Again in , only the Messenger (of those Brethren periodicals I reviewed) covered war tax resistance, but they did so often.

In a Brethren church in Indiana hosted a war tax resistance workshop:

War tax workshop reflects peace witness

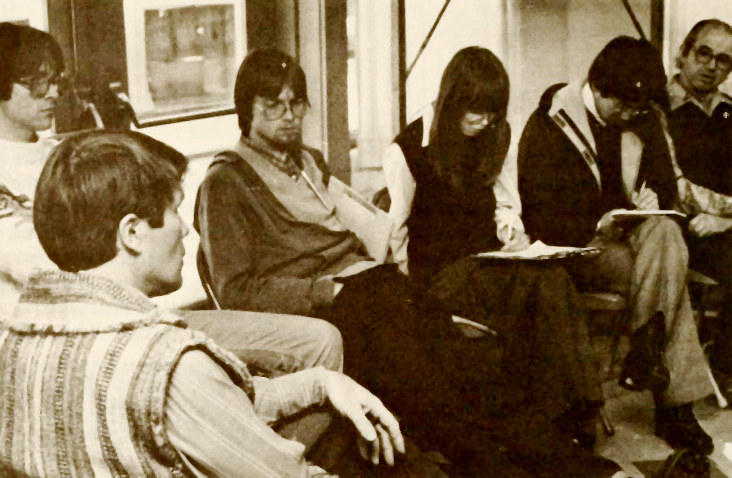

A concern for active Christian peacemaking was the motivation for the gathering of over 50 people from at least seven religious traditions . The event, sponsored by the Peace Action Committee of the Northern Indiana District and held at Prince of Peace Church of the Brethren, was a war tax resistance workshop led by Dale Aukerman of the Brethren Peace Fellowship.

The two main body presentations dealt with “our peacemaking and the end of the world,” and “war tax resistance as seen from the perspective of Matthew 18:15–17.” Participants were called to “claim the sovereignty of God and take our Christian discipleship seriously. The key to our peace witness is to strive to be faithful to God.”

The workshop is one of a growing number being held throughout Brethren churches, often in conjunction with other denominations. The groups explore nuts-and-bolts alternatives of withholding taxes and support each other in maintaining the witness under Internal Revenue Service pressure, as well as sharing the vision of peace inherent in faithfulness to God.

“Participants in the war tax resistance workshop led by Dale Aukerman (lower left corner) explore peacemaking theology and alternatives of withholding taxes.”

Kevin Zimmerman shared the thinking that went into his war tax resistance in the issue of Messenger (source). Excerpt:

Although my body is not being conscripted to support war, my tax money is, and at this point in history which do the military powers need more? My money! As Dale Brown notes, “If it becomes possible through automated warfare to kill and destroy with unmanned aircraft and minimal personnel, then the witness of withholding economic support may become an issue of even greater importance to the conscientious Christian peacemaker.” I am not opposed to supporting my government or paying taxes to my government. But I believe when our government goes directly against Christ’s teachings we are to follow Christ. Peter and the apostles found themselves forced to resort to civil disobedience in an attempt to fulfill Christ’s teachings and, when arrested, responded, “We must serve God rather than men” (Acts 5:29).

I would like to see Congress pass the bill supporting the World Peace Tax Fund. That portion of my taxes supporting our military could instead be put into this fund to be used for such peaceful purposes as United Nations activities, research into nonviolent solutions to international conflicts, disarmaments efforts, and international education and welfare. In this way I can support my government as well as the peaceful lifestyle demonstrated by Christ.

Christianity has never been and will never be a spectator sport. We are commanded to go out and spread the word by helping our neighbors and sharing their burdens, but also by letting our government know too, by letter or by civil disobedience, when they have broken God’s laws. By sharing my feelings, I hope others will seriously and prayerfully consider how their tax money is being spent, their role in our military machine, and Christ’s teachings to “love our enemies.”

The issue covered the Supreme Court ruling against Old Order Amish who wanted their conscientious objection to the social security system allowed by law (source). Excerpt:

When the case reached the Supreme Court, Chief Justice Warren E. Burger agreed with the IRS, saying, “The tax system could not function if denominations were allowed to challenge tax systems because tax payments were spent in a man-er that violates their religious belief.”

Such an attitude could seriously hamper efforts to establish an alternate peace fund into which conscientious objectors could channel taxes that now fund military budgets.

That issue also announced the formation of a “Tax Resister’s Penalty Fund” (still going strong today as the War Tax Resisters Penalty Fund):

Support for Tax Resisters

Dave Leiter, of North Manchester, Ind., is heading up a network of people interested in distributing the burden of penalties or interest levied against military tax resisters. An example of such support would be for 200 people to share a $500 penalty by each contributing $2.50. If interested, write the Tax Resister’s Penalty Fund…

Another article in the same issue, on possible responses to the nuclear arms race (source), recommended war tax resistance as one of the possibilities:

Refuse to pay some of your Federal income taxes as a witness to your faith. If you’re scared, try a small amount like $7.77. If that’s too scary, at least send a letter describing the difficulty of praying for peace and paying for war.

Mike and Carol Zuercher Stern shared their war tax resistance journey in a letter-to-the-editor in the issue (source):

The way a person spends money is an indicator of one’s personal priorities. In the past year (perhaps more clearly than any other time in recent history) our country has corporately demonstrated what it considers to be most important by how it spends money. Top priority is military superiority over all other nations — bigger and better bombs, submarines, missiles, and napalm.

As Christians and conscientious objectors to war, we cannot accept this national priority as though it were our own. We oppose the building of weapons whose ultimate use means the shedding of human blood. Each April 15 we are reminded of our personal participation in funding a national priority which we believe stands in direct contradiction to our Christian faith.

Our response each year has been to file all the legally required tax forms while witnessing by a variety of symbolic protests against the use of tax dollars for weapons of war. This year we felt compelled by conscience to refuse to pay the entire amount of taxes which had not been withheld already from our salaries. This $438, less than 25 percent of our total tax obligation for the year, will be given instead to charitable organizations. In doing so, we affirm our commitment to the gospel of love, healing, and reconciliation.

That issue also reported on Ralph Dull’s theatric tax resistance protest:

Nix on corn for taxes, says IRS to Ralph Dull

Ralph Dull, of the Brookville, Ohio, Church of the Brethren, has refused to pay a portion of his income taxes each year as a protest against military spending. This year he chose a new way to draw attention to the issue.

On he pulled up in front of the Federal Building in downtown Dayton to offer the Internal Revenue Service 325 bushels of corn in lieu of taxes owed. The action was “to dramatize and emphasize the need for the Federal government to turn its priorities around and support constructive people programs,” Dull said, “rather than use our resources for an arms race that is murderous and suicidal.”

He asked the IRS to sign a statement acknowledging the value of the grain and guaranteeing that its value would be used only for non-military purposes. When the IRS refused to sign. Dull sold the corn to a local elevator. A check for about $777 was made out to Church World Service and given to the National Farmers Organization’s Food for Poland project.

“Apart from the religious aspect of this issue,” said Dull, “what this symbolic action lifts up for consideration is human decency. It is vulgar to squander material and human resources while there is so much opportunity to relieve existing human misery.”

An article from the issue, focused on resistance to draft registration, noted in passing that “The United Methodist Church… said [in ], ‘We… support all those who conscienttiously object to preparation in any specific war or all wars; to cooperation with military conscription; or to the payment of taxes for military purposes; and we ask that they be granted legal recognition.”

A report on the Annual Conference in that same issue noted that war tax resistance was a last-minute addition to the agenda:

Study commmittee to provide guidance for employers of “war tax” protesters

Brethren war protesters who decide to withhold tax money going to war purposes may find their employers less than enchanted with the idea. Brethren employers may be sympathetic to the idea but are up against federal regulations to withhold taxes. So what’s a body (such as Annual Conference) to do?

Acting on a late-breaking query from Northern Indiana District, Annual Conference elected a committee of five to study the problem and report in . The committee is charged to come up with helpful guidance for church institutions so they can adequately respond to their employees employees who wish to withhold their “war taxes.”

The study was approved, despite at least one speaker grousing that he hadn’t “heard one good thing about the US government this week.” Chances are he was correct. The Annual Conference of the Church of the Brethren will not be remembered as an exercise in flag-waving patriotism. For the majority of the delegates to Wichita, judging by the voting record, patriotism was best evinced in responsibly and prayerfully calling one’s government to account in the areas of justice and peace.

That committee would include Dale W. Brown, William R. Faw, Ramona Smith Moore, Phillip C. Stone, and Marty Smeltzer West.

In the issue, Ingred Rogers reported on a war tax resisters’ alternative fund that her Brethren church established:

Withholding and choosing life

The Manchester Church of the Brethren has established a “Fund for Life” as an expression of support for those who feel moved to refuse payment of war taxes. This was a significant step in a long process of soul-searching and consciousness-raising.

The process began in when several members formed a tax-concerned group. Driven by the conviction that to contemplate nuclear holocaust is sin against God and humanity, we came together to discuss how to express our conscientious objection to war taxes. Careful reading of the Bible convinced us that the Scriptures give no single, absolute statement about payment of taxes. But we are indeed called to obey God above all, and trusting in weapons of mass destruction is clearly idolatrous.

From the beginning, we saw our action as an effort to maintain faithfully the Brethren peace testimony. It became increasingly important to us to allow the church to make a witness on behalf of tax resisters. Our denomination as a whole had already committed itself to recognition of war-tax resistance as a form of conscientious objection. Now it was a matter of asking for support from the local congregation that had nurtured us and had had a vital influence on tiie formation of our peace position.

After the first church board discussion on the issue, the tax group prepared a proposal for a Fund for Life. The original draft provided that resisters would deposit in the fund the money withheld from taxes. Money unclaimed by the Internal Revenue Service was to become the property of the Manchester church as a completed gift by the original depositor and used for peace work. As in an escrow account, money up to the amount deposited could be returned to the individual if the IRS should claim the sum.

The church board raised two objections. If the money can be returned in full to the original depositor once the IRS demands it, where is the witness, the risk, the sacrifice? If the church holds money owed to the government, might the whole congregation legally be implicated?

The board decided to bring the proposal to the next council meeting for discussion, and to delay a final vote for another six months to allow the congregation to reflect upon the issue of war-tax resistance.

The resulting education program was thorough and rewarding. As expected, we met with disagreement and heated debate. A second draft suggested that the money should be a completed gift from the beginning without strings attached. Also, money deposited would not necessarily have to be withheld from taxes; anyone could contribute as an expression of support.

The tax group found this second draft more true in some ways to the original intent. Both drafts were presented in Sunday school classes. After three more modifications, the group settled on this wording:

- The congregation leaves the withholding of war taxes to the individual conscience of each member or friend.

- Any member or friend of the Manchester Church of the Brethren may contribute money to the Fund for Life.

- The income from said gifts and the gifts themselves shall be used by the church for activities that are expressly peace-making, including the support of those persons mentioned in item four. None of these gifts or the income from said gifts shall be used for the operating budget of the church.

- Upon request, our congregation shall financially assist any member or friend who withholds war taxes if the Internal Revenue Service presses for collection of his/her tax liability. Such contributions shall come from the fund or from special contributions of individual members of the congregation.

This latest version was adopted by the church in the .

Our need for education and discussion on this subject increases. Every year we are painfully made aware of the shift in priorities in our national budget; every year more billions are sacrificed for weapons which will destroy God’s creation. The Fund for Life has been an attempt to seek alternatives to quiet acquiescence. It is a small but significant step in accordance with the faith we proclaim.

An article on “Grassroots Peacemaking” in the issue noted:

The study of peacemaking has led some Brethren to question the payment of taxes that support the military system. Southern Ohio has a special committee on the World Peace Tax Fund. Michigan’s district conference in will act upon a resolution that urges congregations not to pay telephone taxes. Manchester (Ind.) church has created a Fund for Life (see [above]). Galen and Wanda Miller, of Oregon/Washington District, divide their Federal tax into two checks — one made out to the Department of Health and Human Services and one to the Internal Revenue Service — and include a letter stating that they don’t object to paying taxes for constructive programs.