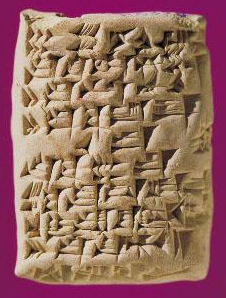

Tax agencies live by bureaucracy and paperwork. Many of the earliest examples of writing in the worlds’ museums are tax records. But some mischievous tax resisters have discovered that this is a vulnerability that can be targeted.

For example, , a video blogger going by the name “StormCloudsGathering” considered the idea of “filling out thousands of random tax returns with nonexistent names and numbers… so suddenly they get flooded with a bunch of returns that don’t make sense…”:

What’s even more brilliant about [this] option is that even non-U.S. citizens — people living in other countries — could participate. You could send in hundreds of tax returns even if you’re an Indonesian. You know: Americans can live in Indonesia, and they’re required to file taxes… there’s no way for them to be sure, just because it’s coming from Indonesia, that it’s not a valid tax return. They would have to do the investigation, and that costs resources.

He recommends filing in the name of particular, offensive, multinational corporations, but I think the average person would have a difficult time filing a sufficiently complex return to serve as a convincing decoy in such a case. Another option would be to file corporate returns for nonexistent corporations, or individual returns for phantom (or dead) people.

War tax resister Ed Hedemann has already made plans for what he calls “zombie war tax resistance” — filling in years of tax returns ahead of time and putting them in pre-stamped envelopes so that his survivors can continue to file (but, of course, refuse to pay!) after he’s gone. “Why give the government a break from having to deal with your resistance when you die?” he asks.

Hedemann also makes a point of periodically filing Freedom of Information Act requests for any information the IRS and other government agencies have been collecting about his activities — hundreds of pages — and he’s put together a guide for other tax resisters to follow in making their own requests.

Currently in the U.S. there is an epidemic of tax fraud in which the fraudsters file for phony tax refunds in the names (and taxpayer identification numbers) of other, real people. This often causes the tax collection bureaucracy to swing into action against the victims of the identity theft, which is both a waste of resources and a way of further alienating the population from the government and its tax bureaucracy — potentially a model that a tax resistance campaign could benefit from.

The IRS has made a big shift in recent years from processing paper income tax returns, filled out by hand, to electronic filing. This is more efficient for the agency, as it no longer has to hire as many people to laboriously transcribe the numbers from paper returns into its computer databases. The agency estimated that it cost about 35¢ on average for the agency to process an electronically-filed return, compared to an average of $2.87 for a paper return.

This suggests that one way to make a minor dent in the agency’s budget and efficiency is simply to file paper returns rather than file electronically (this is still a legal option for individual filers, even those who go to professional tax preparers). But if this became a strategy of a mass-campaign it could even cripple the tax collecting bureaucracy. George Jakabcin, IRS assistant deputy associate chief information officer for systems integration, said in that the agency “would be in a world of hurt” if even half of the people who had switched to electronic filing at that time decided to switch back. “We no longer have the capability to process the additional 43 million returns manually. We no longer have the facilities, we don’t have the IT infrastructure in place to support them, we don’t have the people, and some would argue that we are beginning to lose the expertise.”

The IRS has tried to crack down on people who send them paperwork just to waste their time. They have come up with something called the “frivolous filing penalty” and can use this to ding you $5,000 each time you file any sort of paperwork with them that takes a position they consider to be “frivolous.” They can do this immediately and on the whim of whichever bureaucrat is handling your forms, without going to court, and you are only allowed to appeal your fine before a judge if you pay it first!

War tax resister Karl Meyer wasn’t about to let the IRS think it could intimidate him with such tactics. So in , when the “Cabbage Patch Kids” dolls (each one slightly different) had become ubiquitous, he invented when he called “cabbage patch resistance” — filing a different, blatantly “frivolous” tax return every day. He was assessed $140,000 in penalties in alone (though the penalty was only $500 back then). The IRS never collected the money though. The best it could manage was to seize and sell his car, for a little over $1,000.

“Constitutionalist” and “sovereign citizen”-style tax protest groups in the U.S. are fond of harassing tax officials and other government employees with lawsuits, liens, bogus quasi-official court filings, and so forth. In one example, Eddie Kahn’s “Guiding Light of God Ministries,” filed some 2,000 misconduct complaints against IRS agents. A newspaper article about a subsequent legal case against the group noted that:

Some agents have said that their supervisors ordered them to back off from audits or collection efforts in the face of [such] threats, just to avoid investigations by the Treasury inspector general for tax administration.

Some paperwork tricks are more like “hacking” in that they treat the IRS as a system that processes input and produces output, and note that certain examples of pathological input can result in output unanticipated by the system designers. For example, the IRS gave out $20 million dollars in the filing season when people figured out that if they substantially overpaid a tax return with a bad check, the IRS would cut them a hefty refund check before they noticed they’d been had.

Here are some more examples of paperwork hacks being used against the tax collecting bureaucracy:

- South Carolina’s state government recently passed a law that required all organizations that “directly or indirectly advocate, advise, teach or practice the duty or necessity of controlling, seizing, or overthrowing the government of the United States, the state of South Carolina, or any political division thereof,” to register their activities with the South Carolina Secretary of State and pay a five-dollar filing fee.

A member of the Alliance of the Libertarian Left (which probably qualifies, at least in its more ambitious moments) decided to register, but with a twist:

When belligerence and inhumanity prevail, the peaceful and the humane must find honor in being categorized as the enemies of the prevailing order. Please keep me updated as to the status of our registration. I look forward to hearing back from you as to our official recognition as enemies of your state and its government. … P.S. I am told that there is a processing fee in the amount of $5.00 for the registration of a subversive organization. Our organization is in fact so dastardly that we have refused to remit the fee.

- Prussian farmers in used the bureaucracy against itself.

A New York Times report noted:

[T]he big agrarians… are determined to resort to sabotage of all the tax laws…

[A correspondent in East Prussia says] “They have all filed protests and demanded that they be relieved from paying the tax until the protests are settled. That means a delay of at least three years in collecting the taxes, and it is said that the Provincial Treasury is inclined to grant this request. The big agrarians declared that they would do the same thing with all the tax laws. In Berlin the people might decree what pleased them, they (the agrarians) would not pay the taxes or subscribe to the compulsory loans. They want to sabotage the whole taxation system that they hate, and consequently they want to make so much work for the Treasury officers that the latter don’t know which way to turn.”

- During the Beit Sahour tax strike against the Israeli occupation, Elias Rishmawi worked to get a suit challenging the legality of the tax accepted by Israel’s court system. He remembers: “I had never had an illusion that the Israeli supreme court would give any justice to Palestinians. … [T]he appeal formed the legal coverage by which I and others were able to continue resisting from one side not paying taxes, since there is a case in court and they cannot force me pay until the case is solved they cannot take any actions against us since we have this case, and we kept challenging the system through different means.… This was impossible to achieve without the legal coverage of the supreme court. Because then, I and the others, would have been considered as inciters and then might be imprisoned for ten years. That’s why we needed that coverage.”

- An early form of resistance to Thatcher’s Poll Tax was called the “send it back” campaign.

The idea was that people would register for the tax, as required, but would accompany their registration with questions that would require further manual processing by the individual councils that were processing the tax:

For this and other reasons, the councils were inundated with paperwork, for which they were unprepared. “Councils sat under a mountain of paper. Everything they did seemed to create more work,” wrote campaign historian Danny Burns. He quotes from the Poll Tax Legal Group:Government regulations state: “…if for any reason you consider that you are not a ‘responsible person’ please let me know and return the form to me without completing it.” Stop It wants people to take up this offer by writing to ask if they should be the “responsible person” and suggests they ask who will have access to the information supplied and why the authorities require exact dates of birth. The implementation of the tax was dependent on an accurate register and the protest campaign could make the register “wildly inaccurate,”… Labour MP Brian Wilson, chairman of [the anti-poll tax campaign called] Stop It, said: “It is a campaign of obstruction within the law that does not lead people to incur the substantial penalties that are built into the legislation.” The aim was to have the legislation amended or abandoned.

The paper-work involved with administering the charge is enormous — and likely to get worse. Backlogs switch from one area of activity to another. Indeed, local authorities cannot really do anything without generating more paper-work.

- Kate Harvey, a tax resister for women’ suffrage in 1913, once wrote: “I have just received the first demand note for this year’s taxes. I have torn it up, put it in the envelope in which it came, and re-posted it to the Tax Collector. I suppose it is now reposing in his rubbish basket.”

- The Association of Real Estate Taxpayers in Chicago during the Great Depression led tens of thousands of property owners to demand reassessments of their property, which effectively swamped the Board of Review and allowed the property owners to legally delay tax payment.