During World War Ⅱ the Church of the Brethren held somewhat more firm than they had in War Ⅰ. At least they largely kept their misgivings about war funding, if they were not very consistent about following through on them. A new pacifist war tax resistance movement began to gel outside of the traditional peace churches in the late 1940s, and I’ll be looking to see how or whether the Brethren contributed to this.

The Brethren Evangelist continued to look at war bonds mostly as a positive example of giving that ought to be emulated by Brethren in the post-war period through Church-directed giving. For example, an article on that theme by the Reverend James E. Ault alluded to war bonds in this way: “We have assisted in meeting goals for War Bonds, Victory Bonds, or Community Fund drives until it has become a part of every day experience. These goals would be of very little value if there were not some greater goal to be reached…” (source).

Things took a very different turn in the Gospel Messenger. Harper S. Will presented “A Seven-Point Program for Brethren” in the issue. Will suggested that the arms race and the normalization of military conscription and training meant that Brethren would have to be more active and persistent if they wanted to make progress for a peaceful world. He asked his readers to “[g]o into your closet, quiet your mind, and seek the guidance of the Eternal Spirit” and gave this as one example: “Henry Thoreau did it in the days of the Civil War, and he ended up in jail because he would not pay his taxes.”

In the issue, Rufus D. Bowman addressed “The Church of the Brethren and the Cultural Crisis”. According to Bowman, the Church was being overwhelmed by and absorbed into an unchristian culture. One of the symptoms of this was the half-hearted way Brethren upheld their adherence to non-resistance:

During World War Ⅰ our members purchased war bonds and many of our young men went straight into the army. During World War Ⅱ it is evident that the majority of our members compromised with the war system.

“Shall We Continue to Call Ourselves a Peace Church?” asked Ruth B. Statler in the issue. Statler noted that most Brethren draftees in the last war went into the armed services without taking any sort of conscientious objector status, and that “[a] great many of our church members bought war bonds.”

The issue brought readers news of a war tax resister from the just-emerging modern war tax resistance movement (source):

Mrs. Caroline Urie. wife of a navy officer, a Quaker and veteran social worker, has publicly refused to pay the 34.6% of her income tax which, according to government figures, would go to military expenses. Mrs. Urie wrote President Truman and the U.S. collector of internal revenue that the withheld money would be given to four nonprofit agencies engaged in removing the causes of war. She is willing to pay taxes “for any reasonable constructive purposes.” As a Christian she said, “I must henceforth refuse to contribute in any way I can avoid toward maintaining the institution of war.”

that was followed up by this note:

This copy of a letter to the Collector of Internal Revenue came to the Messenger desk recently.

Enclosed herewith is my income tax return for .

I wish now to announce to the Collector of Internal Revenue and the Treasury Department that I cannot conscientiously continue to pay federal income taxes when so large a proportion of the funds is being used for purposes of war.

This country did not turn to peace at the end of World War Ⅱ, but instead sought to protect and expand an American Empire.

This mad attempt to dominate the world by force of arms, the threat of atomic war, and offers of economic aid only to future allies will lead to devastation and death. I want to dissociate myself as completely as possible from these tragic, suicidal and evil policies, and to do all I can to convince my fellow citizens that we must completely renounce the way of war and violence. ―Marion Coddington, New York, N.Y.

There was also a note in the following issue about a woman who had been denied U.S. citizenship after she stated in her application that she would not be willing to “bear arms in defense of the United States [and] that she had refused to buy bonds in the last war because their proceeds were used to finance war.”

The issue noted briefly that “The National Baptist Sunday School and Training Union Congress at Cleveland, Ohio, recently urged churches and religious bodies not to invest in war or savings bonds which may be used in the financing of war.” (source)

The issue reprinted some resolutions passed by a Quaker gathering on the subject of conscientious objection to war (source). Among these were that “Friends are urged… [t]o avoid engaging in any trade, business, or profession directly contributing to the military system; and the purchase of government war bonds or stock certificates in war industries. [And t]o carefully consider the implication of paying those taxes, a major portion of which goes for military purposes.” The issue also reported that the North Carolina Yearly Meeting of Friends had issued a statement on conscientious objection, which also “urged Quakers ‘to realize that by paying federal taxes we are supporting preparation for war,’ but did not advise that taxes not be paid” (source).

Up to this point, all of this sudden interest in war tax resistance has been focused outside the Church of the Brethren — neither Urie nor Coddington were Brethren, and the statements above are from Quaker and Baptist institutions. But in the issue is a quote from Rufus D. Bowman, who up to this point has been hinting at war tax resistance without actually endorsing it, in which he finally comes out:

My conviction is that all war is sin and out of harmony with the spirit, life and teachings of Jesus. It is, therefore, wrong to participate in war. When war comes, it is difficult in a totalitarian state to keep from helping the war system. The most Christian position is to remain apart from war as far as possible. Accepting any service within the army puts a person under military orders and clouds his testimony against war. Carrying on constructive service projects under church or civilian direction, the giving of a vigorous testimony against war and the payment of war taxes, and giving our lives for a vital peace program represents a consistent Christian position.

The issue continued the new trend of highlighting examples of war tax resisters from other denominations (source):

A Quaker of Moorestown, N.J., William B. Evans, paid his income tax three months ahead of time because he believes in the American government. But he does not believe in war or in the preparation for it; therefore, he deducted from his payment the amount he estimated would be allotted to military purposes. In a letter to the internal revenue office he said that he was giving that money to relief and rehabilitation.

Another note, in the issue (source) read:

Refusal to pay taxes that may be used for military purposes on the ground of conscience is being manifested by small groups of people in the United States, Switzerland, and Norway. In Switzerland a growing group of women, many of them teachers, and in Norway Quakers are withholding taxes for military purposes, but stating their willingness to pay the same amounts for constructive projects.

The issue carried an update on Caroline Urie’s resistance (source):

Mrs. Caroline Urie, seventy-five year old Quaker widow, of Yellow Springs, Ohio, deducted 32.3 per cent of the first installment of her income tax and will donate the deducted amount to nonprofit agencies working for peace. She estimated the deducted amount would be used for military purposes and expressed her opposition to this use of the tax money because “war and preparation for war in the atomic area is a crime against humanity.”

The issue reported on the blooming Peacemakers war tax resistance movement (source):

More than forty individuals throughout America, most of them from the peace churches, submitted only a part of their income tax to the government this year. They sent an accompanying letter saying that they were contributing the rest of the tax to service or peace-making projects. Their basis of refusal to pay all of it was that a high percentage of income tax revenue goes for war purposes.

The issue brought the news that “[i]n Norway the Quakers have decided to pay a peace tax to the government instead of the government defense tax recently voted by Parliament. The government has agreed to this arrangement.” (source) No further details were given, though, so it’s difficult to guess what this amounted to practically. The magazine repeated the news in its issue without adding much in the way of specifics.

There was clearly a hunger for news about war tax resisters, but in all of this there is still no mention of any actual named resister from within the Church of the Brethren itself, except perhaps Rufus Bowman by implication.

The issue included this representation of the debate about war tax resistance in the Church of the Brethren at the time (source):

How Does a Pacifist Act?

One says, “I have to stick my neck out.”

- Vigorous efforts to break with a war system are necessary. What kind of logic is it for a person to say he’s a pacifist and pay income tax — a large share of which goes for war?

- If I refuse my income tax payment, I am protesting in the strongest way I know. Anyone can write letters against a tax. They mean little to our legislators. What counts is conviction so strong that persons refuse to pay no matter what the consequences are. If Gandhi had not been ready to go to jail for what he believed, the Free India Movement would have crumpled before it got well under way. We cannot build a pacifist movement if leaders in the Church of the Brethren are unwilling to risk jail for what they believe.

⋮

Another says, “I must act with moderation.”

⋮

- The extreme and antagonistic position of the tax refusers and nonregistrants seems out of harmony with the Master’s deeds and words: “Render unto Caesar the things that are Caesar’s.” “Blessed are the meek for they shall inherit the earth.”

- I don’t like it that I am forced through my income tax into supporting war preparations. However, if I refuse payment, the government will collect anyway. The way to fight this tax is to work for a change in the law.

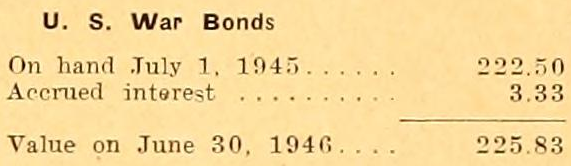

Meanwhile, over at the Brethren Missionary Herald things remained much in the vein of “you gave money for war, won’t you also give some to us?” For example:

How much have members of our churches paid out in taxes and in purchase of war bonds during the past five years? Dare we give the Lord less in the next five years? []