War tax resistance in the Friends Journal in

There was plenty about war tax resistance in the Friends Journal in , but it seemed to involve tax resisting Mennonites as least as often as tax resisting Quakers.

The issue announced that the Center on Law and Pacifism was organizing a critical mass style tax resistance action:

The Center… has prepared and has available a “Conscience and Military Tax Resolution,” which may be signed by any conscientious objector to military taxes, witnessed (not necessarily notarized), returned to the Center. When officially notified by the Center that there are 100,000 such resolutions on file, the signer may carry out his or her resolve to withhold the military portion of the federal income tax. Alternatively, he or she may deposit the withheld taxes in an escrow account for the World Peace Tax Fund, pending passage by Congress of the WPTF Bill, deposit them in an alternative fund or donate them to some other peace purpose.

The issue was all about anti-war work, and it opened with an article on the history of Quaker war tax resistance by editor Ruth Kilpack. Excerpts:

[W]e should not suppose that this is a new concern among Friends and members of other Peace Churches, who, by the very nature of our faith, have a conscience tender to such questionings. For Friends, the searching extends back to the seventeenth century, when Robert Barclay, the English Quaker apologist, wrote in :

We have suffered much in qur country because we neither ourselves could bear arms, nor send others in our place, nor give our money for the buying of drums, standards, and other military attire.

This was the so-called “Trophy Money,” that could be distinguished as such. But common or “mixed” taxes could not so readily be dealt with, since most Quakers believed it was their duty to pay taxes, and the part allocated to the military could not be separated out from the whole.

Today, like those earlier Quakers, we find ourselves in the same dilemma. Law-abiding citizens, we continue to find ourselves troubled by the demand that we pay taxes for purposes we cannot in conscience condone. We cannot pretend that we accept war as a legitimate function of the civil government which we support, and, just as some of our members have refused to serve in the armed services, many are beginning to question the contribution of our money for purposes we eschew for moral, humane, and religious reasons.

Quakers struggled with all these same questionings in the mid-eighteenth century and the period prior to the American Revolution. One of the most articulate on the subject of war taxes was Samuel Allinson, a young Friend from Burlington, New Jersey, who in wrote “Reasons against war, and paying taxes for its support.”

Thus, in words written , he deals with the question of “a remnant who desire to be clear of a business so dark and destructive, that we should avoid the furtherance of it in any and every form.” He describes it as a “stumbling block to others, [which] ought carefully to be avoided,” and sees such avoidance as advancing the Kingdom of the Messiah, that “his will be done on earth as it is done on heaven; a state possible, I presume, or he would not have taught us to pray for it.”

Further, says Samuel Allinson,

We have never entered into any contract expressed or implied for the paym[en]t of Taxes for War, nor the performance of any thing contrary to our Relig[ious] duties, and therefore cannot be looked upon as disaffected or Rebellious to any Gov[ernment] for these refusals, if this be our Testimony under all, which many believe it will hereafter be.

And finally, Samuel Allinson points out that even though earlier Friends paid their taxes (including that going to the military), that is no good reason for our continuing to do so.

It is not to be wondered at, or an argument drawn against a reformation in the refusal of Taxes for War at this Day, that our Brethren formerly paid them; knowledge is progressive, every reform[atio]n had its beginning, even the disciples were for some time ignorant of many religious Truths, tho’ they had the Company and precepts of our Savior…

Friends, we find ourselves in the very position of the Friends being addressed by Samuel Allinson two centuries ago. For myself, I cannot think it is by sheer accident that I have stumbled upon his words now. Neither is it by accident that a growing “remnant” of Friends are awakening to the ambivalence we feel in what we profess and what we practice regarding our involvement in the awesome “stumbling block” of nuclear warfare in our own age. Friends in the past responded to the threats of the age in which they lived according to the light they had. We of our generation have been given even greater light, and we must respond accordingly. Given our heritage, if we don’t respond, who will?

In the meantime, I ask you to think on these things and, to paraphrase George Fox’s advice to William Penn, “Pay thy tax as long as thou canst.”

In the issue, Keith Tingle told readers that they should know “how easy it is to do” war tax resistance… at least in his experience:

My own experience in military tax resistance has been rewarding thus far. By claiming a tax credit for conscientious objection to war on my income tax form, I was refunded $260 from my taxes. Now that the IRS has discovered its mistake, I am resisting through federal tax court the recollection of this money. My appearance in tax court has been reported favorably in three local newspapers, providing an opportunity to publicize the Quaker peace testimony, the history of war tax resistance, the economic impact of military spending, the pacifist position on the military draft, the concept of the World Peace Tax Fund, and the legal assistance offered by the Center on Law and Pacifism.

This has been accomplished with a total expense of about $30 and about thirty hours of time. I have enjoyed the dedicated support of the Committee on War Tax Concerns of Friends Peace Committee and the legal guidance of lawyer Bill Durland at the Center on Law and Pacifism…

The issue noted that conscientious objection to military taxation was on the agenda at the Kent General Meeting in Canterbury, England — though from the sound of it, this was mostly in a theoretical way: presenting the argument that such a thing was a logical and practical counterpart of conscientious objection to military service.

That issue also reported on the case of Cornelia Lehn, an employee of the General Conference Mennonite Church who was trying to convince her employer to stop withholding federal income tax from her salary:

There was a “neither yes nor no” vote on this request by the 500 delegates present. Those who favored a strong tax resistance program did not Nor did those who wanted members to unquestioningly pay taxes as a Christian duty. There was a feeling, however, that neither side really lost. Thirty percent of the delegates were ready for the conference to take action in “some sort of civil disobedience and tax resistance” and it was hoped the number will grow.

I’m struck by this last phrase — “it was hoped the number will grow” — which makes a pretty clear editorial statement of sympathy for those who favored corporate resistance by the Conference and antipathy for “those who wanted members to unquestioningly pay taxes as a Christian duty.” At this time, few if any Quaker Meetings or organizations were willing to go out on that limb, in spite of strong urgings from Quaker war tax resisters that they do so. But I don’t remember the Journal betraying an editorial bias when it reported on this debate in Quaker institutions.

One case in point is a report on the New England Yearly Meeting in which the lukewarm statement is made that “We approved a minute asking New England Friends to give prayerful consideration to non-payment of war taxes.” The New York Yearly Meeting went so far as to “discuss” a “minute on Refusal of Taxes for Military Purposes” and to note that it “was to be commended for consideration by all monthly meetings and individuals.”

The issue had a followup in which the General Conference of the Mennonite Church was proposing launching a lawsuit in which it would seek a judicial ruling to legalize conscientious objection to military taxation, while at the same time it would increase its efforts to pass the “World Peace Tax Fund” legislation.

Maurice McCracken had a piece of autobiography in the issue. Naturally, it touched on his tax resistance:

I had decided that I would never register again for the draft nor would I consent to being conscripted by the government in any other capacity. In contradiction to this position, each year on April 15 I was letting the government conscript my money. Thus I was voluntarily helping the government do what I vigorously declared was wrong.…

Realizing this inconsistency, I decided that in good conscience I could no longer make full payment of my federal taxes. At the same time, I did not want to stop supporting civilian services supported by the government. So, in my tax returns I continued to pay the small percentage allocated for civilian use. The amount that I formerly had given for war purposes I hoped now to give to such causes as the American Friends Service Committee and to support other works of mercy and reconciliation which help remove the roots of violence and war.

As time went on I realized, however, that this was not accomplishing what had been my hope; for year after year the IRS ordered my bank to release money from my account to pay the money I had held back. I then closed my bank account, and at this point it came to me with complete clarity that by so much as filing tax returns I was giving the IRS assistance in the violation of my own conscience, because the very information I was giving on my tax forms was being used in finally making the collection. There is something else that those who withhold a portion of their tax on conscientious grounds should realize. The IRS does not practice line budgeting. All that it collects goes where the government wants it to go, which in ever-increasing proportion goes to finance wars, past, present and future. I have not filed any tax returns, nor have I paid any federal income tax.

On , on charges growing out of my refusal to pay this tax, I was given a six-month sentence, which I spent at Allenwood, Pennsylvania, which is run by the Lewisburg penitentiary.

Some two years my release from Allenwood, in , the Presbytery of Cincinnati, on charges quite unrelated to the real issues, suspended me as a minister. In , this action was upheld by the General Assembly, the highest court of the denomination. In the presbytery declared my ordination to the ministry no longer valid, making a highly questionable presumption that they could cancel out whatever spiritual grace the Holy Spirit had bestowed on me when I was ordained at a meeting of Chicago Presbytery back in .

For nearly eighteen years our congregation has been a member of the National Council of Community Churches. I have been accepted as a minister in full standing, and whatever validity my ordination had back in , is, for them, still valid.

A note in the issue recognized 86-year-old Pearl Ewald’s persistent activism: “Pearl Ewald continued her activities for peace, civil rights and war tax resistance, despite a recurring heart condition. She has been arrested and jailed more than once for stubbornly refusing to discontinue her witness. On one occasion, although desperately in need of medical attention, she refused to be admitted to a hospital, because it was a segregated institution.”

That same issue mentioned the case of Mennonite war tax resister Bruce Chrisman, “who was convicted of failure to file an income tax return in , was sentenced to one year in Mennonite Voluntary Service,” to which I can only think: “Please don’t throw me in the briar patch, Your Honor!”

“I’m amazed,” said Chrisman. “I feel very good about the sentence. The alternative service is probably the first sentence of its kind for a tax case. I think it reflects the testimony in the trial and its influence on the judge.” Chrisman could have been sentenced to one year in prison and a $10,000 fine.

A letter from Mildred Thierman in the same issue challenged Friends:

Could we now unite this year in sending a flood of personal declarations to President Carter and our government, saying that we can no longer, in conscience, allow part of our taxes to be used for the purchase of annihilating weapons? Can we back this up by joining together in significant numbers to withhold whatever portion of our income tax fits our circumstances, in order to make our protest noticed?

A review of Conscience in Crisis: Mennonites and Other Peace Churches in America, , Interpretation and Documents in the issue, summarized its version of the history of Quaker war tax resistance this way:

Testimony against participation in the military and refusal to pay Trophy Money — the English tax to raise money for military regalia (arms were, by law, furnished by the individual soldiers) — were traditional Friends’ observances by the beginning of the period covered by Conscience in Crisis.…

…Friends and other Peace Church members were, by and large, loyal subjects. They paid taxes “for the King’s use” — including the royal decision to make war.

Friends began to question payment of taxes more broadly. The essential issue, according to the authors, was that “the individual is responsible for the actions of his government in a free society.” Israel Pemberton, John Pemberton, John Churchman, John Woolman, and nineteen other Friends petitioned the Assembly on the issue of taxes in :

…Yet as the raising Sums of Money, and putting them into the Hands of Committees, who may apply them to Purposes inconsistent with the peaceable Testimony we profess, and have borne to the World, appears to us in its Consequences to be destructive of our religious Liberties, we apprehend many among us will be under the Necessity of suffering rather than consenting thereto by the Payment of a Tax for such Purposes…

By the time of the Philadelphia Yearly Meeting sessions, Friends decided not to discuss the issue of “mixed” taxes because of a significant lack of consensus. Yet, Friends were increasingly beginning to question less direct forms of support for war not traditionally inconsistent with the peace testimony.

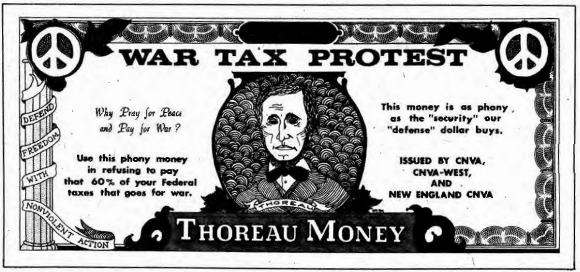

an illustration from the issue of Friends Journal

In the issue, Alan Eccleston wrote of his calling as a peacemaker, and how that manifested for him. Excerpts:

For me personally, the witness to peace has led to war tax resistance. Over the past six years of this witness I have been — and still am — strengthened by others who are not, themselves, war tax resisters.

The witness of war tax resistance is one that raises fear. We have been conditioned to fear the Internal Revenue Service as something nearly equivalent to a ruthless secret police, in its imagined power to terrorize. Most of us, unwilling to admit, even to ourselves, that fear alone would block us from a spiritual witness, find other reasons for willingly paying to produce weapons that can annihilate all humankind.

Based on my own experience, I would say fear imagined is greater in most people than fear actually experienced, and that this is by a factor of ten, at least — maybe 100. Fortunately, borrowing from each other’s experience and knowing others will be there to help us, we can find the courage to move ahead. Then comes the surprise. With dread and foreboding we make our stand. Then, gradually, we become aware that a great weight has been lifted from us. That nagging, cumbersome burden of blocking from consciousness our own complicity with this evil has fallen away. We are lighter, more open, more truthful. We are free, at last, to speak truth to power.

When this affirmation is truly clear in our lives, it will be seen and felt by the president and by Congress. As in , when C.O. status was incorporated in the Selective Service Act, the tax laws will then be amended to create C.O. status for taxpayers and a “World Peace Tax Fund.” That legislation, approved by the world’s leading arms supplier, will move the world one step closer to peace. That portion of our population (approximately four percent during the Vietnam War) which is pacifist would then contribute to peace, not war, and these contributions would total in excess of $2.3 billion every single year — year after year. For the first time in history, peace programs would have a significant budget. The funds could be used to support: a National Academy of Peace and Conflict Resolution; research to develop and evaluate non-military, nonviolent solutions to international conflict; disarmament; retaining workers displaced by conversion from military production; international exchanges for peaceful purposes; improvement of international health, education and welfare; and education of the public about the above activities.

The Friends General Conference in drafted “A Statement of Conscience by Quakers Concerned” and collected signatures. The statement said, in part:

We advocate conscientious refusal to register for the draft and wish young men of draft age throughout the United States to know that if, after thoughtfully considering the reasons and consequences, they refuse to register, we will give them practical and moral support in every way we can, even though our willingness to do so may result in our prosecution, fines and possible imprisonment for disobeying a man-made law that leads us in the direction of war.

Mary Bye wrote in response that although she signed the statement, it felt to her to be something “like a hollow gesture.”

[M]aybe we [adults] should make sure about the beam in our adult eyes before we concentrate on the motes in those bright young eyes of the nineteen- and twenty-year-olds.

“[W]hat would be our reaction to young Quakers pointing out that since it takes money as well as men to fight a war, they encourage Friends beyond draft age to refuse war taxes?

Finally, the issue presented the case of Ruth Larson Hatcher. Excerpt:

Not wishing to contribute tax money for war-making purposes, she managed for years to have an income just sufficient for survival but not large enough to require payment of taxes. Then in a friend persuaded her to accept the management and bookkeeping of a children’s art center. Conscientious and religious beliefs caused her to oppose acceptance of insurance benefits under Social Security, as well as the payment of taxes for war. Her claims for exemption under various sections of the Internal Revenue code of as well as under the First and Fifth Amendments were routinely rejected, until a Supreme Court judge approved her use of Form No. 4361. It seems that this form (and another previously ignored by the authorities) had been used by an Amish sect to avoid the taxes (and payments) of the social security system. Although the Court of Appeals handed down the opinion that exemptions were enacted to accommodate individuals commanded by their conscience or their religion to oppose acceptance of insurance benefits, it refused to accept that this was the exact status of petitioner Ruth Hatcher.

It’s a little unclear what took place here, but it sounds like this is saying that the courts left an opening for people who were not members of sects that qualified for an exemption from the social security system but who held similar beliefs to gain the same exemption. Interesting if true. I was able to find the appeals court decision that ruled against Hatcher, and the earlier Tax Court decision to the same effect, and the District Court decision that affirmed the Tax Court decision. I was not able to find any record of Supreme Court action on the case, but I did find some other cases that cited the Appeals Court decision as precedent, which seems to suggest that the Supreme Court didn’t overturn it (as the above excerpt implies).