This page summarizes . (I’ve put in a few links to previously posted Picket Line pages that expand on things I mention. You can follow these links by clicking on the “♦” symbols.)

Picket Line Annual Report

, the U.S. began its “shock and awe” attack on Iraq. For me, this was the last straw and so I started what I then called “an experiment” in tax resistance so that I would no longer feel as complicit.♦

My goal was to stop financially supporting the U.S. government.

Tax Resistance

I hoped at first to do this legally by lowering my income below the federal income tax line, so I quit my job to start my own small business and I began taking advantage of additional legal tax deductions and credits. This has turned out to be a largely successful method of legally avoiding federal income tax, as well as a rewarding way of making a living, and I continue to operate this way today.

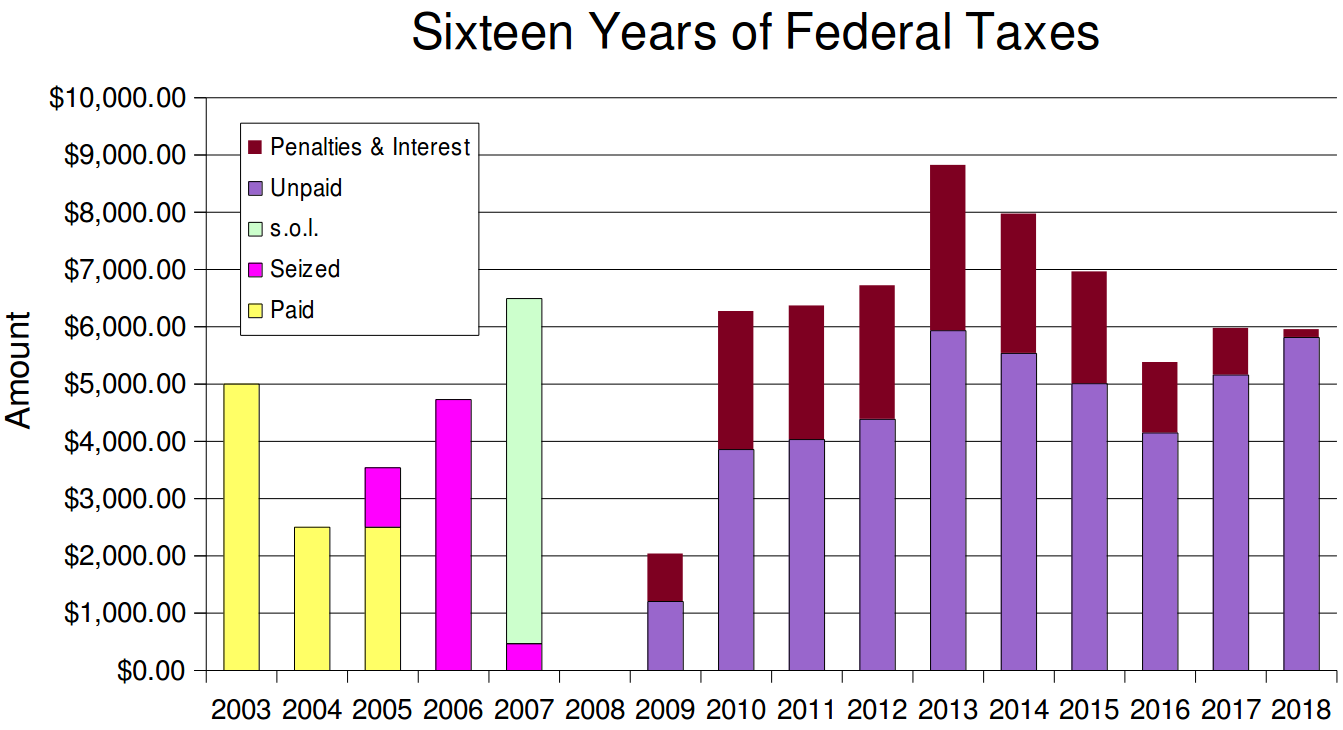

However, I have been assessed a self-employment tax most of these years (this is different from the income tax — much like the FICA tax withheld from the paychecks of employees — but also goes to the federal government). In I decided to stop paying this tax as well. I have not found a useful way to do this legally, and so I have simply refused to write the check. Because of this I have been racking up an unpaid tax bill which, along with penalties & interest added by the IRS (minus a bit that they’ve managed to seize from me over the years, and some that is uncollectible due to the statute of limitations) now adds up to something in the neighborhood of $62,000.

My two-track strategy of legally avoiding income tax while non-legally refusing to pay self-employment tax is somewhat awkward to explain, but has been working for me so far. This year, however, because of changes in the tax law and my overreliance on some incomplete descriptions of those changes in the popular press, I stepped over the federal income tax threshold and was assessed a little income tax as well.

The IRS has on a few occasions levied bank accounts, with some success: They have seized about $6,000 of the total of about $75,000 that I have refused to pay. I don’t have a fail-safe plan to hide my assets, so I expect that the IRS may continue to seize money when they find it, though lately they haven’t shown much enthusiasm for the hunt.

They haven’t taken anything at all from me in several years, or even seem to have tried, though they still send me pleading letters from time to time.♦♦♦♦ Their recent lack of action may mean they’ve run out of easy seizure targets, or it may mean my overdue amount falls under the threshold at which they start trying harder (budget cuts and other crises have caused them to back off on their enforcement). They may also just be biding their time, as the statute of limitations deadline on the oldest remaining unpaid amount doesn’t run out until .

A Statute of Limitations Success

That said, last year for the first time since I started resisting, one of my tax years did reach that 10-year statute of limitations deadline for collection.♦ I had originally been assessed $3,695 in federal taxes for . Over the years, the IRS had added about $2,800 in penalties & interest to that total. Once, they managed to seize $469 from a bank account of mine, which they applied to that year. But the remaining amount — over $6,000 — is now forever out of their grasp. I wrote a check to the Prisoners Literature Project for the unseized portion of my original tax bill to celebrate and to finally practice some of that tax redirection.

A Tax Lien

Last year, for the first time since my tax resistance began, the IRS filed a formal tax lien against me in our local court system. (This would make it easier for them to seize money from me if I were to receive settlements or other court-mediated sources of money, and it puts potential creditors on notice that the agency may step in and take money from me before I have the chance to pay them back.♦)

The lien has not yet had any practical effect on my life or my resistance, although I’ve been getting an awful lot of advertisements in the mail from shady law businesses, and plenty of automated phone calls — I haven’t bothered to answer them, but I suspect they’re from people who want me to buy their “pennies on the dollar” tax debt negotiation services.♦

Passport Worries

The total amount I owe at this point is well over the threshold at which the IRS is supposed to notify the State Department that I ought to be forbidden a passport and perhaps ought to have my passport revoked. So far as I know, this hasn’t happened yet (and they’re supposed to notify me if it has). In fact I applied for a renewed passport last year, and the government sent it out to me without complaint.♦

My 2018 Federal Tax Resistance

I only yesterday finished assembling all of the myriad forms I need to file my taxes this year. Just as the politicians promised, I was able to file my return on a postcard (plus eleven supplementary schedules and forms). After all the dust settled, it turned out that I “owed” and refused to pay $5,951 in federal taxes: $5,554 in self-employment tax, $259 in federal income tax, and a $137 penalty for not paying in quarterly installments like I’m supposed to.

a chart showing my last sixteen years of federal taxes

Sustainability

I want to continue to resist taxes over the long term, so it is important (if I want to stick to the below-the-line method) that my expenses remain low enough that my income-tax-free income is sustainable. was a good year for me income-wise. I brought in more than $39,000 in profit from my business.

I discovered late in the year that the last big federal tax legislation unexpectedly benefited a little guy like me. I can take advantage of the “20% qualified business income deduction” for small business owners. This means I could have earned even more money (up to around $41,000) last year without owing any income tax on it.

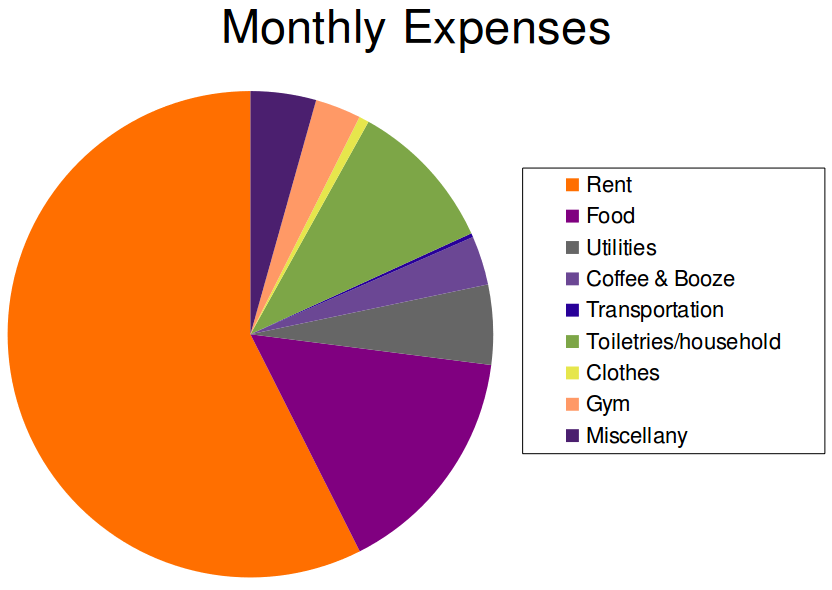

Which is good, as my expenses also have risen in recent years. Rents in my part of California have been rising fast, and rent now amounts to over 60% of my annual expenses. More than half of the taxable dollars I spend go just to keeping a roof over my head. I haven’t done the sort of close, day-by-day look at my spending as I have done in years past, but as best as I can estimate, my regular expenses for things like rent, utilities, food, and transportation that I must pay for out of below-the-tax-line income came to about $1,500 per month, or $18,000 a year:

a look at my typical monthly expenses

Not included in the above pie chart are any business expenses that I can deduct from my income, health expenses (which I pay from my pre-tax Health Savings Account), my self-employment tax assessment (half of which I can deduct), or money I’m saving for retirement (which I do in tax-deferred accounts).

My transportation budget is very low because where I live it’s pretty easy to get around on bike and so I don’t own a motor vehicle and rarely need to use one. I’ve been learning to do my own bike repairs and maintenance at the local “bike kitchen,” which also keeps the costs low.

My health-care expenses are a little higher this year as I joined the YMCA gym across the street. My health insurance expense may rise a bit more in the coming year too, as my increased income may have the result of kicking me out of my excellent Obamacare subsidy bracket. I haven’t done the calculations on this yet. In any case, I can take my health insurance premiums as a business expense, so at least it doesn’t count against my below-the-tax-line spending.

My yearly living expenses took most of my “under the tax line” budget, leaving me very little wiggle room for unexpected expenses or splurging. If I budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect may be seized, that would come to another $5,500 or so of expenses, half of which also counts against the under the tax line budget (and would put me over my limit).

My 1040: A walk-through

Here’s how my 1040 worked out this year. First, my Total Income:

| Total Income | $40,279 |

|---|---|

| Taxable interest | $1 |

| Capital gains | $1 |

| Business income | $39,311 |

| IRA withdrawal | $967 |

My business income came from two sources: my contract work as a technical writer, and sales of my books. The capital gains income comes from a small Lending Club account I started . I don’t think I’ll do that again, as the annual reporting of these numbers to the IRS makes such an account especially vulnerable to seizure (though the agency never seemed to pick up the scent, and I’ve mostly cleaned out that account now).

The IRA withdrawal was really an IRA transfer. I moved some money from my traditional IRA to my Roth IRA. This means I am supposed to declare that money (or my basis in it anyway — and calculating that’s a whole complicated hullabaloo) as income this year.

The reason I did this is because I believed late in the year that I could have brought in much more income while remaining below the income tax line (thanks to the newly-passed tax legislation). I didn’t have time to earn that additional income, so I used this technique to bring in more “income” instead — while at the same time shielding more of my retirement savings from future income tax.

Unfortunately, I miscalculated. I found it difficult to get authoritative information about the new tax legislation in time to do tax planning around it, so I relied on some incomplete information that exaggerated the amount of the Qualified Business Income tax credit I could claim. As it turns out, I should have left well enough alone and just stuck to my earned income for the year.

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $20,240 |

|---|---|

| Total Income | $40,279 |

| HSA deduction | −$3,450 |

| ½ self-employment tax | −$2,777 |

| SEP deduction | −$7,300 |

| Obamacare tax credit | −$12 |

| IRA deduction | −$6,500 |

, I put away $13,800 for retirement and $3,450 for future medical spending (or for retirement, if I stay healthy). Together, those savings represent almost 44% of my earned income for .

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that the half paid by your employer doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves of the tax, so the IRS lets you take half (roughly) of your self-employment tax as an income tax deduction to even things out (even if you’re refusing to pay that tax like I am).

My Adjusted Gross Income is above the $19,000 threshold that would allow me to get the maximum rate on the Retirement Savings Contributions Credit. I incorrectly believed this year that I could get more benefit from the Qualified Business Income credit than I actually could, and so I would not have to rely as much on the Retirement Savings credit, so I did not make a special effort to get below that $19,000 threshold. As we will see, that was a mistake.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $6,592 |

|---|---|

| Adjusted Gross Income | $20,240 |

| Standard deduction | −$12,000 |

| Qualified Business Income deduction | −$1,648 |

In past years there was both a standard deduction and a personal exemption. The new tax law doubled the standard deduction and eliminated the personal exemption (so in practical terms, for me anyway, changed very little). But the law also added a new 20% Qualified Business Income deduction: 20% of that portion of my income that comes from self-employment.

This is meant to level the playing field for those of us who are self-employed or run small businesses and declare our business earnings on our personal income tax forms. The new tax law cut corporate income taxes dramatically, so it was thought that we non-corporate business entities needed a break, too.

But it means that I get a tax break that my employee-brethren, who are doing much the same sort of work that I’m doing as an independent contractor, don’t qualify for. That doesn’t make a whole lot of sense to me, but it works to my advantage. (The law does have a provision that eliminates the credit for service providers like myself, but that provision does not apply until you reach a certain minimum income threshold, which I’m not close to.)

Unfortunately — and this is something that I learned too late to apply it to my tax planning for last year — the credit is capped at 20% of your adjusted gross income minus your standard or itemized deduction (that is, at 20% of what your taxable income would have been without the new qualified business income deduction). This means that instead of getting a $7,862 deduction as I’d hoped, I’m limited to a more meager $1,648 deduction.

Anyway, from there, my tax owed:

| Tax owed | $5,814 |

|---|---|

| Income Tax | $659 |

| Retirement Savings Contributions Credit | −$400 |

| Self-employment tax | $5,554 |

I did not qualify for the maximum 50%/$1,000 Retirement Savings Contributions Credit this year. Because my Adjusted Gross Income was too high, my credit was instead only 20%, or a maximum of $400. I thought that was going to be enough to eliminate my federal income tax, but because of my miscalculation of the new qualified business income deduction, it only lopped off 60% of that tax, and my total tax bill is 5% higher than I thought it would be.

I can refuse to pay that 5% just like I refuse to pay the rest, so I won’t lose sleep over it, but it is a blemish on my under-the-tax-line record.

Other Goals

I hope to encourage people to resist taxes and I try to make The Picket Line a good resource for people who are resisting or considering it. I’ve also been doing a little one-on-one tax resistance counseling as part of NWTRCC’s network of counselors.

I put on a “War Tax Resistance 101” webinar for NWTRCC , a recording of which is available on-line.♦

My interest in chronicling tax resistance history led me to do deep-dives into back issues of Friends Bulletin, The Mennonite,♦ and Gospel Herald,♦ the results of which I shared with readers here.

Last year I produced a Standard Ebooks edition of Aristotle’s Nicomachean Ethics,♦ and I also did a close reading of Aristotle’s Politics and tried to extend his methodology to cover the anarchist polis.♦

I gave a presentation at the Spring 2018 NWTRCC national on how war tax resistance has been incorporated into the practices of American religious groups like Quakers, Brethren, Mennonites, Jehovah’s Witnesses, Catholic Workers, and more recently groups like the Agape Community, Restored Israel of Yahweh, and the new monastic movement.♦ I was also interviewed for The MOON Magazine about “the one-man revolution” and how tax resistance fits in to it.♦

I’ve done a little outreach at local refugee-rights, Women’s March, and other anti-#MAGA events.♦ Mostly I’m very disappointed at how shallow and partisan they are. People seem to relish the opportunity to say how much they disagree with Trump’s policies without having any interest in ending their cooperation with those policies. I’m increasingly sympathetic with the “virtue signalling” explanation for much of this.

The state of the world and the tax resistance movements

Trump is certainly the president America deserves. All of the things that prompted me to turn my back on the government and refuse its demands for help are getting worse day by day. I’m astonished at how willing Americans seem to be to go along with it, or to just indulge in complaining about it, without questioning their loyalty to the system.

I remain hopeful that the empire of the United States will self-destruct under the idiocy and incompetence of its rulers and the narcotic complacency of its subjects. Trump may very well be the last president this country has to suffer through, and if he finally puts a bullet through the skull of this old rabid republic it may not be pleasant, but you can’t say it’s premature.

The IRS continues to be plagued by greater responsibilities but reduced funding, and will take months to recover from the government “shutdown”, making the agency ever less capable and more deserving of contempt.♦ A thriving overseas industry has grown up around impersonating IRS agents in order to shake down Americans over the phone. These and other factors, such as the Trump family’s own notorious evasion of taxpaying, are leading to the collapse of the credibility of the federal tax system. A solid majority of Americans now feel the federal tax system is unfair,♦ and there is hope that the long-standing norm of taxpayer compliance will come to an end.♦

Tax resistance movements

Good-hearted Americans are alarmed and disgusted by Trumpism, and some even allow themselves to consider tax resistance as a response, whether in protest, in nonviolent resistance, or in conscientious objection. As yet, this is largely a simmering chorus of “why we oughta” tweets, but it could yet coalesce into something real. Few people with stature seem to want to lead this parade, though, and those without stature seem to be waiting for a leader to follow, so things are currently stalled. Now that a swarm of Democratic presidential candidates is emerging, I expect most progressive activism to be diverted onto the harmless electoral politics track for the next twenty goddamned months.

The American war tax resistance movement continues to simmer on the back burner, but does not seem to be growing or to be considering any bold initiatives for growth, and has very little influence even in the small American anti-war movement.

Globally, however, tax resistance is more vibrant. Tax resistance in Nicaragua was threatening enough to the regime that it arrested and tortured one of the leaders of the movement.♦ The gilets jaunes movement in France has been extraordinarily powerful, forced the government there to rescind a new tax, and has destroyed about three-quarters of the automated traffic-fine-generating machines in the country.♦

Prospects for the coming year

Assuming no major unexpected expenses or windfalls, and assuming no more big changes to the tax law, I’m well-positioned to live comfortably and well under the income tax line , though I will again “owe” (and refuse to pay) self-employment tax.

I’ve budgeted for the possibility that the IRS may try to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster.

So on to of what no longer seems like an experiment so much as a way of life.