The IRS isn’t the only federal agency that takes money from people. A few days ago, the Erie Peace Initiative blog published the statements of six war protesters who refused to pay the $500 fines a judge had given them after they were convicted for their roles in a federal building blockade. For this refusal, they were sentenced to five days imprisonment.

How you can resist funding the government → other ways the government is funded → fines, fees, fares, and such

Like a lot of people, I’ve been keeping a fraction of an eye on the U.S. Treasury Department’s megalomaniacal thrashings about of late. The more I learn about it the more bafflingly absurd it seems, but I also realize I’m in way over my head and don’t really have any expertise to draw on in interpreting what I learn. On the other hand, those who do have the requisite expertise don’t seem to have the humility to understand that even so, they don’t really understand what they’re doing and have so far led things to ruin — they’re just certain that with a tighter grip on the wheel and a whole lot more money (why don’t we ask the taxpayers for a big loan — they’ve never said no before!) the cards are bound to come up better sooner or later and then this will all be like a bad dream.

But of course I looked for a tax resistance angle. And this is what I came up with:

The U.S. Treasury is seeking (or has just assumed) the “authority to issue up to $700 billion of Treasury securities to finance the purchase of troubled assets. The purchases are intended to be residential and commercial mortgage-related assets, which may include mortgage-backed securities and whole loans” (I’m quoting from the Treasury Department’s press release).

If the U.S. Treasury just seized/purchased your mortgage… now there’s a dilemma! What’s a tax resister to do?

And then I stumbled on this interesting factoid:

When FDIC head Shelia Bair says her agency might have to bolster the FDIC’s insurance fund with Treasury borrowings to pay for the new spate of bank failures, a lot of us, this 40-year banking veteran included, assumed there’s an actual FDIC fund in need of bolstering.

We were wrong. As a former FDIC chairman, Bill Isaac, points out here, the FDIC Insurance Fund is an accounting fiction. It takes in premiums from banks, then turns those premiums over to the Treasury, which adds the money to the government’s general coffers for “spending… on missiles, school lunches, water projects, and the like.”

The insurance premiums aren’t really premiums at all, therefore. They’re a tax by another name.

You’ll recognize this as similar to the trick the government plays with the quasi-insurance trust funds for social security and medicare — the government goes out and spends the money, replacing it with IOUs which it has no plans to honor. And so I got to thinking about how many other ways the government reaches into our pockets, and to what extent we can resist these.

As I noted , a large and growing percentage of Americans do not pay any federal income tax. This poses a bit of a challenge to the American war tax resistance movement, since most of their literature involves resisting that tax. (And the rest mostly concerns the excise tax on local telephone service — which is also becoming less relevant as more people are switching to cell phones and internet telephony.)

So I asked war tax resisters what they thought about all this:

…we need to have something to say when we encounter an activist in the non-income-tax-paying 40%. It may be difficult to recruit someone into war tax resistance when most of our literature concerns a tax that a lot of folks aren’t paying anymore…

…[It] might be a good idea for war tax resisters to consider ways of refining their messages so as to take some of the emphasis off of the federal income tax and instead cover the whole spectrum of ways people fund the government and its policies.

Larry Rosenwald took up the challenge, asking me “what do you see as being included in ‘the whole spectrum of ways people fund the government and its policies,’ and which aspects of that funding do you see as subject to choice and resistance, either implicit or [ex]plicit?”

Which is a good question, and one I don’t know the answer to (or if there’s an answer, especially with things changing so rapidly lately).

I took a look at the federal budget to see what kind of numbers they use. I’m sure that it’s misleading, but it does itemize many of the ways money we earn becomes money they spend.

According to the budget for , the government brought in $2,567,672,504,536 in “budget receipts” — mostly what we typically think of as taxes. These can be broken down as follows:

| 45% | individual income tax |

| 34% | social insurance / retirement |

| 14% | corporate income tax |

| 3% | excise taxes |

| 1% | estate & gift taxes |

| 1% | customs duties |

| 2% | miscellaneous |

Confusingly, one section of the report threw the FICA acronym in with the “individual income taxes” section instead of the “social insurance and retirement” section where I would have expected to find it. So even at this level of granularity, I’m a little confused as to what the numbers mean.

Each of these categories is further subdivided. Under the individual income taxes section, for instance, you can learn that $49,779,182 was donated by the foolish and insane to the presidential campaign fund to help pay for those marvelous political conventions and advertisements we’ve been seeing lately.

The “excise taxes” category is subdivided to show the various taxes and trust funds involved — though there are negative numbers in the column as well, and I’m not sure why — do some of the trust funds give out refunds? do some relinquish their money into the general fund somewhere else? do some involve so much overhead that they don’t end up in the black? In any case, the biggest item here is deposits into the highway trust fund / leaking underground storage tank trust fund — totaling about $40½ billion of the $65 billion in the “excise taxes” category (if I’m reading the numbers right) and coming from the gas tax. There’s a catch-all subcategory also called “excise taxes” that runs another $15 billion, and then another $11½ billion coming from the airport & airway trust fund — money that eventually comes from inflated airline ticket prices I’d imagine. And there are many also-rans: vaccine injury compensation fund, black lung disability trust fund, tobacco excise tax, etc. Because there’s an obscurely-labeled negative $7½ billion or so in the mix, the numbers I’ve given here don’t add up like they ought.

The customs duties aren’t subdivided according to what the duties applied to — except for arms and ammunition — so that’s less helpful. The estate/gift tax is an unsubdivided line-item.

The miscellaneous section has some interesting bits in it. Most of it comes from federal reserve deposits and doesn’t much concern us. Another $10 billion comes from user fees, licenses, filing fees and the like, including that “universal service fund” fee you see on your phone bill (that’s $7½ billion of the ten) and immigration, passport, and consular fees (another billion). The government hauls in $4½ billion from assessing fines, penalties, and from seizing stuff and selling it at auction. It brings in $241 million from “gifts & contributions” — you heard that right — including (get this) $3,594,405 from something called the “Conscience Fund”:

Money voluntarily paid to restore amounts which the donor considers to have been wrongfully acquired or withheld from the Government. Also includes moneys from those… motivated by personal feeling to ease their conscience from wrongful acts against others.

Go fig.

And that wraps up the “budget receipts.” But there are a whole bunch of other receipts that apparently aren’t budgetish. This includes $12 billion in interest on money the government has lent out, for instance to other countries or the international monetary fund. And there’s $3½ billion in dividends on investments it makes via funds it controls and is allowed to invest (e.g. the national railroad retirement fund). It brings in $4 billion in royalties & rents on public lands, for instance when it leases mining, harvesting, or grazing rights. It gets nearly a billion for actually selling stuff — such as timber, mineral products, or power (for example, the government owns the Tennessee Valley Authority, so if you pay your electric bills to them, you’re contributing to the profits of a government-owned utility, and therefore to the federal budget).

In addition to those sales, there’s another $16 billion in sales of government property — almost entirely sales of military equipment to foreign countries. The government also “sells” insurance, collecting $50 billion in medicare premiums, and another $12 billion or so in other stuff, including the new medicare prescription drug scheme, nuclear waste disposal fees, and veterans life insurance.

There’s a $13 billion item called “negative subsidies & downward reestimates” that I could make no sense out of, $2½ billion in miscellany, and a negative billion worth of “receipt clearing accounts.” You tell me.

When you get to the bottom of that, you’ve got another $126½ billion in “proprietary receipts from the public” in addition to the “budget receipts.”

“But that’s not all!” Stick with me as I put on my straw hat and gesture with my cane at the “Intrabudgetary Receipts Deducted By Agency.” What could these be? I think they’re money that one government agency pays to another, that have to be included as receipts to make the accounting come out right. As such, I think we can safely ignore ’em.

After this comes “undistributed off-setting receipts” — $260 billion that seem to me mostly like more of the same, but it’s hard to tell. There’s “interest received by trust funds” which I’m guessing is grouped near the previous bunch because the interest is being paid by the government and the funds are being invested in Treasury securities, but perhaps not. There’s also $6¾ billion in rents and royalties on the outer continental shelf and about the same from the federal communication commission’s auctioning off of bits of the broadcast spectrum (an item that gets duplicated in the list, so perhaps the money is doubled as well).

From here, we hit the final item: “offsetting governmental receipts” — that is to say “regulatory fees” and “other”. The first is over $6 billion worth of fees for things like “mobile home inspection and monitoring,” “pipeline safety,” “bankruptcy oversight,”, “student and exchange visitors” and “immigration user fees.” The latter only comes to $27 million, so I won’t dwell.

Whew! And that doesn’t even cover the various state governments and other sub-franchise operators that the federal government authorizes to take our money from us (or to run monopolies like the state lotteries). And it also doesn’t count the various ways the government can compel us to labor directly for it (rather than supporting it indirectly through money) — everything from prison labor and stop-loss orders, to the hours we spend filling out paperwork. Nor is the hidden tax of inflation and the devaluation of government debt through its underreporting included here. And the various government powers that have significant economic value — for instance the power of eminent domain, the power to print currency, the power to make the rules — don’t make the balance sheet.

The challenge will be to start with something like this and end with some sort of a practical guide for people who want to boycott and divest from Washington. Any ideas?

I’ll highlight a couple of unusual methods that people are using to get between the government and its claims on peoples’ money.

First, here’s a recent profile of Father Louis Vitale, an American Franciscan friar who has been arrested hundreds of times in civil disobedience actions of one sort or another.

Judges are reluctant to sentence him to more time behind bars because that’s just an expensive way of catapulting Br’er Rabbit into the briar patch. So they fine him. He’s propertyless, having taken a vow of poverty, and…

Outside court, Vitale admonishes friends and family members not to pay [the fine]. He would rather go to jail.

Second, here’s the story of Tim DeChristopher:

On , Tim DeChristopher, 27, walked into a Bureau of Land Management building in Salt Lake City where an auction was being held.…

When DeChristopher entered the building, officials mistook him for a bidder and allowed him to enter the auction, where he was given a bidding paddle — number 70. The University of Utah economics student says he stood out in a room filled mostly with veteran oil and gas men, but he started holding up his paddle to bid. By the time officials caught on and stopped the auction, DeChristopher had acquired the rights to 12 parcels of land, totaling 22,000 acres — for $1.79 million that he didn’t have.

DeChristopher’s motives were environmentalist, but his methods worked not just to disrupt the oil & gas companies’ intended use of the land for resource extraction, but also to disrupt the government’s revenue-raising exploitation of the land.

He’s facing federal criminal charges for his action, but he’s confident that the government will have a hard time proving any real damages — the Bush Administration tried to sneak the auction in without following the rules, and it has since been legally invalidated.

Wendy McElroy reports that as receipts from income taxes, property taxes, business taxes, and sales taxes plummet during this recession, governments are boosting some stealth taxes in order to get their hands on more of our loot.

Among these: fines, fees, fares, tickets, tolls, tuition, and access charges. Everything is going up, a little here and a little there. And it adds up. McElroy notes the following news story:

An example… On his website Texas Senator Eliot Shaleigh writes, “A couple of weeks ago, the local paper printed names of El Pasoans with outstanding arrest warrants. 78,000 El Pasoans made the paper! What’s going on here? Here are the facts. Of the 78,000 almost all are for moving violations. In fact, most are violations of the Texas Driver Responsibility Act of . Here’s a breakdown by category of violation… When we compared Austin, same story: 11% of Austin has outstanding arrest warrants. How did that happen?… For the first time, fees, tickets and tuition paid for sizable chunk of the Texas budget. Under the bill, fees escalate dramatically. Theoretically, after three tickets, a driver can owe $3,000 and more, depending on the offense. And if you can’t pay, you go to jail. And that is exactly what happened. Nearly one in ten Texans can’t pay: students, single mothers, working families, essentially low and even middle income Texans whose income can’t keep up with gas, insurance, taxes and tickets too.”

According to Car and Driver, “The metropolitan Detroit area, which has been reeling economically much longer than has the rest of the country. The number of moving violations issued has increased by at least 50 percent in 18 communities in the metro area since — and 11 of those municipalities have seen ticketing increases of 90 percent or more.” [Hat tip to Mike "Mish" Shedlock]

Some bits and pieces from here and there:

- Marlene at Pick My Brain reviews “Death & Taxes,” the new war tax resistance video from NWTRCC: “I listened intently to the 28 voices who spoke with clarity and passion about their call to action and I was definitely inspired to do something, even a token action to resist using my taxes to fund war and militaristic action. … I heartily recommend using this 30 minute DVD in small groups, Sunday School classes, peace and justice retreats, etc. It is fast paced, very positive and upbeat with lively music.”

- RantWoman, at RantWoman and the Religious Society of Friends, reflects on the neglected tradition of Quaker war tax resistance and what it might take to revitalize it in modern Meetings.

- South Carolina is requiring all organizations that “directly or indirectly advocate, advise, teach or practice the duty or necessity of controlling, seizing, or overthrowing the government of the United States, the state of South Carolina, or any political division thereof,” to register their activities with the South Carolina Secretary of State and pay a five-dollar filing fee. A member of the Alliance of the Libertarian Left decided to register: “When belligerence and inhumanity prevail, the peaceful and the humane must find honor in being categorized as the enemies of the prevailing order. Please keep me updated as to the status of our registration. I look forward to hearing back from you as to our official recognition as enemies of your state and its government. … PS. I am told that there is a processing fee in the amount of $5.00 for the registration of a subversive organization. Our organization is in fact so dastardly that we have refused to remit the fee.”

- Paying taxes is not a civic virtue, according to a Google Translation of an op-ed by Thomas Schmid in a recent issue of Welt Online, which namechecks Thoreau on the way to criticizing governments who rely on data stolen from banks in tax havens to crack down on tax evaders.

- Wendy McElroy has an interesting note about the philosopher William Wollaston who investigated the sensible idea that our actions are a more reliable indicator of our beliefs than are our utterances.

- “Where are 1% of American adults?” asks Shakesville. In prison, is the answer. Along with some other revolting statistics about America’s lockdown culture that you’ve probably heard before was this interesting claim: “It is illegal to bring into the United States any goods produced by forced labor or by prisoners, yet American prisoners make 100% of the military helmets, ammunition belts, bulletproof vests, ID tags as well some other items used by the US military. Although a prisoner is not technically forced to work, solitary confinement is the punishment for refusal. They also make 93% of domestically produced paints, 36% of home appliances and 21% of office furniture.”

What ever happened to the tollbooth-destroying family of Rebecca and Her Daughters? Seems they’ve recently been spotted in Arizona. Excerpts:

Arizona speed cameras incite a mini revolt

A masked man, a citizens group, a judge and other motorists are behind the fight against photo enforcement.

Arizonans drive long distances on their highways, and they like to do it fast.

But since the Grand Canyon State began enforcing speed limits with roadside cameras, motorists are raging against the machines: They have blocked out the lenses with Post-it notes or Silly String. During the Christmas holidays, they covered the cameras with boxes, complete with wrapping paper.

One dissenting citizen went after a camera with a pick ax.

Arizona is the only state to implement “photo enforcement,” as it’s known, on major highways and is one of 12 states and 52 communities, plus the District of Columbia, with speed cameras, according to the nonprofit Insurance Institute for Highway Safety.

The cameras, paired with radar devices, photograph vehicles exceeding the speed limit by 11 mph or more. A notice of violation — carrying a fine of $181.50 — is then sent to the address of the vehicle’s registered owner.

Initially, the cameras were thought of as a revenue generator, expected to bring in more than $90 million in the first fiscal year of operation.

But , the cameras generated about $19 million for the state’s cash-strapped general fund, according to a report on photo radar released by the Arizona Office of the Auditor General last month.

As of , only 38% of issued violations were paid, the report said.

The program was designed to encourage people to pay the fine and not fight their violations: No points are added to an offender’s license, and it doesn’t affect insurance.

But, critics note, that hasn’t stopped people from wanting their day in court. About half of the total violations issued are still pending because people have ignored the tickets or have requested hearings to challenge them, according to the state Department of Public Safety.

The violations put an “inordinate” load on the courts, said Terry Stewart, a court administrator with Maricopa County. People have flocked to request hearings at Phoenix courts, and at one point last year, one court branch had cases set up through .

“You just have irate litigants and irate defendants coming in, just mad at the entire photo enforcement system in general,” said Steven Sarkis, a Maricopa County justice of the peace.

The most high-profile protester has been Dave VonTesmar, who has achieved statewide fame through his efforts to fight the tickets with a monkey mask. The 47-year-old flight attendant has allegedly sped past the cameras at least 40 times.

His defense?

There’s no way to prove that he was the driver wearing the mask, he says. Lots of people, he adds, drive his car.

VonTesmar, who signed up for the military on his 17th birthday, says he doesn’t fancy himself a criminal.

Amid empty soda cans on the floor of his white station wagon are various rubber disguises, including the famous monkey mask, a Frankenstein, koala, panda bear and a ghost mask that glows in the dark.

So far, four of VonTesmar’s cases have been dismissed, and he’s been found responsible for seven. The remaining 29 are pending, said VonTesmar’s attorney, Michael Kielsky.

Another dissenter is John Keegan, a judge for the Arrowhead Justice Court, who has called the cameras a constitutional violation. He rejects every photo radar ticket that comes before him.

So far, Keegan says, he’s dismissed more than 7,000 violations, potentially worth more than $1 million.

Government-imposed fines are another form of taxation and another opportunity for resistance. Here’s an example from :

Pub landlord is first person in Britain to be jailed over smoking ban

A former pub landlord became the

first person to be jailed in connection with the smoking ban.

Nick Hogan, 43, was sentenced to six months in prison for refusing to pay a

fine imposed for flouting the legislation.

Hogan, who ran two pubs in Bolton,

became the first landlord convicted of breaking the law for allowing his

customers to routinely light up in his bars.

A judge fined Hogan, of Chorley, Lancashire, £3,000 and ordered him to pay

£7,236 in costs after finding him guilty of four charges under the Health Act

2006.

But the married father-of-two refused to pay the fine and

, after repeatedly being hauled

back before the courts, a judge sitting at Bolton Crown Court finally lost

patience and jailed him.

his wife, Denise, 53, who is

also a publican, said she was disgusted that her husband would be in prison

alongside murderers and rapists.

“Criminals and bad people go to prison not law-abiding businessmen like my

husband who are trying to earn an honest living,” she said. “Nick doesn’t

deserve to go to jail, all he has done is speak his mind and people simply

don’t like it.

“Ninety per cent of people who come into my pub want to smoke, even the

non-smokers think there should be a choice. These laws are ridiculous.”

At the hearing, in , magistrates

were told Hogan held a “mass light-up” in his two pubs, the Swan Hotel and

Barristers’ Bar, in Bolton, on the day the smoking ban came into force in

.

He was visited by inspectors from the local authority, who found letters

taped to pub tables advising customers they had the “freedom to choose

whether or not to smoke”.

They also saw regulars smoking on five separate occasions.

Hogan, who has since sold his lease for both the pubs, was cleared of one

count of failing to prevent his customers from smoking and four further

charges of obstructing council officers.

Deborah Arnott, chief executive of the anti-smoking group

ASH, insisted it was a myth that the

anti-smoking legislation had forced pubs out of business.

She said: “Many pubs have shifted their focus to serving food, so they have

changed their nature.”

She added: “Mr Hogan is the exception, not the norm, because compliance rates

for the ban are way above 90 per cent.”

Hogan was set free when a blogger going by the handle of “Old Holborn” dressed up in a Guy Fawkes mask and cape in order to remain anonymous and delivered a suitcase full of cash to prison to pay Hogan’s fine. The funds had been donated by thousands of people around the world who were sympathetic to Hogan’s fight.

, China Daily carried a story about Chinese tax resister Yang Zhizhu. In protest against China’s “one child policy” Yang and his wife have refused to pay the fine assessed on them for illegally having a second child. Excerpts:

Law professor won’t stop at one

Yang Zhizhu taught law at the Beijing Youth Politics College until he was fired . The school says the law professor defiantly challenged China’s one-child policy by having a second child and refusing to pay the resulting fine. But Yang, 43, says his firing is unjustified and that he is taking a stand against an unfair 30-year-old family planning policy.

Yang’s case has drawn a lot of media attention and in the past two weeks Yang has given interviews to reporters not just from around China, but also from foreign countries, including the Netherlands, France, the U.S. and Germany.

“Since my story was reported earlier , I’ve only taken one short break, . It seems I’ve already became a model protestor against the current family planning policy,”…

The media reports have helped Yang win tens of thousands of hearts across the country. In a survey carried out by www.qq.com, a prominent Chinese website, 75,331 people (91 percent of the survey’s respondents) supported Yang.

Yang’s wife, Chen Hong, 39, gave birth to their second daughter, Yang Ruonan, on . On the same day, the university officials formally announced guidelines outlining punishment for employees who violated the city’s family planning regulations, which included such sanctions as a three-year ban on promotions and a one-year salary freeze.

There was conflict almost immediately and the school fired Yang on after he refused to pay a fine in accordance with the new guidelines.

Yang could have avoided all the drama by paying a fine of 200,000 yuan ($29,283). However, he refused to do so, not because he couldn’t afford it, but because he refused to abide by policy he regards as “ridiculous,” he said.

“Why should I pay money for having my own kid? It’s not human trafficking. It’s our right as citizens. There’s no need for birth control in China, because the birth rate is already quite low in big cities such as Beijing and Shanghai, and China is an aging country,” he said, adding that the fine he refused to pay is 10 times higher than the price of a baby sold by human traffickers.

Even though Yang said he could have afforded the fine, he conceded it would have saddled him with a considerable debt. He had a monthly income of 5,000 yuan before losing his job and his wife has been unemployed since getting pregnant.

Now Yang makes a living by writing for various publications and websites, which, in a good month, brings in about 2,000 yuan.

Some bits and pieces from here and there:

- Carl Watner, proprietor of Voluntaryist.com has put out an anthology of works critical of the practice of taxation: Render Not: The Case Against Taxation. “Some goods and services are essential to human survival, but voluntaryists realize that they need not be provided by the government on a coercive basis. What we oppose is the coercion involved in collecting taxes. We oppose the means and take the position that the ends never justifies the means.”

- Austerity for the citizens and tax payers, more money for the banks and tax farmers: that’s the message the European ruling class is giving the people of Greece, and the Greeks are experimenting with ways of saying “forget it,” or in Greek: “ΔΕΝ ΠΛΗΡΩΝΩ” (I won’t pay). The Greek government intends to combat tax resistance and evasion by increasing fees, fines, and tolls, and by slapping a tax onto electric bills: so “sales of generators have shot up” and people are threatening to simply not pay the extras. The government says it will shut off power to those who resist, but as one resister put it: “when 70% of Greek households don’t pay it, what are they going to do? Cut off the whole lot?” Greek resisters are also occupying toll booths and waving cars through, sabotaging public transit ticketing machines, and unionists at the power corporation have refused to print out and send bills that contain the new tax.

- The IRS has finally taken notice of Cindy Sheehan’s tax resistance, and recently took the unusual step of issuing her a summons to bring all the details of her financial life to their office so they can decide how much of it to seize. Her response? “We will never pay, so stop harassing us.”

- A while back, the U.S. government experimented with turning some of its naughty delinquent taxpayers over to private debt collection agencies. This, they hoped, would result in increased tax revenue, a new source of corporate profit, and some nice campaign contribution kickbacks. It was a bit of a boondoggle, was naturally opposed by the union representing IRS employees, and was scrapped in . But then what happened to all those cases that had been given to the private debt collection companies and then reverted to the IRS? The Treasury Inspector General for Tax Administration took a look. In the sample of cases they investigated, on nearly half the IRS had taken no collection actions since the cases had been returned to them.

- “What it meant to be free, I supposed, was to be free from limits and entanglements, duties and responsibilities; freedom was self-sufficiency, and a major goal in life was to maintain and extend the range of sovereignty.… This viewpoint is utterly bizarre, something we forget because the viewpoint is so prevalent. One mark of our cultural abnormality is how strange it seems to think of freedom as marked by self-restraint, loyalty, fidelity, reverence, piety, or responsibility. We tend to think that freedom is the absence of responsibility.… I am what I am in virtue of the responsibilities I bear. Insofar as I matter as a person, I am constituted not by sovereignty, but by what I owe. And only by knowing what I owe to others do I know who I am and what I’m for; ignorance of owing is to be devoid of a self.”

Some bits and pieces from here and there:

- “LittleSis is a free database of who-knows-who at the heights of business and government.” It seems to be a cleverly-engineered, crowdsourced, ever-evolving database of the connections between politicians, lobbyists, business executives, organizations, bureaucrats, and the like.

- “The Neglected Costs of the Warfare State: An Austrian Tribute to Seymour Melman” — Melman was the Winslow Wheeler of , keeping a watchful and critical eye on the military budget and both its inherent and extravagant waste. This article looks in particular at the opportunity costs of military spending, and at the common fallacy that such spending stimulates the economy and enriches society.

- A little while back I read Visions of Poesy: Anthology of 20th Century Anarchist Poetry and didn’t find anything in it inspiring or interesting, sad to say. Read IOZ’s A Coherent Philosophy instead.

- At Strike the Root, Glen Allport describes How the 1% took America’s Wealth (and How to Get It Back).

- Claire Wolfe has an interesting column on developing derring-do.

- Greek tax protesters in Athens hung their unpaid utility bills on a Christmas tree.

- Argentine congresswoman Griselda Baldata couldn’t help but notice that nobody was maintaining the road on Route 36, but the company in charge of maintenance was still collecting a toll. So she stopped paying and urged her constituents to do likewise.

- Martin Newell, from the London Catholic Worker community, broke into Northwood Headquarters with the hopes of disrupting the disreputable. He was instead hauled into court and fined. He refused to pay and was sentenced to 24 days in prison for his refusal.

- Carl Watner has put his introduction to Render Not: The Case Against Taxation on-line.

In other news, amidst the other tax resistance actions in Greece, officials of the Greek tax agency have gone on strike.

The two-day strike coincides with the last two working days of the tax year, which amplified its effect.

The article reporting on the strike also notes a rise in the number of people who are turning in their car license plates rather than renewing their registration at an increased rate.

Some bits and pieces from here and there.

- A recent outrage-of-the-week was the Obama administration’s attempt to require employers to provide coverage of contraception-related treatment in employer-provided health insurance plans.

Some employers, you see, think contraception is immoral, and don’t think the government ought to be able to force them to violate their consciences by providing a benefit to an employee that an employee might use to do something they think is wrong.

To which many folks said: “Seriously? Of all the things the government forces us to bloody our hands with, you’re getting bent about this?”

For example:

- “Catholic Bishops’ Contraception Coverage Argument Ridiculed By Pacifist Activists” by Zach Carter, HuffPost, quotes war tax resisters Ruth Benn, Karl Meyer, and Bradford Lyttle

- “Pacifists’ ‘Conscience Objections’ to War Taxes Never Get Same Notoriety as Opposition to Funding Birth Control” by David Dayen, FireDogLake, who includes this depressing remark about the collapse of war tax resistance in the Society of Friends: “I went to a Quaker secondary school for a year, and I’m quite sure that many of the believers in the weekly meeting for worship sessions had strong religious objections to their money being used to kill other people, even in self-defense. And yet I don’t remember a single controversy in my lifetime about ‘conscience protections’ for taxpayer funds and their use in war. I don’t even remember any accounting accommodations made for that.”

- “A modest proposal regarding religious liberty” by Mark Gordon, Vox Nova: “The principle being upheld is that as a matter of religious liberty no one ought to be forced to pay for something that violates their conscience. If that is true of government-mandated private insurance policies, and I believe it is, then it is equally true of government-mandated taxes.”

- “Obama’s Big Government Mandates: Why no one should be forced to act against his conscience” by Sheldon Richman, reason.com, who says “Americans have been forced, without their consultation — much less permission — to finance mass murder. It’s called war, invasion, occupation, and special operations. U.S. military missions in Iraq, Afghanistan, Yemen, Somalia, and elsewhere have directly or indirectly killed over a million people who never threatened Americans at home. Those missions have ruined the lives of hundreds of thousands more through injury and the destruction of their homes and societies. The president of the United States refuses to take war with Iran off ‘the table’ … War against Iran would constitute mass murder. The U.S. government should be stopped from engaging in such brutality. But short of that, those with a conscientious objection should be free to opt out of financing these crimes.”

- Resistance to the “Household Tax” continues in Ireland. For some reason, the government is requiring citizens to actively register themselves prior to paying this tax, which is a convenient point of leverage for the resisters, who are encouraging their neighbors to simply refuse to register. “The Household Tax can be defeated by mass non registration and mass non payment but this does mean organising every street and road in the country. The first step in opposing the tax is to refuse to register yourself but to win you must organise with your neighbors — if we all stand together we will win.” Irish parliament members are among the supporters of the Campaign Against Household and Water Taxes, whose spokeswoman explained: “This is not a charge to fund your local community, it is a tax to fund private speculators, bondholders and the bailout. Our incomes and services are being decimated to pay this private debt. Now people have a chance to register their opposition by not registering for this tax. By not registering, we can make this a referendum on the bailouts for the rich and the cuts for us.”

- This is similar to the argument by the “won’t pay” movement in Greece, whose government is nickle-and-diming the citizens by raising rates on utility bills, road tolls, transit fees, and so forth, to try to raise money to pay off international lenders who are openly threatening to abolish representative government in Greece entirely and instead run the country as though it were a bankrupt corporation in receivership. When the government electric power monopoly cut off power to a family of seven with a disabled child because they were unable to pay the hike, members of the “won’t pay” movement reconnected the power themselves in defiance.

- The IRS is being swamped by identity theft cases in which fraudsters use someone else’s social security number to file a tax return that qualifies for a big refund, then cash the check before the victim knows about it. The IRS then pursues the victim for having perpetrated tax fraud and tries to force them to pay back a refund they never saw. The agency’s focus on trying to get more people to file their tax returns electronically has made it easier and faster for the identity thieves to process fake returns wholesale. In Tampa, Florida, where the practice had become so widespread that local tax fraud entrepreneurs even taught classes in how to use the technique, the local news reported a few days back on “hundreds of frustrated people [who] were lined [up] at an IRS building…” waiting in long lines for hours only to find that the IRS personnel they talked to were unable to help them.

When Canada entered World War Ⅱ one of the steps they took at home was to ban the pacifist sect of Jehovah’s Witnesses. You know, because the fate of the free world was at stake or something. (Article from .)

Railway Employe Gets Thirty Days

Convicted of Belonging to Sect Banned by Government.

Fort Erie, Ont. (U.P.) — Edward J. Bambridge, 45-year-old Canadian railroad employe, was under a 30-day jail sentence after being found guilty of belonging to the Jehovah Witnesses sect, banned by the dominion under the Canadian Defense act.

Police Magistrate John B. Hopkins found Bambridge guilty of the charge last night and gave him the choice of paying a $57 fine or serving 30 days in jail. As members of the sect refuse to pay fines, Defense Counsel J.L. Cohen, of Toronto, announced an appeal would be taken to a higher court in an effort to secure a reversal of the verdict.

Bambridge was arrested by the Canadian Royal Mounted police. His case was believed to be the first of its kind in the Niagra peninsula area.

It was the note about “members of the sect refuse to pay fines” that most interested me here. I hadn’t heard that before.

Employers can help tax resisting employees by refusing to withhold taxes from their salaries (see The Picket Line, ) and by refusing to cooperate with salary levies (see The Picket Line, ).

But that’s not all. Today I’ll mention some other ways that employers have helped (or can help) resisting employees:

Kenya in 2008

During a post-election crisis of legitimacy in Kenya in , Charles Kanjama urged the opposition to embrace a nonviolent resistance strategy, with tax resistance at the forefront.

As part of this, he urged people to adopt both legal and illegal forms of tax avoidance. Among the legal techniques he advocated was a sort of tax delaying tactic:

Compliant tax avoidance plays within the rules of the current tax statutes to reduce, delay or eliminate tax liability. For PAYE for example, participating employers and employees can enter into a voluntary contract to convert monthly employment into quarterly or half-yearly employment, thus effectively delaying tax liability for several months.

The Catholic Worker

As Dorothy Day noted,

The C.W. [Catholic Worker] has never paid salaries. Everyone gets board, room, and clothes (tuition, recreation included, as the C.W. is in a way a school of living). So we do not need to pay federal income taxes.

The Other Side

Another Christian activist magazine, The Other Side, published . Staff member Dee Dee Risher said: “We’ve built into our workplace certain small disciplines to remind ourselves that we are on this path of conversion. Our salaries are structured to allow staff members to do war-tax resistance and are intentionally low to remind us of the struggles of the poor and sharpen our willingness to sacrifice.”

NWTRCC notes

NWTRCC, in its publications, has noted a few cases in which employers have been accommodating when confronted with the unusual needs of war tax resisting employees:

Steve Soucy, [a resister] from Orland, Maine, arranged with his employer to reduce his hours after a levy notice arrived at his workplace. “I had received a proposed assessment from the IRS for the first years that I’d earned enough to be taxed. From that notice it was clear they knew my current employer, and so it seemed just a matter of time before they would try to collect directly from my wages. After some soul searching, I decided to prepare myself to leave that position, or cut back my hours, and I began training for a career change to something which I believe will let me earn money in a way that would be more difficult for the IRS to track. Up until the notice of attachment I did not tell my employer why I claimed nine exemptions on my W-4, since if they knew, they would be obliged by law to report me. But once the levy arrived, I was able to be more open about my tax resistance. I wrote a letter to my boss and my program manager (my supervisor’s boss) explaining that for reasons of conscience, I would no longer be able to continue in my position full time. I stated my willingness to work up to a certain number of hours per week until they were able to find a replacement, or decide what to do. I eventually tapered my hours from the maximum allowed before withholding to just a few hours per week, while increasing my employment in my other jobs to cover the loss in income and benefits. The most rewarding part was talking to my co-workers, who I found quite sympathetic to my reasons for tax resistance. In a way it was like coming ‘out of the closet,’ and gave them the opportunity to be supportive.”

A counseling session at NWTRCC’s Kansas City gathering got into stories of responding to salary levies and employers. In a current case, the resister found his employer to be most accommodating and is planning to lower his salary and barter for some benefits that will help keep money from the IRS. The resister was surprised that his employer was so willing to help — as long as the risks to the business were minimized.

One war tax resister writes: “Rent is always my biggest expense and thus the biggest burden on my practice of war tax resistance. Usually, I try to arrange housing as a component of one of my jobs. By doing this, I significantly reduce the amount of cash I need to earn. I currently work as the caretaker of buildings and grounds at a camp for people with disabilities. The camp provides me with a residence on the premises so I can keep watch over the facility and so I can be available on short notice for critical maintenance needs. Although our arrangement is a barter of services in exchange for housing, the value of this particular type of barter is excluded from my income under the Internal Revenue Code…”

Job sharing can be a way of keeping income below taxable levels as well as balancing other parts of life. Nancy and Gary T. Guthrie, a husband-and-wife parenting team, shared the job of Iowa Peace Network Coordinator. This allowed them to be involved in both meaningful employment and parenting; it also let them keep their income below taxable levels.

William Hill asks uncomfortable questions

A woman who worked for the gambling bookmaker William Hill asked her employer to stop withholding taxes from her, on the grounds that under international law it would be illegal for her to continue to pay for what she felt to be illegal warfare conducted by the government. She describes what happened next:

[T]o my amazement, I got a response inviting me to a meeting with the area manager and a chap from Personnel, and we sat down and we discussed the legal implications of paying tax to the U.K. government. And of course they raised all the normal concerns about the legality of not paying tax, and they showed us a copy of a letter that they had received from the Inland Revenue, so William Hill actually wrote to the Inland Revenue, bringing this matter up, and got a response! It was the usual whitewash, along the lines of “we are not aware of any law, blah blah,” — however, they also included in that letter that they’d had a series of other inquiries from other people (they didn’t say whether it was just individuals or whether they were other companies). So the Inland Revenue had already been contacted by other people, already. So, by the end of the meeting, the area manager of our shops and a chap from Personnel, they both seemed pretty-well convinced of the legality of withholding taxes — of course he had to go to the board of directors: if they’re going to withhold my tax, they’ve got to do it for the whole company, haven’t they, or not at all? So we’ll see what happens.

Voices in the Wilderness

Corporations can also refuse to pay taxes that they owe as a group. For example, in the activist group “Voices in the Wilderness” was fined $20,000 for bringing food and medicine into Iraq when that country was under a blockade. They have refused to pay, saying:

Voices will not pay a penny of this fine. The economic sanctions regime imposed brutal and lethal punishment on Iraqi people. The U.S. government would not allow Iraq to rebuild its water treatment system after the U.S. military deliberately destroyed it in . The U.S. government denied Iraq the ability to purchase blood bags, medical needles, and medicine in adequate supplies — destroying Iraq’s health care system.

We chose to travel to Iraq in order to openly challenge our country’s war against the Iraqi people. We fully understood that our acts could result in criminal or civil charges. We acted because when our country’s government is committing a grievous, criminal act, it is incumbent upon each of us to challenge in every nonviolent manner possible the acts of the government.

We choose to continue our noncooperation with the government’s war on the Iraqi people through the simple act of refusing to pay this fine. To pay the fine would be to collaborate with the U.S. government’s ongoing war against Iraq. We will not collaborate.

I covered strikes, including consumer strikes, being used to supplement tax resistance campaigns. Today I’m going to cover a specific variety of consumer strike — a strike against goods sold by the government or by a government-protected monopoly, or goods that are subject to a particular tax. Here are some examples:

- As internet telephony started to become a real option several years ago, some American war tax resisters realized they could avoid the federal excise tax on telephone service by getting rid of their phone lines and switching over to such internet-based plans.

- In , as the U.S. was launching its attack on Iraq, anti-war activists from other countries began to promote a boycott of the products of U.S. government contractors, and even of U.S. companies in general. “The U.S. economy is strung out across the globe,” wrote Arundhati Roy. “Its economic outposts are exposed and vulnerable. Our strategy must be to isolate Empire’s working parts and disable them one by one. No target is too small. No victory too insignificant.”

- When the Continental Congress imposed a tax on postage stamps to help pay for the revolutionary war effort, Quaker James Mott decided to stop using the mail.

He wrote to a friend:

Many years later, Congress issued revenue stamps that had to be purchased and applied to certain types of documents. One Quaker wrote in :Must our correspondence by mail be at end, in consequence of the extra postage? or shall we pay it, and thereby contribute a mite to the support of measures calculated to destroy men’s lives and property? Perhaps I may be alone in refusing to pay postage on letters. Only a few cents — what can this do, it may be said, towards enabling government to prosecute the war? Very little, I own: but the great sum required is made up of littles; and if all those littles are withheld, the effusion of human blood may be at an end. … I cannot… believe it best for me to pay the present demand of additional postage, little as it is, and alone as I may stand.

I am one of those (I suppose there are others), who have felt an extreme unwillingness to help maintain our wars by the use of the revenue stamps, which were legalized expressly for war uses. Our forefathers would have made an emphatic protest against it, if indeed they would not have refused entirely to use the stamps, and borne the consequences, whatever they might have been. … at least we could restrict the use of checks (for example) wherever possible, and diminish in this way our contributions to the war fund.

- Other Quakers began refusing to use or to deal in imported goods, so as to avoid paying import duties that were being directed to military expenses.

Joshua Evans wrote:

Quaker shopkeeper Isaac Martin decided to stop dealing in imported goods rather than pay an import duty:About , I understood a law was made for raising money to defray the expenses of war, by means of a duty laid on imported articles of almost every kind. … I had felt myself restrained, for thirty or forty years, from paying such taxes; the proceeds whereof were applied, in great measure, to defray expenses relating to war: and, as herein before-mentioned, my refusal was from a tender conscientious care to keep clear in my testimony against all warlike proceedings.

[A] weighty concern attended my mind on account of a tax on shop keepers, who dealt in foreign articles, to be appropriated towards carrying on the war against England. I felt much scrupulous in my mind, respecting the consistency thereof with our peaceable principles. … I believed my peace of mind would be affected, if I paid the said tax. So I resigned myself to the Lord’s will, let the event be as it may. But scarcely a day passed, that I had not to turn customers away, who applied for articles which I had on hand, but could not sell, on account of the heavy penalty.

- Quaker meetings also had a policy of warning their members against “sharing or partaking in the spoils of war by purchasing or selling prize-goods” — that is, goods seized from the ships of enemy nations by government-sanctioned pirates.

- Government bonds are an obvious boycott target for people trying to restrict the resources available to the government.

John Payne wrote a tract in entreating Quakers to divest from government bonds that went to pay for wars:

[T]he King [once] had the power of summoning the barons to the field, and the barons their retainers: by these means armies were raised, fields fought, and blood-stained laurels acquired. But now immense sums are wanted; and without them War would be an impossibility. The magnitude of the money necessary, infinitely exceeds any resource which the kingdom can immediately supply: therefore the ingenuity of ministers has recourse to the aid of Funding; that is, of establishing a fictitious capital, which shall bear a certain rate of interest; and any person, purchasing of Government a portion of this fictitious capital, is put into the receipt of interest according to the sum he purchases, and the country is burthened with taxes to support the payment of such interest.

Payne himself went even further. Eager to avoid as much as possible paying money to the British government that was fighting the American revolutionary war, he bricked up a third of the windows of his home to reduce his property tax (which was assessed based on the number of windows), he disabled his coach to avoid its license fee, and he rode miles out of his way to avoid road tolls.No man hazards his veracity by saying that War cannot be now supported without the Funding System. As no man then can deny this solemn truth, is it not astonishing to find Quakers holders of stock, not only in their individual, but in their collective capacity? What then is the conclusion? The Quakers, at the time they declare their fundamental principles prohibit War, are actively and voluntarily supplying the only prop by which the modern system of War is supported.

- Upset at the government siphoning off a portion of pew rents in establishment churches “to relieve the embarrassments in the city finances, occasioned by an extravagant self-elected magistracy,” some people in Edinburgh around the time of the Annuity Tax resistance there proposed also refusing to rent pews until government spending were to become more responsible.

- The “Boycott, Divestment, and Sanctions” movement aims to boycott businesses that profit from Israeli settlement expansion in occupied Palestine.

- The “Potato Movement” in Greece is trying to circumvent the over-taxed middle-men of the above-ground commercial market by directly connecting producers and buyers in a way that is mutually-beneficial to them and less profitable to the state.

- The British government’s enforced monopoly on tea imports into the American colonies was “equal to a tax” in the eyes of Samuel Adams and his fellow patriots.

Boycotts of monopoly tea were widespread, and were famously backed up by acts like the Boston Tea Party, in which monopoly tea was destroyed in bulk.

Other monopoly British imports that suffered from American boycott included house paint, cloth, glass, paper, and dye.

One patriotic song included the lyric:

The use of the taxables, let us forbear:—

(Then merchants import till your stores are all full,

May the buyers be few, and your traffic be dull!) - Boycotts of British-monopoly goods like salt were also, of course, big parts of the Indian independence campaign led by Gandhi.

- During the tax resistance and protests that accompanied the campaign for the Reform Act of , “associations were proposed of persons who would undertake to use no excisable articles.”

- In Russia around the time of the Vyborg Manifesto, a report noted that “the peasants are deciding to boycott all state-owned businesses.” For example: “they have undertaken a concerted abstention from vodka, the manufacture and sale of which intoxicant was made a Government monopoly… [which] has since constituted one of the principal sources of the public revenue.” Another report said that “[t]he leaders of the workingmen’s organization have taken the lead in placing fresh obstacles in the way of the government raising money at home by advising their followers to refuse to use spirits upon which the government collects an enormous tax.”

- In the Vietnam era, “[o]ne pacifist, imprisoned for draft refusal and therefore lacking income to refuse taxes on, gave up smoking because the cigarette tax brings the [U.S.] government more revenue than any other single consumer-commodity tax.”

Another possibility is to obstruct the sale of such goods:

- In Wales, truckers blockaded a Chevron refinery and called upon the tanker operators to join them in shutting it down, to protest the government’s tax on fuel.

- Farmers in Argentina decided in to “halt sales of grains and livestock for a week, setting up roadblocks and hampering exports to press for lower taxes.”

- In Greece, recently, resisters to taxes that were added to utility bills have barricaded the offices of utility companies.

A few more interesting bits and pieces that flew past my eyeballs in recent weeks:

- Ever wonder what all those acronyms and code numbers mean on your IRS transcripts and other correspondence? If so, take a look at IRS Processing Codes and Information. The cover page is marked with the delightful message “ATTENTION: OFFICIAL USE ONLY — WHEN NOT IN USE, THIS DOCUMENT MUST BE STORED IN ACCORDANCE WITH IRM 11.3.12, MANAGER’S SECURITY HANDBOOK. Information that is of a sensitive nature is marked by the pound sign (#).” However, it is publicly available on the IRS website, and some of it is redacted, so I don’t think there are any national security secrets within.

- Someone posted scans of a “Political Art Documentation / Distribution” zine, the first issue of which was devoted to the subject of “Death and Taxes” that celebrated an art show of the same name: “, P.A.D. presented a public art event called Death and Taxes, to protest the use of taxes for military spending and cutbacks in social services… Twenty artists installed works in and out of doors in Manhattan and Brooklyn… The event included posters, graffiti, stickers, overprinted 1040 forms redistributed in banks, typed dollar bills, street theatre, outdoor films, environments, and performances.” Lots of punk rock aesthetic stuff with a war tax protest theme.

- The constitutionalist, “show me the law”-style tax protesters (or “tax deniers,” as the IRS spins it), which have long been an entertaining staple of the scene in the United States, are apparently becoming a rapidly-spreading phenomenon in Canada as well. “The National Post has identified 385 pending tax cases — most using florid and arcane language and claiming bizarre laws that supersede or nullify Canada’s regulations and laws; it prompted the Tax Court to adopt a triage approach to cope with the deluge, grouping cases and directing them to specific judges.”

- When tax auditors showed up at a restaurant in Archanon, Greece, , “there were strong reactions from customers in a large tavern, leading the auditors of the Financial Crimes unit to quickly leave.”

- Thanos Tzimeros, founder of the fledgling Greek political party “Recreate Greece,” has issued a call for tax resistance — or “robbery resistance” as he puts it. His perspective is a bit different from that of the largely leftish “don’t pay” movement. Rather than opposing the austerity and public-sector shrinking that Greece has been strong-armed into accepting by international lenders, he thinks these reforms haven’t gone nearly far enough and that the problem with Greece is that it is being strangled by a political/criminal class. If I’m parsing a Google Translate version of the Greek news article correctly, Tzimeros is encouraging people to pay their taxes into an escrow account and to refuse to turn the money over to the government until such time as it can give a satisfactory accounting of how it spends its budget. He points to bloated and redundant government agencies as examples of taxpayer money being siphoned off to fund a class of parasitical political appointees.

- Here’s the official IRS Office of Chief Counsel memorandum in which the Counsel reminds IRS employees that they cannot willy-nilly assess “frivolous filing” penalties on people who include letters of political protest along with their (otherwise accurate and complete) tax forms. And here is Peter J. Reilly’s take on the case at his Forbes blog.

- And here is another example of governments rigging traffic lights and automatic ticket-generating cameras in a way that makes intersections more dangerous… but more profitable to the taxers.

- NWTRCC has produced a set of war tax resistance talking points for media interviews that might help war tax resisters get their point of view across more effectively through the news media.

- Ruth Benn reflects on her war tax resistance, and the hapless but persistent response from the IRS, at NWTRCC’s new blog, War Tax Talk.

Some international tax resistance news to wind up the old year:

- Fares in the government-run Mexico City metro system went up by 66% recently, and that’s making commuters hopping mad. They’ve formed a movement hashtagged #PosMeSalto (roughly, “Well then, I’ll jump”) and are encouraging passengers to leap the turnstiles and board without paying. Here are some photos of a modern dance troupe doing turnstile-vaults in the Coyoacan station to promote the protest.

- The Bonnets Rouges are still at it. three more traffic radar installations went up in flames a few nights back, in a reemergence of the tactic that has resulted in the destruction of more than 210 such installations since the beginning of the movement.

Some international tax resistance news:

- , a group of business owners in Lviv announced that they would stop paying value-added and income taxes to the Ukraine central government of Viktor Yanukovych — those taxes that go to maintain the military and internal security forces. The businesses plan to continue paying social security and local taxes. They also called on other businesses across Ukraine to join them.

- The “pos me salto” movement of Mexico seems to be spreading to other countries where governments have hiked transit fares as a “stealth tax.”

I’ve seen examples popping up in recent weeks from Rio de Janiero to Barcelona.

protesters in Brazil disable fare gates

- River Att, of Hulme, England, has legally changed his name to River Axe The Tax. Mr. Axe The Tax is fighting increased fees the government is charging to people who live in subsidised housing if the government deems them to have more rooms than strictly necessary: something foes of the policy call the “bedroom tax.”

- Activists in Spain have been promoting something they call “economic disobedience” — a program of disengagement from the official economy and construction of a grassroots economy that includes tax resistance and redirection. A new report from Spain’s Ministry of Finance reveals that the underground economy in Spain has been surging, and now represents about a quarter of Spain’s gross domestic product.

- France’s tax agency misses out on about €10 billion each year thanks to “zappers” — computer programs that businesses can use to override the software on their cash registers to as to hide transactions and avoid reporting receipts.

Some links that have whizzed by my screen in recent days:

War Tax Resisters

- A new edition of The Debt Resisters’ Operations Manual, a project of Strike Debt! has a chapter on Tax Debt: The Certainty of Debt and Taxes that was partially inspired by NWTRCC’s material on the subject. (There was some idea-swapping between the Strike Debt crew and war tax resisters at the NWTRCC national gathering in New York last fall.)

- William Ruhaak of has penned a piece on war tax resistance for Pax Christi U.S.A.’s blog. He invites readers who are struggling with their consciences over the issue of paying for war with their taxes to begin by writing and sharing a “statement of conscience.”

- Esther Epp-Tiessen, of Ottawa’s branch of the Mennonite Central Committee, addresses war tax resistance as protest and as conscientious objection:

Do we use our limited resources of time and money primarily to advance the idea of war tax resistance and a legal peace tax fund for conscientious objectors? Or do we use those resources to speak to the larger policy framework and ethos? To put it crassly, do we advocate for special accommodations for the few? Or do we confront the system that says peace can be built through war and military force?

- Martin Newell has engaged in a variety of anti-war civil disobedience actions, and he was sentenced to 28 days in prison for refusing to pay the fines for his previous convictions. He explained:

Jesus taught us to love not just our neighbours but also our enemies. He showed us by his life and example how to resist evil not with violence but with loving, persistent, firm, active non-violence. It was this revolutionary patience on behalf of the poor and oppressed that, humanly speaking, led to him being arrested, tried, tortured and executed by the powers that be. The acts of witness that resulted in the fines I have refused to pay were a form of conscientious objection. Refusing to pay them is a continuation of that objection. It is a privilege to be able to follow on the path that led Jesus to the way of the cross and resurrection.

Italy

While everyone was busy watching the kerfluffle in Crimea, the people of Venice voted to restore the Venetian Republic and secede from Italy. Italy itself is disregarding the vote and claiming that Venice has no authority to secede. So the movement is moving on to stronger measures. They are taking ideas from other separatist movements: The referendum itself was inspired by a similar effort in Scotland, and they plan now to redirect their federal taxes to the local government, which is a technique they picked up from the Catalan nationalists.

Some are even taking some inspiration from the “Tea Party” apparently. Check out this flashy video:

Netherlands

Christiaan Elderhorst writes about the recent imprisonment of Toine Manders for his work counseling tax avoidance:

Toine Manders works at the Haags Juristen College (Hague Lawyers Board) and specializes in tax avoidance. Manders refers to tax avoidance as a moral duty. Tax revenue is used by the state to pay for war, prisons, the militarization of the police force and the regulatory agencies which constantly privilege big business. This moral duty is connected the Haags Juristen College’s former business practice which was to help individuals avoid the military draft. Avoiding the draft and avoiding taxes are both ways by which personal contribution to state oppression and war is reduced. Calling this a moral duty is not a far-fetched idea.

Austria

Gerhard Höller, a tobacconist from Wagrain, has launched a one-man tax strike.

“Something has to happen at the grassroots, so that those on top notice how much discontent there already is among the population,” says Höller. He was actually a completely apolitical man, he stressed, but the scandals and the squandering of tax money — “from Eurofighters to the Hypo bailout” — had gotten on his last nerve. “Enough is enough.”

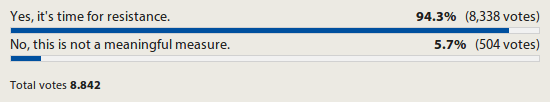

When I last visited the site with the article covering Höller’s case, it had a reader poll attached to it that asked people to give their opinion of tax resistance as a protest tactic:

Venezuela

I’m hearing a lot of buzz in the twitterverse about tax resistance as a possible component of the ongoing demonstrations in Venezuela, but I haven’t found much more solid information yet. Here’s an example:

“Don’t Pay Income Tax in Civil Disobedience. Tax Resistance! It is legitimate and legal as enshrined in article 350 of our Constitution [‘The people of Venezuela, true to their republican tradition and their struggle for independence, peace and freedom, shall disown any regime, legislation or authority that violates democratic values, principles and guarantees or encroaches upon human rights.’]. Right now the Castro-communist regime is transgressing the democratic values, principles, and guarantees and is undermining the human rights of all Venezuelans. Don’t finance the regime!”

England

Another council tax rebel has been jailed. Ross Longhurst stopped paying his council tax in protest against budget cuts:

“These particularly impact on poor people,” he told the court. “We live in a country where the rich are getting richer and the poor are getting poorer.”

He claimed there were 20,000 people in Nottingham in council tax arrears.

“I refuse to pay in solidarity with and in support of the victims of austerity measures. I encourage everyone in court, including the magistrates, don’t pay up.”

Magistrates explained to Longhurst, who arrived with a large group of supporters, that he was likely to go to prison if he refused to pay. Justices even urged him to consult with a duty solicitor. But he confidently said he he had spoken with a lawyer and he did not think there was any need for him to see another one.

Another account adds that “[a]s he was led down to the cells by prison guards he was applauded by his supporters and one could be heard shouting: ‘It’s absolutely disgraceful.’ ”

One of his supporters, who did not want to be named, said afterwards: “It is a travesty that he has been jailed. It is disgusting, he is an elderly man who was trying to make a stand, he was trying to make the area a better place and this is why he is now behind bars. He has worked and paid council tax, but as all of us do, he got sick of it, he was braver than everyone because he stood up for what he thought was right.”

Jehovah’s Witnesses put a lot on the line for conscientious objection, but they show up only rarely in my tax resistance research. Here is one example, from the Mount Vernon, New York Daily Argus:

Sect Members Land in Jail

Refusal to Pay Fines Results in 2-Day Terms

North Pelham, . — Martyrs to their cause, three of “Jehovah’s Witnesses” are serving two-day sentences in lieu of $2 fines which they refused to pay because they “don’t believe in man-made laws.”

The fines were imposed last August when the trio, Mr. and Mrs. Carl Ludovici and Susie Vitting, all of New York City, were found guilty of soliciting without a permit. They had been arrested once before that on a similar charge but were released with warning.

The defendants were attempting to sell religious literature. They refused to pay their fines and appealed to the County Court, which upheld the verdict. They then went to the Court of Appeals, but abandoned the plea, returning to the lower court where, last night, they expressed their willingness to serve jail terms.

In accordance with their principles the trio, along with 100 others of their sect, spent 33 days in the Hudson County Jail since their arrest here, on the same charge, when they refused to pay their fines in Hoboken.

The Jehovah’s Witnesses have eagerly pursued remedies to government violations of their rights in the court system, with some success. In 1940, the Supreme Court ruled, in Cantwell v. Connecticut, that people could not legally be arrested for soliciting without a permit.

Some bits and pieces from here and there:

- The number of tax enforcement personnel working for the IRS is dropping to the lowest level since .

- With only two weeks’ notice, the U.S. State Department announced that its fee for processing an application for Renunciation of U.S. Citizenship is jumping from $450 to $2,350. I guess somebody was starting to get embarrassed at the record number of American citizens saying “to hell with it.”

- The New England Regional Gathering of War Tax Resisters and Supporters will be held in Kennebunk, Maine.

- George Brandes, vice president for health care programs at Jackson Hewitt Tax Service, told a reporter he believes that more than a third of U.S. Taxpayers will owe money on their income tax returns for overpayments of insurance subsidies.

- The IRS levied James Waterman’s bank account, but Waterman got tipped off about it and got to the bank two hours later to clean out one of his accounts. The IRS says that makes the bank liable for what they let him withdraw while the levy was in effect.

- Erica Weiland shares her story of running a war tax resistance information booth at the Seattle Anarchist Bookfair.

- The War Resisters League Handbook for Nonviolent Campaigns is now available on-line.

Some bits and pieces from here and there:

- Two Irish legislators who were convicted of participating in a direct action against U.S. armaments passing through the Shannon airport have refused to pay their fines. One of them, Clare Daly, told reporters: “We have no intention of paying a financial contribution to a State which allows this behaviour [the arms shipments] to continue.”

- Seacoast Peace Response got some press for their annual tax day “penny poll.”

- A man who calls himself “Squirrel” was arrested in Florida for phoning in a threat to destroy the IRS building in Miami.

Some links of interest:

- Waging Nonviolence interviews Alycee Lane, author of Nonviolence Now!

Living the 1963 Birmingham Campaign’s Promise of Peace on the subject of why Martin Luther King’s pledge of nonviolence matters today.

Excerpts:

The Birmingham campaign pledge was a commitment card that, according to Martin Luther King, all volunteers were “required” to sign in order to participate in the movement. I came across the pledge in King’s work, “Why We Can’t Wait,” a book in which he talks about the Birmingham campaign. The card consisted of ten commandments, including: “1) meditate daily on the teachings and life of Jesus. 2) remember always that the nonviolent movement in Birmingham seeks justice and reconciliation — not victory. 3) walk and talk in the manner of love, for God is love. 4) pray daily to be used by God in order that all men might be free. 5) sacrifice personal wishes in order that all men might be free. 6) observe with both friend and foe the ordinary rules of courtesy. 7) seek to perform regular service for others and for the world. 8) refrain from the violence of fist, tongue or heart. 9) strive to be in good spiritual and bodily health. 10) follow the directions of the movement and of the captain of a demonstration.”

With its emphasis on the importance of taking up a daily practice of (for example) courtesy, love, service, meditation and prayer, the pledge really offered to volunteers an opportunity to embrace nonviolence as a way of life. The commandments in effect constitute a daily practice of nonviolence, and as such, it conveys that nonviolent direct action is not merely or solely public protest and organizing. It is also (and perhaps more importantly) speaking, thinking, acting and engaging the world — even at the most mundane level — from an ethic of nonviolence, so that we actually become nonviolence.

It is strategic, I think, for those who are activated to choose not to emulate the very people whom we hope to disarm, to refuse to exchange tit for tat, to withdraw our cooperation with and complicity in creating our culture of violence. It is strategic to demonstrate by word and deed that there is another way to walk in this world and to engage others. It is strategic, in other words, to disarm ourselves and one another just as surely as it is to disarm the state.

It saddens me when folk who are doing righteous work to confront, say, police brutality or economic inequality or environmental exploitation, express the kind of venom they themselves receive because of the work that they do. It saddens me when I say belittling and dehumanizing things about folks with whom I disagree. In those moments, we become allies in nurturing an atmosphere of conflict, hate and violence. We also reveal the extent to which our emotional and spiritual lives have been colonized.

- Increasingly in the U.S., traffic enforcement is not about safety but about generating revenue for the government. This makes our roads less safe, our fiscal processes less transparent, our law enforcement more corrupt, and contributes to the criminalization of poverty.

- Americans spend more money on taxes than on food, housing, and clothing combined.

- Another example of a “suspicious package” causing an evacuation of an IRS office.

- The IRS has been defeated in another case in which they stole money from someone on the pretext that they had been depositing the money in the bank in periodic small amounts in order to avoid the bank’s requirement to report large deposits to the agency. A judge further ordered the agency to pay interest to the victim based on how long they held on to his money. Another triumph of the Institute for Justice, which has been doing some great work helping the little guy stand up to government.

Some recent links from here and there related to tax resistance:

International

- Here’s an interview with Tommaso Cerno, who has recently launched a tax strike for gay rights in Italy. “Only one weapon of resistance remains to us: to evade the state that does not recognize our rights at the only place where it does consider us equal: when we pay taxes.”

- Opposition legislators in the Gilgit-Baltistan Legislative Assembly walked out of the assembly to join an anti-tax business strike.

- Businesses in Accra, Ghana’s capital, also launched a brief shutdown to protest oppressive taxes.

- Gold dealers in India have also shuttered their stores and burnt the finance minister in effigy to protest a new excise tax.

- Joshua Browder, a teenaged computer programmer currently attending Stanford University, has developed a free, on-line tool that guides people in the U.K. through the process of fighting their parking tickets. “Since launching in late 2015, it has successfully appealed $3 million worth of tickets.”

- Periodistas por Encargo reviews the arguments for tax resistance and redirection.

- Tax resistance plays a role in the anti-bullfighting movement in Galicia, to pressure the government not to allocate public funds to events that feature bullfighting.

- Businesses in Huatulco have stopped paying taxes because the government has failed to provide adequate security against violent crime.

- The Suepples public employees union in Venezuela, saying that employee salaries have not kept up with tax hikes, made a declaration of tax resistance. “We aren’t just refusing for the fun of it, we refuse because we’re broke,” said finance secretary Adela Otaiza. The government is using astronomical inflation to ratchet up taxes and ratchet down public employee wages to make up for drops in oil revenues and a poorly overmanaged socialist economy.

- Helen Thornley, at Tax Adviser magazine, looks back at the role tax resistance played in the women’s suffrage fight in Britain.

U.S. Tax News