This page summarizes . (Links to previously posted Picket Line pages expand on things I mention. You can follow these links by clicking on the “♦” symbols.)

Picket Line Annual Report

, the U.S. attacked Iraq. It was the beginning of a foolish, brutal, aggressive war, launched on dishonest pretenses, that had disastrous results. For me it was the last straw, and I started what I then called “an experiment” in tax resistance so that I might no longer feel as complicit.♦ My goal was to stop financially supporting the U.S. government.

Tax Resistance

I hoped at first to do this entirely legally by lowering my income below the federal income tax line. I quit my job to start a one-person consulting business in which I could closely regulate my income, and I started taking advantage of additional legal tax deductions and credits, while also attending more to frugality. This turned out to be a successful method to legally avoid federal income tax, as well as a rewarding way to make a living, and I continue to operate this way today.

However, I have been liable for self-employment tax in most years (this is different from the income tax but also goes to the federal government). In I decided to stop paying that tax as well. I have not found a useful way to do this legally, so I simply refuse to write the check. Because of this I have accumulated an unpaid tax bill which, along with penalties & interest added by the IRS (minus a bit that they’ve managed to seize from me over the years, and some that is now uncollectible due to the statute of limitations) now adds up to something in the neighborhood of $90,000.

My two-track strategy of legally avoiding income tax while non-legally refusing to pay self-employment tax is somewhat awkward to explain, but works for me.

Several years ago, the IRS levied my bank accounts and seized about $6,200 of the total of about $127,000 that I have refused to pay. I don’t have any fail-safe plan to hide my assets, so the IRS could continue to seize money when they find it. However they haven’t taken anything from me for over a decade, or even seem to have tried, though they still send me pleading letters from time to time.♦ This lack of enforcement may mean they’ve run out of easy seizure targets, or it may mean my overdue amount falls under the threshold at which they start trying harder. (Budget cuts and other crises have made the agency something of a paper tiger, though a recent budget boost for the agency may wake up the sleeping beast.) They may also just be biding their time, as the statute of limitations deadline on the oldest remaining unpaid amount doesn’t run out .

In , the IRS filed a formal tax lien against me in our local court system. They updated that lien in each of the following two years, but since then they seem to have stopped doing so.♦♦ The lien did not have any practical effect on my life or my resistance; it mostly meant getting junkmail from shady companies promising they could settle my tax debt for pennies on the dollar.♦ The lien didn’t even register on my credit report, which I found surprising.

The total amount I owe at this point is well over the threshold at which the IRS is supposed to notify the State Department that I ought to be forbidden a passport and perhaps ought to have my passport revoked. It took the agency longer than I expected, but they eventually submitted this notification a few years back.♦ This means that the State Department could revoke my passport at any time, and in any case is not supposed to allow me to renew it when it expires in . So far they have not revoked my passport.

, when another year of my tax debt became uncollectible due to the statute of limitations, I wrote a check for that amount to the Maximum Impact Fund (now called the “Top Charities Fund”) run by the effective altruism group GiveWell, as a charitable donation to celebrate.♦ I hope to do something similar in a month or two when another year’s taxes seem likely to become uncollectible in the same way, though I will need to pick a new destination for the donation (see below).

My 2023 Federal Tax Resistance

After all the dust settled, it turned out that I “owed” and refused to pay $6,473 in federal taxes. (This amount, and the other tax amounts in this report, are estimates; the IRS has been unusually late in getting its tax forms printed and delivered, so I haven’t filed yet.)

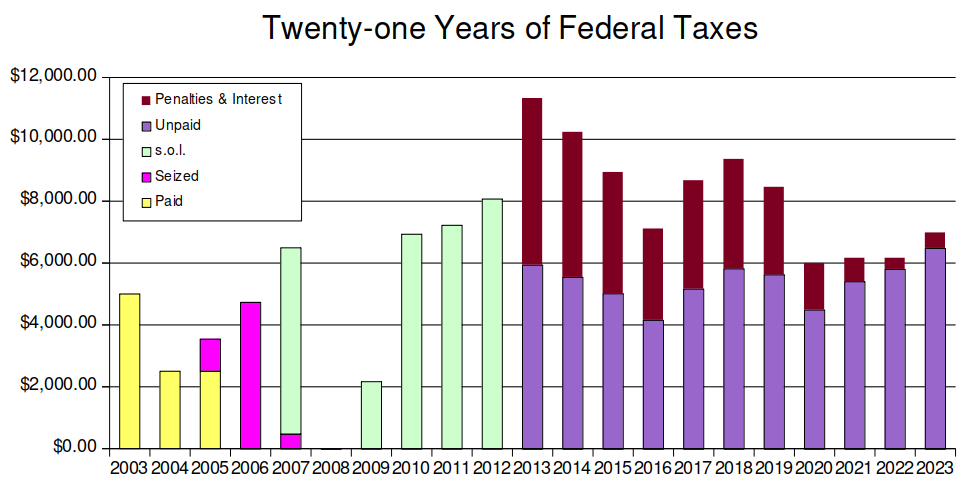

This chart shows my last twenty-one years of federal taxes. In my first three years of tax resistance, I continued to pay my self-employment tax voluntarily. Then I stopped, but the IRS seized enough money from me to pay for what I resisted in 2005 and 2006 and a small part of 2007. The rest of the 2007 amount, as well as the 2009–12 amounts, hit the statute of limitations deadline and is now permanently uncollectible. (In 2008 I did not make enough income to owe any federal tax.) Since then, the agency has collected nothing, though they continue to add penalties and interest to what they say I owe.

Sustainability

I want to continue to resist taxes for the long term, so it is important (if I want to stick to my below-the-tax-line method) that my expenses remain low enough that my income-tax-free income is sustainable. was a good year for me income-wise. I brought in over $45,000 in profit from my business.

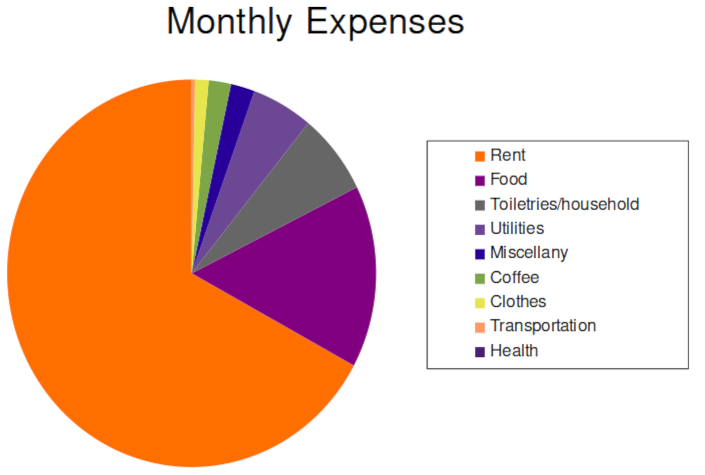

My day-to-day expenses rose last year, thanks to inflation and such. Rents in my part of California are high, and rent amounts to nearly 60% of my annual expenses. As best as I can estimate, my regular costs for things like rent, utilities, food, and transportation that I must pay for out of below-the-tax-line income came to about $1,900 per month, or $23,000 a year:

a look at my typical monthly expenses

Not included in the above pie chart are any business expenses that I can deduct from my taxable income, most healthcare expenses (which I pay from my pre-tax Health Savings Account), my self-employment tax assessment (half of which I can deduct), or money I put aside for retirement (which I typically do in tax-deferred accounts).

I now rent an apartment at which many of the utilities are bundled into the rent. This makes it difficult to compare expenses over time, as in some past years utilities were a more significant distinct line-item.

My transportation budget is very low because where I live it’s easy to get around on bike and so I don’t own a motor vehicle and rarely need to use one. I’ve also been learning to do my own minor bike repairs and maintenance at the local “bike kitchen,” which keeps my costs even lower.

My health expenses were low last year, so I didn’t have to dip far into my Health Savings Account. It’s replenished enough to more than cover my deductible in case I run into bad health luck.

My yearly living expenses take up all of my “under the tax line” budget, but I’ve got enough squirreled away in savings now that I don’t feel like I’m cutting things too close for comfort.

However, if I were to budget-in the imposed self-employment tax (which I don’t intend to voluntarily pay, but which I expect could be seized from me), that would come to another $6,475 or so of expenses, half of which also counts against my under-the-tax-line budget. And even if the government never gets its hands on that money, I’ve adopted the practice of making charitable donations to match the amount of my back taxes that become uncollectible due to the statute of limitations. For example, if my oldest tax debt is voided by the statute of limitations next month, I hope to write a check for $5,932 to some charity to celebrate. I can’t do that within my budget: I have to dip into savings, and I may ultimately have to prematurely tap my Roth IRA if I want to keep that up year after year.

My 1040: A walk-through

Here’s how I expect my 1040 will work out this year. First, my Total Income:

| Total Income | $45,813 |

|---|---|

| Business income | $45,813 |

My total income is all business income, which came mostly from two sources: my contract work as a technical writer, and sales of my books.

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $21,726 |

|---|---|

| Total Income | $45,813 |

| HSA deduction | −$4,850 |

| ½ self-employment tax | −$3,237 |

| SEP deduction | −$8,500 |

| IRA deduction | −$7,500 |

, I put away $16,000 for retirement and $4,850 for medical spending. Together, those savings represent more than 45% of my income.

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This means the half paid by your employer doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves of the tax, so the IRS lets you take half (roughly) of your self-employment tax as an income tax deduction to even things out (even if you’re refusing to pay, like I am).

My Adjusted Gross Income is just below the $21,750 threshold at which I get the maximum rate on the Retirement Savings Contributions Credit. That is the target I try to hit in order to get my federal income tax down to zero.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $6,301 |

|---|---|

| Adjusted Gross Income | $21,726 |

| Standard deduction | −$13,850 |

| Qualified Business Income deduction | −$1,575 |

The Qualified Business Income deduction is 20% of that portion of my income that comes from self-employment, capped at 20% of what my taxable income would be without the deduction. The last big tax law cut corporate income taxes dramatically, and this deduction was meant to give a similar break to non-corporate business entities (like me) who declare business earnings on our personal income tax forms. It doesn’t really matter to the bottom line of how much I owe but I include it here for completeness.

Anyway, from there, my tax owed:

| Tax owed | $6,473 |

|---|---|

| Income Tax | $630 |

| Retirement Savings Contributions Credit | −$630 |

| Self-employment tax | $6,473 |

I plan to file a tax return that shows these accurate amounts, but I will not include a check for the tax due.

Other Goals

I would like to encourage other people to resist taxes too, and I have tried to make The Picket Line a good resource for people who are resisting or considering it. But I’ve been much less active than usual on this front. Last year I stepped back from the blog and stopped creating new content for it. I’d gotten a little tired of being a tax resistance scholar and activist, and felt like decentering tax resistance in my life, to make it more incidental, and to occupy myself more with other pastimes.

Much of my “activism” of late is much less focused on politics and protest and rebellion, particularly on the national/global scale, and much more focused on embarrassingly wholesome direct action at the local scale. I’ve been volunteering regularly for the local food bank’s gleaning project at one of our farmers’ markets, bringing thousands of pounds of fresh produce to a food pantry to give to hungry families. And I’ve been supervising volunteers at a mobile shower trailer program that serves homeless people in our community several times a week. (All of this is much easier for me because of the reduced and more-flexible work hours that are part of my tax resistance, and so can be seen as another form of tax redirection.♦)

However, I did write a post for the LessWrong site called “Redirecting one’s own taxes as an effective altruism method”. And that turned out to be an interesting experience.

LessWrong is a sort of group blog / discussion forum for people in a loosely-defined on-line “rationalist” community. The core ethos of the community is to try to think and communicate more carefully and clearly, and to live more effectively and efficiently. But topics range all over the place. Lately, there’s a great deal of discussion over the prospects of artificial intelligence, for example.

“Effective altruism” has been another frequent topic of discussion there. That’s what I used as the hook for my post. I framed tax redirection as a possible variety of effective altruism and tried to explain its promise and its challenges when seen from that point of view. I explained that in recent years I had been redirecting my federal taxes through the effective altruism charity GiveWell, and explained how readers might do something similar themselves.

The post got much more attention than I thought it would. This was in part because the popular blogger Scott Alexander linked to it on his blog. Opinion was vigorously divided (as of this writing, my post has gotten 89 “votes” with an exactly equal number of up-votes and down-votes).

Another factor that explains the heat of the controversy is that the effective altruism movement was in something of an optics crisis at the time. Disgraced crypto entrepreneur Sam Bankman-Fried had just been convicted of fraud and conspiracy. Bankman-Fried had been a big booster of and donor to the effective altruism movement, and his chicanery left a stain. It looked as though he had been using promises to dedicate his wealth to effective altruism as a fig leaf to hide his embarrassing criminal shenanigans behind. Nay-sayers were eagerly tarring the effective altruism movement with that convenient brush. The effective altruism movement reeled and was in the middle of a lot of hand-wringing about optics and ethics, and then I turned up, encouraging people to dodge their taxes in the cause. To a lot of them, it was just the sort of thing they didn’t want connected with the effective altruism message, especially just then.

GiveWell went so far as to convene a policy discussion on whether to accept redirected taxes as donations, and they decided not to do so. They then reached out to me and basically said “stop giving us your money”:

Going forward, we are implementing a policy that we will not accept donations that we have reason to believe come from an illegal activity. As a result, we would prefer that you not direct those donations to GiveWell, and we plan not to deposit any future checks that we believe come from withheld taxes.

On the one hand, this was disappointing. Sure, it would have been nicer if GiveWell had endorsed my action, or if the effective altruism community had rallied around it. But that was never very likely, and certainly not at a time when effective altruism boosters were desperately trying to look squeaky-clean. On the other hand, the timing of my post was key to its impact. It was discussed more broadly and more seriously than I anticipated. As a result, it seeded the idea of tax redirection in the minds of people other than the usual suspects of conscientious objectors and political activists.

I’ve also been continuing my work on a sequence of essays examining the virtues and how to improve in their practice.

Prospects for the coming year

I maybe picked a bad time to go into semi-retirement as a tax resistance promoter. The National War Tax Resistance Coordinating Committee has noted a significant surge of interest in war tax resistance in recent months, mostly thanks to the war in Gaza. I’ve gotten more than the usual number of questions and requests for consultations from beginning resisters as well, which I’ve fielded as best I can, though I’m starting to get rusty.

Assuming no major unexpected expenses or windfalls, and assuming no more big changes to the tax law, I’m well-positioned to live comfortably and well under the income tax line again , though I will again “owe” (and refuse to pay) self-employment tax.

I’ve prepared for the possibility that the IRS may try to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster. And, if they fail again, I’m also prepared to dip into my savings to give to charity in celebration.

So on to of my “experiment.”