Conference report, part 1: The State of the COMT Movement

The 14th International Conference on War Tax Resistance and Peace Tax Campaigns gave conscientious objectors to military taxation from around the world a chance to compare notes on activities in their countries.

Many groups reported a greying, shrinking movement that struggles to maintain enthusiasm or to make significant headway on primary goals. There were a few bits of news that I thought were especially worthy of note:

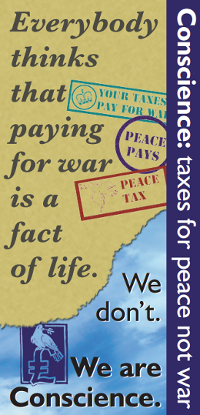

Conscience UK’s Market Analysis and Message Revamp

Conscience UK took the step of asking a professional consultant to do a market analysis. They identified a market segment that is particularly susceptible to the COMT message, and also learned that their messaging was flawed: the new generation identifies the term “conscientious objector” as being archaic and not relevant to them.

Conscience UK has responded to this by recharacterizing its campaign from one that supports conscientious objection to military spending into one that promotes nonmilitary security solutions and wants to give citizens the option to fund them instead of the military. It is collecting examples of successful nonviolent conflict prevention/resolution groups and actions, which it hopes to promote in a “Meet the Real Peacekeepers” campaign. It is also developing a strategy game (tentatively titled “Spend & Defend”) which it hopes to use to highlight how using nonviolent conflict prevention/resolution tactics is more effective and less costly than relying on military solutions.

The Norwegian Peace Fund

Another innovative idea comes from Norway. Activists there are forming what they call the Norges Fredsfond (Norwegian Peace Fund) and are soliciting taxpayers to donate to the fund. When they reach a critical mass of contributors the fund will gain tax-exempt status, and so these donations will reduce the contributors’ taxes at their marginal tax rate (typically 28%, according to Fund promotor Øystein Øgaard — which means that, at least from one way of looking at it, an objector can offset his or her war tax by contributing about three times the amount of the tax to the fund).

The fund is being designed as though it were a government-run peace tax fund accepting tax dollars that would then fund peace-promoting projects. They hope that by laying the groundwork of creating and running such a fund, they will be better able to convince the government to legalize COMT and absorb the fund as the lawful COMT alternative fund.

Peace Tax Funds

Other than the Norwegian proposal (which is just getting off the ground), there is little new to report on the Peace Tax front. There are many organizations in many countries working for this, and one international group nominally devoted to the same task, but none are making any headway or reporting any big changes in their approaches. Belgium’s campaign is dormant for lack of activist support, and Germany has suspended lobbying activity after their lobbying campaign resulted in negligible results.

Those of you who are following the U.S. version of the legislation can be assured that it will be introduced again this year, without any anticipated changes. The number of cosponsors for the House bill shrunk to eight last year, and four of those have now moved on from the House (the bill was not introduced in the Senate), so this is a challenge. The National Campaign for a Peace Tax Fund has set a goal of 19 cosponsors in the House and a sponsor in the Senate this year.

Tactical Innovation

I gave a presentation on the variety of tactics used by tax resistance campaigns throughout history and around the world to augment their campaigns, and tried to explain how reviewing these tactics and those campaigns might help us craft our campaigns to be more successful. You can find the slides I used in this presentation on-line if you’d like a better idea of what I was talking about.