Frida Berrigan Reviews NYC Tax Day Protests

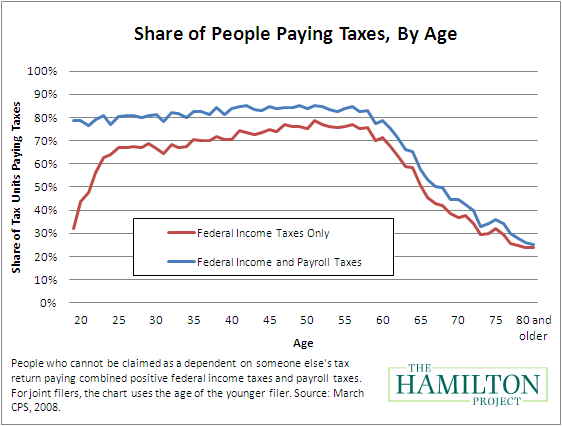

You have heard before about the rise of the “lucky duckies” — that being the Wall Street Journal editorial page’s term for the growing number of Americans who do not have to pay any federal income tax because their income is low enough to put them under the income tax line after credits and deductions.

The Journal would have us believe that this is the result of the usual government conspiracy to punish society’s virtuous and politically powerless wealth producers for the benefit of those lazy freeloaders whose poverty makes them the darling of politicians everywhere. Or something like that. I don’t smoke what they’re smoking, so I don’t know for sure what they’re getting at.

To some extent, this phenomenon has resulted from the “end of welfare as we know it” and its replacement by tax credits like the Earned Income Tax Credit and the Child Tax Credit. But you may have wondered to what extent this all can be explained not by such changes in the law, but by demographic changes, as the ranks of the retired grow, and people come to live off of their savings rather than their income.

Turns out, this might explain a lot.

Over , the number of Americans aged 25–64 is expected to rise by 9.4% while the number of Americans aged 65 or older is expected to rise by 79.2%, which will inevitably exacerbate this issue (expect the Wall Street Journal to continue blaming this on the poor and their uncannily effective Washington lobbyists).

Thanks to John Kindley at People v. State for plugging The Picket Line.