Tax resistance notes from hither and yon:

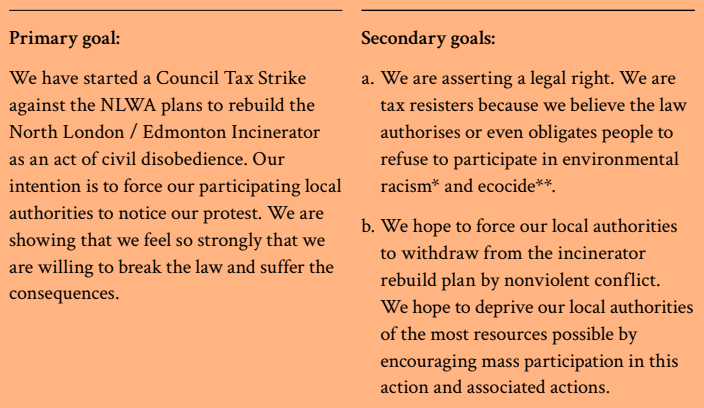

- Activists who oppose North London Waste Authority’s plans to build a new, bigger incinerator in Edmonton have been promoting a council tax strike.

Last I looked, two dozen strikers were holding back a portion of their tax.

The group has composed a North London Incinerator Council Tax Strike Handbook which, I’m delighted to report, is clearly inspired by the work I did for 99 Tactics of Successful Tax Resistance Campaigns.

For example:

- Democrats in Congress are having more trouble than expected getting everyone in and out of the clown car. The upshot is that the painstakingly-negotiated “Build Back Better Act” is in jeopardy — along with the $80 billion in new IRS funding that was part of the bill.

- The Taxpayer Advocate released her annual report. Some excerpts:

was surely the most challenging year taxpayers and tax professionals have ever experienced — long processing and refund delays, difficulty reaching the IRS by phone, correspondence that went unprocessed for many months, collection notices issued while taxpayer correspondence was awaiting processing, limited or no information on the Where’s My Refund? tool for delayed returns, and — for full disclosure — difficulty obtaining timely assistance from TAS.

, examination coverage has decreased, enforcement efforts have been negatively impacted, and the Level of Service has continued to drop as the IRS’s workforce and budget have declined. On the resources side, the IRS’s baseline budget has been reduced by about 20 percent on an inflation-adjusted basis , and its workforce has shrunk by about 17 percent.

There is no way to sugarcoat in tax administration: From the perspective of tens of millions of taxpayers, it was horrendous.

[T]he number of individual income tax returns the IRS receives — a reasonable approximation of its workload — has increased by 19 percent , while its baseline appropriation on an inflation-adjusted basis has decreased by nearly 20 percent. This imbalance has left the IRS without enough resources to meet taxpayer needs, let alone to invest in additional personnel and technology.

The IRS has not finished processing millions of original and amended returns from , even though returns will soon arrive for processing.

According to the Department of the Treasury, the gross tax gap — the difference between taxes paid and taxes owed — is estimated to have totaled about $580 billion in , up from an estimated amount of nearly $440 billion in , and is expected to rise to about $7 trillion by if left unaddressed.

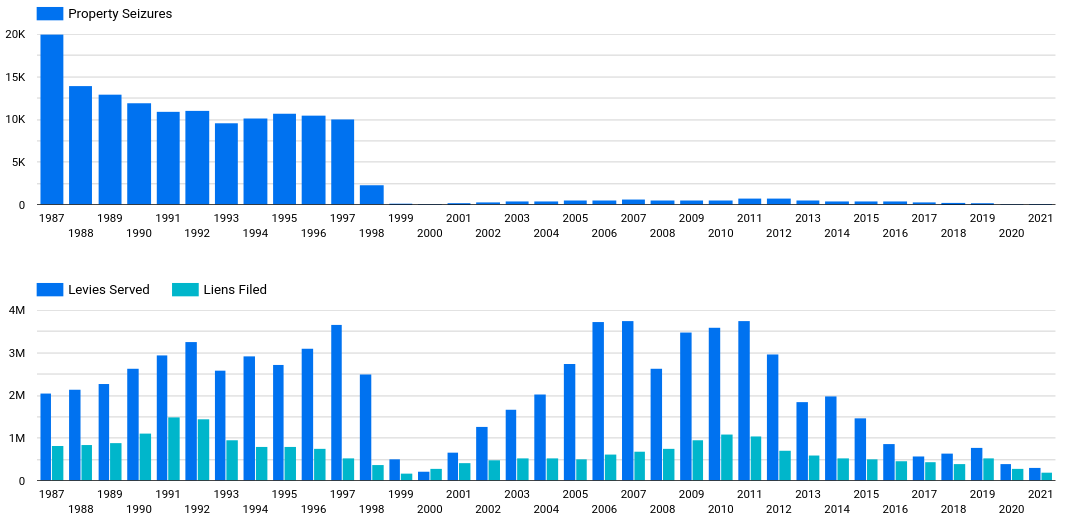

The report also included some totals for levies, liens, and seizures, so I can update these graphs:Processing a paper-filed return is significantly more expensive for the IRS than processing an e-filed return due to the costs associated with training, recruiting, and staffing for manual data transcription. In fact, the cost to process a paper-filed Form 1040 in was $15.21, which is substantially higher than the $0.36 cost to process an e-filed return.

- More excitement from the human war on traffic ticket robot cameras, as fire, spray paint, and other sorts of sabotage knocked cameras out of commission in France, Germany, and Italy in recent weeks.