War tax resistance in the Friends Journal in

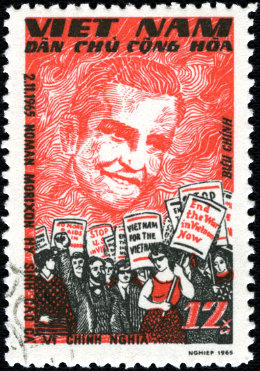

On , a 31-year-old American Quaker named Norman Morrison went out to the sidewalk in front of U.S. Secretary of Defense Robert McNamara’s office in the Pentagon, doused himself in kerosene, and set himself on fire as a protest against the American war on Vietnam.

His suicide stunned the Society of Friends and made more urgent the already percolating questions about the moribund Quaker peace testimony and how much Friends were willing to put on the line for it.

This is reflected by the increased attention given in the pages of Friends Journal in to the issue of war tax resistance.

In , a “Friends’ Conference and Vigil on the War in Vietnam” asked the “Friends Coordinating Committee on Peace… to prepare a bulletin urging Friends to consider how paying taxes and buying war bonds involved them in financing the military.”

A number of Quakers signed a “No Taxes for Vietnam War” tax refusal vow that was organized by Maurice McCracken’s “No War in Vietnam Committee.” These included, according to the issue of the Journal, “Franklin Zahn, Bob and Marj Swann, Arthur Evans, Bradford Lyttle, Johan W. Eliot, Staughton Lynd, Wilmer Young, George and Lillian Willoughby, and Marion C. Frenyear.”

The lead editorial in that issue was entitled “To Pay or to Protest?” and the author was determined to give no definitive advice on either side of that question. The editorial begins by stating the case for Quaker taxpayer misgivings, then moves on to note that “a few pacifists” have been resisting, and to claim that “this year the number of tax-refusers will be far greater than ever before,” while other taxpayers who share their misgivings are either unwilling to take on the risks of tax resistance or believe that such an action amounts to “dodging the law and leaving someone else to carry a burden which they themselves will not assume.”

The editorialist then quotes from a letter written by a resisting employee “to her employing group” (why so coy about which group?) in which she writes that while she would be happy to “pay twice as much as required by the present law” for the more benign things the government buys, “I cannot bring myself to furnish money to be used in a way that will bring death to fine young American boys and men and also to Vietnamese men, women, and children.” If “the employing group” were to cooperate in her request to stop withholding income tax from her salary, the editorialist wonders, “[w]ill it (or its members) be penalized?”

This is another strange example of the Journal taking an issue that was obviously a direct concern to Quakers and to Quaker Meetings, and trying to abstract it and cast it off into the distance somewhere in order to consider it dispassionately and indecisively.

From here the editorialist compares the Quaker war tax resister of today to the Quaker abolitionist “in the years before the Civil War when some members wanted to give all-out aid to the cause of abolition while others counseled caution, advocating strict adherence to the letter of such laws as those requiring fugitive slaves to be returned to their masters.”

Nowadays we tend to view with shame the historical evidence that all Friends did not work wholeheartedly for the abolition of slavery; will the time come when the Friends who follow after us have a similar feeling about those of their predecessors (including the present writer) who lacked the courage to resist conscription of their dollars to do the killing that they themselves refused to do?

After a quick detour through “There are those who say… there are others who counterargue…” territory, the editorialist recommends that people interested in tax refusal contact the Committee for Nonpayment of War Taxes or the Peacemakers, and gives their addresses.

Finally, there is a brief nod in the direction of war tax resistance being a time-honored Quaker practice. The editorialist mentions that Franklin Zahn has authored a booklet on “Early Friends and War Taxes,” which includes the quote that ends the editorial, from the letter sent by John Woolman & co. to their fellow-Friends in :

Raising sums of money [for] purposes inconsistent with the peaceable testimony we profess… appears to us in its consequences to be destructive of our religious liberties; we apprehend many among us will be under the necessity of suffering, rather than consenting thereto by the payment of a tax for such purposes.

In the issue, an article about a Quaker movement in which people voluntarily taxed themselves 1% of their income for the support of the United Nations began this way: “All Friends, whether or not they would refuse to take up arms, are caught up in the military machine through payment of Federal income tax.” This seems to indicate that there was still a blind spot that was making it difficult for some Quakers to even see the various alternatives to paying the federal income tax.

A report on the Philadelphia Yearly Meeting in the same issue noted:

After consideration, the Yearly Meeting concurred with the concern of the Friends Peace Committee that fresh attention be given to the effort to devise a formula acceptable to the Internal Revenue Service and to Congress, which would permit persons to withhold that proportion of their income taxes applicable to military purposes and apply it to constructive purposes of government. Because a Monthly Meeting secretary and a youth worker for the Peace Committee have asked their employers to cease withholding income tax from their salaries, the problem is being thrust upon the Yearly Meeting. Friends, whatever their judgments about a particular action, are sympathetic toward those who engage in it for reasons of conscience.

In furtherance of its concern… the Friends Peace Committee received authorization to seek personal conferences with officials of the Internal Revenue Service to acquaint them with the basis and reality of the concern to refuse payment of taxes for military purposes. Perhaps such conversations may increase understanding on the part of the officials and may enable them, while carrying out their duty and enforcing the law, to understand and respect the refusers.

A conference at Pendle Hill “on the search for peace” in , concerned the “basic question… [of] whether the militaristic society in which we all live could be influenced through techniques of reason or whether religious pacifists, in their deep alienation, should rather seek a more radical strategy of protest.” At one point, according to the coverage in the issue of the Journal, William Davidon “spoke frankly and clearly on the moral philosophy behind his refusal to pay those taxes which, he felt, would support the war in Vietnam.”

Martin A. Klaver contributed the lead editorial in the issue — “More on Tax-Refusal” — which is worth reproducing completely here as a good overview of the issue of war tax resistance as it stood at that time:

“Friends Journal,” writes John R. Ewbank, patent attorney and a member of Abington Meeting, Jenkintown, Pa., “might well mention the ‘mildest form of tax-refusal for Milquetoasts’: the refusal to pay the federal tax on telephone usage when billed for it. The telephone company can carry the accumulated unpaid tax until it equals the deposit, and then assess a charge for nominal discontinuance and reconnection, so that the penalties for prolonged persistence are paid to the phone company instead of to the government. How long it is worth while to carry the protest is a matter of individual judgment…”

For nearly a hundred years, John Ewbank adds, Americans have not been faced with a levy so conspicuously labeled “war tax” as this revived tax on telephone usage. According to his letter to the telephone company, “The publicity connected with the telephone tax has been so specifically related to the Vietnam war, and I am conscientiously so opposed to the Vietnam war, that my payment herewith omits the $1.03 federal tax. There are so few opportunities for protest — even feeble, futile protest — that [this] becomes one of the few available gestures.”

For Milquetoasts or not, feeble or not, the gesture is a form of civil disobedience differing more in degree than in kind from refusal to pay the federal income tax — or that part of it that goes for war. It seems a little unfair to make it at the expense of the telephone company, which is thereby put to added trouble and expense, if only in its bookkeeping department, but it is a protest.

This year, it appears, the thin ranks of those refusing to pay income taxes for reasons of conscience were somewhat augmented. An release from the office of A.J. Muste cites a statement signed by 360 persons, declaring that they would refuse to pay taxes voluntarily as long as United States forces continue to be used “in violation of the U.S. Constitution, international law, and the United Nations Charter.”

The release says that some signers are leaving the money they owe the government in banks, where the Internal Revenue Service can seize it, while others will contribute it to CARE, UNICEF, or similar agencies. It also notes that, according to the Internal Revenue Code, “willful refusal to pay taxes may be punished by jail sentences of up to one year and fines as high as $10,000.”

This is not tax-refusal for Milquetoasts, although in the past fines and jail sentences have been rare indeed. The law is enforced by placing a lien on the tax refuser’s property or attaching his salary. There have been a number of instances where actions instituted against individuals were simply dropped. But if tax-refusal should reach important proportions, the present seemingly casual attitude might change; the IRS might decide that it must do something to show that it is not virtually inviting more and more trouble.

Philadelphia Yearly Meeting was concerned this year with the problem posed by employes of two Quaker groups who have asked their employers not to withhold federal taxes from their salaries. The Yearly Meeting’s Peace Committee is not only seeking a solution to this problem but is also seeking special conferences with Internal Revenue Service officials to acquaint them with the reasons why some Friends refuse to pay their taxes.

During the Yearly Meeting’s discussion it was brought out that Friends Committee on National Legislation for some time has been exploring the possibility of drafting legislation in this area making it possible for Americans who have conscientious objections to having their property used for war to pay equivalent taxes for other uses. A number of congressmen have been receptive to the idea, but so far no formula has been found that promises to attract the necessary support.

Meanwhile most Quakers (like this one) pay their income taxes (including the reimposed telephone tax) without a murmur. But there is a consensus on a fundamental: Friends’ basic belief that in matters of conscience each individual must choose his own course. If that course brings him into conflict with government, he must decide for himself what he must do: obey in silence, obey and at the same time protest, or resort to civil disobedience of one kind or another. Whether any government can grant any of its citizens the “right” to violate any of its laws is open to debate. The citizen can hardly lay claim to such a right, yet when he feels that he has a duty to break the law, when he says, “God helping me, I can do no other,” then we must accord him our respect.

The issue noted that “two young Quaker workers… have voluntarily taken drastic cuts in salary rather than pay taxes for war in Vietnam.” The two were John L.P. Maynard and Robert W. Eaton, who reduced their incomes to the maximum allowable before federal income tax withholding began — something on the order of $75 per month.

The Conservative branch of the Ohio Yearly Meeting met in . According to William P. Taber, Jr.’s report on the meeting, “we asked our members to consider supporting tax refusal and the sending of aid to the civilians of all Vietnam.”

On the other hand, at the Westerly (Rhode Island) Monthly Meeting, the message was more mixed: “Many Friends feel that not to pay their taxes is disrespect for the law, breeding anarchy. Yet they deplore the fact that their tax money is being used to prosecute a morally indefensible war in Vietnam.” The best they could come up with was to approve a suggestion that Friends accompany their tax payments with a statement of protest.

The pseudonymous history columnist “Now and Then” took up the issue of war tax resistance in the issue:

A scruple against paying taxes which directly or indirectly support war has had a long if sporadic history among members of the Society of Friends. It received official support in London in when decision was made that fine or punishment for such refusal could be reported by the meeting in the annual listing of “sufferings for Truth.” At Philadelphia Yearly Meeting every year lately this concern has been voiced by individuals. In the Meeting went so far as to authorize some minor action on the subject, including a delegation to visit the Internal Revenue authorities and to explain the tender conscience of the increasing number of Friends who refuse part or all of their Federal income tax.

The most intensive consideration of the matter among the Meeting’s membership appears to have occurred more than two centuries ago. Before the Pennsylvania Assembly was asked by the mother country to supply men and funds for British military enterprises in the colonies. The Quaker legislators, when they complied, did so uneasily, with the excuses that it was for defense or that the money was voted nominally for the sovereign’s use and that they were not responsible for what use the king (or queen) chose to make of it. They also accepted as a permanent unqualified mandate the words of Jesus, “Render unto Caesar the things that are Caesar’s.” Sometimes Friends distinguished as acceptable mixed taxes and as unacceptable those taxes that were definitely labeled for war.

We are indebted to John Woolman’s Journal (Chapter Ⅴ) for an account of the exercise that arose in Philadelphia Yearly Meeting both in and in . In the former year a committee was appointed which issued an epistle expressing the feeling that “the large sum granted by the late act of Assembly for the King’s use is principally intended for purposes inconsistent with our peaceable testimony,” and that “as we cannot be concerned in wars and fightings, so neither ought we to contribute thereto by paying the tax directed by the said act, though suffering be the consequence of our refusal.” Woolman speaks of the conference on the subject “as the most weighty that ever I was at.” There was not unanimity in the group. Some who felt easy to pay the tax withdrew, but twenty-one substantial Friends subscribed the epistle; they included John Woolman, John Churchman (who also mentions the matter in his Journal), Anthony Benezet, John Pemberton, and Samuel Fothergill, an English public Friend visiting America.

In the Yearly Meeting of the matter was opened again, and a committee of about forty Friends were appointed to consider “whether or no it would be best at this time publicly to consider it in the Yearly Meeting.” Visitors from other Yearly Meetings — including John Hunt and Christopher Wilson from England — were asked to join the committee. The decision was negative. There was difference of opinion on the subject, and “for that and several other reasons” the committee unanimously agreed that it was not proper to enter into public discussion of the matter. Meanwhile it recommended that Friends of differing opinions “have their minds covered with fervent charity towards one another.” One wonders why the different result from two years before and what were some of the “other reasons.”

Part of the answer, I think, is to be found in a letter to John Hunt and Christopher Wilson, sent to them by the Meeting for Sufferings in London. This letter is dated and is signed by Benjamin Bourne, clerk. I shall quote it as I have copied it from the manuscript minutes of the Meeting. It falls in date between the two Philadelphia Yearly Meetings described above, at the second of which Hunt and Wilson were present and in a position to transmit the urgent advice of London Friends.

The main purpose of their mission to Pennsylvania, as is well known, was to prevent the home government’s proposed requirement of an oath for members of the Assembly by asking Friends to refuse to run for election. The British Friends asked the government to let them attempt first to bring about the purging of the Assembly of Quakers. In this they succeeded to the extent that most Friends withdrew from the Assembly; thus the threat was averted. Evidently the same pressure was exercised to encourage Friends to pay provincial war taxes to the British crown and particularly not to publicize their scruple against paying them. But neither the minutes of Philadelpha Yearly Meeting for (under ) nor its epistles — whether to London Yearly Meeting or to its own members — are so explicit as the letter. After repeating the primary commission to the English delegates to try “to prevail on Friends in Pennsylvania to refuse being chosen into Assembly during the present commotions in America” and “to make them fully sensible of their danger, and how much it concerns them, the Province, and their posterity to act conformably to this request and the expectations of the government,” the letter continues:

And as you will know that very disadvantageous impressions have been made here by the advices given by some Friends against the payment of a tax lately laid by the provincial assembly, it is recommended in a particular manner that you endeavour to remove all occasions of misunderstanding on this account, and to explain and enforce our known principles and practice respecting the payment of taxes for the support of civil government agreeable to the several advices of the Yearly Meeting founded on the precept and example of our Saviour.

May that wisdom which is from above attend you in this weighty undertaking, and render your labours effectual for the purposes intended that you may be the happy instruments of averting the dangers that threaten the liberties and privileges of the people in general and restore and strengthen that union and harmony which ought to subsist in every part of our Christian Society.

Two brief lists were delivered with the above letter: extracts from London Yearly Meeting minutes of , , , , and , in which the payment of dues to the government is inculcated; and titles of Acts of Parliament, seven chapters in four Acts from the reigns of William and Mary and Queen Anne, “wherein it is expressed that the taxes are for carrying on a war.” The final phrase was to leave no doubt that English Friends encouraged no escape on the ground that a Quaker conscience could assume the doubtful or peaceful purpose of the legislation.

The grounds on which the scruple among Friends was silenced in are clear. Friends had long paid such taxes and wished to obey the laws. If Pennsylvania Friends refused to vote for them as assemblymen or to collect them as tax collectors or to pay them as subjects, the liberties enjoyed in the colony, such as permitting affirmations in place of oaths, would be terminated. The exhortations in the gospels and New Testament epistles in favor of paying Caesar his dues were applicable. The early Quaker examples of civil disobedience in other matters were forgotten, and the relevance of the continuing Quaker testimonies against personal participation in war and against the payment of tithes was not cited. In the latter area Friends were resolutely against payment and suffered ruinous distraints. Evidently dues for the support of “hireling ministers” seemed more obnoxious than taxes for the prosecution of war. If Colonial Friends disagreed with the practice of Friends in England or even with one another they would expose the Society to disharmony.

When Woolman’s Journal was reprinted in England in the whole section on paying or not paying taxes was omitted, but in America the problem already was taking a different form. Friends and others had opposed taxation without representation when the Stamp Act was passed in . With the outbreak of the Revolution the issue was one of using continental currency or of paying taxes to support war against Great Britain. This, many American Friends (like Job Scott) and Meetings were willing openly to oppose.

The New York Yearly Meeting issued a statement “on the tragic situation in Vietnam,” saying that it represented “a supreme test” to “the spiritual vitality of the Religious Society of Friends.” The statement, reprinted in the issue of the Journal included this point:

- We call upon Friends to examine their conscience concerning whether they cannot more fully dissociate themselves from the war machine either by tax refusal or by changing their occupations.

The issue noted that “the newsletters of several Friends’ organizations” are encouraging their readers to “protest your telephone war tax” but also suggests that in some cases the protest was a pretty pathetic one: “Stickers saying ‘The Vietnam War Tax Included in This Bill Is Paid Only Under Protest’ are available from the American Friends Service Committee.”

The following issue included a letter-to-the-editor from Franklin Zahn in which he encouraged a more practical approach: “Each month I pay all of my phone bill but 7 percent, informing the company it is against my conscience to pay the direct war tax. For five months the company added the unpaid balances to each new bill, then wrote it was referring the unpaid total to Internal Revenue Service and wiping my bill clean of debt… How will Internal Revenue handle this? Past experience with unpaid income taxes indicates IRS may ask for payment but make no bank account seizure until the amount totals more than $5, at which time it takes an extra 6 percent (per annum) as fine. Not paying direct war taxes is part of Quaker peace testimony. Don’t pay for a wrong number.”

Franklin Zahn

We’ve encountered Franklin Zahn before. He was listed as the contact person for “a leaflet on tax refusal” in a issue, and also something described as “the historical material” on the subject — “Early Friends and War Taxes” (perhaps the same leaflet).

Here is some more of his work:

- In the issue, he responded in a letter-to-the-editor to an article that apparently suggested “that Friends drop their middle-class attitude of changing law and join the less privileged whose only method has been evading law.”

Zahn responded:

A basic test for conscience is the categorical imperative: What happens if everybody else did the same? For [draft] evasion, I can see only the tightening up of conscription law. For open resistance, however, the end of conscription.

For myself, personally beyond the applicable age, the corresponding form of resistance is refusal to pay war taxes. If everyone in the world practiced it, the result would be close to total elimination of war.

I recently harbored an AWOL who jumped ship fifteen minutes before it sailed for Vietnam, but a better Quaker witness and confrontation would have been for both of us openly to declare our civil-military disobedience — he, his desertion; I, my aiding and abetting, and face the penalties for our actions. But maybe I should rejoice in that having evaded the law I have lost some middle-classness.

- In the issue, he suggested that the spirit of the gospels meant that the “Render Unto Caesar” episode should be interpreted anew:

In the matter of war taxes, were Jesus addressing Christian stewards of God’s wealth who were citizens in a free democracy and responsible for its conduct and were be to pick up an American coin with its inscription, “In God We Trust,” his words might very well be:

If the God you trust is Mars, pay your taxes to him.

- In the issue, he gave “a historical summary” of how Quakers had dealt with the issue of war taxes:

With war taxes as with slavery, John Woolman stands out as the pioneer in getting the Society of Friends to face the issue. His motivation in bringing the concern to Philadelphia Yearly Meeting in came from the increasing willingness of the Quaker government of the colony of Pennsylvania to vote money for war.

The Quaker Assembly had begun to weaken in its peace testimony in . First it had refused to vote £4000 for an expedition into Canada, forthrightly saying, “It was contrary to their religious principles to hire men to kill one another.” But later they voted £500 “for the Queen” as a token of their respect, with a rider saying, “The money should be put into a safe hand till they were satisfied from England it should not be employed for the use of war.” But in a similar request resulted in £2000 being voted, with Isaac Norris echoing Fox in explaining: “We did not see it to be inconsistent with our principles to give the Queen money notwithstanding any use she might put it to, that not being our part but hers.”

That same year William Penn reputedly wrote the Queen (I have not found historical verification): “Our civil obedience is only due to Christ, not to confound the things of God with Caesar’s; for no man can be true to Him that’s false to his own conscience, nor can he extort from it a tribute to carry on any war, nor ought true Christians to pay it.” [I also have been unable to find a source for this quote —♇]

Whatever influence the letter may have had, the fact seems to be that none of the £2000 voted “for the Queen’s use” was spent on the military expedition. But the principle of passing the buck for war seems to have been established in the Assembly, which took the view that while Quakers refused to bear arms themselves they did not condemn it in others. In the Assembly told the Governor it could not vote money for war, but acknowledged that on the other hand it had obligations to aid the government. The crisis, however, came in the French and Indian War in , when individual taxpayers decided they could no longer pass the war buck to the Assembly.

In of that year John Churchman and other Friends met with Assembly Friends, and about twenty of them said, in part:

“…As the raising sums of money, and putting them into the hands of committees, who may apply them to purposes inconsistent with the peaceable testimony we profess, …appears to us in its consequences, to be destructive of our religious liberties; we apprehend many among us will be under the necessity of suffering, rather than consenting thereto, by the payment of a tax for such purposes; and thus the fundamental part of our constitution may be essentially affected, and that free enjoyment of conscience by degrees be violated;…”

The setting for this ultimatum is of interest: Quaker tax-payers, one-third of the population of the colony, Quaker Assemblymen a majority in a legislature which had non-Quakers like Benjamin Franklin — the most important person in the colony.

The Assembly, when the vote came, said it could not give money for munitions but that, as a “tribute to Caesar,” it was voting £4000 for “bread, beef, pork, flour, wheat, or other grain.” The Governor who had received the request from New England for a grant to buy a different granular material, told the Assembly that their term “other grain” meant gunpowder and so spent the money.

Woolman’s thoughts about war taxes and his journeying to Philadelphia Yearly Meeting that year with his concern are familiar in his Journal. One passage, however, seems pertinent to as Friends urge a divided Congress to cut off war funds:

“Some of our members who are officers in civil government are… called upon in their respective stations to assist in things relative to the wars… if they see their brethren united in payment of a tax to carry on the said wars, may think their case not much different, and so might quench the tender movings of the Holy Spirit in their minds.”

On , he; Churchman and others drew up an Epistle to Pennsylvania Friends:

“…The large sum granted… is principally intended for purposes inconsistent with our peaceable testimony; we therefore think that as we cannot be concerned in wars and fightings, so neither ought we to contribute thereto, by paying the tax directed by said act, though suffering be the consequence of our refusal.… Though some part of the money to be raised… is said to be for such benevolent purposes as supporting our friendship with our Indian Neighbors and relieving the distresses of our fellow-subjects, who have suffered in the present calamities, …we could most cheerfully contribute to those purposes, if they were not so mixed, that we cannot… show our hearty concurrence therewith without at the same time assenting to… practices which we apprehend contrary to the testimony which the Lord hath given us to bear…”

The “tax” committee of Yearly Meeting decided that refusal should be an individual matter, and in we find Friends like Joshua Evans conscious there was no solid front: “I found it best for me to refuse paying demands on my estate which went to pay the expenses of war, and although my part might appear at best as a drop in the ocean, yet the ocean, I considered, was made of many drops.”

The effect of such witness was not to stop the war but, as Woolman may have felt of even greater importance, to help Quaker legislators to be true to their own “tender movings.” In that year the last of the Quaker Assemblymen had resigned and no more ran for the office — in Franklin’s approving words, “choosing rather to quit their power than their principle.” The 70-year experiment of a Quaker government came to an end over the question of war taxes. By , according to James Pemberton, it was clear the war-makers were extracting their toll: “The tax in this country [is] pretty well collected and many in this city particularly suffered by distraint of their goods and some being near cast into jail.”

Two decades later, when the bigger test of the Revolutionary War came and the “fighting” Free Quakers separated, tax refusal was so well established that some Quakers appear almost to have over-reacted. In The Quakers in the American Colonies, Rufus Jones writes:

“There was plenty for the overseers to do in these early days of the war.… Shutting their hearts against the pleadings of mercy for their brothers and sons who had joined the ‘associators’ or paid war taxes, or placed guns for defence upon their vessels, or paid fines for refusing to collect military taxes, or in any way aided the war on either side, they cleared the Society of all open complicity with it. The offense was reported to one Monthly Meeting, and at the next the testimony of disownment would go out.”

While by today’s permissive standards of the Society such peace witness seems more hysterical than historical, we need to be aware that in this period as in the Civil War, “tax” sometimes meant the substitutionary amount paid in lieu of military service by COs.

In New England the question of paying war taxes to the rebelling colonial governments was the precipitating cause for the split-off of Free Quakers. There, as elsewhere, when the Revolutionary War broke out, Friends generally agreed they should not pay specific war taxes but on “mixed” taxes — the subject of the 1755 Epistle in Pennsylvania — there was no consensus.

Job Scott in New England Yearly Meeting was the most erudite and detailed advocate of not paying mixed taxes. In his essay, subtitled “A truly conscientious scruple with respect to the payment of such taxes as are in part demanded for and applied to the support of war and fighting,” and addressed to “Friendly reader,” he reasoned in 1780:

“Now then, if a collector of taxes comes to me and in Caesar’s name demands a tax of £20 which I am persuaded is so far mixed, part for war and part for other charges, that my conscience forbids my paying it… I am not to blame for not paying it: if Caesar pleaseth to separate them I can gladly pay the one part and refuse the other.… though magistry be a divine ordinance, yet it does not follow that every requisition of the civil magistrate ought to be actively obeyed, anymore than because it is a duty indispensable and incumbent on all mankind to pay all their just debts, that therefore we must pay all demands however unjust.”

Tradition-minded Friends who used the Caesar argument sometimes pointed to George Fox who in , paying a specific war tax for the Dutch war, made a distinction between this and direct military service. But the homeland of Quakerdom by had also moved towards tax refusal; in London Yearly Meeting minuted its censure on “the active compliance of some members with the rate (tax) for raising men for the Navy” and directed local Friends to have such cases under their care. Those who paid war taxes without even waiting for the process of distraint were considered to have acted “inconsistently.”

In less material on taxes was published by Friends. Perhaps there is here a fruitful field awaiting some researcher of yearly and quarterly minutes [indeed there is –♇]. Was there less interest in the problems, or was refusal taken for granted? Did non-Friend Thoreau’s ringing call to refusal in the Mexican-American War preempt the field? Whatever the reasons, as Friends face today’s violence with its automated battlefields and nuclear missiles — where the conscription of human bodies for mass armies may become less important — and conscription of money for sophisticated technology more important — the relevancy of the tax question to a modern, effective peace testimony has reached an all-time high.

- In its issue, the Journal noted that the IRS had made a half-hearted attempt to seize Zahn’s “1955 Dodge station wagon” for $6.58 in resisted phone tax.

Although contemplating lying in front of the car as a final protest before the towing, Franklin calmly removed his personal effects from the car and showed no agitation at this seizure of his property. At the last minute, however, the IRS men suddenly removed the chains, saying, “We just got new orders — we’re calling off the dogs.” The mood changed from one of tense formality to joviality as the men left. “It was as though,” Franklin says, “they were glad the little bluff had failed.”

- A letter-to-the-editor from Zahn appears in the issue, in which he responds to “a frequent objection to war tax refusal: that it logically leads to a host of other tax refusal.” He suggests that because military expenses are such an overwhelming part of the federal budget, only war resisters are likely to find tax resistance to be a tempting tactic. And anyway, “if a few other than war objectors choose to refuse, I see no objection to their doing so.”

- In the issue, Zahn writes in to make a fresh case for war tax refusal:

In refusing personal service, one considers one’s integrity — conscience: Can I be part of a machine geared to agony and death? But often a different criterion is applied to refusal to pay: How effective a protest is it? If the protest-value of tax refusal is the only consideration, Friends may feel the effort is better spent in writing a legislator or phoning the White House. (But I have found that a letter to the government saying I am refusing to pay war taxes is one letter officials never ignore.)

Arguments against the effectiveness of war tax refusal can be self-fulfilling prophecies. Friends may not wish to join a public witness which is so small it attracts little notice — therefore it remains small. Yet it is possible that an announcement of intention to pay no further war taxes would be the most single effective act against the arms race that members of the Society of Friends could take.

But sudden, dramatic decisions for effectiveness are not in the manner of Friends. Perhaps we should forget all about witness and consider tax refusal purely as personal integrity. This basis, after all, is the one for our day-to-day decisions in matters of principle. We refuse to steal, not as some witness in influencing others, but because for us stealing is wrong. We refuse to cheat, not as some protest against dishonesty or against anything else, but because cheating is not the way of the life of the Spirit. Questions of effectiveness become irrelevant.

The corresponding question for taxes could be, explicitly: Should I, a person in whom there is that of God, voluntarily pay all money asked of me for the purpose of injuring and killing millions of other persons in whom there is also that of God?

If trying to hold back some one-third of our federal income tax (which will go next year for current military uses) is too boggling, we can start modestly and refuse payment of only ten dollars — a small pinch of incense not voluntarily laid on Caesar’s altar. It can, to our conscience, be a symbol of our refusal of total submission to the military-industrial complex. But it can also symbolize the positive. It can be given to the Right Sharing of World Resources of Friends World Committee. It is possible a small amount like ten dollars will not even be collected by IRS. Each of us can try such an experiment for one year, and from then proceed as way opens.

- Finally, in the issue, the Journal announced Zahn’s death (nearly a year after ). It called him “a peace activist and worldly ascetic” and said that he practiced “religious asceticism — regular meditation, vegetarianism, celibacy, and voluntary poverty — as both the sustenance for his personal spiritual life and public witness to the power of love and truth in the world.” He was among those conscientious objectors who at first accepted alternative civilian service, and then decided to resist the draft entirely. He also was among those who tried to sail into nuclear weapons test zones to disrupt the tests.