An Associated Press dispatch from , as headlined by The Kansas City Times:

Pacifist Fouls Up As a Tax Dodger

Washington, . — A 72-year-old pacifist sat down in a Treasury corridor to begin a hunger strike which was quickly interrupted by [a] Secret Service agent.

Max Sandin of Cleveland, O., a sign painter, said he would stay in the hall until he starved to death.

Two agents took Sandin into custody and turned him over to a hospital for mental observation.

A conscientious objector in both wars, Sandin has refused to pay federal income taxes . The Internal Revenue service has attached his monthly social security check for $116 to meet back tax payments.

He was, according to a later article, “found sound of mind and discharged on his own responsibility.”

the District of Columbia Commission on Mental Health dismissed a petition to commit Sandin to an insane institution. The commission said the finding that Sandin was of sound mind came after examining Sandin and discussions with relatives, friends, and witnesses.

That was over a week and a half after the Secret Service grabbed him, though.

Another unsympathetic headline topped the United Press coverage in the Sandusky, Ohio Register :

Doesn’t Pay Taxes, But Asks Benefits

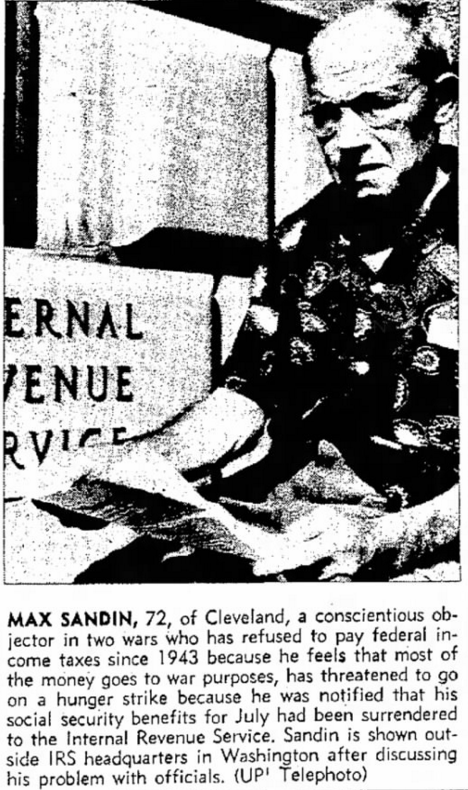

Cleveland (UPI) — Max Sandin, 72, was en route to Washington to conduct a hunger strike at the U.S. Treasury Building until his social security payments are restored.

Sandin, a conscientious objector in two wars, has refused to pay federal income taxes because most of the money goes to war purposes, he said.

He was notified that his social security benefits for had been surrendered to the Internal Revenue Service.

The government claims he owes several thousand dollars in income taxes.

“I am 72-years-old and unable to work,” Sandin said. “Without social security I will starve.”

He said he is going to starve in Washington and “the government can do as it pleases with me.”

He was in the news when he and three other pacifists protested against obstruction of Polaris-carrying submarines at New London, Conn.

He related that he had been sentenced to death as a conscientious objector in but this was later reduced by presidential action to a prison sentence and he served about five months.

“Now, years later, they take a second action which can kill me because I am a pacifist and have worked for a peaceful world without war,” Sandin said.

A Scripps dispatch added these details:

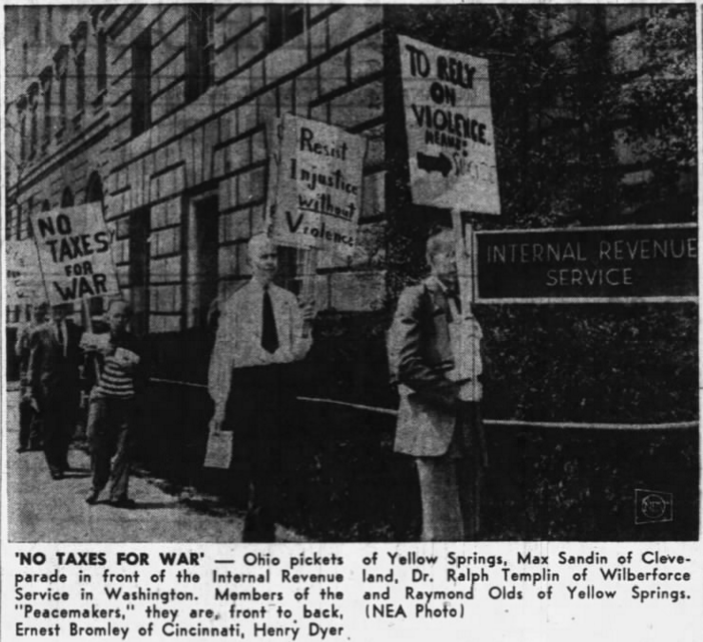

Max hitch-hiked from Cleveland to Washington. he spent all day parading with fellow Peace Action colleagues before the White House, and arguing with Internal Revenue officials.

Late in the day, IRS spokesmen admitted there was a possible legal loophole through which Max might wriggle, should he choose to do so.

“The Social Security law says no one can attach the payments to individuals, but our law doesn’t except the beneficiaries,” explained Lawrence George, spokesman for the tax-collection service. “There’s a possible conflict in this case which could be taken to court.”

Max said he wouldn’t fight his battle in court.

“No lawyer in the world could defend me against not paying my income tax,” he said in broken English. “Besides, I have no money for that.”

The government had started seizing not only Sandin’s $116 monthly Social Security check, but also his $31 monthly Painters Union Pension, leaving him with essentially no income.

In , Sandin was sentenced to death after being “found guilty of having refused to obey an order of his superior officer to clean up a pile of refuse in camp.” He was a conscientious objector, but because of the grounds on which he objected, he was found not qualify for that status officially, and so his refusal to serve was treated as simple insubordination. While at Camp Funston, Sandin and other objectors were subjected to brutal treatment, which became a minor scandal at the time. President Wilson commuted Sandin’s sentence to 15 years (though in fact he was released from the Fort Leavenworth disciplinary barracks on ).

The following comes from the Mansfield, Ohio News-Journal:

He Pays, But Indirectly

Fights Against Paying Taxes for War

Cleveland — (INS) – Max Sandin, 59, of Cleveland, refuses to pay federal income taxes because of his convictions against war.

Nevertheless, he pays them, if only indirectly.

, long before a new cult of pacifists began refusing to pay taxes for “war preparations,” Sandin has not paid a single cent of income taxes of his own volition.

Every year, the pacifist sends the Bureau of Internal Revenue a tax form bearing his name and address and a note saying:

As a conscientious objector, I refuse to pay income taxes — not to help war directly.

Tax collectors continually send him notices, visit him at home and call him into the revenue office for conferences. Once they attached and took his pay for $145 on a painting job.

The collectors also filed a $2,800 tax lien against him, meaning that if he ever owns property, the government will collect its due. Meanwhile, interest and penalties add to the bill.

Tax officials in Cleveland, however, would not comment on Sandin’s case or that of any other Clevelander who may be one of about 150 persons throughout the nation belong[ing] to the “Peacemakers,” a pacifist organization.

During the First World War, Sandin was sentenced to be shot because he refused to bear arms. He said his objection was political, rather than religious. President Wilson, however, commuted the death sentence.

Here’s another piece on his tax resistance, from the Circleville, Ohio Herald, :

Stubborn War Objector Still In Private War With Tax Collector

Cleveland (AP) — The little bald man said he wouldn’t pay his income tax , just as he has refused to pay it when he decided Uncle Sam used tax money to pay for wars.

There was a fleck of white paint under Max Sandin’s ear as he sat in the newspaper office to make his annual declaration. It was literally an earmark of his trade, house-painting.

In his hand he carried a news release headed: “43 refuse to pay federal income tax,” and it was from the “Tax Refusal Committee of Peacemakers.”

Actually the number now is 42, because Mrs. Caroline F. Urie, a naval officer’s widow, died last week.

Sandin was a personal friend and neighbor in suburban Lyndhurst of Mrs. Urie, who made headlines by withholding 75 per cent of her income tax payment. She figured that percentage went for military expenditures, so she paid it to charities instead of to the government.

“I won’t pay even 25 per cent,” said Sandin, “because they would take 75 per cent of that and use it for war purposes.”

Sandin’s stand for peace has, of course, got him into his own small private war with the Internal Revenue collectors. Outnumbered, he has lost a few battles, but his foe is fighting on a long front and is unwilling to spend the time, patience, or money to achieve total victory that would net about $3,000 in tax money. Also, the opposing high command doesn’t want Sandin as a prisoner, and in the skirmishes the house-painter has certain tactical advantages.

When Sandin works steadily for the same contractor, the Internal Revenue officers latch onto his pay check before he gets it. When he gets his own painting jobs, the collectors have to wait outside his home, board the bus with him and give notice to the homeowner that Uncle Sam, not Sandin will collect for the paint job.

Peace from this private war with the tax collectors is just around the corner for Sandin, who is 65. He plans to retire and write a book entitled “Political War Objector.”

In it he will tell how he has opposed war since World War Ⅰ, when he was sentenced to die for refusing to bear arms but was saved from a firing squad by President Woodrow Wilson’s last-minute reprieve. And he will tell how he was jailed in for refusal to register for the draft in World War Ⅱ.

“I oppose war politically, not religiously,” he explained. “Who am I to say that I’m the only person whose conscience objects to war?”

Sandin’s retirement income won’t be a matter of much concern to the Internal Revenue Department. It will come mostly from social security.

“I paid those taxes,” he said.