This page summarizes . (Links to previously posted Picket Line pages expand on things I mention. You can follow these links by clicking on the “♦” symbols.)

Picket Line Annual Report

, the U.S. attacked Iraq. It was a foolish, brutal, aggressive war launched on dishonest pretenses that had disastrous results. Back then America was mostly okay with that sort of thing. For me, though, it was the last straw, and I started what I then called “an experiment” in tax resistance so that I would no longer feel as complicit.♦ My goal was to stop financially supporting the U.S. government.

Tax Resistance

I hoped at first to do this entirely legally by lowering my income below the federal income tax line. So I quit my job to start my own small business where I could closely regulate my income, and I began taking advantage of additional legal tax deductions and credits. This has turned out to be a successful method of legally avoiding federal income tax, as well as a rewarding way of making a living, and I continue to operate this way today. (As I work from home by default, I’ve also been less impacted than many by the pandemic measures, so that’s been a nice bonus.)

However, I have been assessed a self-employment tax most of these years (this is different from the income tax but it also goes to the federal government). In I decided to stop paying this tax as well. I have not found a useful way to do this legally, and so I have simply refused to write the check. Because of this I have been accumulating an unpaid tax bill which, along with penalties & interest added by the IRS (minus a bit that they’ve managed to seize from me over the years, and some that is uncollectible due to the statute of limitations) now adds up to something in the neighborhood of $83,600.

My two-track strategy of legally avoiding income tax while non-legally refusing to pay self-employment tax is somewhat awkward to explain, but it has been working for me so far.

Over the years, the IRS has on a few occasions levied my bank accounts, with some success: They seized about $6,200 of the total of about $105,000 that I have refused to pay. I don’t have any fail-safe plan to hide my assets, so the IRS may continue to seize money when they find it, though lately they haven’t shown much enthusiasm for the hunt. They haven’t taken anything at all from me for over a decade, or even seem to have tried, though they still send me pleading letters from time to time.♦

Their recent lack of action may mean they’ve run out of easy seizure targets, or it may mean my overdue amount falls under the threshold at which they start trying harder (budget cuts and other crises have caused them to back off on their enforcement).♦♦ They may also just be biding their time, as the statute of limitations deadline on the oldest remaining unpaid amount doesn’t run out .

In , the IRS filed a formal tax lien against me in our local court system. They updated that lien periodically thereafter.♦♦ The lien has not yet had any practical effect on my life or my resistance; it has so far mostly meant getting a lot of junkmail from companies promising they can settle my tax debt on the cheap.♦ The lien doesn’t even register on my credit report, which I found surprising.

, when another year of my tax debt became uncollectible due to the statute of limitations, I wrote a check for that amount to the Maximum Impact Fund run by the effective altruism group GiveWell as a charitable donation, to celebrate.♦ I hope to do something of this sort again in a month or two when another year’s taxes are likely to become uncollectible in the same way.

Passport Worries

The total amount I owe at this point is well over the threshold at which the IRS is supposed to notify the State Department that I ought to be forbidden a passport and perhaps ought to have my passport revoked. It took the agency longer than I expected, but they finally submitted this notification.♦ This means that the State Department could revoke my passport at any time, and in any case is not supposed to allow me to renew it when it expires. So far they have not revoked my passport.

My 2021 Federal Tax Resistance

After all the dust settled, it turned out that I “owed” and refused to pay $5,396 in federal taxes.

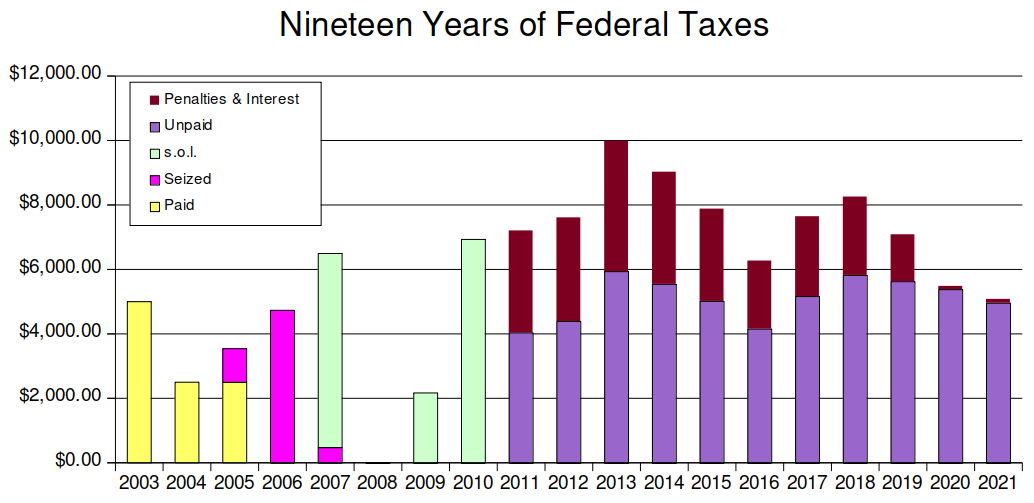

This chart shows my last nineteen years of federal taxes. In my first three years of tax resistance, I continued to pay my self-employment tax voluntarily. Then I stopped, but the IRS seized enough money from me to pay for what I resisted in 2005 and 2006 and a small part of 2007. The rest of the 2007 amount, as well as the 2009 and 2010 amounts, hit the statute of limitations deadline and is now permanently uncollectible. (In 2008 I did not make enough income to owe any federal tax.) Since then, the agency has collected nothing, though they continue to add penalties and interest to what they say I owe.

Sustainability

I want to continue to resist taxes over the long term, so it is important (if I want to stick to my below-the-tax-line method) that my expenses remain low enough that my income-tax-free income is sustainable. was a good year for me income-wise. I brought in more than $36,000 in profit from my business.

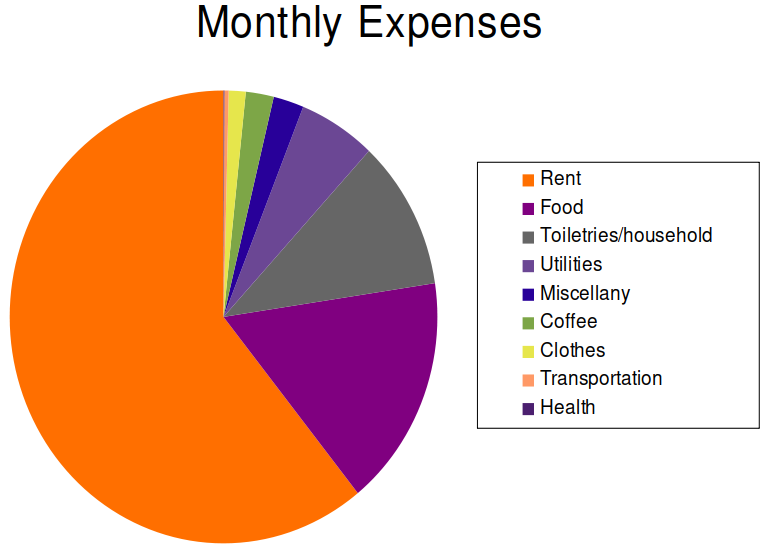

My day-to-day expenses stayed pretty steady last year. Rents in my part of California are high, and rent amounts to over 60% of my annual expenses. More than half of the taxable dollars I spend go just to keeping a roof over my head. As best as I can estimate, my regular expenses for things like rent, utilities, food, and transportation that I must pay for out of below-the-tax-line income came to about $1,565 per month, or about $18,775 a year:

a look at my typical monthly expenses

Not included in the above pie chart are any business expenses that I can deduct from my taxable income, most healthcare expenses (which I pay from my pre-tax Health Savings Account), my self-employment tax assessment (half of which I can deduct), or money I’m saving for retirement (which I do in tax-deferred accounts).

I now rent an apartment at which many of the utilities are bundled into the rent. This makes it difficult to compare expenses over time, as in some years the utilities were a significant distinct line-item.

My transportation budget is very low because where I live it’s pretty easy to get around on bike and so I don’t own a motor vehicle and rarely need to use one. I had to replace most of the worn-out drive train on my bike this year, but even that ended up costing less than a tank of gas, so even when biking is expensive it’s cheap. I’ve also been learning to do my own minor bike repairs and maintenance at the local “bike kitchen,” which keeps my costs even lower.

My health expenses were low last year, so I didn’t have to dip too far into my Health Savings Account. Now it’s replenished enough to more or less cover my deductible in case I run into bad health luck.

My yearly living expenses take most of my “under the tax line” budget, leaving me about $1,000 in wiggle room for unexpected expenses or splurging. , with all of those tax-free forgiveable PPP loans and government stimulus payments and such, I had a lot of extra wiggle room on top of that, but that’s not something I can count on regularly.

If I were to budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect could be seized from me, that would come to another $5,200 or so of expenses, half of which also counts against the under the tax line budget. Even if that never comes to pass, though, I’ve adopted the practice of making charitable donations to match the amount of my back taxes that become uncollectible due to the statute of limitations. I can’t do that within my budget, though: I have to dip into savings and I may ultimately have to prematurely tap my Roth account if I want to keep that up year after year. If my oldest tax debt is voided by the statute of limitations next month, I hope to write a check for $4,031 to some charity or other to celebrate.

My 1040: A walk-through

Here’s how my 1040 worked out this year. First, my Total Income:

| Total Income | $40,602 |

|---|---|

| IRA distributions | $3,767 |

| Business income | $36,836 |

My business income came mostly from two sources: my contract work as a technical writer, and sales of my books.

My IRA “distribution” was really a rollover from my traditional IRA into my Roth IRA. By making this rollover, I shield that money from future taxation, but am taxed on it today instead. I hoped that I could roll over that amount and still remain under the income tax line, so my tax rate on that money today would be zero, but I miscalculated slightly.

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $20,391 |

|---|---|

| Total Income | $40,602 |

| HSA deduction | −$3,600 |

| ½ self-employment tax | −$2,602 |

| SEP deduction | −$6,997 |

| Obamacare tax credit | −$12 |

| IRA deduction | −$7,000 |

, I put away $13,997 for retirement and $3,600 for medical spending. Together, those savings represent more than 47% of my earned income.

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that the half paid by your employer doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves of the tax, so the IRS lets you take half (roughly) of your self-employment tax as an income tax deduction to even things out (even if you’re refusing to pay that tax like I am).

Because of a misestimation on my part, my Adjusted Gross Income failed to drop below the $19,750 threshold that would have allowed me to get the maximum rate on the Retirement Savings Contributions Credit. That is the target I try to hit in order to get my federal income tax down to zero.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $6,033 |

|---|---|

| Adjusted Gross Income | $20,391 |

| Standard deduction | −$12,550 |

| above-the-line charitable giving deduction | −$300 |

| Qualified Business Income deduction | −$1,508 |

In past years there was both a standard deduction and a personal exemption. The last big tax law doubled the standard deduction and eliminated the personal exemption (so in practical terms, for me anyway, changed very little). But the law also added a new 20% Qualified Business Income deduction: 20% of that portion of my income that comes from self-employment (but capped at 20% of what my taxable income would be without the deduction).

This is meant to level the playing field for those of us who are self-employed or run small businesses and declare our business earnings on our personal income tax forms. The last big tax law cut corporate income taxes dramatically, so it was thought that we non-corporate business entities needed a break, too.

But it means that I get a bit of a tax break that my employee-brethren, who are doing much the same sort of work that I’m doing as an independent contractor, don’t qualify for. That doesn’t make a whole lot of sense to me, but it works in my favor. (The law does have a provision that eliminates the credit for service providers like myself, but that provision does not apply until I reach a certain minimum income threshold, which I’m not close to.)

Anyway, from there, my tax owed:

| Tax owed | $5,408 |

|---|---|

| Income Tax | $603 |

| Retirement Savings Contributions Credit | −$400 |

| Self-employment tax | $5,205 |

I’m a little disappointed about not completely eliminating my income tax this year, but a foot-fault like this doesn’t make much difference: it’s the total tax that matters, and that’s more-or-less in line with my typical year, and I don’t plan to pay it in any case. I filed my tax return showing these accurate amounts, but did not include a check for the tax due.

Other Goals

I hope to encourage people to resist taxes and I try to make The Picket Line a good resource for people who are resisting or considering it. I’ve also been doing a little one-on-one tax resistance counseling as part of NWTRCC’s network of counselors.

But I’ve been much less active than usual on this front. I didn’t publish any new articles or record any new seminars. I haven’t been particularly active in the national or international war tax resistance network. However I was happy to see that the Edmonton Incinerator tax resisters drew on my work to produce their council tax strike handbook.♦

Much of my activism of late has become much less focused on “politics” and “protest” on the national/global scale, and much more focused on direct action at the local scale. I’ve been volunteering regularly for the local food bank’s gleaning project at one of our farmers’ markets, bringing thousands of pounds of fresh produce to a food pantry to give to hungry families. And I’ve been supervising volunteers at a mobile shower trailer program serving homeless people in our community three times a week. (All of this is much easier for me because of the reduced and more-flexible work hours that are part of my tax resistance, and so can be seen as another form of tax redirection.♦)

I’ve also been working on a sequence of articles examining the virtues and how to improve in their practice, and I see this as a political as well as personal effort:

I think the longer, harder, more subtle project of helping people improve is a more reliable path to a better future than trying to impose wise policies on them from on high. If people become braver, wiser, more just, and more honorable, public policy will follow their lead. If people become more cowardly, foolish, grasping, and disreputable, conniving politicians will lead them by the nose.

The state of the world and the tax resistance movements

The IRS continues to be troubled by greater responsibilities but reduced funding, compounded by the difficulties the pandemic has caused for everyone, making the agency ever less capable and more deserving of contempt.♦ The agency put nearly all of its enforcement processes on hold for months, and still hasn’t gotten back up to what-passed-for-speed, with the agency still sitting on millions of unprocessed forms that have been languishing for months even as the paperwork from a new tax season begins to pour in.♦ These and other factors, such as the increasingly notorious evasion of taxpaying by America’s wealthy, are leading to the collapse of the credibility of the federal tax system, and there is hope that the long-standing norm of taxpayer compliance will come to an end.

Tax resistance movements

The American war tax resistance movement is limping along and only occasionally shows signs of life. Globally, however, tax resistance is more vibrant. For example, opponents of the military coup in Myanmar are braving an increasingly violent crackdown to refuse funding to the regime.♦ And opponents of the Edmonton incinerator have enlisted dozens of tax resisters in their campaign.♦

Prospects for the coming year

Assuming no major unexpected expenses or windfalls, and assuming no more big changes to the tax law, I’m well-positioned to live comfortably and well under the income tax line , though I will likely again “owe” (and refuse to pay) self-employment tax.

I’ve prepared for the possibility that the IRS may try to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster. And, if they fail again, I’m also prepared to dip into my savings to give to charity in celebration.

So on to of what no longer seems like an experiment so much as a way of life.