On , The Deseret News published a piece on the American war tax resistance movement:

Why They Won’t Pay

Millions of Americans are sitting up late these nights, agonizing over their financial records, fighting their way through a maze of federal regulations and puzzling over the inconsistencies of their own arithmetical prowess. They’re involved in the nation’s annual orgy of self-revelation: preparation of personal income tax returns.

For many, hours of hard labor will be crowned by the distasteful task of getting out the bankbook, figuring out whether to refinance the car or postpone that midwinter vacation and then writing a check to Uncle Sam for the amount still owed. But for a few, the culmination of the long agony of tax forms will be the pleasure of writing a little note to the tax collector, and sending that instead of a check.

The note will say simply that the author is not paying 10 per cent, or 23 per cent or 67 per cent, or all of his federal income tax as a protest against the Vietnam war. In a few months, after the exchange of some nasty notes, the Internal Revenue Service will almost certainly get its money, with interest — from the offender’s bank account, by seizing his paychecks or perhaps by selling his car. But even though the protester is clearly violating the law, there is almost no chance he will go to jail. Meanwhile, the nontaxpayer will have made his point: that he disagrees with government policy on Vietnam and that he is not voluntarily financing the war.

Estimates of how many protesters are not paying their taxes vary widely. A spokesman for the Internal Revenue Service in Washington said that in , only 583 persons who filed returns did not pay all or part of their taxes as a protest. This was out of a national total of 73,000,000. But other estimates are higher. Maris Cakars, the enthusiastic young Oceanside native who runs the New York-based Tax Resistance Project of the War Resisters League, said that he had on file 1,000 names of persons who said they refused to pay all or part of their federal income tax . Predictably, the government says the number of protesters has leveled off. The protesters say it is climbing.

A larger group has taken to refusing to pay its telephone tax — the 10 per cent federal excise tax added each month to each customer’s phone bill. This tax was continued in largely to pay the costs of Vietnam. According to a spokesman for American Telephone & Telegraph Co., about 5,600 telephone users nationwide refused to pay the tax on their bills in the third quarter of . This has remained constant since late , he said. However, Cakars said he believed the figure was closer to 10,000, while the IRS said there were 18,000 cases in . But the IRS spokesman added that many of these were repeaters — one customer who refused to pay for 12 months would be counted as 12 in that figure.

The most famous offender is folk singer Joan Baez. Since , she has been withholding roughly 60 per cent of her federal taxes, which she says is the portion of federal expenditures used to support past, present and future wars. This is in the form of the present defense budget, veterans’ benefits and interest on the portion of the national debt paid for past wars. The IRS has merely attached a lien on her bank account, and has recovered most of what she owes plus interest and penalties.

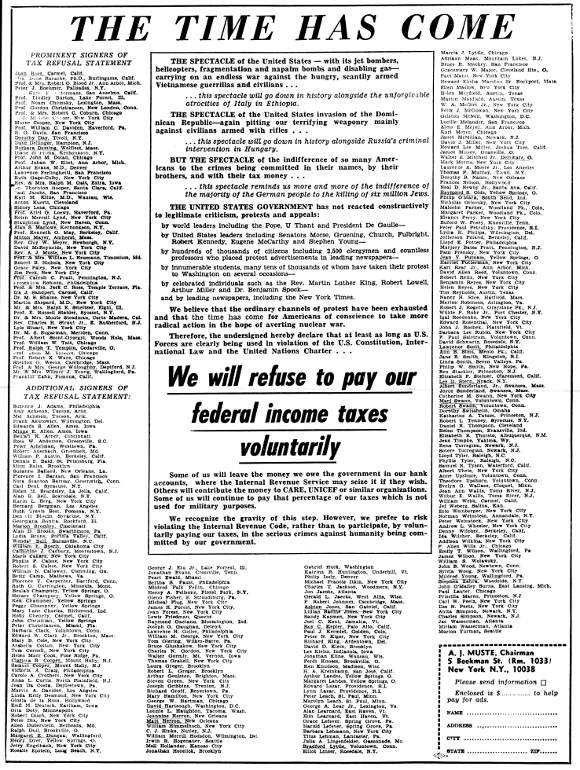

Other notables have also expressed interest in such protest. In , when Congress was initially considering levying a 10 per cent surtax which most believed was to support the Vietnamese war, 448 writers and editors signed a newspaper advertisement stating that they would not pay the surtax or any other war-designated increase. About a third also added that they would not pay the 23 per cent of the current taxes that they believed was financing the Vietnam war effort. When action on the surtax was postponed several months — past the filing deadline — the movement fell apart and no one kept any records of how many did not pay. Gerald Walker, an editor of The New York Times Magazine, who organized the protest, recently refused even to talk about the effort.

Willful failure to file a return or to pay taxes owed are both punishable by fines of up to $10,000 and jail terms up to a year. But both the government and those organizing tax resistance say that only a handful of tax protesters have spent any time behind bars since the end of World War Ⅱ. The longest period known was six months by a New London, Conn., man. He served his time not for refusing to pay taxes, but for contempt of court, when he defied a court order to tell where he had his bank account. Nobody is in jail for tax resistance at the present time, according to the IRS. The revenue service has little interest in locking up tax delinquents, a spokesman said recently. “In most cases, we have gotten the money,” he said. “All we want to do is to get the money that’s coming to us. After all, is IRS going to ask the Justice Department to go to a federal grand jury and get a jury trial to put a man in jail for a dollar, when all we have to do is go to his bank account? These people are making a protest, but most of them are doing it openly, so there’s no fraud or evasion. This way, they apparently feel they’ve satisfied their protest feelings, and we end up getting the money anyway — sometimes with added penalties.” Since Vietnam, he said, the most drastic step the IRS has taken was to seize a California man’s car, sell it and deduct the owed taxes. “He ended up buying his car back anyway,” the spokesman said.

The government, the protesters claim, is also anxious to avoid a confrontation that would produce a test case, a martyr and added publicity. “We’re anxious for a confrontation,” said Cakars. “It would help to add one more serious headache for the government while the war goes on.”

One New York lawyer, who has advised protesters on tax evasion and refusal, doubts that the government would dare prosecute protesters on a large scale. “Many people would be delighted to be put in jail for a cause like this who would not like to be put in jail for passing a red light,” he said. “But the government doesn’t want to raise the issue that someone is being put in jail for not paying $14. It’s the same reason they are so slow to prosecute for burning a draft card.” The lawyer added that any massive prosecution would tend to win sympathy for the protesters from many persons who are now neutral or apathetic. “If they become too repressive, it sounds too much like 1984,” the lawyer said.

So far, the protest movement has been limited mainly to longtime pacifists and professionals. Pacifists have been protesting the use of tax money for armaments for years. The movement was popularized after World War Ⅱ by the late A.J. Muste, clergyman-philosopher, who refused to pay his taxes . Cakars’ War Resisters League, which is one of the organizations promoting tax resistance to its mailing list of 10,000, has been in business advocating peace policies since World War Ⅰ.

Since the Vietnam war most of those who have joined the protest are professionals and intellectuals. Many are clustered around college towns, such as Cambridge, Mass., and Berkeley Calif. Professionals are particularly attracted, said Cakars, because they are often self-employed and therefore not subject to employers’ withholding their taxes.

One organizer who has hopes of expanding the protest to the middle class is Ted Webster, a self-employed publisher in Roxbury, Mass. Webster started the Roxbury War Tax Scholarship Fund, into which tax protesters have put $8,000. The money is kept in a savings account, and only Webster keeps records of how much belongs to each protester, thereby preventing the government from seizing the individual’s money. Interest goes to a scholarship for a poor Negro student.

Webster says he is not a pacifist but merely objects to his tax moneys being spent on the “boon-doggle and pork-barrel military-industrial complex.” He counts on the increasing discontent of the great bulk of U.S. taxpayers to add fuel to the protest, as more and more question the need for the present level of military spending. “I’m trying to convey to taxpayers generally that a good deal of their money is generally being wasted,” Webster said. “Americans don’t mind killing people, as long as it doesn’t cost us anything. But now it’s coming home to the middle class, who are being hit hard with taxes and getting a bit uptight about it.”

Reasons for tax resistance vary, but most of those interviewed said they were too old to refuse to be drafted, or felt they had been denied a pro-peace choice among the presidential candidates, or felt that, in accordance with the results of the Nuremberg was crimes trials, they did not want to contribute voluntarily to a government policy which they feel is immoral. E. Russell Stabler, a special associate professor of mathematics at Hofstra University who has not paid the balance due on his income tax , said: “I feel we are bound by a higher law. We cannot abide by the U.S. income tax law and at the same time avoid responsibility for criminal acts committed in our name and by conscription of our own funds.” He said that he willingly told the IRS where his bank account was, and that the money, plus penalties, had been seized each year. But at least his conscience is absolved. “It’s just a different view of patriotism from the standard one,” he said with a chuckle. “We used to offer to pay the money we owed into a special fund earmarked for constructive, peaceful purposes, but the government wasn’t interested.” Did Stabler, who is 62, ever fear being jailed? “I suppose anybody who does this runs a risk of going to jail eventually, but the government has been fairly generous about it,” he said.

Like most college faculty members, Stabler has not been threatened by his employer for his unorthodox views. There is talk among war protesters that others have had their jobs threatened or even lost them, for nonpayment of taxes. But this is difficult to substantiate because employer disapproval of an unorthodox employe can be subtle and may also be attributable to other “quirks” in the employe. Employers do, however, cooperate with the IRS by making protesters’ paychecks available for seizure — in fact they are required to by federal law.

One protester who has so far avoided all government attempts to collect his back taxes is Eric Weinberger, who is a paid worker for the Fifth Avenue Peace Parade Committee. His employer has refused to turn over his paychecks to the IRS although Weinberger has not paid anything for five years. He said he does not own a car or a house and has so little money that he does not even have a bank account that can be seized. He has been threatened with prosecution, he said, but no further action has been taken. He added with a note of resignation, “I suppose they’ll find some way to get it eventually. But they’ll have to take it. I’m a pacifist and I don’t intend to give them my money for the purpose of war.”

I’m a little surprised I hadn’t come across the name Maris Cakars before in my research. He was active with the War Resisters League and with the Committee for Non-Violent Action during the Vietnam War period, and both of those organizations were close to the war tax resistance movement of the time.

Of the other tax resisters mentioned in the article whose names I hadn’t come across before — E[dward?]. Russell Stabler, Gerald Walker, Ted Webster, and Eric Weinberger — I wasn’t able to find out much more. You can find some of Stabler’s work in mathematics on-line. Walker is mentioned in a couple of articles about the Writers & Editors war tax protest, and besides his work for The New York Times Magazine is also known as the author of the novel Cruising which was adapted into the Al Pacino movie of the same name. Ted Webster remains a mystery to me. I found a photo of an Eric Weinberger from serving up food to the homeless in front of the Bush/Quayle campaign headquarters in Boston in a “Food Not Bombs” action — perhaps the same Eric Weinberger, perhaps not.

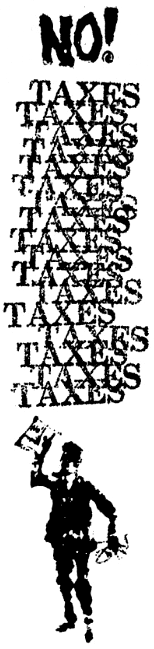

![No Income Tax For War! Now Particularly the U.S. War in Vietnam. Statement: Because so much of the tax paid the federal government goes for poisoning of food crops, blasting of villages, napalming and killing of thousands upon thousands of people, as in Vietnam at the present time, I am not going to pay taxes on 1966 income. Name ___. Address ___. [In order to withdraw support from war, particularly the savage and expanding war in Southeast Asia– Some are refusing to pay their total tax, or some portion. ☐ Some have in advance lowered their income so as to owe none. ☐ (for our information, would you like to check which form of nonpayment you are following?) NOTE: There are laws which (although not usually applied to principled refusers) cover possible fine and jail term for non-payment of a legally-owed amount.]](noIncomeTaxForWar.png)