was the first full day of the joint National War Tax Resistance Coordinating Committee Fall gathering / 25th annual New England Gathering of War Tax Resisters and Supporters in Boston.

The gathering began, as many such meetings do, with introductions. To mix things up, we first spent some time getting acquainted with our neighbors and then went around the circle introducing each other and briefly summarizing some of their recent war tax resistance-related work. This gave us a great overview of the variety of such activism.

For example, I introduced Andrea, who has spent the last several years concentrating in her work on the plight of political prisoners and on prison reform. She is now starting a worker-owned cooperative and is intentionally designing its operating charter so that it will function to help facilitate the war tax resistance of those of its worker/owners who are resisters.

After introductions, people shared some of the challenges and boosts they had encountered in their recent war tax resistance practice. Some examples I remember:

- Several people remarked on how doing war tax resistance as part of a community of resisters — or even with just a single buddy — can help everyone involved, not only in their own practice but in some way making the whole greater than the sum of its parts.

- Larry Rosenwald talked about how he refuses to pay his taxes, but doesn’t take steps to resist the inevitable IRS levy that follows. Instead he uses the occasion to publicize the fact that he’s been levied and to explain why he resists (often in the form of an op-ed essay).

- One person suggested that a winning message for reaching out to young people is “you’ve already been drafted,” meaning, of course, that though there’s no military conscription, the tax system forces us all to be galley slaves rowing the ship of state.

- Bob Bady recalled that back when the IRS was trying to seize his house, he asked Ernest Bromley how he’d dealt with the stress when the IRS tried [unsuccessfully, see The Picket Line, ] to seize his house. Bromley answered: “I just assumed it was God doing it and accepted it; that freed me up to do what I had to do.” That threw Bady for a loop, but he says with some more perspective he gets it: “The things I spent years worrying about losing turned out to be no big deal.”

- Clark Hanjian said that in his experience, we have a lot more allies than we might think. When he, sometimes with trepidation, has to explain his resistance to someone like a potential employer, he finds that surprisingly often they respond not with bewilderment or hostility but with a sympathetic nod and a “that’s a good idea.” [Clark asked me to correct the record: “It made me chuckle when I read the phrase ‘sometimes with trepidation,’ since I don’t think I’ve ever used the word ‘trepidation’ in reference to myself, and especially not in reference to my WTR. On the contrary, I usually try to take a fearless (some might call it careless) approach to my WTR. I recall my comment was in response to a woman who spoke about her fear of WTR, so perhaps some notes got interchanged? Anyway, the only reason I mention this is because I think that part of the benefit of sharing our stories with others is to reduce fear. I thought maybe you might want to revise this account so we don’t introduce fear into a story where none exists.”] (Case in point: on night we went out for beers after the meeting and got into conversation with the shift manager at the pizza pub, who then spent the next fifteen minutes at our table talking about a documentary on Afghanistan he’d recently seen and ended by telling us how important he thought our work was.)

- One resister mentioned that when he went to court to be sentenced for civil disobedience (I forget whether it was tax resistance related or not; I think not), the court was packed with supporters who quietly stood up when he was being sentenced, and how important this support had been to him.

- One resister read about how a local school was suffering from funding cuts, and so sent her tax payment directly to the school that year instead of to the IRS, and wrote them a letter explaining what she was doing and why.

- Another talked about her struggle to withdraw from California’s CalPERS state employee pension system, out of disagreement with the military industry investing of that system.

- A low-income / simple-living resister talked about how after an expensive emergency medical treatment, she wrote polite letters to the various medical staff who had treated her expressing her gratitude and explaining that she would be unable to immediately pay their bills (and why) and asking to work with them to come to an agreeable and possible payment plan. Most either forgave the bill entirely or reduced it to an immediately-payable amount. One even said that her letter had been appreciatevely passed around and posted in the office for others to read.

- Another remarked that as a child of Holocaust survivors who owes his existence to noncooperators who took risks to shelter his parents, he comes to war tax resistance through asking “how can I thank those people in some small way?”

From here, we broke up into two groups to discuss more specific tactical challenges, opportunities, and inspirations. The larger group was for people who earn a taxable income and use a variety of strategies to resist some or all of the taxes due. The smaller group, that I joined, was for those of us who earn an income below the federal income-tax threshold as a method of war tax resistance.

Many of those in our group expressed that they were partially motivated to choose this tactic because it challenged not only taxes but our larger complicity with the warfare state by means of our participation in the consumerist/capitalist economy. “I’m a war tax resister not just because of war,” Juanita Nelson said, “but what leads to war.”

Many also felt that this was a particularly easy form of tax resistance, and one with many fringe benefits. Some expressed what I certainly found to be true: that while we may have less income than we could, we feel more wealthy in terms of non-material goods, and we appreciate being able to put more of our time and energy into non-money-earning activities.

This ease, and the fact that this form of tax resistance is relatively non-confrontational, was also seen by some as a drawback. Some felt guilty when comparing their resistance to those resisters who risk fines and property seizures and prison. Others missed having a dramatic opportunity to say “No!” on April 15th.

On the other hand, some liked the fact that this form of resistance was an ongoing, every-day, lifestyle change. One said that the sort of constant attention it requires was a way of praying for and receiving the “daily bread of insight” that nourishes her practice.

One conferee worried that this form of resistance tended to be too solitary, and that it didn’t lend itself immediately to the sort of collective action necessary to push for change. She recommended that we integrate consciousness-raising sessions about community and about attitudes toward money into our practice.

We also discussed a lot of practical challenges: what sorts of tax credits and deductions are available and how to apply for them; how to reduce big-ticket expenses like rent and transportation; how to afford health insurance, or how to best live without it; how to live on a low income while at the same time paying down student loan (or other) debt; whether it makes sense to resist the income tax with this method and the payroll tax by refusing to pay; whether it is hypocritical to accept government services or assistance while trying to avoid supporting the government, or whether it would be a “foolish consistency” to try to completely turn your back on government benefits; what to do when the law starts to require you to take minimum pension distributions.

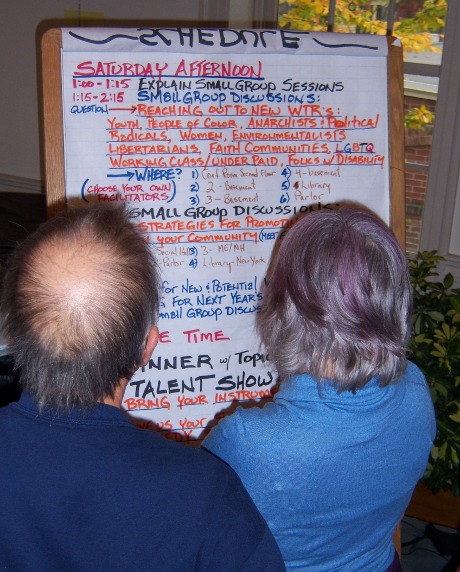

Looking over the day’s schedule

After this session, the meeting split again, into smaller groups, deliberately divided up so that people from any particular region were scattered among the various groups. Then each group brainstormed on the topic of how to strengthen the war tax resistance movement, and how to do better outreach particularly among specific groups like “youth, people of color, anarchists & political radicals, women, environmentalists, libertarians, faith communities, LGBTQ, working class / underpaid, and folks with disabilities” — many of which have been underserved by our outreach thus far. Following this brainstorming, we met again, this time grouped by region, to share some of the results of the brainstorming.

Some of what stood out to me from this discussion:

- We might all benefit from some skills training in basic icebreaking and pressing the flesh. The normal bell-curve of how comfortable people are reaching out to strangers is not ideally-tuned for outreach, and it is adjustable by some training.

- One person made a big push for community television as a possible outlet for getting the word out. I was skeptical (who watches community television?) but by producing such shows you can also become better acquainted with video production in general, which can have benefits beyond community television. We might get more out of our actions if we also capture them on video.

- Our movement has an image problem. We’re typecast as “aging hippies” and this interferes with our ability to bring in people from different demographics. Some of the things we do to create a comfortable space for ourselves at meetings like this (the way we run meetings, the songs we sing, the food and drink we prepare, the extracurricular activities we offer) do not necessarily feel welcoming to people who don’t already fit the stereotype or who don’t want to be identified with it.

- One way of making our meetings more inviting to people outside of the usual suspects is to spend some time at meetings of activist groups of a different flavor. One Boston-area group, recognizing that it had gotten into a pale-granola rut, sent emissaries to more diverse activist groups in the area and reformulated their meetings and other activities to better fit with the scheduling, amenities, location, and other expectations of a larger variety of people.

- One person mentioned the challenge presented by the fact that April 15th is no longer such a climactic public event. With more people filing electronically rather than taking that last-minute trip to the post office, Tax Day rallies are less effective. Maybe we should try to compose some sort of viral email to circulate in early April to take the place of our post office banner waving?

- Another attendee expressed that she felt that poor people were more and more connecting the lack of opportunities in their communities with the enormous military budget and imperial priorities, and thought that we could do fruitful outreach that way. Other groups that people thought might be ripe for our message were Palestinian rights activists (who are already very conscious of the connection between U.S. tax dollars and the repression of Palestinians), and people in the “Time Bank” and other alternative currency movements.

After this we again split up into sessions, one with a South-East regional focus, another to plan next year’s New England gathering, and one (that I joined) to do Q&A for new resisters. It was a short Q&A session — not our usual workshop — but we had an experienced resister there representing each of the three major divisions of resistance: below-the-tax-line resistance, filing but not paying, and not filing. Questions were asked and answered, concerns addressed, scenarios teased out.

All in all a very well-run and well-hosted meeting, with most of the credit going to the New England gathering.

is our NWTRCC business meeting at which we will consider proposals, adopt a budget and objectives for the coming year, pick a spot for the next gathering, and take care of other such business. Then we’ll have a counselor’s training session with some help from our legal advisor. But more on that tomorrow…