This is the twenty-fifth in a series of posts about war tax resistance as it was reported in back issues of Gospel Herald, journal of the (Old) Mennonite Church.

The debate about war tax resistance continued at a simmer through , and by the end of the year it was clear that the Mennonite Church would have to have the same debate about withholding taxes from its employees’ salaries that had occupied the General Conference Mennonite Church .

Joel Kauffmann’s “Pontius” comic strip was a regular feature in Gospel Herald. This example comes from the issue.

The issue included this interesting note:

The Center for Discipleship and the Peace Studies Program at Goshen College will cosponsor a seminar on “Conscientious Objection to Military Taxes” on Goshen’s campus, . The program will feature an Internal Revenue Service representative addressing the legalities of withholding military taxes; discussion of improved communication between tax withholders, the government, and the church; and a look at various patriotic and biblical objections raised by nonwithholders. The purpose of the seminar is not to foster debate on the morality of tax withholding; rather, persons who are already withholding taxes or who are seeking additional information on the issue are encouraged to attend. In lieu of a registration fee, participants will be asked to make a $10 tax-deductible contribution.

I wonder if you could rope an IRS spokesperson into addressing a war tax resistance conference today.

The included an article that summed up the state of the war tax issue in the Mennonite community. It’s the same article that appeared in The Mennonite around the same time and that I reproduced here when I was going through those archives (see ♇ 4 August 2018 — search for “Military taxes — continuing agenda in 1984”).

War tax resistance foe D.R. Yoder wrote a commentary for the issue in which he argued that tax resistance was ineffective because the government can just rely on borrowing or seigniorage if it runs out of tax money, which means ultimately the costs not paid by war tax resisters just get shifted to other people, which isn’t very Christian.

Robert V. Peters promoted simple living, in part as a tax resistance strategy, in his article “Stewardship: a pilgrim’s progress”:

One stewardship issue that is seldom brought up, although one of the most important, is how we use our tax dollars. Becky and I are comfortable in paying local and state taxes but have come to feel that we cannot pay any of our federal income taxes, given their use in fueling the arms race. We note the irony that while the average Mennonite family gives the church $430 a year for peacemaking it pays the IRS $1,500 for its militarism. A 4 percent tithe for the church, and a 10 percent tithe for the government! Our response is to reduce our taxable income and refuse to pay anything, choosing instead to use this money for serving the kingdom. Friends of ours have taken other options such as matching their giving to the IRS with their giving to the church, refusing to pay a percentage of their tax dollars, enclosing a letter of protest with their payment. We feel that how we use our money is a crucial test of our loyalties and commitments and must become a stewardship issue for this generation.

Imagine with us what could happen if we Mennonites were to take the steps outlined in books like Beyond the Rat Race. Imagine if we were to give as much to the church as we give the IRS, or if we gave our tax dollars to the work of the church, withholding them from military use?

Titus Martin responded, in the issue:

I want to make a few comments… especially on the last part concerning the average Mennonite family giving “a 4 percent tithe for the church, and a 10 percent tithe for the government.” I cannot understand how he can withhold all income taxes from Uncle Sam in light of the fact the U.S. government is very reasonable in its demands. The government allows us to give 50 percent to charitable causes without too many restrictions, though there are some.

Thus I ask, until we give 50 percent to charity which the government allows, who is responsible if it is not spent right? Peters talked about the tithe for the church. Personally I believe many of us should give much more. Just because we feel our government does not spend all our tax money right does not give us the right to withhold all or part of our tax money.

There was a passing mention of war tax resistance at the Bijou Community in a article:

[Esther (Leatherman)] Kisamore, formerly of Pennsylvania, is a member of a Christian community, called Bijou House, consisting of 13 persons. There are four other Mennonites in this house community; the next largest group represented is Roman Catholic. The group shares economic resources and lives below the taxable income level as a way of avoiding the payment of war taxes.

The issue contained a pro-taxpaying op-ed from Harold Hartzler. Christians should pay taxes gladly, he wrote, citing Romans 13. Taxes help our terrific government; we shouldn’t try to lower our taxes but should indeed pay even more than is required; the government should simplify taxes and broaden the tax base, and should increase taxes even if that makes things “unbearable.”

Alongside that commentary was this one, credited to Call to Peacemaking:

Praying and paying: a dilemma

The question begins to sound like a cliché, we’ve heard it so often: Can we go on praying for peace while paying for war?

But the question won’t go away. Every year in the United States we are reminded of the reality of military preparations when the president presents the proposed budget to congress. This year the figures reach almost beyond our imaginations, near a trillion in total spending with more than a third for war. A military expenditure of that enormity was once associated only with the waging of all-out war. Now it is only preparation for war, plus minor (?) interventions here and there.

We only need to reflect for a moment on the consequences of the kind of war we’re preparing for to know in our hearts that the government is buying us less security. That’s the purpose of the state? To brandish a nuclear sword which guarantees that if used it will fulfill the prophecy of Jesus: “They who take the sword will perish with the sword.”

Between the time the budget is unveiled and when we can no longer delay the moment of truth with the Internal Revenue Service is usually a little less than three months. Plenty of time to agonize whether what Caesar is demanding to support the arms race is really what is due to Caesar.

An increasing number of concerned persons recognize the dilemma of praying and paying and are seriously trying to decide how to resist. A leaflet, “Stages of Conscientious Objection to Military Taxes,” by Bill Strong at the Philadelphia Yearly Meeting of Friends and Linda Schmidt of Mennonite Central Committee describes what some have done in response to the question of taxes for war.

The leaflet is available from New Call to Peacemaking, Box 1245, Elkhart, IN…

Reporter Steve Shenk brought this news in the issue:

Virginia peace group offers food for thought

As tax season rolls around, taxpayers are faced with many facts and figures that concern the conscience as well as the wallet. For some Christians payment of federal income tax — the portion which goes to finance the military — is a dilemma.

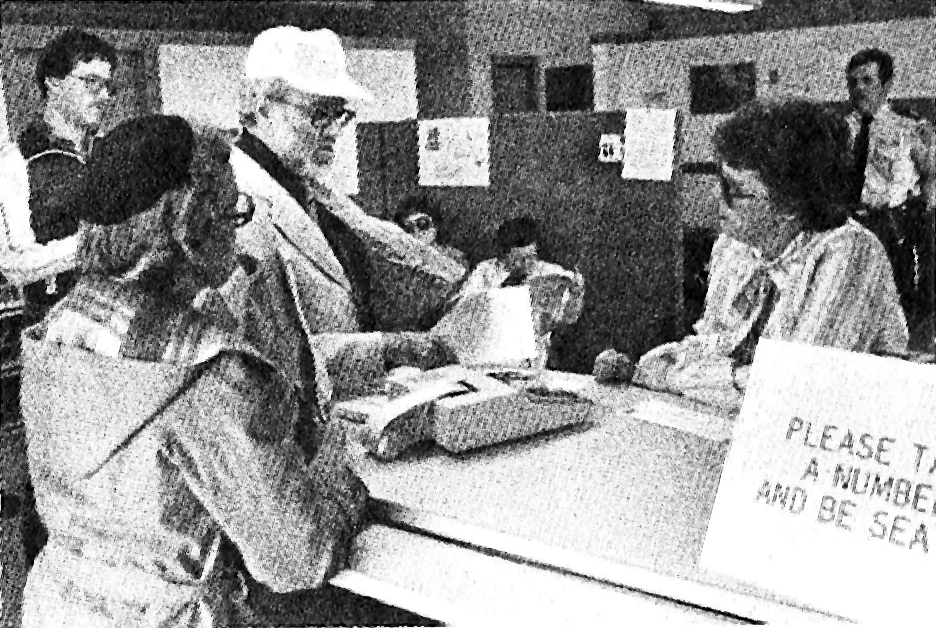

This year a group called Christians for Peace, consisting of largely Mennonites from the Harrisonburg, Va., area, gathered at the regional office of the Internal Revenue Service in Staunton, Va., on , 1984. They came to register their concern about the amount of income tax money which is used for military purposes. Instead of bringing their normal checks, they came with a truckload of food for the IRS.

The food was purchased with money that the participants withheld from their tax payments. “We seek to follow Jesus’ call to be peacemakers by directing our resources away from the instruments of death and toward life,” explained Wendell Ressler, one of the organizers of the event. “We cannot reconcile Jesus’ call to love our enemies with our government’s call to help pay for their destruction.”

The group began the witness with a short worship service in front of the IRS building. There was a short mime skit entitled The Global Garden Deli which visualized their feelings about paying for military expenditures. The theme song, “I Am Not Willing to Buy Your Bombs, Sam,” sung to the melody “I Have Decided to Follow Jesus,” was heard between prayers and testimony of the group members.

Wendell Ressler then read a short statement of purpose to the small crowd of onlookers. He explained that this action was really a pledge to reexamine the effects of the group’s lifestyle on other people. “We do not wish to be protected if it means others are killed in our names. We gladly pay taxes which are used to enrich the lives of others, but it is immoral for our government to play Russian roulette with the future of our planet.”

Christians for Peace members, Milo and Viola Stahl, then entered the IRS building to offer their bags of groceries in payment for the military portion of the income tax. They were cordially received by the representative for the regional director of the IRS, but told that the IRS could not accept the bread. When the Milo Stahls asked the representative what the IRS would like them to do with the food, the representative replied, “That is your prerogative, but I cannot accept it.”

The food was then presented to the Blue Ridge Area Food Bank, Inc., a nonprofit community organization that distributes 220,000 pounds of food each month to hungry people in the area. Executive Director Phil Grasty was careful to note that he did not want to take a political stand on the issue, but he was “happy to receive the food.” Over 1,000 pounds of canned goods were donated to the organization.

The group repeatedly tried to explain that their intention was not to harass the IRS personnel. Instead their goal was to represent their concern as a Christian witness. “The reason that I am here,” said Christian for Peace member Nate Barge, “is that for me it is an act of faith. I am trying to bring evangelism and social action together.”

The event attracted passersby to stop and watch the demonstration. One of them, Dave Murphy, a member of the Staunton Christian Fellowship Baptist Church, said, “I think it is a nice effort on their part to present what they believe about military spending… after all it is the American way to speak out. I am particularly pleased that they are giving the food to the Food Bank where it will do some good.”

The following news brief was found in the issue:

Religious war tax movement growing rapidly in U.S.

Two years after Seattle Archbishop Raymond Hunthausen’s decision to withhold half of his federal income taxes, a religious “war tax” movement is growing rapidly. Its numbers are being swelled both by Hunthausen imitators and by creative new forms of protest by people who are upset by the nuclear arms race but reluctant to put themselves outside the law.

According to new Internal Revenue Service figures, the type of protest popularized by the Seattle archbishop has increased nearly fivefold in the last three years, while alternative forms of protest, some of them revived from the Vietnam War era, have also become more frequent. Among the latter protesters are people who refuse to pay a small, token amount of tax, or withhold federal excise taxes from their monthly telephone bills. Others file a return and write “paid under protest” on the check, or file for a refund of military taxes already paid. Increasing charitable giving to reduce the amount of income subject to tax, and changing one’s lifestyle to live below a taxable income level, are also gaining acceptance. Many religious groups, in addition, are pressing Congress for legislation that would allow “conscientious objectors” to divert all their taxes to “peaceful” purposes.

The Mennonite Central Committee held its executive committee meeting in :

Military tax issue raised

Executive Secretary Reg Toews reported that three staff members have requested that MCC no longer withhold the military portion of the federal withholding tax from their paychecks.

Member Larry Kehler of Winnipeg, Man., noted that "this is a very volatile issue in our constituency." It was observed that MCC is in a unique position, since it represents a wide coalition of conferences, who come to this issue with various degrees of intensity. “Just to discuss this issue is to raise concern in many groups,” Toews said.

The executive committee stated their intention to take seriously the request from the staff members, as well as constituency concerns. They asked administrative staff to work on a plan, to be discussed by the committee in , concerning how this issue should receive broader testing.

A letter to the editor from Steven G. Gehman () rejected on scriptural grounds the “witnessing” justification of war tax resistance, but left open the possibility that it was justified on the grounds of conscientious objection to participation in war:

I have struggled with the war tax issue and have not reached any definite answer. I cannot feel comfortable knowing that a great portion of my taxes is devoted to killing or creating the potential to kill, and knowing that Jesus commands us to have no part in war. But neither am I comfortable with war tax resistance. There are no records of Jesus opposing taxes to the Roman military machine. In Romans 13:1–5 Paul states his view that the government bears the sword as God’s servant. First Peter 2:13 gives us the injunction to submit to human authority.

I do not think either or both of these passages in themselves yield a final answer to the war tax issue. They do help to sharpen the questions. If the government bears the sword as God’s servant, total disarmament cannot be the goal or the reason for war tax resistance. Neither is the desire for an effective witness to the government sufficient reason to resist payment since we are commanded to submit to human authority.

The question of whether or not payment of war taxes is right hinges on whether or not payment of these taxes constitutes participation in a killing machine to an extent forbidden by the example and teachings of Jesus. What effect does current military technology have on our response to this issue?

An conference in Japan included war tax resister Michio Ohno:

Michio Ohno, pastor of the Mennonite congregation in Toke outside Tokyo, told of his pilgrimage which included being a pastor in the United Church before becoming a Mennonite. He also made an eloquent appeal for a peace stance and the nonpayment of military taxes.

J. Ward Shank, in a “Update on the peace movement in the Mennonite Church”, criticized the modern centrality of anti-war activism among Mennonites, suggesting that it had displaced more basic Christian themes. “Peace is a fruit of the gospel, not its basis, or necessarily the heart of it,” he wrote. The article only mentioned war tax resistance in passing, but of course was relevant to it. It prompted a great deal of back-and-forth in the letters to the editor column.

The Mennonite Church’s general board’s “council on faith, life, and strategy” met in . It turned out that the Mennonite Church, like its cousins the General Conference Mennonite Church, had employees who wanted their church to stop withholding war taxes from their paychecks. This time around, the Mennonite Church wouldn’t have the luxury of playing spectator in the debate:

One of the stickier issues arose out of a request from a couple employed by Mennonite Board of Missions that federal income taxes not be withheld from their paychecks. They want to stop paying the portion of their taxes that goes to the military. The council tried to clarify the issue by raising underlying questions such as “Shall a church perform a function on behalf of the state, in this instance collecting taxes?” and “Should a church institution place employees in a position where they do not have the option to follow their conscience on this issue?” Vigorous discussion led to two recommendations: (1) That this question might be considered in the forthcoming Conversations on Faith Ⅱ meeting. (2) That a task force be appointed by the General Board.

I noticed that tax resistance was on the agenda at the General Conference Dialogue on Faith in also, but there wasn’t anything meaty in the article worth reprinting here.