Here’s an apology from a 13-year IRS veteran, in ’s New York Times:

How you can resist funding the government → about the IRS and U.S. tax law/policy

Today, some highlights from the just-released IRS Oversight Board Annual Report. It’s remarkably redundant. There’s really not much here that hasn’t been said before by other overseers.

First thing to catch my eye was the claim that “Taxpayers increasingly recognize that the IRS provides good quality service.” Delving into the details shows how this was determined:

Well in excess of 80 percent of respondents in nearly all service channels rated their satisfaction with IRS service as better than, or the same as, other government agencies.

Now that’s setting the bar! Imagine the guffaws in the corporate boardroom if someone came in saying “our surveys show that more than 80% of our customers say that our customer service is at least as good as that of the government bureaucracies they interact with!”

The Board makes six recommendations for closing the “tax gap”. Five of these are the sort of boilerplate that I’ve seen in these sorts of reports before (simplify the tax code, enable the government to more closely monitor a larger variety of financial transactions, improve “customer service”, do more research into the nature of the tax gap, reach out to professional tax practitioners), but number six is new and has a delicious irony to it, at least from the perspective of this conscientious tax resister:

[T]here must be more emphasis on personal integrity in making tax decisions. The Board has found that the vast majority of taxpayers state that their personal integrity is a very important factor in influencing their tax compliance. In our survey, 82 percent of taxpayers cite personal integrity as the principal factor for reporting and paying their taxes honestly. Our tax administration system should challenge taxpayers and preparers to be conscious of the need for integrity when making tax decisions, and maintain the highest standards of compliance.

The Government Accountability Office released its own report on the tax gap , and the Senate Budget Committee held a hearing on the topic. Both of these, along with the Oversight Board report, use a study to estimate the size and extent of this gap — one that relied on decades-old data and guesstimates in parts.

And that doesn’t even count esoteric things like taxes on virtual goods and currencies, such as those obtained in on-line role playing games. To the extent that these have real-world value (and they do — check eBay), their acquisition (even their virtual acquisition) is taxable income. The IRS could try to enforce this tax under current law, but it doesn’t know where to begin and would rather ignore the whole issue and hope it goes away. Is this part of the “tax gap” between what the law allows the government to steal and what it actually stuffs in its loot bag? That’s just one example of the sort of thing the study didn’t even attempt to measure.

Truth is, nobody knows how big the gap is today or how it is composed.

A handful of interesting things that stumbled on our internets recently:

- Over at the LegalMatch law blog, Kate Langmore reviews the prospects for a tax resistance campaign by opponents of California’s Proposition 8.

- An ex-cop is working on a reality TV show designed to catch cops breaking the law. In the first episode, they catch cops lying to obtain a search warrant and then film them busting into their targeted house — only to find Christmas trees growing where they expected to find a marijuana farm, and surveillance cameras transmitting their surprised expressions back to KopBusters central.

- Wendy McElroy has been journaling a year of frugality at her blog — getting the jump on what’s likely to become an increasingly popular genre.

- At Tax Update Blog, Joe Kristan reports that the IRS’s “Offers in Compromise” program doesn’t seem to have much to recommend it:

One tax attorney writes:If you watch too much late-night cable television, you probably have seen commercials that make it appear that paying federal taxes is no big deal, because you can always work out a “pennies on the dollar” deal. Don’t count on it.

I regularly tell my clients that Offers in Compromise based on doubt as to collectibility are a crap shoot. You can meet all of the suggested requirements and the IRS can still legally reject your Offer merely because it feels it’s not in its best interests.

Of course, by the time you find out that the Offer is not in the government’s best interest you have voluntarily given it all of the information it needs to seize your assets and have also given them at least an additional year (the filing of an Offer extends the statute of limitations) to collect the tax.

- Kristen McKee’s working on some pre-new year’s resolutions. “One thing I’ve noticed in my deschooling process is my shift from helpless victim, to active participant, in many different areas of my life,” she writes. One of those areas is taxes: “In the past, I paid my taxes the easiest way I could figure out so I could get the most money back, or the way I knew most others to do it. This year I am trying to be true to what I really feel is important and learn how to minimize or eliminate the taxes I pay that go to fund a war.”

- Francois Tremblay investigates how shared belief generates power and notices the charmingly naïve and unashamedly naked liberal ideology hanging loose at Check Your Premises.

- More local currency news: Introducing the Milwaukee Bucks.

A few more interesting bits and pieces that flew past my eyeballs in recent weeks:

- Ever wonder what all those acronyms and code numbers mean on your IRS transcripts and other correspondence? If so, take a look at IRS Processing Codes and Information. The cover page is marked with the delightful message “ATTENTION: OFFICIAL USE ONLY — WHEN NOT IN USE, THIS DOCUMENT MUST BE STORED IN ACCORDANCE WITH IRM 11.3.12, MANAGER’S SECURITY HANDBOOK. Information that is of a sensitive nature is marked by the pound sign (#).” However, it is publicly available on the IRS website, and some of it is redacted, so I don’t think there are any national security secrets within.

- Someone posted scans of a “Political Art Documentation / Distribution” zine, the first issue of which was devoted to the subject of “Death and Taxes” that celebrated an art show of the same name: “, P.A.D. presented a public art event called Death and Taxes, to protest the use of taxes for military spending and cutbacks in social services… Twenty artists installed works in and out of doors in Manhattan and Brooklyn… The event included posters, graffiti, stickers, overprinted 1040 forms redistributed in banks, typed dollar bills, street theatre, outdoor films, environments, and performances.” Lots of punk rock aesthetic stuff with a war tax protest theme.

- The constitutionalist, “show me the law”-style tax protesters (or “tax deniers,” as the IRS spins it), which have long been an entertaining staple of the scene in the United States, are apparently becoming a rapidly-spreading phenomenon in Canada as well. “The National Post has identified 385 pending tax cases — most using florid and arcane language and claiming bizarre laws that supersede or nullify Canada’s regulations and laws; it prompted the Tax Court to adopt a triage approach to cope with the deluge, grouping cases and directing them to specific judges.”

- When tax auditors showed up at a restaurant in Archanon, Greece, , “there were strong reactions from customers in a large tavern, leading the auditors of the Financial Crimes unit to quickly leave.”

- Thanos Tzimeros, founder of the fledgling Greek political party “Recreate Greece,” has issued a call for tax resistance — or “robbery resistance” as he puts it. His perspective is a bit different from that of the largely leftish “don’t pay” movement. Rather than opposing the austerity and public-sector shrinking that Greece has been strong-armed into accepting by international lenders, he thinks these reforms haven’t gone nearly far enough and that the problem with Greece is that it is being strangled by a political/criminal class. If I’m parsing a Google Translate version of the Greek news article correctly, Tzimeros is encouraging people to pay their taxes into an escrow account and to refuse to turn the money over to the government until such time as it can give a satisfactory accounting of how it spends its budget. He points to bloated and redundant government agencies as examples of taxpayer money being siphoned off to fund a class of parasitical political appointees.

- Here’s the official IRS Office of Chief Counsel memorandum in which the Counsel reminds IRS employees that they cannot willy-nilly assess “frivolous filing” penalties on people who include letters of political protest along with their (otherwise accurate and complete) tax forms. And here is Peter J. Reilly’s take on the case at his Forbes blog.

- And here is another example of governments rigging traffic lights and automatic ticket-generating cameras in a way that makes intersections more dangerous… but more profitable to the taxers.

- NWTRCC has produced a set of war tax resistance talking points for media interviews that might help war tax resisters get their point of view across more effectively through the news media.

- Ruth Benn reflects on her war tax resistance, and the hapless but persistent response from the IRS, at NWTRCC’s new blog, War Tax Talk.

Networks of enterprising people around the world have discovered that they can siphon off some of the IRS’s ill-gotten goods by impersonating U.S. taxpayers and applying for refunds. This has become an enormous enterprise, with practitioners both foreign and domestic (including some who have managed to rake in hundreds of thousands of dollars this way from behind bars), and the IRS has only managed to slow the bleeding.

And now these criminal entrepreneurs have struck on the idea of working the game from the other side — they’re impersonating the IRS itself, calling up American citizens, and threatening them with government retribution — such as imminent arrest, deportation, license revocations, or property seizure — if they don’t pay some invented tax liability immediately (but, pay to the scammers, not to the real IRS).

The government calls it the “largest ever” scam of this sort — involving tens of thousands of victims, and millions of dollars in extorted payments. Hilariously, in warning people about the scam, the Treasury Inspector General for Taxpayer Administration claims:

“If someone unexpectedly calls claiming to be from the IRS and uses threatening language if you don’t pay immediately, that is a sign that it really isn’t the IRS calling,” he [Inspector General J. Russell George] said.

Sounds like Mr. George has never gotten a call from the IRS before!

The upshot of this is that the real IRS is going to have a harder time than usual distinguishing itself from smaller-scale thieves, and is going to have to devote even more energy into trying to assert its legitimacy.

And that’s energy the agency doesn’t have to spare — it has fewer employees now than at any time in the last decade, and much more to do: including implementing much of Obamacare, chasing down the rampant identity thieves, and responding to sweeping Congressional subpoenas regarding the TEA Party-targeting kerfluffle.

And morale at the agency has taken a dive for a number of reasons, exacerbating office conflicts, as a whistleblowing letter from IRS attorney Jane J. Kim reveals.

Some news in brief from here and there:

- The IRS Commissioner and the National Taxpayer Advocate are each predicting that the upcoming federal income tax filing season will be especially challenging for the agency.

Indeed they’re throwing around adjectives like “miserable,” “worst,” and “unacceptable” and they haven’t even really gotten started yet.

Among the factors making this year particularly bad are the launch of Obamacare’s tax credits (and penalties), hostility from Congress, and uncertainty in tax law because Congress has yet to decide which expiring tax laws it will retroactively extend at the last minute.

Good luck getting help from the agency over the phone if you get confused. They’re expecting to be able to answer only about half of the calls they get, after an average on-hold time of over a half-hour, and even then will only be able to answer the most elementary tax questions.

All of this is bound to increase taxpayer frustration and anger towards the tax-collecting bureaucracy, as well as making it a more unpleasant place to work. - A fellow named Valentin from Chicheboville decided to protest the enormity of his taxes by paying them with an enormous check — a piece of cardboard two-meters long.

- You may have heard of mass protests in Mexico over the government’s collusion in massacres of student demonstrators there recently. The protesters have admirably started burning government buildings including the statehouse in Guerrero and the headquarters of the Institutional Revolutionary Party. A side-note of interest here is that some businesses in Acapulco, Guerrero, have launched a tax strike to protest the government’s failure to protect the tourist trade from the losses caused by demonstrators!

- The government of Greece keeps adding to the Greek tax burden, and more Greeks keep reaching their last straw. , another 851,201 Greeks were added to the delinquency lists, raising the total from 2,451,909 to 3,303,110 — about 30% of the population of Greece. The government is using a variety of carrots and sticks to try to bring these numbers down.

- l’intraprendente takes a look at the fizzling of the Northern League’s anticipated tax strike.

Before the U.S. federal government “shutdown,” back in , I ordered a batch of this year’s tax forms from the IRS. I like to file on paper, rather than electronically, in part because if we all did that we’d bring the IRS to its knees. But anyway… during the “shutdown” the IRS sent me a letter saying it had gotten my order but would not be able to fulfill it right away. Here we are in mid-February, three weeks after the “shutdown” ended, and I’m still waiting.

That’s just a superficial indication of the chaos that’s roiling the already-overtaxed (ha!) agency. Years of increasing responsibilities, budget cuts, blows to employee morale, and ever-more-dilapidated IT infrastructure (“profoundly archaic”, one recent report put it, and risking a “catastrophic systems collapse”) have taken their toll. Hiring freezes have led to a graying workforce that is retiring in droves. The “shutdown” was further insult to the injuries.

And that, in a year when the agency has had to change its rules and processes to deal with a new tax law and the most radically restructured tax forms in recent memory. That all requires employee retraining which was supposed to have been happening in the weeks leading up to tax filing season, that is, the time when the agency had to shut its doors and send its seasonal employees home.

Employees came back to their desks last month to find five million unsorted pieces of mail waiting for them. Taxpayers who tried to call the agency to resolve unpaid tax bills failed to reach a human voice 93.3% of the time and waited on the phone an average of over an hour and a half.

In other news…

- The new federal income tax law that goes into effect this filing season was the usual slapdash exercise in political posturing and lobbyist pissing matches. Naturally a plethora of loopholes and shelters bubbled to the surface after the ooze settled. A set of tax law experts has made “an effort to supply the analysis and deliberation that should have accompanied the bill’s consideration and passage,“ and they conclude that “[m]any of the new changes fundamentally undermine the integrity of the tax code and allow well-advised taxpayers to game the new rules through strategic planning.” Details here: The Games They Will Play: Tax Games, Roadblocks, and Glitches Under the 2017 Tax Legislation

- After all of the talk of tax cuts, Americans may be surprised at getting fewer, smaller, and later-to-arrive income tax refunds than they’re used to this year. While that’s not a very meaningful metric in the big scheme of things, it is something that can contribute to the degradation of taxpayer morale, as many taxpayers — subconsciously or merely short-sightedly — see their tax refund as a measure of how generous or costly the government is to them.

- The usual stories about massively profitable companies like Netflix or Amazon not paying taxes (or indeed getting tax refunds) are also doing the rounds and eroding taxpayer morale this year.

- Susanne Großmann of Pax Christi and Netzwerk Friedenssteuer attempted last week to appeal for a refund of 5% of her taxes, on conscientious objection to military taxation grounds.

Your up-to-the-minute tax resistance news:

- The IRS is giving off a powerful odor of desperation as it enters tax filing season. The agency has a backlog of some fourteen million unprocessed tax returns and other taxpayer correspondence from previous years still to get through. Some taxpayers have complained of getting upsetting notices that the agency had no record of them filing their taxes last year, when in fact their tax return is still sitting in this gigantic pile (or has been lost in the shuffle). Members of Congress, smelling blood in the water, signed a letter demanding that the IRS stop harassing taxpayers in this way. (Memo to Congress: you don’t have to resort to pleading in a letter; the IRS is part of the federal government and you could pass legislation to fix this if you really meant it.) The agency responded by suspending some such taxpayer notices but also noting that by law, if they don’t send certain notices out, they lose the ability to pursue people who actually did fail (or refuse) to file. Meanwhile, the agency is shifting 1,200 employees from their regular duties (like enforcement) to doing data entry so as to try to whittle down this backlog.

- Florida Man is back in the news, this time for using IRS databases to download people’s past tax returns and then filing additional fake returns in their names in order to get fraudulent refunds.

That sort of identity theft and refund fraud has made the IRS eager to tighten up security. They’re under pressure to allow taxpayers to conveniently view their tax statements and other such information on-line in the same way they have come to expect to view their bank accounts, utility bills, and everything else in our digital age. On the other hand, cunning and not-so-cunning fraudsters like Florida Man see such convenient access as a recklessly-guarded vault full of government money ripe for the picking. What is the IRS to do?

Their response was to invite the usual suspects in government contracting to bid on a contract to square the circle and make the problem go away. The winning bidder apparently was military contractor ID.me, and the IRS has begun rolling out their solution and telling users of on-line IRS account services that they’ll need to reenroll with ID.me if they want to continue to access their accounts. However, the rollout has gone poorly. As I noted last month the sign-up process is clumsy, time-consuming, and buggy. It’s also uncomfortably invasive — requiring a face scan and copies of a variety of documents. ID.me sent out a press release claiming that those face scans were only used in a very limited way to verify identity but then had to walk back that claim when it was shown to be untrue. Privacy advocates and people & groups with a host of other concerns have been urging the IRS to reconsider.

- Lincoln Rice, who heads the National War Tax Resistance Coordinating Committee (NWTRCC), was interviewed on the Tax Chats podcast.

- Danny Burns’s excellent history of the Poll Tax Rebellion has been released in free text and PDF forms on-line, apparently with the blessing of the author.

- There’s a new NWTRCC newsletter out.

As I noted late last year, the number of Americans who renounced their citizenship hit new highs again. But that’s not the whole story. As it turns out, in order to renounce your citizenship, you first have to appear in person at an embassy or consulate for an “exit interview.” And, with the covid epidemic as an excuse, these offices have been refusing to grant such interviews, meaning that thousands of Americans who would like to formally renounce their citizenship have been prohibited from doing so.

Clarification: the number of Americans who renounced their citizenship hit new highs in , according to numbers released , but it looks like ’s numbers dropped considerably from there, with the unwillingness of embassies to process renunciations being one reason for the drop. ―♇

- The ragtag human guerrilla war against the robot traffic ticket hordes continues, with humans taking robots out of action in the United States, France, Martinique, and Italy and in the United States, Italy, New Zealand, and France in recent weeks.

Just when I think I’ve heard it all about the troubles at the IRS, everything turns out to be worse than I heard:

- Remember when I told you about how the IRS was rolling out a new way for people to sign on to their on-line systems, and that it was a bit invasive, difficult, and buggy? And then remember when I told you how the rollout was going poorly and generating a lot of push-back? Well, the awful just continues to pile up and now the IRS is scrapping the new sign-on process and going back to the drawing board. Meanwhile, some seven million people may have tried to use the new process to log in, a process that included sending in “selfies” for biometric testing, which attracted the ire of privacy advocates. The contractor who designed and operated the identification verification service says these people can request to have these selfies deleted. Reading between the lines, I think this contractor is going to try to force everybody to use the back-up plan that was already in place for if the automatic selfie-check didn’t work: to have a video chat with an employee who would “eyeball” the chatter to see if their identity matches up with what’s on their paperwork. This isn’t really any less invasive than the selfie method, but maybe it triggers people’s “big brother” alarms less. It’ll certainly be less automated and therefore more expensive and time-consuming.

- But the IRS is no stranger to doing things the more expensive and time-consuming way. For example, their mail-sorting and -opening machines have been broken for a long time, and IRS employees now have to do the work by hand. This means that if you send them a check, it takes them longer than it should for them to get that check out of the envelope and into the U.S. Treasury. This delay also means the government loses out on interest they could be earning on that money. How much interest? About $165 million a year. It would only cost $650,000 to buy completely new machines, or $365,000 to repair the broken ones.

- And remember how I told you how the IRS had stopped sending out some enforcement notices to taxpayers? Taxpayers were getting frightening notices suggesting that the IRS didn’t think they’d filed their taxes, when in fact their tax returns were sitting in an enormous pile of tax returns the agency hadn’t gotten around to processing yet. So the IRS said it would stop sending out a few types of notice until it got all that sorted out — but said that it couldn’t stop sending out a bunch of others because it might mean they’d lose their chance to go after genuine tax scofflaws. Well, now they’ve thrown in the towel and said they’ll stop sending out a dozen more types of notices including the balance due, balance due second notice, notice of intent to levy, and withholding compliance letters that are standard issue to tax resisters like myself.

- And remember how I told you that the IRS had a backlog of some 14 million unprocessed tax returns and other taxpayer correspondence? Turns out it’s more like 24 million. Meanwhile: “The agency sought to fill 5,000 positions for several campuses across the country in time for this tax season but was able to hire fewer than 200.”

- In other news, the IRS is eager to reduce the size of the underground economy by demanding more reports on gig workers and others who get irregular payments through platforms like Paypal, Venmo, Etsy, and Zelle. But this isn’t going smoothly either. It seems to be raising more resentment than tax money, at least so far. And it’s easy to bypass. If you pay someone using one of these platforms and explicitly say you’re paying for goods or services, maybe it’ll eventually get reported as income. But if you don’t say this, as far as the platform is concerned maybe you’re just sending a gift or reimbursing someone for part of a meal you shared where they picked up the tab. Is today’s IRS going to send auditors out to make sure nothing falls through the cracks this way? Yeah sure.

In other news:

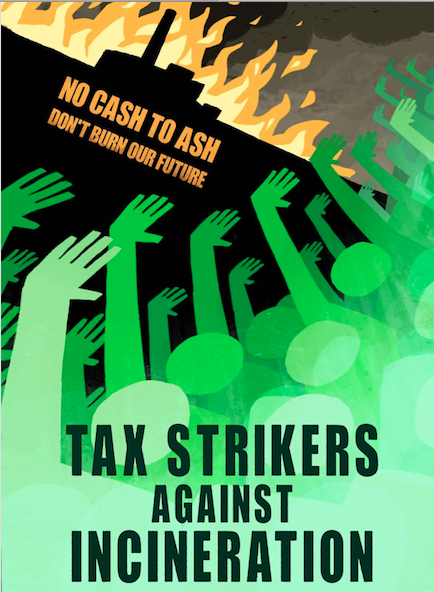

- The tax strike against the Edmonton Incinerator continues to attract more strikers as the early adopters prepare for their first day in court.

- Turkish opposition politician Kemal Kılıçdaroğlu announced that he plans to refuse to pay his utility bills until president Erdoğan withdraws 50% price hikes instituted at the beginning of the year. Some Alevist cemevis have also stopped paying.

- The ragtag human guerrilla war against the traffic ticket robots continues, with robots succumbing to human attacks or being frustrated by human ingenuity in the U.K., Australia, Brazil, Italy, and France in recent weeks.

Yesterday I was on a panel concerning “Resisting Taxes in the Trump Era” at the National War Tax Resistance Coordinating Committee’s spring gathering. Below is a summary of my remarks:

We can no longer reliably extrapolate from long-standing precedent about how the government operates, or how it responds to tax resisters, to anticipate the near future. While past tax policy changes have been slow, gradual, and predictable, near-future changes are likely to be abrupt, arbitrary, and unstable.

This presents us with new challenges but also new opportunities. I want to consider five areas the war tax resistance movement in the U.S. should be aware of, observant about, and prepared for. But it’s too early to draw strong conclusions about any of them:

- Changes at the IRS

- The possible end of the federal income tax

- Expanded government information-sharing

- Anti-Trumpery tax resistance

- How to resist tariffs

Changes at the IRS

First: the IRS is being significantly degraded and is in disarray. There have been four acting IRS commissioners already in the first four months of the Trump Administration, serving between four days and six-and-a-half weeks each. There is no Senate-confirmed commissioner. In addition there have been thousands of dismissals of probationary IRS employees, and many others have accepted buyout offers to retire early. Furthermore, the recently-released presidential budget assumes a further 25–50% headcount reduction at the agency. The enforcement & collection branches have not been spared from this slaughter.

The agency was already on-the-ropes before all this happened. For years they have lost headcount and their budget has dwindled, even as their responsibilities and the number of taxpayers has increased. There was briefly some hiring and a budget boost at the agency during Biden’s term, but that hardly had begun to take effect before Trump’s crew came in and eviscerated it.

As a result, we can predict that the already feeble agency will be further incapacitated.

Second: there has been a collapse of the post-Nixon consensus that put a firewall between IRS enforcement and political appointees. For the last 50 years it would have been considered a serious taboo for the president or one of his political appointees to try to go to the IRS and say “you should audit so-and-so; I think they’re up to something (or: I don’t like them).” IRS enforcement decisions were firmly in the hands of career IRS employees, not political appointees. Trump is putting an end to that. He’s put a political appointee in charge of the IRS Criminal Investigation Division. He’s being aggressive in using his powers to punish political enemies or to shake down deep-pocketed victims. We can expect that he will use the IRS in this way, too.

Will this affect American war tax resisters? Probably not right away. I don’t think we’re on Trump’s enemies radar, and we’re not attractive shakedown targets. But if tax resistance becomes a more prominent part of the anti-Trumpery movement, then, yes: expect politically-motivated reprisals.

The possible end of the federal income tax

Trump has repeatedly claimed that he plans to replace the IRS with an “External” Revenue Service, and replace income taxes with tariffs. Of course, Trump claims a lot of things, and that’s never been a good reason to take those claims seriously. But there are some other lines of evidence that suggest this may be for real.

Trump’s nominee for IRS Commissioner, Billy Long, when he was in Congress, co-sponsored legislation to abolish the IRS and replace the federal income tax with a sales tax. This idea of replacing income taxes with consumption taxes has been floating around conservative circles for decades, but hasn’t had enough traction to go anywhere yet. The “serious people” mostly ignore these proposals as being too onerous to accomplish and too likely to go very badly, but Trump shows strong signs of being willing to do very disruptive things and to not care much if they’ll go badly, so I think we have to consider the possibility.

This is not something Trump could do directly by fiat. Congress would have to act to eliminate the federal income tax or the Internal Revenue Service. But potentially Trump could force their hand by 1) unilaterally enacting tariffs, as he can do and has done, and 2) making the IRS so dysfunctional that it can no longer effectively collect income taxes, as he seems to be doing. At that point, Congress might be faced with a fait accompli and might believe that if it wants to continue to have a budget to spend, it must allow Trump to raise tariffs (or other consumption taxes) to make up for what the IRS is unable to collect.

This is probably not happening right away. The current Trump budget and tax proposals are for income tax cuts and for cuts to the IRS but not elimination of either.

Where would this leave war tax resisters, who tend to concentrate on the federal income tax as the most important source of war funding? We would have to retool to resist these new taxes in new ways. (More on this below.)

Expanded information-sharing among federal agencies

A variety of legal firewalls, bureaucratic hurdles, and incompatibilities have prevented federal government agencies from sharing information with each other. Some of that fell away during the consolidation of the Department of Homeland Security after 9/11. Now many of the remaining firewalls seem to be dropping to DOGE.

Most news I’ve seen about this is in the immigrant-crackdown context. For example, the IRS is sharing info from people’s tax returns, and the postal service is sharing information about people’s mailing addresses, to help ICE find immigrants to deport.

Potentially this could make it easier for the IRS to find assets or previously shadowy income. There’s no sign that this is happening yet, and it would be yet another task for a gutted IRS to try to tackle, so maybe it’s unlikely, but it’s worth keeping on the radar, and we should raise the alarm if anyone notices anything.

Anti-Trumpery tax resistance and war tax resistance

There’s a lot of eagerness among anti-Trumpery activists for some strong, collective action, which could include tax resistance (see for example the National Tax Strike under the Choose Democracy umbrella).

Where does the war tax resistance movement fit in? Anti-Trumpery tax resistance isn’t “war” tax resistance. Sure, you can stretch “war” metaphorically to cover deportations, civil liberties collapse, evasion of due process, Constitutional crisis, willful malgovernance, fascism, white supremacy, and so forth, but it’s awkward. Most of NWTRCC’s outreach and educational material assumes that war and militarism are the focal concern of tax resisters, and to these new resisters this has the potential to be alienating at worst or confusing at best.

Of course, if Trump invades Greenland or Canada or something, then the anti-Trumpery movement will probably develop a strong anti-war focus, and then war tax resistance rhetoric will fit right in. I suppose we can’t rule that out.

It’s an encouraging sign that the War Tax Resisters Penalty Fund mutual aid program now explicitly welcomes anti-Trumpery tax resisters as well as traditional war tax resisters. Maybe we can learn from the process they went through as they decided to become more accommodating to a new set of resisters.

Correction: the WTRPF board has since released a statement that says they are not going to extend the fund to cover tax resisters who are not resisting from anti-war motives. I had based what I said here on a statement from a member of the WTRPF board who apparently misstated the position of the organization.

How to resist tariffs

Trump would seemingly prefer that tariffs permanently make up a predominate portion of federal government income (and therefore military budget income), as they did in the 19th century. How could war tax resisters continue to resist if this were to come to pass?

Tariffs are taxes that apply to imported goods and that are paid by the U.S. importer. So you can resist to some extent simply by not importing anything so that you personally do not pay the tax. But the typical American is going to be paying tariffs indirectly as a consumer of goods whose prices include the costs of tariffs to the importer or manufacturer.

Note that tariffs apply not only to consumer-ready goods (like imported cars) but also to imported raw materials and intermediate manufacturing goods. For this reason, the prices of many “domestic” products will embed tariffs just as much as do imported ones. A tax resistance strategy of consuming only “Made in the U.S.A.” domestic goods will not be effective.

Some tactics that might be worth considering if tariffs make up a large amount of military income include:

- Anti-consumerism, lifestyle simplification, DIY, grow-your-own, repair/reuse/recycle: spend less money in general, take more of your life out of the marketplace, and you’ll spend less on tariffs.

- Smuggling: if tariffs are high, smuggling will become highly profitable and will certainly emerge. We can help nourish that and can redirect our own consumption to smuggled goods.

- Domestic manufacture: try to produce and market goods that deliberately and carefully avoid tariffs. Spread awareness about tariff-free goods.

- Promote avoidance strategies: there will certainly be loopholes that can be exploited to reduce or eliminate tariffs; we can help importers learn about and use them.

- Disrupt the tariff-collection bureaucracy: anything we can do to make the tax collectors’ work more difficult and less efficient will give the Pentagon less to play with.

These tactics (or similar ones) apply also to other consumption taxes that might be in the cards (e.g. a sales tax or use tax).