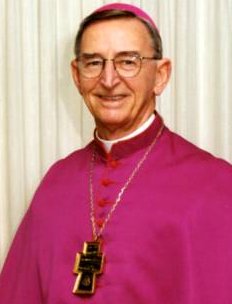

On , the New York Times reported on a threatened anti-abortion tax strike by an American Catholic bishop:

If the final version of the national health care package President Clinton outlined this week includes coverage for abortion, at least one Roman Catholic bishop will refuse to pay his Federal taxes.

“It’s a matter of conscience,” said Bishop Victor H. Balke of the Diocese of Crookston, Minn. “It’s the taking of human life, and I’m not going to pay the Government any money to pay for the taking of a human life.”

To those liberals who disagree, Bishop Balke likes to remind them that two decades ago, as a seminary rector, he withheld his taxes to protest the United States’ involvement in Vietnam.

His actions, he argues, are consistent. In Vietnam, he said, he was protesting the killing of Americans and Vietnamese “in what I thought was an immoral war.” In the case of tax money paying for abortion, he said, the issue is “defending the lives of unborn children.”

“ ‘Thou shalt not kill’ is still the law of God even if it is no longer, in the case of the unborn, the law of the land,” he said.

In a column in his diocesan newspaper, Bishop Balke also urged the 42,000 Catholics in his diocese to consider withholding their taxes.

The United States Catholic Conference, the national body of bishops of which Bishop Balke is a member, embraced many aspects of the Clinton health plan, “particularly in its commitment to universal access,” but made clear its opposition to covering abortion, calling its inclusion in the plan “a tragic step backward.”

When asked if the idea of a tax revolt could spread, a spokesman for the bishops said he did not think it would come to that. “Our hope and our instinct is that there is enough opposition” to abortion coverage “that it will not be included” in the final health care plan, said the spokesman, Msgr. Francis J. Maniscalco.

A follow-up article in the Philadelphia Inquirer said:

Victor Balke protested the carnage in Vietnam by refusing to pay his federal income taxes.

Now he is the Roman Catholic bishop of Crookston, Minn., and he again finds himself pondering the possibility of breaking the law. This time, the issue is abortion. If health-care reform leads to federal subsidies for abortion, Bishop Balke said, he will not pay.

“I thought that war was immoral killing. I think abortion is immoral killing,” he said.

Throughout the nation’s history, there have been tax resisters — from the 18th-century Quakers who refused payment during the French and Indian Wars, to the 19th-century writer Henry David Thoreau protesting slavery by refusing to pay his poll tax, to the estimated 20,000 tax resisters who protested the Vietnam War.

Now, anti-abortion activists are threatening to join their ranks if abortion is offered as a standard benefit in the health-care plan being considered in Congress.

“To compel a man to furnish contributions of money for the propagation of opinions which he disbelieves is sinful and tyrannical,” said James Smith, Washington representative for the Southern Baptist Convention, quoting Thomas Jefferson.

Asking abortion opponents to help fund abortions “is a violation of the very essence of freedom of conscience,” Smith said. If such a thing happens, he added, “I’m sure there will be some Southern Baptists who will seriously contemplate some form of civil disobedience.”

An estimated 1.5 million abortions are performed each year in the United States. Two-thirds of private insurance plans now cover abortions, according to the Alan Guttmacher Institute, a New York-based research group that supports abortion rights.

The federal Medicaid program has not paid for the abortions of poor women, except in extreme circumstances, since 1977. Thirteen states, including New Jersey, do provide funding.

Health-care reform could nullify the restriction. Under President Clinton’s plan, all women would be offered a benefits package that would include abortion. Employers also would be required to help pay for abortion services by providing insurance for their workers.

The cost of abortion represents a tiny portion of health-care spending. Even if taxpayers paid for every abortion in the United States, the cost would amount to $1 out of every $4,000 in the federal budget. Yet there are few more emotional issues in the health-care debate.

“It had to be included,” said Laurence O’Connell, head of a think tank in Chicago called the Park Ridge Center for Health, Faith, and Ethics. But O’Connell, who served on a working group for the President’s health-care package, understands the fixation with the question of abortion.

“It goes to the very heart of what people sense is human,” he said.

To feminists, any health-care plan worthy of the name must include abortion services and help for women who cannot afford to end an unwanted pregnancy.

Since an early-term abortion can cost more than $250, or most of a poor family’s monthly welfare allotment, about 20,000 Medicaid-eligible poor women now carry unwanted pregnancies to term each year, said Rachel Gold, a policy analyst with the Guttmacher Institute.

Protesters may talk about tax resistance, said Marcy Wilder, legal director of the National Abortion and Reproductive Rights Action League. But the issue to her is really about women and who has power over their bodies.

“We don’t think a small group of anti-abortion activists should be able to deny coverage for abortion services to all women in America,” she said.

Jeannie Rosoff, president of the Guttmacher Institute, said abortion opponents already were helping to pay for abortions through private insurance plans.

“If you belong to an HMO that covers 100,000 people, your money goes into a pool and you are paying for other people’s abortions now,” Rosoff said.

But a government using public funds to guarantee access to abortion would cross a terrible line, according to Steven McFarland, director of the conservative Christian Legal Society’s Center for Law and Religious Freedom. His employer has chosen an HMO with strict limits on abortion coverage. He said he feared that government mandates would take away that choice.

In levying taxes, he wondered, “isn’t there a place for respecting issues that are life-and-death issues?”

He said he recognized the potential for havoc that tax resistance has.

“Can a free society afford to give exemptions on the basis of religious conviction? Think about the implications.”

Yet in McFarland’s internal debate between conscience and practicality, his conscience gets the last word.

“Somebody’s just as dead whether I pulled the trigger or wrote a check to the government that pays for someone to pull the vacuum extractor. That child or Viet Cong is still dead.”

For his part, Bishop Balke uses Thoreau to explain his position. Refusing to pay a poll tax as a protest against slavery, Thoreau asked, “Is there not a sort of bloodshed when the conscience is wounded?”

Another version of this article quotes Balke saying: “No health-care plan worthy of that name can include abortion. I’m withholding my taxes if it comes to that. I have no illusion it will stop one abortion. I’ll do it on principle and to make a moral statement about the horror of abortion.”