From the Daily Mail, one story of the individual council tax protests that broke out in Britain, largely (at least in my records) in the span.

Soldier tax protester freed after secret donor pays debt

A 75-year-old retired soldier jailed for refusing to pay his council tax was

being freed after an anonymous

benefactor cleared the £1,300 debt, a local authority said.

Great-grandfather Richard Fitzmaurice, of Heacham, Norfolk, was given a

32-day sentence by magistrates in King’s Lynn, Norfolk, on

after King’s Lynn and West Norfolk

Borough Council failed to persuade him to pay his latest annual bill.

Mr. Fitzmaurice said he was not paying because he thought the tax unfair. A

council spokesman said an anonymous

donor had cleared the debt and Mr. Fitzmaurice would be freed later.

“The debt has been cleared by a benefactor who wishes to remain anonymous,”

said a spokeswoman for King’s Lynn and West Norfolk Borough Council. “We

have informed the Prison Service and would expect Mr. Fitzmaurice to be

released later .”

Mr. Fitzmaurice, who is thought to be at Lincoln prison, told journalists

before the hearing that he was: “going to stand my ground and I’m ready to

face the consequences”.

His son-in-law, Arthur Osborne, 54, said he was astounded that Mr.

Fitzmaurice had been jailed. The council said it had been justified in

pursuing the pensioner.

Mr. Dobson said he sympathised with Mr. Fitzmaurice’s objection to the

council tax. “I do sympathise. I’m a pensioner and an old soldier myself,”

he said.

“But Mr. Fitzmaurice has picked a fight with the wrong people. His argument

is with the Labour Government, not this council.

“We have a duty to pursue anyone who will not pay council tax. Otherwise

lots of people wouldn’t pay.

“And we didn’t decide to jail him. The court did that. He was treated no

differently to anyone else. We exhausted every option.”

Mr. Fitzmaurice was unhappy about the way the council funded legal advice

for Mr. Dobson after a complaint was made that the councillor had breached a

local authority code of conduct.

The complaint related to an extension of a council employee’s work contract

and it was alleged that Mr. Dobson had abused his position. Mr. Dobson was

cleared of any wrongdoing.

Mr. Dobson added: “I refute all the allegations he made about me and refute

any suggestion that I have misused any money.”

A council spokeswoman said: “The Borough Council of King’s Lynn and West

Norfolk is totally committed to achieving value for money for all its council

taxpayers and following a massive efficiency drive was the only council in

England to reduce its council tax last year, which it did by 3%.

“However, council tax funds a broad range of services including the police,

fire service, county and parish council services — not just those services

provided by the borough council.

“If the borough council fails to collect council tax from an individual then

every other council taxpayer in the borough bears the cost of that failure.

“We owe it to them to ensure that all council tax is collected.”

She added: “Mr. Fitzmaurice does not qualify for council tax benefit, so

although he can afford to pay, he is choosing not to. As a result he has

been subject to the same recovery processes as any other non-payer. These

recovery processes are prescribed in law.

“Mr. Fitzmaurice has chosen to pursue the matter in this manner, rather than

settle his liability and raise his issues through legitimate methods. The

decision to impose a custodial sentence, and the length of that sentence,

rests with the magistrates.”

She went on: “This is the background to the legal expenses referred to by

Mr. Fitzmaurice. A complaint was made by the former leader of the opposition

against the leader of the council, councillor John Dobson to the Standards

Board for England.

“The complaint was investigated by an Ethical Standards Officer for the

Standards Board for England. An initial draft report was issued indicating

that the council leader had offended against three sections of the

Councillors’ Code.

“The report was challenged by the leader, who was advised by officers of the

council as well as by senior councillors on the Local Government Association

to get legal support.

“The report was shown to be substantially wrong on all three areas where the

Ethical Standards Officer had contended that the leader had offended against

the code.

“When the final report was issued, the leader was exonerated on all counts.

If the council leader had not employed a lawyer to challenge these points,

which were complex and required legal analysis to clarify, there is every

possibility that a miscarriage of justice would have occurred.

“A meeting of the full council agreed, unanimously, to reimburse the legal

expenses incurred by the leader, a decision that was also examined in detail

by the Council’s Cabinet Scrutiny Committee.

“Since this case, the council has taken out insurance to cover any similar

cases where a councillor has to defend his conduct and his case is upheld.

Such insurance was not available at the time.”

Here are some excerpts from other stories of council tax resistance. From the edition of The Telegraph:

Council tax rebels appear in court vowing to go to jail

Hundreds of homeowners rebelling against record council tax increases are

facing prison after being summonsed to court for non-payment of their bills

as part of a protest which has been dubbed the “Can Pay, Won’t Pay” campaign.

The rebels are angry over the increase in council tax rates that have soared

by as much as 40 per cent in the past two years. They have vowed to go to

jail rather than pay up.

District councils have sent out the summonses during the past few weeks. The

threats, however, appear to have made the householders even more determined;

a few have already defied magistrates’ orders to settle the outstanding bills.

Among them is Rae Hoffenberg, a retired interior designer, who has been sent

a final warning by Tower Hamlets council in east London. She has paid no

council tax this year and in the latest warning was given 14 days to pay or

face the bailiffs or imprisonment.

Miss Hoffenberg, who is in her mid-60s, appeared before Bow Street

magistrates in London three weeks ago to defend her decision not to pay the

Band H council tax on her two-bedroom flat in a converted Victorian warehouse

in Limehouse, which increased by 17.2 per cent to £1,469.93

. “I am prepared to go to prison,”

she said. “I have got to fight the cause. My council tax is unbelievably high

and the council is unbelievably arrogant.”

Another protester facing court is Ian Drover, from Hedge End, near

Southampton, who has been ordered to pay the council tax on his four-bedroom

detached house in full or appear

on .

Mr Drover, 43, a businessman, joined the rebels after reading about their

campaign in The Telegraph in . His Band

E council tax increased by 14 per cent from £1207.11 last year to £1377.09

this year.

He had been paying the tax at last year’s rate but has now stopped all

payments after his summons arrived. Mr Drover, who has never been in trouble

with the law before, said: “I am prepared to go the whole way on this. If

none of us takes a firm stand against these threatening, high-handed and

avaricious council officials, precious little will change. I am a

hard-working individual, a law-abiding citizen contributing a considerable

amount to the taxman, but every year I am faced with significantly higher

council taxes.”

Many of the dissenters are pensioners, who say that the value of their

pension has been eroded by council tax rises that have exceeded inflation.

The average rise has been 7.2 per cent a year since Labour came to power in

, while inflation has averaged less than

three per cent.

Sylvia Hardy, 71, a retired social worker from Exeter, Devon, received a

final warning letter from her local council two weeks ago. Her Band B council

tax on her two-bedroom flat increased by 18.5 per cent this year from £544.21

to £644.74. She was given seven days to pay or face legal action, though so

far no further action has been taken against her.

She said: “I am not paying. I will not let the bailiffs in and I am prepared

to go to jail. I have no family, so if I do end up in prison I’m not going to

upset anyone. At my age I don’t feel that it matters if I have a criminal

record.”

Dennis Mardon, the revenues and benefits manager for Exeter district council,

said: “We have to collect council taxes and we will take court action if

people do not pay.”

More than 250 people in Devon have refused to pay the increased council tax

rates and dozens in other local authority jurisdictions have received final

warnings.

Hundreds of protesters in Surrey, Hampshire, Kent, East Sussex,

Buckinghamshire, Cumbria, Yorkshire, Lancashire and Somerset — who have

united under an umbrella organisation called IsItFair? — have also been sent

summonses.

Most of the rebels are in the south of England. They have accused the

Government of discriminating against them geographically and therefore

economically. Council taxes in the south have increased by an average of 16

per cent this year compared with eight per cent in the North, traditionally a

Labour stronghold.

The increases have meant that Band D properties — the most numerous in

England — have had their council taxes increased by an average of 12 per cent

this year, taking the typical annual council tax bill above £1,000 for the

first time.

Eric Pickles, the shadow spokesman on local government, said: “It is clear

now that the Government is in a panic. To most people this is another stealth

tax. Most of these rebels will never have broken the law before and must be

desperate.”

A spokesman for John Prescott, the Deputy Prime Minister, said: “We do not

think that there were any good reasons for the high increases, but it is an

offence not to pay your council tax.”

IsItFair? can be reached via its website: www.isitfair.co.uk

Council tax rebels in court protest

A retired former magistrate made

a defiant stand against the “unfair and iniquitous” council tax after he was

taken to court for refusing to pay his full bill.

About 50 other council tax rebels and supporters demonstrated outside Newton

Abbot magistrates court in Devon, singing For He’s a Jolly Good Fellow as

David Richardson, 84, a former Royal Navy Volunteer Reserve, was summonsed

for non-payment of £70.20.

He said: “I refused to pay because it was the only way to highlight the

hardship this is causing to those on fixed, small and modest pensions. But I

don’t intend to cost the taxpayers three square meals a day and a television

by making the court lock me up.”

He added: “This tax is unjust and iniquitous because it takes no account of

ability to pay and each year we are facing soaring tax increases. I felt

there was no option but to stand up for it.”

Afterwards, his wife said: “I entirely support everything my husband has done

and I am immensely proud of him for having the courage to make this stand.”

Albert Venison, the chairman of the Devon Pensioners Action Forum, who led

the court protests, said: “This is the first of very many of our members who

will soon be clogging up the court system in Devon.

“There is a lot of anger about the size of the increases and the impact they

are having on older people.”

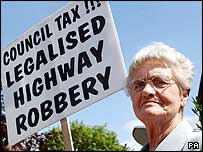

“Grey martyrs” take tax fury to the streets

Pensioner groups are planning mass rallies to protest against another

inflation-busting increase in council tax disclosed in

’s

Times.

To highlight the cause, the growing anti-council tax lobby is seeking “grey

martyrs” prepared to go to court, and even to prison, over nonpayment of

bills.

Potential volunteers are being given advice on what they can say in court,

what the bailiffs are entitled to remove and how to get round rules that take

backdated payments out of the state pension. The self-employed with no

pensions and hidden savings are the strongest candidates, as non-payment can

lead to prison sentences.

Rallies are being held to coincide with court appearances of the hundreds of

pensioners who have so far refused to pay all or part of their bills.

The escalation of the council tax rebellion comes after a survey in

The Times showed proposed average council tax

increases of 7 per cent, three times the rate of inflation. It also coincided

with meetings held by Nick

Raynsford, the Local Government Minister, with West Oxfordshire district,

which is proposing a 33 per cent increase, and Breckland council, which has

just revised a 14 per cent increase down to 12 per cent.

“There will be inevitably be a fair degree of unrest as any increase in April

above the cash increase in the state pension is just not going to be

acceptable to pensioners,” Help the Aged said.

At least 30 groups have now been set up throughout the country to campaign

for the abolition of council tax based on property prices. These groups are

co-ordinated by the IsItFair campaign, based in Hampshire, which is supported

by the National Pensioners Convention and the Royal British Legion.

Dozens of local groups have also been set up by pensioners across the

country. They include the Harrow Council Tax campaign and the Devon

Pensioners’ Action Forum.

Christine Melsom, a founder member of IsItFair, said that thousands of

pensioners had joined the groups. She said the campaign was now focusing on

the court appearances of people who had refused to pay council tax. A rally

is to be held in Barnstable, outside

North Devon Magistrates’ Court, and on in Exeter. “We notify every group about our rallies and sometimes

people come from all over the country,” Mrs Melsom said.

She admitted that campaign groups were now encouraging volunteers to refuse

to pay all or part of their council tax payments. She also said that they

were frustrated because once the cases reached the courts, many pensioners

agreed to pay the fines rather than face the bailiffs or prison.

While most defaulters would not go to jail because the Government was

entitled to deduct payments from state pensions, the self-employed “don’t

always have state pensions and if they have hidden savings the Government

cannot deduct council tax payments. Of course we do not ask them not to pay

their council tax. But if they volunteer we can help them and highlight their

case.”

Protesting pensioner will go to jail rather than pay

A defiant 83-year-old pensioner who was taken to court for refusing to pay an

18 per cent increase in her council tax said

that she was prepared to go to

jail.

Elizabeth Winkfield emerged from court dressed in grey and surrounded by

elderly campaigners vowing to continue her rebellion. “I am past being scared

about what will happen to me,” she said.

Miss Winkfield is the latest “grey martyr” to risk a prison sentence to

highlight pensioners’ anger against successive rises in council tax. As

disclosed in The Times, campaign groups are now

galvanising pensioners throughout the country to refuse to pay all or part of

their council tax bills in protest at the increases. Last year the average

rise was 13 per cent and this year it is to be 7 per cent, according to a

Times survey.

Miss Winkfield, who makes her own clothes and lives on the state pension of

£312 a month, was ordered to pay £99 plus £10 costs after a brief appearance

in court .

Outside Barnstaple Magistrates’ Court in Devon Miss Winkfield, dressed in a

grey coat, jumble-sale hat and a suit she made herself, said: “Even if I was

a millionaire I would not pay it. I might die before I pay. I am past being

scared about what will happen to me. If they send me to prison, then that is

what will happen. I have never been in a prison. I don’t like the idea, but I

would just put up with it.”

Miss Winkfield, who lives alone in a bungalow at Westward Ho!, admitted in

court that she had no defence to failing to pay £98.80 of the £747.812 tax on

her Band C home. She decided to pay a 2.5 per cent increase, in line with

inflation, rather than the 18 per cent set by Devon County Council.

She was the only one of 110 people ordered to pay their council tax to attend

the hearing . It was explained to

her that the council had a number of methods of enforcing the order to pay

the tax before the last resort, when she could be sent to prison.

Asked in court how she would feel if bailiffs were sent in to seize goods

from her home, she said: “I haven’t got much for them to take.”

Another Devon pensioner is due in court this month over non-payment of

council tax. Sylvia Hardy, 71, from Exeter, is due before magistrates on

over the £91 she owes on her

Band D flat.

The Telegraph also covered the Winkfield case:

I’ll go to prison, says council tax woman rebel, 83

An 83-year-old woman said yesterday she would go to jail rather than pay her

full council tax.

Elizabeth Winkfield left Barnstaple magistrates court in Devon to cheers from

supporters as a pensioners’ revolt against above-inflation council tax rises

spread.

Miss Winkfield is one of 820 members of the Devon Pensioners’ Action Forum,

which was created after the county council increased its tax by 17.9 per cent

last April.

She faced a bill of £787.81p

for her band C bungalow in Westward Ho! on the north Devon coast. She held

back £98.80, deciding that, in line with inflation, she was prepared to pay

only 2.5 per cent more than the previous year.

Miss Winkfield, who was wearing a suit she made herself and a hat from a

jumble sale, was ordered to pay the council £99 and £10 court costs.

As 30 members of the action forum waved banners in support after the hearing,

she said: “Even if I was a millionaire I would not pay it.

“I might die before I pay. If they send me to prison, then that is what will

happen. I paid the 2.5 per cent increase but I cannot afford any more. I

don’t like the idea of prison but I would put up with it.”

Miss Winkworth was one of 110 people issued with liability orders by North

Devon magistrates on behalf of Torridge district council, one of the

authorities collecting the tax for the county council.

Albert Venison, 79, who is organising the revolt, said his campaign was ready

to contest all 54 county council seats next year.

Condemning the liability orders as “diabolical and unsympathetic”, he said:

“Miss Winkfield did absolutely brilliantly.

“It is a sad reflection on our society when an 83-year-old woman is taken to

court because she owes 98 quid to the council. She has worked hard all her

life. God knows, she must have paid enough tax over the years.”

Another council tax strike around the same time was motivated by anti-Traveller sentiment, according to a Telegraph article:

Villagers refuse to pay council tax in protest at travellers’ camp

A village is planning the country’s biggest council tax revolt to protest

against the establishment of a huge, illegal travellers’ camp on its

outskirts.

More than 1,000 householders in Cottenham, just outside Cambridge, have

already pledged to withhold payment on their

bills in an attempt to force the

local council to take swifter action against hundreds of travellers who have

moved on to a site on the edge of the village.

The BBC had several reports on the protests. :

Barbara Lockwood, 72, owes Broadland District Council more than £160 after

refusing to pay last year’s 16% rise.

Mrs Lockwood, from Hellesdon, founder of Folk Against Council Tax

(FACT), was warned by Norwich Magistrates

on to pay up or face bailiffs.

Mrs Lockwood said after the hearing it was against her principles, but she

may have to settle the tax bill.

“I come from an age group of people who did their best to pay into private

pensions, to buy their own home and have something worthwhile to live on.

“But we pensioners are slowly waking up to the fact that we are being

absolutely fleeced,” she said.

In court she read out a long political statement applauded by fellow

FACT members, but magistrates said it was

the wrong place for such a statement and had no option but to grant the

district council a liability order.

On , magistrates in Llwynypia,

Rhondda, ordered Angela Richards to pay almost £1,000 arrears.

But she says the tax is unfair and she will face the consequences even if that

means jail.

Rhondda Cynon Taf council said it had “explored all the options available to

assist Mrs Richards meet her council tax liability.”

A retired clergyman and his wife say they will go to jail rather than pay

their council tax increase in protest over the system.

Alfred and Una Ridley, both 70, from Towcester, owe £596.15, claim South

Northamptonshire District Council.

On , Towcester magistrates issued

a liability order, which means that they will have to go back to court if they

do not pay up.

The couple insisted they would not make the payment on a matter of principle.

A court packed with the Ridleys’ supporters heard Alison Sharman, prosecuting,

say the pair had been issued with demand notices and a reminder before being

ordered to court.

“I’m a protester against the council tax system,” Mr Ridley told magistrates.

“It takes no account of people’s ability to pay and this hits those on low

fixed-incomes and pensioners. It makes day-to-day living very difficult.”

Mr Ridley said the council tax for had increased by 8.5% against the backdrop of what he called

“appalling” wastage.

Mr Ridley said he was paying council tax at last year’s rate, plus an amount

to cover inflation, until , when the

summons was issued.

His wife, a part-time music teacher, stood by his side in the dock.

She later told magistrates that pensioners had suffered because of the

widening gap between state pensions and council tax.

Magistrates’ chairman Wendy Huckaby said she understood what they were doing,

but had to issue a liability order.

Speaking outside court, Mrs Ridley said she was determined to fight the

“unfairness” of the issue by going to prison if necessary.

“I’ve never been to prison so I can’t get my head around what it would be

like,” she said.

“I don’t look upon it as a jolly or an easy thing to do so I would have to

take it realistically when it happened to me.”

The Daily Mail did a follow-up on the Winkfield case ():

Rebel pensioner: I’d be a fool to pay council tax

An 84-year-old woman is due back in court this week after again refusing to

pay her full council tax.

Asked today whether she would ever be prepared to pay the full sums,

Elizabeth Winkfield said: “If I give way now I will look a fool, won’t I?

“I am not going to volunteer to pay.”

The grey-haired 4ft

10in rebel is set to appear

before magistrates on in

Barnstaple, north Devon, over £128.58 she owes for her

council tax.

Miss Winkfield, who lives alone in her Band C bungalow in Westward Ho!, is

still being pursued by bailiffs for the £172.90 she owes after failing to pay

her full bill from Torridge

district council.

That outstanding sum includes sums for bailiffs and summons costs.

Miss Winkfield said she was prepared

to go to prison, adding: “I am too old to worry about it that much.”

As for Chancellor Gordon Brown’s Budget announcement of a one-off £200

payment for pensioners to help with council tax bills, she said: “It is a

sop. He just wants people to vote for him.”

Her protest began two years ago when her council tax rose by £114 to £747 and

she paid the council just an extra 2.5% to meet inflation.

When her council tax rose by 6% to £793 for

she again paid the council only

extra 2.5% for inflation.

The pensioner’s council tax bill for the 12 months to

is set to rise by 3.8%.

After her first court appearance, Miss Winkfield was critical of the way the

Government “poured money down the drain” and gave millions a year to the EC.

“I would not pay the bill if I was a millionaire, and I am not refusing

because I cannot afford it. I am making a stand because it is iniquitous,”

she said.

Miss Winkfield will be supported on

by members of the Devon

Pensioners’ Action Forum, which has been campaigning for council tax reform.

Chairman Albert Venison said today: “We will have as many people there as

possible.”

And the BBC returned to the Hardy case ():

Pensioner prepared to go to jail

A Devon pensioner has been given a suspended seven-day prison sentence for

refusing to pay all her council tax.

Sylvia Hardy, 73, of Barrack Road, Exeter, is continuing to refuse to pay the

outstanding £63.71 she owes Exeter City Council.

Magistrates told Ms Hardy the debt must be paid within 56 days otherwise they

have the option to send her to prison.

Outside court on , Ms Hardy called

the tax “daylight robbery” and said she would not be paying it.

She said her pension simply cannot keep up with the rises in council tax.

Ms Hardy said: “We’ve tried all the other methods — talking to the

councillors, the MPs, writing

letters, you name it.

“But it still went on and we feel we’ve got to do something and if you start

on direct action you’ve got to go the whole way. It’s no good giving up half

way or they’ve won.”

Members of the Devon Pensioners’ Action Forum had earlier tried to stop

officials entering the Exeter court.

Passing sentence, the chairman of the bench told Mrs Hardy she had now had

her day in court. He urged her to pay the outstanding amount and not become a

martyr.

Last year the 73-year-old wrote to Exeter City Council, asking them not to

accept any donations or payments on her behalf, after they had accepted a

cheque to pay her bill following a court appearance.

In 2005, The Times reported on what it said was the first person imprisoned for council tax resistance ():

Vicar who refuses to pay council tax is sent to jail

Alfred Ridley arrived at Towcester Magistrates’ Court carrying his toothbrush

after refusing to comply with a court order that he repay £691.15 in arrears

that he owed to South Northamptonshire Council. He was jailed for 28 days.

“We have been very patient with you,” John Woollett, a magistrate, told him.

“As you have failed to pay we have no alternative but to enforce the

suspended prison sentence.”

Mr Ridley replied simply: “All right,” but his supporters, who had packed the

courtroom, cried “Shame!” “It’s a disgrace!” and “Kangaroo court!” Mr Ridley

then addressed the court, saying: “The council tax has risen by 76 per cent

in the last few years. I’m not paying it because it’s an illegal tax.”

Mr Woollett had to be escorted from the court complex by police after he was

surrounded by booing protesters.

Mr Ridley said that despite being anxious about going to jail he would not

pay an “unfair” council tax increase. “I am prepared to go to jail

but I am only the first,” he said.

“I am anxious about it, I don’t know what it is like in prison.”

Mr Ridley and his wife Una, 72, had paid an increase of 2.5 per cent on their

previous bill to cover inflation, leaving them only £63 in arrears, but with

court and bailiff costs the amount they owe now stands at nearly £700.

After the hearing Christine Melsom, the founder and leader of the national

anti-council tax pressure group Is It Fair?, said she was shattered by the

decision: “It is a really wicked tax, and an upside-down world when a man

goes to prison for withholding a portion of his council tax when you can hit

someone over the head with a bottle and get a caution. People have come here

from as far away as Sheffield, Blackpool and Cornwall to support Mr Ridley.

We have thousands of members of all ages from across the country.”

Mrs Melsom added that she was considering staging a protest march in London.

Meanwhile, Mr Ridley’s son Joel, 35, said: “He is a man of principle and he

might well go through all this again when he comes out. It all depends on how

he finds the next 28 days.”

Mrs Ridley said that she was proud of her husband’s stance and that she was

preparing to write letters to Tony Blair every day during his imprisonment:

“The state of the council tax system is a very serious issue. The Government

needs to listen and put things on a basis of people’s ability to pay. We knew

this would be the end of a long journey.”

Earlier Mrs Riley told The Times how the couple had managed to foil efforts

by bailiffs to remove property. “So long as you make yourself secure, close

all the downstairs windows and all the upstairs ones too, the bailiffs cannot

make an entry,” she said.

Joe Harris, general secretary of the National Pensioners’ Convention, said:

“It is a disgrace that in a country with the fourth-richest economy in the

world we are locking up pensioners because they can’t afford to pay their

council tax.

“While ministers are sunning themselves on foreign beaches, English courts

are sending older people to prison because their state pension is so

pitifully low.”

The Ridleys receive £400 a month church pension as well as the basic state

pension of £131.20, so they do not qualify for pension credit.

Juliet Lyon, director of the Prison Reform Trust, said: “The average cost of

keeping someone in jail for a month is more than £3,000. Surely there must

have been a cheaper way of dealing with the £63 originally owed?”

She added: “Protest and civil disobedience also raise the question of whether

campaigners should be able to choose prison to publicise their cause.”

Mr Ridley’s prediction that he is “only the first” is likely to be realised

when Sylvia Hardy, 73, appears before Exeter magistrates on

. The former social worker

faces seven days in jail for non-payment of her council tax bill.

…and the BBC put in their two pence ():

A retired vicar, jailed for refusing to settle his council tax bill, has been

told he will spend all his sentence in the high security Woodhill Prison.

Alfred Ridley, 71, from Towcester, Northants, has been told that because he

is serving a short 28-day sentence it is not worth moving him.

Ridley was jailed on by

Towcester magistrates for ignoring a court order to pay the arrears.

On his wife Una Ridley said her

husband did not mind Woodhill Prison.

“They said he will spend all the time in Milton Keynes. I don’t mind and

neither does he because it is only half an hour for me to visit him,” she

said.

Woodhill houses some of the most violent prisoners in the country.

Mrs Ridley said she visited her husband on

and he was in a “bullish” mood

having been to church that day.

She said: “He told me it was a good strong service with lots of modern hymns.

“The staff are treating him well and are very polite and courteous.”

Ridley, a retired former Church of England clergyman, was jailed for ignoring

a court order that he repay £691 in arrears to his local authority.

He had been given a suspended sentence in

but refused to comply with the court

order to repay the money.

Ridley was told by Towcester Magistrates there was “no alternative” but to

jail him.

The dispute arose when the council announced it was increasing its annual tax

by 8.5% in one go. Ridley and his wife Una refused to pay a rise above the

rate of inflation.

South Northants Council have now said that when he is released he will not be

liable for the money.

Mrs Ridley revealed that another council tax protestor Sylvia Hardy from

Exeter, who is also facing jail for non-payment, is to visit her husband at

Woodhill on .

…and then Sylvia Hardy was put behind bars. The Daily Mail reports ():

“Terrified” pensioner jailed over £53 tax bill

She has paid taxes throughout her life, has never claimed benefits and has

never been in trouble with the law.

But retired social worker Sylvia Hardy, 73, became the first woman pensioner

to be jailed for refusing to pay council tax arrears

when she was sentenced to seven days

in prison at Exeter magistrates court.

She said she was “terrified” by the thought of prison but vowed to carry out

her protest because it was “the only way to get our voices heard”. She had

been told the prison beds were “very hard” and was worried sleeping on them

with her bad back would be painful.

Ms Hardy, 73, from Exeter, Devon, failed to pay her arrears of £53.71 in

council tax from last year — plus £10 costs — and was in breach of a 56-day

suspended committal order.

Jailing her for seven days at Exeter Magistrates’ Court chairman Louis

Crowden said: “If everyone paid their debts on the basis of what they thought

appropriate this country would descend [sic] into anarchy.

“You have been given every chance to pay and have willfully refused to do so.”

The chairman said they had no choice but to commit Ms Hardy to prison for

seven days, telling her: “You may think you are a martyr but you are not.”

As Ms Hardy, from Barrack Road, Exeter, was led away the chairman of Devon

Pensioners’ Action Forum, Albert Venison, shouted at the bench: “You are on a

completely different planet you people.” There were other shouts of “pompous

ass” and “shame” from other supporters of Ms Hardy who were packed into the

small courtroom.

Ms Hardy marched to the court from her home accompanied by banner-waving

supporters, and was greeted by a huge crowd of other backers before she went

in to face the magistrates.

She was told that a telephone offer of payment for her outstanding arrears

had been made, but she politely refused it. In court the clerk, Paul Vincent,

asked her whether she intended to pay the outstanding amount today or at any

time, and Ms Hardy replied: “No.”

Prosecutor Kevin Hughes told the magistrates: “She has made it clear to the

council she has no intention of paying the £63.71. We are here to ask you to

consider whether she should go to prison for seven days.”

Ms Hardy, who refused an offer to speak to the court’s duty solicitor, told

the court: “I made a decision to withhold part of the council tax demanded by

Devon County Council because the increases during the past 10 years have

risen by 50 per cent.

“In one year alone the increase was 18.5 per cent and in another 10 per cent.

My occupational pension increases by only 1.7 per cent a year and the

inflation rate by between one per cent and three per cent. On top of this

tax, we are required to pay the highest water rate in the country, plus

ever-increasing payments for gas, electricity, telephone, etc, well above the

inflation rate.”

She said incomes for the majority in the South West fell far behind these

demands, and people were losing the ability to have any kind of quality of

life. “Undoubtedly this is totally unfair and has got to stop,” said Ms Hardy.

She told the court: “Letters and lobbying to

MPs and councillors have fallen

on deaf ears and all that is left is to take direct action, whatever the

consequences.

“Throughout history, people have fought to change laws which are unjust, and

often the only way to do this is to break the law or ignore it and to accept

the punishment. That is why I am appearing here today to accept my punishment

for desperately trying to salvage my ever-reducing quality of life.

“We are trying to bring home to central government and local government that

if something is not done very soon to put right the many injustices the

people of this country have to suffer year on year, the normally docile

English people will say enough is enough and will all gather together in mass

civil disobedience.” Ms Hardy said she had sensed for some time the anger

which was in evidence in the community, adding: “I feel that an uprising is

not far away.”

She went on: “If the sacrifice of my liberty for seven days does anything to

force politicians to begin to serve those who elected them to office, it will

be worthwhile.” Ms Hardy said those with incomes just above the cut-off point

for means-tested handouts were being subjected to discrimination and this

was “totally, totally unfair”.

She continued: “Even now there are several pensioners in other parts of the

country who are already in prison or about to be committed because of the

obscene council tax demands. Many people believe that this tax is daylight

robbery, so why are we victims rather than the perpetrators being sent to

prison?”

She called on all councils throughout the

UK to “grasp the

nettle and tell the Government that you will stop providing the expensive

services, such as education, unless sufficient sums are made available, and

stop leaving it to the oppressed taxpayers to do your jobs for you”. Ms

Hardy’s supporters were planning to travel in a convoy of cars to the prison

in which she will serve her sentence to demonstrate outside in a show of

support.

morning a band of Ms Hardy’s

supporters will hold a vigil outside Exeter Cathedral, and will do so every

day until she is released from prison. Ms Hardy left behind a comfortable

two-bedroomed top-floor flat with distant views to the sea and across the

city.

Before she went into court , she said

she believed the stance of the tax rebels had played a part in the

Government’s decision to shelve the re-evaluation of the council tax system.

A few days ago she visited retired vicar Alfred Ridley, 71, from Towcester,

Northants, after he became the first council tax rebel to be jailed for

refusing to pay arrears.

Adrian Thomas, spokesman for Help the Aged, said: “Help the Aged cannot

condone the breaking of the law. We do, however, recognise the fundamental

unfairness of council tax and the massive impact relentless rises have had on

pensioners’ quality of life.

“Pensioner poverty is a reality for two million people in this country. They

desperately need, and deserve, a system that takes into account ability to

pay.

“We are calling for decisive action from the Government to reform local

taxation. Any indication from this week’s Labour Party conference that this

is on the cards would be warmly welcomed.”

Mr Thomas added: “We are concerned at reports that Mrs Hardy suffers from

food allergies and as such is not expecting to be eating much during her stay

in prison. We would hope that any similar cases would be dealt with by

magistrates passing non-custodial sentences.”

Hardy was scheduled to be released on . The BBC reported ():

Supporters of the pensioner have been holding a vigil for her in the grounds

of Exeter Cathedral.

Organisers of the vigil said they would be at the cathedral between 1000 and

1600 BST for the rest of the week.

Only two protesters will be at the cathedral at any one time, but organisers

said it was enough to keep Sylvia Hardy and the council tax in everyone’s

thoughts.

Stan Fitton, one of the organisers, said: “Judging from the passers-by, most

people are fully aware of what’s happened to her and we’ve had a lot of

sympathy and interest.”

Britain’s biggest pensioner organisation, the National Pensioners’

Convention, condemned the sentence.

Convention president Frank Cooper said: “Sylvia has taken a courageous stand

to highlight the inadequacy of the basic state pension by showing how

difficult it is for millions of older people to make ends meet and pay their

bills.”

Ms Hardy was said to be in a “good frame of mind” after her first night in

prison, council tax activist Albert Venison said, although she did not sleep

well because the cell’s hard bed aggravated a back condition she has.

The Sun reported that Hardy was unrepentant ():

Tax rebel: I’ll go back

A rebel council tax pensioner freed from jail after an anonymous benefactor

paid her debt said she would be prepared to return to prison over her

campaign.

Sylvia Hardy was dramatically freed early from prison last night.

And the 73-year-old vowed: “I’ll go back if I have to.”

Sylvia revealed she would not pay the full council tax bill for this year — and expected to be up in court again.

She said: “I am not paying my full tax this year either. I have had my final

demand.

“No doubt I will be getting a letter telling me I have got to go to court

again.

“I will go to prison again if necessary,” she added.

Sylvia was released after just 30 hours of her seven-day sentence when her

tax arrears of £53.09 were paid.

She was driven 100 miles by taxi from Eastwood Park prison, Gloucs, to her

home in Exeter.

As she got back to her flat, clutching a huge bouquet, she said: “I don’t

have any regrets.

“This Government has to learn that we pensioners are not going to take these

rises and there are plenty of others who are prepared to do what I have done.”

Sylvia said she was well treated in jail by staff and inmates, who had seen

her case in the news. She admitted she had found it hard to sleep and had

suggested bringing in Jamie Oliver to improve prison food.

Sylvia was jailed because she refused to pay an above-inflation rise on her Band B flat.

Council tax campaign leader Albert Venison, 80 said she had seemed in “good spirits”.

A pensioner who says he’d rather go to jail than pay his council tax remained defiant on when Lynn magistrates ordered him to pay up.

Veteran soldier Richard Fitzmaurice (74), of Heacham, is refusing to pay a

penny, despite being given just 14 days to pay his council tax in full — just

under 1,300.

Failure to pay will result in bailiffs being sent to his home in Ringstead

Road, and if that fails he could be jailed for up to three months.

The great-grandfather appeared in court on a summons for non-payment of

almost 400 he owes West Norfolk Council so far on his Band D home.

He has refused to pay since the last increase in

and although he can afford it, he

decided to take a stand because of its “blatant abuse” of pensioners.

He has objected to council tax rises for many years, but he said the “last

straw” came when taxpayers’ money was used to pay a 23,000 legal bill racked

up by Tory council leader John Dobson when he hired a lawyer to defend

himself against Labour allegations.

Presiding magistrate Norman Jelliman told Mr Fitzmaurice the council was

acting properly in now asking for the full amount.

Imposing a liability order requiring him to pay in full, he said: “You have

to realise the council deals with thousands of council taxpayers. There has

to be rules otherwise there would be chaos. It can’t change those rules to

suit particular individuals.”

Mr Fitzmaurice told magistrates he would not pay up, and outside the court he

said he was still prepared to go to prison.

“Once I’ve been to jail I know I will have to eventually pay, and I will, but

I am going to jail first to show my protest is sincere.

“I am protesting not for myself but for all the other pensioners who can’t

afford their council tax. I know the difference between right and wrong,

and I’m not the kind of chap who would break the law willingly, but I am

doing this out of principle.”

Sylvia Hardy was back at it in 2007 (BBC News, ):

A Devon pensioner has appeared in court for refusing to pay her council tax

and vowed to go to prison for a second time rather than pay what she owes.

Sylvia Hardy, 75, admitted owing £74 council tax to Exeter City Council when

she appeared before city magistrates.

Magistrates made a liability order but costs of £35 requested by the council

were not granted.

The chairman said: “We recognise you are on a restricted income. We are not

going to order costs.”

Ms Hardy, from Barrack Road, Exeter, was accompanied to court by members of

the Devon Pensioners Action Forum.

She was summoned over a shortfall in the £740 bill for her Band B two-bedroom

flat.

Afterwards, the retired social worker said she would not pay and expected

visits from the bailiffs before being brought back to court for non-payment

at a future date.

The self-confessed rebel began her protest against council tax in

, when it rose by 18.5% and her pension

increase was less than 3%.

In she was sentenced to seven

days in prison for withholding payment of £53.

But she was released after just two days when a mystery benefactor, calling

himself Mr Brown, paid her outstanding bill.

The arrests of retired vicars, veterans, and other pensioners proved to make for such bad press, that the government by was making plans to eliminate the possibility of jail sentences and to rely on civil proceedings against resisters to try to find and seize their assets. See “Council tax rebels to have bank accounts frozen instead of being imprisoned” Daily Mail :

[Local Government Minister John Healey] added: “Our aim is to increase

collection rates still further and cut the number of people sent to prison

each year for not paying their council tax.”

Some 368 people were sent to prison for non-payment of council tax in

, he said. Another 335 were committed

but did not serve a sentence.

There has been a number of high-profile council tax protesters who have

attracted national attention by risking jail through their refusal to pay.

Most recently, 71-year-old Josephine Rooney spent a second stint behind bars

after steadfastly declining to pay her Derby City Council bills.

Miss Rooney refused to pay in protest about the poor state of her street,

which has been a magnet for drug-taking and prostitution.

Last month, the city council finally wrote off her £1,476 bill for

to

because it is regarded as

“irrecoverable” once a sentence has been served.

In , the latest year for which

figures are available, more than £130 million was written off by town halls.