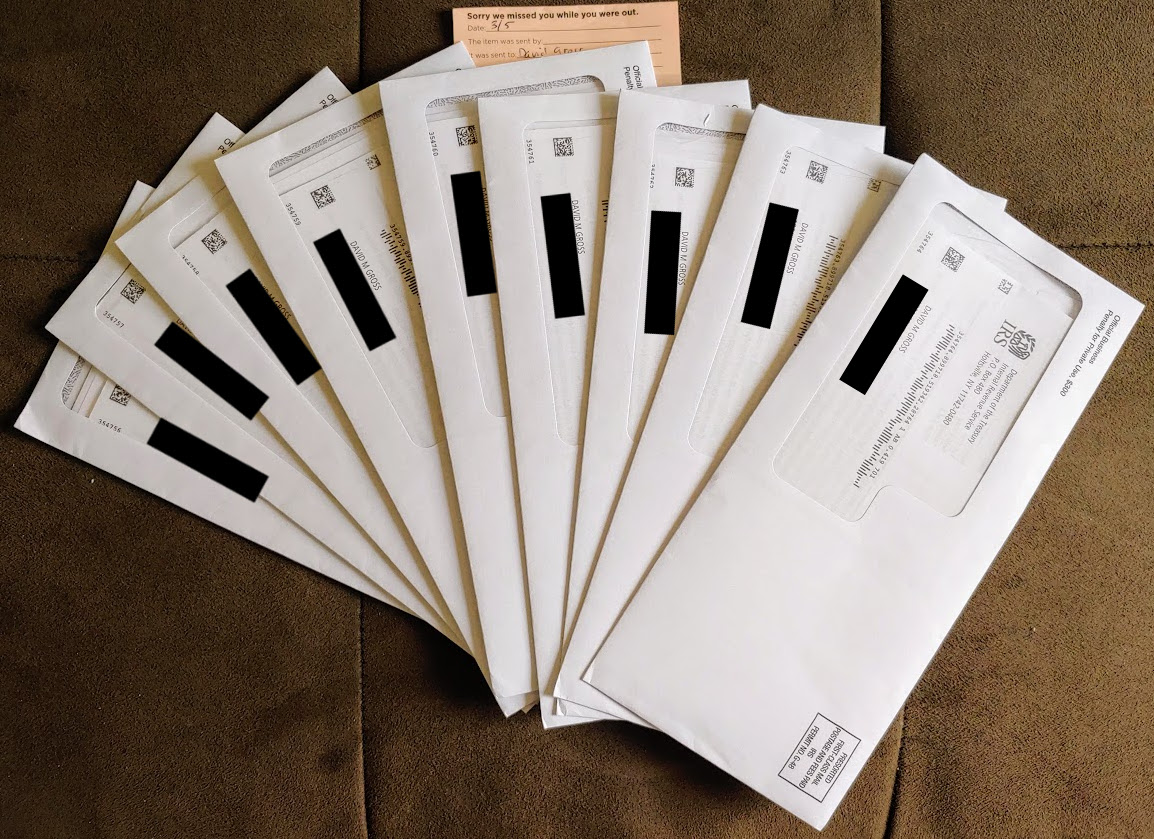

Another day, another nine freaking envelopes from the IRS.

Because it’s the government, the IRS sends me one notice, for each tax year for which I have refused payment, each in its own envelope with its own return envelope and three pages of boilerplate. The letters simply tell me the balance due for each year. A single four-page letter covering all the years would have conveyed the same information at less expense and bother, but they want to remind me how wastefully they squander the money other people give them.

However, for me there was a silver lining in all this boondoggletry. The nine envelopes I got today covered tax years 2010–2018 (I haven’t filed for 2019 yet). Tax year 2009 was missing. This suggests to me that perhaps as far as the IRS is concerned, that year has already hit the ten-year statute of limitations expiration date for collection action and they have given up on it. I won’t formally declare victory for another couple of months as I know a lot of times one of leviathan’s claws doesn’t know what the other claws are doing. I note for example that in the IRS’s on-line tool for checking your tax balance my 2009 tax year still shows as due. But it’s a promising sign.

Meanwhile, the agency still doesn’t have all of its tax forms ready for tax year 2019. I ordered forms back in January , and they’ve been sending them to me in dribs and drabs since then, along with notices saying the rest are not yet available.