Free Radio Santa Cruz has released an MP3 audio recording of an interview with Ed Hedemann of the National War Tax Resistance Coordinating Committee.

Miscellaneous tax resisters → individual war tax resisters → Ed Hedemann

’s first article about war tax resisters has gone out over the wires — a little earlier than usual, I think, thanks to Deena Gudzer, of Columbia University’s journalism department.

It’s got some quotes from tax resisters Ed Hedemann, Peter Goldberger, Robin Harper, Karl Meyer, and Dennis Dalton, a dissent from an activist who doesn’t see much point in war tax resistance, and some beside-the-point boilerplate rebuttalizing from an IRS spokesman.

Ed Hedemann discussed war tax resistance on Robert Lorel’s Radioactivity show on WMNF of Tampa Bay, Florida and invited listeners to call in with their questions. If you’re listening to the audio download, the Hedemann segment starts about 17 minutes in.

The war tax resistance press blitz continues.

The Oregonian covers the tax resistance of John & Pat Schwiebert, and the recent IRS levy of their pension.

“We are real conscientious objectors to war,” John Schwiebert says. The couple is too old to be drafted — if there was still a draft — and “noncooperation is the only way we can object.”

“We are prepared, in any way, to resolve conflict by any peaceful means,” [Pat] says. “Living in community has taught us that conflict is inevitable and that there are ways to resolve that conflict peacefully.”

The Schwieberts live simply. They do not own a house, living in a community of nine adults at the 18th Avenue Peace House in Northeast Portland, a ministry of Metanoia Peace Community United Methodist Church. They have worked, not for full salaries, but for reduced stipends that are below taxable limits. They do not have checking or savings accounts and are careful not to own property that may be seized by the government.

For many years they managed to live without earning enough money to owe federal taxes. But that changed in , when John Schwiebert’s pension kicked in. Their solution has been to calculate the amount they owed, according to the IRS 1040 form, and present that money to Multnomah County. , they presented $3,500 to the Board of County Commissioners.

The Columbus Dispatch takes a look at resisters Rod Nippert, Ed Hedemann, and Marjorie Nelson and demonstrates some of the variety of tactics and motives among war tax resisters:

The IRS has continually tried to collect from Nippert and so far has failed.

“They would do all of these liens and notices, but they could never find anywhere to get any money,” he said, laughing.

Nippert said he typically owes between $500 and $1,000 a year.

“I always do sit down and fill out a tax form to see what I would owe,” he said. “I’m always sure to donate at least that much to organizations that are doing good works for humanity.”

Nippert said he doesn’t oppose everything the federal government does. He just can’t get around the war issue.

“I can’t fight in a war, and I can’t pay for anybody else to fight in a war. And anything I give (the IRS), they’ll take a percentage of it to use for war.”

Nelson is a Quaker who stopped paying part of her federal income tax in , around the time she visited Vietnam with the American Friends Service Committee.

Every year, she carefully calculates how much of her tax bill will go to fund current wars (she doesn’t mind paying for veterans’ benefits) and deducts it from her tax check. She includes a letter to the IRS explaining her reasoning.

And every year, the IRS collects the money anyway, by attaching a bank account or garnisheeing her wages. She doesn’t fight it.

“This is a testimony, this is a witness,” Nelson said. “I’m conscientiously opposed to war, but I have never tried to do anything underhanded or sneaky to keep them from collecting it if they have to do that.”

More tax resisters in the news:

- Janine and Ben Martin Horst ask readers of the Eugene, Oregon Register-Guard to just say no to funding war in Iraq.

For some of us in the peace movement, however, it is not only Congress that holds the power of the purse. We believe it each individual’s right to say “not in my name and not with my money!” Some of us are willing to sacrifice security and comfort by refusing to pay for the war through our federal income taxes. We are war tax resisters, and here are some of our stories.

- The New Jersey Star-Ledger profiles war tax resisters Bryan Nelson and Ed Hedemann.

Nelson, who works as a union organizer, considers what he is doing an act of civil disobedience. He knows his decision could lead to penalties including fines or jail.

“It’s a serious act to violate the law,” he said. “I respect the law and the tax system. I’m not trying to evade taxes. I’m just trying to minimize my complicity in what the government is doing. I want my money to go where it can help.”

More tax resistance news is trickling in during .

The Brooklyn Eagle quotes war tax resisters Ed Hedemann, Robin Harper, and Karl Meyer.

Hedemann… has not paid any federal income tax and has no intention of starting now.

The 62-year-old, mild-mannered pacifist says he owes the government $70,000. This sum is worth several cluster bombs at $14,000 each and dozens of $9 hand grenades, but instead, he has donated the money to Global Exchange, American Friends Service Committee and other humanitarian efforts. Hedemann says he sleeps better knowing his tax dollars are being redirected to peaceful causes. “I run a risk of getting in trouble for not paying my taxes, but not as big a risk as the people of Iraq will suffer if I do pay,” said Hedemann, the author of War Tax Resistance: A Guide to Withholding Your Support from the Military.

The antiwar activist is so dedicated to his cause that he lives on the brink of poverty; he doesn’t own a home, car or bank account for fear the IRS will seize his assets. “I don’t want to finance this country’s war-making machine,” Hedemann said.

Elsewhere: In South Bend, Indiana, a dozen people held signs and distributed War Resisters League pie charts to last-minute filers at the post office. And in Austin, Texas, the groups Austin Conscientious Objectors to Military Taxation and CodePink Austin joined up at the downtown post office to hold signs and hand out flyers about military spending and taxes.

In Portland, Oregon, CodePink and the War Resisters League were joined by Physicians for Social Responsibility and the American Friends Service Committee to make that much more upsetting for taxpayers.

On in Pittsburgh, the Raging Grannies, Women’s International League for Peace and Freedom, and the American Friends Service Committee “sang and distributed 400 ‘where your tax money really goes’ leaflets outside the Squirrel Hill post office.”

The Occupation Project in St. Louis, Missouri held up large orange “Caution Signs” at the post office on :

The first sign will say: “Caution, War Tax Payment Zone”. The next will read “Pause before you Pay for”. And the then the following signs will read, “House to House Searches”, “Torture”, “Hundreds of Thousand of Refugees”, “Over 3200 U.S. Military Dead”, “Over 600,000 Iraqi Dead”.

Five protesters in sackcloth and ashes were arrested at the Chicago federal building on .

After I decided against going on Fox News, Ed Hedemann of NWTRCC jumped on the grenade.

I salute Ed’s courage and endurance, but I think I made the right decision. Here’s how Fox’s Neil Cavuto led off the segment:

Well, would the economy and the stock market be doing even better today if there weren’t [chuckle] people like my next guest. Get this: he has not paid the IRS a dime in taxes in and owes the government to date seventy thousand dollars, which he says he has since given to charity.

Remarkable, isn’t it? — the conservative host of a conservative business news segment saying that the economy might be doing better if more people paid more taxes! That’s how desperate they are to tar a war tax resister on Fox.

Things got better from there, though, and Ed held up well under pressure. I’m sure it will come as a bit of a shock to Fox Business News viewers to see a man who hasn’t paid income tax to the IRS in , and is still walking free without submitting to fear of the government.

Here’s some quick reaction from the News Hounds who “watch FOX so you don’t have to.” And more excerpts (I especially like this bit):

Cavuto: “So, people watching this show are going to say, ‘Hey, I’m workin’ my keteester off. I’m paying my taxes. Ed’s getting a pass. That’s not fair.’ ”

Hedemann: “No, but I am paying my taxes. I just don’t send it to the IRS.”

Cavuto: “Alright. Well, a lot of people could say I wanna give to charity, I wanna do this, but I have to pay Uncle Sam. You’re saying no you don’t?”

Hedemann: “Yeah. No I don’t.”

Cavuto: “So, if everyone did that, Ed, in the country, what would happen?”

Hedemann: “I think we’re less likely to have problems with war. But I think that in a democracy, citizens should have a right to say where their tax money goes and so I’m doing that directly.”

The war tax resistance pledges keep coming:

- I feel certain fear. / The price I must pay / For a conscience clear / And for peace, I pray

- Michelle Shocked, Los Angeles, California

- What can we do now but knock it up a notch? I’m with Code Pink on this one.

- Jill Sobule, singer/song writer

- I have been a war tax resister for 24 years. For the last several years, I have not owed any tax money. When I realized that , I would be paying for the war in Iraq, I withheld the approximate eight percent of my tax dollars that would fund the Iraqi war and sent those funds to Code Pink, which has worked tirelessly to stop this extremely immoral war. I know that it is only a small step on my part, but it is one step that I felt I must take. It would be great if all of us who oppose this war would take that step; the impact would be enormous. Perhaps someday people will understand that there is no reason to fear the IRS, we have the power, and they do not. And without our money, our government would have a hard time fighting wars.

- Wendy Emrich, Philanthropist and mother

- [T]he Bush Administration has done a very good job of convincing us that nothing we do will make difference. Doing nothing contributes to the supporting the war. The one act we can take is to withhold a portion of our taxes. Yes, it is a risk, but if we are not willing to take a risk, then we are part of the problem.… We need hundreds of thousands of tax payers to join us. That goal will be achieved one tax payer at a time. If we want to bring an end to the war, we have act. We invite all tax payers to become part of the solution by joining the war tax resistance movement.

- Jim Allen, Sociology Professor, St. Louis University

- Congress and the American people would rather send our diminished tax dollars to Iraq than make the hard decisions we must make as human beings who are collectively still waging a brutal war in Iraq. All that is asked of us is that we pay taxes to fund whatever our government can come up with next. All that is asked of you now when it comes to this war — is that you do not! Our soldiers do not want our tax dollars or theirs spent on keeping them in Iraq. They want to come home and have health care and support to heal from a war that will affect them and their families for the next three generations. There will be no tax dollars for them here, as long as we keep sending more over there.

- Patricia Foulkrod, documentary filmmaker

- I will not be paying any taxes until our government starts to develop nonviolent solutions for international problems.

- Joy Ellison, Vancouver, Washington

- In the tradition of the patriots that founded this country, we must speak out against tyranny!

- Suzanne Wheatley, Silver Spring, Maryland

- I do not support the Iraq war nor will I support a war with Iran!

- Karen Gray, Plainfield, Indiana

- I do not want my taxes used to support illegal wars.

- Nancy Gilbertson, Moravia, New York

- About damn time someone had such a good idea.

- Bert McKinley, Chamblee, Georgia

- Our Government has taken the country into illegal wars based on lies, and does not act in our best interest. Tax resistance seems to be needed to move our country and the world in a better direction.

- Marion Ward, Vancouver, Washington

- Why wait?! I’m already redirecting my taxes from the IRS/Pentagon axis to peaceful groups.

- Ed Hedemann, Brooklyn, New York

- Get up — stand up! Non-violent civil resistance is essential.

- Kyle Finch, Topanga, California

- This I believe important: don’t pay for what you believe is evil.

- Meg Palley, Nevada City, California

- Whatever it takes to make a difference for my children and their children and their children’s children’s children.

- “Gramma of 4,” Long Beach, California

- Not only does our humanity demand that we put an end to war, the challenges of Global Climate Change and Peak Oil make it mandatory that we shift our priorities now.

- Elizabeth Morrison, Los Angeles, California

- I cannot live with the hypocrisy of protesting against the wars in Iraq and Afghanistan while, simultaneously, paying to fund these wars with federal income taxes. I must obey my conscience. It is the right and reasonable thing to do.

- Louise Legun, Allentown, Pennsylvania

- I have been a war tax resister , and have been through numerous struggles with the IRS to resist paying taxes for war. I have refused to pay taxes and the IRS has eventually collected from me by taking the money from my bank accounts, and each year I still refuse to pay them. I would urge anyone who opposes the war in Iraq to refuse to pay some or all of your federal income tax, and send a letter to the IRS with your 1040 forms stating why you are refusing to pay. It may seem risky or frightening but I urge you not to be intimidated by the IRS, they will not throw you in jail or take your house; if you don’t pay they will send you letters demanding payment, and eventually will take money out of your bank accounts (if you have anything in your accounts). The worst that will happen is that they will take the money you owe them and add on some extra fees for penalties. I strongly support Code Pink’s tax boycott campaign.

- Kathy Labriola, Berkeley, California

- No longer can I hold hands with such villainy.

- Matt Dinsmore, Asheville, North Carolina

- Thank you for the impetus and support in this campaign to resist paying for the wars. Perhaps a rebuild Iraq fund can be started for our diverted tax money.

- Kaye Werner, Bellingham, Washington

- Yes, let’s cut off the fuel lines to this war machine!

- Brian Ciesko, Cincinnati, Ohio

- Cannot wait to see what tax season brings!

- Kelly Dolcini, Sacramento, California

- I am already a war tax resister, . I highly urge folks to withhold all of their taxes until we elect leaders who, to put it simply, put people before profits…

- Nancy Jakubiak, Clarksville, Indiana

- I’m not paying whether or not anyone else doesn’t.

- Rebecca Cummings, Vernalis, California

- I refused to pay Federal 1040 additional taxes in . I currently owe over $4,000, and am making small monthly payments. I sent letters to the IRS and my respresentatives stating my position. I also sent those letters to the National War Tax Resistors Coordinating Committee, for publication on their website. I am looking for a few other courageous souls to join me. Thanks for making this commitment.

- John Phillips, Lake Forest, California

- I’ve marched and written copious letters to my reps, to no avail. Sign me up so I can help end our illegal Iraq occupation.

- Laila Selk, La Honda, California

- As a military family member, I will not spend one more dime on this illegal, immoral occupation that is breaking the military and its families.

- Stacy Bannerman, Fife, Washington

- This government is criminal and it is illegal to support it financially!

- anonymous, Boston, Massachusetts

- I’ll send this to as many people as I can — we must act collectively to end the illegal occupation!

- Diane Haugesag, Minneapolis, Minnesota

- It is time to put our money where our mouth is.

- Joseph Durocher, Orlando, Florida

A few short bits from here-and-there:

- Jed Lipinski has a war tax resistance article in The Brooklyn Rail featuring Ruth Benn, Ed Hedemann, Lily Dalke, and Jesse Davis.

- Peace Pundit shares some take-away from a recent war tax resistance conference.

- The Ojai Post ruminates on the bloated military budget and what taxpayers can do about it.

- John Dear, speaking at a recent Pax Christi conference, urged his listeners: “If we are serious, we have to move into tax resistance.”

Ruth Benn, NWTRCC’s coordinator, attended the 12th International Conference on War Tax Resistance & Peace Tax Campaigns in Manchester, England .

she wrote up a preliminary report on the goings-on. Some excerpts:

There were about 60 people from 14 countries — about standard for these conferences. Sadly I have to report that our efforts to get George Rishmawi from Palestine to the conference ended in a refused visa, so that he could not travel to the conference. The British organizers tried really hard to get thru the red tape but to no avail. Two people from Ghana were refused visas also.…

…As with most conferences (at least in my humble opinion) the time spent talking with folks at meals and between the organized sessions is at least as important as anything that comes up in the sessions. Quite a few of my conversations were with individuals from other countries who are war tax resisters, who refuse to pay at least some of taxes due to their respective governments. Many combine their refusal with redirecting the money to some kind of fund for nonviolent defense or peace-building funds.

As we have found in the past, it is more difficult to resist in most countries because of the way taxes are pulled from paychecks. Those who resist tend to be self-employed. In general, collection is much faster in other countries than has been our experience in the U.S. (at least up to now), and many organizers at this conference make no effort to build WTR, seeing it as futile. The majority of people at the conference are working on peace tax fund campaigns or looking for ways to take their complaint of being forced to pay for war through some court system or U.N. body. I think 5 of the Peace Tax Seven were in attendance, and they are slowly making their way into the European Court of Human Rights. Daniel Jenkins from the U.S. reported on the effort to bring a formal complaint to a U.N. body. The Germans have a resister or two in their circles, but are focusing on a new effort of 10 people to take a complaint to a German high court based on the budget being a violation of fundamental rights because of the military spending. The Germans are trying to get away from appealing through the tax system and instead trying this more direct route to the government officials who create the budget. In Norway peace tax fund campaigners are appealing to their local councils; if the council accepts their complaint as an “initiative of national interest” then the council can send a complaint up to the next level of the government system.

I attended two workshops that related more generally to organizing, with both having some focus on how to widen our efforts. Groups and campaigns in every country seem to face issues similar to our own. “How to bring in more young people” was the topic of one workshop. While no group seemed to be doing any better than many of us here in the U.S., many are looking for answers in the internet, such as getting into Facebook and other networking sites, and upgrading our websites. The Danish peace tax fund campaign has been working with the model U.N. program in high schools with some success at making “the right not to pay for war” a topic in those discussions. One person noted that the activists groups that seem to be most successful at drawing in young people are the ones that give new members something to do immediately and regularly. There was also a good deal of discussion of language, in particular the use of the word “conscience,” and whether that is a word that resonates with young folks today. Because the hosting group was Britain’s “Conscience: the peace tax campaign,” it was the local folks who were having this discussion among themselves and also bringing it to the conference. “Taxes for Peace Not War” was a slogan that many people appreciated due to the positive spin.…

…There were small group sessions to talk about the common ground between war tax resisters and peace tax campaigns and develop ideas about how we can all work together more across international boundaries. I don’t know if any of the groups came up with any brilliant insights on this. My group did spend quite a bit of time comparing our tax systems and learning more precisely what each of our organizations do. It’s hard to figure out how to work together without understanding more about each situation; there’s a lot of confusion about why there is such a “strong” war tax resistance movement in the U.S. as compared to other countries. One person said rather emphatically — “I just don’t understand why anyone would be a war tax resister without also working for a peace tax fund.” Others perceived that peace tax fund campaigns and WTR need each other, that you can’t have one without the other; I said that I could certainly resist without any connection to a peace tax fund campaign, but I began to see that many Europeans see the effort to actually redirect military taxes to a fund that is only for peace-building efforts or alternative defense is primary to their peace tax fund campaigns. I think the U.S. efforts have never had this peace-building fund as an emphasis; the peace tax fund bill as it has been written in the U.S. redirects the taxes of conscientious objectors to the non-military spending in the U.S. budget, not to a specific peace-building effort. I found that insight rather interesting as I never understood so clearly how many of the campaigns are writing their bills for this specific purpose.

In my small group and in general there was clearly interest in making Conscience and Peace Tax International more of an umbrella group for all of our work. Due to technicalities of nonprofit status, NWTRCC has not been an official member of CPTI but has been a supporter. CPTI was founded as more of a link for the peace tax fund campaigns than for WTRs, but we’ll see how things develop. Many wanted to see more organizing successes and ideas posted on the CPTI website. Right now it has links to the groups in each country and information on WTR court cases and conscientious objection rulings within the U.N.…

…If you’ve read this far, you get the bonus link to some of Ed Hedemann’s photos from the conference. They are posted at: http://www.nwtrcc.org/ManchesterConference_2008.html.

Ruth Benn has expanded on her impressions of the 12th International Conference on War Tax Resistance and Peace Tax Campaigns over at the NWTRCC website.

Included with that article is another by Ed Hedemann in which he compares war tax resistance in the U.S. with that in other countries, particularly those in Europe. Excerpts:

U.S. peace activists who want to refuse to pay for war have it easy, at least compared to most of the rest of the world. In the United States, everyone who wants to resist taxes can do so.

We must file — or refuse to file — income tax returns, which makes refusal possible, whereas in most countries that option doesn’t exist. For example, in Britain, unless you’re self-employed, there is no income tax return to file. Income taxes are taken directly from your paycheck (through Pay As You Earn — PAYE) and employees cannot control the amount that is withheld unless their employer is willing to be complicit…

…The consequences for those who are able to resist (mostly the self-employed) are also a bit different. Generally, a court order is required in Britain to seize personal property, which is done more frequently than in the United States. In other countries (such as Germany), if there is a judgment against a resister, tax agents can come to your house and put stickers on personal property (TV set, computer, bicycle, etc.) to indicate that these items will be seized in 30 days unless the government gets paid. Also, it appears that the percentage of resisters being sent to jail — though small in number (only four in the last 20 years) — is higher in Britain than in the United States. The sentences have ranged from a week to four weeks.

As a result of these restrictions, the numbers of war tax resisters in other countries are much smaller than the several thousand in the United States. For example, in Belgium, only one person is known to be a war tax resister.

Benn and Hedemann both note the differences between the peace tax fund proposals in Europe from the one in the United States. In the U.S., the Religious Freedom Peace Tax Fund Act would wall off federal military spending from other federal spending and would mandate that tax contributions from conscientious objectors could only be applied to the non-military budget items. The proposals of European peace tax fund plan advocates, by contrast, “are geared towards having their taxes put into new programs established to develop systems of nonviolent defense as an alternative to the military.”

I checked out the documentary Anarchism in America from the library and gave it a watch last night. As an overview of American anarchism, it’s pretty superficial, and too deferential to the halloween-costume anarchism of punk rock. But the movie has its moments, and includes good interviews with a couple of tax resisting anarchists: Karl Hess and Ed Hedemann.

As it turns out, I could have spared myself a trip to the bookmobile. The documentary is on-line:

NWTRCC’s newsletter is out. Among the news to be found therein:

- A report on the recent national gathering in Eugene

- Some news about the uptick in “frivolous filing” penalties and warnings aimed at war tax resisters

- Counseling notes including news about the new policy of allowing employers to give their employees tax-free bicycle commuting reimbursements, a reminder that if you’re given a summons to appear before the IRS you should ask for reimbursement of expenses, and a note about the “socially responsible” investment business Pax World Fund getting caught investing irresponsibly.

- International News — an update on the case of Siân Cwper that I mentioned . Apparently the British revenue department is playing some strange games with the members of the Peace Tax Seven. (For more on the Peace Tax Seven, see this report on The Shrieking Violet.)

- Ideas and Actions — including a report on tax resistance for same-sex marriage rights, a report from Ed Hedemann who spoke about war tax resistance with a class of seventh-graders, and a new NWTRCC-themed scarf (perfect for fundraising at winter demonstrations).

- Notes about updated literature — including the booklet War Tax Resisters and the IRS which “gives a flow-chart style version of the risks of refusing to pay for war if the IRS notices.”

- A request for nominations for NWTRCC’s administrative committee — there will be two vacancies on the committee to fill at the national gathering.

- A call for fundraising help particularly to help promote Steev Hise’s upcoming war tax resistance documentary

- Reflections and lessons learned by Becky Pierce — “I have been a war tax resister for the past 43 years, all of my adult working life…” This includes some useful information on IRS collection tactics, for instance how they go about hunting for assets to seize as the statute of limitations closes in and they start to get desperate.

NWTRCC’s Ed Hedemann appeared on ’s episode of GRITtv with Laura Flanders. (His part of the show starts at 28:30.)

Hedemann talked about his more than 35 years of war tax resistance, the War Resisters League pie chart showing lopsided military spending, and how he asserts his own budget priorities through redirection. And he answers the frequently-asked-question: “how do you stay out of jail?”:

War tax resister Ed Hedemann and a pseudonymous pro-life/anti-war tax resister are among the activists featured in a new book: Crimes of Dissent: Civil Disobedience, Criminal Justice, and the Politics of Conscience by Jarret S. Lovell. Excerpt:

[W]ith a permanent military budget, war tax resistance need not occur solely during times of open or “hot” warfare. On the contrary, it can take place annually through small but nonetheless direct measures that impede the collection of revenue, as Ed Hedemann explained:

Being a war tax resister — despite the myths about this — does not require a change in one’s life. You could refuse to pay a dollar of your income tax, and there’s no sacrifice in that, although it’s a dollar or ten dollars that the government is not going to ignore. You send a letter along with it. It doesn’t require anything excessive on your part or a change in lifestyle. So what if they seize a dollar plus interest in penalties?

At the same time, when carried out to the fullest, tax resistance can require major sacrifices in one’s life, as Hedemann explained:

I refuse to pay any of my federal income tax because I just don’t want to have any part of [my income] willingly going over to the government. Now, this does require some sacrifice. For example, if I take a salary job, the chances are that the IRS will eventually find out who I work for and seize the money from my paycheck. So I’ve been avoiding salary jobs. I work as an independent contractor for a variety of nonprofit groups.… I can’t have a bank account with a Social Security number on it.… So I have my money in somebody else’s Social Security number in an account in another state. I also can’t own a house or a car because I don’t want that seized. So I’ve rearranged my life to some degree because I’m so determined to go the extra mile and not allow the government to [pay for war].

War, however, is not the only motivation for tax resistance. Recall that in the previous chapter we met “Bob,” whose tax resistance centered in part on the issue of abortion. When he returned from his tour in Vietnam, he made a decision never to lend his support to a policy that allows for killing, which for him simply meant war. “I wrote letters to the secretary of the Treasury, the IRS, the Department of Defense outlining my opposition, telling them that I’m not part of the game anymore.” It was around that time that Bob found out that his pregnant girlfriend was seeking an abortion and that the U.S. Supreme Court was reviewing Harris v. McRae, a case that questioned the constitutionality of the Hyde Amendment, which placed restrictions on the federal funding of abortions through Medicaid.

For a time, Bob worked with Operation Rescue obstructing access to abortion clinics, but he quickly felt that the organization attracted elements that betrayed his stance on nonviolence. Eventually, the confluence of his experience in Vietnam, the national debate over the funding of abortion, and the discovery of his girlfriend’s pregnancy all led to his move toward tax resistance, which for him was the most direct and nonviolent means of intervening in the carrying out of policy. So he began making life arrangements that allowed him to earn less than the taxable income while being able to continue speaking out about the “voluntary nature of taxes.” As Bob sees it, it matters not whether the issue is war, abortion, or any other government program:

If people continue to fund the monster, the monster is going to continue to grow and do its evil deeds. It’s gotten to the point where the number, depth, and quality of the evil deeds have gotten so huge that we need to defund it. That’s how we can really make this thing turn around: defund it.

The New York Times news service carried this report on , or thereabouts:

Minister Refuses to Pay Military Share of Taxes

by Douglas C. McGill

New Haven, Conn. — For the last two years, the Rev. Carl Lundborg, pastor of the First & Summerfield United Methodist Church here, has not paid half of the federal income tax he owed.

Instead, both years, he sent the Internal Revenue Service a letter that read in part, “My obligations as a Christian and a citizen are no longer reconcilable. The 50 percent of my taxes that support the military I cannot pay.”

A few months after he filed his tax return this year, an IRS agent visited his home and tried to collect the taxes due. “He was very pleasant,” Lundborg said. “But I said I didn’t plan to pay the taxes, and I didn’t offer any information.”

Several weeks later, the agent visited Lundborg’s church and ordered the church board to turn over Lundborg’s salary until the taxes he owed, together with interest and penalties, were paid in full.

, after the regular service, 40 church members voted unanimously not to honor the IRS order.

“He should have the right to act on his own conscience,” said Adeline Tucker, a church member, after the vote. “We have people in the congregation who do not agree with his position who still voted to support that right.”

Lundborg, who is 43 years old and known as Skip to his parishioners, has been pastor of the church for three and a half years. Before that, he worked for a total of three years at churches in Long Island, and spent nine years as a minister in Brooklyn.

His New Haven church has 270 members, including professionals, working class people and students. It is downtown, near the Yale University campus, across from the New Haven Green.

“What’s strange,” Lundborg said, “is that I’m very respectful of authority. I’ve never been arrested before, even for speeding. Now, every time I see a brown envelope from the IRS I really get scared. Sometimes I just leave it on the desk and open it the next day. What I’m doing is very scary.”

Still, Lundborg said, he is forcing himself to go through with the protest because he believes unabated tax support for a military buildup may end in a nuclear war that could destroy life on Earth.

“I’m not trying to be un-American,” he said. “But if it comes to that, I want to be more for the World. Of course, I want the Russians to stop the arms race, too. But this is where I live, this is where I can have some impact, so this is where I begin.”

After their meeting, church members gathered in an informal talk. Most of the people said they agreed with Lundborg’s feelings about nuclear war, but had voted more to support his right not to pay taxes than to support the political message behind his action.

“I don’t think our minister should be harassed because of his conscience,” said Harold Peterson, a church member. “If the clergy, whose job it is to preach the Gospel, can be harassed this way, there’s no hope for the laity.”

During the meeting, Peterson had urged the church to back Lundborg because “the church is being used as an instrument to come between Skip and his conscience. I think we should say ‘No,’ that we will not become that instrument.”

Some church members were ambivalent about the reasons for their vote. “I feel my taxes are determined by a legal process, with which I may or may not agree, and it’s my duty as a citizen to pay them,” said Dr. John Marsh. “But I definitely support Skip’s decision not to do so if he wants. That may sound hypocritical, but that’s the way I feel.”

Others said their vote was meant as a clear endorsement of Lundborg’s position on the arms race. “There are just too many people who aren’t eating,” said Adeline Tucker. “There ought to be an adequate defense, but what we have now is ridiculous.”

Edward Dobihal, chairman of the church’s administrative board, said the church would hire a lawyer to fight any enforcement action by the Internal Revenue Service against the church. He said the lawyer would argue that it would be unconstitutional to force the church to turn over its minister’s salary.

Albert Seeley, the IRS collections officer in New Haven assigned to Lundborg’s case, refused to discuss the case. But he did say that, in general, the agency could bring a civil suit against a third party for failing to honor a claim. A 50 percent fine could be levied against the third party, calculated on the amount of money it was withholding.

According to Larry Batdorf, a spokesman for the IRS in Washington, the agency could also place a claim against a person’s property to collect taxes due. Criminal charges may also be brought against tax resisters, although this is done relatively infrequently, he said.

According to both the IRS and peace groups around the United States, the amount of tax resistance because of moral opposition to military expenditures has increased in the past four years.

Edward Hedemann, who works full-time for the War Resisters League, said there were now 10,000 to 20,000 war tax resisters in the United States.

Batdorf of the IRS said the number was much smaller. 186 people who said they were war-tax resisters refused to pay federal taxes on their returns, 313 in , 328 in , 947 in and 844 for .

This is the first news account I’ve seen where the IRS had numbers like that to rattle off. Nowadays, they are forbidden by law from keeping statistics like this. I wonder what their methodology was.

Ed Hedemann of the National War Tax Resistance Coordinating Committee has put together some interesting charts and tables showing all known prosecutions and property seizures against U.S. war tax resisters since the 1940s:

The new issue of More Than a Paycheck, NWTRCC’s newsletter, is on-line. Among the news you’ll find there:

- Talking Taxes and Taking Action Against Military Spending — how activists are using “penny polls” to start a conversation about government spending priorities

- Counseling Notes — how tax resisters can avoid getting preyed upon by “settle with the IRS for pennies on the dollar” companies; more “frivolous filing” overreach from the IRS; and increased use of IRS enforcement tactics isn’t leading to increased tax revenue

- Many Thanks — to the generous donors who keep NWTRCC in business

- Criminal Cases and Fear — Karl Meyer writes from the standpoint of decades of experience with war tax resistance about what factors increase the likelihood of criminal prosecution for war tax resistance. Larry Dansinger and Ruth Benn add two cents apiece.

- War Tax Resisters in History — Ed Hedemann reviews some of his research into the U.S. government’s use of property seizures and criminal cases as tools against war tax resisters in the post-World War Ⅱ era

- War Tax Resistance Ideas & Actions — Evan Reeves tries a new way of paying-as-a-protest; a look at the Quaker “Movement of Conscience” project; a review of Muriel T. Stackley’s War is a God that Demands Human Sacrifice; honoring peacemakers Martha Graber and Fern Goering; upcoming events at which NWTRCC will have a presence; and a look at the new $10.40 For Peace project, another attempt to ease peace activists into war tax resistance.

- Resources — notes on the Death & Taxes DVD, the new “Thoreau and His Heirs: The History and the Legacy of Thoreau’s Civil Disobedience” study kit, and the NWTRCC fundraising scarves

- NWTRCC News — a note on the upcoming national conference in Boston next month

- a Profile of war tax resister Heather Snow

The latest issue of More Than a Paycheck, NWTRCC’s newsletter, is now on line. Some of what you’ll find within:

- Ed Hedemann tells of how he used the Freedom of Information Act to find out how the IRS was pursuing him over the years

- Frank Donnelly and Jack Moe write about the experience of war tax resisters in federal prison camps

- Reports on the 5,574-checks protest of Evan Reeves, and the NWTRCC presence at the School of the Americas Watch protest and the Gandhi-King Conference on Peacemaking

- A wrap-up of the business meeting held at the NWTRCC national gathering last month

- A profile of war tax resister Patricia Tompkins

On , the Village Voice published an article on tax resistance against the Iraq war:

Dollar Dissent

Tax Resisters Chip Away at Bush’s War Chest

Chisun Lee

Police horses won’t stop them. Ranks of cops in riot gear won’t stop them either. Even rush hour traffic on Manhattan’s Fifth Avenue won’t stop Americans determined to end the war in Iraq. The tax man, however, gives them pause.

“It’s surprising to me that people are more willing to risk arrest than refuse to pay their taxes. The fear of the IRS is tremendous in this country,” says Ed Hedemann, author of the 144-page War Tax Resistance: A Guide to Withholding Your Support From the Military. Hedemann has not paid any federal income tax and does not plan to start .

the Bush administration hit up Congress for $75 billion in taxpayer money to cover immediate war costs (some $30 billion of which the Pentagon has already spent). With unrest over this war evoking comparisons to the Vietnam era, when war tax resistance was at its peak, Hedemann hopes to multiply the “several thousand” compatriots he believes he has nationwide. Already, dozens of how-to sites have cropped up on the Internet, and lefty discussion groups have begun to embrace the idea.

While jail time and bad credit are real possibilities for war tax resisters, Hedemann says such consequences are far rarer than most people imagine and are easily avoided. There is a degree of tax resistance for every level of risk tolerance, he says. The tamest form is to pay all owed taxes but include a letter demanding that the money not be spent on the military. Another mild mode is to underpay by just a dollar, or not to pay the 3 percent federal excise tax on telephone bills, a tax which in the past rose with war costs and thereby became an object of protest.

The next level up entails not paying a percentage of one’s taxes equivalent to the portion of federal funds used for military purposes, a figure whose estimates vary widely — from 20 percent to 80 percent — depending on the source and the definition of “military.” (Even diehards like Hedemann pay safely nonmilitary taxes, like Social Security and state and local levies.)

But the ultimate form of tax resistance is not to pay any federal income tax at all and then keep the government from collecting it anyway. After all, tax resistance is supposed to transcend symbolism and deplete the dollars and cents that purchase the very tanks and missiles of the war machine. Rather than profit from their protest, resisters are expected to funnel their unpaid taxes into socially beneficial causes. In its highest form, Hedemann admits, war tax resistance “takes hard work.”

It requires something of a holistic lifestyle commitment. The successful war tax resister does not have seizable assets, such as a bank account, home, or car. He works for an employer who agrees not to withhold federal taxes from his paycheck. Or he earns so little that he is exempt from being taxed. Hedemann, 58, says he rents an apartment in Park Slope, Brooklyn, and describes himself as a freelancer for nonprofits. “I do have a bank account,” he says, “but it’s not in my name.”

U.S. Treasury Department spokesperson Tara Bradshaw says, “Every American should pay their fair share of taxes.” The government does not track nonpayers “that way,” meaning by cause, she says, so it is difficult to tell how well the resisters’ message gets across. (Hedemann discovered through a Freedom of Information Act request, however, that the IRS had kept his letters.)

Potential consequences naturally include fines, typically a percentage of the unpaid taxes, plus interest. Hedemann says that anyone who files a return form but refuses to pay — the strongest form of protest — should expect at least a written notice from the feds. He recalls a few instances when IRS agents, seemingly unfamiliar with the First Amendment, fined people who paid all their taxes but also wrote in with political complaints. “That’s always been reversed, of course,” he says.

The IRS can place a lien on property, tarnishing a person’s credit. (Hedemann says he has “a lousy credit rating,” although he managed to obtain “regular credit cards” with some effort.) In , there has been only one case each of house seizure and car seizure, he says. “Usually, these kinds of things happen in isolated areas,” he says, such as suburban Massachusetts, where war tax resisters stick out. Never, to his recollection, in New York City.

Then there are the criminal penalties. Tax evasion, “willful failure to pay,” and fraud can land a person in federal court, according to the IRS. In , 30 people have gone to jail, typically for one to three months, on resistance-related charges, Hedemann says. Some were convicted of fraud, usually claiming too many dependents. The bulk of convictions resulted from people refusing to divulge financial information to IRS investigators. Hedemann himself was prosecuted for that . “It was a rather intensive instance,” he recalls. A particularly industrious agent charged him with contempt for not disclosing his assets. “The judge, a Bush One appointee, ruled in my favor, based on my right not to incriminate myself,” he says.

“You really have to go out of your way to go to jail. The IRS gives you all kinds of opportunities,” he says, to pay up and avoid repercussions, as the agency’s own collection rule book notes. The risks are worthwhile, Hedemann insists, because “tax resistance has a direct impact on the government.”

Federal budget experts are quick to disagree with him. Robert McIntyre heads Citizens for Tax Justice, a Washington, D.C.-based nonprofit known to lean liberal. Nevertheless, he puts war tax resistance “somewhere between silly and evil.” Silly, because if resistance were actually to rise to a felt level, the government would simply borrow the money it could not get from taxes to keep the war going. And evil, because resisters are “putting their share of the government on other people.” (A bill to create a peace tax fund — a federally approved way to pay taxes but keep them away from the military — was introduced in the spring of and supported by a number of Congress members, including current House minority leader Nancy Pelosi. It has not been reintroduced this year.)

If war tax resisters intend to deplete the funding merely for this particular war, they should know that its cost is relatively low and easily supported by other means, according to Steven Kosiak, director of the nonpartisan Center for Strategic and Budgetary Assessments. (Moreover, Kosiak doubts that “it’s even intellectually possible” to deduce what percentage of the war payout derives from personal income tax revenue.) The Korean War cost 14 percent of the U.S. gross domestic product, he says, and the Vietnam War cost 19 percent. Current estimates for the war in Iraq amount to 4 percent or less.

The entire military budget for — minus the cost of the war in Iraq — comes in it at about $390 billion. Hedemann admits that the occasional resister “may not bring the military to a grinding halt.” Yet if the hundreds of thousands of recent anti-war protesters were to decide, “ ‘I’ve had enough of marching, I want to do something more,’ ” says Hedemann, “it would be something the government couldn’t ignore.”

Around the middle of April as the federal income tax filing deadline approaches, tax resistance articles hit the media frequently. Here are some examples from past years:

- “Tax Deadline Brings Protest And Ice Cream” The [Sumter, South Carolina] Daily Item

- A post-tax-day wrap-up quotes war tax resister Ed Hedemann, and also Jack O’Malley, one of three Catholic priests in Pittsburgh who were refusing to pay war taxes.

- “Farmer tries to pay his taxes with grain”

- A news report on tax day protests includes a mention of “Seven Pittsburgh priests [who] will refuse to pay about a third of their federal income taxes in a protest against the nuclear arms race” and of war tax resister Ralph Dull, who “drove a truck filled with 325 bushels of corn to the IRS office in Dayton” in lieu of cash payment.

- “Protesters resist military taxes” The [Pennsylvania State University] Daily Collegian

- Rita Snyder, Kathy Levine, and Donald Ealy quoted about the war tax resistance movement.

- “War tax resisters refuse to pay Uncle Sam” The Nevada Daily Mail

- Bill Ramsey, Jenny Truax, Rebekah Hassler, Tom & Suzanne Makarewicz, and Mary Loehr mentioned and/or quoted.

Cindy Sheehan’s weekly radio show/podcast — Cindy Sheehan’s Soap Box — featured war tax resisters Ruth Benn and Ed Hedemann in its latest episode:

There’s a new issue of More Than a Paycheck, NWTRCC’s newsletter on-line. Contents include:

- Charles Carney reflects on his conversion to war tax resistance, partially motivated by the war tax resistance of Archbishop Raymond Hunthausen in .

I have been able to divert over $100,000 away from the Boeings and the Halliburtons of the world to the Oxfams and Amnesty Internationals and Physicians for Social Responsibility and Harvesters of the world. It all started for me with that very liberating idea of unilateral disarmament. What a freeing thing to be able to lay down my sword and shield. What a freeing thing to tell the government, to tell the military-industrial complex, to tell Wall Street: “No you can’t have my money. All my checks will be written out to the people. All my checks will be written out to the 99 percent; no more checks written out to the 1 percent.”

- Notes about the IRS policy on salary levies and on employers who are willing to work with resisters to help them resist such levies, on banks versus credit unions, and on the effectiveness of scary letters from the IRS.

- Information about the upcoming International Conference of War Tax Resisters and Peace Tax Campaigns, on the European Court of Human Rights case for conscientious objection to military taxation being pursued by Roy Prockter, and on a new director for the American peace tax fund promoting group.

- A report from the 26th annual New England Regional Gathering of War Tax Resisters.

- Ed Hedemann’s proposal for “zombie war tax resistance,” in which he suggests that resisters prefill war-tax-refusing tax returns for several years in the future, and leave instructions for people to file them each year after your death. “Why concede the ‘death’ part in that old saying about certainty? Why give the government a break from having to deal with your resistance when you die? What if there were a way to continue war tax resistance from the grave?”

- An update on the case of imprisoned war tax resister Carlos Steward.

- Reports from the NWTRCC national gathering.

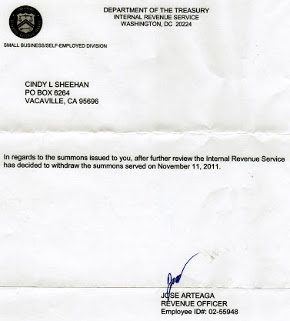

- Cindy Sheehan’s response to the IRS notices and summons concerning her war tax resistance.

Some bits and pieces from here and there:

- In , in a little-noticed case, Kawashima v. Holder, the U.S. Supreme Court ruled (6–3) that tax evasion — at least when it involves “fraudulent or deceitful conduct” and results in a loss of $10,000 or more to the government — is a crime that justifies the government deporting you even if you are an otherwise legal resident alien.

- Fox Business looks at a bill passed by the U.S. Senate that would deny or revoke passports from Americans who have tax debts in excess of $50,000.

- Ruth Benn and Ed Hedemann have released a free supplement that brings the information in their guidebook War Tax Resistance up-to-date.

- There’s a fascinating excerpt from Adam Kotsko’s new book Why We Love Sociopaths: A Guide to Late Capitalist Television up at The New Inquiry. He looks at the rise of popular sociopathic protagonists in drama, popular literature, reality television, politics, and so forth, and speculates as to why people are fantasizing about powerful, uncaring people.

- Ed Agro continues his series on war tax resistance at Engaging Peace.

The issue of More Than a Paycheck, NWTRCC’s newsletter, is now on-line, and includes:

- Clare Hanrahan’s tax day speech: “We must stop supporting this system of destruction. Not merely because it is immoral and unjust, but because it is illegal — according to International Law.”

- counseling notes — Congress considers revoking passports from tax delinquents, the IRS struggles to cope with a flood of tax fraud, and Ed Hedemann suggests low-income tax resisters inflate the numbers on their income tax statements so they have something to resist.

- international news — tax resistance in Spain, and a new nonviolent campaign guide from War Resisters’ International

- legal news — updates on the Frank Donnelly and Cindy Sheehan cases

- action reports and photos

- reports from the NWTRCC national gathering in Chicago

- a collection of brief “how I became a war tax resister” anecdotes from attendees at the Chicago conference

Whenever the authorities arrested, prosecuted, imprisoned, or seized property from Quaker war tax resisters, whatever Meeting that Quaker belonged to was sure to make note of it in their book of “Sufferings.” These ordeals “for conscience sake” were marks of honor and proofs of faith and these books were in turn the evidence of martyrdom that sanctified the Meeting.

“Friends were always careful to put their sufferings on record,” wrote Stephen B. Weeks, in Southern Quakers and Slavery. “Whatever else the Quaker might suffer, he could not bear for the shade of oblivion to come over the record of his testimonies.”

It was easier for a Quaker to exhibit fortitude in the face of government reprisal if he or she knew that this would be remembered respectfully.

Monthly Meetings press their cases

It was a common practice for Monthly Meetings to pass their records of sufferings along to be recorded also at the Quarterly Meeting level, and then finally at the Yearly Meeting.

After the American Revolution, some American Monthly Meetings used this to press for more respect for war tax resistance in the Yearly Meeting. Officially, only Quakers whose tax resistance was due to militia exemption taxes and other taxes that were explicitly and exclusively destined for war spending were to have their sufferings recorded. But some Monthly Meetings recorded sufferings for Quakers who were resisting general taxes, the bulk of which went to pay off war debt.

In , David Cooper wrote of the Rhode Island Yearly Meeting:

By a previous rule, such who paid any tax wholly for the support of war should be dealt with as offenders, but Friends were allowed to pay mixed taxes a part whereof was for civil purposes and part for war, nor were sufferings of those who declined to pay these taxes received or recorded. This subject now occasioned much debate, which resulted in a minute directing such sufferings to be recorded as their testimony against war.

In another case around the same time, the monthly meeting in Evesham, New Jersey tried to forward the sufferings of its members who had refused to pay war taxes, but their Quarterly Meeting in Salem balked at recording them and forwarding them further. This led to a great deal of debate in the Quarterly Meeting and kept war tax resistance on the front burner there — and also in the Yearly Meeting, which appointed a committee of 36 Friends who unanimously recommended that these sufferings be accepted and recorded.

NWTRCC’s lists

Ed Hedemann has been maintaining lists of American war tax resisters in the modern era who have had property seized by the IRS or have been taken to court, convicted, or jailed.

Badges awarded by the Women’s Tax Resistance League

As I mentioned the British women’s suffrage movement awarded badges to women who had been imprisoned for the cause, which is a different way of making note of and commemorating such things.

Poll Tax resisters in the United Kingdom

When local council governments in the United Kingdom tried to shame tax resisters by publishing their names in the newspapers during the Poll Tax rebellion of the Thatcher era, the newspapers who published the lists of “shame” found themselves on the receiving end of letters to the editor from resisters who were outraged that they had not made the list — and demanding that their names be included too!

When people are arrested, tried, or imprisoned for tax resistance, their comrades have sometimes used this as an occasion to hold rallies or other demonstrations. This shows support for the people being persecuted, demonstrates determination in the face of government reprisals, and can be a good opportunity for propaganda.

Here are some examples:

- When Russell Kanning was convicted for leafletting at the IRS office in Keene, New Hampshire, supporters demonstrated at the jail, holding up “Free Russell Kanning” signs.

- During the Dublin water charge strike, according to one organizer: “The campaign immediately took a decision that when any individual was summonsed to court, we would turn up and contest every case — and that we would turn up in force. … And when the first court appearances took place, over 500 people turned up outside Rathfarnham courthouse to support their neighbours. We marched to the courthouse, had stirring speeches, several songs including ‘You’ll never Walk Alone’ and ‘Bridge Over Troubled Water’ and an amazing sense of our unbeatability.”

- Sylvia Hardy, an elderly woman from Exeter, refused to pay her council tax, calling it highway robbery that the tax rates have risen by double-digits per year, while her pension rises at only 1.7% annually. When she was summonsed to court, she walked alongside banner-waving supporters and was met by a crowd of supporters outside the courthouse.

- Another pensioner who refused to pay his council tax bill for similar reasons, David Richardson, was taken to court in . About fifty supporters demonstrated outside, singing “For He’s a Jolly Good Fellow,” for Richardson.

- Brian Wright was the first person imprisoned for failure to pay Margaret Thatcher’s “Poll Tax” — 700 people held a rally outside the prison to show support. Other prisons holding poll tax resisters were later picketed by protesters.

- When J.J. Keon, a Socialist from Grafton, Illinois, was jailed for refusing to pay what he contended was an illegal poll tax in , Socialist Party spokesman Ralph Korngold came to town and gave a speech outside the prison urging people to join Keon in resisting and to ask why no rich tax dodgers were behind bars.

- Maurice McCrackin was jailed for war tax resistance in . While there, war tax resister Richard Fichter picketed the federal prison camp where he was held. Before that, he’d picketed the courthouse where McCracken was being tried.

- When the IRS took war tax resister Ed Hedemann to court in to try to force him to turn over financial documents to the agency, some 25 supporters, waving signs and handing out leaflets, joined him to demonstrate outside the courthouse before the hearing.

- Prior to war tax resister Frank Donnelly’s sentencing on tax evasion charges in , dozens of supporters rallied outside the courthouse. One supporter noted that “[i]n addition to showing up at his sentencing, Donnelly’s friends in Maine threw three ‘Going-Away-To-Jail Parties’ for Donnelly in the days leading up to his prison sentence. In one party surprise, Donnelly cut into a fresh Maine blueberry pie, and he found a file baked into the pie.”

The women’s suffrage movement in the United Kingdom was particularly noted for its courthouse and jailhouse rallies:

- When Clemence Housman was jailed for failure to pay about $1 of tax in — with the authorities telling her that they were authorized to keep her in jail until she paid up, however long that took — the Women’s Tax Resistance League held a protest outside the prison, and “gave three rousing cheers for Miss Housman, which… it is hoped reached the lonely prisoner in her cell.” The league then organized a procession to the prison gates. The four mile walk, over muddy streets on a rainy day, ended in a surprising victory, as the government had thrown in the towel and released Housman — without getting a penny from her — after five days.

- When a Women’s Suffrage wagon full of activists descended on the courthouse where Janet Legate Bunten was being charged with refusal to take out a license for her dog, the authorities panicked. “The court was twenty minutes late in taking its seat,” a sympathetic observer noted, “and it was freely rumoured that the reason of the delay was that more police were sent for to be in attendance before the proceedings began! There certainly was an unusual number present for so insignificant a court.”

- The Women’s Tax Resistance League organized “a great gathering” to support Kate Harvey who was charged with ten counts of failing to pay national insurance taxes on her gardener’s salary. Following the sentence, they shouted “Shame!” to the judge, then held a “poster parade” to the town square and held a mass meeting there.

Tax agencies live by bureaucracy and paperwork. Many of the earliest examples of writing in the worlds’ museums are tax records. But some mischievous tax resisters have discovered that this is a vulnerability that can be targeted.

For example, , a video blogger going by the name “StormCloudsGathering” considered the idea of “filling out thousands of random tax returns with nonexistent names and numbers… so suddenly they get flooded with a bunch of returns that don’t make sense…”:

What’s even more brilliant about [this] option is that even non-U.S. citizens — people living in other countries — could participate. You could send in hundreds of tax returns even if you’re an Indonesian. You know: Americans can live in Indonesia, and they’re required to file taxes… there’s no way for them to be sure, just because it’s coming from Indonesia, that it’s not a valid tax return. They would have to do the investigation, and that costs resources.

He recommends filing in the name of particular, offensive, multinational corporations, but I think the average person would have a difficult time filing a sufficiently complex return to serve as a convincing decoy in such a case. Another option would be to file corporate returns for nonexistent corporations, or individual returns for phantom (or dead) people.

War tax resister Ed Hedemann has already made plans for what he calls “zombie war tax resistance” — filling in years of tax returns ahead of time and putting them in pre-stamped envelopes so that his survivors can continue to file (but, of course, refuse to pay!) after he’s gone. “Why give the government a break from having to deal with your resistance when you die?” he asks.

Hedemann also makes a point of periodically filing Freedom of Information Act requests for any information the IRS and other government agencies have been collecting about his activities — hundreds of pages — and he’s put together a guide for other tax resisters to follow in making their own requests.

Currently in the U.S. there is an epidemic of tax fraud in which the fraudsters file for phony tax refunds in the names (and taxpayer identification numbers) of other, real people. This often causes the tax collection bureaucracy to swing into action against the victims of the identity theft, which is both a waste of resources and a way of further alienating the population from the government and its tax bureaucracy — potentially a model that a tax resistance campaign could benefit from.

The IRS has made a big shift in recent years from processing paper income tax returns, filled out by hand, to electronic filing. This is more efficient for the agency, as it no longer has to hire as many people to laboriously transcribe the numbers from paper returns into its computer databases. The agency estimated that it cost about 35¢ on average for the agency to process an electronically-filed return, compared to an average of $2.87 for a paper return.

This suggests that one way to make a minor dent in the agency’s budget and efficiency is simply to file paper returns rather than file electronically (this is still a legal option for individual filers, even those who go to professional tax preparers). But if this became a strategy of a mass-campaign it could even cripple the tax collecting bureaucracy. George Jakabcin, IRS assistant deputy associate chief information officer for systems integration, said in that the agency “would be in a world of hurt” if even half of the people who had switched to electronic filing at that time decided to switch back. “We no longer have the capability to process the additional 43 million returns manually. We no longer have the facilities, we don’t have the IT infrastructure in place to support them, we don’t have the people, and some would argue that we are beginning to lose the expertise.”

The IRS has tried to crack down on people who send them paperwork just to waste their time. They have come up with something called the “frivolous filing penalty” and can use this to ding you $5,000 each time you file any sort of paperwork with them that takes a position they consider to be “frivolous.” They can do this immediately and on the whim of whichever bureaucrat is handling your forms, without going to court, and you are only allowed to appeal your fine before a judge if you pay it first!

War tax resister Karl Meyer wasn’t about to let the IRS think it could intimidate him with such tactics. So in , when the “Cabbage Patch Kids” dolls (each one slightly different) had become ubiquitous, he invented when he called “cabbage patch resistance” — filing a different, blatantly “frivolous” tax return every day. He was assessed $140,000 in penalties in alone (though the penalty was only $500 back then). The IRS never collected the money though. The best it could manage was to seize and sell his car, for a little over $1,000.

“Constitutionalist” and “sovereign citizen”-style tax protest groups in the U.S. are fond of harassing tax officials and other government employees with lawsuits, liens, bogus quasi-official court filings, and so forth. In one example, Eddie Kahn’s “Guiding Light of God Ministries,” filed some 2,000 misconduct complaints against IRS agents. A newspaper article about a subsequent legal case against the group noted that:

Some agents have said that their supervisors ordered them to back off from audits or collection efforts in the face of [such] threats, just to avoid investigations by the Treasury inspector general for tax administration.

Some paperwork tricks are more like “hacking” in that they treat the IRS as a system that processes input and produces output, and note that certain examples of pathological input can result in output unanticipated by the system designers. For example, the IRS gave out $20 million dollars in the filing season when people figured out that if they substantially overpaid a tax return with a bad check, the IRS would cut them a hefty refund check before they noticed they’d been had.

Here are some more examples of paperwork hacks being used against the tax collecting bureaucracy:

- South Carolina’s state government recently passed a law that required all organizations that “directly or indirectly advocate, advise, teach or practice the duty or necessity of controlling, seizing, or overthrowing the government of the United States, the state of South Carolina, or any political division thereof,” to register their activities with the South Carolina Secretary of State and pay a five-dollar filing fee.

A member of the Alliance of the Libertarian Left (which probably qualifies, at least in its more ambitious moments) decided to register, but with a twist:

When belligerence and inhumanity prevail, the peaceful and the humane must find honor in being categorized as the enemies of the prevailing order. Please keep me updated as to the status of our registration. I look forward to hearing back from you as to our official recognition as enemies of your state and its government. … P.S. I am told that there is a processing fee in the amount of $5.00 for the registration of a subversive organization. Our organization is in fact so dastardly that we have refused to remit the fee.

- Prussian farmers in used the bureaucracy against itself.

A New York Times report noted:

[T]he big agrarians… are determined to resort to sabotage of all the tax laws…

[A correspondent in East Prussia says] “They have all filed protests and demanded that they be relieved from paying the tax until the protests are settled. That means a delay of at least three years in collecting the taxes, and it is said that the Provincial Treasury is inclined to grant this request. The big agrarians declared that they would do the same thing with all the tax laws. In Berlin the people might decree what pleased them, they (the agrarians) would not pay the taxes or subscribe to the compulsory loans. They want to sabotage the whole taxation system that they hate, and consequently they want to make so much work for the Treasury officers that the latter don’t know which way to turn.”

- During the Beit Sahour tax strike against the Israeli occupation, Elias Rishmawi worked to get a suit challenging the legality of the tax accepted by Israel’s court system. He remembers: “I had never had an illusion that the Israeli supreme court would give any justice to Palestinians. … [T]he appeal formed the legal coverage by which I and others were able to continue resisting from one side not paying taxes, since there is a case in court and they cannot force me pay until the case is solved they cannot take any actions against us since we have this case, and we kept challenging the system through different means.… This was impossible to achieve without the legal coverage of the supreme court. Because then, I and the others, would have been considered as inciters and then might be imprisoned for ten years. That’s why we needed that coverage.”

- An early form of resistance to Thatcher’s Poll Tax was called the “send it back” campaign.

The idea was that people would register for the tax, as required, but would accompany their registration with questions that would require further manual processing by the individual councils that were processing the tax:

For this and other reasons, the councils were inundated with paperwork, for which they were unprepared. “Councils sat under a mountain of paper. Everything they did seemed to create more work,” wrote campaign historian Danny Burns. He quotes from the Poll Tax Legal Group:Government regulations state: “…if for any reason you consider that you are not a ‘responsible person’ please let me know and return the form to me without completing it.” Stop It wants people to take up this offer by writing to ask if they should be the “responsible person” and suggests they ask who will have access to the information supplied and why the authorities require exact dates of birth. The implementation of the tax was dependent on an accurate register and the protest campaign could make the register “wildly inaccurate,”… Labour MP Brian Wilson, chairman of [the anti-poll tax campaign called] Stop It, said: “It is a campaign of obstruction within the law that does not lead people to incur the substantial penalties that are built into the legislation.” The aim was to have the legislation amended or abandoned.

The paper-work involved with administering the charge is enormous — and likely to get worse. Backlogs switch from one area of activity to another. Indeed, local authorities cannot really do anything without generating more paper-work.

- Kate Harvey, a tax resister for women’ suffrage in 1913, once wrote: “I have just received the first demand note for this year’s taxes. I have torn it up, put it in the envelope in which it came, and re-posted it to the Tax Collector. I suppose it is now reposing in his rubbish basket.”

- The Association of Real Estate Taxpayers in Chicago during the Great Depression led tens of thousands of property owners to demand reassessments of their property, which effectively swamped the Board of Review and allowed the property owners to legally delay tax payment.

Ruth Benn and Ed Hedemann of NWTRCC are going to be guests of Cindy Sheehan this evening on her call-in show, which, as I understand it, is something like a radio show but you tune in by calling a conference call line (218.632.0995, code #73223). The show starts at . Sheehan promises to replay and archive the show on her “Soapbox” starting on if you miss it.

Some bits and pieces from here and there:

- Another town in Catalonia, Alella, has begun refusing to forward its municipal taxes to the Spanish central government and is instead paying the money to the Taxation Agency of Catalonia, as part of a spreading Catalan nationalist tax resistance movement. (Més)

- I haven’t heard anything further from War Resisters International to justify their decision to pay their previously resisted taxes to the British government “under protest” while trying to portray their capitulation as some sort of war tax resistance action. Ruth Benn of NWTRCC, however, reports that “I did get a bit more explanation from someone with WRI, which has been refusing to turn over withheld taxes . They would keep the money withheld in an envelope in the office if the Revenue folks came to collect, which may have happened in . ‘This time, however, they threatened to take us to court,and we thought that would be a good opportunity. So we wrote saying that we’d rather they took us to court so we could explain to a judge why we thought it was important to resist taxes when the government is behaving so badly… That’s why they sent round a debt collection company. We didn’t have the money in the office, and then decided that trying to pay in cash (which they won’t normally accept — especially when it’s about 2,700 pounds) to see if it might make our protest a more newsworthy event.’ ” That’s a little confusing, but if I’m reading it right, still sounds pretty pathetic.

- If you missed the conference call with Cindy Sheehan, Ruth Benn, Ed Hedemann and three other war tax resisters talking shop, you can hear a recording here.

- The Treasury Inspector General for Tax Administration has an update on tax fraud perpetrated by U.S. prisoners, an industry that has been growing in recent years. In , prisoners filed at least 91,434 tax returns that claimed $757,600,000 in refunds that they did not legally qualify for. The IRS caught most of this in time, but still issued $35,200,000 in refunds they wish they hadn’t.

A bunch happened while I was away and I’m only just getting caught up. Here’s the highlight reel:

- The IRS has been pursuing war tax resister Cindy Sheehan for months, and not long ago they hauled her into court to try to get a judge to order her to cough up financial information they could use against her. She fought back, with help from NWTRCC and its legal advisor. The IRS has apparently thrown in the towel! Sheehan posted to her blog a letter she got from the agency in which it informs her that they have withdrawn their summons.

- There’s a new issue of NWTRCC’s newsletter on-line, with content including:

- Ruth Benn and Ed Hedemann comment on the popular War Resisters League federal budget pie chart, why its numbers differ from those of some other groups, and some of the judgment calls that go into its calculations.

- A first look at the responses to NWTRCC’s questionnaire surveying people in the war tax resistance movement.

- Some notes on the taxable income baseline, how to adjust your withholding as a new employee, and the latest news on the telephone excise tax resistance front.

- A brief article on War Resisters International’s flamboyant tax capitulation last month. (See also the coverage of this in SchNEWS and The Friend.)

- A review of war tax resister Peg Morton’s new book Feeling Light Within, I Walk.

- Announcing the upcoming NWTRCC national gathering in Asheville, North Carolina.

- A profile of war tax resister Andrea Ayvazian.

- A coalition of groups have organized a “Pull the Pork (from the Pentagon)” national day of action to try to point out that the sacred cow of Pentagon spending is really a pricey pig in a poke.

- Levante profiles ecological and antimilitarist activist Francesc García Barberà, who was involved in the Spanish struggle for the recognition of conscientious objection to military service, and in its war tax resistance movement. Excerpts (my translation):

As a conscientious objector, García Barberà performed alternative service in the Barrio del Cristo, where he became involved in the Workers’ Catholic Action Brotherhood, to which he remains linked, as with the objector movement. “The objection is in all of life; it’s not only not doing military service, but it’s rethinking the role of the Army and of military spending. The movement did not end when objection was legalized nor when conscription was abolished,” he notes.

Today he is associated with pacifist groups, never fails each year to make a symbolic assault on the NATO base in Bétera, and practices tax resistance, like a handful of Alaquàsers of his generation. “We omit the percentage that we estimate is dedicated to military spending (between 7% and 12%) and redirect it to Caritas or some NGO,” he explains, which on some occasions has meant conflict with the Treasury Department. “Armies defend borders when what ought to be defended is a dignified life for people. And even if they are dressed up as humanitarian actions, they serve large vested interests. In a war the strongest wins, not the most just,” he says.

- Amy Wachspress reminisces about her years as a war tax resister in on her blog.

- Armies of citizen informers… a behind-the-Iron-Curtain Orwellian nightmare, or the latest IRS business plan? IRS payments to what it calls “whistleblowers” who inform the agency on tax evaders jumped from $8 million in to $125.4 million in . A single $100-million payoff to an informer inside the Swiss bank UBS helped boost the total this year.

Democracy Now! has a good piece on war tax resistance featuring an interview with Ed Hedemann: