Google is starting to do for newspaper archives what it has been doing for books: putting scanned images on-line and making them text-searchable. Hooray for Google, says I.

Here are a few articles I found while browsing around today:

A couple of pieces regarding a reconstruction-era dispute over the legitimacy of the Louisiana state government (in which tax resistance played a role):

- Affairs in Louisiana: Proclamation of Gov. Kellogg to Delinquent Tax-Payers The New York Times

- Repudiators in Louisiana The New York Times

Some pieces from the tax resistance campaign for women’s suffrage:

- [Bernard] Shaw on Women’s Rights: Would Get Another Wife, He Says, If Jailed Like Mr. Wilts The New York Times

- Take Duchess’s Silver Cup: Distraint Owing to Refusal of Suffragist Peeress to Pay Tax The New York Times

- A joint demonstration of the Tax Resisters’ League and militant suffragettes… The New York Times

More on the ostensibly voluntary “liberty bonds” in the United States during World War Ⅰ:

- [Billy] Sunday Attacks ‘Bond Shirkers’: And He Would Shoot “Like Traitors” Those Who “Knock the Buying” The New York Times

- Will Ask Proved Bond Slackers to Make Statement to People The Evening Independent

- New Plan to Reveal Slackers St. Petersburg Daily Times

- Slackers Beware The Union County Journal

Gandhi’s campaign for Indian independence:

- Hindu Campaign Costing Money The Evening Independent

Miscellaneous war tax resistance articles:

- Five Members of Faculty Will Withhold War Taxes to Voice Vietnam Dissent The Harvard Crimson

- Tighter Objector Rule Asked Pittsburgh Post-Gazette

The Nixon Administration asked the Supreme Court today to rule out draft exemptions for men who are conscientiously opposed to the Vietnam war but not to all wars.

…

Besides, the Administration argued, if selective exemptions are approved people could refuse to pay their taxes on religious grounds or could defy other laws.

- Excise tax resistance fails to go unnoticed The Daily Collegian (concerning phone tax resistance)

- Tax resistance is historical means of protesting war Columbia Missourian

- Lutheran group issues call for tax resistance against arms race St. Petersburg Times (also covered in the Pittsburgh Post-Gazette)

- Local man won’t pay federal income taxes Columbia Missourian (George Mummert)

- Local Quakers support stand of tax resister Columbia Missourian (Richard Catlett, David Wixom)

- Tax Resisters Give Money to Hospice Associated Press

- Protesters resist military taxes Penn State Daily Collegian

- Nuclear Protester May Lose Home Over Tax Stand The New York Times

- ‘Alternative Revenue Service’ Unveiled The Seattle Post-Intelligencer

- War Foes Urge Withholding of Taxes The Seattle Times

- Taxes for Life The New York Times

- Victory for war tax resister Green Left Online (Robert Burrowes in Australia)

- Tax critics don’t leave lawn despite order Associated Press (Kehler/Corner case)

- ‘Conscience’ Doesn’t Take the 1040 EZ Route New York Daily News (Kehler/Corner case; review of An Act of Conscience)

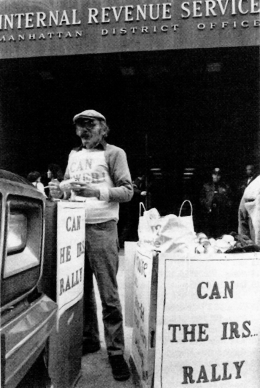

- War Tax Resisters Will Turn Themselves in to IRS press release,

- Don’t Like Military Spending? Give Your Tax Dollars to Someone Else! The Portland Mercury

- War Resisters: ‘We Won’t Go’ to ‘We Won’t Pay’ The New York Times

Archbishop Raymond Hunthausen’s war tax resistance:

- Hunthausen Joins Rally at Submarine Base The Seattle Post-Intelligencer

- Bishops oppose nuclear arms St. Petersburg Times

- Area Priests Declare Their Support for Hunthausen The Seattle Post-Intelligencer

- Anti-War Archbishop Who Came Under Fire from the Vatican The Seattle Post-Intelligencer

Miscellaneous other articles of note:

- Finding Out Who ‘Really’ Spends Your Tax Money St. Petersburg Times (a conservative tax revolt group working with war tax resisters & Noam Chomsky)

- Washington [D.C.] Official Urges Tax Refusal to Push Statehood The New York Times (“Walter E. Fauntroy, the District of Columbia’s Delegate to Congress, has urged residents here not to pay their Federal taxes until Congress makes Washington the 51st state.”

- Israelis Yield West Bank Taxation and Health to Palestinians The New York Times

[C]ollection will be a formidable challenge after years in which taxes were identified by Palestinians with foreign occupation.

Tax resistance is strong in the territories. It spread during a seven-year uprising against Israeli rule, when Palestinians working in the tax department resigned. According to Israeli estimates, only 20 percent of Palestinians taxed in the West Bank met their payments in 1993, when tax revenues totalled some $90 million.

The Palestinian Authority has already run into difficulties collecting taxes in Gaza and Jericho, and it has published appeals in recent weeks urging tax payment as a national duty. Outside of Jericho, it has no police powers in the West Bank, and the legal system there remains under Israeli control.

“Taxes are the dowry of independence and the key to democracy,” said Atef Alawneh, director general of the Palestinian finance department, at the ceremony today in Ramallah.

“Nonpayment of taxes under occupation was a national struggle worthy of praise,” he added. “Now it is 180 degrees different. Now delay in paying means a delay in building the Palestinian state.”

Zuhdi Nashashibi, the finance minister in the Palestinian Authority, said he was confident Palestinians would now “hurry to pay” their taxes.

Mr. Alawneh argued that collection by Palestinians would be more effective because it would lack the coercion of military occupation, would extend to places the Israelis were unable to reach because of security concerns, and would create new revenue sources. The tax authorities will not use force, he said, but will rely instead on friendly persuasion and public goodwill.

Remember what this sort of thing used to be like? You’d get yourself down to the library, and then you’d look through each volume of the Reader’s Guide to Periodical Literature or whatever, one at a time, hoping that what you were looking for was among the things the editors of that guide felt was worth indexing. Then with luck, some of what you were looking for was available in bound volumes, microfilm, or microfiche on-site (elsewise you could always try for inter-library loan, but that might take a couple of weeks). In the case of the first, you could find it on the shelves or ask the reference librarian, and then thumb through the pages, but in the case of the latter two, you’d have to haul your film over to a reader (one that wasn’t broken or occupied) and then spend five minutes or so just trying to locate the pages you were interested in. Then, if it turned out to be good, you’d have to scribble things down or drop in some coin for a barely-legible photocopy.

I like the future.