The Tax Foundation also notes:

What took me so long?

The Tax Foundation also notes:

What took me so long?

There’s an interesting entry over at the Living on Less blog . It discusses how exaggerated the perception of wealth is in the United States and how it is that even relatively well-off people have the impression that they’re falling behind as they scramble to try to live an artificially expensive lifestyle they feel they should be able to afford.

In other words, less than I earned, tax-free, this year. The author goes on to talk about why so many people think “that owning a new car, a house in the suburbs [which can easily cost half a million dollars!], and expensive gadgetry like big screen TVs, palm pilots, cell phones, etc. is the affordable norm for the average person.” Not surprisingly, advertising and “lifestyle” reporting is blamed (One note: “Not long ago, the Today show presented the following: the results of a survey by a travel magazine on its readers’ favorite vacations [favorite destination: Sydney, Australia; favorite hotel: some Beverly Hills hotel whose rooms cost $350 a night], and a feature on new leisure boats available for sale [least expensive boat: a catamaran for $5000; most expensive boat: a yacht for $300,000]. The New York Times travel section stated recently that vacationing on a yacht is no longer just for the rich: a one-week vacation is available on a rented yacht for a mere $4800!”).

This mass hallucination even reaches, sadly, to the war tax resistance movement — which often makes tax resistance through income lowering sound like a frightening plunge into the depths of deprivation. Take, for instance, the edition of the War Resisters League book War Tax Resistance, which has this caveat about that form of tax resistance:

For most people in this country, this is not a realistic option, and it leaves them little room to incorporate war tax resistance into their lives. Promotion of this method may discourage people who might otherwise be sympathetic to war tax resistance.

As I’ve noted often in the last couple of weeks, about 25% of the people who file income tax returns in the United States are already living below the tax line. So it’s absurd to say that a lifestyle that is already being practiced by a quarter of us is “not a realistic option” for “most people in this country.” But even people in the war tax resistance movement, who should know better, have an unrealistic view both of how much you can earn and still stay below the tax line, and of how far such an income puts you from relative or absolute poverty.

I’ve mentioned before the factoid about how few American “taxpayers” actually pay federal income taxes. Until now, I haven’t been able to track down any detailed numbers. I found a report from the Tax Policy Center that spells it out.

It turns out that the numbers are even more dramatic than what I’ve been quoting. In part this is due to the effects of recent tax legislation, which (primarily due to an increased per-child tax credit) pulled yet more people off the tax rolls. But also, the figures I’d seen before only showed how many tax filers didn’t owe taxes — ignoring the people who don’t even file.

So here are the numbers: There are about 138,959,000 “estimated nondependent tax units” in the US. That’s tax-wonk-ese for people who aren’t declared as dependents on other people’s tax forms. So, in other words, there are about 139 million potential taxpayers in the US.

Of this bunch, 18,131,000 don’t file returns at all. “Almost all nonfilers have estimated adjusted gross income of less than $10,000. They are also disproportionately elderly…” Then there are 33,544,000 who file returns but don’t end up owing anything.

So, we’ve got 139 million potential taxpayers, of whom over 51 million don’t pay a dime. That’s more than 37% of us.

It’s in the U.S., and so I’m expecting a flurry of news releases, blog posts, and media mentions of tax issues and tax resistance stories. I’m going to be over in Oakland at a protest with the Northern California War Tax Resistance group for much of the day, though, and then I’m going on vacation for a few days, so I’ll have to blog some of it later.

Today, though, I want to call your attention to this press release from the Tax Foundation. I’ve mentioned before on The Picket Line how few Americans actually pay federal income tax. Last I checked, about 37% of Americans who could pay (they’re old enough, they’re not dependents of another taxpayer) don’t. A handful of these are tax protesters, but most of them just don’t make enough income to be taxed.

Well, as impressed as I was by that 37% number — it’s so last year!

The Tax Foundation tracks how recent changes to the tax laws and to income demographics have pushed this number higher: “, a record 44 million tax returns — one-third of all returns filed — will have no income tax liability because of the available credits and deductions in the tax code. This is a 50 percent increase in the number of zero-tax filers in just . In addition to these zero-tax filers is 14 million individuals or households who do not earn enough to file a tax return. Overall, some 58 million taxable households are outside of the income tax system.” (That’s out of something like 140 million total taxable households — 41% pay no federal income tax.)

This is amazing. And there are two important implications of this for war tax resisters. The first is that income tax resistance is easy — if you don’t want to pay the federal income tax, just join the other 58 million taxable households who’ve figured out the secret. It’s not rocket science. The second is that the government is perfectly capable of carrying out expensive wars and other disastrous and destructive policies without income taxes from 58 million households it could be collecting money from. In other words — massive war tax resistance may be necessary, but it is not sufficient, to restrain a bellicose government.

The Tax Foundation’s newsletter has a front-page article about the 44 million Americans who will file income tax returns that show zero federal income tax liability. These are people who are doing essentially the same thing that I’m doing (though few may share my motives). The percentage of tax returns that show zero tax liability has jumped in recent years:

| Number of Zero-Tax Filers (in Millions) | Zero-Tax Filers as a Percentage of All Filers | |

|---|---|---|

| 18.6 | 19.8% | |

| 16.7 | 16.5% | |

| 21.5 | 19.0% | |

| 26.7 | 22.6% | |

| 29.9 | 23.1% | |

| est. | 44.0 | 33.0% |

“In addition to these zero-tax filers,” the article continues, “roughly 14 million individuals and families will earn some income but not enough to be required to file a tax return. When these non-filers are added to the zero-tax filers, they add up to 58 million income-earning households who will be paying no income taxes.” The article goes on to give some demographic information about who these zero-tax filers and non-filers are.

I’ve been unfaithful. Instead of creating more content for The Picket Line, I went and wrote an only somewhat self-promoting entry for Wikipedia on “Lucky Duckies.”

Seeing as how it is now released under the GNU Free Documentation License, however, I’ll reproduce it here:

The new SOI Tax Stats report on individual income tax data is out. It covers individual income tax returns through .

The first thing I looked for was “how many people who file taxes actually owed any federal income tax at all for ?” In , Americans filed 134,372,678 income tax returns. Of those, 90,593,081 (67.42%) were “taxable returns” — meaning those returns on which there was a “total income tax” for the year.

That is to say that 32.58% of those households who filed their tax returns owed no federal income tax at all in . To clarify: this does not mean that they didn’t owe any extra when they filed their returns, but that they did not owe any federal income tax at all throughout the year. If any had been withheld from their wages, they got every dime back as a refund.

If you’re in the two-thirds who are funding Dubya’s adventures with your paycheck, consider joining the other third who aren’t.

(I’ve written about the Lucky Duckies who don’t pay federal income tax before. See for instance .)

The Tax Foundation puts a lot of effort into tracking down and analyzing those of us in the United States who don’t pay any federal income tax because we’re not liable for any — a group that’s been growing for more than two decades and now includes about a third of American households.

The Foundation, which subscribes to the “Lucky Ducky” interpretation of this phenomenon, sees this as a bad thing. When they discuss it, they have a tendency to pretend there are no such things as FICA, inflation, excise taxes, corporate taxes, sales taxes and other state taxes, and so forth, and so they will claim that these lucky duckies are “nonpayers” who “have no tax liability” because their “entire tax liability” is “wiped out” by various credits and deductions that legislators use “to funnel money to groups of people they want to reward” who then end up “disconnected from the cost of government.” The subsequent Wall Street Journal editorial about how awful the government is to the virtuous rich then just about writes itself.

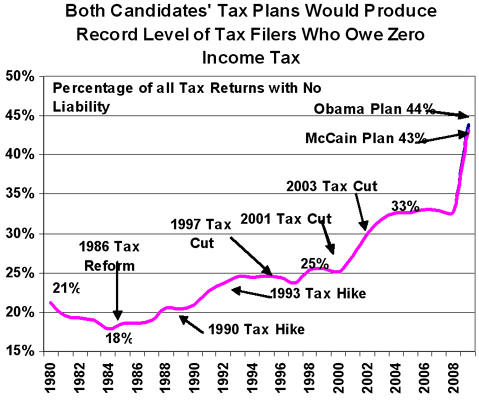

Be that as it may, the Foundation has done a lot of useful work crunching the numbers, and they’ve just come out with a new report on how the tax proposals of Obama & McCain might affect this lucky ducky phenomenon. You’ll be delighted to hear that both candidates plan to dredge huge new additions on the duck pond:

According to the most recent IRS statistics for , some 45.6 million tax filers — one-third of all filers — have no [federal income] tax liability after taking their credits and deductions.…

Tax Foundation estimates show that if all of the Obama tax provisions were enacted in , the number of these “nonpayers” would rise by about 16 million, to 63 million overall [44%]. If all of the McCain tax proposals were enacted in 2009, the number of nonpayers would rise by about 15 million, to a total of 62 million overall [43%].

Of course, all this has to be taken with a big, bumper-sticker-laden grain of salt. Obama & McCain are promising lots of things, and neither one is likely to be faithful to those promises once it actually comes time to try to push legislation through Congress.

There’s a new Statistics of Income Bulletin out, with preliminary numbers from the filing season showing the number and percentage of “lucky duckies” who file tax returns showing that they owed no federal income tax all year:

| Tax Year | Number of Zero-Tax Filers | Zero-Tax Filers as a Percent of All Filers |

|---|---|---|

| 42,500,000 | 32.6% | |

| 43,800,000 | 32.6% | |

| 45,700,000 | 33.0% | |

| 46,600,000 | 32.6% | |

| 51,600,000 | 36.3% | |

| 58,600,000 | 41.7% |

You’re reading that right: 41.7 percent of all households who filed tax returns last year owed no federal income tax at all for the entire tax year. That doesn’t mean they didn’t owe any extra on , but that they didn’t owe any federal income tax at all on the income they earned in . If you paid your income taxes you should feel like a chump.