This report summarizes . In some places I’ve put links to previous Picket Line entries that expand on some of the topics I mention. You can follow these links by clicking on the “♦” symbols.

Picket Line Annual Report

, the United States began its “shock and awe” attack on Iraq. This shameful and repulsive act was the last straw for me and I started what I then called “an experiment” in tax resistance so that I would no longer feel as complicit.♦

A review of my goals

My primary goal was to stop financially supporting the activities of the U.S. government. I hoped at first to be able to do this legally by reducing my federal income tax burden to zero. So I lowered my income below the federal income tax line by quitting my job to become an independent contractor, and by taking advantage of legal tax deductions and credits.

Tax Resistance

I missed my goal of avoiding all federal income tax, but in I have largely succeeded.

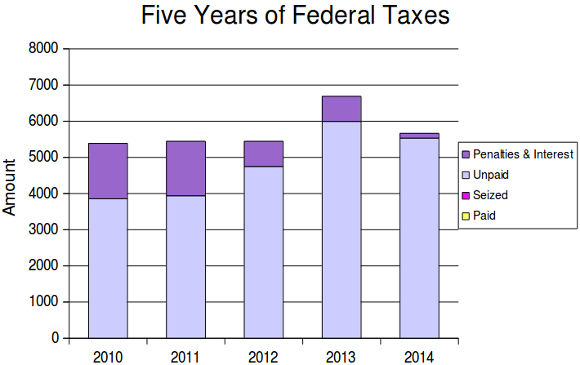

However, I have been assessed a federal self-employment tax most of these years (this is different from the income tax). In I decided to stop voluntarily paying this tax as well. I have been unable to find a useful way to do this legally, and so I have simply (but illegally) refused to write the check. Because of this I have been racking up an unpaid tax bill, along with IRS-added penalties & interest, which by now totals about $37,000.

The IRS has occasionally attempted to levy bank accounts to seize these back taxes, with mixed success. They have seized about $6,000 of the total of about $43,000 (including penalties & interest) that I have refused to pay so far. I don’t have a fail-safe plan to hide my assets, so I expect that the IRS may continue to seize money if they find it, though lately they haven’t shown much enthusiasm for the hunt. They haven’t managed to take anything from me in several years, though they still send me pleading letters from time to time. Their recent lack of action may be because they’ve run out of obvious targets, or it may be because my total overdue amount falls under the threshold at which they start trying harder (budget cuts have caused them to back off a bit on their enforcement). They may also just be biding their time, as the statute of limitations deadline on the oldest unpaid amount doesn’t run out for a few years yet.

My two-track strategy of legally avoiding the federal income tax while illegally refusing to pay the self-employment tax is an awkward and perhaps untenable compromise, but for me it currently seems the best alternative.

I owed, and refused to pay, about $5,681 in federal taxes, which represents $5,130 in self-employment tax, $418 in federal income tax, and a $133 “late” payment penalty. This is the first year I’ve owed any federal income tax since the year I started my “experiment” — this is because I miscalculated and overshot my maximum adjusted gross income by $328. That $328 ended up costing me $418… for a marginal income tax rate of over 125%… whoops.

a chart showing my last five years of federal taxes, none of which have yet been collected by the IRS

Although excise taxes are a very small part of what the government tries to get me to pay, I’ve adopted avoidance techniques here as well: for instance, I long ago gave up owning a car, so I pay very little federal excise tax on gasoline (at least directly), I don’t smoke and so I don’t pay tobacco taxes, and I homebrew beer and hard cider so as to reduce my contributions to the federal excise tax on alcoholic beverages.

Sustainability

I want to resist taxes over the long term, and so it is important that my expenses remain low enough that my tax-free income is also a good and sustainable one. was a good year for me income-wise. I brought in about $36,300 in profit from my business.

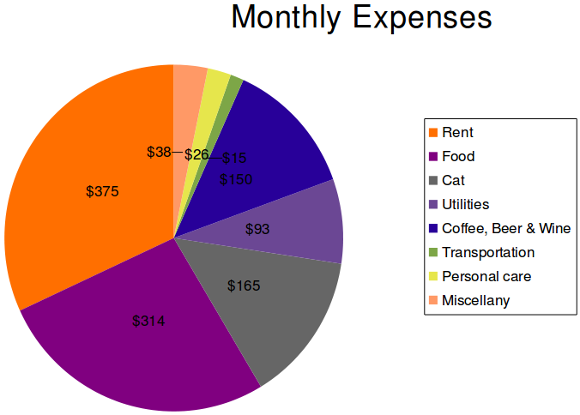

My regular expenses for things like rent, utilities, food, transportation, and such come to about $1,575 per month. But some of these expenses (business expenses, medical expenses that I can pay via my Health Savings Account) do not count toward the $18,000 tax-free disposable income that I’m allowed to use under my DON Method of tax resistance. My health insurance is now heavily subsidized via Obamacare, but this doesn’t mean much to my bottom line as this was an expense I could have taken as a tax deduction anyway.

a look at my typical monthly expenses

Not included in the above pie chart are any business expenses that I can deduct or my self-employment tax assessment (half of which I can deduct). My yearly living expenses take a bit more than $14,000 out of that $18,000. If I budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect may be seized, that would come to another $6,000 or so, half of which also counts against the $18,000 (and puts me close to my limit).

This expenses pie chart is a little deceptive when compared to those of other years. My rent is lower than usual because I buy and prepare most of the household food and so pay some of my “rent” off that way.

My cat is more than usually expensive as it has diabetes and so needs regular insulin injections and prescription food. My transportation budget is low because where I live it’s pretty easy to get around on bike so I don’t own a motor vehicle and rarely need to use one.

Things were pretty fat this year, and my expenses stayed pretty flat. I did a close audit of my spending to try and figure out whether I was sticking to a sustainable budget. I seem to be doing fine.♦

My 1040: A walkthrough

Here’s how my 1040 worked out this year. First, my Total Income:

| Total Income | $36,453 |

|---|---|

| Taxable interest | $146 |

| Business income | $36,307 |

My business income came from two sources: my contract work as a technical writer and sales of my books. The interest income came from a small Lending Club account I started last year.

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $18,328 |

|---|---|

| Total Income | $36,453 |

| HSA deduction | −$3,300 |

| ½ self-employment tax | −$2,565 |

| SEP deduction | −$6,748 |

| Self-employed health insurance deduction | −$12 |

| IRA deduction | −$5,500 |

, I put away $12,248 for retirement and $3,300 for future medical spending (or for retirement, if I stay healthy). Together, those represent over 40% of my Total Income for .

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that half of your FICA doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves and it’s all considered income, so the IRS lets you take half (roughly) of your self-employment tax as a deduction here to even things out (even if you’re refusing to pay it like I am).

I don’t have as much of a health insurance deduction this year as in years past, as Obamacare has reduced my premiums to a negligible amount. The upshot of this is that I was not able to earn quite as much income this year, but my expenses were also lower so lifestyle-wise it was a wash.

My Adjusted Gross Income is just above the $18,000 threshold that allows me to get the maximum rate on the Retirement Savings Contributions Credit, so I missed my target and owed $418 in federal income tax this year: it’s a tiny amount compared to the self-employment tax, and now that I’m resisting by simply refusing to pay it’s less tactically important that I stay below the tax line, but I still found it embarrassing.

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $8,178 |

|---|---|

| Adjusted Gross Income | $18,328 |

| Standard deduction | −$6,200 |

| Personal exemption | −$3,950 |

And from there, my tax owed:

| Tax owed | $5,548 |

|---|---|

| Income Tax | $818 |

| Retirement Savings Contributions Credit | −$400 |

| Self-employment tax | $5,130 |

Other Goals

I hope to encourage other people to consider tax resistance and I hope that The Picket Line is also a good resource for people doing tax resistance and for those considering it. I keep trying to make it more useful.

I had the pleasure last year of being contacted by an activist in Hong Kong’s Umbrella Movement to consult with them about adding tax resistance campaigns to their campaign for political liberalization there.

The state of the world and the tax resistance movements

The Obama administration continues to advance America’s repulsive policies on war & militarism, Big Brotherish snooping, impunity for torturers, propping up tyrants, and so forth. The thievery and mendacity of the politicians and the wizards of financial corruption that eat from the same troughs in Washington seems to know no bounds.

My only consolation is that the politicians in charge are so craven and short-sighted as to be unable or uninterested in preventing the entirely foreseeable meltdown of the system that nurtures them. Indeed they seem to be falling over each other to press for “solutions” that exacerbate the problems. The system seems to have built-in incentives that drive it to suicide, which takes some of the pressure off of those of us who are trying to kill it.

The IRS in particular continues to be plagued by greater bureaucratic responsibilities but reduced funding, making it less capable and more deserving of contempt. The tax system has become so unmanageable that criminals (some from behind bars while doing time on other charges) are milking it for billions of dollars by means of identity theft and tax fraud, while an entire overseas industry has grown up around impersonating IRS agents in order to shake down Americans over the phone.♦ These and other factors have led to predictions that the public credibility of our federal tax system may soon collapse and the long-standing norm of widespread taxpayer compliance will come to an end in this country.

Tax resistance movements

The war tax resistance movement (and the anti-war movement in general) is in the doldrums. Peace activists, though some have finally recovered from their Obamania, do not seem be inclined to adopt stronger tactics, by and large, but are satisfied with marches and speeches and petitions and occasional symbolic trespassing/blockade civil disobedience and other such pussyfooting.

I confess frustration and I despair of seeing Americans rise up to reclaim some dignity and decency. When I started this experiment I was all fired up with the project of convincing all the angry anti-war protesters out in the streets to buckle down and start making resistance and dissent part of their day-to-day lives. Now I more and more see myself as mostly just trying to keep the flame lit so that should people ever feel the weight of that final straw they won’t have to start from scratch.

Tax resistance movements seem to have been breaking out all over the world, though I wonder how much of this is a trend and how much of it is my increased ability to monitor current events in foreign languages thanks to some neat internet tools. The bonnets rouges movement in France, in particular, with their Rebeccaite tollgate destruction sprees, was fascinating to watch unfold, and it was heartening to see them succeed in their dramatic direct action campaign to force the government to rescind its hated tax, but if I’d had to rely on accounts in the English-language press I might not have even been aware it was happening.

Prospects for the coming year

Assuming no major unexpected expenses, and assuming the tax law doesn’t undergo any radical changes, I’m well-positioned to live comfortably and well under the income tax line .

I will likely “owe” self-employment tax again . I’ve budgeted for the possibility that the IRS may find a way to seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster.

So on to of what no longer seems like an experiment so much as a lifestyle.