In , two Brethren-linked groups started war tax resisters’ penalty funds, and the Annual Conference considered two queries on whether or how Brethren churches should refuse to pay the excise tax on their phone bills.

The issue brought this heartening news (source):

No one in the crowd offered bids for the Subaru station wagon, which was being auctioned by the Internal Revenue Service. The IRS had seized it from Stephen and Phyllis Senesi as partial payment of taxes that the couple has refused to pay. As conscientious objectors to paying taxes that fund the US military, the Senesis have withheld about $6,500 over the past five years. Several area peace groups had organized the nonviolent protest at the auction. When the IRS agent called for bids on the car, the crowd responded first with silence, and then with “We choose life over death.” Phyllis Senesi is a member of Skyridge Church of the Brethren, Kalamazoo, Mich.

A letter-writer in the issue tried to turn the tables on the tax resisters, saying their refusal to pay “could mean one less defensive hour by a protective policeman. This failure to defend could result in the undefended death of some person. The person who machinated the tax resistance is an indirect killer; category, murder.” (source)

A news brief an that issue (source) read:

The Midland (Mich.) congregation has voted to withhold the federal excise tax on its telephone bill, saying, “We do not believe that paying for war is loving.” The money withheld will be used to buy peace literature for their library. Since the congregation wants its action to be done publicly and submissively, the witness commission will enclose letters with the monthly payment.

And another on the same page:

Chuck Boyer, peace consultant for the denomination, is compiling a list of people willing to be contacted when someone faces grave financial need because of faithful witness to Christ. Such instances include Brethren who suffer loss because of conscientious objection to payment of war taxes. To join the list, write to Chuck Boyer…

Ford Secrist wrote in to the issue with his “War Tax Dilemma”:

My conscience of recent months has given anguish and now distress, because I do not want to pay the military part of my federal income taxes. I am now a redirector of my war taxes to peace.

My dilemma is that I am treated as a criminal with a lien. I am not a tax dodger or evader. I wish to pay all my taxes for peace. My correct amount has been reported.

The World Peace Tax Fund bill… is one way out of this dilemma. Its goal is a law permitting people morally opposed to war to have the military part of their taxes allocated for peacemaking.…

That issue also brought this news (source):

Two Brethren-related peace organizations have begun tax resister’s penalty funds to support those who conscientiously choose to withhold war taxes. In both cases, the fund reimburses those who have been fined by the Internal Revenue Service, and supporters of the fund share the total cost. The two groups are the North Manchester, Ind., chapter of the Fellowship of Reconciliation and the Iowa Peace Network. For more information, write…

That issue also brought a preview of coming attractions at the upcoming Annual Conference (source):

The Michigan query points out the use of the federal telephone excise tax to pay for past and present military expenditures and states that Michigan District will withhold the tax, redirecting the amount to a peace tax fund. In commending this witness to Annual Conference for study and prayerful consideration, the district is asking for affirmation of the action.

The General Board query asks for the appointment of a committee to study and recommend how Brethren should respond to the dilemma of paying taxes for war.

Walter Fitzsimons wrote an opinion piece for the issue that talked all around the issue of war tax resistance, seemed to conclude that such resistance was futile because it would not stop the march of militarism, then took an about-face and said that even if that is true it could be a worthwhile action of persuasion, but then ended on a write-your-congressman note without taking a stand either way (source).

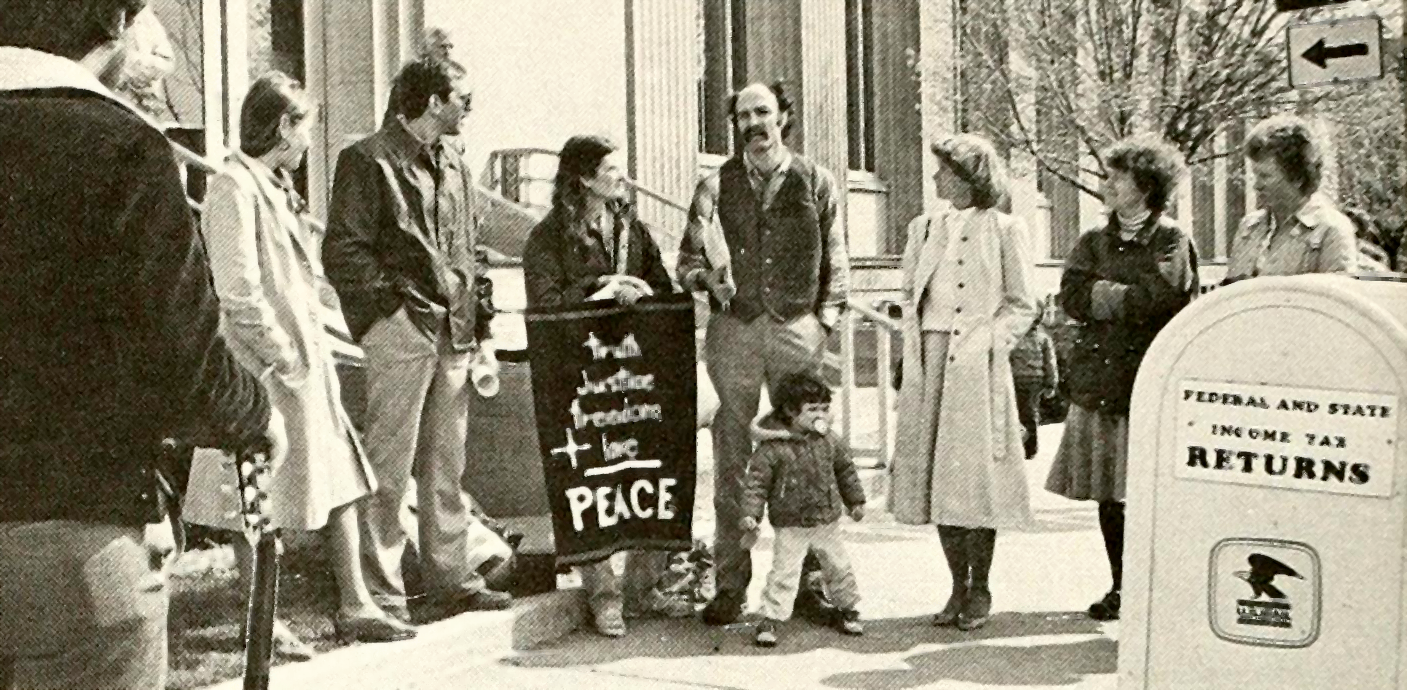

“Church of the Brethren student Mike Yoder (right), of Morgantown, W. Va., helps carry a ‘Bread not Bombs’ banner in a tax-time peace witness. The event was ‘an act of faith,’ said one participant. ‘I am trying to bring evangelism and social action together.’ ”

The issue covered a tax day protest:

Peace group pays taxes with truckload of food

For some Christians, paying the percentage of federal income taxes that goes toward the military is a dilemma. This year, a Harrisonburg, Va., group called Christians for Peace gathered at the regional office of the Internal Revenue Service in Staunton to register their concern. They brought a truckload of food, bought with the money withheld from their tax payments.

“We seek to follow Jesus’ call to be peacemakers by directing our resources away from the instruments of death and toward life,” explained Wendell Ressler, one of the organizers of the event. “We cannot reconcile Jesus’ call to love our enemies with our government’s call to help pay for our enemies’ destruction.” In a short statement to onlookers, he said, “We gladly pay taxes which are used to enrich the lives of others, but it is immoral for our government to play Russian roulette with the future of our planet.”

IRS officials were cordial, but explained that they could not accept the food. The bags of groceries — including more than 1,000 pounds of canned goods — were presented to the Blue Ridge Area Food Bank.

Another article on the same page noted that a Portland, Oregon “Peace” congregation had “voted to withhold the federal excise tax on its telephone bill as a way ‘to say no to militarism and yes to life-affirming programs.’ The money will be sent to the Brethren World Peace Academy…”

The pastor of that Peace Church, Rick Ukena, and his wife Twyla Wallace were profiled in the issue (source). Excerpt:

Just before Rick left the pastorate of Peace Church of the Brethren in Portland, Ore., he and his wife, Twyla Wallace, discussed with me their refusal to pay war taxes. “Refusing to pay that portion of our taxes that goes for military purposes is merely an extension of the decision I made in [to become a conscientious objector],” Rick says. “Paying taxes for war is no different from providing bodies for military purposes.”

Rick likens their present witness to that of past Brethren: “Historically, the Church of the Brethren youth have been conscientious objectors to military service. Military tax resistance is an equally important statement for peace.”

, Rick and Twyla have redirected a portion of their federal taxes as an effort to lift up their opposition to current priorities of the federal budget. With the filing of their returns, they sent that portion to Health Help, a low-income health clinic in Portland. “Nevertheless,” says Rick, “the IRS, during that time, has seized over $1,000 from our checking account for non-payment of taxes.” A lien was also threatened against the Portland congregation, since the IRS ordered the church to pay Rick and Twyla’s taxes. In a specially called members’ meeting, the IRS demand was turned down by a unanimous vote.

“We were joyed with the support that we received from the congregation as it was placed in a position of choosing between compliance with human laws aimed at destroying life and a higher order that commands us to love one another, even our enemies,” Rick says.

As mentioned above, there were two items concerning war tax resistance on the Annual Conference agenda in . The issue tells us how they fared (source):

The delegates established a committee to study and recommend how the Brethren should respond to the dilemma of paying taxes for war. Brought by the General Board, the query on taxation for war said that “our government continues to put its faith in weapons that can destroy all human life on our planet.” The query also pointed out that expenses for present and past military efforts currently total about one-half of all federal expenditures.

The concern of the related query, a Michigan District resolution on telephone tax redirection, was adopted by the delegates, and the issue of telephone tax withholding was assigned to the war tax committee. Michigan District voted in to withhold federal excise taxes on district telephone bills, and to inform the Internal Revenue Service of the action.

It’s hard to believe that at this point there was much more for yet another a committee to say on the issue, so many similar committees had been formed and had issued reports in recent years. This committee would consist of Philip W. Rieman, Arlene E. May, Violet Cox, Richard O. Buckwalter, and Gary Flory.