When you’re trying to expand the ranks of tax resisters in your campaign, you need good educational tools. People are often reluctant to resist either because they aren’t sure how to go about it, or because they only have a vague idea of the likely consequences (and so are likely to exaggerate their frightfulness).

When NWTRCC conducted a survey of non-resisting anti-war activists , the most popular answer to the question “Which resources would help you decide to participate [in a tax resistance campaign]?” was: “clear idea of likely consequences” and the two top responses to the question about “the most important reason you have not done war tax resistance” were “fear legal consequences” and “need more information.”

People like to stick with the familiar, and if you ask them to take a jump into the unknown, they will imagine the worst as a way to justify their reticence. If you can be clear, thorough, and credible in demonstrating how to resist and what the consequences are likely to be, you can eliminate the biggest obstacle to the growth of your campaign.

This is easier said than done, however. It can be difficult to be clear and thorough if you are going up against a tax agency that is arbitrary or that changes its rules suddenly, and it can take time to establish credibility.

Today I’ll give a few examples of how tax resistance campaigns have dispelled ignorance about tax resistance.

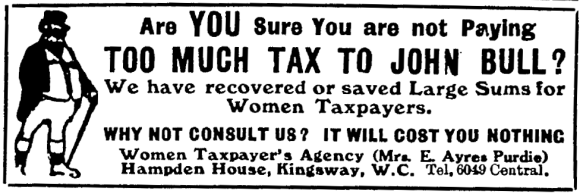

- Ethel Ayers Purdie ran what she called the “Women Taxpayer’s Agency” and counseled British women’s suffrage activists both on how to best resist their taxes on no-taxation-without-representation grounds, and on how they could exploit legal quirks to avoid taxes (for instance, archaic laws that made husbands wholly legally liable for their wives’ taxes).

She also published a pamphlet about that particular legal quirk, which concluded:

Members of the Women’s Tax Resistance League regularly gave lectures on their tactic of choice at suffragist meetings, and thereby recruited new resisters.Many married women, including leading actresses, doctors, titled women, business women, and various others having property, businesses, investments, &c., or being in receipt of salaries, have succeeded in demonstrating their non-taxability, and thereby involved the Revenue in a total loss of the tax illegally charged on them.

- The American war tax resistance group NWTRCC publishes a number of specialized how-to pamphlets that cover various techniques of tax resistance (such as refusing to file, filing and refusing to pay, living on a non-taxable income) and strategies for coping with possible consequences (such as government collection efforts). They also have a nationwide network of people who offer one-on-one counseling sessions for potential resisters or for current resisters who are running into snags. Local groups in the network periodically run workshops at which people can come to learn about the variety of war tax resistance methods and ask questions of people who have experience with them.

- The current tax resistance movement in Spain, which has its roots in the war tax resistance movement there but which has expanded to a broader anti-government pro-autonomy critique, recently published half a million copies of a tabloid that included its call to resist alongside some practical instruction on how to go about resisting both the pay-as-you-earn income tax and the value-added tax.

- American constitutionalist, “show-me-the-law”-style tax protest often spreads by means of workshops run by self-styled experts who have discovered or invented new (and increasingly baroque) legal arguments that prove that most people are not legally liable to pay the federal income tax. Although these arguments don’t typically stand up in court, they are sufficiently credible to the lay audience that they can convince many people to begin resisting. For example, in , an epidemic of tax protest swept General Motors plants in Flint, Michigan, as thousands of employees there told GM to stop withholding income tax from their salaries after they attended seminars or listened to lectures on tape from the tax protester group “We The People ACT.”

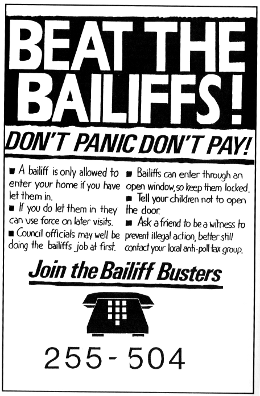

- Resisters to Thatcher’s Poll Tax gained confidence thanks to the efforts of the Poll Tax Legal Group which, among other things, “produced over 30 accessible legal bulletins on the Poll Tax and a book called To Pay or Not To Pay.”

To combat the threat of property seizure — often the threat itself was enough to intimidate people into stopping their resistance — the movement made efforts to educate the public about the seizure process and about ways to frustrate it:

[T]he first task of Anti-Poll Tax Unions was to inform people about what the bailiffs could and couldn’t do. In Scotland, people were advised not to tell the sheriffs where they worked, not to tell them which banks they used, and not, under any circumstances, to let them into their houses. They were also told to inform the local group as soon as the sheriffs threatened anything. The Anti-Poll Tax Unions advised people to move possessions to local friends’ houses before the date of the poinding and offered to help with the moving. People were told to leave their cars well away from their homes. They were informed that a wrongful poinding could be appealed against and, in many cases, this was done successfully. People were also told how to avoid bailiff action by signing away their possessions to people who lived outside of the area or, preferably, to their children. There are now young children who technically own all of their parents’ possessions.

Some local law centres went onto the offensive against the bailiffs, providing information to the public, which totally undermined their actions. One morning in , the bailiffs delivered over 4,000 intimidation notices to people throughout Bristol. By 7:30 a.m. the law centre had heard about this and contacted all local radio stations. By 8:00 p.m. the news bulletins which went out every fifteen minutes, reported:

Today bailiffs have delivered notices for payment to over 4,000 people in Bristol. A spokesperson from the law centre said that they were illegal and should be ignored.

So most people ignored them.

- The Bardoli satyagraha depended on regular distribution of news bulletins from campaign headquarters to the scattered villages of the province, to make sure everyone was on the same page about strategy, and to counteract government propaganda and rumor.

These also came to be powerful propaganda tools to affect Indian opinion outside of the resisting region:

A campaign like this could not be carried on without a publicity department. The peasants could not be asked to subscribe to daily papers or even to the weekly Navajivan, and outside papers could at best give an outside view of the campaign. A publicity office was therefore opened with Sjt. Jugatram Dave at its head. With an artist’s pen and with a knowledge of the whole taluka [district] at his fingertips, he took to this work like a duck to water. The arrangement was to issue a daily news bulletin and publish Sjt. Vallabhbhai’s speeches in pamphlet form and to distribute them free to the agriculturists all over the taluka: For four or five days cyclostyled [mimeograph-like] copies were issued, but arrangement was soon made to get them printed daily at Surat, and a start was made with 5,000 copies. The arrangement answered most admirably, the villagers waiting anxiously for the patrikas every morning and devouring the contents with avidity. All the Gujarati and almost all the English dailies of Bombay reproduced them verbatim, and as the movement gathered force, every important town and village in Gujarat began to get copies of the bulletin with the result that over and above ten thousand copies distributed in Bardoli, four thousand copies were subscribed to by places outside.