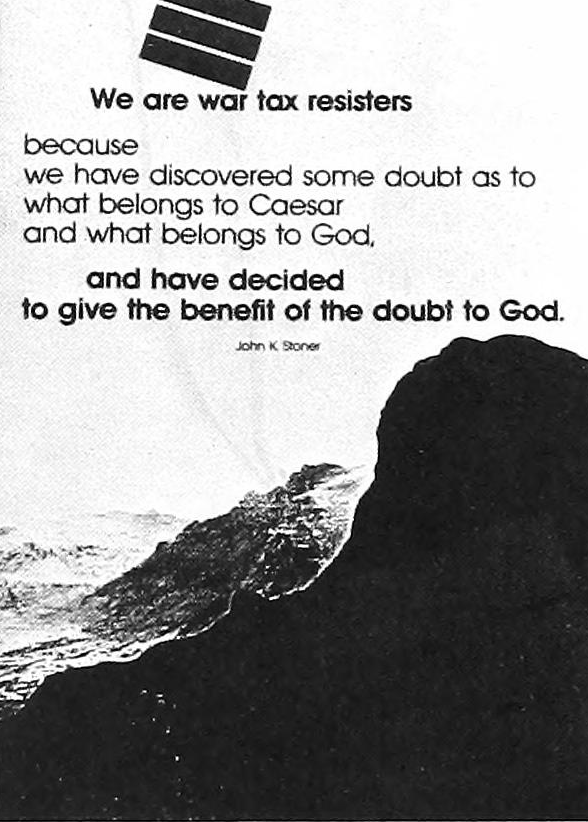

The issue announced that a new poster was available from the MCC:

That issue also included an article on “How to start a peace tax fund” (that is, a collective redirection fund). Excerpts:

Seattle Mennonite Church established a Northwest Peace Fund in to receive donations and recoverable deposits from people withholding a portion of their federal income taxes or phone taxes because of the large military buildup in the United States. Anyone who wishes to may donate to the fund so that the resulting interest can be used for local peace activities.

Interest from the Northwest Peace Fund has been used to support peace-related projects in the Puget Sound area, such as the Emergency Feeding Program and the Victim Offender Reconciliation Program (VORP).

While the Seattle Mennonite Church’s Northwest Peace Fund will accept deposits and contributions from outside the Northwest, we strongly encourage each Mennonite congregation to establish its own peace fund.

We approved these seven operating guidelines:

- This fund will be called the Northwest Peace Fund. It will be a non-profit investment fund that will generate income. This income will be distributed for peace and social concerns projects in the Pacific Northwest.

- The peace fund will be administered by three peace fund representatives selected by the peace and social concerns committee of the Seattle Mennonite Church initially for one-, two-, and three-year terms, and for two- year terms thereafter. Current peace fund representatives are Charles Lord, Bob Hamilton and David Ortman.

- Money may be deposited into the fund through a peace fund representative either on a donation or recoverable-deposit basis: (a) Donations will be retained to generate income for the fund, (b) Recoverable deposits may be placed in the peace fund for a period of up to five years. During this time period such funds may be returned to the depositor within 30 days upon written request of the fund’s address, given below. Recoverable deposits will be used to generate income during the time these funds remain available. After a period of five years, if not reclaimed, such deposits will revert to the status of donations.

- The fund will operate on a fiscal year ending on May 31. One meeting of the peace fund representatives will be held each April to prepare an annual report, copies of which will be available upon request. At this meeting the peace fund representatives are also authorized to distribute up to all income generated from the fund to peace and social concern projects in the Pacific Northwest. Any disbursement must have prior approval of the Seattle Mennonite Church advisory council.

- The peace fund is authorized to budget up to 10 percent of any income generated by the fund to cover costs of advertising the fund to attract additional deposits and to provide copies of the annual report. Any peace fund representative is authorized to withdraw within 30 days any recoverable deposit to a depositor upon a written request by the depositor.

- In the event of the dissolution of the peace fund, all funds will be transferred to another peace fund escrow account and the depositors notified.

- The mailing address of the fund will be…

Peace Tax Fund campaign director Marian Franz also wrote in with a brief note in which she suggested war tax resisters prompt their Congressional representatives to become Peace Tax Fund law supporters:

Sometimes the sequence goes like this (and I wish it would more often): Carl Lundberg, a United Methodist pastor from New Haven, Conn., refuses to pay the military portion of his taxes. The Internal Revenue Service comes to garnishee the wages. The congregation has a meeting. The vote is unanimous. The answer is, No, they will not cooperate with the IRS because they will not be tax collectors, because they will not violate the pastor’s right to his own views of conscience and living by those, etc. Then in the same year the U.S. Senator from Connecticut, Lowell Weicker, becomes a co-sponsor of the Peace Tax Fund Bill. Is there a connection? I think there is and that more will be coming. That is because I am a person of hope.

Another invitation for war tax resisters to redirect their taxes through the MCC U.S. Peace Section’s “Taxes for Peace” fund appeared in the edition. This time the funds were to be disbursed to both the National Campaign for a Peace Tax Fund and to the Christian Peacemaker Teams program. The note said about $4,000 had been donated to the fund .

This brief note appeared in the edition:

The Commission on Home Ministries is interested in hearing from Mennonites who have placed some of their resisted military taxes into alternative peace funds. Information on recent judicial decisions affecting such peace funds is available from the General Conference Peace and Justice office…

The Randy Kehler / Betsy Corner siege, which was a cause célèbre in war tax resistance, hit the pages of The Mennonite in its edition:

Randy Kehler and Betsy Corner’s Colrain, Mass., home is scheduled to go on the auction block any day. The Internal Revenue Service seized their house for non-payment of $20,000 in taxes and $6,000 in fines and fees. The couple has been withholding their federal taxes for 12 years, donating the money to a shelter for homeless women and children, a veteran’s outreach center, and a local peace group. Kehler says they are willing to risk the consequences “because we can’t not do it.” While the IRS is looking for a buyer, many local realtors will not touch the sale of the house because of strong community sentiment in favor of the couple’s decision.

The issue carried this news:

After 7½ years of litigation, 27 hearings, and with a case file that grew two inches thick, the Tokyo District Court has ruled against a taxpayers’ organization that sought to end the Japanese government’s collection of income taxes for military purposes. The case had its origin after the bank accounts of Akiteru Nakagawa and Mennonite minister Michio Ohno were attached by the government and the telephone of Yoshinori Tan was seized, in each instance due to their non-payment of taxes.

The Mennonite Church and the General Conference Mennonite Church voted to combine into a single organization at their joint conference in . This, I hope, will simplify things for me at least, as it’s been difficult to keep track of the subtle differences in names between the two organizations and their subcommittees. Also at that conference:

The Mennonite Church narrowly (59 percent) approved a resolution calling for its General Board to take four steps on military tax-withholding. It will establish a policy of not withholding (U.S.) federal income taxes from wages of any of its employees who make this request because of conscientious objection to war. The resolution supports “other church boards and agencies that may adopt similar policies,” giving direction, not a mandate. The General Conference took a similar action in in Bethlehem, Pa., but with a stronger vote, 71 percent.

The edition included an editorial by Muriel T. Stackely that brought readers up to speed on the history of the withholding debate. Excerpt:

Our conference [the General Conference Mennonite Church] now does not withhold federal tax from those employees requesting this.

“We immediately notified the Internal Revenue Service,” says conference treasurer Ted Stuckey, “explaining our actions, being open, concealing nothing. That was . We still have not heard any more from the IRS — after getting its initial response, which told us that this was illegal. We answered that we knew it was illegal but that it was in response to the action taken by the delegate body.”

Currently three employees of our conference offices in Newton, Kan., are requesting that tax not be withheld. They are treated as self-employed people. They say, observes Ted, that they have appreciated the opportunity to witness in this way. The amounts not paid to IRS have been symbolic rather than comprehensive.

A letter from Charles Hurst and Maria Smith in the issue explained their tax resistance:

One expression of our commitment to non-violence has been war tax resistance. Thus we and our friends found that our commitment to practice war tax resistance encouraged our commitment to a simple lifestyle.

We have defined war tax resistance as filing our taxes, but refusing to pay 50 percent of what is owed because that is the portion of U.S. income tax that goes toward military spending. Fifty percent is a conservative estimate because parts of the U.S. military budget are hidden or secret.

We have learned that if we own a car, even one that is six years old, the IRS will sell it at a public auction to collect back taxes. It became obvious that consumerism and war tax resistance are incompatible. As a result several of our friends have made a conscious decision to do job-sharing or half-time employment. It has worked out that between couples both parents can act equally as care-takers for the children while also having employment, which is psychologically rewarding and complementary to their vision of participating in God’s reign on earth.

Our choice of war tax resistance as a way of reducing our participation in the U.S. war machine has made a simple lifestyle almost mandatory because it has led us to lower our tax liability and lower our material consumption.

Another editorial by Muriel T. Stackely, this one in the edition, complained that “the 7,000 brochures about the Peace Tax Fund distributed at our triennial session in Normal, Ill., among 8,000 Mennonites netted one, one new membership for this campaign that says to the U.S. government, I want my tax dollars to be used to promote life, not death; peace, not war.”

Finally, the edition included this news:

War Resisters League is initiating organizing for major Tax Day demonstrations in Washington and San Francisco on . Based on the theme “Alternative Revenue Service,” the actions will emphasize the U.S. government’s militaristic spending priorities and will feature a 1040 EZ Peace tax form and the distribution of redirected tax dollars to peace and social justice programs. WRL is inviting other tax resistance and peace groups to join in planning the actions. For more information contact Ruth Benn, War Resisters League…