This report summarizes . In some places I’ve put links to previous Picket Line entries that expand on some of the topics I mention. You can follow these links by clicking on the “♦” symbols.

Picket Line Annual Report

, the United States began its “shock and awe” invasion of Iraq. For me, this shameful and repulsive act was the last straw and I started what I then called “an experiment” in tax resistance so that I would no longer feel complicit.♦

A review of my goals

My primary goal was to stop financially supporting the activities of the U.S. government. I hoped to do this legally by reducing my federal income tax burden to zero, so I lowered my income below the tax line by taking legal deductions and credits.

Tax Resistance

I missed my goal of avoiding all federal income tax, but in I succeeded.

However, I have been assessed a federal self-employment tax most of these years (this is different from the income tax). In I decided to stop voluntarily paying this tax as well. I have been unable to find a useful way to do this legally, and so I have simply (but illegally) refused to write the check. Because of this I have been racking up an unpaid tax bill, along with penalties & interest.♦

The IRS has periodically attempted to levy bank accounts to seize these back taxes, with mixed success. They haven’t managed to take anything from me in several years, though they send me pleading letters from time to time. Their recent lack of action may be because they’ve run out of obvious targets, or it may be because my total overdue amount falls under the threshold at which they start trying harder (budget cuts have largely caused them to back off a bit on their enforcement).

My two-track strategy of legally avoiding the federal income tax while illegally refusing to pay the self-employment tax is an awkward and perhaps untenable compromise, but for me it currently seems the best alternative.

I owed, and refused to pay, about $4,750 in federal taxes, all from the self-employment tax.

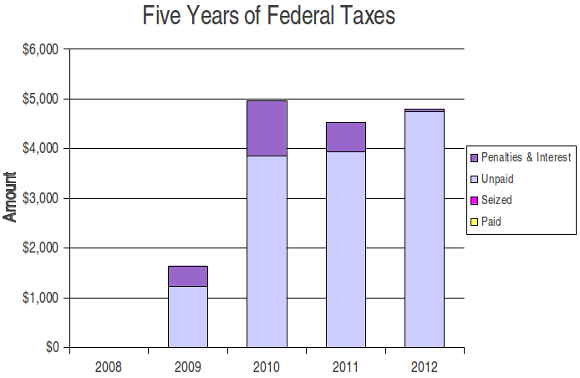

a graph showing my last five years of federal self-employment taxes, none of which have yet been collected by the IRS

The IRS has seized about $6,237 (or perhaps $6,072; our figures differ) of the total of about $24,000 (which includes penalties and interest) that I have refused to pay so far. I don’t have a fail-safe plan to hide my assets, so I expect that the IRS will continue to seize money if they find it, though lately they haven’t shown much enthusiasm for the hunt.

Although excise taxes are a very small part of what the government tries to get me to pay, I’ve adopted avoidance techniques here as well: for instance, I long ago gave up owning a car, so I pay very little federal excise tax on gasoline (at least directly), I don’t smoke and so I don’t pay tobacco taxes, and I home-brew beer and hard cider so as to reduce my contributions to the federal excise tax on alcoholic beverages.

Sustainability

I want to resist taxes over the long term, and so it is important that my expenses remain low enough that my tax-free income is also a good and sustainable one. was a good year for me income-wise. I brought in about $35,750 in profit from my home-based business.

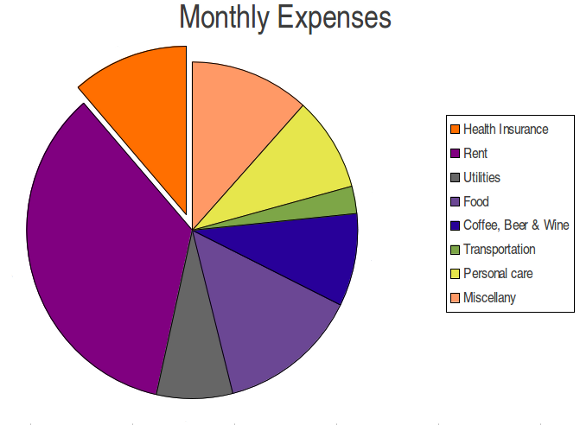

My regular expenses for things like rent, utilities, food, transportation, and such come to about $1,400 per month. Because I’m self-employed, my health insurance premium is a deductible expense that doesn’t count toward the $17,750 tax-free disposable income that I’m allowed to use under my DON Method of tax resistance (in addition, I use a Health Savings Account so my health insurance deductible is also tax-free).

a look at my typical monthly expenses (my health insurance premium is a tax-free business expense, so doesn’t count against my below-the-tax-line budget)

Not included in the above pie chart are any business expenses that I can deduct or my self-employment tax assessment (half of which I can deduct). My yearly living expenses take about $17,000 out of that $17,750. If I budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect may be seized, that would come to another $4,750, half of which also counts against the $17,750 (and puts me well over the limit).

Things were pretty fat this year, income-wise, but some of my expenses also rose (for instance, my cat was diagnosed with diabetes and has required a lot of expensive medical tests). I did a close audit of my spending to try and figure out whether I was sticking to a sustainable budget. I seem to be doing okay, but without a whole lot of wiggle room.♦

My 1040: A walk-through

I haven’t finished filling out my tax returns this year, but I’ve been tracking the numbers in a spreadsheet so that I have a pretty good idea of how it will look. Here’s how I think my 1040 will work out this year. First, my Total Income:

| Total Income | $35,644 |

|---|---|

| Business income | $35,691 |

| Taxable interest | $33 |

| Capital gain/loss | −$80 |

My business income came from two sources: my contract work as a technical writer / web programmer and sales of my books. The capital losses are left over from sales of mutual funds and stocks a few years back (carryover losses, that is).

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $16,261 |

|---|---|

| Total Income | $35,644 |

| HSA deduction | −$3,100 |

| ½ self-employment tax | −$2,730 |

| SEP deduction | −$6,629 |

| Self-employed health insurance deduction | −$1,924 |

| IRA deduction | −$5,000 |

, I put away $11,629 for retirement and $3,100 for future medical spending (or for retirement, if I stay healthy). Together, those represent over 40% of my Total Income for .

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that half of your FICA doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves and it’s all considered income, so the IRS lets you take half of your self-employment tax as a deduction here to even things out (even if you’re refusing to pay it like I am).

My Adjusted Gross Income is well below the $17,750 threshold that allows me to get the maximum rate on the Retirement Savings Contributions Credit, so I hit my target.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $6,511 |

|---|---|

| Adjusted Gross Income | $16,261 |

| Standard deduction | −$5,950 |

| Personal exemption | −$3,800 |

And from there, my tax owed:

| Tax owed | $4,747 |

|---|---|

| Income Tax | $651 |

| Retirement Savings Contributions Credit | −$651 |

| Self-employment tax | $4,747 |

I expect that number to jump a bit in (if my income stays about the same) since the self-employment tax has risen after a temporary cut.

Other Goals

I hope to encourage other people to consider tax resistance and I hope that The Picket Line is a good resource for people doing tax resistance and for those considering it. I keep trying to make it more useful.

I contributed an article about low-income tax resistance to Sharable magazine, which then became the headline topic on the Porc Therapy podcast.♦♦ I have also spread the word elsewhere, and have done a bit of one-on-one counseling to help new resisters hit the ground running. The write-ups on tax resistance I’ve done for Wikipedia get lifted or paraphrased from time-to-time in mainstream media reports.

I finished categorizing the research I have been doing for my next book, tentatively titled Tactics of Successful Tax Resistance Campaigns, and delivered a presentation summarizing some of this research at the 14th International Conference on War Tax Resistance and Peace Tax Campaigns in Bogotá, Colombia, last month.♦♦

I created a press release to support Cindy Sheehan in her battle with the IRS, and to link her work with that of other California war tax resisters.♦

I’m on a new NWTRCC committee called the “Rapid Outreach Working Group” which hopes to help emerging anti-war activist campaigns and groups to incorporate war tax resistance into their projects. So far we’ve done a lot of fishing but not much catching, although we did link up successfully with the Global Day of Action on Military Spending last year. I have also done a lot of behind-the-scenes work to maintain the NWTRCC website and to keep its Facebook presence lively.♦

The state of the world and the tax resistance movements

By now it is clear that the evil of the American government was in no ways diminished by the election of the Nobel Ridiculous Peace Prize laureate. The Obama administration is maintaining America’s repulsive policies on war & militarism, Big Brotherish snooping, impunity for torturers, propping up tyrants, and so forth. The thievery and mendacity of the politicians and the wizards of financial corruption that eat from the same troughs in Washington seems to know no bounds.

My only consolation is that the politicians in charge are so craven and short-sighted as to be unable or uninterested in preventing the entirely foreseeable meltdown of the system that nurtures them. Indeed they seem to be falling over each other to press for “solutions” that exacerbate the problems. The system seems to have built-in incentives that drive it to suicide, which takes some of the pressure off of those of us who are trying to kill it.

The IRS in particular continues to be plagued by greater bureaucratic responsibilities but reduced funding, making it less capable and more deserving of contempt.♦ The tax system has become so unmanageable that criminals (some from behind bars while doing time on other charges) are milking it for billions of dollars by means of identity theft and tax fraud.♦

Tax resistance movements

The war tax resistance movement (and the anti-war movement in general) is in the doldrums. Peace activists, though some have finally recovered from their Obamania, do not seem be inclined to adopt stronger tactics, by and large. There has been some soul-searching inside war tax resistance circles about how to improve the image, increase the influence, and expand the reach of the war tax resistance movement.♦

Now that I’ve moved out of the San Francisco bay area and back to my old home town of San Luis Obispo, I’ve started to hunt around for local anti-war or libertarian/anarchist communities that might be receptive to the tax resistance message. If there’s an anti-war movement here, they’re hiding well, but I’ve put some baited hooks in the water.

I confess myself to be frustrated and I despair of seeing Americans rise up to reclaim some dignity and decency. When I started this experiment I was all fired up with the project of convincing all the angry anti-war protesters out in the streets to buckle down and start making resistance and dissent part of their day-to-day lives. Now I more and more see myself as mostly just trying to keep the flame lit so that should people ever feel the weight of that final straw they won’t have to start from scratch.

To the extent that the remnants of the “Occupy” movement represent the cutting edge of progressive activism, there isn’t much there for war tax resisters to grab on to yet. “Progressives” seem so eager to defend government taxes and spending, or to “tax the rich” from motives little-removed from pure spite, that they’re willing to blind themselves to all the harm the government does with what it already takes.♦

Internationally, tax resistance seems to be becoming a more prominent tactic. I’ve noticed recent examples from Spain (and Catalonia), Greece, Italy, the United Kingdom, Chile, Indonesia, and Ireland, for instance (but maybe I’m just getting better at monitoring international news). Spain has been a particularly interesting case, as the war tax resistance movement there has expanded their critique, their participation, and their tactics to embrace new anti-austerity and anti-centralization activists.

The Picket Line

I have been using The Picket Line as a big cluttered desk to hold and index the material I have been collecting on tax resistance campaigns from around the world and throughout history, and I think I’ve probably lost a lot of readers by doing this, though in these days of feed aggregators and the like, it’s hard to get a feel for my audience size. Lately, I have been bringing things back around to the present day by creating a summary of the lessons from history in preparation for writing a book on the subject (which I’m hard at work on now and hope to get published in the coming year).

Prospects for the coming year

Assuming no major unexpected expenses, and assuming the tax law doesn’t undergo any radical changes, I’m well-positioned to have of living comfortably and well under the income tax line.

In any case, I will likely “owe” self-employment tax again , at the new higher rate. I’ve budgeted for the possibility that the IRS may find a way to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster.

So on to of what no longer seems like experiment so much as a lifestyle.