Today, some excerpts from the news archives about war tax resister Richard Catlett:

The reader’s view

Local Quakers support stand of tax resister

To the editor:

On , Richard Catlett, who is one of our church members and a war-tax resister, went to prison for failing to file federal income tax forms.

We who belong to the Columbia Monthly Meeting of the Religious Society of Friends (Quakers), in agreement with Richard Catlett’s war-tax resistance, condemn last year’s military budget, which was the largest in our history. Last year the United States spent $32 billion on weapons that have the sole purpose of killing people and destroying property. The United States alone has enough nuclear weapons to destroy all humans on this earth many times. The SALT talks and the SALT Ⅰ treaty, while attempting to halt the arms race, have actually increased weapon production in both the United States and U.S.S.R. Similarly, foreign military sales, the proposed neutron bomb and the building of civil-defense shelters, only increase the chances of our nation starting or participating in a nuclear war that would inevitably result in the destruction of our nation.

We strongly support disarmament as it represents the only realistic hope for the survival of our nation, as well as the majority of people on earth. It is good to have war-tax resisters and we urge others to support disarmament and war-tax resisters like Richard Catlett.

David Wixom

for Colombia Friends (Quaker) Meeting

And some background:

Local war protester leaves for jail term

By J. Russell King

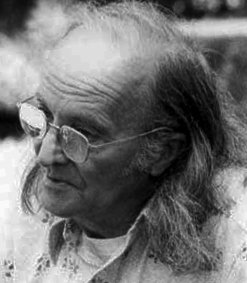

Missourian staff writerThough Richard Catlett does not like to classify himself, he is what most people would call a radical.

He has been a union organizer, a peace protestor, a civil rights activist, and a registered Socialist.

He performed alternative military service as a conscientious objector rather than go to war. And he has refused to pay federal income tax because the money is used to buy guns and soldiers. As a result, he’s gone to prison.

The Columbia [Missouri] resident is 69 years old.

Escorted by a group of fellow Quakers — members of the Religious Society of Friends — he turned himself in Friday to the U.S. Marshal’s office in Kansas City, Mo., to be taken to a federal corrections facility to serve 60 days for “willful failure to file a tax return.”

Catlett isn’t embarrassed to be going behind bars.

“I have absolutely no regrets,” Catlett said last week. “I’m unregenerate, proud of what I’ve done.”

Catlett sees his refusal to pay federal taxes as a moral issue, not a legal one.

“It’s immoral to pay someone to do what it would be immoral to do yourself,” he said.

“War is immoral, and I can’t pay taxes that will buy war.”

Catlett has consistently paid state and local taxes, though he says he disagrees with the way much of that money is spent.

“But there is a difference between not liking what the government does with your money, and letting them use it for immoral purposes,” he said.

Catlett’s pacifist beliefs go back almost as far as he does. He says his father would not let him join the Boy Scouts because of their “militaristic tendencies.”

After World War Ⅱ — during which he served with the National Park Service and in a Forest Service camp — Catlett quit paying taxes.

“It was evident that the United States was re-arming Europe, that there would be no attempt to promote peace,” he said. “We were already at war — the Cold War — with Russia.”

Spending most of his life since the war in farming and construction work, Catlett moved to Columbia from Springfield in . Through his activity against capital punishment, he became acquainted with local Quakers, and joined the newly formed Columbia Friends Meeting shortly after his arrival.

Catlett and his sister started a health food store in , but in the Internal Revenue Service seized his share of the business for back taxes.

He worked in the store for two years after he lost his share of ownership, but now is retired.

“I have no income anymore,”

Catlett said. “That way I can comply with the terms of probation, because I won’t need to file a return anyway — the government still won’t get any of my money.”

After the 60 days of imprisonment, Catlett still will have three years of probation. He said he would have served the entire sentence as a year of prison with no probation — “I don’t like the idea of a judge trying to run my life for three years” — except for the needs of his family.

“My wife has supported my needs through this whole thing, so I must support hers,” Catlett said. “She and Richie (Catlett’s son) need my presence.”

Catlett and his wife, Carol, 30, were married in . Their son is 20 months old.

Catlett’s case has become well-known in pacifist circles; the actual jailing of war resisters who refuse to pay federal taxes is unusual. Letters from Friends meetings throughout the country poured into the U.S. District Court offices of Judge Elmo B. Hunter while Catlett’s sentence was under consideration.

The Quakers helped pay part of his heavy legal expenses.

Catlett appealed the District Court verdict to the U.S. Court of Appeals for the 8th Circuit; its decision against him was handed down . Catlett said he could not afford an appeal to the Supreme Court, especially since the chances of the court hearing his case, a misdemeanor, were minuscule.

“Quakers have gone to jail because of their beliefs for centuries,” Catlett said. “It’s part of our tradition speaking truth to power.”

Quakers believe the taking of a human life, under any circumstance, is a violation of the laws of God. This stems from the basic principle among Friends that “There is that of God in every man” — that within all persons is contained a part of the eternal and almighty.

Though the 150,000 Friends in the United States are split into a number of groups with varying worship practices and religious beliefs, this anti-war, non-violent stance is a common thread among them.

The local Friends meeting, made up of about 30 members, is affiliated with the Illinois Yearly Meeting, a traditional “silent-meeting” body generally considered liberal theologically. Silent-meeting Quakers have no clergy.

Catlett finds it difficult to say whether anything positive has resulted from his fight against the IRS and, as he sees it, against war.

“It isn’t like an election, where you just count the votes to see who won. But the U.S. Attorney’s office was forced to face up to this issue; so was the court,” Catlett said. “And maybe because of the publicity this has received, more people will stop to think about the issue, too.”

He sees a few personal benefits as a result of the case.

“I know a lot more people now, and it’s certainly gratifying to get the kind of support I’ve received from all over the country,” Catlett said.

“I still have plenty of friends,” he said, “and I think my standing in the community as a man of integrity has been enhanced.”

When he returns to Columbia, Catlett will have many interests to occupy his time.

“I haven’t been bored a day in my life, I’ve never been without plans for the future,” he said.

Catlett said that being sentenced to federal prison has not changed his attitudes toward the government, toward the issue of war and taxes, or toward society.

“When I get out, I’ll continue to work for a more just and equitable society,” Catlett said. “I realize one individual is not going to change society next month or next year.

“But I do believe a more just and equitable society is possible — otherwise I’d check out and try some other world.”

The author of that piece accompanied it with another backgrounder:

tax resistance is historical means of protesting war

By J. Russell King

Missourian staff writerTax resistance as a form of protesting war in America goes back at least as far as , when Henry David Thoreau refused to pay a poll tax because he disapproved of the United States’ war with Mexico.

Thoreau spent a night in jail for that action, and it appears Richard Catlett of Columbia will spend two months in federal prison for his. But the actual imprisonment of war resisters who refuse to pay taxes has been unusual in recent years.

George Willoughby, clerk of the Committee on War Tax Concerns of the Philadelphia Yearly Meeting of the Religious Society of Friends, said he knows of only two or three other cases in which tax resisters have been sent to jail.

“But the failure to file a return at all as in Catlett’s case is a different form of tax refusal from that taken by most war resisters,” Willoughby said.

The most common form of war tax resistance during the Vietnam War was the refusal to pay the 10 percent federal tax on telephone service. Time magazine in reported that more than 56,000 Americans took this action as a form of protest against the war.

Others — 1,740 in — filed income tax returns, but withheld payment of a portion of the tax to protest military spending.

In both these cases, the IRS has usually recovered the money through seizure of the protesting taxpayer’s bank account, salary or property. Perhaps because of this, charges seldom have been filed against war tax resisters.

Willoughby said that though only a small number of Quakers are active war tax resisters — no exact figures are known — the position is one that is endorsed and respected by the Society.

“How far the individual Friend takes his witness for peace is an individual matter, but tax resistance is certainly a logical extension of the Society’s long tradition of peace concerns,” Willoughby said. He and his wife are tax resisters themselves.

“We feel, now that we are older and the government no longer seeks to use our bodies to make war, that the only effective witness is to try to keep them from using our money to make war,” Willoughby said.

Several non-Quaker organizations also have encouraged tax refusal as a form of war protest, particularly during the Vietnam years.

A proposal before Congress is the World Peace Tax Fund, which would allow taxpayers to channel that portion of their tax payments ordinarily used for military expenditures into peace-related projects.

“It’s much like conscientious objectors to military service; they still serve, but in another capacity,” Willoughby said.

The bill picks up more support in Congress each year, Willoughby said, but he does not expect its passage soon.

“In effect, it allows the taxpayer to tell the government how he wants his money spent. That’s a power the government is not likely to give up without a fight.”