This report summarizes . In some places I’ve put links to previous Picket Line entries that expand on some of the topics I mention. You can follow these links by clicking on the “♦” symbols.

Picket Line Annual Report

, the U.S. invasion of Iraq began. For me, this was the last straw and so I started what I then called “an experiment” in tax resistance.♦

A review of my goals

My primary goal was to stop financially supporting the U.S. government. I hoped to do this legally by reducing my federal income tax burden to zero — lowering my income below the tax line by taking legal deductions and credits.

Tax Resistance

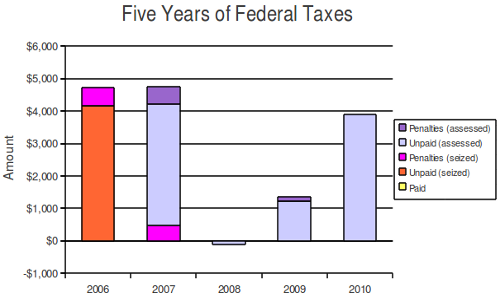

I missed my goal of avoiding all federal income tax, but in I have succeeded. However, I have had a federal self-employment tax assessment most of these years (this is different from the income tax). I decided to stop voluntarily paying this tax as well, and so I have since been charged penalties & interest in addition to the assessed tax. The IRS has periodically attempted to levy bank accounts to seize these back taxes, with mixed success. They didn’t manage to take anything from me , though they sent me a few pleading letters.♦

My two-track strategy of legally avoiding the federal income tax while illegally refusing to pay the self-employment tax is an awkward and perhaps untenable compromise, but for me it currently seems the best alternative.

I owed, and refused to pay, about $3,850 in federal taxes, all from the self-employment tax.

The IRS has seized about $6,200 of the total of about $16,000 that I have refused to pay so far. I don’t have a fail-safe plan to hide my assets, so I expect that the IRS will continue to seize money if they find it.

Although excise taxes are a very small part of what the government tries to get me to pay, I’ve adopted avoidance techniques here as well: for instance, I long ago gave up owning a car, so I pay very little federal excise tax on gasoline (at least directly), I don’t smoke and so I don’t pay tobacco taxes, and I home-brew beer and hard cider so as to avoid the federal excise tax on alcoholic beverages. For the first half of I tried drinking no taxed alcoholic beverages unless I was at someone else’s home or on those rare occasions when I was in a bar or restaurant. That worked well until a month-long vacation interrupted my home-brewing schedule and left me high and dry for a while, so I slipped back into less-pure habits.

Sustainability

I want to resist taxes over the long term, and so it is important that my expenses remain low enough that my tax-free income is also a good and sustainable one. was a good year for me income-wise. I brought in close to $33,000 in profit from my home-based business.

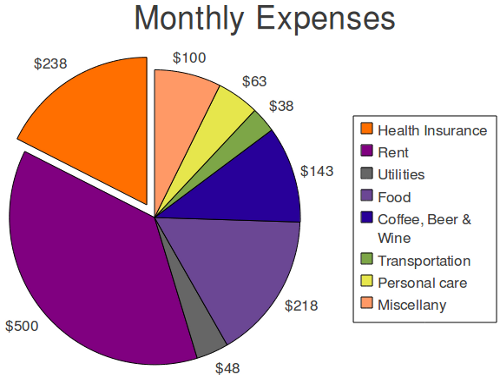

My regular expenses for things like rent, utilities, food, transportation, and such came to about $1,350 per month. Because I’m self-employed, my health insurance premium is a deductible expense that doesn’t count toward the $16,750 tax-free disposable income that I’m allowed to use under my DON Method of tax resistance (in addition, I use a Health Savings Account so my health insurance deductible is also tax-free).

Not included in the above pie chart are any business expenses that I can deduct or my self-employment tax assessment (half of which I can deduct). My yearly living expenses, therefore, take about $13,300 out of that $16,750. If I budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect may be seized, that would come to another $4,000 or so, half of which also counts against the $16,750.

Things were pretty fat this year and I felt more financially relaxed. I didn’t adopt any notable new cost-saving measures, and I never got around to doing my annual ritual of taking a month to carefully account for all of my spending, day in and day out.

My 1040: A walk-through

Here’s how my 1040 worked out this year. First, my Total Income:

| Total Income | $29,822 |

|---|---|

| Business income | $32,822 |

| Taxable interest | $0 |

| Capital gain/loss | −$3,000 |

My business income came from two sources: my contract work as a technical writer / web programmer and sales of my books. The capital losses are from sales of mutual funds and stocks.

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $16,133 |

|---|---|

| Total Income | $29,822 |

| HSA deduction | −$3,050 |

| ½ self-employment tax | −$2,128 |

| SEP deduction | −$813 |

| Self-employed health insurance deduction | −$2,697 |

| IRA deduction | −$5,000 |

, I put away $5,813 for retirement and $3,050 for future medical spending (or for retirement, if I stay healthy). That represents almost 30% of my Total Income for .

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that half of your FICA doesn’t count as your income and so you don’t pay income tax on it (isn’t that rich — they charge you income tax on money you never saw because it was taken as your contributions to social security — and then they may charge you income tax again on your social security benefits if you’re lucky enough to live so long!). If you’re self-employed, you pay both halves and it’s all considered income, so the IRS lets you take half of your self-employment tax as a deduction here to even things out (yes, even if you’re refusing to pay it like I am).

My Adjusted Gross Income is below the $16,750 threshold that allows me to get the maximum rate on the Retirement Savings Contributions Credit, so I hit my target.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $6,783 |

|---|---|

| Adjusted Gross Income | $16,133 |

| Standard deduction | −$5,700 |

| Personal exemption | −$3,650 |

And from there, my tax owed:

| Tax owed | $3,856 |

|---|---|

| Income Tax | $678 |

| Retirement Savings Contributions Credit | −$678 |

| Self-employment tax | $4,256 |

| Making Work Pay credit | −$400 |

Hopefully I got it right the first time . Last year I incorrectly failed to apply for the Earned Income Tax Credit because I mistakenly assumed I wouldn’t qualify. The IRS was happy to correct my mistake.♦

Other Goals

I hope to encourage other people to consider tax resistance and I hope that The Picket Line is a good resource for people doing tax resistance and for those considering it. I keep trying to make it more useful.

I wrote articles on tax resistance and related issues for the New Escapologist♦ and Living Nonviolence♦. I have also spread the word elsewhere, and have done a bit of one-on-one counseling to help new resisters hit the ground running. The write-ups on tax resistance I’ve done for Wikipedia get lifted or paraphrased from time-to-time for mainstream media reports.

I’ve translated, inexpertly, a number of articles and essays concerning the war tax resistance movement in Spain, which is engaged in some more sophisticated dialog and criticism than can be found in the current English-language movement.♦♦♦♦♦

I published a new book this year, Rebecca Riots!: True Stories of the Transvestite Terrorists who Vexed Victoria, combining a reprint of Henry Tobit Evans’s book on the toll resistance campaign in Wales with some additional material.♦

I’ve been serving on the Administrative Committee of NWTRCC, helping organize meetings and do some of the behind-the-scenes business. I’ve put in a lot of hours trying to help organize the upcoming Spring national gathering in Berkeley. I also did a lot of behind-the-scenes work to pave the way for the launch of the redesigned NWTRCC website.♦

The state of the world and the tax resistance movements

The wars drag on, and the Obama administration is maintaining America’s repulsive policies on war & militarism, Big Brotherish snooping, impunity for torturers, propping up tyrants, and so forth. The thievery and mendacity of the politicians and the wizards of financial corruption that eat from the same troughs in Washington seems to know no bounds. My only consolation is that the politicians in charge are so craven and short-sighted as to be unable or uninterested in preventing the foreseeable meltdown of the system that nurtures them.

The war tax resistance movement (and the anti-war movement in general) is in the doldrums, deflated by the election of Obama who, though he has surrounded himself with hawks in his cabinet, increased the size and expense of the military, quickly ramped up the Afghanistan war, endorsed the Patriot Act, maintained the status quo at Guantanamo, and given a free pass to the nation’s torturers, seems to still be the darling of many of the progressives who make up the bulk of the ostensible peace movement.

I confess myself to be frustrated and I despair of seeing Americans rise up to reclaim some dignity and decency. When I started this experiment I was all fired up with the project of convincing all the angry anti-war protesters out in the streets to buckle down and start making resistance and dissent part of their day-to-day lives. Now I more and more see myself as mostly just trying to keep the flame lit so that should people ever feel the weight of that final straw they won’t have to start from scratch.

That said, I certainly admire Bradley Manning’s action, and I did find the WikiLeaks operation to be encouraging. It strikes me as a vulnerable model, but its at least temporary successes in grassroots anti-authoritarian activism were well-testified-to by the venomous frenzy of the reactions of the defenders of the status quo.♦

Prospects for the coming year

Assuming no major unexpected expenses, and assuming the tax law doesn’t undergo any radical changes, I’m well-positioned to have of living comfortably and well under the income tax line.

That said, I’ve entered a disruptive period in my personal life — my long-term relationship (almost as long as this blog’s “experiment”) has come to an end and I’ve been hunting for a new place to live. I’m also expecting to take this opportunity to do some lifestyle reassessment along the way. It’s hard to tell how well my past budget will predict my future expenses, but I figure that while some line-items are likely to change, the bottom line probably won’t move much.

In any case, I will likely “owe” self-employment tax again . I’ve budgeted for the possibility that the IRS may find a way to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster.

I continue to research historical examples of tax resisters and tax resistance campaigns, partially in preparation for a new, expanded edition of my American Quaker War Tax Resistance collection. I still daydream from time to time of distilling some of what I’ve learned about tax resisters and tax resistance campaigns historically into a book of advice for tax resistance organizers, in the hopes that the campaigns of tomorrow can learn from the successes, failures, and challenges of those that came before.

So on to of what is looking less and less like an experiment and more and more like a lifestyle.