Today, some excerpts from The Catholic News Archive concerning tax resistance in .

The Catholic Worker reviewed Donald Kaufman’s summary of the Christian argument for war tax resistance:

The Tax Dilemma: Praying for Peace, Paying for War. By Donald D. Kaufman. Herald Press, Scottdale, Pa. 15683. 101 pages. $3.95. Reviewed by Lee LeCuyer.

In this book, Donald D. Kaufman discloses the long tradition of Christians refusing to pay for war. This tradition is rooted in Jesus’ simple but difficult command, “You cannot serve two masters, God and Mammon.”

Donald Kaufman, pointing out how the early Christians interpreted Jesus’ response to the Pharisees, “Give back to Caesar what belongs to Caesar — and to God what belongs to God” says “We do know that Christians refused to pay taxes for Caesar’s pagan temple in Rome. For this reason, we can understand how erroneous it is to deduce from this story about the temple tax a command for the payment of all taxes.”

The dilemma of paying taxes, of praying for peace while financing war, is a clear example of conflicting duties. Christians are to be obedient to civil authorities, yes. But they are also to be obedient to God. Here we observe two masters and two opposing commands.

Since World War Ⅱ, the foundation of international politics has been the “balance of power.” The enormous human resources wasted in maintaining this precarious and deadly balance have already resulted in much human suffering and neglect. Ultimately, this can only lead to genocide, the crime of murdering the human race. Have we not idolized death, making its “power” the only significant foundation of our political relationships?

“You shall have no false gods before me.”

Jesus told Peter that “those who live by the sword shall die by the sword.” Isaiah told the nations: “Arm but be crushed! Arm but be crushed! Form a plan, and it shall be thwarted; make a resolve, and it shall not be carried out, for ‘With us is God.’ For thus said the Lord to me, taking hold of me and warning me not to walk in the way of this people: ‘Call not alliance what this people calls alliance, and fear not nor stand in awe of what they fear. But with the Lord of Hosts, make your alliance — for Him be your fear and your awe.’ ”

This is the message we Christians have tried to bring to the nations. Be not afraid. Do not fear death. Fear only Him who can take away more than earthly life, and lay aside your weapons.

As individuals, the only way we have to cast aside our armaments is to stop providing for them. Perhaps now is the time for Christians to refuse to pay for Uncle Sam’s pagan temple in Arlington, Va., the Pentagon.

Are we expected to finance the most deadly military arsenal in the history of the world? As Christians, our allegiance is to Christ and His Word. What is expected of us? — That is the heart of the matter. “Give back to God what belongs to God,” our trust, our fear, our hope, our faithfulness, and our obedience.

The Introduction to The Tax Dilemma: Praying for Peace, Paying for War, was written by John K. Stoner. It clarifies the specifically Christian call for tax resistance. We reprint it here, in the hope that Donald D. Kaufman’s brief but important book will reach a wide audience and initiate a widespread and thoughtful Christian response.

“But what can I do? I am only one person.” ―Author Unknown.

The most common response of people to the unprecedented moral crisis of the world arms race is a sense of futility. Many people will agree that the survival of the human race itself is in jeopardy. Few will agree as to what can be done about it. An even smaller number believe that they personally can do anything.

Moreover, it is distressing to observe how many people attempt to absolve themselves of any personal responsibility for the situation we are in. They blame the government, big business, fate, God, or the devil. There is a great deal of passing the buck.

Especially, of passing the buck to Caesar. In the form of taxes, that is. War taxes. Yes, the word is out: there is such a thing as taxes for war. The government, if it calls it anything, calls it defense spending. People with a commitment to speak the truth, such as Christians, have a responsibility to expose the deceptive euphemisms and call a war tax a war tax.

At which point we return to the words of our unknown author, and supply her with another quote. “I can do something about the taxes I pay for war.”

This book is about doing that something. But there is much more.

The book issues a challenge to a wide audience — Christian and non-Christian. God’s claim on humankind is universal. What does it mean for the church to be praying for peace and paying for war? Donald Kaufman explores this contradiction from many angles and draws on many sources, but all with a view to finding the path of Christian obedience.

I have heard many Christians say that they do not engage in war tax resistance or protest because it is ineffective. The government ultimately gets the money, the resister makes no impact, and the exercise is futile. Apart from the fact that this appeal for success is strange talk for people whose hero and leader ended up being crucified, I hear in this an unspoken message that also doesn’t quite fit. The general demeanor of these folks toward society and government is one of studious conformity to accepted practice and one does not have to be richly endowed with imagination to infer that tax resistance or protest looks very risky to them. Which adds up to suggesting that their real reason for not engaging in tax resistance is that they think it would be too effective — in challenging accepted myths, clarifying the moral issue, and inviting the neighbor to take a similar stand.

In this regard, it might just be that the church should embrace tax resistance as the moral equivalent of disarmament. It has become fairly acceptable in at least some church circles to call on government to take risks for peace in the way of disarmament. In those circles it has not been unusual to look with some disdain on those who called for tax resistance as a form of response to the arms race. Given the meager successes of all the disarmament talks of history, including the United Nations Special Session on Disarmament, from a purely strategic point of view it might begin to occur to us that disarmament is such an intractable problem that we shall have to appeal to the people over the heads of the politicians to do something about it. But on a level deeper than calculating strategies for success, the church should be asking its members what is the right thing for them to do regardless of the consequences. If the generals, presidents, and ambassadors have decided to continue the arms race, shall the Christians continue to pay for it?

For the church (indeed, for any sizeable denomination of the church) to embrace war tax resistance as a spiritual commitment and a stated policy would be the moral equivalent of a government seriously embracing a policy of disarmament. Both would involve risk, both would be unprecedented, and both would be right.

But what government is ready to do the right thing on disarmament? And what church is ready to do the right thing on war taxes?

There are costs and risks involved.

John K. Stoner

Copyright by Herald Press.

, this announcement appeared in that paper:

The annual New England Catholic Peace Fellowship Conference has been scheduled for . The theme of the NECPF conference, at Mt. Alvernia High School, Newton, Mass., is “Praying for Peace/Paying for War?” It will include a major address by Elizabeth McAllister, as well as workshops on tax refusal. Further information on registration and materials is available from NECPF, Center of Concern, Mont Marie, Holyoke, Massachusetts 01040.

The National Catholic News Service sent out this dispatch on :

Tax Resistance Studied by Italian Pro-Lifers

Milan, Italy (NC)— The Italian pro-life movement is studying a proposal to fight the country's liberalized abortion law through “fiscal conscientious objection,” tax resistance.

A recent communique from the coordinating committee of the Milan based Movement for Life hinted that it may urge pro-life Italians to withhold part of their taxes as a protest against the law which took effect .

The committee said the abortion law made abortion, or actually the killing of children before birth, a social service to which all (taxpayers) must contribute.

Italy’s abortion law allows state funded abortions virtually on demand in the first three months of pregnancy for adult women.

The pro-life movement is also studying ways of pressuring against the election of Simone Veil, a Frenchwoman who supports abortion, as president of the new European Parliament. The Movement for Life is backing Emilio Colombo, an Italian, for the post.

The first anniversary of the law’s enactment last month prompted various demonstrations throughout the country. The Movement for Life announced on that it had collected over a million signatures from supporters of a national referendum to repeal the law.

Another dispatch from the same service, dated :

Canadian pro-lifer jailed in tax refusal case

By Joann McGarry

Winnipeg, Manitoba (NC)— While Canadian pro-lifer Joe Borowski is turning his energies to apostolic work among fellow inmates at Headingly Provincial Jail, his friends and supporters are trying to raise enough money to free him.

Borowski, chairman of the Alliance Against Abortion, has refused to pay federal income tax as a protest against Canadian laws providing federally funded abortions. His current 90-day sentence for contempt of court arises from his refusal to supply documents on his financial status to the Canadian income tax office.

Borowski began his sentence .

Before the sentence began, Winnipeg lawyer Ernest Wehrle began a “Friends for Joe” fund to raise the money Borowski owes in back taxes.

The fund has about $7,000 in cash and pledges, said Wehrle.

“The amount owed could be anywhere from $10,000 to $25,000, he said.

Accountants for Borowski and the federal Income tax department currently are working out the figure.

Payment of the tax bill would free Borowski from jail, at least until the next tax period, said Wehrle.

“He has always said he’d rot in jail before he’d finance abortions But I’d say he has achieved his aim and could do more if free to fight in another way,” added Wehrle.

In a letter to the Canadian Register, Catholic newspaper published in Toronto, Borowski said jails are “greatly overlooked missions” for religious work.

“The spiritual hunger is great. It’s an old frontier that has just been overlooked or neglected,” said Borowski.

Borowski receives Communion every day, say the two priests who visit him regularly.

“You could say Joe is a very ‘apostolic’ guy. Whenever I go to see him, he has three or four guys waiting to see me,” said Father Pat Morand, Borowski’s pastor.

Borowski has initiated a court case against the federal government in which he hopes to show that the nation’s abortion laws contravene the Canadian Bill of Rights.

The Catholic Worker included this article:

Tax Resistance

By Bill Barrett

The Christian tradition has always supported and encouraged those believers who could not, in good conscience, participate in the organized killing of war. Though the majority of Christians in each age have not always followed this position, there have been moments in Western history when Christian pacifism substantially affected all of society. When thousands upon thousands of lay men and women joined the Third Order of Saint Francis of Assisi, promising never “to take up lethal weapons, or bear them about, against anybody,” feudalism in Western Europe collapsed. Feudal lords were unable to fight their wars because so many peasants had joined the Third Order. Since their founding in , the Quakers, Mennonites, and Brethren, the “historic peace churches,” have given a consistent witness of conscientious objection. Though relatively few in number, their presence has been a continual reminder to the American conscience.

In centuries past, the main need of a warring state was soldiers; Napoleon once boasted that he “could use 25,000 bodies a month.” Although armies still enlist thousands of youth and are eager for more, we must recognize that there is a demand today for ever-increasing monies to finance the technology of war. War’s menace has been transformed into a spectre more horrible than ever. Today, even more than soldiers, governments require tremendous amounts of money to develop and build their nuclear weapons systems. The Pentagon maintains 140 different systems with the capacity to destroy every Soviet city of over 100,000 people forty times, at a cost of over 150 billion dollars. This money must be raised by the federal government, and it is raised through our taxes. As more people realize this and make the connection between our tax money and U.S. military spending, tax resistance grows.

Money for War

There are two main approaches to conscientious objection to war taxation, and they are not mutually exclusive. The first of these is the more direct: refusing to pay for what one will not do. Federal taxes are paid on many items, though not all are military related. F.I.C.A. Social Security withholding and the federal gasoline tax, for example, do not finance military spending. But there are other federal taxes specifically intended for military expenses.

The federal telephone excise tax was first imposed by the War Tax Revenue Act of ; it was repealed and reinstated several times until World War Ⅱ when, in , the first tax on all telephone service was enacted to underwrite that war. Due to expire in , the tax was extended in to raise money for the Vietnam war. Now due to expire in (unless Congress again renews it), this tax continues to pay the war debts of Vietnam. Many people refuse to pay this tax, usually less than one dollar each month, when it appears on their phone bills. One simply pays the balance of the bill, enclosing a note of explanation to the phone company. Most telephone companies consider this a matter between the individual and the government, and simply inform IRS that the tax is not being paid. In fact, as long as the telephone company is paid the money owed it for phone service, Federal Communications Commission regulations make it illegal for service to be cut off. Though IRS occasionally sends notices of tax due and even “final notice before seizure,” no one has yet faced criminal penalties for refused telephone tax.

Besides the federal telephone tax, an important source of revenues for the Pentagon is the federal income tax. Resisting income tax is a bit more complicated because of the withholding system, but because so much of the military’s money is generated by this source, more and more Christians are exploring ways of refusing to pay it. One way, perhaps the simplest, is the way of voluntary poverty. If one earns less than a certain amount ($3300 for a single person in ), the federal government claims no tax due. Not only is nothing contributed for the building of bombs, but the choice of voluntary poverty allows one to share in a rich tradition of the Church.

Some people who do earn taxable incomes refuse a small symbolic portion of their income tax, or they pay the tax but write a letter of protest about the government’s incredible priorities which increase military spending year after year while cutting budgets in areas of human need, such as food, housing and education. (What horrible proof that “even when they are not used, by their cost alone armaments kill the poor by causing them to starve.” Message from the Holy See to the UN, ) Some resisters withhold the portion of their taxes that would go to the military (47.3% in ), while others refuse to pay any federal income tax, realizing that a large portion of whatever they pay will be used for exactly those purposes to which they object in conscience. Although the U.S. Tax Code does not care what is done with refused taxes (it cares only that it receive the money), most conscientious objectors to war taxes contribute the amount they have refused, whether from telephone or income taxes, to a group or project that they believe is working toward peace.

A great deal of helpful information on ways of refusing war taxes, and on the legal consequences, is available from the Center on Law And Pacifism, 300 W. Apsley St., Philadelphia, PA 19144, telephone 215: 844‒0365, especially in their publication People Pay for Peace: A Military Tax Refusal Guide for the Radical Religious Pacifist ($2.00).

Besides the direct action of tax refusal, there is also a second approach, for while the right to conscientious objection to participation in war is recognized by U.S. Selective Service law, the U.S. Tax Code makes no such provision. Even First Amendment rights have not been acknowledged by the Tax Court system, which has ruled that IRS regulations take precedence over constitutional requirements! There is, however, a bill in Congress that would recognize the right of conscientious objection to military taxation. The World Peace Tax Fund Act, H.R. 4897 in the 94th Congress, would direct that portion of the taxes of conscientious objectors that would otherwise go to military spending be diverted instead to peace education and similar programs. While the bill does have a number of co-sponsors in the House, Representatives need to hear that their constituents support the right of conscientious objectors to legally prevent their tax money from buying more nuclear weapons. Copies of the bill, and more information, can be had from the National Council for a World Peace Tax Fund, 2111 Florida Ave. NW, Washington DC 20008, telephone 202: 483‒3752.

Selective Service law presently makes some provisions for conscientious objectors to war. Tax law does not. But conscience must be followed, whether a government declares it legal or not. The Second Vatican Council wrote, in its document on The Church Today (GS 16), “In the depths of their conscience, people detect a law which they do not impose on themselves, but which holds them to obedience. Always summoning them to love good and avoid evil, the voice of conscience can, when necessary, speak to their hearts more specifically: do this, shun that. For people have in their hearts a law written by God. To obey it is the very dignity of the person; according to it they will be judged.”

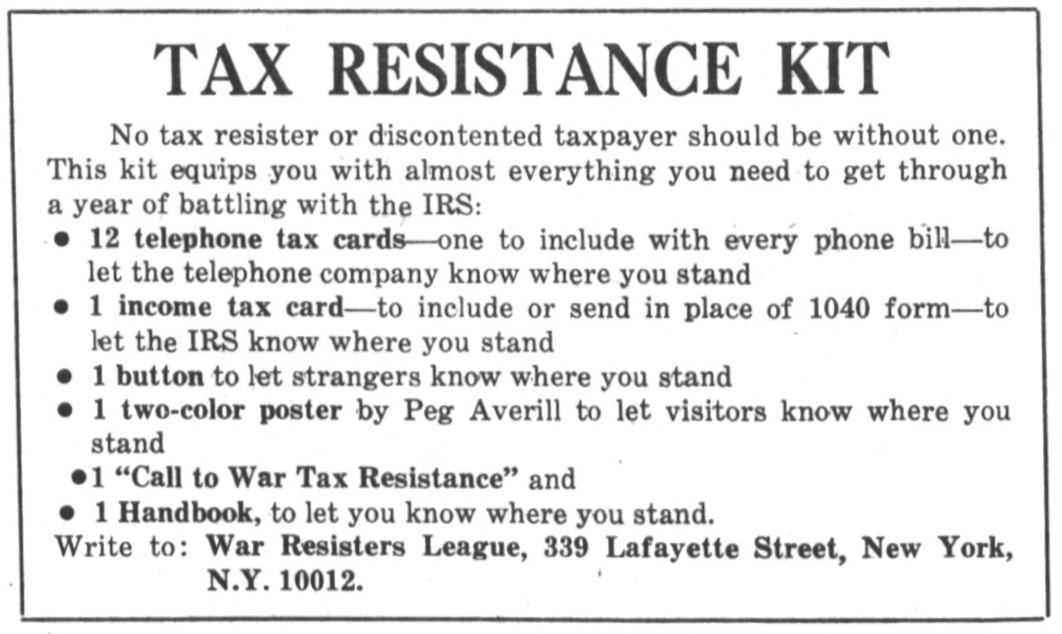

That article was followed by this ad:

The archives show next to nothing for (at least with the search terms I chose), so I’ll skip ahead to next.