the American Revolution was portrayed as the culmination of a tax revolt in this educational cartoon short that aired frequently between Saturday morning cartoons in the United States in

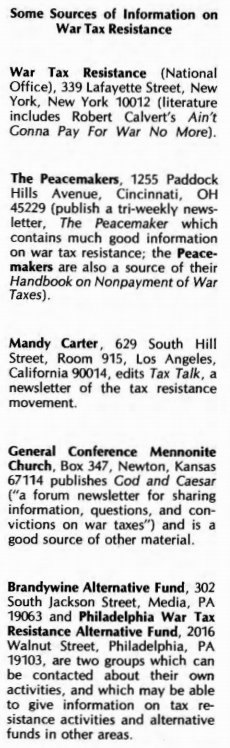

War tax resistance in the Friends Journal in

I was a little too young to be much of an observer of the political scene, but I remember as being something of an orgy of innocent patriotism. America was sick of being cynical and wanted to go back to being stupid — besides, the Vietnam War was mostly over, at least for most Americans, and we’d given Nixon the heave-ho — and so there were plenty of red-white-and-blue commemorations of the bicentennial of the signing of the Declaration of Independence.

The Friends Journal wasn’t quite so willing to get with the star-spangled program. In particular, it intensified its coverage of war tax resistance during the bicentennial year.

The issue was the Friends Journal’s first special issue devoted to war tax resistance.

It starts off with a couple of inspiring quotes on the subject from A.J. Muste and David Dellinger, then opens with a piece by Jennifer S. Tiffany on how she met the challenge of deciding whether to pay or to resist. Excerpts:

This fall was a time when I was grappling a great deal with the question of war tax resistance. To start with, I knew and had known for a long time that I could not be clear in paying taxes to any state which would use them to pay for war-making. Particularly, I could not contribute to the nuclear death race between this nation and the Soviet Union. Perhaps it goes back to the civil defense tests and simulated nuclear air-raids which had terrified and confused me when I was a child. Anyway, the imperative, the need to keep clear of war (to use Bruce Baechler’s words), had always been strong. I had been acting on it, in small ways, for a long while-avoiding earnings beyond the taxable minimum, for example, and claiming six “peace dependents” on my W-4 form when my income did exceed this minimum. I also corresponded with the IRS concerning my views and actions. However, a disclarity still existed regarding full resistance, with all the possible ramifications on my life and lifestyle. The question was, to me, was I strong enough and centered enough to maintain a taxable income level, restructure my life in such a way as to prevent eventual government levies, and go on with my resistance? Could I face creatively the possibility of putting a good deal of energy into court cases with the eventuality of prison? I came into meeting for worship one morning at the height of these grapplings.

As I settled in, I was astounded. Somehow the fears and conflicting leadings within me changed. They did not fade or diminish, but grew into context. The spirit of the meeting, the presence of loving Friends, who loved whether or not they agreed with one another’s approach, literally overwhelmed me. The presence of God wholly covered the gathering, and finally clearness came.

Our God, the Presence in our worship and acts of witness, is a gentle, healing, loving, empowering God, one who speaks strongly and softly from within us. At the same moment as making demands on our lives, this Presence says, “You need not fear; if you act on this I will sustain and strengthen you throughout the whole process. I am…” This was a moment of resolution for me. I was no longer entangled in a negative refusal to pay taxes, but was healed and sustained and led to a positive witness. I could go on.

It is in this context that tax resistance has its roots and life. War tax resistance, any resistance to war and to those authorities which bring about war, is not a negative presence: every no implies a yes, and this no to killing and death can be a yes to healing and life. Within tax resistance dwell seeds which can help a whole new order to grow — seeds which deny fear and powerlessness in the face of death; seeds which lead us to the creation of healing alternatives to structures which sustain death. As John Woolman puts it, “to turn all we possess into the channel of universal love becomes the whole business of our lives.”

I can speak only of my moment of resolution, the clearness and joy which is liberated in my life through a tax witness. As I see it, this issue of Friends Journal is not a coercive tool, saying “you must for these reasons refuse to pay your taxes or I will no longer judge you to be a good Friend.” The point of this issue is not to define terms for judgment, to draw lines of inclusion and exclusion. Our faith is an experiential one, and your experience of real clarity is as right and valid for you as mine is for me. The point is to lay ourselves open to what speaks truthfully in us, to really open ourselves to the spirit which utterly denies war, to really grapple with the questions this raises and the demands it makes on our lives. One of those questions has to do with tax resistance. This is an invitation to grapple with it, and a reaching out which says there is a great company of people, past and present, who have done so.

There is a process of empowerment, growth and the birth of community among people which can take root through tax resistance. First comes the knowledge that the authorities of death are not all-powerful, that the laws and structures which sustain any war machine are in fact quite weak. As Marion Bromley says in her article, “What can they take away that is of real value?” Second dawns the realization that alternatives are possible: through the flaws in the death order, we glimpse the order of life. And, although such consequences as possible imprisonment or loss of property, and the inward struggle with fear, are largely borne alone, the vision is shared by a growing company of sisters and brothers. Isolation is hard to feel when so many glimpse the possibility of a new order — an order beyond war. Finally and especially, tax resistance often grows as an act of ministry, an act of obedience to the loving and healing spirit. War tax resistance is one aspect of a community set on fire with the presence of a gentle, empowering God.

Bruce Baechler thought the question of whether Quakers should resist war taxes was a no-brainer. He wrote in from prison (where he was doing time for draft resistance) with this defense of war tax resistance. Excerpts:

Do Friends support war? At one time this could be answered with a “not at all.” These days, though, it seems to depend on how one defines support. Friends, generally, denounce war in the strongest terms. Indeed that’s all many people know about us. But for the most part Friends can no longer claim to renounce, or “utterly deny” war.

Friends today are not compelled to bear arms… instead of fighting with outward weapons ourselves, we are merely asked to buy the weapons through taxation, and leave the dirty work to others. And most of us do.

Yet we cling to our traditional peace testimony, often expressed as early Friends did in the Declaration of :

We utterly deny all outward wars and strife, and fightings with outward weapons, for any end, or under any pretense whatsoever; this is our testimony to the whole world.

This is strong language. One cannot, without being hypocritical, utterly deny something and still give it material support. But most Friends do.

There are many reasons given for paying taxes. Most of these are quite valid, if one thinks of tax resistance as a protest. But I see a difference between various types of protests, such as vigils and letters to Congress, and nonsupport, or remaining clear of war, as by tax resistance.

In protesting, one makes her/his views known, but leaves it up to someone else (the government) to make the decision. Governments are not noted for their receptivity to the pacifist message, and it is unlikely they will be in the near future. I am not deriding protest — much has been accomplished through it. I am just saying that it is not enough.

Nonsupport, on the other hand, emphasizes individual responsibility. To refuse to pay one’s taxes is to accept responsibility for the way they would be spent, and to refuse to allow them to be spent for immoral purposes.

Tax resistance should not mean just withholding taxes from the government. An integral part of tax resistance is to redirect the money normally spent for taxes into life supporting channels. In many places this is done through Alternative Funds, where the resisters in a community band together to make most effective use of the money. Thus not only is money diverted from warmaking, but at the same time it is made available as a resource for peaceful activities.

Perhaps the biggest problem most Friends have with not paying for war is that it is illegal. One faces the prospect of prison for it, and this alone is enough to make most people give it only superficial consideration. Hopefully the World Peace Tax Fund, if established by Congress, will alleviate some of this problem in much the same way that the Conscientious Objector provisions in the draft laws gave a legal alternative to the army. But in the meantime the problem remains.

Friends have often suffered for their beliefs. Throughout our history large numbers of Friends have been imprisoned, tortured, and killed for preaching and practicing the message of the Inward Light. Would you stay away from a Meeting for Worship if to go meant certain arrest? Would you attend but not speak when moved, if that would be dangerous (a situation facing Korean Friends today)? Would you join the army to avoid prison? Kill to avoid being killed? The question is where to draw the line. When, to you, does the personal suffering involved in a course of action outweigh the reasons for taking that course? Each person must decide for her/himself.

Another response to the problem of imprisonment is that if any substantial number of Friends did engage in tax resistance, the likelihood of their being imprisoned would be small, and some provision in the law would probably be made for them, thus eliminating the problem and encouraging more people to resist.

Jack Cady shared his long, meandering letter to the Director of the IRS. Excerpts:

[O]ur first confrontation… will be the examination of my tax return. I expect the examination is prompted by my refusal last year to pay half of my income tax. I will refuse. to pay half of the tax again this year, although because of withholding, your agency already has most of the money. I refuse to pay half of the tax on various grounds, some of which are moral, some of which are legal. The refusal is prompted by the expenditure by our government of over fifty percent of tax monies on the maintenance and purchase and use of armies and weapons. Through its agency, Internal Revenue Service, the United States Government seeks my complicity in the violation of twenty centuries of moral teaching. The government is in further violation of the Constitution of the United States. It is also in violation of various international treaties and agreements, and is, in fact, engaged in crimes against peace and crimes against humanity.

In requiring that I pay taxes for the support of war, planning for war, offensive weapons and the maintenance of a standing armed force sufficient to engage combat on a worldwide scale, the U.S. Government through its agent IRS is in violation of the First Amendment to the Constitution, which guarantees my religious freedom. I am a member of the Port Townsend meeting for worship of the Society of Friends (Quaker). The Quaker belief and effective detachment from war dates from the beginnings of the Society in . The precedent of refusal to pay war taxes in America dates from when John Woolman, John Churchman, and Anthony Benezet refused to pay for the French and Indian wars. Nonviolence and refusal to pay or endorse either side in a combat dates in U.S. history from the revolution when Quakers who refused to kill were stoned or beaten under the brand of Tory. I claim my devout belief in God and the injunction that we may not kill as sufficient reason to refuse this tax. I would expect that opposition to this view would also have to overcome three hundred years of Quaker nonviolence and two hundred years of U.S. acceptance of Quaker attitudes that insist on nonviolence.

[I]n asking taxes, the U.S.A. through its agent IRS seeks my complicity in crimes against peace and crimes against humanity as defined by the Nuremberg Principles. These principles hold that citizens of a nation are guilty of crimes committed by that nation if they acquiesce to those crimes when, in fact. a moral choice is open to them.

In requiring that I pay taxes to support a war industry and armed forces capable of contending on a worldwide scale, the U.S. Government is threatening both my moral and my physical existence. I am not being protected, because the U.S. builds atomic weapons, B-1 bombers, atomic submarines, poison gas, lasers, rocketry, napalm and all of the other expensive paraphernalia of war. These do not protect me. They invoke the suspicion and fear of other nations, and they provoke among other nations the building and stockpiling of similar weapons.

[T]he U.S. now gives every indication that it is, in fact, not a nation of laws but a nation of men and corporations. This, despite the resignation from office of Richard Nixon and Spiro Agnew. I charge that the freedom of the citizen is largely illusory, and that the payment of taxes, the keeping of tax records, the invasion of privacy by IRS and other agencies of government, the making of rules by agencies (rules that have the force and effect of law but which are not to be challenged in courts), the maintenance of records or files on the political, religious, economic and moral statements and actions of the individual, the power to levy fines and licenses by agency rule, and the presumption by government that citizens are guilty of any agency charge and must therefore bear the burden of proof of their innocence; all of these show the citizens of the U.S. are no longer free.

I have two main intentions in this tax refusal. The first is quite clear. I do not intend to pay for the destruction of other human beings, nor endorse by word or deed the crimes of the United States. The second intent is a little more nebulous but it is just as strong. It is strong because I love my country.

In this refusal I intend that the United States will display by its action whether or not a citizen, raised to believe in U.S. principles of freedom, equality, protection under the laws; raised, in fact, under statements like, “With a proper regard for the opinions of mankind,” can indeed trust and believe in the way he has been raised. Either the Constitution is sound or it is not. The U.S. will either honor its national and international commitments or it will not. The courts will either face issues or the courts will duck them.

…If the rules of IRS are bigger than the Constitution, the UN Charter, the Nuremberg Principles and the Christian teaching of two thousand years, then I believe it is time that the U.S. acknowledge this…

The next article came from Marion Bromley. Excerpts:

Ernest and I began a tax refusers’ newsletter soon after our marriage in . In all the time since, only a tiny proportion of Friends and other pacifists have become tax refusers, and we sometimes try to understand why. It has been, for us, more a personal imperative than a carefully reasoned political position, though we have done what we could to expound on all aspects of refusing to allow one’s labor to be taxed for war and weaponry.

Most people, whether they are pacifists or not, seem to respect our “right” to refuse taxes when we have a chance to explain how we feel about it. In turn we have to accept the “right” of others to continue to pay large sums in taxes, even though the U.S. budget continues to be overwhelmingly devoted to war and the war system.

Before 1800 taxes were levied largely for specific things such as bridges, schools, highways. A levy for war was as separate as the others. Quakers, Mennonites and a few others who had strong scruples against paying for the militia or for gunpowder refused to pay and sometimes suffered distraint of goods or imprisonment for their stand. When all these items began to be lumped together into one, general tax, it was no longer so simple an issue. Some, with a considerable feeling of relief, began to pay; others paid more out of frustration. And one of the most potent testimonies against war during became lost.

Now, in , probably no reasonable person believes that the billions to be spent for weapons research, deployment of armies and nuclear weapons, nuclear submarines prowling the ocean floor, planes carrying nuclear bombs, and intercontinental ballistic missiles will be in any sense a “defense” for anyone. Since such policies and practices will probably lead to a nuclear holocaust at some future time, maybe distant, maybe near, paying for these weapons comes close to being an evil act. It may be that the reason most Friends do not see it in that light is that they are conscientiously committed to liberalism — to the direction the federal government began in and from which there is now no retreat. The federal government, in order to ease suffering and to maintain control over its own populace, began to assume some social responsibility. Possibly most Friends are in the same position as those who began paying the “mixed” taxes in . But in the whole world has witnessed the kind of horror that a powerful military state can unleash even without resort to the ultimate weapon.

…In an individual such behavior would be deemed madness. Would a mad individual be permitted to continue such activities because that individual was also performing some useful services?

Another aspect of liberalism that has probably influenced Friends greatly in the past fifty years is the commitment to law. I cannot explain why most Friends think it is almost a religious principle to honor the law and the courts, while I feel it is very low on my list of loyalties. My religious instincts are insulted when I observe a judge in the robes of a priest, high above others in the courtroom, the witnesses and observers in pews and the bailiff enforcing a hushed silence. My view is that this holy-appearing scene is for the purpose of defending the property and the power of the people who have those commodities. It is the same in a socialist or a capitalist state.

It is certainly an acceptable arrangement for people to agree on certain codes or laws, agreements about property. I would not disobey laws for frivolous reasons. But I have no qualms about disobeying laws which would force me to pay for murder and other crimes related to the war system.

Civil disobedience which requires long-term adherence, such as arranging to make one’s living without the withholding system, perhaps is considered impossibly difficult by many conscientious people. For many Friends, commitment to a service type vocation seems to require “fitting in” with a professional life style. The scale has not been invented which could balance service that is beneficial to others with the negative effects of supporting warmaking and possibly silencing one’s conscientious stirrings. The only contribution I can make to such considerations is my testimony that refusing to pay income taxes has proved to be a blessing in many ways. For one thing, it resulted in our “backing into” a simple life style, consuming less than we otherwise would. Friends who have valued simplicity know of its blessings — the simple life is more healthful, more joyful, more blessed in every way.

A new friend we met following seizure of Gano Peacemakers’ property, our home for 25 years, wrote us after moving from Cincinnati that he supposed we were having a very sad summer at Gano this year, knowing that we would be evicted in the fall. This notion was quite contrary to the way we felt. We were enjoying the time here more than ever before. The growing season seemed more productive than ever, and the surroundings more beautiful. We were working very hard, preparing leaflets, signs and press releases, corresponding, thinking of new ways to tell everyone who would listen that the IRS claims were fraudulent and politically motivated. We expected to be evicted but never had the feeling that we would “lose” in the struggle.

(The following paragraph, concerning the eventual IRS surrender in the Gano Peacemakers case, is largely obscured in the PDF.)

One of the pleasant feelings we have about the reversal of the sale (besides knowing that we can continue to live on these two acres) is that many people have told us they got a real lift when they heard that some “little people” had prevailed in the struggle with the IRS. We had the feeling that our daily leafleting and constant public statements during the seven months’ campaign had, at the least, the effect of showing that people need not fear this government agency. People do fear the IRS and that is an unworthy attitude. What can they take away that is of real value?

Jack Powelson struck a dissenting note, listing war tax resistance among a number of popular Quaker positions that he felt to be sentimentally motivated and economically naive. Excerpt:

Friends are concerned about paying taxes to a government that allocates a high proportion of its budget to the military. But we also know that if enough Friends refused to pay taxes so that the government was seriously impeded in its operations, the first items to be cut would be welfare and education, and the poor would suffer.

The Journal then quoted John A. Reiber on his vision for “a cultural revolution with political implications, not a political revolution with cultural implications.” Excerpt:

The most effective social changes are not going to come from within the system, but without it. We must realize that the vast, impersonal and powerful institutions are not intrinsic to our survival and well-being, but, in fact, extrinsic and harmful.

What we must do to achieve a cultural (r)evolution is to, first of all, withdraw our support of our unendurable, tyrannical and inefficient institution of the government. One way of doing this is through tax resistance. But tax resistance, by itself, is only a part of the solution. Money, time and energy should be channelled into alternatives to our technological mass consumption/ mass waste society, our irrelevant and oppressive educational institutions and our mass media which don’t meet our informational needs.

Craig Simpson next gave a report on war tax resistance as it was practiced internationally. Excerpts:

During the Peace Research and Peace Activists Conference in Holland in , I met Susumu Ishitani, a member of the Japanese Conscientious Objectors to War Taxes Movement (COMIT). The group is the first of its kind in Japanese history and was started in . It is made up of Christian pacifists — Mennonites, FOR members and Quakers — as well as non-church pacifists. The group apparently has been growing rather quickly. They have meetings all over Japan, print articles in newspapers, and hold press conferences. Their emphasis is on the refusal of the 6.5% of their taxes which goes for the so-called “Self-Defense Forces.” They have even written a “Song of 6.5% or 6.5% for a Peaceful World” protesting war taxes and expressing the need for money to stop death and the pollution of our environment. Susumu is a wonderful and gentle member of the group. Outside of his job as a university professor he is active as a member of the local Friends Meeting in Minato-ku (Tokyo). He also trains students in nonviolence and works to raise consciousness about the Japanese government’s involvement with the repressive South Korean government. He clearly sees the importance of not sending his money to the government for destructive purposes.

COMIT was still in operation at least as late as , but I haven’t been able to find much about them on-line.

France… has a long tradition of resistance to war and the military. The tax refusal movement began in its present state in during the first French atomic tests in the South Pacific when a number of people decided to refuse the 20% of their taxes which would go to the war department. This money was redistributed to organizations working for peace and developing social alternatives. Groups soon were organizing in Orleans, Paris, Mulhouse, Lyon, and Tours and by were working in cooperation with one another. They then made a decision to broaden the movement by asking people to refuse only 3% of their income tax. They felt this way they would be able to attract more people because of the minimum of risk. Many of these people decided to redistribute their money to the peasant-worker struggle in Larzac.

Larzac is a plain in Southern France where a group of peasants, farmers and shepherds have been resisting the expansion of an army training base onto land where they have lived and worked for centuries. The Larzac struggle has become extremely important in France. It receives broad support from leftists, environmentalists, workers and antimilitarists. The peasants, who have come to believe strongly in nonviolent struggle, have used some very creative tactics to draw attention to their plight. For example, they drove their tractors from Southern France onto the streets of Paris. On the way, they were met in Orleans by 113 tax refusers who gave their tax money to the peasant struggle instead of to the military. This link between the peasant struggle against the military and the people who refused taxes solidified the movement and both benefited.…

By , 400 French people had become tax refusers and at latest count as many as 4,000 are giving their money to Larzac instead of the government. Many farmers, workers and pacifists are involved now in the refusal of taxes to support the Larzac struggle. Most recently in France, pacifists are discussing and organizing for 100% refusal of their taxes as their non-cooperation with the military becomes more consistent with their lifestyles.

There were also several letters to the editor on the subject:

- Mary Bye wrote in to explain the rationale behind her tax resistance. “I believe that my tax dollars go to support a system which perpetuates misery and suffering in large parts of the world. Here at home we have set up a monstrous military budget while the programs for the poor, the minorities, the disadvantaged and the defenseless are being cut. I believe that the first step to moral health is to realize the callous role of oppressor we, as a nation, play abroad and at home. The second step is to act.” She said tax resistance works for her because “I know of no other way to introduce this concern into the courts, and… I want to commit my money to help meet human needs neglected by the government. I give voluntarily an amount equal to that computed by IRS regulations to help build a community of caring.”

- Ross Roby wrote in to promote the World Peace Tax Fund Act. “Essentially, this bill would provide conscientious objectors to war (male and female, young and old) an alternative to having their Federal tax payments used to finance government agencies that wage war and those that contribute to the waging of war by our government and by other governments of this world.” He complained that the proposal hadn’t gotten much Quaker support: “Are we unable to recognize a friendly hand when it does not come in Quaker garb? Or, has vocal pacifism fallen so irrevocably into the hands of radical resistants that a congressional bill which proposes accommodating conscientious objection to the realities of the Internal Revenue Service (and vice versa) is automatically dismissed?” He described the mechanism of the Act this way: “It sets up a Fund for Peace to which we, conscientious objectors to war, would automatically contribute as we paid our usual federal income tax. If the federal budget were determined, by an impartial authority, to contain sixty per cent for military purposes, then sixty cents of each dollar we pay would enhance the treasury of a fund that builds peace…”

- Jim Forest wrote about his decision to stop tax withholding from his paycheck by filing a new W-4 form. “We will be using these moneys for human needs that aren’t being adequately met in the present world: hunger, housing, resistance to militarism, various efforts for impoverished people, etc. We receive fund appeals each day which, had we the means, we would respond to, or respond to more generously. Now we will.”

- Donald Hultgren gave a report of Robin Harper’s talk about war tax resistance and charitable redirection at the Quaker Meeting in Cornwall, New York.

- Harold R. Regier, the Peace and Social Concerns secretary of the General Conference Mennonite church, wrote to thank the Journal for its “encouragement in our efforts to work at war tax payment/resistance issues.”

Harold R. Regier, the last letter writer I mentioned, said that: “One of our efforts along this line was to convene a war tax conference to look particularly at the theological and heritage bases for war tax resistance.” The Journal article that followed concerned this conference. A note at the top of that article said that “[o]ne hundred twenty persons registered” for a Mennonite/Brethren in Christ sponsored conference to seek theological and practical discernment on war tax issues.” That conference issued a summary statement, which the Journal reprinted. Excerpts:

After considering the New Testament texts which speak about the Christian’s payment of taxes, most of us are agreed that we do not have a clear word on the subject of paying taxes used for war. The New Testament statements on paying taxes (Mark 12:17, Romans 13:6–7) contain either ambiguity in meaning or qualifications on the texts that call the discerning community to decide in light of the life and teachings of Jesus.

Although those in the Anabaptist tradition were generally consistent in their historical stand against individual participation in war, they were not of one mind regarding the payment of taxes for war. Evidence suggests that most Anabaptists did pay all of their taxes willingly; however, there is the early case of the Hutterite Anabaptists, a sizable minority in the Anabaptist movement, who refused to pay war taxes.

In the later stages of Anabaptist history there is no clear-cut precedent on the question of war taxes. During the American Revolution most Mennonites did object to paying war taxes, yet in a joint statement with the Brethren they agreed to pay taxes in general to the colonial powers “that we may not offend them.”

The record continued to be mixed until the present day. Only a small minority chose to demonstrate their allegiance to Christ through a tax witness.

So far most discernment on the war tax issue has been done on an individual level as opposed to a church or congregational level. Although individuals struggling with the issue have been supported by similarly concerned brothers and sisters, wider church support has been lacking. While recognizing the need for a growing consensus in these matters, we know that not all in the Mennonite/Brethren in Christ fellowship are agreed on an understanding of scriptural teaching and a faithful response regarding war taxes. We are ready to acknowledge this disagreement and seek to continue discerning God’s will in this. But as a church community, we feel we should be conscious of the convictions and struggles of our sisters and brothers and supportive of the steps they have taken and are considering.

And all that’s just from one issue!

The issue included an article by Robin Harper about the Brandywine Alternative Fund, one of “a series of experiments [that] go by various names: fund for humanity, people’s life fund, life priorities fund, war tax resistance alternative fund.” Excerpts:

As many as forty sprang into existence in as the country’s agony over Vietnam reached a crescendo.

Though each is organized and operated a bit differently, the basic concept is to pool federal war taxes (both telephone and income) conscientiously withheld from the IRS and redistribute them, by loans or grants, to community groups working for peace, social justice, and other areas of social change.

…the Brandywine Alternative Fund serves Delaware and Chester Counties just west of Philadelphia. Although the greater part of the Brandywine fund comes from “reallocated” federal taxes, we also encourage deposits of personal savings. This policy has not only enlarged the fund but has also broadened participation to include persons eager to help “reorder our nation’s priorities away from the military” who don’t choose to use the particular method of principled tax resistance. In addition, seven monthly meetings, churches and civic groups have made deposits or contributions to the alternative fund, following the precedent of London Grove Friends Meeting. This development of religious and other community groups investing in Brandywine is, I believe, a rather new departure for the alternative fund movement and offers an opportunity for sensitizing even larger numbers of people to issues of war preparations, civilian priorities and tax accountability.

Through the growth of our alternative fund, we have begun to take our central concern to the people of the communities in which we live; we are seeking creative ways to support financially some of those groups which are addressing a range of social and economic problems largely neglected by government; and we have undertaken the task of stripping the mask off one of our most powerful institutions — the IRS — as we portray its grim role in the betrayal of our society’s and world’s ultimate security.

The issue had some Revolutionary War-era history lessons. Nonviolence theorist Gene Sharp wrote an article on “The Power of Nonviolent Action” in which he pointed out (among other things) the usefulness of tax resistance in the struggle for American independence:

During the Townshend resistance, in … for example, a London newspaper reported that because of the refusal of taxes and the refusal to import British goods, only 3,500 pounds sterling of revenue had been produced in the colonies. The American non-importation and non-consumption campaign was estimated by the same newspaper at that point to have cost British business not a mere 3,500 pounds but 7,250,000 pounds in lost income. Those figures may not have been accurate, but they are significant of the perceptions of the time. The attempt to collect the tax against that kind of opposition was not worth the effort, and the futility of trying eventually became apparent.

Finally, Lyle Tatum examined the Philadelphia Yearly Meeting’s activity around . Excerpts:

Although the Yearly Meeting was clear that members should not participate in military activities or pay direct war taxes, some areas were more difficult to decide. Bills of credit, a form of negotiable instrument sanctioned by the colonies, were controversial. The use of them stood in a similar position to the payment of taxes today. To those Friends who were trying to get other Friends to stop using bills of credit, the Yearly Meeting minuted a bit of advice:

…we affectionately exhort those who have this religious Scruple, that they do not admit, nor indulge and Censure in their Minds against their Brethren who have not the same, carefully manifesting by the whole tenor of their Conduct, that nothing is done through Strife, or Contention, but by their Meekness, Humility and patient Suffering, that they are the Followers of the Prince of Peace.

Philadelphia Yearly Meeting of met in , just a little more than two months after . As we have seen, pressure on the peaceable testimony had been growing over the previous few years. In the face of this, the Yearly Meeting minuted:

…we cannot consistent with our Christian peaceable Testimony… be concerned in the promoting of War or Warlike Measures of any kind, we are united in Judgment that such who make religious Profession with us, & do either openly, or by Connivance, pay any Fine, Penalty, or Tax, in lieu of their personal Services for carrying on the War under the prevailing Commotions, or do consent to, and allow their Children, Apprentices, or Servants to act therein do thereby violate our Christian Testimony, and by so doing manifest that they are not in Religious Fellowship with us…

In spite of their many hardships, Friends were holding firm. Loyalty oaths were going strong in . It was minuted:

…in some places Fines or Taxes are and have been imposed on those who from Conscientious Scruples, refuse or decline making such declaration of Allegiance and Abjuration, it is the united Sense and Judgment of this Meeting, that no Friend should pay any such Fine or Tax…