This page summarizes . I’ve put in some links to previous Picket Line pages that expand on topics I mention. You can follow these links by clicking on the “♦” symbols.

Picket Line Annual Report

, the U.S. began its “shock and awe” attack on Iraq. This shameful and repulsive act was the last straw for me and I started what I then called “an experiment” in tax resistance so that I would no longer feel as complicit.♦

A review of my goals

My goal was to stop financially supporting the U.S. government. I hoped to do this legally by lowering my income below the federal income tax line, so I quit my job to start my own small business and I began taking advantage of additional legal tax deductions and credits.

Tax Resistance

I missed my goal of avoiding federal income tax, but in I have largely succeeded.

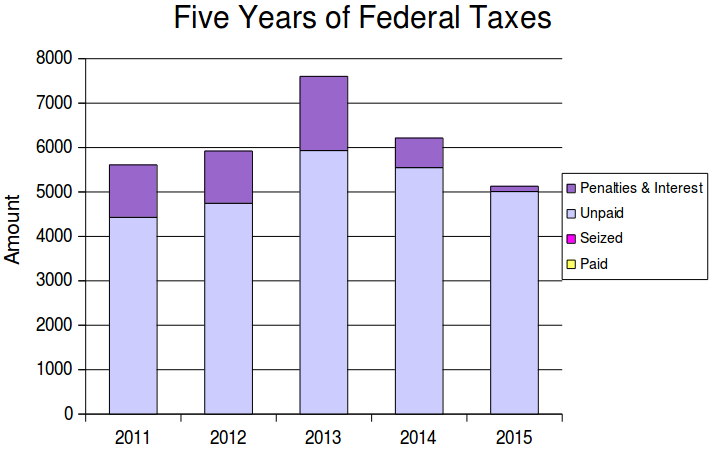

However, I have been assessed a self-employment tax most of these years (this is different from the income tax). In I decided to stop paying this tax as well. I have not found a useful way to do this legally, and so I have simply (but not legally) refused to write the check. Because of this I have been racking up an unpaid tax bill, along with IRS-added penalties & interest, which now adds up to more than $42,000.

The IRS has occasionally levied bank accounts to seize these back taxes, with some success. They have seized about $6,000 of the total of about $49,000 (including penalties & interest) that I have refused to pay. I don’t have a fail-safe plan to hide my assets, so I expect that the IRS may continue to seize money if they find it, though lately they haven’t shown much enthusiasm for the hunt. They haven’t taken anything from me in several years, though they still send me pleading letters from time to time. Their recent lack of action may mean they’ve run out of easy targets, or it may mean my overdue amount falls under the threshold at which they start trying harder (budget cuts have caused them to back off a bit on their enforcement). They may also just be biding their time, as the statute of limitations deadline on the oldest unpaid amount doesn’t run out for a couple of years yet.

My two-track strategy of legally avoiding income tax while refusing to pay self-employment tax is somewhat awkward, but it seems the best choice.

I “owed” and refused to pay $5,127 in federal taxes: $5,007 in self-employment tax and a $120 penalty for not paying on time.

a chart showing my last five years of federal taxes, none of which have yet been collected by the IRS

Although excise taxes are a small part of what the government tries to get from me, I’ve adopted avoidance techniques here too: for instance, I long ago gave up owning a car, so I pay little excise tax on gasoline (at least directly), I don’t smoke and so I don’t pay tobacco taxes, and I home-brew beer so as to reduce my contributions to the excise tax on alcoholic beverages.

Sustainability

I want to resist taxes over the long term, so it is important that my expenses remain low enough that my tax-free income is also a sustainable one. was a good year for me income-wise. I brought in about $35,500 in profit from my business.

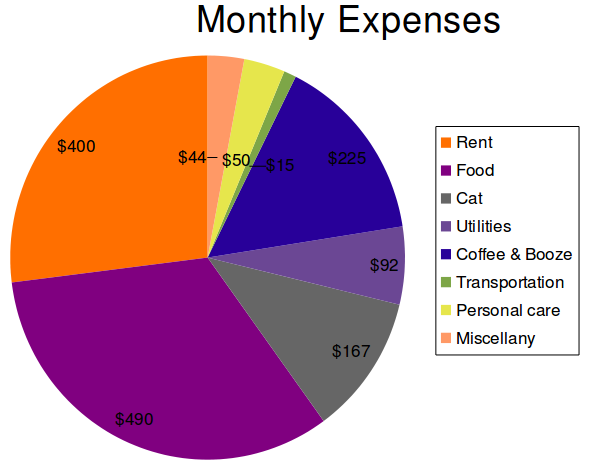

My regular expenses for things like rent, utilities, food, and transportation come to about $1,600 per month:

a look at my typical monthly expenses

Not included in the above pie chart are any business expenses that I can deduct from my income, health expenses (which I pay from my pre-tax Health Savings Account), or my self-employment tax assessment (half of which I can deduct).

My rent is lower than it has been in the past because I buy and prepare most of the household food and so pay some of my “rent” off that way.

My cat is more than usually expensive as he has diabetes and so needs regular insulin injections and prescription food. My transportation budget is low because where I live it’s pretty easy to get around on bike so I don’t own a motor vehicle and rarely need to use one.

I had unusually high medical expenses last year, but I paid them all from my Health Savings Account which I had been depositing money into for years, so this was not worrisome to my budget or my financial peace of mind.

My yearly living expenses took almost all of the $18,000 that constitutes my “under the tax line” spending money. If I budget-in the imposed self-employment tax, which I don’t intend to voluntarily pay, but which I expect may be seized, that would come to another $6,000 or so, half of which also counts against the $18,000 (and puts me over my limit).

My income was about as high as I could get it under my plan this year, but my expenses rose as my spending discipline weakened. I did a close audit of my spending to try and figure out whether I was sticking to a sustainable budget. I discovered I was spending too freely.♦ Since then I’ve been tightening my grip on my wallet a bit and I hope my next audit will show improvement.

My 1040: A walk-through

Here’s how my 1040 worked out this year. First, my Total Income:

| Total Income | $35,699 |

|---|---|

| Taxable interest | $215 |

| Business income | $35,524 |

| Capital gains | −$40 |

My business income came from two sources: my contract work as a technical writer and sales of my books. The interest income and capital loss came from a small Lending Club account I started . I don’t think I’ll do that again, as the annual reporting of these numbers to the IRS makes such an account especially vulnerable to seizure (though the agency doesn’t seem to have picked up the scent yet).

Now on to my Adjusted Gross Income:

| Adjusted Gross Income | $17,723 |

|---|---|

| Total Income | $35,699 |

| HSA deduction | −$3,350 |

| ½ self-employment tax | −$2,510 |

| SEP deduction | −$6,604 |

| Self-employed health insurance deduction | −$12 |

| IRA deduction | −$5,500 |

, I put away $12,104 for retirement and $3,350 for future medical spending (or for retirement, if I stay healthy). Together, those savings represent over 40% of my Total Income for .

The self-employment tax deduction works like this: When you work for someone else, your employer pays half of your FICA and the other half comes out of your paycheck. This is just silly accounting for the most part, but it does mean that the half paid by your employer doesn’t count as your income and so you don’t pay income tax on it. If you’re self-employed, you pay both halves of the tax and it’s all considered income, so the IRS lets you take half (roughly) of your self-employment tax as a deduction to even things out (even if you’re refusing to pay the tax like I am).

My Adjusted Gross Income is below the $18,000 threshold that allows me to get the maximum rate on the Retirement Savings Contributions Credit, so I hit my target and owed no federal income tax this year (last year, I just missed the target and so I owed a small amount).

Now we go from Adjusted Gross Income to Taxable Income:

| Taxable Income | $7,423 |

|---|---|

| Adjusted Gross Income | $17,723 |

| Standard deduction | −$6,300 |

| Personal exemption | −$4,000 |

And from there, my tax owed:

| Tax owed | $5,007 |

|---|---|

| Income Tax | $742 |

| Retirement Savings Contributions Credit | −$742 |

| Self-employment tax | $5,019 |

| Obamacare tax credit | −$12 |

Other Goals

I hope to encourage people to resist taxes and I try to make The Picket Line a good resource for people who are resisting or considering it.

I also published some writing elsewhere, including a piece on why people should consider not voting for the Center for a Stateless Society blog, a piece on the history of war tax resistance among Quakers for the Friends Journal, and one on the War Tax Resisters Penalty Fund for Waging Nonviolence.

The state of the world and the tax resistance movements

The Obama administration continues to advance America’s repulsive policies on war & militarism, Big Brotherish snooping, impunity for torturers, propping up tyrants, and so forth. The next administration will probably be even worse, judging from the quality of the politicians angling to lead it.

My only consolation is that these politicians are so craven and short-sighted that they are oblivious to the entirely foreseeable meltdown of the system that nurtures them. Indeed they seem to be falling over each other to press for “solutions” that exacerbate the problems. The system seems to have built-in incentives that drive it to suicide, which takes some of the pressure off of those of us who are trying to kill it.

The IRS continues to be plagued by greater responsibilities but reduced funding, making it less capable and more deserving of contempt. The tax system has become so unmanageable that criminals (some from behind bars while doing time on other charges) are milking it for billions of dollars by means of identity theft and tax fraud, while a thriving overseas industry has grown up around impersonating IRS agents in order to shake down Americans over the phone. These and other factors have led to predictions that the credibility of the federal tax system may soon collapse and the long-standing norm of taxpayer compliance will come to an end.♦

Tax resistance movements

The U.S. war tax resistance movement is in the doldrums. It does most of its work in the “progressive” arena, which itself is pretty lackluster these days, even when it isn’t hopelessly intoxicated by the presidential election. Meanwhile, anti-war activists on the libertarian or paleocon side of things don’t seem to have developed much of a culture of direct action or civil disobedience in which war tax resistance could thrive, in spite of some recent feints in that direction from folks like Charles Murray♦ and Ron Paul.♦

I despair of seeing Americans rise up to reclaim some dignity and decency. When I started this experiment I was all fired up with the project of convincing the angry anti-war protesters in the streets to buckle down and make resistance and dissent part of their day-to-day lives. Now I see myself as mostly trying to keep the flame lit so that if people finally feel the weight of that final straw they won’t have to start from scratch.

In more encouraging news, tax resistance movements are breaking out elsewhere all over the world (though I wonder how much of my perception of this is a result of my increased ability to monitor current events in foreign languages thanks to some neat internet tools). While in the U.S. people resignedly grumble “death and taxes, what can you do?” I’ve seen tax resistance campaigns break out in Argentina, Belarus, Burundi, the Congo, Denmark, Ghana, Iceland, India, Israel, Italy, Kenya, Mexico, New Zealand, Pakistan, Puerto Rico, Russia, South Africa, Spain, Venezuela, and Wales, as well as ongoing campaigns in Catalona, Greece, Honduras, Ireland, Italy, and Spain.♦ There is a lot of encouraging innovation coming out of the “comprehensive disobedience” movement in Spain, in particular.♦

Prospects for the coming year

Assuming no major unexpected expenses, and assuming no big changes to the tax law, I’m well-positioned to live comfortably and well under the income tax line , though I will again “owe” self-employment tax.

I’ve budgeted for the possibility that the IRS may seize money from me for unpaid back taxes, so in case this happens, it won’t be a disaster.

So on to of what no longer seems like an experiment so much as a way of life.