In readers of the Messenger learned the legal how-tos of war tax resistance, while even the conservative Brethren Evangelist was willing to publish “New Call to Peacekeeping”’s summons to war tax resistance.

As had become common at this point, discussion of the World Peace Tax Fund bill often overshadowed war tax resistance when war taxes were discussed. The bill was boosted in (source), (source), and (source). Here’s another example mention, from an profile of Charles Anderson (source):

Charles admits some pangs of conscience over his life-style. His own affluence is difficult for him to reconcile with peacemaking, since he believes that the gap between the prosperous and the poor breeds violence. His payment of tax, more than half of which is used for military purposes, is also stressful. Support of the World Peace Tax Fund is an effort to resolve this personal conflict.

In the magazine reported that the Mennonites seemed to out in front of the Brethren on the war tax issue (source):

Church as tax collector protested by Mennonites

Delegates attending a special meeting of the General Conference Mennonite Church in Minneapolis in voted to launch a vigorous campaign to exempt the church from acting as a tax collector for the state. The 500 delegates at the conference, called to discern the Christian response to militarism, passed the resolution by a nine to one margin.

A central focus of discussion was tax resistance already being practiced among Mennonites and the request of one such person, a General Conference employee, that the church stop withholding war taxes from her wages. The General Board denied her request because it is illegal for an employer not to act as a tax collector for the Internal Revenue Service.

Delegates affirmed that decision but instructed the General Board to vigorously search for legal avenues to exempt the church from collecting taxes so individuals employed by the church would be free to follow their own conscience.

The issue profiled Ralph Dull, and noted that “throughout the past 25 years… the Dulls have withheld from their taxes the portion allotted to the military.” (source)

“Sometimes you get so frustrated, you just have to do something,” Ralph said. For the past two years Ralph and others have taken food to the IRS as a witness that taxes should be used for feeding the hungry instead of supporting the military.

“I’m not sure it does any good, but it raises the issue.”

Phil Rieman wrote in to the issue, urging Brethren to stick together in order to overcome the fear of government reprisals when considering war tax resistance (source).

The issue reprinted a lengthy article by William Durland, a lawyer who founded the Center on Law and Pacifism (and later helped found NWTRCC), on the practical and legal aspects of war tax resistance:

Praying for peace: Guidelines on military tax refusal

When President Carter’s military tax budget for was criticized, he replied that he would not apologize for it. While recommending cutbacks in health, education and human needs, he increased the portion of the budget allocated to bombs and bullets.

Many Christians are beginning to realize that they cannot use mammon for murder and expect a welcome at the millennium. So they are looking for advice on ways to refuse complicity with the war machine.

Recently the Center on Law and Pacifism was organized in Philadelphia to serve people who need advice and support in the relationship of their radical religious, pacifist convictions to the laws which attempt to obstruct their conscientious objection to violence. One of the main projects of the Center has been to aid people in their quest for information on how to be military tax refusers. The Center is in the process of publishing such a study and the following is an overview of that report.

People want to know how to withhold their taxes, what happens if they do so and what legal remedies exist for them to witness to their conscientious objection in the courts of this land. Usually people who are in this position are employees. So we will talk about them first, then the employer, the corporation, the income tax refuser and the telephone tax refuser. Employees receive their income in the form of wages which are subject to withholding before they see their check. Employees must fill out a W4 form with their employer. The W4 form determines the amount of money to be withheld from each paycheck. The more allowances you claim the less money is withheld.

You are allowed a number of allowances on your W4 form depending upon how many dependents you have and what your anticipated itemized deductions are. The employer determines how much money to withhold from your weekly paycheck on the basis of your W4 form. Therefore, in order to reduce or eliminate withholding, you can file a new W4 form claiming more allowances. There is nothing fraudulent about this procedure as long as you inform the IRS when you file your income tax return as to why you took the allowances on your W4 form. When it comes time for your income tax, it is important that it be consistent with this claim. This is done by taking a war tax deduction on your income tax form under “miscellaneous deductions.”

This is one of four methods to avoid withholding. The second method is by working in an occupation exempt from the withholding law. A third method is by becoming self-employed as a consultant or independent contractor. Fourth, by earning less than a taxable income you can avoid not only withholding, but also any income tax liability whatsoever.

If you are successful in computing the sufficient number of allowances — which will constitute rendering your withholding to a point where you can take your deduction on your income tax — then no further problem remains until that time for the employee. However, should the employee choose not to use the allowance method, but rather to ask the employer not to withhold any of the withholding tax, then there is a problem for both employer and employee.

The Internal Revenue Code of , as amended, requires employers making payment of wages to deduct and withhold from such wages a tax determined in accordance with IRS tables. The employer is liable for the amount required to be deducted and withheld. Any employer who fails is liable to the IRS for that amount plus a civil penalty equal to the tax amount. There is also a criminal penalty of $10,000 fine and/or five years imprisonment for willful failure to pay or collect the amount due.

Some employers have wanted to protect the right of their employees to exercise their rights of conscience even though the employer does not share the same viewpoint. In this event, employers have refused to withhold and have been taken to court. Eventually they wind up paying and requiring the employee to reimburse them.

But what if the whole corporation becomes a war tax refuser, rather than just one of its employees? In that event the corporation will not withhold any tax at all because they are conscientiously opposed to paying military taxes.

Recently we have seen some organizations which were created on radical religious, pacifist principles beginning to refuse to pay military taxes as a corporation rather than simply to support the conscience of one or more of their employees. They see this as their own witness to the immorality of war taxes. There is a possibility of losing tax-exempt status and other rights, but they are willing to witness in this way and suffer for conscience’s sake.

Everyone who makes a minimum amount of money a year is required by law to file an income tax return. Whether you made your money as an employee, an employer or are self-employed, you must file form 1040 and complete Schedule A (“Itemized Deductions”) in order to take an income tax deduction for war. Those who are self-employed can write in a “war tax credit” instead of a deduction, and simply withhold a percentage of the tax owed and send a letter to the IRS explaining what they are doing.

Another popular way of resisting military taxes has been refusal to pay the tax on the telephone bill. In times past, the IRS took quite a bit of time tracing down telephone tax refusers. Since the end of the Vietnam War, this has not been the case, although we have heard of one case recently where the telephone company closed down the service of a telephone tax refuser.

Whatever category you are in, you must decide how much to refuse and what you are going to do with that money. Many organizations, such as the World Peace Tax Fund and the various chapters of War Resisters League, are equipped to advise you on the breakdown of the national budget. But generally, from year to year, the military portion of the budget is calculated anywhere from 35 percent to 53 percent, depending upon whether current military expenditures for past wars are included.

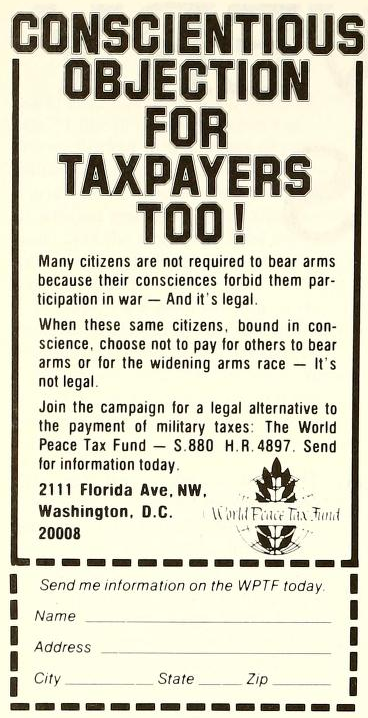

For those who wish to put their money to good use while it is being withheld, there are various alternative funds which invest in human resources and use your money for that purpose. Many people hope that the World Peace Tax Fund Act — designed to allow the taxpayer to earmark a specific amount of tax money to go into a federal fund to be used only for peaceful purposes — will be approved by Congress soon.

What happens when you take these steps? How do you cope with the IRS? No matter what category of refuser you are, what generally is going to happen to you is something like this: If a tax is owed, a notice of tax will be sent to you. The IRS is required to issue this bill which is a demand for payment. You are then required by law to make payment within 10 days of the date of this bill. If the tax remains unpaid after the 10-day period, a statutory lien is automatically attached to your property. The law also provides for interest and penalty for late payment at this time.

Once this notice of tax lien has been filed at your courthouse, it becomes a matter of public record and may adversely affect your business transactions or other financial interests. It could impair your credit rating; therefore, it is normally filed only after the IRS has sent you a second notice of deficiency and tried to contact you personally, giving you the opportunity to pay.

After the lien has been filed, a levy may be taken. A levy is the taking of property to satisfy tax liability. The tax may be collected by a levy on any property belonging to you. In the case of levies being made on salaries or wages, you will usually be given written notice, in addition to the notice of demand, at least 10 days before the levy is served.

Generally, court authorization is not required before a levy action is taken, unless collection personnel must enter private premises to accomplish their levy action. The only legal requirements are that the taxes are owed and that the notice and demand for payment have been sent to your last known address. In taking a levy action, the IRS first considers levying on such property as wages, salaries and bank accounts. Levying on this type of property is referred to as a seizure.

Willful failure to file or pay income tax can result in a criminal sentence of one year and/or $10,000 fine. However, we know of no cases which have ever resulted in criminal penalties, except where there is a total failure to file any income tax form at all.

When you receive your notice of deficiency from the IRS, you will also be notified that you may elect to appeal your case to the US Tax Court; if you decide to do so within 90 days of that time, the IRS process against you is halted for the duration of the case. Several people have gone to Tax Court following this procedure, although in no case has anyone “won” there.

The Center on Law and Pacifism has advised and supported people filing cases in Tax Court and on the Appellate and US Supreme Court levels also. If you lose your case in Tax Court, you may appeal to higher courts, and ultimately to the Supreme Court. These appeals are based on the First Amendment free exercise of religion and other constitutional provisions.

Many of us are presently refusing 35 to 50 percent or more of our income taxes. For others just beginning to consider war tax refusal, or those reluctant to refuse taxes in those quantities, a new project called People Pay for Peace, under the auspices of the Center on Law and Pacifism, offers an opportunity to participate.

The Center is coordinating this symbolic tax refusal movement by new reformers who withheld from their tax returns a few dollars, symbolizing their witness against military armament. The amount is so small that it is unlikely the IRS will try to levy it. Multiplied by thousands of people, this small amount will constitute a significant conscientious objection to payment for war.

There is still time to build the kingdom, time to protest armaments, time to create a spiritual community for those who turn from the idols of fear.

If I were to say to you, “I will not kill my neighbor, but I will pay someone else to do it,” would you not hold me accountable? If we refuse to kill our neighbor but allow our government to do it with our money, are we not to be held accountable?

But then we must witness and suffer the consequences of our military tax refusal for conscience’s sake. This is the price some Christians are paying for peace in .

According to another article in that issue, of 200 people who responded to a “Survey on Life-Style Changes” in an earlier issue of the magazine, 20% had taken the step of “keeping income down in order not to pay taxes.” Another 25% wanted nothing to do with such a step. (source)

I was a little surprised to see the fairly conservative Brethren Evangelist devote several pages of its issue to reprinting part of the Statement of the Findings Committee of the “New Call to Peacekeeping” conference (source). The Brethren Church was not (as the Church of the Brethren was) a partner to this conference, but they did send an observer.

The magazine was careful in its preface to say: “The printing of this Statement does not mean that either the Peace Coordinator [Doc Shank of the Brethren Church, who attended the conference] or the Brethren Publishing Company endorses it in its entirety. It is our hope that it will be read carefully and with an open mind.” Mention of tax resistance was brief in the published excerpt (“We urge the development of support groups within congregations and meetings for those individuals who are working at peace issues such as war tax resistance, simple lifestyles, and nonviolent action.”) but this makes for a rare positive mention in this usually more stodgy magazine.

In the magazine followed up with a second excerpt from the Statement (source). This one was more explicit and direct:

- We call upon members of the Historic Peace Churches to seriously consider refusal to pay the military portion of their federal taxes, as a response to Christ’s call to radical discipleship.

- We challenge ourselves and also our congregations and meetings to uphold war tax resisters with spiritual, emotional, legal, and material support.

- We call on our church and conference agencies to enter into dialogue with employees who ask, for reasons of moral conviction, that their taxes not be withheld.

- We suggest that alternative “tax” payments be channeled into a peace fund initiated by the New Call to Peacemaking or into existing peace funds of constituent groups.

- We call on our denominations, congregations and meetings to give high priority to the study of war tax resistance in our own circles and beyond.

Another element of the statement gave a thumbs-up to the World Peace Tax Fund legislation.

There were a couple of horrified letters to the editor that followed, from Brethren who didn’t want to see their church tangled up with the anti-war movement, but otherwise not much discussion.