While I was busy going through Friends Journal back issues, I didn’t attend much to tax resistance news in the here-and-now, so I’ll try to give a recap today of some of the news about international tax resisters that caught my notice:

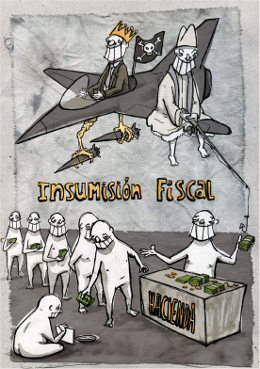

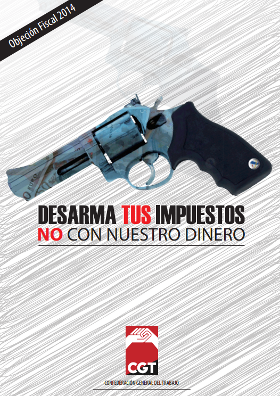

Spanish war tax resisters

The Spanish magazine Números Rojos published an article about tax resisters there. Excerpts (translation mine):

And you, have you been obedient?

Since the fall into hell of the American financial giant Lehman Brothers in , international banks have received injections of public money coming from various governments to the tune of $4.6 trillion, an amount sufficient to eradicate world hunger 92 times over. This embarrassing data forms part of an investigation from Arcadi Oliveres, professor of Applied Economics at the Autonomous University of Barcelona and president of the organization Justícia i Pau (“Justice and Peace”). Oliveres was, 30 years ago, one of the originators of the first tax resistance initiative organized in our country. He decided, in defiance of the Law, but favoring his conscience, not to contribute to the government’s military spending. He became a tax resister. Today, for reasons like the data cited above, many citizens have begun processes of resistance that involve new ways to use their money.

Those first war tax resisters of opened a new path for the honorable citizen. It was not meant to trick the Treasury so as to keep the money. The taxpayer challenged the collector, and questioned the legitimacy of the spending they considered immoral. In the absence of ethical behavior from the state, the good citizen, they argued, did not have to obey it. “The people are afraid to disobey, but if nobody had done so before there would still be slaves on the streets and blacks would be standing in the back of the bus,” Oliveres told Números Rojos. The professor took as model conscientious objectors who refused to do compulsory military service in : “For not wanting to do their military year and a half they were sent to prison for three years, even to penal colonies in the Sahara. They had no fear; for this reason they were so important.” That struggle is won — compulsory military service was abolished in Spain on — though war tax resistance, which began to be practiced in continues to be considered illegal evasion.

Calculating the Deduction

The process of becoming a tax resister is very simple, although there is no fixed rule. It amounts to adding to your tax return a new deduction of x euros, corresponding to your personal contribution to government military spending. But the calculation of this option can have a variety of sources: some people estimate military spending in the total federal budget each year and apply this percentage directly as a deduction on their return (between 6–15%, depending on which items are considered military spending). Others take as their reference the data suggested each year by antimilitarist platforms (last year military spending of €666.14 per person was calculated). And others redirect a fixed amount each year from the taxes owed on their return (traditionally €84). Then, depending on how the final result changes, the objector may have to pay less to the Treasury than is owed — if it is positive — or may recover more money from the Treasury than it has to pay — if it is negative.

In either case, before filing, the objector has already redirected the amount he or she does not accept as legitimate government spending to an institution for social good — whichever the objector wants, although there are lists of groups to contribute to. Of course, the reasons for resisting are specified on the return itself, and also communicated to the tax agency at the time of filing. But what happens next? “if it comes out negative, you will claim an amount from the Treasury, which is not returned to you, and generally that’s that. But when it is positive, you neglect to pay a part. In this case, it may be that nothing happens — according to Ecologists in Action, in 90% of cases the incident goes undetected — but the tax agency may come after you and end up levying not only the amount you refused to pay but also an administrative penalty,” Oliveres said.

With exceptions, like in when the Supreme Court of Catalonia found in favor of the former Catalonia Parliament deputy Joan Surroca, who in deducted from the amount that he had to pay in taxes a percentage corresponding to military spending and gave the money to an NGO that assists African women. The treasury then fined him 54,896 pesetas (€329), a penalty that Surroca appealed. Finally the court ruled in his favor by understanding that the offender, by sending his resisted taxes to an NGO, did not have the intent to profit from his action. A landmark judgment, but precise.

But how many pacifist tax resisters are there in Spain? It is difficult to calculate — not everyone who does it talks about it — but according to the associations and platforms associated with this movement there may be between 1,000 and 2,000 people each year: “the number is very stable, although there are sharp peaks in times of armed conflict when Spain is involved, as with the Iraq war,” explains Arcadi Oliveres. So in the fiscal campaign, it is estimated that at least 5,000 people became tax resisters. Today, the economic crisis has not produced a significant increase in antimilitarist objectors, “even allowing for awful data, like the fact that in the state spent €1,300 million to construct a combat aircraft, the same amount of money that it saved by freezing pensions.”

From pacifism to rebellion

In , the Right of Rebellion movement (www.derechoderebelion.net), with the help of more than €8,000 raised through a crowdfunding initiative, printed 5,000 copies of the “Manual of Economic Disobedience” (the edition is available on the web), a document intended, in its own words, “to all of those people who would like to take steps to make their lives exemplars of their thought and feeling.” So the group intended to “initiate and extend a campaign of tax resistance aimed at the Spanish state and at those who control it… to show that we will not pay their debts, because we do not recognize the existing Constitution or the existing puppet government of global financial capitalism…”

As the most important step of disobedience, the manual teaches the option of making a partial income tax resistance, similar to that of the war tax resisters, but including also deductions for such items as the amortization of public debt, the interest on the debt, payments for the monarchy, the Senate, the prisons, the police, or the church, until the total comes to almost 30% of the federal budget. The authors of the manual make it clear that the decision about what parts to deduct must be decided by the taxpayer, but suggest a standard 25% of what is on the return.

Offices of Disobedience

The goal of resistance is to divert money that doesn’t go to the Treasury to “autonomous projects that will be useful to meet the needs of the people.” After publishing its manual, and without much time to prepare, Right of Rebellion began organizing a series of Offices of Economic Disobedience in various cities around the nation, which learned about and advised anyone who was interested in becoming a tax resister in the tax resistance campaign of . Although it is difficult to know the exact number of people who joined this campaign, the figures tossed about by different offices were very modest, not reaching even a hundred or so resisters. In spite of this, the constituents of the Office of Economic Disobedience in Lavapiés (Embajadores, 49; Madrid), considered the accounting “very positive”: “not so much with the economic level of project supported — just over €18,000 in total — but by, above all, the number of people, from all classes, who were interested in this issue.”

Meanwhile, as the tax season numbers are coming in, Right of Rebellion continues to promote other forms of disobedience, such as certain techniques of resistance to the VAT (in the declarations of independent companies or cooperatives), rent for people who have been evicted (preventing or indefinitely delaying the eviction), or bankruptcy (as freedom to carry out different actions). The ultimate goal would be an actual departure from the “official” economic system and the creation of new, alternative forms of living.

Integrated Cooperatives

The “Manual of Economic Disobedience” relies on a call for comprehensive cooperatives, “a legal form that allows construction of an arena of autonomous economic relations among the participants that is protected from public or private liability, and quite legally minimizes tax and social insurance liability, shielding as much as possible from the acts of the banks or government.” Furthermore, this new way of life permits “bankrupt or unemployed beings as people, according to the system and the existing legal framework, but at the same time to be able to live completely normally, working and consuming in an autonomous manner, without worrying about seizures of prior debts.” In short, a permanent economic disobedience, a collective evasion of the system clinging to a self-sufficient, multisectorial structure, where the members, involved to a lesser or greater extent, coexist and cooperate at the margin of the system. Indeed, the cooperatives possess a system of communal services, using alternative currencies and relying on self-financing social cooperatives to obtain credit without interest.

The Solidarity Scam

One of the major promoters of the Catalan Comprehensive Cooperative is Enric Durán. This activist burst into the limelight in when he announced himself, in an article in the self-published Crisi, which had “stolen” €492,000 from the banks. Step by step, he described how he had taken out 68 different loans from 39 banks on various pretenses: to buy a car, renovate his house, etc. And how he had created a shell company and falsified documents to justify nonexistent income, in order that the credit control system would not detect its growing debt.

While the mainstream media were trumpeting his “exploit,” Enric fled to South America with €8,000 in his wallet. The rest had been given, as was explained in the manifesto, to autonomous social project. This action, whether described as financial disobedience or a solidarity con, sounded around the world and the press named its actor the “Robin Hood of banks.” Enric returned to take credit for the legitimacy of his action, and was imprisoned . He was finally released, though with a pending criminal trial that was to have been held . Enric failed to attend “because he doesn’t believe that the judicial system has standing to judge,” so the Provincial Court put out a bench warrant for him on . The prosecutor asked for an eight-year sentence, six for an ongoing offense of falsifying a commercial document, and two for criminal bankruptcy.

While eluding justice, Durán continues to vindicate resistance: “any act of insubordination is a welcome step, and although at first it may seem like an isolated action, it is from such small actions that we build a strategy with a long-term goal,” although clearly these processes are initially marginal, “historically risky actions, if they involve individual responsibility, are taken only by the minorities involved. The key is that these minorities are able to organize to better influence the majorities.”

Disobedience of the system

Other citizens who dissent from the economic relations imposed by the system, like the lawyer, writer, and expert on disobedience José Luis Carretero, do not understand the processes of economic disobedience as an “exit”: “you have to take a step toward disobedience, but not as an alternative to confrontation. You can’t get anything without an effective, mass confrontation.” Carratero has reservations about measures like tax resistance, “it has a very limited and token run. I get these dynamics if they are done with other actions, like the occupation of vacant housing for instance. In the short run, I think we should try to find an alliance with various sectors that are confronting austerity. In the long run, turn back the social segmentation processes that have taken place in recent decades. But from the grassroots, not from outside of the system.” For Carretero, since the 15-M outbreak, as the topic of disobedience is no longer taboo, “those who talk about these things were once marginal — I felt like a Martian. Most saw capitalism as a good thing that allowed you to have a house or a car. That has changed somewhat, but the problem remains that they see no alternative.”

With less theory and more concrete actions, the campaigns of economic disobedience of the “I won’t pay” movement have taken root in many sectors through social networking, where they already have some 30,000 followers. They called a rebellion against toll roads in Catalonia and managed to get some 60,000 people, according to Abertis, the collecting company, to refuse to pay to use the road. They managed to mobilize, , hundreds of people in several demonstrations in Madrid against the so-called “rate hikes” for public transit, which upped the price of tickets for members of the community some 11%. Another action called “I won’t repay” inspired citizens not to pay the euro-per-prescription in the communities where it was imposed — Catalonia and Madrid — before it was suspended by the Constitutional Court. According to the founder of “I won’t pay,” Álex Corrones: “Not only do we believe that it is right to disobey laws that are unjust, but that it is our obligation as responsible citizens.” For Corrones, it is not enough to demonstrate: “demonstrations have been controlled. And if they get out of hand, there are 200 cops to fire on command.”

war tax resisters in Asturias

A report on the war tax resistance campaign in Asturias this year said that it had “led workshops in all parts of Asturias, conducted five street actions, and has delivered thousands of information packets, which have been supplemented by the educational conference with Tica Font and Pere Ortega of the Centro Delás research center, and the contributions of Arcadi Oliveres in another conference.”

In Gijón, the resisters tried a new twist on the tactic of paying taxes with goods instead of money: “trying to deposit a missile and several grenades with the tax authorities.” You will probably not be surprised to learn that the tax agency frowned on this variety of payment.

Catalonia

The National Conference of the Catalan Republic, a nationalist group, met to try to plan a path forward to Catalan independence. The Secretary General of the Republican Left of Catalonia opened the conference and, for the first time I’m aware of, made a link of sorts between the tax resistance of Catalan nationalists and that of Spanish war tax resisters. He complained: “We live in a state that allocates a good part of our taxes in having an army that invests thousands and thousands of euros in military upgrades.”

The group is pushing for a referendum on Catalan independence, and is meanwhile trying to create a new state within the shell of the old, by creating new Catalan institutions and trying to vest in them the authority currently held by federal ones. One of these is a Catalan tax agency, and some resisters have adopted the tactic of paying their federal taxes there instead of to the federal agency.

Madagascar

Businesses in Madagascar have begun refusing to submit taxes to the government, depositing the money in an escrow account instead. The businesses, which represent a large percentage of the country’s tax base, are reacting to a crisis of stability and perceived legitimacy in the government, to the extent that, according to the chair of the Madagascar’s Enterprises Union, “We no longer know with what kind of authorities we should deal at this stage.”

Zimbabwe

The recent elections in Zimbabwe went off without a hitch, at least from the perspective of incumbent lunatic Robert Mugabe, who made sure that the vote would come out his way. The Movement for Democratic Change, whose party was defeated in the “election,” is not accepting these results. A Movement leader, Roy Bennett, called on people to stop paying taxes. “The people of Zimbabwe have to demonstrate what the polls said: that they are the majority and that they are completely dissatisfied with [the ruling party], and for this reason are resorting to passive resistance.”

Ghana

Italy

Italy’s is the latest government to try to slip new taxes into utility bills as a way of trying to sneak tax hikes past its subjects — the latest is something called “tares” which is ostensibly part of the garbage bill. A “No Tares Steering Committee” is preparing a tax strike in protest.

Greece

“Resistir por Um Resistir por Todos”

A Portuguese group is pressing a legal claim that people unemployed in the ongoing economic crisis should be exempt from taxation, on the grounds that the tax agency must leave them the money they need to live on. A judge ruled against them, but on what appears to be a technicality (saying that they could not challenge the taxation policy itself, but must challenge a particular lien against a particular tax refuser).

Peggy Thomas

The HebdenBridgeWeb blog introduced its readers to war tax resister Peggy Thomas. Excerpts:

Peggy Thomas, a retired teacher who lives in Hebden Bridge, is refusing to pay the Inland Revenue some of her income tax. She is a conscientious objector and against taxes being used for warfare.

Peggy told the HebWeb that the nature of conscientious objection had completely changed. Today, it is not about young people refusing to fight; it is about money. Today’s wars can be fought with just a few men but the weapons are much far more expensive and deadly. That’s why she’s withholding a proportion of her tax, a proportion which would otherwise be spent on war and weapons.

Peggy told the HebWeb, “At the beginning of the invasion of Iraq, the then Chancellor Gordon Brown, told the House of Commons not to worry about how our participation in the ‘coalition of the willing’ would be financed. He assured MPs and the country that all the money needed would be available. Of course it was; 10% of the Government budget is set aside for warfare.”

Peggy is not alone in withholding taxes. An organisation called “Conscience” is campaigning to end compulsory contributions to warfare. Conscience believes that those who object in principle to warfare should be able to divert 10% of their taxes to peaceful pursuits. For example, some people donate their 10% withheld tax to charities such as Oxfam.

When Peggy first started withholding her tax, the Inland Revenue ignored her, and just took the tax she owed out of any refund she was due. If she sent a letter explaining, they’d reply that they couldn’t enter into correspondence about the matter.

But this year the Inland Revenue started to get a little more serious with Peggy and started to talk about debt collection agencies. Conscience were able to reassure Peggy that in the first instance the debt collection agency would not be allowed to take anything from her. And that what she should do is write to the debt collection agency explaining the situation.

In her letter, Peggy wrote, “The right of conscientious objection, which was won, not without a struggle, during the First World war, protected people who did not want to kill other people from having to take part in warfare. Once conscription was abolished, this right was taken from us. Now our money is conscripted and used to finance killing.”

Council tax resistance

June Farrow is still resisting her council tax (see ♇ for an earlier mention of her resistance). She recently lost a court case and was ordered to pay over £1,000 in taxes and court fees.

“The poorest are footing the bill for those in multiple occupancy. The burden is put on the very poor,” she said.

“I am doing this for many of us, not just myself. Everyone I speak to says ‘we support you, our mother or our father is like you, they are struggling too.’

“The only weapon we have got is not to pay council tax.”

She said she has been paying some of her council tax but she could not afford to pay all of it.

“I have been paying £25 a month and that is all I can afford,” she said.