The New York Yearly Meeting of the Religious Society of Friends (Quakers) reaffirmed “that the use of their taxes to pay for war violates their religious conviction”:

Tax resistance in the “Peace Churches” → Quakers → 20th–21st century Quakers

From reading my blog lately, you might think that American Quaker war tax resistance stopped 125 years ago. But, of course, it’s still going on today. A couple of reports from the recent New England Yearly Meeting of Friends make note of how Meetings like this continue to struggle with the issue:

- At Teeksa Photography, Skip Schiel mourned

at what he saw to be a half-hearted interest in such issues:

And on a more encouraging note, he quotes from the opening prayer of outgoing presiding clerk Christopher McCandless:[L]ike a person with an ailing stomach or chronic arthritis, not life threatening, simply annoying, distracting, worrisome, who then dilutes focus on issues in the wider world, NEYM turns inward, year after year. Our stated theme was “War, God Help Us!” and some like Ernestine Buscemi in the keynote and Peter Crysdale in the bible half hours attempted to refer to it. Despite their attempts, little attention was directed to societal issues such as the war in Iraq, the threat of war with Iran, torture, erosion of civil liberties, environmental desecration, racism, to name a few of the pressing problems of our day. We (I say we inaccurately — I attended only one hour of one business session, not boycotting, just displeased and choosing to devote myself to other matters during that period) passed several minutes about the Iraq war and torture, but I’ve heard these were relatively weak, mostly for internal communication (other meetings and Quaker bodies), lacking substantial discussion, let alone controversy and debate which might stir the pot more, and without action components. Lo and horrors should we ever call for tax resistance or surrounding the Pentagon or joining the equivalent of the Poor Peoples’ Campaign — or freeing one’s slaves.

“God, help us: Help us to be Your people, a people of peace in a world awash in the imagery and realities of war. Forgive us our complicity, by our corporate silence and the taxes we render unto America, in our nation’s headlong prosecution of military responses to the violence in the world.…”

- Will T. at Growing Together in the Light

mentions tax resister Paul Hood’s talk at the meeting:

Paul Hood gave a lengthy testimony of his experiences as a marine in the Pacific in World War Ⅱ and how he was eventually led to being a tax resister. Although he hasn’t paid Federal income taxes since the Vietnam War, he found to his surprise that he was eligible to a tax rebate check this year. After giving it some thought he filed a tax return and has now decided to give his rebate check to the Yearly Meeting.

Google is starting to do for newspaper archives what it has been doing for books: putting scanned images on-line and making them text-searchable. Hooray for Google, says I.

Here are a few articles I found while browsing around today:

A couple of pieces regarding a reconstruction-era dispute over the legitimacy of the Louisiana state government (in which tax resistance played a role):

- Affairs in Louisiana: Proclamation of Gov. Kellogg to Delinquent Tax-Payers The New York Times

- Repudiators in Louisiana The New York Times

Some pieces from the tax resistance campaign for women’s suffrage:

- [Bernard] Shaw on Women’s Rights: Would Get Another Wife, He Says, If Jailed Like Mr. Wilts The New York Times

- Take Duchess’s Silver Cup: Distraint Owing to Refusal of Suffragist Peeress to Pay Tax The New York Times

- A joint demonstration of the Tax Resisters’ League and militant suffragettes… The New York Times

More on the ostensibly voluntary “liberty bonds” in the United States during World War Ⅰ:

- [Billy] Sunday Attacks ‘Bond Shirkers’: And He Would Shoot “Like Traitors” Those Who “Knock the Buying” The New York Times

- Will Ask Proved Bond Slackers to Make Statement to People The Evening Independent

- New Plan to Reveal Slackers St. Petersburg Daily Times

- Slackers Beware The Union County Journal

Gandhi’s campaign for Indian independence:

- Hindu Campaign Costing Money The Evening Independent

Miscellaneous war tax resistance articles:

- Five Members of Faculty Will Withhold War Taxes to Voice Vietnam Dissent The Harvard Crimson

- Tighter Objector Rule Asked Pittsburgh Post-Gazette

The Nixon Administration asked the Supreme Court today to rule out draft exemptions for men who are conscientiously opposed to the Vietnam war but not to all wars.

…

Besides, the Administration argued, if selective exemptions are approved people could refuse to pay their taxes on religious grounds or could defy other laws.

- Excise tax resistance fails to go unnoticed The Daily Collegian (concerning phone tax resistance)

- Tax resistance is historical means of protesting war Columbia Missourian

- Lutheran group issues call for tax resistance against arms race St. Petersburg Times (also covered in the Pittsburgh Post-Gazette)

- Local man won’t pay federal income taxes Columbia Missourian (George Mummert)

- Local Quakers support stand of tax resister Columbia Missourian (Richard Catlett, David Wixom)

- Tax Resisters Give Money to Hospice Associated Press

- Protesters resist military taxes Penn State Daily Collegian

- Nuclear Protester May Lose Home Over Tax Stand The New York Times

- ‘Alternative Revenue Service’ Unveiled The Seattle Post-Intelligencer

- War Foes Urge Withholding of Taxes The Seattle Times

- Taxes for Life The New York Times

- Victory for war tax resister Green Left Online (Robert Burrowes in Australia)

- Tax critics don’t leave lawn despite order Associated Press (Kehler/Corner case)

- ‘Conscience’ Doesn’t Take the 1040 EZ Route New York Daily News (Kehler/Corner case; review of An Act of Conscience)

- War Tax Resisters Will Turn Themselves in to IRS press release,

- Don’t Like Military Spending? Give Your Tax Dollars to Someone Else! The Portland Mercury

- War Resisters: ‘We Won’t Go’ to ‘We Won’t Pay’ The New York Times

Archbishop Raymond Hunthausen’s war tax resistance:

- Hunthausen Joins Rally at Submarine Base The Seattle Post-Intelligencer

- Bishops oppose nuclear arms St. Petersburg Times

- Area Priests Declare Their Support for Hunthausen The Seattle Post-Intelligencer

- Anti-War Archbishop Who Came Under Fire from the Vatican The Seattle Post-Intelligencer

Miscellaneous other articles of note:

- Finding Out Who ‘Really’ Spends Your Tax Money St. Petersburg Times (a conservative tax revolt group working with war tax resisters & Noam Chomsky)

- Washington [D.C.] Official Urges Tax Refusal to Push Statehood The New York Times (“Walter E. Fauntroy, the District of Columbia’s Delegate to Congress, has urged residents here not to pay their Federal taxes until Congress makes Washington the 51st state.”

- Israelis Yield West Bank Taxation and Health to Palestinians The New York Times

[C]ollection will be a formidable challenge after years in which taxes were identified by Palestinians with foreign occupation.

Tax resistance is strong in the territories. It spread during a seven-year uprising against Israeli rule, when Palestinians working in the tax department resigned. According to Israeli estimates, only 20 percent of Palestinians taxed in the West Bank met their payments in 1993, when tax revenues totalled some $90 million.

The Palestinian Authority has already run into difficulties collecting taxes in Gaza and Jericho, and it has published appeals in recent weeks urging tax payment as a national duty. Outside of Jericho, it has no police powers in the West Bank, and the legal system there remains under Israeli control.

“Taxes are the dowry of independence and the key to democracy,” said Atef Alawneh, director general of the Palestinian finance department, at the ceremony today in Ramallah.

“Nonpayment of taxes under occupation was a national struggle worthy of praise,” he added. “Now it is 180 degrees different. Now delay in paying means a delay in building the Palestinian state.”

Zuhdi Nashashibi, the finance minister in the Palestinian Authority, said he was confident Palestinians would now “hurry to pay” their taxes.

Mr. Alawneh argued that collection by Palestinians would be more effective because it would lack the coercion of military occupation, would extend to places the Israelis were unable to reach because of security concerns, and would create new revenue sources. The tax authorities will not use force, he said, but will rely instead on friendly persuasion and public goodwill.

Remember what this sort of thing used to be like? You’d get yourself down to the library, and then you’d look through each volume of the Reader’s Guide to Periodical Literature or whatever, one at a time, hoping that what you were looking for was among the things the editors of that guide felt was worth indexing. Then with luck, some of what you were looking for was available in bound volumes, microfilm, or microfiche on-site (elsewise you could always try for inter-library loan, but that might take a couple of weeks). In the case of the first, you could find it on the shelves or ask the reference librarian, and then thumb through the pages, but in the case of the latter two, you’d have to haul your film over to a reader (one that wasn’t broken or occupied) and then spend five minutes or so just trying to locate the pages you were interested in. Then, if it turned out to be good, you’d have to scribble things down or drop in some coin for a barely-legible photocopy.

I like the future.

Cherice at Quaker Oats Live discusses her feelings about war tax resistance. The issue came up at a recent Friends meeting, and she seems to have gone from curious to gung-ho in a hurry:

My solution: Quakers, Mennonites, Brethren, and whomever else wants to participate refuses to pay war taxes for a few years, and we suffer the consequences. I think we should campaign for a war-tax-free in all Quaker meetings and Mennonite/Brethren/etc. communities. What are they going to do — throw us all in jail? Maybe. But they can’t do that forever. No one wants to pay their taxes for a bunch of Quakers and other pacifists to sit in jail for not paying taxes. It doesn’t make sense.

So are we willing to actually suffer a little bit to be consistent about our peace stance? Are we willing to make a bit of a sacrifice to ensure that our money isn’t paying to kill people?

Anyone with me on a war-tax-free ?

Martin Kelly at The Quaker Ranter reacts to Cherice’s recent post at Quaker Oats Live about war tax resistance. Excerpts:

What if our witness was directed not at the federal government but at our fellow Christians? We could follow Quaker founder George Fox’s example and climb the tallest tree we could find (real or metaphorical) and begin preaching the good news that war goes against the teachings of Jesus. As always, we would be respectful and charitable but we could reclaim the strong and clear voices of those who have traveled before us. If we felt the need for backup? Well, I understand there are twenty-seven or so books to the New Testament sympathetic to our cause. And I have every reason to believe that the Inward Christ is still humming our tune and burning bushes for all who have eyes to see and ears to listen. Just as John Woolman ministered with his co-religionists about the sin of slavery, maybe our job is to minister to our co-religionists about war.

But who are these co-religionist neighbors of ours? Twenty years of peace organizing and Friends organizing makes me doubt we could find any large group of “historic peace church” members to join us. We talk big and write pretty epistles, but few individuals engage in witnesses that involve any danger of real sacrifice. The way most of our established bodies couldn’t figure out how to respond to a modern day prophetic Christian witness in Tom Fox’s kidnapping is the norm. When the IRS threatened to put liens on Philadelphia Yearly Meeting to force resistant staffers to pay, the general secretary and clerk said all sorts of sympathetic words of anguish (which they probably even meant), then docked the employee’s pay anyway. There have been times when clear-eyed Christians didn’t mind loosing their liberty or property in service to the gospel. Early Friends called our emulation of Christ’s sacrifice the Lamb’s War, but even seven years of real war in the ancient land of Babylonia itself hasn’t brought back the old fire. Our meetinghouses sit quaint, with ownership deeds untouched, even as we wring our hands wondering why most remain half-empty on First Day morning.

The Progressive, in , carried an article from Milton Mayer about tax resistance:

If You Want Mylai, Buy It

Young men are a dime a dozen. What the Army wants is a dime to buy a dozen young men with.

Either give them the dime or don’t give them the dime — but stop asking, “What can an old man do?”

April 15 is the date. April 15 is the date you turn over a quarter of your income to Behemoth, and half to three-quarters of what you turn over goes to the Army to buy a dozen young men to populate (and depopulate) Perforation Paddy. “I sent them a good boy,” said Private Meadlo’s mother after Mylai, “and they made him a murderer.”

If you want it, buy it. If you don’t, don’t. But stop asking, “What can an old man do?”

If, like me, you had a good year and made more than $625 in , the Internal Revenue Act requires you to file an income tax return. If you refuse (rather than evade) the requirement to file, you are still a felon, but you should notify Behemoth and all its minions lest you be hanged for the wrong reason. (The Act simply punishes “failure to file” and “failure to pay”.) I shouldn’t refuse to file, myself, but better men than I have taken the position that filing is more than a formality; the best of them, A.J. Muste, always filed an appropriately marked Bible instead of a return.

So, too, as the antics proceed, you will be asked (unless you have a readily attachable pay-check) where you stash your money so that Behemoth’s little boys in blue can go and get it. Here again I should comply, myself, lest Behemoth get the impression that I am playing a cat-and-mouse (or mouse-and-cat) game. But this decision, too, like whether or not to file a return, is probably a matter of temperament.

The purpose of taxation is to enable people collectively to buy what they want. Sometimes when some of them want a little something special and some of them don’t — for instance, throughways financed by tolls — those who want them pay for them and those who don’t want them don’t. But Mylai is financed by the general fund of the Treasury, on the assumption that everybody wants Mylai. Behemoth has no way of knowing that the assumption is false unless those who don’t want it refuse to buy it. A vote for Nixon (or Humphrey) or Johnson (or Goldwater) is a vote for Mylai. (“It was murder. We were shooting into houses and at people — running or standing, doing nothing.” — Sergeant Charles Hutts.)

The nation-state is not merely fallible; it is, as every Judeo-Christian (or Christeo-Judean) schoolboy knows, unholy because it divides the family of man into we and they. Only men are, or may be, holy in a world of nation-states, and they dare not perform an unholy act to preserve such an institution. Still the conscientious tax refuser is a conscientious citizen of the nation-state. He would gladly pay his taxes for the things all the people in it (including him) want. In Norway (in this respect the only even halfway civilized country in the world) the conscientious citizen may have his tax payment segregated for the support of the United Nations if he does not want to buy Mylai.

Bucking always for salvation, the conscientious citizen is nevertheless up against some serious objections to his refusal to send a dozen young men to the edge of the ditch in Mylai. The objections appear to be six in number:

Objection 1: The legal penalty of five years in stir and/or a ten-thousand-dollar fine. The U.S. Government has not yet pressed for the penalty in any case of tax refusal that I know of — partly, I suppose, because Behemoth does not know what to do about conscience, partly because the use of force, violence, and other lawful means of penalizing conscientious people always increases their number. (Better pretend they’re not there — up to a point.)

But the number is increasing anyway, and it is not unlikely that it is approaching that point. When it is confident that it has got its Haynsworth-Carswell Court, Behemoth may feel constrained some one of these days to press for the penalty. The tax refusal movement, for twenty years amorphous, is now coordinated by War Tax Resistance, whose address, I am reliably informed, is 339 Lafayette Street, New York, N.Y. 10017, and whose telephone number (212‒477‒2970) was discovered in the Manhattan telephone directory by a task force of forty FBI agents led personally by J. Edgar Hoover. Desperado Bradford Lyttle of WTR reports 181 active refusal centers across the country and estimates 15,000 refusers in .

Answer to Objection 1: There are worse things than losing five years and/or ten thousand dollars, and Mylai is one of them.

Objection 2: The loss of job or reputation. Ten years ago (even five) many tax refusers lost jobs (or failed to get them) as a consequence of the invariable FBI “inquiry.” That’s less likely (but only less likely) now. Loss of reputation, on the other hand, has never appeared to be consequential; I have never known anybody to the left of Orange County, California, who thought that a tax refuser was anything worse than crazy, and even in Orange County they hate taxes.

Answer to Objection 2: There are worse things than losing a job (though that is easier for a light-fingered clown like me to say than it is for an honest workingman).

We proceed now from the nuts-and-bolts to the nitty-gritty, as follows:

Objection 3: Tax refusal is ineffective because “they” get the money anyway (by force, violence, or other lawful means).

Answer to Objection 3: True, true; but, then, so is everything else ineffective (including two victorious world wars to save the world for democracy). To man, all things are impossible. If whatever you do is ineffective, you might as well buck for salvation and do what is right.

Objection 4: Tax refusal is illogical: If you refuse to pay half your income tax, half of what you do pay will be used for Mylai, as will more than the other half (since Behemoth, when it seizes the other half by force, violence, and other lawful means will also seize twelve per cent per annum interest on it).

Answer to Objection 4: This is true only if logic is a brance of effectiveness — and even then it is only half true. Behemoth will lose money on the deal because it will have to spend more to collect it than it gets. In one instance I know of, where the refuser took his case “on up,” it must have cost $25,000 in salaries and travel expenses of Treasury and FBI dicks, district attorneys, assistant attorneys-general, judges, and court attachés to collect and hold on to $32.27 (and the refuser took his own expenses in the case as a tax deduction). It is true, none the less, that in the end Behemoth will get all the money it wants for Mylai, by raising this tax rate if necessary.

But there is another, and more significant, logic: the logic of symbolism (not to be confused with symbolic logic). The only action a man can take against the nation-state is symbolic. He can not prevent its depredations but only repudiate them persistently in the hope of (a) salvation and (b) the sympathetic infection of his fellow-citizens. It is not logical symbolically (for instance) to bomb the ROTC building, because people sympathize with the victim of a bombing, and, besides, Behemoth has all the ROTC buildings it wants and is always eager to build new ones and add the building costs to its Gross National Product billboard. (The Army doesn’t need ROTC buildings or ROTC except as a symbol of militarism; no European army would dare ask a university to disgrace itself by letting its students be marched around the premises.) What is logical symbolically is for students to sit nonviolently in front of the ROTC building and be hauled violently away. Tax refusal is logical symbolically.

Objection 5: Tax refusal is a disavowal of representative government.

Answer to Objection 5: It is, if, and only if, by representative government is meant majoritarianism and not representation at all. If you are an American citizen and you do not want Mylai and won’t buy it, you are not represented. The Congressmen (including the Senators) who deplore Mylai all buy it, without exception. The last one who wouldn’t was Representative Jeannette Rankin of Montana, who voted all alone against the second go-around of the War to Make the World Safe for Democracy. The conscientious citizen who does not want Mylai and will not buy it is driven to self-government by the failure of representative government to represent him.

Objection 6: Tax refusal is anarchy, and anarchy is the worst thing that can befall society.

Answer to Objection 6: Anarchy is not the worst thing that can befall a society; it is the second worst. The worst is tyranny, and the worst tyranny is self-evidently that which requires the innocent to kill the innocent. (“I love women. I love children, too. I love people.” — Lt. William L. Calley.) He who does not want and will not buy tyranny must, like George Washington, take his chances on anarchy.

So hopelessly unholy is the nation-state that it drives the conscientious citizen to anarchy and then accuses him of driving it to anarchy when he tries to disengage himself from its tyranny. In the interesting case of the $32.27 cited above, Attorney Francis Heisler was arguing for the refuser before the U.S. Circuit Court of Appeals, and one of the judges said to him: “Counsel, is your client aware that if this Court holds in his behalf the Court itself will be laying the axe to the root of all established government?” “I think he is, your honor,” Attorney Heisler replied.

The objections considered, we proceed to the obstacles. There is only one that appears to be insuperable: withholding, the worst crime ever committed against liberty by a good man. When Beardsley Ruml thought up “pay-as-you-go,” everybody cheered except the company bosses who had to do the detestable New Deal’s detestable bookkeeping for it. (Anybody remember when the Connecticut manufacturer, Vivian Kellems, led the Old Guard attack on Social Security by refusing to make the employe deductions?) Under withholding, most of the people who don’t want to buy Mylai have already had it bought for them by April 15. They can sue to recover — some have — but nobody has made it to the Supreme Court yet. Others reduce or eliminate the withholding by claiming excess dependents (the whole population of Vietnam, for instance) in calculating their estimated tax. Again, I suppose, a matter of temperament, and mine doesn’t happen to run that cat-and-mouse way — though their cause is just, and we have indeed made the whole population of Vietnam our dependents.

A few religious organizations — not the churches, of course — have refused to withhold the tax from the pay of their employes who do not want to buy Mylai. The most respectable of them is the American Friends Service Committee, with which I confess to being associated. (Personally leading a task force of eighty FBI agents, J. Edgar Hoover discovered the association by looking in the Philadelphia telephone directory, so there is no point in my denying it.) But the AFSC has a task force of eighty Philadelphia lawyers, and one of these years a test case will go to Washington. Meanwhile, however, the conscientious citizen who waits for a test case will go on buying Mylai until the whole of Vietnam is a ditch.

A few years ago a new form of refusal got rolling, available to people trapped by withholding. This was non-payment of the telephone tax (which goes into the general Treasury), on the ground that Chairman Mills of the House Ways and Means Committee had argued its necessity for continuance of the war against Mylai. I’m uneasy about the telephone tax refusal myself; again, I suppose, a matter of temperament. There seem to me to be two visible arguments, and one invisible, against it.

First, I can not bring myself either to do or not to do anything on the bases that what a Congressman says is true. And second, it seems to me that if you are going to fight City Hall you should go for the jugular. The income tax is the jugular. The telephone tax is one of those petty excises, no more significant fiscally, and no more to be singled out, Congressman Mills to the contrary notwithstanding, than the whiskey, movie, or airplane tax.

But the invisible, base-of-the-iceberg, stem-of-the-martini-cherry argument for paying the phone tax is, I’m afraid, one of craven convenience. If Behemoth were to put me in jail for five years for income tax refusal, I’d refuse to pay my telephone tax instantly. But living where and how I do, running a little back-bedroom sweatshop out in the country, I can’t make it very well (still worse, very sick) without a telephone. Discussing telephone tax refusal with some of my anarchist friends, I have discovered that some of them were for it because they didn’t feel quite up to going to the mat on the income tax, and still others because they understood that the telephone company, like Vivian Kellems, was no more enthusiastic about collecting the Mylai tax than they were about paying it and would not jerk the phone out for non-payment of the tax.

This last seemed to me to be a misreading of history. Unlike Vivian Kellems and the American Friends Service Committee — Right and Left united across the years by the mounting terror of the Middle — the telephone company has no principle except money; and Behemoth’s agent, the Federal Communications Commission, is where the money is. In the Communist countries like Spain and Greece and, come to think of it, every other country in the world, the post office operates the telephone and telegraph systems, whose profits subsidize the carrying of the mails; in the only truly free country in the free world the money-losing branch of the communications system is communized and the money-making branches are Government-protected private monopolies.

But telephone tax refusal caught on until, according to the calculation of War Tax Resistance, there are now more than 100,000 practitioners of it. For a couple of years nobody did anything about them. But reports have begun to filter in of Government agents swarming over refusers and, more ominously, of the jerking of telephones by the company on behalf of its protector, the Government. As the reports spread it may be anticipated that there will be a falling-away of telephone tax anarchists, as, I suppose, there will be of income tax anarchists when Behemoth decides that they are getting to be too much of a nuisance and starts throwing them into the pokey.

Until that time the only obstacle (not objection) to income tax refusal, other than withholding, is the harassment it entails. The smart way to live alongside Behemoth is not to attract his attention, and whoever attracts his attention is in for it. Twenty years ago he was paying his harassers $40 a day. It must be $80 now, or $100; there is nothing niggardly about Behemoth.

He sends two kinds of harassers around. The first is a ritualistic cut-out character whom it’s a positive pleasure to be harassed by. He is the warm handclasp type, around thirty-five and running to pudge from running around in his down-payment Impala. He wants to have a little talk with you.

“Homyonum’s the name, Mr. Murgatroid, from the Internal Revenue Service.”

(Warm handclasp.)

“Sit down, Homyonum, sit down, and tell me what I can do for you.”

“To be perfectly frank, Mr. Murgatroid, I think that I may be able to do something for you.”

“Well, now, Homyonum, that is nice — I never expected the Internal Revenue Service to do something for me. Do sit down and have a nice glass tea.”

(He will, and he does.)

“Mr. Murgatroid, we of the Treasury Department are actually your agents. We are here to help you.”

“How sweet of you, Homyonum. One lump or two?” (Two.)

“Mr. Murgatroid, I want you to know that I respect your position, but I think you are ill-advised to refuse to pay your income tax.”

“Homyonum, my boy, your advice is ill. Milk? Lemon?” (Milk.)

“I beg your pardon, Mr. Murgatroid?”

“Not at all, and do let me tell you why your advice is ill. If my position is, as you say, respectable, then yours is not, since the two positions are contradictory. Do you follow me?”

“I —.”

“What I am trying to tell you, Homyonum, since you respect my position, is that you are trying to tell me that I ought not to pay my income tax and neither ought you. You do want to be respectable, don’t you?”

A little more of this standoff, a warm handclasp, and Homyonum is gone wherever such people go nights and is seen no more. He makes his report, the report spends two or three months going through channels, and then Behemoth hands one of his judges a distraint warrant to sign and sends one of his blue-boys around to attach your unattached property (money in the bank, wages coming in, shoes off your feet) in the amount in which you are delinquent in buying Mylai.

The other kind of harasser is another glass tea entirely. He is tall, sallow, dour, ulcerated: a certified public accountant who doesn’t know anything about your income tax refusal (he says), but has been sent to audit your return. “I suppose,” he says, “that your name came up on a spot check. Of course you have all your records and a receipt for each expenditure — if I may just look at them.” At the end of two weeks, at $40, $80, or $100 a day, reducing the Gross National Product by that much, he has discovered that you owe Behemoth $1.14 (or Behemoth owes you $1.14; that’s not the point of it at all) and you and your back-bedroom are a shambles.

He turns up the next year, on the dot, to do it all over again, and then you know he is lying about the spot check (and even he beginst to suspect he is). Meanwhile, he has converted you into a fox. You spend half your life (at $40, $20, or $10 a day) keeping records of your expenditures. You spend the other half of your life like the mouse you were not going to play in the cat-and-mouse game, scurrying for loopholes down which you can hurry. You end up beating your wife, cursing your children, and, of course, kicking the cat. And that, not the $1.14, is the point of it. If Behemoth can make your life unbearable, you will buy Mylai.

It is the very devil to be harassed, but what did you expect — a valentine from Mrs. Mitchell? It’s like (or even as) Give-’Em-Hell-Harry used to say: If you can’t stand the heat, stay out of the kitchen. You harass them, and they harass you back, and they’ve got the big battalions on their side. (You know Whom you’ve got on yours.)

And you harass them back and they harass you back. Who said ineffective? Behemoth has the whole country, the whole world, computerized to take care of everything — everything but one man who says, No, sir, instead of Yes, sir. It takes one (count ’em, one) man to obstruct the machine by introducing the human element into it. The grind-organ monkey is suddenly a monkey-wrench. I put it to you: What more can an old man do? The machine has not been built yet, and won’t be, that does not come down with the gripes while it digests a human being.

Mind you, I am not advocating income tax refusal; not I. For all I know the advocacy itself constitutes a felony, especially if it creates a clear and present danger that the Army won’t be able to buy a dozen young men with machine guns at the edge of the ditch in Mylai. Operating on a very low and cautious level, I say unto you only, Give them the dime or don’t give them the dime — but don’t ask, “What can an old man do?” If you want Mylai, buy it; if you don’t want it, don’t. That’s the free enterprise system, and do you believe in the free enterprise system or are you some kind of a Communist?

Operating on the highest level of all, under a law that even the Supreme Court (Girouard, etc.) admits is higher than the Internal Revenue Act, Jesus Christ was asked by the Pharisees whose the tribute money was, and you know what he said and you know that he said it perceiving their wickedness. (Matt. 22:18.) If you have to choose between Christ and the Pharisee who, like the Pharisee of old, occupies the highest seat in the Temple, you are in a tight spot. I’d play it safe myself: Better to do time than eternity.

A biographical note accompanying the article says that “Mr. Mayer began his own tax refusal adventures more than twenty years ago. (He is the anti-hero of the $32.27 case he cites in this article.)”

Some bits and pieces from here and there:

- Marlene at Pick My Brain reviews “Death & Taxes,” the new war tax resistance video from NWTRCC: “I listened intently to the 28 voices who spoke with clarity and passion about their call to action and I was definitely inspired to do something, even a token action to resist using my taxes to fund war and militaristic action. … I heartily recommend using this 30 minute DVD in small groups, Sunday School classes, peace and justice retreats, etc. It is fast paced, very positive and upbeat with lively music.”

- RantWoman, at RantWoman and the Religious Society of Friends, reflects on the neglected tradition of Quaker war tax resistance and what it might take to revitalize it in modern Meetings.

- South Carolina is requiring all organizations that “directly or indirectly advocate, advise, teach or practice the duty or necessity of controlling, seizing, or overthrowing the government of the United States, the state of South Carolina, or any political division thereof,” to register their activities with the South Carolina Secretary of State and pay a five-dollar filing fee. A member of the Alliance of the Libertarian Left decided to register: “When belligerence and inhumanity prevail, the peaceful and the humane must find honor in being categorized as the enemies of the prevailing order. Please keep me updated as to the status of our registration. I look forward to hearing back from you as to our official recognition as enemies of your state and its government. … PS. I am told that there is a processing fee in the amount of $5.00 for the registration of a subversive organization. Our organization is in fact so dastardly that we have refused to remit the fee.”

- Paying taxes is not a civic virtue, according to a Google Translation of an op-ed by Thomas Schmid in a recent issue of Welt Online, which namechecks Thoreau on the way to criticizing governments who rely on data stolen from banks in tax havens to crack down on tax evaders.

- Wendy McElroy has an interesting note about the philosopher William Wollaston who investigated the sensible idea that our actions are a more reliable indicator of our beliefs than are our utterances.

- “Where are 1% of American adults?” asks Shakesville. In prison, is the answer. Along with some other revolting statistics about America’s lockdown culture that you’ve probably heard before was this interesting claim: “It is illegal to bring into the United States any goods produced by forced labor or by prisoners, yet American prisoners make 100% of the military helmets, ammunition belts, bulletproof vests, ID tags as well some other items used by the US military. Although a prisoner is not technically forced to work, solitary confinement is the punishment for refusal. They also make 93% of domestically produced paints, 36% of home appliances and 21% of office furniture.”

Quakers will not pay taxes

Philadelphia (UPI) — Philadelphia Quakers say it is not unreasonable for them to follow their beliefs and refuse to withhold federal taxes from employees who are conscientious objectors to war taxes, the head of the local church said .

Samuel Caldwell, general secretary of the Philadelphia Yearly Meeting of the Religious Society of Friends, said that was their central argument when they appeared in federal court to answer an Internal Revenue Service suit.

The suit, filed in , is seeking payment of $11,224 in taxes from the employees, plus $5,614 in penalty from the Quakers.

From the Afro American:

Tax resisters give money to agency

Philadelphia — Several hundred tax resisters, who have refused to pay their taxes as a protest against government military spending, turned over their tax money to a Roman Catholic agency which runs a soup kitchen for the poor at a ceremony in Philadelphia .

The event at St. John’s Hospice, 13th and Race Sts, is part of a war tax resisters’ witness and rally which started at noon at City Hall West, Philadelphia.

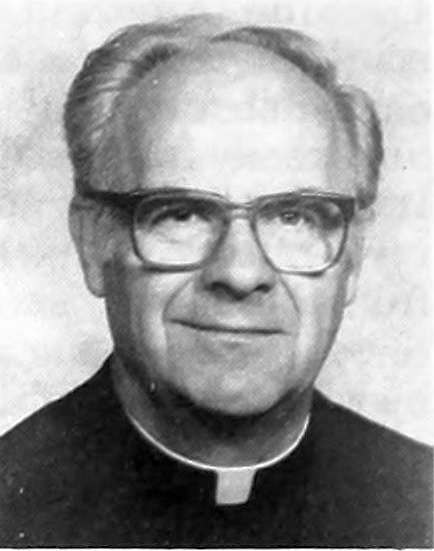

The funds were received by Brother Stanley O’Neil. The hospice is run by the Brothers of the Good Shepherd.

Following the presentation at the Hospice rally participants met with Senators Arlen Specter and John Heinz at their offices in the Federal Building, 6th and Arch Sts, Philadelphia, to petition for the transfer of military taxes to peaceful purposes.

The rally is being organized by the War Tax Concerns Committee of the Philadelphia Yearly Meeting of the Religious Society of Friends (Quakers).

Bill Strong, of the committee staff, said a growing number of Quakers and other Philadelphians are refusing to pay their taxes through a variety of methods including: non-payment of the military portion (34 percent of income taxes goes for current military spending), non-payment of the three per cent “military tax” levied on phone bills, adaptation to a simpler life style below the taxable level, and general protest activities.

Speakers at the rally included Peggy Hasbrouck, of the Brandywine Peace Community; Robin Harper, of Pendle Hill, a tax refuser for the past 19 years; Lillian Willoughby, a founder of the Movement for a New Society, a social change agency based in Philadelphia; Joe Volk, peace education secretary of the American Friends Service Committee and Father Paul Washington, Episcopal Church of the Advocate, Philadelphia. The program will include music by several high school choral groups.

For a while, it seems, Bill Strong was the Philadelphia go-to guy for quotes about Quaker War Tax Resistance. Here’s another article, from that confusedly refers to war tax resistance as a modern invention among Quakers rather than an old tradition being rediscovered after nearly a century of near-dormancy:

Quakers consider withholding taxes to protest arms

Philadelphia — For three centuries, Quakers have refused to go to war. Now, an increasing number of them are considering whether they also should refuse to help pay the country’s military bills.

Tax resistance — withholding all or part of tax payments as a protest against military spending — will be the central topic of discussion among Quakers gathered at the Friends Meeting House here for the Philadelphia Yearly Meeting.

The program for the yearly meeting, which began and concludes , lists tax resistance as a “burning concern” for Quakers to consider.

A grass-roots interest in tax resistance has developed among Quakers in the 100 monthly meetings — local Quaker congregations — in Pennsylvania, New Jersey, Delaware and Maryland that make up the Philadelphia Yearly Meeting, according to William Strong of the yearly meeting’s War Tax Concerns Committee.

The issue was one of three main topics of concern suggested by the monthly meetings for this year’s agenda, said Betty Balderston of the yearly meeting’s Committee on Aging.

Some Quakers “never have seen their own financial involvement” in war, even though they might have worked for peace, said Strong, a former bank trust officer.

Historically, the burden of opposing war has fallen on young Quaker men who refuse to fight, Strong said. Tax resistance spreads the responsibility to other Quakers.

And here’s an Associated Press dispatch from :

Quaker-Led Tax Protest Gets Boost from Other Faiths

Philadelphia, (AP) — Quakers are taking the lead in a growing movement that subjects members to a painful dilemma — obeying the law or following their pacifist beliefs by refusing to pay taxes that go to the military.

When most Americans meet the Internal Revenue Service deadline Friday for filing income tax returns, up to 10,000 forms from Quakers will contain adjustments for withholding the “war tax,” said Bill Strong, a member of the Religious Society of Friends’ War Tax Committee.

“I used to think three years ago that this was an off-the-wall, peculiar obsession of a handful of particular Quakers,” said Strong, who has chosen to keep his income below the taxable level for three years.

“But we’re convinced now that this is moving to the center. You’re getting people who are thinking about it for the very first time. That’s exciting,” Strong said.

Other churches are beginning to join the movement, Strong said, adding he’s particularly heartened by support from Roman Catholics.

“We’re 100,000; they’re 50 million. When our concern starts bouncing back as their concern, don’t you think we feel good?”

Some members of the two faiths were preparing to join in protest , when several hundred protesters planned to turn over their tax money to the Catholic hospice Brothers of the Good Shepherd during a Quaker witness and afternoon rally at City Hall.

The protest was among 70 planned across the country, with thousands of Quakers participating, said Strong, 53, who is on leave from his job as a trust officer at a bank to advise tax resisters.

Quakers, who abhor killing and live by the creed of “God in every man,” helped lead the struggle to free American slaves in the early 19th century. Some were imprisoned for refusing to fight in World War Ⅰ; others persuaded Congress in to establish a conscientious objector provision to the draft laws.

The Quakers’ tax resistance has taken many forms.

Some have refused to pay a 3 percent excise tax on their telephone bills, which Strong claims raises $2 billion a year for the military.

Others refuse to pay 36 percent of their income taxes, claiming 28 percent goes to the military and 8 percent represents interest on the Social Security trust fund which they say goes to the military.

And some have also withheld an additional 17 percent of their taxes that they say covers the cost of past wars, including veterans payments and war-related interest on the national debt, Strong said.

“For others, withholding 53 percent isn’t enough because they know that no matter what taxes you put in, they go to the military. And they refuse all taxes, turning in a blank 1040. That’s a criminal offense,” Strong said.

A Quaker in Seattle, Irwin Hogenauer, 70, says he hasn’t paid taxes since .

“I’ve lived a life of principle and I’ll continue to stand by it,” he said.

Hogenauer was the subject of my Picket Line entry. A different version of the above article continues as follows:

Hogenauer, who is now retired, managed for most of his working life to keep his income below the taxable level.

“People who are conscientious objectors often mold their lifestyles so they don’t have any taxes to pay,” said Helen Provost-Kees, an IRS spokeswoman in Seattle.

Single people who earn $5,400 or less a year or couples who earn under $7,400 owe no taxes, she said.

Still, the decision to break the tax law is difficult for many.

“It troubles us to find ourselves in conflict with what we judge to be a fair obligation to pay the taxes,” said Joe Volk, secretary of the American Friends Service Committee’s Peace Education branch and a tax resister since .

Robin Harper is still an active tax resister. Lilian Willoughby remained a dedicated activist into her 90s, and died in . Joe Volk is now the executive secretary of the Friends Committee on National Legislation. Paul Washington died in after a long career of shaking things up in Philadelphia.

When I was doing research for American Quaker War Tax Resistance, I deliberately chose to limit the timespan I was researching to the pre- period because I didn’t want to deal with the fuss of trying to track down the copyright of obscure works published after that time.

But what I discovered was that evidence of Quaker war tax resistance petered out almost entirely during the twenty years after the end of the American Civil War.

The tradition of war tax resistance, which had been so strong at one point that Quakers risked being disowned by their meetings if they were caught paying war taxes and refused to sincerely repent, died out so thoroughly that when Quaker conscientious objectors rediscovered war tax resistance in the latter half of the 20th Century, many seemed to think that it was a new innovation to the Quaker Peace Testimony.

It remains a mystery why the tradition died out. Here’s another data point, though, from the Reading Eagle (excerpt):

A Friend [H.M. Wallis] in Reading, Berkshire, Eng., writes to the Public Ledger, Philadelphia, to explain the attitude of the members of his sect in England, as follows:

“The real feeling of the Society of Friends in England may be gauged from the fact, which is not disputed, that no Friend, so far as is known, has declined to pay his war taxes, so called.

Even the Friends who during the South African war permitted the authorities to distrain upon their goods rather than pay the (then) war tax, and the still larger number who refused for years to pay education rates, have seen their ways to pay the much larger war taxes of today without demur.”

In , the Associated Press covered the case of war tax resister Priscilla Adams:

I.R.S. Sues Quaker Group

Philadelphia, — Priscilla Adams says she does not mind paying taxes — she just does not want her money going to the military.

Because of that, Ms. Adams, a Quaker organizer, finds herself in a court battle with the Internal Revenue Service.

Ms. Adams, 50, has refused to pay at least some of her federal taxes for many years and owes the government more than $42,000 in back taxes, interest and fines. She says she would rather her money went to further peaceful causes.

“They can do things like the checkoff for the presidential election campaign; they could easily do an accommodation for a peace-tax fund,” Ms. Adams said Wednesday from her house in Willingboro, N.J.

The I.R.S. stepped up the pressure in the dispute on when it sued her employer, the Philadelphia Yearly Meeting of the Religious Society of Friends, for refusing to garnishee her wages. The government wants to impose a 50 percent penalty, more than $21,000, against the society, a regional Quaker organization.

“That would be a hefty price for what we believe is right,” said Gretchen Castle, a leader with the group. “I think that there are other ways the government can do it that are more friendly, more supportive of our faith.”

The government is seeking taxes and penalties ; after that period the Quakers began to withhold taxes from Ms. Adams’s paychecks — she earns about $32,000 a year — and put them in an escrow account to which the I.R.S. has access. The Quakers say they do not want to help the tax agency collect the back taxes and penalties by garnisheeing additional wages.

Nationally, about 8,000 Americans withhold some or all of their federal income taxes because of their political beliefs, often because they oppose military spending, according to the National War Tax Resistance Coordinating Committee.

Ms. Adams is the only employee of the Philadelphia Yearly Meeting who does not pay income taxes, Ms. Castle said, although a few take other actions, like refusing to pay federal telephone taxes that go to the military.

Ms. Adams sued the government on religious freedom grounds in 1996, asking the I.R.S. to set up a fund for conscientious objectors and to excuse her tax fines and penalties because her beliefs provided “reasonable cause” for nonpayment.

The Court of Appeals for the Third Circuit rejected her arguments, and the Supreme Court declined to hear the case.

Peter Goldberger, a lawyer who represented Ms. Adams and now represents her employer, said Quaker leaders hoped to formulate a response to the lawsuit at their meeting.

Ms. Adams, who is married and has two children, said she might quit her job if the Quakers lose the case, rather than see most of her income go to the I.R.S.’s general fund.

For now, she lends the amount in dispute to charitable causes she supports. She says she will not demand repayment unless the tax agency comes after her.

More Than a Paycheck reported last year that the Philadelphia Yearly Meeting decided to continue refusing to garnish Adams’s wages according to the Meeting’s explicit policy on such matters.

I think I’m a little late to this party, but it only now showed up on my radar. Conscience Studio is a Quaker-oriented group that focuses on living life conscientiously. They have a service program centered on development and human rights issues in Indonesia, and a strong war tax resistance focus.

Among the war tax resistance-related pages on their site are:

- A Declaration of Conscience

- A declaration you can sign to complain that, against our deeply-felt values, “we are all ultimately compelled to pay taxes used for military purposes, and that we have a continuing liability to do so in the future. We have thus been obliged, and are being obliged, in direct violation of our consciences, to be complicit in the funding and waging of war.”

- Signators of Declaration of Conscience

- Nadine Hoover’s signing statement.

- Writing a Statement of Conscience

- Some recommendations for how to format your statement of conscientious objection and what points to cover.

- Testimonies

- Notes from Margaret Fell, Karen Reixach, Jens Braun, Kristin Buchholz, Peg McIntire, the New York Yearly Meeting, and others.

- Frequently Asked Questions

- Of which there is one, apparently: “Can I still write a statement of conscience while in the midst of the internal debate [over how far I’m willing to go]?”

- Articles

- Includes reports on war tax resistance from Nadine Hoover, Dan Jenkins, Karen Reixach, and Tom Rothschild.

Oh how far the Quakers have fallen since the days when they were notorious for their refusal to participate in war! Take a look at this sad notice:

Here’s an AP dispatch that I found in the Free Lance-Star of Fredericksburg, Virginia:

Protestant groups eye war-tax resistance

New York (AP) — Three Protestant denominations opposed to war are considering a new kind of tax resistance — refusal to pay taxes that go for arms and equipment for war.

Following a year-long series of joint regional conferences under the banner of a “New Call to Peacemaking,” the three historic “peace” churches have set a national conference about it in Greenlake, Wis.

The meeting is to consider regional proposals for some form of tax protest against spending for armaments and munitions of war.

The denominations, whose hallmark for centuries has been conscientious objection to participation in violence and war, are all relatively small. But they’ve had an influential impact on Christianity at large and on American thought.

They are the Society of Friends, involving about 100,000 Quakers; the Church of the Brethren, a Midwest-based denomination with about 180,000 members, and the Menonites, totaling about 130,000

Although many of them have protested war in the past by refusing to accept military service, the nature of modern war has turned “from manpower to money for technology and automated weapons,” the churches said.

In a joint statement, they said members of the movement now are “poised for stronger action.”

“The time has come for all Christians and people of all faiths to renounce war on religious and moral grounds,” the new cooperative coalition of peace churches said in its new call.

Regional meetings at 26 locations have been held in the last year about the issue, with more than 1,500 persons taking part, citing war and violence as “denials of the life and teachings of Jesus Christ.”

At one of the conferences at Old Chatham, N.Y., , it raised this question: “Are we going to pray for peace, and pay for war?” Another in Wichita, Kan., declared that 50 percent of funds collected from income taxes are used for military-related purposes and for manufacture of destructive weapons. The meeting encouraged “individuals who feel called to resist the payment of the military portion of their federal taxes.”

A meeting in North Manchester, Ind., proposed making use of the current tax revolt highlighted by California’s Proposition 13 and the distress at the national debt and inflation to further the peace cause.

The Indiana meeting suggested “legislative approaches that attract” the concerns of millions. The meeting urged an annual 5 percent decrease in military spending until it is cut 25 percent.

“The supposition that arms provide security is an illusion,” say the planners of the October conference in their letter of invitation.

“We call for a world based on peaceful order rather than the ‘balance of terror’ fueled by nuclear arsenals and the spreading arms sales.”

The “New Call to Peacemaking” isn’t so new anymore — but it’s still active, as is its sister project Every Church a Peace Church.

As I alluded to , a group of Quakers from the Pacific Yearly Meeting is trying to reinvigorate the tradition of Quaker war tax resistance.

Some of them are resisting their taxes in some way, and a couple of them are trying to get the government to recognize their conscientious objection to military taxation by means of legal challenges.

But most of what they seem to be asking their fellow Quakers to do in this campaign is to “Pay Under Protest” — in which they would pay their taxes just as usual, but would then write their Congressional representatives to complain about the injustice of it all.

Their literature plays up this “Pay Under Protest” campaign as being “a campaign for war tax resisters” and a way to “take a stand against war taxes” as though writing a letter to your congressperson were actually a form of tax resistance.

I think the organizers see this as a way for potential resisters to dip their toes in the war tax resistance pool, and at least to get thinking about how they might confront their taxpayer complicity. By enabling people safely and easily to get just a little forward momentum in this area, perhaps the campaign will cause them eventually to adopt some genuine war tax resistance tactics.

I’m worried that such an approach might backfire, and make it seem as though since the organizers are demanding only a small, insignificant, useless gesture, they must not be motivated by a very urgent concern.

Telling a Quaker that when she pays her taxes she’s buying war and that she should therefore start paying under protest is like telling a smoker that you’re concerned that he is in danger of cancer, heart disease, and emphysema and so you think he should start smoking under protest. (How concerned are you really?)

The campaigners have convinced the Palo Alto Meeting to approve the following minute on war taxes:

As a faith community, we believe that war violates our shared religious conviction that we should love our enemies and acknowledge and nourish that of God in every life.

We declare as a corporate body our objection to paying war waxes. We express our conviction in acts of individual witness ranging from letters of protest to government officials to acts of civil disobedience.

Nice that it merits mention, but pretty weak sauce. Compare that vague expression of disapproval with the unambiguous declaration of conduct that the Philadelphia Yearly Meeting put out back in the day (this version comes from the Rules of Discipline of ; I’m not sure when it was originally adopted):

It is the judgment of this meeting that a tax levied for the purchasing of drums, colors, or for other warlike uses, cannot be paid consistently with our Christian testimony.

If you would like to assist in the effort to reinvigorate war tax resistance in the Pacific Yearly Meeting, or if you are a Pacific Yearly Meeting Quaker who practices some form of war tax resistance or protest and you would like to add your name to their list, contact Elizabeth Boardman, one of the campaign organizers.

The new issue of More Than a Paycheck, NWTRCC’s newsletter, is on-line. Among the news you’ll find there:

- Talking Taxes and Taking Action Against Military Spending — how activists are using “penny polls” to start a conversation about government spending priorities

- Counseling Notes — how tax resisters can avoid getting preyed upon by “settle with the IRS for pennies on the dollar” companies; more “frivolous filing” overreach from the IRS; and increased use of IRS enforcement tactics isn’t leading to increased tax revenue

- Many Thanks — to the generous donors who keep NWTRCC in business

- Criminal Cases and Fear — Karl Meyer writes from the standpoint of decades of experience with war tax resistance about what factors increase the likelihood of criminal prosecution for war tax resistance. Larry Dansinger and Ruth Benn add two cents apiece.

- War Tax Resisters in History — Ed Hedemann reviews some of his research into the U.S. government’s use of property seizures and criminal cases as tools against war tax resisters in the post-World War Ⅱ era

- War Tax Resistance Ideas & Actions — Evan Reeves tries a new way of paying-as-a-protest; a look at the Quaker “Movement of Conscience” project; a review of Muriel T. Stackley’s War is a God that Demands Human Sacrifice; honoring peacemakers Martha Graber and Fern Goering; upcoming events at which NWTRCC will have a presence; and a look at the new $10.40 For Peace project, another attempt to ease peace activists into war tax resistance.

- Resources — notes on the Death & Taxes DVD, the new “Thoreau and His Heirs: The History and the Legacy of Thoreau’s Civil Disobedience” study kit, and the NWTRCC fundraising scarves

- NWTRCC News — a note on the upcoming national conference in Boston next month

- a Profile of war tax resister Heather Snow

I shared an Associated Press dispatch from about a then-upcoming meeting of Quakers, Brethren, and Mennonites who were planning to coordinate war tax resistance. Today, an article reporting on how the conference went, from the Milwaukee Sentinel:

Sects Urge Tax Protest for Peace

— A national meeting of “historic peace churches” — Quakers, Mennonites and Brethren — agreed to support those who refuse to pay “the military portion” of their federal taxes.

The possibly illegal “war tax resistance” position is a giant step for many in the churches from the passive refusal to bear arms and turning the other cheek.

Statements such as “we are praying for peace but paying for war” prodded the more than 300 delegates at a New Call to Peacemaking conference to back what advocates called an economic moral equivalent to military conscientious objection.

The lengthy statement also urged total disarmament after arms reduction, formation of a peace church delegation to President Carter, establishment of a world peace tax fund and simpler lifestyles.

It is not binding on the 350,000 members of the churches in the US or the nearly one million members worldwide.

The four day conference at the American Baptist Assembly here followed 26 regional meetings with participation by more than 1,500 Quakers, Mennonites and Brethren.

The joint meetings in themselves were a new ecumenical venture in breaking stereotypes. It was the first time in recent years representatives of the churches had met in such a conference.

The national conference challenged congregations and church agencies to consider refusing to pay the military portion of their federal taxes, generally thought to be about half, as a response to Christ’s call to radical discipleship.

It also asked them to “uphold war tax resistors with spiritual, emotional, legal and material support,” and to consider requests of employees who ask that their taxes not be withheld.

As I mentioned last month, the “New Call to Peacemaking” isn’t so new anymore — but it’s still active, as is its sister project Every Church a Peace Church. I think the new $10.40 for Peace campaign may also spring from these roots.

I’ve been hoping to get to the bottom of the mystery of how American Quaker war tax resistance went into a tailspin at some point after the American Civil War. I still don’t have an answer, but here’s another clue, and one that shows that at least as late as some Quakers were still very concerned about not paying war taxes. This comes from the Friends’ Intelligencer for :

A Friend who recently called at the office of the West Grove (Pa.) Independent said to the editor that he tries to avoid sending a check in payment of a bill, as this requires a stamp (war tax), holding the belief that he becomes a party to the iniquity of war by using the stamp.

This stamp tax was one of a number of war taxes instituted to pay for the Spanish-American War. Quakers also got caught by some of these other war taxes, particularly the estate tax, which some embarrassed Meetings found themselves reporting when Friends died and left their estates to the Meeting.

The new issue of More Than a Paycheck, the newsletter of the National War Tax Resistance Coordinating Committee, is on-line. Among the contents:

- Tips on organizing, recruiting, coalition-building, and media outreach

- An update on the Conscience and Military Tax Campaign. This is an alternative fund to which war tax resisters can redirect their taxes. It has a national focus and so is an alternative to the various regional alternative funds.

- Notes about tax law changes, levy procedures, and social security levies

- An update on the status of the Religious Freedom Peace Tax Fund bill

- Notes about upcoming actions and gatherings, about how to write imprisoned resisters, and about on-line resources

- News from the Philadelphia Yearly Meeting about their policy towards employees who are war tax resisters (with a link to a PDF of that policy statement)

- A note about the organizational tax resistance of War Resisters International in London

The Friends Intelligencer devoted some space to covering the Philadelphia Yearly Meeting.

The ninth query called forth regret that Friends had not maintained a stronger and more consistent testimony against war, but had paid the war taxes without protest. Lydia H. Price said that if Friends had been more faithful a few years ago these recent wars might have been prevented.

This was the time of the U.S. war in the Philippines. It was also, alas, a time when American Quaker war tax resistance was on the wane.

The 8 August 1981 Nashua Telegraph carried an article by Associated Press “Religion Writer” George W. Cornell. Some excerpts:

A-bomb anniversary brings peaceful fight

New York (AP) — In a time of military buildup, the “peace” people are marching, praying, fasting and signing petitions. Several denominations have made “peacemaking” a current priority. And some church leaders, including a bold bishop, have advised refusing to pay the portion of taxes that goes for arms.

[A]dvocacy of withholding so-called “war taxes” — the share of federal income taxes that go for military equipment — came not just from traditional “peace” denominations, but from a Roman Catholic archbishop.

Archbishop Raymond G. Hunthausen of Seattle, in a speech that has since evoked wide and varying reactions, suggested Christians refuse to pay the half of their federal income taxes going for armament.

“We have to refuse to give our incense — in our day, tax dollars — to the nuclear idol,” he said. “I think the teaching of Jesus tells us to render to a nuclear-arms Caesar what Caesar deserves — tax resistance.

“Some would call what I am urging ‘civil disobedience.’ I prefer to see it as obedience to God.”

Similar suggestions have come from some other Christians, most solidly from leaders of three relatively small, but historic “peace” denominations — The Church of the Brethren, the Friends and Mennonites.

A joint meeting of them under the banner of “New Call to Peacemaking” said paying for war is wrong and asked members to “consider refusal to pay the military portion of their federal taxes, as a response to Christ’s call to radical discipleship.”

In separate denominational actions, the Church of the Brethren has supported “open, massive withholding of war taxes” and the Mennonites general conference is fighting in court against being required to withhold taxes partly used for military purposes from employes’ income.

The New York-based War Resisters League estimates 2,000 to 10,000 Americans annually hold back part of their taxes, some eventually being forced to pay but continuing to repeat the protest.

A wire report on showed that Quakers in New York had rediscovered war tax resistance:

New York, (AP)— Quakers in the New York area were encouraged today to refuse to pay taxes or hold jobs that contribute to the war effort in Viet Nam.

The Society of Friends office here made public a document or “testimony” approved at an annual meeting last month at Silver Bay on Lake George, N.Y..

The message was described as perhaps the “strongest message of the 20th Century by a major body within the denomination.”

In the document, Quakers were promised financial help through special committees if they changed jobs or refused to pay taxes in protest against the war.

Entitled “Message to Friends on Viet Nam,” the document said members of the society must “stand forth unequivocally and at all costs to proclaim their peace testimony.”

The 72 Friends “meetings” or congregations in New York, Northern New Jersey and Southern Connecticut were called upon to “support acts of conscience by setting up committees for sufferings…”

Such committees, the statement said, should “keep close touch with deeply exercised Friends and their families who may need spiritual and material care because of their witness.”

I haven’t had any luck finding the text of this “Message to Friends on Viet Nam” on-line. Hugh Barbour’s Quaker Crosscurrents: Three Hundred Years of Friends in the New York Yearly Meetings mentions it briefly, and also notes that:

Conscription was a major concern of the sessions as well, and the yearly meeting approved a “Letter to Friends Troubled by Conscription” for distribution to the monthly meetings. They also agreed that the yearly meeting should refuse to honor liens on the wages of employees made for collecting taxes that were not being paid for reasons of conscience. In the sessions Friends were urged to protest against taxation for war by refusing to pay the federal telephone tax, and the yearly meeting agreed to publicize its own refusal to pay this tax “imposed for the specific purpose of procuring funds for the support of the military action in Vietnam.”

That “Letter to Friends” is another document that seems to have missed the Internet bus.

The New York Yearly Meeting is still working on conscientious objection to paying for war, though the meeting’s last “minute” on the subject, in is vague and noncommittal:

The Living Spirit works in the world to give life, joy, peace and prosperity through love, integrity and compassionate justice among people. We are united in this Power. We acknowledge that paying for war violates our religious conviction. We will seek ways to witness to this religious conviction in each of our communities.

The edition of The Friend reprinted a paragraph from the Episcopal Reporter. Excerpts:

The Society of Friends has practically passed from Europe, as conscription makes their presence there next to impossible. In Holland, where they were once so numerous, they can no longer live, and only a few are left in France, Germany, Denmark, and Norway. In other European countries they have been called upon to endure many and grievous persecutions because of their refusal to serve in the army, but, as was expected, they have remained true to their principles. In Scandinavia, they are well treated and never persecuted, though in Norway they have often suffered severely. One Friend in Norway has been imprisoned five times for refusing to pay the “blood-tax.”

The following was reproduced without further editorial comment in the Friends’ Intelligencer, and is more good evidence of the decay of Quaker war tax resistance around the turn of the century:

The following report of Concord [Pennsylvania] Quarterly Meeting on , is taken from the West Chester Local News:

In reply to the suggestion made by one of the speakers as to whether Friends could consistently pay income tax, Charles Paxson said that there was a time when refusal to pay taxes to be used for purposes of war was the only way in which Quakers could bear testimony against this evil. Today there are many and more efficient ways. Friends are loyal to the government, even though there may be some points in which they differ from its present policy. Taxes are not all used for war purposes, and the refusal to pay them would gain nothing in point of principle and would do harm by being misunderstood and misinterpreted.…

I’m curious as to what Paxson meant by these “more efficient ways” of bearing testimony against war that had in his view made war tax resistance obsolete.

Some bits and pieces from here and there.

- A recent outrage-of-the-week was the Obama administration’s attempt to require employers to provide coverage of contraception-related treatment in employer-provided health insurance plans.

Some employers, you see, think contraception is immoral, and don’t think the government ought to be able to force them to violate their consciences by providing a benefit to an employee that an employee might use to do something they think is wrong.

To which many folks said: “Seriously? Of all the things the government forces us to bloody our hands with, you’re getting bent about this?”

For example:

- “Catholic Bishops’ Contraception Coverage Argument Ridiculed By Pacifist Activists” by Zach Carter, HuffPost, quotes war tax resisters Ruth Benn, Karl Meyer, and Bradford Lyttle

- “Pacifists’ ‘Conscience Objections’ to War Taxes Never Get Same Notoriety as Opposition to Funding Birth Control” by David Dayen, FireDogLake, who includes this depressing remark about the collapse of war tax resistance in the Society of Friends: “I went to a Quaker secondary school for a year, and I’m quite sure that many of the believers in the weekly meeting for worship sessions had strong religious objections to their money being used to kill other people, even in self-defense. And yet I don’t remember a single controversy in my lifetime about ‘conscience protections’ for taxpayer funds and their use in war. I don’t even remember any accounting accommodations made for that.”

- “A modest proposal regarding religious liberty” by Mark Gordon, Vox Nova: “The principle being upheld is that as a matter of religious liberty no one ought to be forced to pay for something that violates their conscience. If that is true of government-mandated private insurance policies, and I believe it is, then it is equally true of government-mandated taxes.”

- “Obama’s Big Government Mandates: Why no one should be forced to act against his conscience” by Sheldon Richman, reason.com, who says “Americans have been forced, without their consultation — much less permission — to finance mass murder. It’s called war, invasion, occupation, and special operations. U.S. military missions in Iraq, Afghanistan, Yemen, Somalia, and elsewhere have directly or indirectly killed over a million people who never threatened Americans at home. Those missions have ruined the lives of hundreds of thousands more through injury and the destruction of their homes and societies. The president of the United States refuses to take war with Iran off ‘the table’ … War against Iran would constitute mass murder. The U.S. government should be stopped from engaging in such brutality. But short of that, those with a conscientious objection should be free to opt out of financing these crimes.”

- Resistance to the “Household Tax” continues in Ireland. For some reason, the government is requiring citizens to actively register themselves prior to paying this tax, which is a convenient point of leverage for the resisters, who are encouraging their neighbors to simply refuse to register. “The Household Tax can be defeated by mass non registration and mass non payment but this does mean organising every street and road in the country. The first step in opposing the tax is to refuse to register yourself but to win you must organise with your neighbors — if we all stand together we will win.” Irish parliament members are among the supporters of the Campaign Against Household and Water Taxes, whose spokeswoman explained: “This is not a charge to fund your local community, it is a tax to fund private speculators, bondholders and the bailout. Our incomes and services are being decimated to pay this private debt. Now people have a chance to register their opposition by not registering for this tax. By not registering, we can make this a referendum on the bailouts for the rich and the cuts for us.”

- This is similar to the argument by the “won’t pay” movement in Greece, whose government is nickle-and-diming the citizens by raising rates on utility bills, road tolls, transit fees, and so forth, to try to raise money to pay off international lenders who are openly threatening to abolish representative government in Greece entirely and instead run the country as though it were a bankrupt corporation in receivership. When the government electric power monopoly cut off power to a family of seven with a disabled child because they were unable to pay the hike, members of the “won’t pay” movement reconnected the power themselves in defiance.

- The IRS is being swamped by identity theft cases in which fraudsters use someone else’s social security number to file a tax return that qualifies for a big refund, then cash the check before the victim knows about it. The IRS then pursues the victim for having perpetrated tax fraud and tries to force them to pay back a refund they never saw. The agency’s focus on trying to get more people to file their tax returns electronically has made it easier and faster for the identity thieves to process fake returns wholesale. In Tampa, Florida, where the practice had become so widespread that local tax fraud entrepreneurs even taught classes in how to use the technique, the local news reported a few days back on “hundreds of frustrated people [who] were lined [up] at an IRS building…” waiting in long lines for hours only to find that the IRS personnel they talked to were unable to help them.

On , William Edgerton addressed a conference at Spiceland (Indiana) Quarterly Meeting (of Quakers), and touched on the decline of war tax resistance in the Society of Friends. Excerpts:

One definition of militarism is “a warlike or military spirit.” That spirit persecuted our church fathers because they refused to bear arms, and consistently declined to use them even in self-defence. By their patience and fortitude under suffering, they fairly earned the reputation we have inherited of being as a body opponents of all war. Within the memory of living men this spirit imposed fines on Friends or whoever refused to muster, i.e., take lessons in the art of manslaughter, and further distrained property if the fines were not paid.

Those regarded then as consistent Friends refused to pay, and suffered the loss. The principle was held so firmly that not a few were disowned (before my recollection), as I am informed, for paying their fines.

Later, those who paid their fines were not disciplined, and so by degrees and by temporizing the clearness of the testimony was lost.

When the Civil War came on, Southern Friends much more generally adhered to their peace principles and suffered personal abuse than did those under the Washington government. Its lenient Secretary of War, after conference with representative Friends, consented that conscientious persons might take places in hospital service instead of using guns. Some, perhaps, availed themselves of this questionable commutation, but observation, confirmed by reports of recruiting officers, warrants the belief that the large yearly meetings of the middle West furnished as many soldiers in proportion to their membership as other denominations, or even the general citizenship. For generations Friends had been known as opposed on principle to both war and slavery, and thus it came about that the Quakerly hatred of slavery and the inherited hatred of war were set over against each other. For Friends to appear to be neutral in this death struggle between slavery and the government would look like a betrayal of the sacred cause of freedom. To profess sympathy with the purpose of government, and yet refuse the support able-bodied Friends could give in military service, would seem to the authorities and our unconvinced members, too, as inconsistent, if not insincere.

Under this utmost possible strain — apparent conflict between two righteous commandments — our practical testimony against war broke down. Whether this consideration palliates the course of those who engaged in fighting or not, when the church never disowned a soldier as such, nor demanded that he condemn his conduct, nothing can avert the conclusion that the standard erected by our fathers has been let down.

Indeed, are not many active members regularly drawing pensions as soldiers? I am credibly informed that some recorded ministers do that very thing.