Great Protest Meeting Against the Imprisonment of Mr. Mark Wilks.

“No Government Can Stand Ridicule. The Position is Ridiculous!”

The great meeting of indignant protest against the imprisonment of Mr. Mark Wilks, held at the Caxton Hall on , under the auspices of the Women’s Tax Resistance League, will be not only memorable but epoch-making.

The fight for woman’s citizenship in “free England” has led to the imprisonment of a man for failing to do what was impossible.

Throughout the meeting the humor of the situation was frequently commented upon, but the serious aspect was most strongly emphasized.

Sir John Cockburn, who presided, struck a serious note at the outset; for anything, he said, that touched the liberty of the citizen was of the gravest importance.

He remarked that it was the first occasion on which he had attended a meeting to protest against the action of law.

The resolution of protest was proposed by Dr. Mansell Moullin, whose many and continued services to their Cause are warmly appreciated by all Suffragists, in a very able speech, and ran as follows:—

That this meeting indignantly protests against the imprisonment of Mr. Mark Wilks for his inability to pay the tax on his wife’s earned income, and demands his immediate release.

This meeting also calls for an amendment of the existing Income-tax law, which, contrary to the spirit of the Married Women’s Property Act, regards the wife’s income as one with that of her husband.

A Husband the Property of His Wife.

Dr. Moullin expressed his pleasure in supporting his colleague, Dr. Elizabeth Wilks, in the protest against the outrage on her husband.

The case, he said, was not a chapter out of “Alice in Wonderland,” but a plain proof that, although imprisonment for debt has been abolished in England, a man may be deprived of his liberty for non-payment of money which was not his, and which he could not touch.

The only argument that could be used was that Mr. Wilks was the property of his wife.

Twice distraint had been made on the furniture of Mrs. Wilks, the third time the authorities carried off her husband; it is the first occasion on which it has been proved that a husband is the property of his wife.

The law allows a man to put a halter round the neck of his wife, take her to the market-place and sell her, and this has been done within recent years; but there is no law which allows the Inland Revenue authorities to sell a husband for the benefit of his wife.

Governments, he added, can stand abuse, but cannot stand ridicule, and the position with regard to Dr. Wilks and her husband is both ridiculous and anomalous.

The serious question behind the whole matter was how far anyone is justified in resisting the law of the land.

The resister for conscience’ sake is the martyr of one generation and the saint of the next.

Dr. Moullin doubted whether the Hebrews or Romans of old would recognise what their laws had become; we are ashamed of the outrageous sentences for trivial offences passed by our forefathers; our children will be ashamed of the sentences passed to-day.

Everything in the law connected with women required reconstruction from the very foundation, declared Dr. Moullin.

Constitutional methods, like Royal Commissions, were an admirable device for postponing reform; all reformers were unconstitutional; they had to use unconstitutional methods or leave reform alone.

The self-sacrifice of an individual makes a nation great; that nation is dead when reformers are unwilling to sacrifice themselves.

No Man Safe.

Mr. George Bernard Shaw was the next speaker, and gave a characteristically witty and autobiographical address.

He said that this was the beginning of the revolt of his own unfortunate sex against the intolerable henpecking which had been brought upon them by the refusal of the Government to bring about a reform which everybody knew was going to come, and the delay of which was a mere piece of senseless stupidity.

From the unfortunate Prime Minister downwards no man was safe.

He never saw his wife reflecting in a corner without some fear that she was designing some method of putting him and his sex into a hopeless corner.

He never spoke at suffrage gatherings.

He steadily refused to join the ranks of ignominious and superfluous males who gave assistance which was altogether unnecessary to ladies who could well look after themselves.

Under the Married Women’s Property Act the husband retained the responsibility of the property and the woman had the property to herself.

Mr. Wilks was not the first victim.

The first victim was G.B.S. The Government put on a supertax.

That fell on his wife’s income and on his own.

The authorities said that he must pay his wife’s supertax.

He said, “I do not happen to know the extent of her income.”

When he got married he strongly recommended to his wife to have a separate banking account, and she took him at his word.

He had no knowledge of what his wife’s income was.

All he knew was that she had money at her command, and he frequently took advantage of that by borrowing it from her.

The authorities said that they would have to guess at the income; then the Government passed an Act, he forgot the official title of it, but the popular title was the Bernard Shaw Relief Act.

They passed an Act to allow women to pay their supertax.

In spite of this Act, ordinary taxpayers were still apparently under the old regime, and as Mrs. Wilks would not pay the tax on her own income Mr. Wilks went to gaol.

“If my wife did that to me,” said Mr. Shaw, “the very moment I came out of prison I would get another wife.

It is indefensible.”

Women, he added, had got completely beyond the law at the present time.

Mrs. [Mary] Leigh had been let out, but he presumed that after a brief interval for refreshments she would set fire to another theatre.

He got his living by the theatre, and very probably when she read the report of that speech she would set fire to a theatre where his plays were being performed.

The other day he practically challenged the Government to starve Mrs. Leigh, and in the course of the last fortnight he had received the most abusive letters which had ever reached him in his life.

The Government should put an end to the difficulty at once by giving women the vote.

As he resumed his seat Mr. Shaw said: “I feel glad I have been allowed to say the things I have here to-night without being lynched.”

Bullying Fails.

Mr. Laurence Housman laid stress on the fact that the Government was endeavouring to make Mrs. Wilks, through her affection, do something she did not consider right.

Liberty could only be enjoyed when laws were not an offence to the moral conscience of a people.

Laws were not broken in this country every day because they were not practicable.

Every man, according to law, must go to church on Sunday morning, or sit two hours in the stocks; it was unlawful to wheel perambulators on the pavement.

If the police were compelled to administer all the laws on the Statute Book, England would be a hell.

To imprison Mr. Wilks for something which he had not done and could not do was as sane as if a servant were sent to prison because her employer objected to lick stamps under the Insurance Act.

The Government had tried bullying, but women had shown that it did not pay.

Self-respecting people break down a law by demonstrating that it is too expensive to carry.

Question for the Solicitor to the Treasury.

The legal aspect was the point specially dealt with by Mr. Herbert Jacobs, chairman of the Men’s League for Women’s Suffrage.

He said that it was stupidity, not chivalry, which deprived the husband under the Married Women’s Property Act of of the right to his wife’s earnings, but did not relieve him of responsibility to pay for her.

Imprisonment for debt has been abolished; but if it could be shown that a man had the means to pay and refused to pay, he could be sent to prison for contempt of court.

Mr. Jacobs suggested that the Solicitor to the Treasury should be asked to reply to the following question: “What has Mr. Wilks done or omitted to do that he should be imprisoned for life?”

The law, he added, does not compel a man to do that which he cannot possibly perform.

The action of the Internal Revenue authorities may be illegal; it certainly is barbarous and ridiculous.

Bad Bungling

Mr. H[enry].G[eorge].

Chancellor pointed out that the Married Women’s Property Act was an endeavour by men to remove injustice to women, but because they did not realise the injustices from which women suffer and avoided the woman’s point of view, they bungled badly.

No one can respect a ridiculous law, and the means to be taken in the future to avoid making ridiculous laws, must be to give women the right to make their opinions effectively heard through the ballot-box.

Mr. Chancellor said that he had investigated 240 Bill[s] laid on the table of the House, and had found that 123 were as interesting to women as much as to men; twenty-one affected women almost exclusively; six had relation to the franchise.

“When we consider these Bills,” he added, “we rule out the whole experience and knowledge of women.

We must abolish sex privilege as it affects legislation.

I appeal to men who are Antis to consider the Wilks case, which is possible just so long as we perpetuate the huge wrong of the continued disenfranchisement of women.”

Refinement of Cruelty

In a moving speech Rev. Fleming Williams declared that the case of Dr. Wilks and her husband ought to appeal to men all over the country.

He spoke of the personal interviews he had had with Mr. Wilks in the presence of the warder, and of the effect of imprisonment upon him.

It was impossible to contemplate without horror the spectacle of the Government’s attempt to overcome the wife’s resistance by the spectacle of her husband’s sufferings.

If she added to his pain by humiliating surrender, it would lower the high ideal he cherishes of her principles.

“She dare not do it; she will not do it!” exclaimed Mr. Williams. He added that he had had an opportunity of waiting upon the Inland Revenue Board and tried to show them how their action appears to outside people.

He had suggested that, in order to bring the law into harmony with justice, representative public men in co-operation with the Board should approach the Treasury to secure an alteration in the law.

“But,” declared Mr. Williams, “if women are made responsible by law it will not bring the Government an inch nearer the solution of the difficulty.

They may imprison women for tax resistance, but married men would not stand it.

The only way is to say to Dr. Wilks, “We will give you the right to control the use we intend to make of your money.”

The resolution was passed unanimously with great enthusiasm, and thus ended a meeting that will be historic.

The Campaign.

A great campaign is being carried on for the release of Mr. Mark Wilks.

On , the Women’s Tax Resistance League held a meeting, followed by a procession in the neighborhood of the prison, and on Sunday there was a large and very sympathetic meeting in Hyde Park.

Mrs. Mustard took the chair.

Mrs. [Charlotte] Despard and Mrs. [Margaret] Parkes were the speakers.

The resolution demanding the release of Mr. Wilks was carried unanimously.

Nightly meetings are held in Brixton by the Men’s Federation for Women’s Suffrage.

A great demonstration will take place on , in Trafalgar-square.

Members of the Women’s Freedom League and all sympathisers are asked to come and to bring their friends.

There will be a large attendance of London County Council teachers — more than 3,000 of whom have signed a petition against the arrest of Mr. Wilks.

A deputation of Members of Parliament and other influential men is being arranged by Sir John Cockburn to wait upon Mr. Lloyd George and to see him personally about the case.

Ignominious Defeat of Law-Makers.

We hope earnestly that before this issue of our Vote appears, news of the release of Mark Wilks will be brought to us.

It seems to us impossible that the authorities of the country can persist in their foolish and cruel action.

But, in the meantime and in any case, it may be well for us seriously to consider the situation.

We are bound together, men and women, in a certain order.

For the maintenance of that order, it has been found necessary for communities and nations all over the world to impose laws upon themselves.

In countries that call themselves democratic, it is contended that the civil law is peculiarly binding, because the people not only consent, but, where they have sufficient understanding, demand that the laws which bind them shall, in certain contingencies, be made or changed or repealed according to their need, and because by their voice they place in seats of power the men whom they believe to be honest and wise enough to carry out their will.

That, at least, is the ideal of democracy.

For several generations the British nation has claimed the honour of being foremost in the road that leads to its achievement.

We (or rather the men of the country) boast of our free institutions, of our free speech, of the liberty of the individual within the law to which he has consented, of the right to fair trial and judgment by his peers when he is accused of offences against that law; above all — and now we have the difference between a democratically governed country and one under despotic rule — not to be liable to punishment for the omission of that which he is unable to perform.

It seems clear and simple enough — what any intelligent schoolboy knows; and yet our so-called Liberal Government, which flaunts in every direction the flag of democracy, which proclaims, here severely and there with dulcet persuasion, that liberty for all is their aim, and that “the will of the people shall prevail,” does not hesitate, when it is question of a reform movement which it dislikes and despises, to set itself in direct opposition to its own avowed principles.

For what do the arrest and imprisonment of Mark Wilks mean?

We are perfectly certain that it will not last long.

Stupid and inept as it has been, the Government, we are certain, will not risk the odium which would justly fall upon it if this outrage on liberty went on.

A Government which has much at stake and which lives by the breath of popular opinion cannot afford to ignore such strong and healthy protest as is being poured out on all sides.

To us, who are in the midst of it, that which seems most remarkable is the growth of public feeling.

In the streets where processions are nightly held, we were met at first by banter and rowdyism.

“A man in prison for the sake of Suffragettes!”

To the boy-mind of the metropolis, on the outskirts of many an earnest crowd, that seemed irresistibly funny; but thoughtfulness is spreading; into even the boy-mind, the light of truth is creeping.

If it had done nothing else, the imprisonment of Mark Wilks has certainly done this — it has educated the public mind.

It is not we, the Suffragists alone — it is women and men in hosts who are asking, What do these things mean?

On the part of these in our movement they mean courage, determination, skilful generalship — aye, and speedy triumph.

On the part of our opponents, perplexity and failure.

“This is defeat, fierce king, not victory,” said Shelly’s Prometheus, when from his rock of age-long pain he hurled heroic defiance at his tormentor.

The ills with which thou torturest gird my soul

To fresh resistance till the day arrive

When these shall be no types of things that are.

Woman, in this professedly liberty-loving country, may echo the hero’s words.

Defeat, in very truth, for what can the authorities do?

Their position is an extraordinary one.

In a lucid interval, politicians — not clearly, it may be, understanding the issues involved — passed the Married Women’s Property Act.

We believe there were no Antis then to guide and encourage woman-fearing man.

This may partly account for it.

In any case, the deed was done.

Married, no less than single women and widows, became owners of their own property and lords of their own labour.

It would have saved the country from much unnecessary trouble if, then, politicians had gone a step further, if they had recognised woman’s personal responsibility as mother, wage-earner or property-owner, and had dealt with her directly.

Love of compromise, unfortunately, weighs too deeply on the soul of the modern politician for him to be able to take so wise a course, and it is left for his successor to unravel the tangle.

What are the authorities to do?

While, with threats of violence and dark hints of disciplined, organised resistance, Ulster defies them, Suffragists by almost miraculous endurance are breaking open prison doors.

While brutal men, under the very eyes of a Minister of the Crown, are torturing and insulting women, in token, we presume, of their devotion to him, the story of the wrongs of women — not only these but others — is being noised abroad.

None of our recent publications has been bought so freely as “The White Slave Traffic.”

While well-known women tax-resisters are left at large, a man who has not resisted, but who respects women and will not coerce his wife, is arrested and locked up in prison without trial, and, since he cannot pay, for an indeterminate time.

A pretty mess indeed, which will take more than the subtlety of an Asquith, a Lloyd George or a McKenna to render palatable to the men on whose votes they depend for their continuance in power!

In a few days they will be faced with a further difficult problem.

Women are prepared to resist, not only the Income, but also the Insurance Tax.

Let us see what the alternatives are.

Mark Wilks may be let out as Miss [Clemence] Housman was; but that will not help the Government.

It is a poor satisfaction to a creditor of national importance to know that his debtor is or has been in prison.

He wants his money, and the example of one resister may be followed by many others.

If so, that big thing the Exchequer suffers.

The creditor may, when Parliament comes together, pleading urgency, pass an Act which will make married women responsible for their own liabilities.

That might result in a revolt of married women which would have serious consequences.

Men who live at ease with their children, shepherded by admirable wives, would find it, to say the least, inconvenient to be deprived periodically of their services.

And these men might be in the position of Mark Wilks.

They might not be able to pay, while their wives might have no goods on which distraint could be made.

Truly the position would be pitiable.

Over the Insurance Act the same difficulties will arise.

What is a distraught Government to do?

The answer is clear.

The one and only alternative that lies before our legislators is at once to take steps whereby women — workers, mothers, property-owners — shall become citizens.

That done, we will pay our taxes with alacrity; we will bring our quota of service to the State that needs our aid, and the unmannerly strife between man and woman will cease.

In the meantime, the law and the legislator are defeated ignominiously, and it is becoming more and more evident that, in a very near future, “the will of the people shall prevail.”

C. Despard.

The “Favouritism” of the Law.

It would be very difficult, if not impossible, to devise a situation which would show more clearly than does the Wilks’ case, how absolutely incapable is the average man of grasping a woman’s point of view, or of realising her grievances and legal disabilities.

For seventy years men have been cooly appropriating the Income-tax refunded by the Inland Revenue on their wives incomes.

Did anybody ever hear of a man raising a protest against the state of the law which made it possible and legal for a husband to do this?

My own experience covers a good many years of Income-tax work, and the handling of some hundreds of cases, but the only complaints I have ever heard have come from the defrauded wives.

I have observed that the men always accepted the position with the utmost equanimity.

But now, when by the exercise of considerable ingenuity, women have contrived, for once in a way, to put the boot on the other leg, the Press and the public generally is filled with horror, and the air is rent with shrieks of protest from the male sex.

The Evening News sapiently remarks that women might have been expected to have more sense than to seek to show up a law which is “so obviously in their favour”!

And The Scotsman says: “One would imagine that the last thing the Wilks’ case would be used for is to illustrate the grievance which woman suffers under the law.

Here two laws combine to favour the wife and inflict wrong upon the husband.”

And it goes on to deride women and “their inherent illogicality.”

Here we see clearly manifest the absolute incapacity of man to realise the existence of any injustice until it touches himself or his fellow man.

Nothing could well be more logical than the holding of a man responsible for non-payment of his wife’s Income-tax, since it is the necessary and inevitable corollary of the theory that a wife’s income belongs to her husband, and that all refunds of Income-tax must be made to him, and to him only.

It is in accordance with logic and also with strict business principles that no person can claim the advantages of his legal position while repudiating its disadvantages.

Thus if a man dies leaving money, his son cannot claim to take that money and at the same time repudiate his father’s debts.

He must accept the one with the other.

And in exactly the same way, women are no longer going to allow men to claim their legal right to demand re-payment of their wives’ Income-tax, unless they also accept their legal responsibility for its non-payment.

The game of heads-I-win-tails-you-lose is played out, and the sooner men realise this fact the better it will be for everybody.

The “logic” of The Scotsman and its contemporaries is no longer good enough for women.

The law must be forced to take its course where men are concerned as it does where women are concerned.

As to the provisions of the Income-tax Act favouring the wife and wronging the husband, I can only say that Mr. Wilks’ case is the first in all my experience where these provisions acted adversely to the husband.

And even in this case they only so acted because women had laid their heads together to bring it about, and thus show how little men relish a law of their own making when it begins to act on the boomerang principle, and they find themselves “hoist with their own petard.”

A few actual instances, casually selected out of a large number, will show how wives have hitherto been “favoured.”

A man and his wife have £100 a year each, taxed (at 1s. 2d. in the £) by deduction before they receive it.

There are four children, on each of whom the husband is entitled to claim a rebate of £10 a year.

(The wife, it should be noted, can never claim any rebate whether she has a dozen or a score of children.

And if a widow, having children, re-marries, the rebate on these children goes to their step-father.)

Consequently the husband can, and does, reclaim not only the tax deducted from his own income, i.e. £5 16s. 8d., but also the £5 16s. 8d. deducted from his wife’s income.

So he really pays no tax at all, and gains £5 16s. 8d. while she loses a similar amount.

Thus the actual position is, that the wife is only worth £94 a year, while he is worth £106 a year, though nominally their incomes are the same.

If single, each could claim repayment of £5 16s. 8d., therefore marriage represents a loss to the wife, but a profit to her husband.

A member of the Women’s Freedom League was forced to leave her husband on account of his misconduct, and to bring up and educate her children without any financial aid from him.

But for a number of years he regularly drew the “repayment” of her Income-tax, until a merciful Providence removed him from this mundane sphere, by which time it was calculated that she had lost, and he had gained, about £200. At his death she, of course, ceased to be a legal “idiot,” and was allowed to claim her repayment for herself.

I may remark here that the Income-tax Act has a favourite method of classifying certain sections of the community, namely, as “idiots, married women, lunatics and insane persons.”

I don’t know precisely what the difference is between a “lunatic” and an “insane person,” but doubtless there is a difference, though unintelligent persons might think they were synonymous terms.

As regards the point of resemblance between the “idiot” and the “married woman,” it is rather obscure, but after intense mental application I have succeeded in locating it; and really when somebody illuminates it for you it becomes clear as daylight.

It is quite evident to me that our super-intelligent legislators are convinced that the woman who is capable of going and getting married is an utter “idiot,” and in fact next door to a “lunatic.”

Well, men ought to know their own sex, and if they say that the women who marry them are idiots, it must be true, I suppose.

We may therefore take it that a woman evinces her intelligence by remaining unmarried.

I ought humbly to explain that, being married myself, I am only one of the idiots, and therefore my ideas on any subject must not be taken to have the slightest value.

But to return to our instances of “favouritism,” another man has £230 a year and his wife £170 a year.

She pays Income-tax (deducted before receipt) to the tune of £9 18s. 4d., and he pays 2s. 6d..

It sounds impossible, perhaps; but when you know the rules it is quite simple.

To begin with, he gets an abatement of £160, which leaves him with £70. Then he gets a further abatement of £67 for insurance premiums, a great part of which premiums are paid by his wife on her own life.

This leaves him with a taxable income of slightly over £3, on which he pays 9d. in the £1., amounting to half-a-crown.

This couple have no children.

If they had any he would begin not only to pay no tax himself, but to have some of hers repaid to him.

She, however, under any circumstances, will always be mulcted of the £9 18s. 4d.; unless she becomes a widow, when she will be able to reclaim the whole amount.

(The official forms supplied to those reclaiming Income-tax read: “A woman must state whether spinster or widow.”)

If we reverse the financial position of this couple, and assume that she receives £230 and he only £170, she would then be paying £13 8s. 4d. Income-tax.

Contrast this with his payment of half-a-crown in the same circumstances, and observe how highly she is “favoured.”

He, however, would then pay nothing and would receive a “refund” of nearly £3 10s. a year.

A very enterprising and smart young fellow was able to treat himself to a really nice motor-cycle — not the sort that has a side-car for a lady — out of his wife’s “repaid” tax; repaid to him, I mean.

He can’t support himself, but depends on her, as she has just about enough for them both to rub along on, though she can’t afford luxuries for herself, and wouldn’t have paid for his.

But the Inland Revenue gave him her money quite cooly and without the slightest fuss.

The “Scotsman” will be pleased to hear that this poor husband manages to bear up quite bravely under his “wrongs,” and seems indeed to get a considerable amount of satisfaction out of them.

His wife, I am truly sorry to say, doesn’t properly appreciate the favour shown to her by the law.

But then men are naturally brave, and women are by nature a thoroughly ungrateful lot I expect, if they could only see themselves as The Scotsman and The Evening News see them.

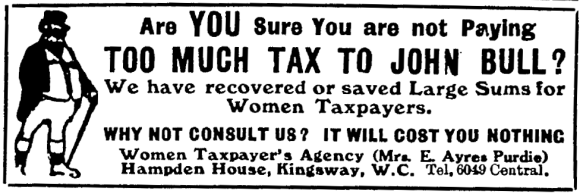

Ethel Ayers Purdie.

Another article from the same issue reads:

Forerunners.

In this connection it is interesting to note that three years ago two members of our Edinburgh Branch, the Misses N[annie]. and J[essie].

Brown, walked from Edinburgh to London, chatting of Woman Suffrage with the villagers all along the line of route southwards, many of whom had then not even heard about this question.

They started from Edinburgh in and reached London before .

A further point of interest is that the father of these ladies was the last political prisoner in Claton Gaol in .

Mr. Brown’s offence was his refusal to pay the Annuity Tax which he considered an iniquitous imposition.

He was imprisoned for one week, but received the treatment of a political prisoner; he had the satisfaction of knowing that his protest led to the repeal of the Annuity Tax.

The next people who committed a political offence in Edinburgh were two Suffragettes, who — fifty-two years later than Mr. Brown’s incarceration — were imprisoned, but were not treated as political prisoners.

Another article from the same issue:

In Hyde Park.

Notwithstanding the showers a good crowd gathered on to hear Mrs. Despard, who spoke of the anomalies existing in our laws affecting women and taxation, and referred at length to the imprisonment of Mr. Mark Wilks for his inability to pay his wife’s taxes on her earned income.

A resolution expressing indignation at this and demanding Mr. Mark Wilks’ release was passed with only five dissentients.

The chair was taken by Mrs. Mustard, who told the audience of the indignation felt by the Clapton neighbours and friends of Mr. and Dr. Elizabeth Wilks over his imprisonment.

A note in another article about the activities of local branches said, in part:

…On evening we had our usual open-air meeting.

Mr. Hawkins kindly chaired, and Mrs. Tanner spoke with her usual excellency, bringing in the “Wilks” case in her speech, as a specimen of anomaly in law in which the man suffers.

The crowd was sympathetic as regarded “poor old Wilks,” but was swayed otherwise by mistaken ideas of our aims and motives.…