The Progressive, in , carried an article from Milton Mayer about tax resistance:

If You Want Mylai, Buy It

Young men are a dime a dozen. What the Army wants is a dime to buy a dozen young men with.

Either give them the dime or don’t give them the dime — but stop asking, “What can an old man do?”

April 15 is the date. April 15 is the date you turn over a quarter of your income to Behemoth, and half to three-quarters of what you turn over goes to the Army to buy a dozen young men to populate (and depopulate) Perforation Paddy. “I sent them a good boy,” said Private Meadlo’s mother after Mylai, “and they made him a murderer.”

If you want it, buy it. If you don’t, don’t. But stop asking, “What can an old man do?”

If, like me, you had a good year and made more than $625 in , the Internal Revenue Act requires you to file an income tax return. If you refuse (rather than evade) the requirement to file, you are still a felon, but you should notify Behemoth and all its minions lest you be hanged for the wrong reason. (The Act simply punishes “failure to file” and “failure to pay”.) I shouldn’t refuse to file, myself, but better men than I have taken the position that filing is more than a formality; the best of them, A.J. Muste, always filed an appropriately marked Bible instead of a return.

So, too, as the antics proceed, you will be asked (unless you have a readily attachable pay-check) where you stash your money so that Behemoth’s little boys in blue can go and get it. Here again I should comply, myself, lest Behemoth get the impression that I am playing a cat-and-mouse (or mouse-and-cat) game. But this decision, too, like whether or not to file a return, is probably a matter of temperament.

The purpose of taxation is to enable people collectively to buy what they want. Sometimes when some of them want a little something special and some of them don’t — for instance, throughways financed by tolls — those who want them pay for them and those who don’t want them don’t. But Mylai is financed by the general fund of the Treasury, on the assumption that everybody wants Mylai. Behemoth has no way of knowing that the assumption is false unless those who don’t want it refuse to buy it. A vote for Nixon (or Humphrey) or Johnson (or Goldwater) is a vote for Mylai. (“It was murder. We were shooting into houses and at people — running or standing, doing nothing.” — Sergeant Charles Hutts.)

The nation-state is not merely fallible; it is, as every Judeo-Christian (or Christeo-Judean) schoolboy knows, unholy because it divides the family of man into we and they. Only men are, or may be, holy in a world of nation-states, and they dare not perform an unholy act to preserve such an institution. Still the conscientious tax refuser is a conscientious citizen of the nation-state. He would gladly pay his taxes for the things all the people in it (including him) want. In Norway (in this respect the only even halfway civilized country in the world) the conscientious citizen may have his tax payment segregated for the support of the United Nations if he does not want to buy Mylai.

Bucking always for salvation, the conscientious citizen is nevertheless up against some serious objections to his refusal to send a dozen young men to the edge of the ditch in Mylai. The objections appear to be six in number:

Objection 1: The legal penalty of five years in stir and/or a ten-thousand-dollar fine. The U.S. Government has not yet pressed for the penalty in any case of tax refusal that I know of — partly, I suppose, because Behemoth does not know what to do about conscience, partly because the use of force, violence, and other lawful means of penalizing conscientious people always increases their number. (Better pretend they’re not there — up to a point.)

But the number is increasing anyway, and it is not unlikely that it is approaching that point. When it is confident that it has got its Haynsworth-Carswell Court, Behemoth may feel constrained some one of these days to press for the penalty. The tax refusal movement, for twenty years amorphous, is now coordinated by War Tax Resistance, whose address, I am reliably informed, is 339 Lafayette Street, New York, N.Y. 10017, and whose telephone number (212‒477‒2970) was discovered in the Manhattan telephone directory by a task force of forty FBI agents led personally by J. Edgar Hoover. Desperado Bradford Lyttle of WTR reports 181 active refusal centers across the country and estimates 15,000 refusers in .

Answer to Objection 1: There are worse things than losing five years and/or ten thousand dollars, and Mylai is one of them.

Objection 2: The loss of job or reputation. Ten years ago (even five) many tax refusers lost jobs (or failed to get them) as a consequence of the invariable FBI “inquiry.” That’s less likely (but only less likely) now. Loss of reputation, on the other hand, has never appeared to be consequential; I have never known anybody to the left of Orange County, California, who thought that a tax refuser was anything worse than crazy, and even in Orange County they hate taxes.

Answer to Objection 2: There are worse things than losing a job (though that is easier for a light-fingered clown like me to say than it is for an honest workingman).

We proceed now from the nuts-and-bolts to the nitty-gritty, as follows:

Objection 3: Tax refusal is ineffective because “they” get the money anyway (by force, violence, or other lawful means).

Answer to Objection 3: True, true; but, then, so is everything else ineffective (including two victorious world wars to save the world for democracy). To man, all things are impossible. If whatever you do is ineffective, you might as well buck for salvation and do what is right.

Objection 4: Tax refusal is illogical: If you refuse to pay half your income tax, half of what you do pay will be used for Mylai, as will more than the other half (since Behemoth, when it seizes the other half by force, violence, and other lawful means will also seize twelve per cent per annum interest on it).

Answer to Objection 4: This is true only if logic is a brance of effectiveness — and even then it is only half true. Behemoth will lose money on the deal because it will have to spend more to collect it than it gets. In one instance I know of, where the refuser took his case “on up,” it must have cost $25,000 in salaries and travel expenses of Treasury and FBI dicks, district attorneys, assistant attorneys-general, judges, and court attachés to collect and hold on to $32.27 (and the refuser took his own expenses in the case as a tax deduction). It is true, none the less, that in the end Behemoth will get all the money it wants for Mylai, by raising this tax rate if necessary.

But there is another, and more significant, logic: the logic of symbolism (not to be confused with symbolic logic). The only action a man can take against the nation-state is symbolic. He can not prevent its depredations but only repudiate them persistently in the hope of (a) salvation and (b) the sympathetic infection of his fellow-citizens. It is not logical symbolically (for instance) to bomb the ROTC building, because people sympathize with the victim of a bombing, and, besides, Behemoth has all the ROTC buildings it wants and is always eager to build new ones and add the building costs to its Gross National Product billboard. (The Army doesn’t need ROTC buildings or ROTC except as a symbol of militarism; no European army would dare ask a university to disgrace itself by letting its students be marched around the premises.) What is logical symbolically is for students to sit nonviolently in front of the ROTC building and be hauled violently away. Tax refusal is logical symbolically.

Objection 5: Tax refusal is a disavowal of representative government.

Answer to Objection 5: It is, if, and only if, by representative government is meant majoritarianism and not representation at all. If you are an American citizen and you do not want Mylai and won’t buy it, you are not represented. The Congressmen (including the Senators) who deplore Mylai all buy it, without exception. The last one who wouldn’t was Representative Jeannette Rankin of Montana, who voted all alone against the second go-around of the War to Make the World Safe for Democracy. The conscientious citizen who does not want Mylai and will not buy it is driven to self-government by the failure of representative government to represent him.

Objection 6: Tax refusal is anarchy, and anarchy is the worst thing that can befall society.

Answer to Objection 6: Anarchy is not the worst thing that can befall a society; it is the second worst. The worst is tyranny, and the worst tyranny is self-evidently that which requires the innocent to kill the innocent. (“I love women. I love children, too. I love people.” — Lt. William L. Calley.) He who does not want and will not buy tyranny must, like George Washington, take his chances on anarchy.

So hopelessly unholy is the nation-state that it drives the conscientious citizen to anarchy and then accuses him of driving it to anarchy when he tries to disengage himself from its tyranny. In the interesting case of the $32.27 cited above, Attorney Francis Heisler was arguing for the refuser before the U.S. Circuit Court of Appeals, and one of the judges said to him: “Counsel, is your client aware that if this Court holds in his behalf the Court itself will be laying the axe to the root of all established government?” “I think he is, your honor,” Attorney Heisler replied.

The objections considered, we proceed to the obstacles. There is only one that appears to be insuperable: withholding, the worst crime ever committed against liberty by a good man. When Beardsley Ruml thought up “pay-as-you-go,” everybody cheered except the company bosses who had to do the detestable New Deal’s detestable bookkeeping for it. (Anybody remember when the Connecticut manufacturer, Vivian Kellems, led the Old Guard attack on Social Security by refusing to make the employe deductions?) Under withholding, most of the people who don’t want to buy Mylai have already had it bought for them by April 15. They can sue to recover — some have — but nobody has made it to the Supreme Court yet. Others reduce or eliminate the withholding by claiming excess dependents (the whole population of Vietnam, for instance) in calculating their estimated tax. Again, I suppose, a matter of temperament, and mine doesn’t happen to run that cat-and-mouse way — though their cause is just, and we have indeed made the whole population of Vietnam our dependents.

A few religious organizations — not the churches, of course — have refused to withhold the tax from the pay of their employes who do not want to buy Mylai. The most respectable of them is the American Friends Service Committee, with which I confess to being associated. (Personally leading a task force of eighty FBI agents, J. Edgar Hoover discovered the association by looking in the Philadelphia telephone directory, so there is no point in my denying it.) But the AFSC has a task force of eighty Philadelphia lawyers, and one of these years a test case will go to Washington. Meanwhile, however, the conscientious citizen who waits for a test case will go on buying Mylai until the whole of Vietnam is a ditch.

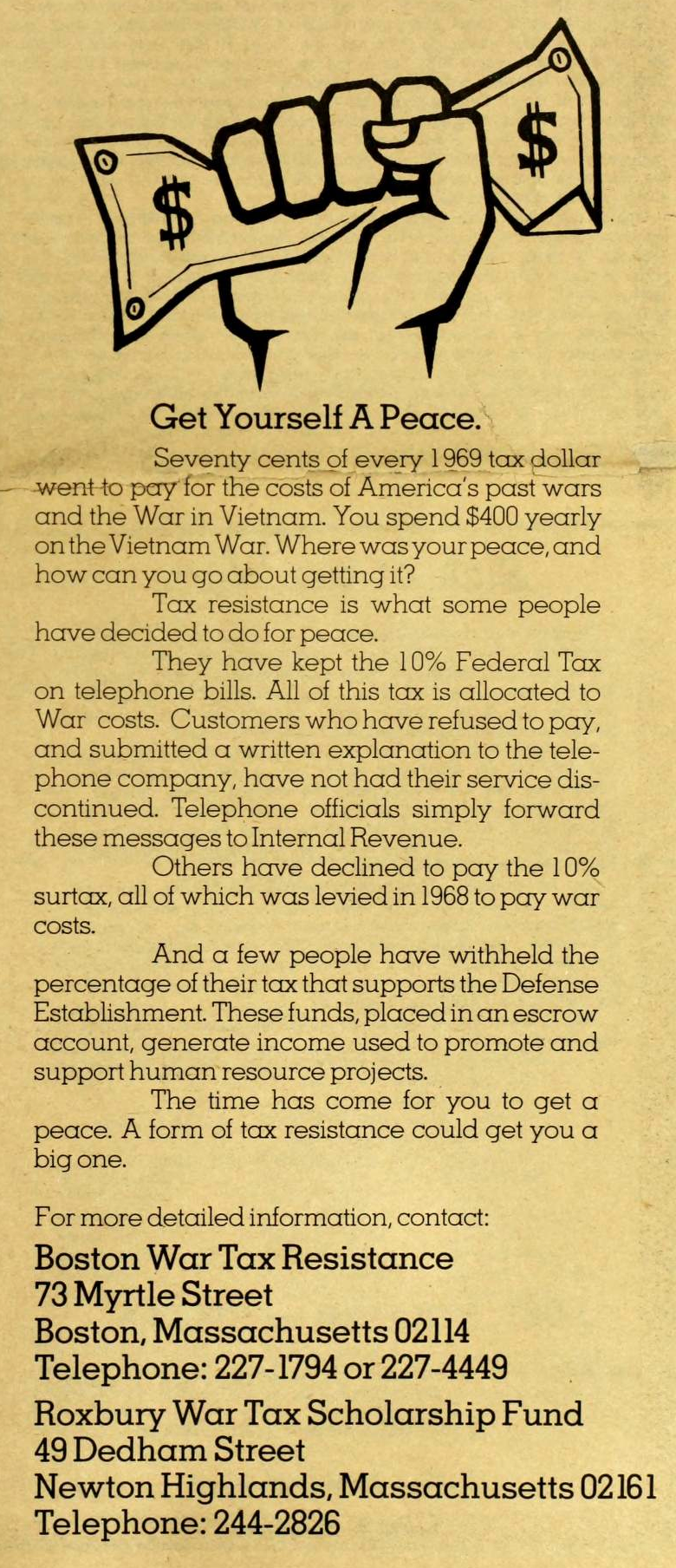

A few years ago a new form of refusal got rolling, available to people trapped by withholding. This was non-payment of the telephone tax (which goes into the general Treasury), on the ground that Chairman Mills of the House Ways and Means Committee had argued its necessity for continuance of the war against Mylai. I’m uneasy about the telephone tax refusal myself; again, I suppose, a matter of temperament. There seem to me to be two visible arguments, and one invisible, against it.

First, I can not bring myself either to do or not to do anything on the bases that what a Congressman says is true. And second, it seems to me that if you are going to fight City Hall you should go for the jugular. The income tax is the jugular. The telephone tax is one of those petty excises, no more significant fiscally, and no more to be singled out, Congressman Mills to the contrary notwithstanding, than the whiskey, movie, or airplane tax.

But the invisible, base-of-the-iceberg, stem-of-the-martini-cherry argument for paying the phone tax is, I’m afraid, one of craven convenience. If Behemoth were to put me in jail for five years for income tax refusal, I’d refuse to pay my telephone tax instantly. But living where and how I do, running a little back-bedroom sweatshop out in the country, I can’t make it very well (still worse, very sick) without a telephone. Discussing telephone tax refusal with some of my anarchist friends, I have discovered that some of them were for it because they didn’t feel quite up to going to the mat on the income tax, and still others because they understood that the telephone company, like Vivian Kellems, was no more enthusiastic about collecting the Mylai tax than they were about paying it and would not jerk the phone out for non-payment of the tax.

This last seemed to me to be a misreading of history. Unlike Vivian Kellems and the American Friends Service Committee — Right and Left united across the years by the mounting terror of the Middle — the telephone company has no principle except money; and Behemoth’s agent, the Federal Communications Commission, is where the money is. In the Communist countries like Spain and Greece and, come to think of it, every other country in the world, the post office operates the telephone and telegraph systems, whose profits subsidize the carrying of the mails; in the only truly free country in the free world the money-losing branch of the communications system is communized and the money-making branches are Government-protected private monopolies.

But telephone tax refusal caught on until, according to the calculation of War Tax Resistance, there are now more than 100,000 practitioners of it. For a couple of years nobody did anything about them. But reports have begun to filter in of Government agents swarming over refusers and, more ominously, of the jerking of telephones by the company on behalf of its protector, the Government. As the reports spread it may be anticipated that there will be a falling-away of telephone tax anarchists, as, I suppose, there will be of income tax anarchists when Behemoth decides that they are getting to be too much of a nuisance and starts throwing them into the pokey.

Until that time the only obstacle (not objection) to income tax refusal, other than withholding, is the harassment it entails. The smart way to live alongside Behemoth is not to attract his attention, and whoever attracts his attention is in for it. Twenty years ago he was paying his harassers $40 a day. It must be $80 now, or $100; there is nothing niggardly about Behemoth.

He sends two kinds of harassers around. The first is a ritualistic cut-out character whom it’s a positive pleasure to be harassed by. He is the warm handclasp type, around thirty-five and running to pudge from running around in his down-payment Impala. He wants to have a little talk with you.

“Homyonum’s the name, Mr. Murgatroid, from the Internal Revenue Service.”

(Warm handclasp.)

“Sit down, Homyonum, sit down, and tell me what I can do for you.”

“To be perfectly frank, Mr. Murgatroid, I think that I may be able to do something for you.”

“Well, now, Homyonum, that is nice — I never expected the Internal Revenue Service to do something for me. Do sit down and have a nice glass tea.”

(He will, and he does.)

“Mr. Murgatroid, we of the Treasury Department are actually your agents. We are here to help you.”

“How sweet of you, Homyonum. One lump or two?” (Two.)

“Mr. Murgatroid, I want you to know that I respect your position, but I think you are ill-advised to refuse to pay your income tax.”

“Homyonum, my boy, your advice is ill. Milk? Lemon?” (Milk.)

“I beg your pardon, Mr. Murgatroid?”

“Not at all, and do let me tell you why your advice is ill. If my position is, as you say, respectable, then yours is not, since the two positions are contradictory. Do you follow me?”

“I —.”

“What I am trying to tell you, Homyonum, since you respect my position, is that you are trying to tell me that I ought not to pay my income tax and neither ought you. You do want to be respectable, don’t you?”

A little more of this standoff, a warm handclasp, and Homyonum is gone wherever such people go nights and is seen no more. He makes his report, the report spends two or three months going through channels, and then Behemoth hands one of his judges a distraint warrant to sign and sends one of his blue-boys around to attach your unattached property (money in the bank, wages coming in, shoes off your feet) in the amount in which you are delinquent in buying Mylai.

The other kind of harasser is another glass tea entirely. He is tall, sallow, dour, ulcerated: a certified public accountant who doesn’t know anything about your income tax refusal (he says), but has been sent to audit your return. “I suppose,” he says, “that your name came up on a spot check. Of course you have all your records and a receipt for each expenditure — if I may just look at them.” At the end of two weeks, at $40, $80, or $100 a day, reducing the Gross National Product by that much, he has discovered that you owe Behemoth $1.14 (or Behemoth owes you $1.14; that’s not the point of it at all) and you and your back-bedroom are a shambles.

He turns up the next year, on the dot, to do it all over again, and then you know he is lying about the spot check (and even he beginst to suspect he is). Meanwhile, he has converted you into a fox. You spend half your life (at $40, $20, or $10 a day) keeping records of your expenditures. You spend the other half of your life like the mouse you were not going to play in the cat-and-mouse game, scurrying for loopholes down which you can hurry. You end up beating your wife, cursing your children, and, of course, kicking the cat. And that, not the $1.14, is the point of it. If Behemoth can make your life unbearable, you will buy Mylai.

It is the very devil to be harassed, but what did you expect — a valentine from Mrs. Mitchell? It’s like (or even as) Give-’Em-Hell-Harry used to say: If you can’t stand the heat, stay out of the kitchen. You harass them, and they harass you back, and they’ve got the big battalions on their side. (You know Whom you’ve got on yours.)

And you harass them back and they harass you back. Who said ineffective? Behemoth has the whole country, the whole world, computerized to take care of everything — everything but one man who says, No, sir, instead of Yes, sir. It takes one (count ’em, one) man to obstruct the machine by introducing the human element into it. The grind-organ monkey is suddenly a monkey-wrench. I put it to you: What more can an old man do? The machine has not been built yet, and won’t be, that does not come down with the gripes while it digests a human being.

Mind you, I am not advocating income tax refusal; not I. For all I know the advocacy itself constitutes a felony, especially if it creates a clear and present danger that the Army won’t be able to buy a dozen young men with machine guns at the edge of the ditch in Mylai. Operating on a very low and cautious level, I say unto you only, Give them the dime or don’t give them the dime — but don’t ask, “What can an old man do?” If you want Mylai, buy it; if you don’t want it, don’t. That’s the free enterprise system, and do you believe in the free enterprise system or are you some kind of a Communist?

Operating on the highest level of all, under a law that even the Supreme Court (Girouard, etc.) admits is higher than the Internal Revenue Act, Jesus Christ was asked by the Pharisees whose the tribute money was, and you know what he said and you know that he said it perceiving their wickedness. (Matt. 22:18.) If you have to choose between Christ and the Pharisee who, like the Pharisee of old, occupies the highest seat in the Temple, you are in a tight spot. I’d play it safe myself: Better to do time than eternity.

A biographical note accompanying the article says that “Mr. Mayer began his own tax refusal adventures more than twenty years ago. (He is the anti-hero of the $32.27 case he cites in this article.)”

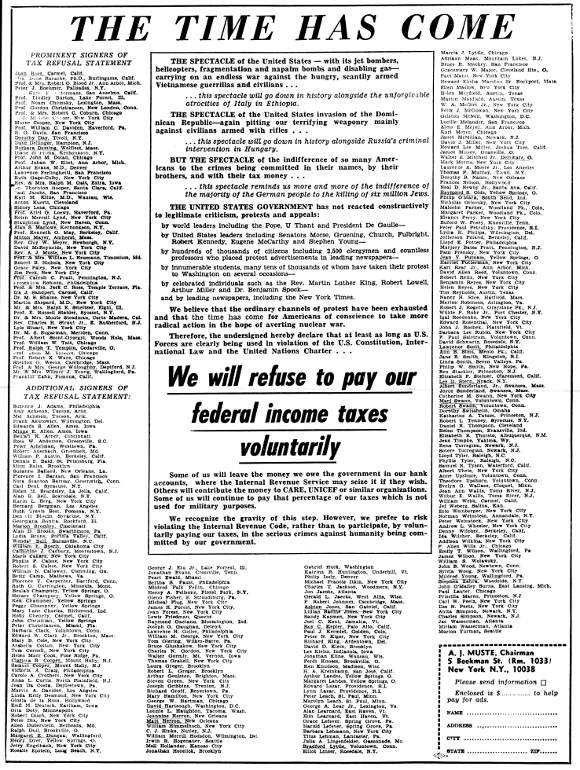

![No Income Tax For War! Now Particularly the U.S. War in Vietnam. Statement: Because so much of the tax paid the federal government goes for poisoning of food crops, blasting of villages, napalming and killing of thousands upon thousands of people, as in Vietnam at the present time, I am not going to pay taxes on 1966 income. Name ___. Address ___. [In order to withdraw support from war, particularly the savage and expanding war in Southeast Asia– Some are refusing to pay their total tax, or some portion. ☐ Some have in advance lowered their income so as to owe none. ☐ (for our information, would you like to check which form of nonpayment you are following?) NOTE: There are laws which (although not usually applied to principled refusers) cover possible fine and jail term for non-payment of a legally-owed amount.]](noIncomeTaxForWar.png)