Some links that have whizzed by my screen in recent days:

War Tax Resisters

- A new edition of The Debt Resisters’ Operations Manual, a project of Strike Debt! has a chapter on Tax Debt: The Certainty of Debt and Taxes that was partially inspired by NWTRCC’s material on the subject. (There was some idea-swapping between the Strike Debt crew and war tax resisters at the NWTRCC national gathering in New York last fall.)

- William Ruhaak of has penned a piece on war tax resistance for Pax Christi U.S.A.’s blog. He invites readers who are struggling with their consciences over the issue of paying for war with their taxes to begin by writing and sharing a “statement of conscience.”

- Esther Epp-Tiessen, of Ottawa’s branch of the Mennonite Central Committee, addresses war tax resistance as protest and as conscientious objection:

Do we use our limited resources of time and money primarily to advance the idea of war tax resistance and a legal peace tax fund for conscientious objectors? Or do we use those resources to speak to the larger policy framework and ethos? To put it crassly, do we advocate for special accommodations for the few? Or do we confront the system that says peace can be built through war and military force?

- Martin Newell has engaged in a variety of anti-war civil disobedience actions, and he was sentenced to 28 days in prison for refusing to pay the fines for his previous convictions. He explained:

Jesus taught us to love not just our neighbours but also our enemies. He showed us by his life and example how to resist evil not with violence but with loving, persistent, firm, active non-violence. It was this revolutionary patience on behalf of the poor and oppressed that, humanly speaking, led to him being arrested, tried, tortured and executed by the powers that be. The acts of witness that resulted in the fines I have refused to pay were a form of conscientious objection. Refusing to pay them is a continuation of that objection. It is a privilege to be able to follow on the path that led Jesus to the way of the cross and resurrection.

Italy

While everyone was busy watching the kerfluffle in Crimea, the people of Venice voted to restore the Venetian Republic and secede from Italy. Italy itself is disregarding the vote and claiming that Venice has no authority to secede. So the movement is moving on to stronger measures. They are taking ideas from other separatist movements: The referendum itself was inspired by a similar effort in Scotland, and they plan now to redirect their federal taxes to the local government, which is a technique they picked up from the Catalan nationalists.

Some are even taking some inspiration from the “Tea Party” apparently. Check out this flashy video:

Netherlands

Christiaan Elderhorst writes about the recent imprisonment of Toine Manders for his work counseling tax avoidance:

Toine Manders works at the Haags Juristen College (Hague Lawyers Board) and specializes in tax avoidance. Manders refers to tax avoidance as a moral duty. Tax revenue is used by the state to pay for war, prisons, the militarization of the police force and the regulatory agencies which constantly privilege big business. This moral duty is connected the Haags Juristen College’s former business practice which was to help individuals avoid the military draft. Avoiding the draft and avoiding taxes are both ways by which personal contribution to state oppression and war is reduced. Calling this a moral duty is not a far-fetched idea.

Austria

Gerhard Höller, a tobacconist from Wagrain, has launched a one-man tax strike.

“Something has to happen at the grassroots, so that those on top notice how much discontent there already is among the population,” says Höller. He was actually a completely apolitical man, he stressed, but the scandals and the squandering of tax money — “from Eurofighters to the Hypo bailout” — had gotten on his last nerve. “Enough is enough.”

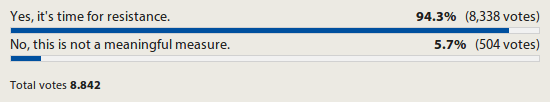

When I last visited the site with the article covering Höller’s case, it had a reader poll attached to it that asked people to give their opinion of tax resistance as a protest tactic:

Venezuela

I’m hearing a lot of buzz in the twitterverse about tax resistance as a possible component of the ongoing demonstrations in Venezuela, but I haven’t found much more solid information yet. Here’s an example:

“Don’t Pay Income Tax in Civil Disobedience. Tax Resistance! It is legitimate and legal as enshrined in article 350 of our Constitution [‘The people of Venezuela, true to their republican tradition and their struggle for independence, peace and freedom, shall disown any regime, legislation or authority that violates democratic values, principles and guarantees or encroaches upon human rights.’]. Right now the Castro-communist regime is transgressing the democratic values, principles, and guarantees and is undermining the human rights of all Venezuelans. Don’t finance the regime!”

England

Another council tax rebel has been jailed. Ross Longhurst stopped paying his council tax in protest against budget cuts:

“These particularly impact on poor people,” he told the court. “We live in a country where the rich are getting richer and the poor are getting poorer.”

He claimed there were 20,000 people in Nottingham in council tax arrears.

“I refuse to pay in solidarity with and in support of the victims of austerity measures. I encourage everyone in court, including the magistrates, don’t pay up.”

Magistrates explained to Longhurst, who arrived with a large group of supporters, that he was likely to go to prison if he refused to pay. Justices even urged him to consult with a duty solicitor. But he confidently said he he had spoken with a lawyer and he did not think there was any need for him to see another one.

Another account adds that “[a]s he was led down to the cells by prison guards he was applauded by his supporters and one could be heard shouting: ‘It’s absolutely disgraceful.’ ”

One of his supporters, who did not want to be named, said afterwards: “It is a travesty that he has been jailed. It is disgusting, he is an elderly man who was trying to make a stand, he was trying to make the area a better place and this is why he is now behind bars. He has worked and paid council tax, but as all of us do, he got sick of it, he was braver than everyone because he stood up for what he thought was right.”