Code Pink sent this out to their mailing list this morning:

“It is not enough to say we must not wage war. It is necessary to love peace and sacrifice for it.” — Martin Luther King, Jr.

As we honor Martin Luther King, Jr.’s birthday, we want to celebrate his legacy not just with words, but with action. We ask you to join us in taking one of the strongest stands you can against war: refusing to fund it with your money.

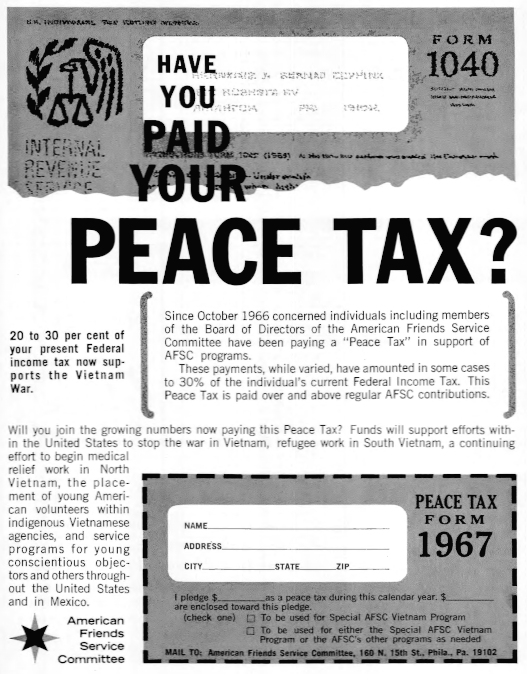

Former Secretary of State Alexander Haig once said “Let them march all they want, as long as they pay their taxes.” Well, we have marched, we have vigiled, we have sent letters and phone calls and faxes, but Congress continues to fund Bush’s war. In the spirit of Martin Luther King, Jr. and as part of the American tradition of non-violent civil disobedience that goes back to Henry David Thoreau, now is the time for us to take the matter of war funding into our own hands and stage a tax revolt.

In our flash video at the end of his anti-war speech MLK says; “Take a Stand, Tomorrow may be to late.” Each year we have taken a stand, and it is a very personal one, but one we can do together.

Our Don’t Buy Bush’s War campaign calls people of conscience to take a stand against the war in Iraq or the threat of war in Iran by signing a pledge that when joined by 100,000 other signatories, they will refuse to pay their taxes until the US gets out of Iraq (a fully operational plan begun). Our campaign offers safety in numbers and a firm stand against the Administration’s funding of the war.

We know you’ll have many questions about the campaign, and perhaps some fears. Please go to www.dontbuybushswar.org to sign our pledge, learn about other ways to support the campaign, and find answers to your concerns.

Be assured that CODEPINK will continue to work to end to this war, to restore our Constitution, to close Guantanamo, and to redirect our nation’s resources towards the needs of its people.

Thank you for standing with us in Dr. King’s memory.

Six hours later, over a hundred new people have made the pledge, and they’re still coming in fast. Here are what some of the signers have written:

- As the Bush administration responds only to threats of defunding, this is my line in the sand.

- Steven Humes, Durham, North Carolina

- As an educator, I believe that we have a responsibility to invest in our next generation here at home, rather than in military dominance of sovereign nations halfway around the world. I will put the amount I withhold directly into our educational system.

- Suzanne Knoll, Goleta, California

- I love a good Tea Party!

- Kimberly Wyke, Camden, Maine

- I will no longer pay for what I do not want. I will no longer act as an American who is for war. I am a human being on this planet who respects other human beings and my actions will follow in line with my words. My tax dollars will be used for the cause of good not evil.

- Sarah Ealey, Kentfield, California

- A government that does not listen to us should not be funded by us.

- Tara Mulqueen, Brooklyn, New York

- Don’t feed the hand that bites you.

- Paul Eagle, Belfast, Maine

- There is strength in numbers but even if this becomes a solitary endeavor, I’ll know I tried.

- Mary Jane McElrath, Miami, Florida

- Don’t wait for the group to do it. Start (or refine) your practice of mindful consumption by refusing to consume war, and redirect your money now.

- Lee Gough, Brooklyn, New York

- When the American people stop paying for war, wars will cease. Lets set a good example for Congress on how to stop a war!

- David Hartsough, San Francisco, California

- The war in Iraq costs $6,000.00/second. That figure doesn’t take into account all the other police actions ‘our’ government forces on ‘sovereign’ nations around the world. How can anyone of conscience support that?

- Matthew Schmidt, Barnesville, Ohio

- War can not continue without our taxes. Pure and simple.

- Lakshmi Kerner, Oakland, California

- I get angry every time I think of my tax dollars going toward anything this current regime endorses!

- Diane Birmingham, Fort Collins, Colorado

- I have not paid the percentage of taxes that go to war voluntarily for over 20 years. I will continue to protest war in this way. The government eventually comes and gets the money, but my conscience is clear that I haven’t willingly paid for people to die.

- Mike Ellison, Vancouver, Washington

- This is a beautiful thing!

- Christopher Constantin, Three Rivers, California

- I started resisting . This is the only real way we the people can change the coarse in our foreign policy.

- Nicholas Collins, Phoenix, Arizona

- Let’s stop funding the war and fund peace instead! Imagine a world where we fund peace, not war.

- anonymous, Venice, California

- I am encouraging all my friends to join in the modern day tea party

- Bridget Miller, Centreville, Maryland

- I worry about tax gestapo at the door, but we have to do something they will notice!

- Emery Goff, Farmington, Maine

- Enough’s enough. I have to take a stand and so does everyone else.

- Reich Benasutti, Lawrenceville, Georgia

- Thank you, Code Pink.

- Jason Dalldorf, Fresno, California

- We have lost our Democracy; we have destroyed another nation illegally, immorally and unjustly. I refuse to continue paying for death and destruction.

- Rayeanne King, Oak Bluffs, Maryland

- It’s about time we all take this stand!

- Lyn Gottschalk, Green Bay, Wisconsin

- I am an American citizen living in Canada. I pay U.S. taxes, but the amount is minimal. Nevertheless, I will sign the pledge and withhold a % (not sure how much yet). What the U.S. does affects everyone in the world, wherever they are.

- Elizabeth Whitmore, Ottawa, Ontario

- I’ve already cried out in this wilderness known as America. We the people are and have been struggling against the ‘policies’ of this misadministration. Perhaps this action will open your eyes and ears. Can you hear us yet?

- Kathy Walsh, Lake Worth, Florida

- This is not our war! Hear our voices we will not fund your war any more! If you want war go there yourselves!

- Krystal Ansley, Jacksonville, Florida

- My husband and I withheld 28% of our federal income taxes for . That percentage is the portion that the AFSC (Quakers) said goes toward current military and defense spending i.e. war in Iraq and Afghanistan. We don’t plan on paying at least that amount , either. We have been receiving threatening letters from the IRS for months. The last letter we got threatened us with a $5000 fine or jail time. We know the IRS only wants their stinking money, and they don’t want to throw us in jail and have to pay for us to be there.… In the letter we received from the IRS last week, they said our reason for not wanting to pay was frivolous. We call it taking a principled stand and doing the right thing. We will wait them out.… These fascists in U.S. government are a bunch of murdering thieves. We will not give our hard-earned dollars to people who wantonly kill other people and steal the natural resources of their country. If they won’t listen to anything else they’ll damned well listen up when the money spigot is turned off. Every single American taxpayer should suck it up, stop being afraid of the government we are all 100% part owner of and cut off the money that goes toward maiming and killing innocent people and contributes directly to the bloated war machine.

- Kris Graham, Houston, Texas

- I will no longer support this war with my tax money. We have voted and tried to work within the system to no avail. I do not know what else to do to stop war.

- Susan Thorpe, Tucson, Arizona

- What gives you the right to take my money and millions of taxpayers’ money and use the billions to bully, harass, and kill innocent victims.

- Cynthia Stokes-Adam, Brooklyn, New York

- Bush threatens to bomb Iran unless its citizens engage in just such civil disobedience as this. Let’s show them how like we did in Boston Harbor.

- Tim Wood, Atlanta, Georgia

- The two of us signed this prepared petition because we have been withholding the military portion of our income tax liability . At that time we realized we could not conscientiously pay for war when we were praying for peace.

- Barbara & Jim Dale, Decorah, Indiana

- Like the majority of citizens of the United States of America I am fed up with the Bush/Cheney Administration’s illegal tactics to scare us into funding a war that should never have been started.

- Valory Warncke, Maumee, Ohio

- We know the wars are created to line the pockets of the thugs who create it for greed and to control the people. I won’t pay and I won’t be controlled by the thugs.

- Shiara Lightfoot, Buena Vista, Colorado

- I have not ever done this before, but I am ready to do it now.

- Liz Aaronsohn, New Britain, Connecticut

- Thank you Code Pink.

- Ann Meany, Saint Paul, Minnesota

- I cannot, in good conscience, continue to throw away my hard-earned money to fund killing in the name of capitalism’s violence against American citizens, innocent foreigners, and our dying planet.

- Hal Goldfarb, Mesa, Arizona

- It is a human right to refuse to participate in killing and war. I am happy to join with others in redirecting our taxes away from aggression and violence and toward building a peaceful world.

- Susan Quinlan, Berkeley, California

- No funding of Bush/Cheney illegal war. Not now nor in the future.

- Kathleen Wolfe, Des Moines, Washington

- It’s funny, not really, that I have been saying this for many years: civil disobedience works.

- Leslie Provatas, Orient, New York

- When our children and grandchildren look back at this moment in history and ask what we did to stop the insanity, I hope we can say that we did at least this much, if not much more.

- Christopher Senn, Orcas, Washington

- This is a fantastic idea! I have thought about this long and hard in the past. I don’t want my hard earned tax dollars funding a senseless war! Thank you for your sincere hard working efforts which I wholeheartedly support!

- anonymous, Muskegon, Michigan

- I can no longer support the death of innocent people, by funding this war through my hard earned and very needed dollars! War serves no one! This one, in particular, is insane, and we must stop it! No funding from my part!

- Susan Janes, Pittsburgh, Pennsylvania

- War is evil, and the wars being waged in my name on the Iraqi & Afghani people are particularly sickening. Terrorism is best deterred with ethical behavior & education. My ethical behavior will now include withholding my tax dollars. My government has disregarded every other effort I and hundreds of thousands of others have made to request & demand the cessation of these wars. We must push back. Thank you Code Pink.

- Mary E. Stone, Montague, California

- Yes, it’s time for this action. Nothing seems to have an impact in this country any more except for money. Brilliant!!

- Carol Bayard, Maplewood, New Jersey

- We must stop plundering and destroying out of greed. I will not let my money go there anymore.

- Karen Boyer, Portland, Oregon

- I strongly support this effort to make war tax resistance a more public statement against the war machine. Thanks!

- anonymous, Portland, Oregon

- I’m sick of my tax dollars going to this blood war for oil, and I have nothing for myself or my daughter. But most of the people I know don’t want to pay taxes for this lying crap.

- Brenda Brown, Placitas, New Mexico

- No Killing in my name. Signing this petition is an ethical necessity for me personally. I have to take this stand in order to live honestly.

- Mathilda Cassidy, Santa Rosa, California

![No Income Tax For War! Now Particularly the U.S. War in Vietnam. Statement: Because so much of the tax paid the federal government goes for poisoning of food crops, blasting of villages, napalming and killing of thousands upon thousands of people, as in Vietnam at the present time, I am not going to pay taxes on 1966 income. Name ___. Address ___. [In order to withdraw support from war, particularly the savage and expanding war in Southeast Asia– Some are refusing to pay their total tax, or some portion. ☐ Some have in advance lowered their income so as to owe none. ☐ (for our information, would you like to check which form of nonpayment you are following?) NOTE: There are laws which (although not usually applied to principled refusers) cover possible fine and jail term for non-payment of a legally-owed amount.]](noIncomeTaxForWar.png)