The Tax Foundation puts a lot of effort into tracking down and analyzing those of us in the United States who don’t pay any federal income tax because we’re not liable for any — a group that’s been growing for more than two decades and now includes about a third of American households.

The Foundation, which subscribes to the “Lucky Ducky” interpretation of this phenomenon, sees this as a bad thing. When they discuss it, they have a tendency to pretend there are no such things as FICA, inflation, excise taxes, corporate taxes, sales taxes and other state taxes, and so forth, and so they will claim that these lucky duckies are “nonpayers” who “have no tax liability” because their “entire tax liability” is “wiped out” by various credits and deductions that legislators use “to funnel money to groups of people they want to reward” who then end up “disconnected from the cost of government.” The subsequent Wall Street Journal editorial about how awful the government is to the virtuous rich then just about writes itself.

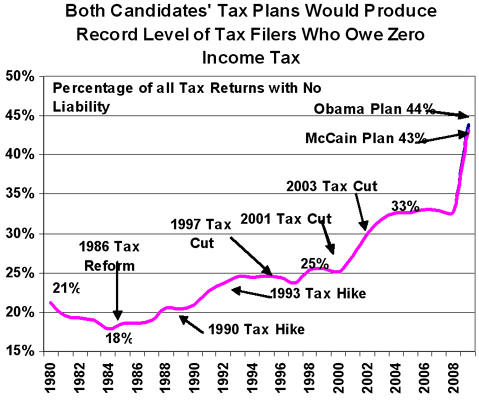

Be that as it may, the Foundation has done a lot of useful work crunching the numbers, and they’ve just come out with a new report on how the tax proposals of Obama & McCain might affect this lucky ducky phenomenon. You’ll be delighted to hear that both candidates plan to dredge huge new additions on the duck pond:

According to the most recent IRS statistics for , some 45.6 million tax filers — one-third of all filers — have no [federal income] tax liability after taking their credits and deductions.…

Tax Foundation estimates show that if all of the Obama tax provisions were enacted in , the number of these “nonpayers” would rise by about 16 million, to 63 million overall [44%]. If all of the McCain tax proposals were enacted in 2009, the number of nonpayers would rise by about 15 million, to a total of 62 million overall [43%].

Of course, all this has to be taken with a big, bumper-sticker-laden grain of salt. Obama & McCain are promising lots of things, and neither one is likely to be faithful to those promises once it actually comes time to try to push legislation through Congress.