A typical government gambit in its battle against tax resisters is to say, “okay, if you won’t pay us taxes, we’ll seize your property instead.”

Some tax resisters have responded to this by taunting back: “you’ll have to find it first.” And one way they have made good on this is by arranging to have other people hold their property in their names. Here are some examples:

- Some war tax resistance “alternative funds,” into which resisters pay their taxes into rather than submitting them to the government, have a dual purpose: they serve as ways to redirect tax money to causes the resisters find more palatable than government expenses, and they serve as a holding tank for funds that the resisters can later reclaim if back taxes are ever seized from them.

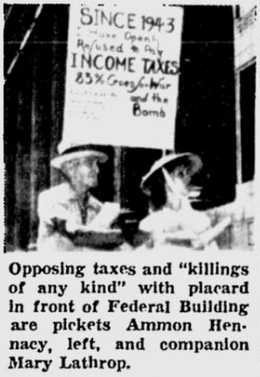

- The tax collector was so frustrated trying to seize anything at all from tax resister Ammon Hennacy that, when Hennacy was picketing the IRS office one day, the agent assigned to his case walked up to him and seized his picket sign — telling him he planned to auction it off! The next day, Hennacy was picketing again with some new signs that he and a friend had hastily made the night before… each one carefully marked “this sign is the personal property of Joseph Craigmyle.”

- In the Irish Tithe War, farmers would give temporary pasturage to the livestock of people when seizures were impending:

An organised system of confederacy, whereby signals were, for miles around, recognised and answered, started into latent vitality. True Irish ‘winks’ were exchanged; and when the rector, at the head of a detachment of police, military, bailiffs, clerks, and auctioneers, would make his descent on the lands of the peasantry, he found the cattle removed, and one or two grinning countenances occupying their place. A search was, of course, instituted, and often days were consumed in prosecuting it.

- Observers noted that during the resistance by British nonconformists against the taxes for sectarian education included in the Education Act, “they are taking the precaution of putting their property out of their own names, so that the collectors will not have anything to levy on.” Resister John Clifford said, “In the hope of preventing the authorities from getting their money in this way I made over all my household effects to my wife, but the collectors seized them just the same.” Another resister, Thomas Watson, foiled the collectors for at least eight years with the same technique.

- Tax resister Karl Hess sold the rights to royalties from his book to a community organization he worked for, so as to get a more easily-concealable lump sum of cash instead of a more-seizable royalty stream.

- War tax resister Aleck Dodd transferred his property into his wife’s name when he began to resist, in order to “protect my family from the possible results of my action, and not to evade the collection of my tax by due process of law.”