In a recent report published for Congress by the Taxpayer Advocate Service, an overseer organization of the IRS, the figure for the total estimated tax gap attributed to noncompliant taxpayers was given as $310.6 billion.

(The tax gap is defined as the difference between total earned income and total income reported.)A further breakdown of the numbers shows $30.1 billion was lost because people failed to file tax returns, $248.8 billion was lost to underreporting income and $31.8 billion was lost to underpaid taxes. In effect, the IRS concludes that a full 15 percent of taxpayers are noncompliant, though not necessarily criminals. Tax fraud or evasion by individuals, as opposed to corporations, is overwhelmingly responsible for the tax gap, especially from incomes based on easily concealed cash transactions.

How you can resist funding the government → other tax resistance strategies → tax evasion / fraud → the “tax gap”

A section from Bruce Bartlett’s paper Tax Reform Agenda For The 109th Congress notes that tax evasion seems to be on the rise:

At the same time that the corporate income tax is being undermined largely by legal tax avoidance, the personal income tax is increasingly being eroded by tax evasion. The best data we have on this comes from comparing the Internal Revenue Service’s measure of adjusted gross income taken directly from tax returns to the Commerce Department’s measure of AGI compiled from data on wages, interest and dividends paid by businesses. In , the gap between these two figures reached $961.1 billion or 13.7 percent of the Commerce Department’s estimate of AGI. This is the largest gap . It suggests that the federal government is losing at least $100 billion per year just due to the non-reporting of taxable income on personal tax returns.

Some news on tax evasion from TaxWire:

The IRS’s efforts to shrink the tax gap — the difference in the amount of taxes owed and taxes paid — must improve significantly to preserve the public’s confidence in the tax system and help offset mounting deficits, panelists agreed on .

Speaking at the American Bar Association Section of Taxation’s midyear meeting in San Diego, National Taxpayer Advocate Nina Olson and copanelists David Cay Johnston, reporter for The New York Times, and Patrick Heck, Democratic chief tax counsel for the Senate Finance Committee, suggested that recent estimates of a $250 billion to $300 billion tax gap are probably not accurate — and are very likely too low.…

Olson also suggested that increasing compliance, and therefore reducing part of the tax gap, depends on changing social norms. She said the largest section of the tax gap — roughly 67 percent — results from nonreporting and underreporting by self-employed individuals, typically on income that is not subject to information reporting.

The social norm among that group is that it is all right not to report income, Olson said. “What kind or resources does it take to change the social norm?” she asked, suggesting that the IRS needs a nationwide strategy to clean up the “entire environment” of noncompliance.

Just how widespread is tax evasion? Well, according to an IRS study of ’s individual (non-corporate) federal income tax returns, more than 15% of what people owe they don’t pay and the IRS fails to recover through audits and other enforcement mechanisms.

The difference between what U.S. taxpayers owe the U.S. government and what they actually pay on time totals more than $300 billion a year, the Internal Revenue Service said on .

A research project at the federal tax agency found that the U.S. tax gap ranged from $312 billion to $353 billion in , compared with an earlier estimate of $311 billion. The project assessed individual, not corporate, taxes.

IRS enforcement activities helped recover about $55 billion of that total gap, leaving a net tax gap of $257 billion to $298 billion… That yields a noncompliance rate of 15 percent to 16.6 percent…

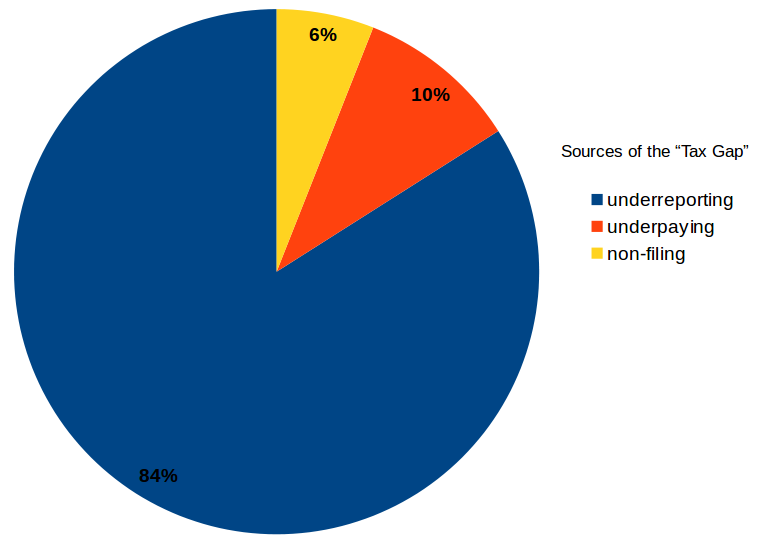

The biggest culprit was underreporting of income, which accounted for more than 80 percent of the total tax gap. Non-filing and underpayment each accounted for about 10 percent of the gap, the IRS said.

A facts & figures report (PDF) from the IRS breaks down the numbers even further, and also has a lot of data about how enforcement has changed over .

Some possibly good news from Bloomberg:

Americans avoided paying taxes on a record $1 trillion in income in , according to a new federal government report. ¶ The annual study by the Commerce Department’s Bureau of Economic Analysis shows the gap between true income and the amount Americans reported on income-tax filings has increased 35 percent

While this news report plays up the possibility that more people are cheating more brazenly on their taxes, I’m not convinced that this is necessarily the case. The BEA report compared its estimates of how much income people received with what people reported to the IRS as Adjusted Gross Income. But Adjusted Gross Income is usually adjusted in such a way as to reduce it, quite legally and ordinarily, from what the BEA considers your income (an exception to this would be capital gains, but , in the wake of the dot com bust, for all I know there were more capital losses than gains to report anyway). There are new ways to reduce Adjusted Gross Income now that weren’t an option before or were less-valuable; perhaps this is just measuring that.

On I wrote about a new report on the “tax gap” — the difference between the money people earn and what they report to the IRS. I was skeptical that the report was actually measuring what it was reported to be measuring. For more on that debate, from people who are more qualified than I on the subject, click here.

Roth & Company “Tax Updates”, in the course of discussing that recent tax gap report, includes a snippet from James Surowiecki’s The Wisdom of Crowds on “the collective problem of how to get people to pay their taxes”:

[T]here are three things that matter. The first is that people have to trust, to some extent, their neighbors, and to believe they will generally do the right thing and live up to any reasonable obligations. The political science professor John T. Scholz has found that people who are more trusting are more likely to pay their taxes and more likely to say it’s wrong to cheat on them. Coupled with this, but different from it, is trust in the government, which is to say trust that the government will spend your tax dollars wisely and in the national interest. Not surprisingly, Scholz has found that people who trust the government are happier (or at least less unhappy) about paying taxes.

The third kind of trust is the trust that the state will find and punish the guilty, and avoid punishing the innocent… If people think that free riders — people not paying taxes but still enjoying all the benefits of living in the united states — will be caught, they’ll be happier (or at least less unhappy) about paying taxes. And they’ll also, not coincidentally, be less likely to cheat.

If Surowiecki is right, then those of us who oppose the funding of government can possibly invert this and try to attack those three pillars of support for taxpaying. The easiest of these pillars to attack may be “trust that the government will spend your tax dollars wisely and in the national interest.” And to address that point, here’s “Cicero” from To The People:

I’ve never liked saying that members of Congress spend money like drunken sailors, because sailors spend their own money whereas politicians spend other people’s money. But, no matter what you call it Congress is out of control. An Webmemo by the Heritage Foundation shows conclusively that Bush and the Republican Congress have plundered our nation.…

Highlights:

- Federal spending has grown twice as fast under President Bush as under President Clinton. In , inflation-adjusted federal spending neared $22,000 per household, the highest level since World War Ⅱ.…

- While members of Congress claim there is no “fat” left in the federal budget, Heritage claims otherwise:

- The Defense Department wasted $100 million on unused flight tickets and never bothered to collect refunds even though the tickets were refundable.

- The federal government spends $23 billion annually on special interest pork projects such as grants to the Rock and Roll Hall of Fame or funds to combat teenage “goth” culture in Blue Springs, Missouri.

- Washington spends $60 billion annually on corporate welfare, versus $43 billion on homeland security.…

- Over one recent 18-month period, Air Force and Navy personnel used government-funded credit cards to charge at least $102,400 for admission to entertainment events, $48,250 for gambling, $69,300 for cruises, and $73,950 for exotic dance clubs and prostitutes.

And for those Republican loyalists see the evidence that Congress and the Dubya Squad have been inflating the size and power and hunger of the federal government, who respond by saying “at least they’re cutting taxes”… I present for your consideration Dubya’s Treasury Secretary John Snow bragging that Washington has taken in the “highest level of federal receipts in history” since Dubya signed the Jobs and Growth Act.

The IRS finally finished crunching the numbers on their study of the “tax gap” — the difference between what they think people should have paid and what they did pay. The numbers were in-line with earlier estimates: “The IRS estimated that the gross ‘tax gap’ stands at $345 billion annually. The IRS recaptures about $55 billion of this through enforcement actions, leaving a net gap of $290 billion.”

The TaxProf Blog has a list of a number of papers that the Statistics of Income Division of the IRS released along with its “tax gap” report.

While we’re on the subject — just how much tax evasion is there in the United States today? Does anyone know? The IRS has its own guess (around $350 billion), but the Treasury Inspector General for Tax Administration doesn’t think much of it.

Among the side notes of TIGTA’s study is a survey of 1,033 IRS managers asking their opinions about the “tax gap.” One of the questions asked the managers to pick from a list of thirteen “the top five reasons for [tax] noncompliance, in the order of frequency.”

When the thirteen items were then ranked, “Form of protest” (that is, “conscious willingness to not comply because of disagreement over government policies or actions such as war, social programs, or similar”) came in at #6. 6% of the IRS managers considered it the number one reason they encounter for why people don’t pay their taxes (on the other hand, 66% of the managers didn’t even list it in the top five).

The “tax gap” — the difference between what the law requires taxpayers to pay and what they actually fork over — is usually reported as being about $300 billion. This number is based on a study, which in turn extrapolates from the results of earlier surveys. The numbers are stale, and weren’t all that good to begin with, but they’re about all we have.

A new report from the IRS shows how they plan to address this gap and to obtain fresher figures.

One thing I noted while skimming through the report is that although the tax gap estimate does include taxes due on income from the “underground economy,” it apparently does not include income from that part of the underground economy that is itself illegal (such as the drug trade):

…IRS estimates of the tax gap are associated with the legal sector of the economy only. Although tax is due on income from whatever source derived, legal or illegal, the tax attributable to income earned from illegal activities is extremely difficult to estimate.

Perhaps when this part of the tax gap is unearthed and brought to light, our cruel and tedious national experiment with prohibition will finally end.

The U.S. Government Accountability Office says that it believes “at least 61%” of sole proprietors in the U.S. underreported their net business income for the tax year.

“Aha!” says Congress, “we’ve found the Fountain Of Tax Gap! Let’s tap it!” Trouble is, the bulk of sole proprietors have total receipts of under $25K. You’ve got to squeeze a lot of them to get a cup of juice.

The IRS last tried to figure out the “tax gap” — its name for the difference between how much tax the law obligates people to pay and what the government successfully squeezes out of them — based on data from the tax year.

It has occasionally released reports on the tax gap since then, but these have just been statistical extrapolations of the data from the 2001 survey.

But the IRS has been working on a new study of the tax gap, based on tax year , the results of which they released this afternoon — Friday afternoon, which is usually the time chosen by government agencies to release reports they hope the news media will ignore. This is probably a sign that the report isn’t good news for the IRS, so let’s take a closer look.

First, though, look at this summary graphic that purports to show where the gap comes from — which taxes, and which varieties of collection failures (nonfiling, underreporting, and underpayment). Note that only for the “underpayment” category does the IRS claim to provide “actual amounts” — this is only about 1½% of the total tax, and 10% of the estimated gross tax gap. The rest of the gap is based on estimates (some based on data last collected as far back as 1984!), although in some cases the agency could not even provide estimates. This was also true of the numbers.

The agency reports little change between and in the rate of taxpayer noncompliance. The rate is slightly higher in (with 16.9% of taxes not voluntarily paid on-time, and 14.5% remaining uncollected after IRS enforcement activity), but within the margin of error of the earlier estimates.

The total amount of “underpayment” (that is, amounts that people or corporations declared that they owed, by filing forms or what-have-you, but failed to actually remit by the deadline) — the only part of the new estimates that the IRS had the capability to directly measure rather than estimate — rose in from $33 billion to $46 billion, a 39% increase. This, while the estimated total tax liability only rose 26%, from $2,112 billion to $2,660 billion.

What I take away from glancing at this report is 1) the IRS didn’t make any headway on tax compliance , and may have lost ground if you think there is reason to suspect that they have been generous in keeping their extrapolated estimates flat while their actually-measured numbers took a leap; and 2) that the government doesn’t really have a very good idea of how big the tax gap is or where its biggest problems are. These are the best numbers it has, and they are so loosely guesstimated as to inspire little confidence in their accuracy.

A common argument against tax resistance goes something like this: The government will add penalties and interest and such to the amount you refuse to pay, and when they eventually wring the money out of you, in the end you’ll have given even more financial support to the government than you would have if you’d just paid up in the first place.

Today I’ll show you some evidence that I hope will convince you that this is not a very good argument.

Lots of people don’t pay the IRS what the agency thinks they should. The IRS has tried to figure out where this missing money is hiding, but their methodology isn’t all that great, and it’s not an easy mystery to solve.

Their best guess is that the vast majority of missing taxes comes from “underreporting” — that is, taxable activities that the IRS never becomes aware of. For example: if you placed a bet with a friend on the outcome of the Super Bowl, the winner of that bet should have added the amount won to their income and should have paid taxes on it, according to the IRS anyway. Most people don’t go out of their way to report taxable transactions like these that the IRS wouldn’t learn about on its own, and so a lot of these transactions never get taxed and they stay in the “underground economy.”

An estimated 84% of the “tax gap” comes from unreported taxable activities like these. Another 6% comes from taxable activities the IRS does learn about, but for which the responsible party never bothers to file a tax return. The remaining 10% comes from people whose tax debt is registered on paper according to Hoyle, but who never get around to forking over the money.

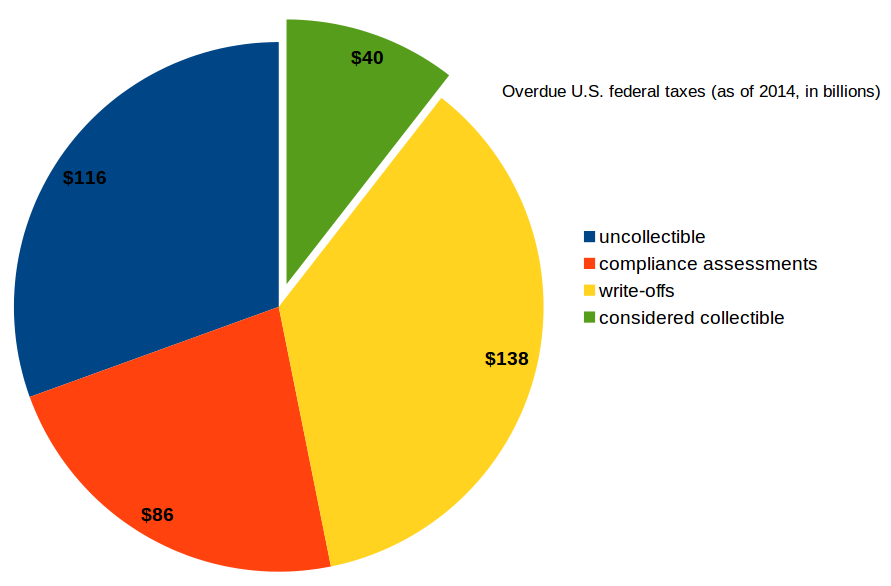

According to IRS financial statements for , there were at that time about $380 billion in outstanding unpaid taxes that it knew about. This includes about $205 billion in interest & penalties added to the originally-due taxes, but it does not count any taxes that people have thus far successfully evaded by keeping out of the IRS’s view — that is, all the stuff in the 84% blue area above. It also doesn’t include amounts that the agency can no longer pursue because the statute of limitations has expired.

Of that $380 billion, the agency considers $116 billion to be “currently uncollectible” (“primarily because of the economic situations of the taxpayers”). Another $86 billion is something called “compliance assessments” — which I think means the IRS tells a taxpayer who hasn’t filed a return (or a fully-revealing one) what the agency suspects the taxpayer would have owed if they had filed accurately, but the taxpayer isn’t going along with it and the controversy is still in limbo. The agency doesn’t have much confidence in collecting this money either. There is also a category called “write-offs” that totals $138 billion. This is tax debt that is hopelessly uncollectible because the taxpayer is bankrupt, insolvent, dead, vanished into thin air, or something of that sort. That only leaves about ten percent of the total that the IRS considers to be collectible and includes as a potential asset on its financial statements.

So to $175 billion in unpaid taxes, the IRS has added $205 billion in interest & penalties, but it only expects to collect $40 billion of the total (in recent years it has actually collected closer to $46–49 billion per year by means of its enforcement arm, so it may somewhat exceed its expectations). This I think shows conclusively that people who don’t pay their taxes do not, in the aggregate, ironically end up paying more to the government.

of the $380 billion owed to the IRS in back taxes, the agency only hopes to collect the $40 billion green slice of the pie

For tax resisters — who are typically alive, solvent, and often have seizable assets and income streams — the news isn’t quite as good as this chart would suggest. But even from juicy targets like us, the IRS fails to seize enough money in penalties and interest from some of us to make up for the money it fails to seize from those of us it lets slip through its clutches.

An informal survey of war tax resisters a few years back, for example, found that the IRS had successfully seized only about 25% of what those resisters had refused to pay.

In addition, it is costly for the agency to deploy its collection apparatus: sending out all of those letters, filing liens & levies, managing the associated bureaucracy — all of that costs money. The IRS spends about $5 billion dollars on enforcement (including investigations, audits, and collection), and so resisters contribute to this additional cost of the government conscripting our support.

So if you are hesitating to refuse to pay taxes because you worry that by doing so you may inadvertently swell government coffers… I hope this has reassured you that in the aggregate, tax resisters do indeed cost the government money.

The IRS today released a new estimate of the “tax gap”, or what the gap was on average during the span. (See ♇ 6 January 2012 for their previous report, on the tax gap.)

In summary, the IRS estimates that Americans “voluntarily” and on-time cough up 81.7% of what is due, and the agency successfully shakes down the reluctant for an additional 2%, leaving 16.3% uncollected.

The agency says that although the gross (voluntary/on-time) and net (total) tax gaps rose 1.8% and 5.5% respectively from those reported in the previous estimate, this does not in their opinion indicate that noncompliance is increasing and the tax gap is growing larger. Instead, they say “improvements in the accuracy and comprehensiveness of the estimates” is to blame, which is another way of saying the earlier estimates were probably too low and should be retrospectively increased.

Here is some data on where the agency thinks the missing money is hiding:

| component of gross tax gap | average annual amount | as a percent of the total |

|---|---|---|

| nonfiling | $32 billion | 7.0% |

| underreporting | $387 billion | 84.5% |

| underpayment | $39 billion | 8.5% |

| source of gross tax gap | average annual amount | as a percent of the total |

|---|---|---|

| individual income tax | $319 billion | 69.7% |

| corporate income tax | $44 billion | 9.6% |

| employment tax | $91 billion | 19.9% |

| estate/excise taxes | $4 billion | 0.9% |

| source of net tax gap | average annual amount | as a percent of the total |

|---|---|---|

| individual income tax | $291 billion | 71.7% |

| corporate income tax | $35 billion | 8.6% |

| employment tax | $79 billion | 19.5% |

| estate/excise taxes | $1 billion | 0.2% |

I haven’t seen the complete report, only a summary, so I haven’t learned much, and I don’t know which of their method changes resulted in the higher estimates — or whether their claim that there was no underlying change in taxpayer behavior is plausible.

- Greek “won’t pay” movement activist Stratos Daskarolou was recently sentenced to a 42-day prison term for refusing to pay road tolls. Supporters of Daskarolou rallied in Kalamata, and one supporter, Zoe Konstantopoulou, former speaker of the Hellenic Parliament, filmed herself driving from Athens to Kalamata, lifting the tollgates out of her way along the path.

- Filmmakers in Tamil Nadu have halted all film releases. They are protesting against the state’s refusal to lift a 10% entertainment tax in the wake of the launch of the new nationwide 28% goods and services tax. In a typical year, “Kollywood” puts out hundreds of films worth hundreds of millions of dollars at the box office.

- “Employees of the Internal Revenue Service are the target of a fast rising number of threats…”

- Uhuru Kenyatta, president of Kenya, told vendors at Kongowea market to stop paying regional taxes. He also said he had instructed police not to act against tax resisters. From the looks of things, this is part of a feud between Kenyatta and political rival Ali Hassan Joho, governor of Mombasa.

- As I mentioned , disgraced credit reporting agency Equifax was untimely awarded a no-bid fraud prevention contract by the IRS. Howls of outrage ensued. Then the Equifax website was hacked, tricking visitors into installing malware. That was the excuse the IRS needed to back out of the contract.

- A columnist for the Dallas News created an #EverybodyFileAProtest campaign, encouraging people in the Dallas-Fort Worth area to challenge their property tax assessment. He claims 40,000 more people than usual have filed protests so far this year. “The idea was to clog up the system so that appraisal districts would settle informally, either in person or online, with homeowners to avoid so many appeal hearings.”

- Widespread resistance to the “soda tax” in Cook County, Illinois, led the Board of Commissioners to repeal the two-month-old tax on a 15‒1 vote.

[A] significant number of residents of Cook County began buying their soda and other sweetened beverages of choice outside the city limits. Yes, you read that correctly. The passage of the Cook County Soda Tax spurred residents to go out of their way to make sure that they bought their sugary drinks in other counties. They basically began importing their own sugary drinks — thus depriving the County not only of revenues from the new Soda Tax but all other tax revenues from those sales (or other sales that might occur in conjunction with those sales) as well. And of course this also meant depriving Cook County businesses of their own revenues from those sales — with some retailers reporting overall beverage sales declines of up to 47%.

But more embarrassing yet for the County, sugar-addled tax protesters even began tweeting about it — posting pictures of their receipts from sugary drink purchases outside of Cook County (many of which were promptly picked up and retweeted by the more beverage industry organized forces pushing for retail).

- Jay A. Soled and James Alm suggest that the “tax gap,” between what the government thinks people should pay and what they actually pay, is going away. This for three reasons: diminishing use of cash is making transactions easier for the government to track; the databasification of everything is making it easier to surveil the population; and globalization & concentration means more people are employed by large firms, which shrinks the underground economy.

Some links from here and there:

- The new U.S. government policy of denying passports to people with large federal tax debts is beginning to get more fundamental criticisms. Here’s Kevin D. Williamson at National Review:

The U.S. government is building the world’s largest debtors’ prison: the United States.

The right to travel is — like the right to free speech, the right to be free from unlawful search and seizure, and the right to petition the government for redress of grievance — a basic civil right. Americans as free people have a God-given right to come and go as they please, irrespective of the preferences of any pissant bureaucrat in Washington. Yes, we curtail people’s rights in certain circumstances — when they have been charged with a crime and convicted after due process. Tax fraud is a crime; having unpaid taxes is not.

- “What is War Tax Resistance? Inspiration, Calculation, and the Face of Evil.” Graham Smith introduces war tax resistance to the anarchist / voluntaryist community, and gets some enthusiastic responses in the comments.

- Those businesses in Connecticut that rely on road transport plan to protest new tolls and gas & tire taxes by surrounding the state Government Center with their vehicles.

- According to a new study, the “tax gap” — the difference between what the law says people owe and what they actually cough up — has probably been vastly underestimated. This is because the very wealthy evade taxes at a higher rate, and have more access to more sophisticated tax evasion strategies, than the rest of us, and the tax gap estimating methodologies don’t sufficiently take this into account. This is more ammo for the “rich people don’t pay their fair share” argument. The researchers concentrated on Scandinavia, and took advantage of data revealed in the Panama Papers and related leaks. They found that while on average 3% of personal taxes are evaded in Scandinavia, households in the top 0.01% of net wealth evade taxes on about 25% of their income via the use of offshore accounts.

- Traders in the Bakaara Market in Mogadishu closed their doors in a hartal to protest tax hikes.

The U.S. Government Accountability Office has issued its latest financial audit of the IRS.

The report reiterates what we already knew — that most of what people fail to hand over to the government voluntarily, and the interest & penalties that the IRS adds to those amounts, the government never collects and never really expects to:

Analysis of Unpaid Assessments — Most Unpaid Assessments Are Not Receivables and Are Largely Uncollectible

The unpaid assessment balance includes amounts owed by taxpayers who file returns without sufficient payment as well as amounts assessed through the IRS enforcement programs. As reflected in the supplemental information to the IRS Financial Statements, the unpaid assessment balance was $398 billion… Of the total unpaid assessments balance, $215 billion (54 percent) consists of interest and penalties. Also, 45 percent of the total outstanding balance of IRS unpaid assessments is largely uncollectible because it is composed of compliance assessments and write-offs.… Write-offs are assessments considered to have no future collection potential.

A table further on in the report details this:

(In Billions) 2018 2017 Federal taxes receivable, net $58 $52 Total unpaid assessments $398 $382 Compliance assessments (65) (74) Write-offs (115) (111) Gross federal taxes receivables 218 197 Allowance for uncollectible taxes receivable (160) (145)

The report also offered the latest estimate of the “tax gap”:

The gross tax gap is the amount of true tax liability for a given tax year not paid voluntarily and/or timely. The most recent estimate of the gross tax gap is $458 billion.…

There are three primary sources of noncompliance:

- nonfiling tax gap (the tax not paid on time by those who do not file required returns on time;

- underreporting tax gap (the net understatement of tax on timely filed returns); and

- underpayment tax gap (the amount of tax reported on timely filed returns not paid on time).

The estimated noncompliance of each of these components is $32 billion for nonfiling, $387 billion for underreporting, and $39 billion for underpayments. Additionaly, the gross tax gap can be grouped by type of tax, as follows:

- $319 billion for individual income tax,

- $44 billion for corporation income tax,

- $91 billion for employment tax, and

- $4 billion for combined estate and excise tax.

The net tax gap is the gross tax gap less tax subsequently collected for a tax year either voluntarily or from IRS administrative and enforcement activities. As a result, the net tax gap is the portion of the gross tax gap that will not be paid. The portion of gross tax gap to eventually be collected is estimated to be $52 billion, resulting in a net tax gap of $406 billion. The estimated net tax gap by type of tax is:

- $291 billion for individual income tax,

- $35 billion for corporation income tax,

- $79 billion for employment tax, and

- $1 billion for combined estate and excise tax.

In other news:

- One of the tools the IRS uses against tax scofflaws like myself is to file a federal tax lien in the local court system of the scofflaw. This puts creditors and the local legal system on notice that the IRS intends to step in and assert its rights to seize money. This can make it difficult to get credit, and also makes it easier for the feds to seize anything awarded by the courts in lawsuits, probate resolution, etc. However (and this is where it gets interesting and newsworthy), filing a lien costs money. And the IRS thinks several California counties are charging them too much, and so they have started to refuse to pay. In response, some counties are refusing to process the IRS liens. Alas, this filing fee, and the standoff between the bureaucracies, also applies to paperwork to release a previously-filed lien. So this doesn’t always work in the scofflaw’s favor. Here’s some news coverage:

- War tax resister Larry Bassett was interviewed on the Parallax Views podcast. Bassett is the subject of the recent documentary film The Pacifist and is responsible for the largest known individual act of war tax resistance, in terms of the amount of dollars resisted at once.

- Another Treasury Inspector General for Tax Administration report points out that reduced IRS resources means collapsing tax enforcement capability. “As more taxpayers experience little to no consequences for non-filing, the long-term impacts may include potential erosion of the voluntary compliance rate.”

- Via a review by Ariel Jurow Kleiman of Marjorie E. Kornhauser’s American Voices in a Changing Democracy: Women, Lobbying, and Tax 1924–1936, I learned of a “Meat Strike” meant to protest New Deal-era taxes on meat processing by boycotting meat purchases. The offensive tax was eventually thrown out as unconstitutional.

- The IRS issued an update to its estimate of the “tax gap” (the difference between how much tax people are supposed to pay and how much they do pay). The upshot is that they think little has changed: people pay about 84% of what the agency believes they owe. However, the last time I looked at the details of one of these “tax gap” reports, I noticed a lot of hand-waving, guesswork, and extrapolation, and only a little empirical data collection, so I would recommend taking these numbers with a grain of salt.

- More attacks on traffic ticket issuing radar cameras — in France & Italy; Mexico, Germany, and France; and France again. Revenue from the cameras is only half of what the government had hoped for and budgeted for in France this year, and the government has had to divert some of that money to installing more heavily-fortified cameras.

- The simple home of war tax resistance legends Juanita & Wally Nelson in Deerfield, Massachusetts has been restored as a “living memorial” to the inspirational couple.

- The 15th International Conference on War Tax Resistance and Peace Tax Campaigns will be held in Edinburgh. The last such conference was held in in Bogotá, Colombia.

As I mentioned , IRS Commissioner Charles Rettig reported to Congress that the agency’s estimates of the “tax gap” have been far too low and the real number is more than double what has been reported: as much as $1 trillion dollars per year.

The “tax gap” is defined as the difference between what the tax laws say people ought to be paying in taxes to the federal government and what they actually cough up when all is said and done. To put the $1 trillion figure in perspective, the IRS collects about $2 trillion in individual federal income tax each year. That’s a lot of tax evading.

But it’s also kind of phony, in that nobody expects that any amount of tax enforcement is going to bring in an extra $1 trillion or anywhere near it. The voting public wouldn’t tolerate being suddenly milked for an extra tril’, nor for the more invasive IRS that would be required to find it.

However, the Biden administration is hoping they can get their hands on at least some of that yearly trillion by boosting the IRS enforcement budget. That way, if things go according to plan, they can have more revenue to play with without taking the political hit of raising tax rates or expanding the tax base. (Though they want to do all that, too, but hope you’ll believe it’ll only tap people richer than you.)

Recent links of note:

- The Catalan independence group Assemblea Nacional Catalana asked the Generalitat de Catalunya to give formal legal protection to taxpayers who send their taxes to the Catalan regional government rather than to the Spanish central government. Currently, the Catalan tax agency forwards such payments to the Spanish government, so resisters who pay their taxes to Catalonia instead of Spain are engaging in a mostly-symbolic action. But separatists hope that the Catalan government at some point could end such forwarding, or threaten to do so, as a tactic to further the cause of independence.

- The military junta in Myanmar is sending soldiers door to door to threaten to kill resisters who have been refusing to pay government bills.

Myanmar’s shadow Opposition government, the National Unity Government, has urged the public to stop paying for electricity. In , it said that 97 percent of people in Mandalay and 98 percent in Yangon had done so, costing the regime $1 billion by that point.

For a while now, U.S. taxpayers have been able to access some of their tax records held by the IRS via the agency’s on-line portal. This required a somewhat onerous process of signing up for an account — a process that’s a bit more invasive and difficult than signing up for a similar account at your bank. I’ve tried to talk a few war tax resisters through the process because it can be useful to have better visibility into what information the IRS is assembling about you. But often, they throw up their hands at some point and say it’s not worth it, because it really does seem like more trouble than it ought to be.

Apparently it wasn’t nearly awful enough yet. “We’re bringing you an improved sign-in experience,” says the agency. Improved how? Read it and weep.

The agency says that by , the only way to log in to irs.gov will be through ID.me, an online identity verification service that requires applicants to submit copies of bills and identity documents, as well as a live video feed of their faces via a mobile device.

[C]ompleting the process requires submitting at least two secondary identification documents, such as as a Social Security card, a birth certificate, health insurance card, W-2 form, electric bill, or financial institution statement.

After re-uploading all of this information, ID.me’s system prompted me to “Please stay on this screen to join video call.” However, the estimated wait time when that message first popped up said “3 hours and 27 minutes.”

- The income of “closely-held businesses” (Schedule C / pass-through / non-corporately structured) in the United States is taxed at special rates and with special rules, but on the owners’ individual tax returns. A new report from the Urban-Brookings Tax Policy Center says that these special rules, combined with some clever gaming of the rules and some outright noncompliance, mean that about half of that income goes completely untaxed.

- More traffic ticket radar robots fell to gunfire, paint, and fire in the ongoing human rebellion, in New York, Kazakhstan, France, Germany, and Italy, in recent weeks.

- The latest encouraging trend: clever children as young as nine years old launching distributed denial of service attacks against the computer networks of the schools that institutionalize them.

One theory is that youngsters can fall into denial-of-service attacks by firstly playing online games, and then falling into installing mods, hacks, and even remote access trojans to get the upperhand on their gaming rivals.

Some tabs that have slid through my browser in recent days:

- The IRS published a new estimate of the federal “tax gap” — the difference between the amount of taxes people legally owe and what they actually fork over. The new estimate, which is based on data from the period, puts the tax gap at almost $500 billion dollars. The government recovers some of that through nagging and enforcement actions, leaving about $428 billion that never gets captured. I haven’t looked into the methodology by which these numbers were conjured up. Several years ago I took a deeper look and found that these estimates typically did a lot of extrapolating from even older guesstimates. It’s also the sort of calculation that must necessarily concentrate on “known unknowns” while the “unknown unknowns” remain in the shadows. As a result, it’s the kind of number that ought to have broad error-bars around it, but for some reason it’s always reported as a single, precise amount.

- Last time I checked in with the “Don’t Pay” U.K. campaign, it was collecting signers to a pledge to begin refusing to pay home energy bills on if the pledge were to get a million signers (they had collected 108,000 ). When I look at their site to day, I see that they have pivoted a bit. Now they claim that 256,924 people “have pledged to strike” on , and they don’t mention anything about a one-million-person threshold.

- The scrappy human rebellion against the traffic ticket robots continues. Shotgun fire in Cyprus, blinding paint in Germany and France, fire and paint in France, blunt force trauma in Germany, lens-smashing and legal action in Spain, an angle grinder in France, more paint in Germany, a dozen stacked tractor tires in France, ramming and yet more paint in Germany were among the tactics used against the radar cameras.

- Spartacus Educational profiles Women’s Tax Resistance League pioneer Octavia Lewin.