I took a closer look at that recently-released Government Accountability Office report (“Strategic Human Capital Management is Needed to Address Serious Risks to IRS’s Mission”).

Some things I thought were interesting:

- “Nearly half of IRS’s Senior Executive Service (SES) is eligible to retire” (along with 21.3% of the rest of the employees).

- “IRS exit survey results found 32 percent of separating employees indicated poor office morale strongly influenced their decision to leave.”

- Reductions in staff from 2011 to 2017 “have been most significant within IRS Enforcement, where staffing declined by 27 percent.”

- “IRS officials told us that, unlike other areas where the agency is legally required to perform certain functions, the agency has flexibility to curtail many enforcement activities when attrition rates increase. Auditing tax returns, for example, is a critical part of IRS’s strategy to ensure tax compliance and address the tax gap, or the difference between taxes owed and those paid on time. Our analysis of IRS data shows the number of individual returns audited has declined each year between fiscal years 2011 through 2017, a 40 percent decline.” Audits of large corporation have fallen even more dramatically.

- Revenue Officers are the IRS employees who handle individual cases of tax noncompliance, including meeting face-to-face with such scofflaws and initiating enforcement actions like filing liens and seizing property. “[T]he total number of revenue officers at IRS declined by nearly 40 percent from fiscal years 2011 through 2017, and entry-level revenue officers declined by 86 percent during that same period.”

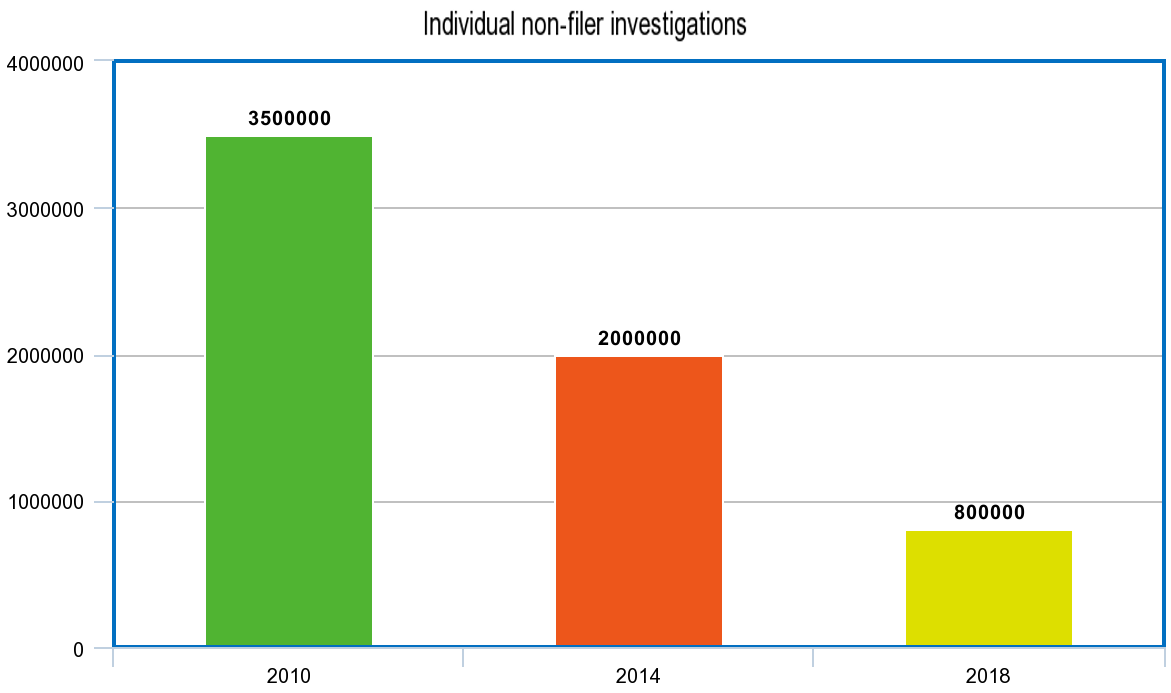

- “IRS decided to scale back nonfiler investigations in light of declining staffing, according to IRS officials. We reported in tax year 2010 that IRS started 3.5 million individual nonfiler cases and 4.3 million business nonfiler cases. In tax year 2014, nonfiler cases dropped to 2 million for individuals and 1.8 million for businesses, a reduction of 43 percent and 58 percent, respectively. More recently in fiscal year 2018, IRS data show nonfiler investigations declined to 0.8 million for individuals and 0.4 million for businesses.”