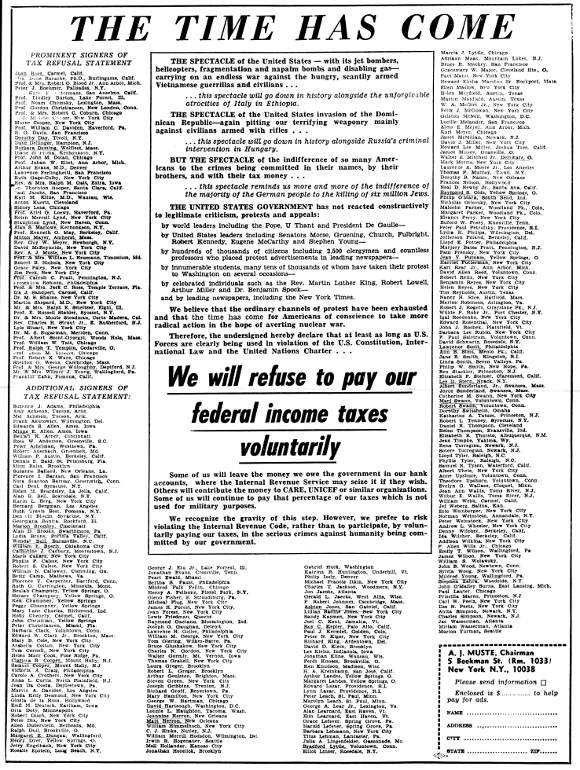

The time has come, and that time was .

350 Balk at Taxes in a War Protest

Ad in Capital Paper Urges Others to Bar Payment

Washington, — Some 350 persons who disapprove of the war in Vietnam announced that they would not voluntarily pay their Federal income taxes, due . They urged others to join them in this protest.

The Internal Revenue Service immediately made clear that it would take whatever steps were necessary to collect the taxes.

The group announced its plans in an advertisement in The Washington Post.

“We will refuse to pay our Federal income taxes voluntarily,” the advertisement said. “Some of us will leave the money we owe the Government in our bank accounts, where the Internal Revenue Service may seize it if they wish. Some will contribute the money to CARE, UNICEF or similar organizations. Some of us will continue to pay that percentage of our taxes which is not used for military purposes.”

Joan Baez, Lynd, Muste

The first signature on the advertisement was that of Joan Baez, the folk singer. Others who signed it were Staughton Lynd, the Yale professor who traveled to North Vietnam in violation of State Department regulations, and the Rev. A.J. Muste, the pacifist leader.

The advertisement contained a coupon soliciting contributions for the protest. The ad said that further information could be obtained from Mr. Muste at Room 1003, 5 Beekman Street, New York City.

Those who placed the advertisement — which bore the heading “The Time Has Come” — said that those who sponsored it “recognize the gravity of this step. However, we prefer to risk violating the Internal Revenue Code, rather than to participate, by voluntarily paying our taxes, in the serious crimes against humanity being committed by our Government.”

The advertisement mentioned not only the war in Vietnam “against hungry, scantily armed Vietnamese guerrillas and civilians” but also “the spectacle of the United States invasion of the Dominican Republic,” an event the sponsors said “will go down in history alongside Russia’s criminal intervention in Hungary.”

Cohen Is Determined

The determination of Internal Revenue to collect the taxes the Government is owed was expressed in a formal statement by the Commissioner of Internal Revenue, Sheldon S. Cohen.

He said Internal Revenue would take “appropriate action” to collect the taxes “in fairness to the many millions of taxpayers who do fulfill their obligations.”

The Government has been upheld in court on all occasions when individuals have refused to pay taxes because of disapproval with the uses to which their money was being put, revenue officials said.

Ad Prepared Here

The headquarters of the Committee for Nonviolent Action, 5 Beekman Street, said that it had prepared the advertisement carried in the Washington newspaper after receiving 350 responses to invitations it had sent out soliciting participation in “an act of civil disobedience.”

A spokesman for the committee said that Mr. Muste, the chairman, was out of town and would return in about a week. The spokesman said that although monetary contributions in response to the advertisement had not yet begun to come in, the committee was prepared to mail literature explaining its program to those who responded to the advertisement.

The spokesman said that the tax protest had been intended to represent “a more radical and meaningful protest against the Vietnam War.”

The committee announced that members would appear at in front of the Internal Revenue Service office, 120 Church Street, to distribute leaflets concerning the tax protest.

It also said that a rally and picketing would be staged from , in front of the Federal Building in San Francisco under the sponsorship of the War Resisters League. The league also has offices at 5 Beekman Street.

With press coverage like this, including even the address to write to for more information, Muste hardly needed to pay for ad space in the Times (assuming they would have printed the ad — many papers rejected ads like this).

Some other names I recognize from the ad are Noam Chomsky, Dorothy Day, Dave Dellinger, Barbara Deming, Diane di Prima, Lawrence Ferlinghetti, Milton Mayer, David McReynolds, Grace Paley, Eroseanna Robinson, Ira Sandperl, Albert Szent-Gyorgyi, Ralph Templin, Marion Bromley, Horace Champney, Ralph Dull, Walter Gormly, Richard Groff, Irwin Hogenauer, Roy Kepler, Ken Knudson, Bradford Lyttle, Karl Meyer, Ed Rosenthal, Maris Cakars, Gordon Christiansen, William Davidon, Johan Eliot, Carroll Pratt, Helen Merrell Lynd, E. Russell Stabler, Lyle Stuart, John M. Vickers, and Eric Weinberger.

The text of the ad (without the signatures and “coupon”) is as follows:

The Time Has Come

The spectacle of the United States — with its jet bombers, helicopters, fragmentation and napalm bombs and disabling gas — carrying on an endless war against the hungry, scantily armed Vietnamese guerrillas and civilians… this spectacle will go down in history alongside the unforgivable atrocities of Italy in Ethiopia.

The spectacle of the United States invasion of the Dominican Republic — again pitting our terrifying weaponry mainly against civilians armed with rifles… this spectacle will go down in history alongside Russia’s criminal intervention in Hungary.

But the spectacle of the indifference of so many Americans to the crimes being committed in their names, by their brothers, and with their tax money… this spectacle reminds us more and more of the indifference of the majority of the German people to the killing of six million Jews.

The United States government has not reacted constructively to legitimate criticism, protests and appeals:

- by world leaders including the Pope, U Thant and President De Gaulle —

- by United States leaders including Senators Morse, Gruening, Church, Fulbright, Robert Kennedy, Eugene McCarthy and Stephen Young —

- by hundreds of thousands of citizens including 2,500 clergymen and countless professors who placed protest advertisements in leading newspapers —

- by innumerable students, many tens of thousands of whom have taken their protest to Washington on several occasions —

- by celebrated individuals such as the Rev. Martin Luther King, Robert Lowell, Arthur Miller and Dr. Benjamin Spock —

- and by leading newspapers, including the New York Times.

We believe that the ordinary channels of protest have been exhausted and that the time has come for Americans of conscience to take more radical action in the hope of averting nuclear war.

Therefore, the undersigned hereby declare that at least as long as U.S. Forces are clearly being used in violation of the U.S. Constitution, International Law and the United Nations Charter…

We will refuse to pay our federal income taxes voluntarily

Some of us will leave the money we owe the government in our bank accounts, where the Internal Revenue Service may seize it if they wish. Others will contribute the money to CARE, UNICEF or similar organizations. Some of us will continue to pay that percentage of our taxes which is not used for military purposes.

We recognize the gravity of this step. However, we prefer to risk violating the Internal Revenue Code, rather than to participate, by voluntarily paying our taxes, in the serious crimes against humanity being committed by our Government.