NWTRCC is holding its semi-annual gathering in Las Vegas . I’ll be there, presenting a draft of a new edition of the NWTRCC “Practical War Tax Resistance” series pamphlet on low-income / simple-living.

How you can resist funding the government → the tax resistance movement → conferences & gatherings → Fall 2006 NWTRCC national in Las Vegas, Nevada

, the National War Tax Resistance Coordinating Committee (NWTRCC) held its annual Fall gathering, this time hosted by the Catholic Worker house in Las Vegas. About twenty of us came from around the country to take care of organizational business, plot strategy, set goals, brainstorm, and swap stories.

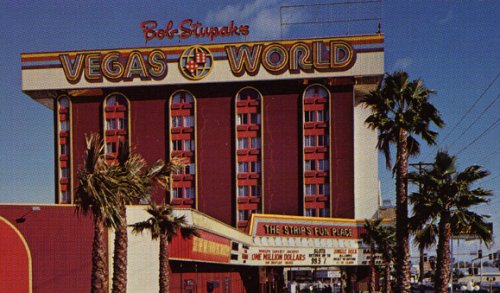

I used to come to Vegas from time-to-time to gamble & gawk, usually staying at Bob Stupak’s Vegas World and taking advantage of one of his complex coupon offers with which you could — if you had enough self-restraint in the casino — drive away from Vegas no poorer than when you arrived, with your room and much of your gambling paid for by Stupak.

According to one of our hosts at the Catholic Worker house, Stupak used to come down and volunteer at their soup kitchen from time-to-time as well. “He’d hand out cigarettes, too, which was very popular.” He even had his 50th birthday at the Catholic Worker kitchen. It’s a side of the polyester huckster I wouldn’t have guessed at.

On , before our meeting got started, a number of us joined up with some people from Nevada Desert Experience and Pace e Bene for a brief shift-change vigil at the Nevada Test Site.

While most of the weekend’s discussions were focused on a specific set of agenda items, night was dedicated to a more free-ranging discussion on the theme of “Money.” The seed for this discussion was an article Karen Marysdaughter had written in about how unchallenged attitudes about money and financial security prevent many people from considering war tax resistance, and discourage those who do consider it. She concluded:

I believe that long-held and firmly implanted notions about money, unless continually questioned and challenged, are likely to dominate people’s thinking about affluence, risk and self-worth. If we are to increase our numbers as a WTR movement, I think we need to include a critique of values and attitudes about money in our work and offer lots of explicit support for people who are changing their economic lifestyles in order to resist paying military taxes.

I took some notes on the conversation that we had, which I’ll share here in a fairly raw state:

One resister related his story of how his family had been resisting war taxes for years, but that the IRS had managed to seize over $100,000 in taxes, interest, and penalties. Not only did they lose this money, but because over the years they had been redirecting their tax payments to worthy causes, their overall payments were more than double their tax bill. Now, he says the family is practicing “the DON Method” instead.

On the one hand, he said, his family had not successfully kept any money from the government over the years, as the IRS had been successful in seizing the entire withheld amount. On the other hand, “it’s important to say ‘no’ to the government,” he believes, even if the government doesn’t take ‘no’ for an answer.

Another resister noted, however, that in her Quaker community the idea that “the government will just end up getting the money in the end anyway” is a frequently-expressed reason why people don’t consider tax resistance.

One resister told of how his family uses untaxed state subsidies for their foster children as one way of staying under the tax line (but another asked if it is really ethical to accept cash subsidies from the same government you’re actively trying to avoid funding). Another resister said he hasn’t filed a tax return and works entirely in the cash economy, without credit cards or a bank account.

We talked a bit also about the distorted measure of affluence and security that we’re used to applying in the United States, and how even in the war tax resistance movement we sometimes describe the experiences of tax resisters using terms like “sacrifice,” and “suffering,” and “voluntary poverty” in ways that would seem ridiculous and obscene to the world’s poor.

As Karen Marysdaughter put it in her article: “For example, peace activists risk injury and death in Nicaragua, but can’t imagine living without health insurance. Our whole world risks nuclear holocaust, but voluntarily living on a low income is somehow too scary. As with affluence, we compare our financial risks to those of people who are more financially secure than we are, rather than to the vast majority of people in the world who really live on the edge.”

I recapitulated my observations about the taboo about sharing information about personal financial information I’ve noticed among my friends (see The Picket Line, ):

…it would be easier for many people to blog about the follies of their sex lives than about the line items in their budgets… everyone has a budget but nobody is supposed to really talk about it. If you pay too much attention to money it must be because you’re poor, or stingy, or greedy, or obsessed with money in a vulgar way, or something shameful like that.

[T]he part of our lives that we hide in this way is a big part of the lives we live. Somehow in the course of history, while we were acquiring tools like money and credit and capital and commerce to supplement and amplify our ways of living, we were also shoving a lot of how we live behind a veil.

The irony is that these same tools give us a convenient notation for quantifying and reconciling much of our incomes and outgoes, the heartbeats of our economic health — it’s as if someone has handed us binoculars and we responded by putting on a blindfold.

This taboo has some big disadvantages — it means that we don’t compare notes and learn from each other’s experiences, and also it means that we often do not look at our own economic behavior very closely…

[B]ecause we hide our true economic health from each other, we evaluate each other very superficially — we judge someone’s well-being by sizing up their bling because we know no better and aren’t supposed to ask. We envy people whose sparkling debts are crushing them and pity people who would rightly fight tooth and nail not to trade places with them.

It’s hard not to entertain conspiracy theories when confronting this. After all, it’s easier to make a profit off of customers who can’t tell whether or not they’re being ripped off, and it’s easier for a government to tax people who won’t bother to translate that lost money into lost time and energy because they don’t know any better.…

One resister noted that the collapse of family and community support for the elderly and infirm is one reason why people are increasingly fearful for their financial security on the one hand, and feel dependent on a government-provided safety net on the other.

All in all, this was a very good icebreaker conversation to have had on , though nothing much was decided or resolved. I’ll share my observations about the remainder of the meeting.

I wrote up some of my impressions of of ’s NWTRCC meeting in Las Vegas.

I took notes on-and-off through and I’ll write up those things I remember that might be of interest.

The New Pamphlet I’ve Been Working On

I was at the meeting in part to present a first draft of a new edition of NWTRCC’s “Practical War Tax Resistance” pamphlet #5 on low-income / simple-living as a war tax resistance technique. On night we distributed a few copies of this draft and over the course of I had a chance to sit down with a number of people and listen to their suggestions for improvement. (If you would like to review the document, send me email and I’ll send you a copy of the draft.) I’m aiming to have a final draft ready in , and with any luck we’ll have our new edition back from the press .

Not Much Evidence of a Tax Resistance Groundswell

Despite the growing anti-war sentiment in the country, there has been no evidence of a corresponding groundswell of interest in war tax resistance. For the most part, people reported that their local groups were treading water in terms of membership and outreach. There was more resignation than frustration expressed on this point, as most of us have become used to being, as we’d characterize it anyway, well ahead of the curve on this. Many people also expressed that they often hear about lone-wolf tax resisters who for whatever reason never feel the need to align themselves with tax resistance organizations, so that the actual number of tax resisters is hard to gauge.

Survey in Progress

, NWTRCC started conducting a survey, informally, often at rallies, protests, and other activist events, to get a feel for what makes people choose or avoid tax resistance, and to do some concept testing of a possible large-scale one-year tax resistance campaign.

Of the few hundred people who have responded to the survey thus far, 47% are not doing any tax resistance now, and of that group, 61% would “consider participating in a one-year commitment to refuse a portion of your federal income taxes and redirect your taxes to a humanitarian cause if thousands joined you publicly” on a particular date.

All this sounds pretty good, and we plan to continue the survey , but even if we find a potential for this sort of tax resistance avalanche, NWTRCC alone doesn’t really have the resources to organize and launch it. My hope is that we can package these persuasive survey results along with offers of our own specialized expertise and sell the idea of such a campaign to one of the larger national anti-war groups who could launch a campaign like this in a heartbeat if they cared to. My own feeling is that this sort of thing is exactly the sort of sustained nationwide civil disobedience campaign the peace movement has been looking for; they just don’t know it yet.

Phone Tax Resistance Going Out of Style

Phone tax resistance has been a useful way of getting potential resisters to take the first step. It’s pretty easy to do, and the risks are very low, and so many tax resisters have gotten their feet wet in this way. However the proliferation of phone companies and phone plans, and the recent abolition of the phone tax on long-distance, have muddied the waters a bit. There’s a pretty good chance that the excise tax on local service is on the way to the trash heap as well, so NWTRCC has begun to deemphasize phone tax resistance and the Hang Up On War campaign. We’re still looking for the next “gateway” resistance tactic — any ideas?

Dan Jenkins Tries to Get the Courts to Recognize COMT

Briefly mentioned was Daniel Jenkins’s court appeal in which he is asserting a right to conscientious objection to military taxation under the 1st Amendment and 9th Amendment to the Constitution and the Religious Freedom Restoration Act. The case strikes me as a long shot, but Jenkins seems to be putting a lot of good work into it, and his research into conscientious objection in early American law is interesting.

Better Video Offerings, and a Contest

Some folks are trying to improve NWTRCC’s multimedia educational and persuasive offerings. This is a good thing (our local tax resistance group still uses a slide show made during the Reagan administration, complete with a tape recording that goes “beep” when you’re supposed to flip to the next slide). Alas, I was in a different workshop when this was being discussed, so I didn’t learn as much about this as I could have, but the project also includes a video contest — anyone can enter by producing a short video on the topic of war tax resistance — with cash prizes for the winning entries. I’ll post more details on The Picket Line when the contest officially launches .

A New Flyer on W-4 Resistance

NWTRCC’s produced a new flyer on W-4 resistance (adjusting the withholding allowances on your W-4 form so that your employer sends less of your paycheck to the IRS) that may be helpful to folks who would like to resist their income tax but who find themselves with nothing but a refund to resist when April 15th comes around.

Tax Resisters and Student Financial Aid

A preliminary fact sheet was distributed that covers the implications for war tax resisters who are participating in student financial aid programs, or whose children are. It’s not ready for publication just yet, but looks like it will be a useful resource when the time comes.

A Report from the International Conference on War Tax Resistance and Peace Tax Campaigns

We also got to read Larry Rosenwald’s report back from the International Conference on War Tax Resistance and Peace Tax Campaigns which was held in Woltersdorf, Germany . He was struck by the differences between the tax resistance movement in the United States and its counterparts in the rest of the world (Europe in particular).

In Europe, the movement is focused more on using the law and the courts (national and international) to legalize some form of conscientious objection to military taxation, and less focused on civil disobedience and forms of extralegal conscientious objection. They find it confusing that in the United States there’s both a Peace Tax Fund campaign and an organized war tax resistance movement.

NWTRCC has added some Readings on Money to their website.

At the NWTRCC national gathering in Fall, , we held a discussion about money. The seed for this discussion was an article by Karen Marysdaughter about The Influence of Money on Decisions to Engage in War Tax Resistance.

Some notes from this discussion are included on the new NWTRCC page, along with the following:

- George Salzman’s “Inheritance and Social Responsibility” — about how he creatively used an inheritance in socially productive ways while keeping the IRS’s hands off of it.

- A debate on interest between Juanita Nelson and Bob Irwin. Nelson sees interest on loans and bank deposits and such as inherently unethical, Irwin disagrees.

- Jay Sordean takes a look at the Federal Reserve and how money comes into being in his essay on War, the National Debt, Taxes, and the Creation of Money.

- Another collection of writings looks at various issues associated with Nonprofits and Tax-Exempt Status. While becoming tax-exempt and then defending your tax-exempt status may seem like it should be a no-brainer for folks who are tax resisters, tax exempt status comes with strings attached and may be more trouble than it is worth.

- Finally: one of the traditionally most successful outreach tools of war tax resistance groups is the “penny poll.” This page shows you how different groups have gone about making government budget priorities visible and visceral.