America I’ve given you all and now I’m nothing.

America two dollars and twentyseven cents .

I can’t stand my own mind.

America when will we end the human war?

Go fuck yourself with your atom bomb.…

―Allen Ginsberg, America,

America I’ve given you all and now I’m nothing.

America two dollars and twentyseven cents .

I can’t stand my own mind.

America when will we end the human war?

Go fuck yourself with your atom bomb.…

―Allen Ginsberg, America,

In , Allen Ginsberg wrote a letter to the Secretary of the Treasury David Kennedy to tell him why Ginsberg would not be paying his taxes. The Allen Ginsberg Trust has put this letter on-line. Excerpts:

I am not able to pay this money into our Treasury to be expended in the continuing illegal and immoral effort to kill or subdue more Vietnamese people.

…I am physically, mentally and morally unable to earn moneys to pay for the Vietnam war. The basic, traditional ethics of my profession as Poet prohibit me from assigning money earned incidental to the publication of literary compositions pronouncing the inhumanity, ungodliness and contra-patriotic nature of this war toward funding the very same war.

…I can’t live in peace with myself and pay taxes into a fund which goes directly into the Vietnam War. This prospect has made me physically ill. Thus if our tax system is so inequitable that it cannot find a reasonable alternative, such as payment of these taxes into a fund which is not used in this war, then I will be relieved to go to jail rather than pay money to the war.

Truth be told, part of my harsh reaction to the Iraq Moratorium that I posted here on was probably from envy at how their call to vague and lukewarm action has attracted some 2,000 signers, support from dozens of organizations, and endorsements from various celebs, while the War Tax Boycott is still trying to build up a head of steam, without much in the way of organizational or big-name support.

There was a time, though, when influential people were eager to sign on to a war tax boycott.

On , the New York Times reported:

WRITERS PROTEST VIETNAM WAR TAX

133 Will Refuse to Pay if Surcharge Is Approved

By MORRIS KAPLAN

A number of writers and editors have joined in opposing tax payments to support the war in Vietnam by pledging to withhold payment of President Johnson’s proposed 10 per cent income tax surcharge if Congress approves it.

Many of them have also promised to deduct 23 per cent from their tax bills as an estimate of the percentage used to fight the war. A statement in support of this dissent has been signed by 133 writers.

Each dissenter has sent $10 or more to the Writers and Editors War Tax Protest, a group headed by Gerald Waker of Manhattan. Mr. Walker, assistant articles editor of The New York Times Sunday Magazine, said the money would be used for expenses and to pay for a newspaper advertisement planned for .

The proposal for a 10 per cent surcharge on corporate and individual taxes is now before the House Ways and Means Committee and is expected to be reported out next month. The President has said it would relieve a budget deficit of possibly $28-billion.

More Support Sought

Mr. Walker expressed hope that the protest would win the support of from 300 to 500 writers and editors.

Among those who have pledged support are Eric Bentley, drama critic who is Brander Matthew Professor of Dramatic Literature at Columbia University, and Ralph Ginzburg, the New York publisher who is still appealing a Federal Government pornography conviction.

Others include Fred J. Cook, author and magazine writer; Betty Friedan, author of “The Feminine Mystique”; Dwight Macdonald, New Yorker Magazine critic, and Merle Miller, Thomas Pynchon and Harvey Swados, novelists.

A letter accompanying the protest statement points out the possible consequences of willfully refusing to pay Federal income taxes. Violators of the law could receive up to one year in prison and up to $10,000 in fines.

Others Not Prosecuted

Mr. Walker said, however, that of the 421 signers of a similar no-payment ad last year in a Washington newspaper, not one had been prosecuted and sentenced. Of an estimated total of 1,500 additional protest nonpayers, he added, none has been prosecuted since the war in Vietnam began.

The Internal Revenue Service has chosen, so far, to collect unpaid taxes by placing a lien on the incomes of those who refuse to pay, or by attaching their bank accounts or other assets. In addition, a 6 per cent interest penalty is charged each year on the unpaid tax balance.

The group’s appeal for support included a quotation from Henry David Thoreau’s “Civil Disobedience,” written in and protesting American involvement in the Mexican War. The writer said, in part:

“When… a whole country is overrun and conquered by a foreign army, and subjected to military law, I think it is not too soon for honest men to rebel and revolutionize.… If a thousand men would not pay their tax bills this year, that would not be a violent and bloody measure, as it would be to pay them, and enable the state to commit violence and shed innocent blood.”

That’s a weird note to end the piece on. The Thoreau quote is strangely ellipsized to make it sound like he thought that somehow the United States had been overrun and conquered by Mexico or something, or that civil disobedience was appropriate only when you’ve been invaded by a foreign army and subjected to military law. Here’s the full quote, which makes its relevance (to the Vietnam War then, to the Iraq War now) more clear:

But enough nitpicking. This appeal brought in 133 writers and editors. , the list had swelled to 448 (it would go even higher than the 500 that Gerald Walker originally hoped for), and included such names as Nelson Algren, James Baldwin, Noam Chomsky, Philip K. Dick, Lawrence Ferlinghetti, Allen Ginsberg, Paul Goodman, Norman Mailer, Henry Miller, Tillie Olsen, Grace Paley, Robert Scheer, Susan Sontag, Terry Southern, Benjamin Spock, Gloria Steinem, William Styron, Hunter S. Thompson, Kurt Vonnegut, and Howard Zinn.

As far as I can tell, the IRS didn’t take legal action against anyone who signed on to this list (though it probably sent threatening letters or engaged in administrative sanctions like levies and liens).

Nixon won the presidential election in , and among his campaign promises had been to end Johnson’s 10% surtax and somehow salvage “peace with honor” in Vietnam. A couple of years later, the surtax breathed its last. It took a few more years to get U.S. troops out of Vietnam.

In , the Washington Monthly carried a story about war tax resisters written by Kennett Love, himself a signer of the “Writers and Editors War Tax Protest” pledge.

Tax Resistance: Hell No — I Won’t Pay

“We believe that the right of conscientious objection to war belongs to all the people, not just to those of draft age,” says a pamphlet now being sent out across the country from a littered, poster-bright office on New York’s Lower East Side. It carries a radical call to the citizenry to come out against the war in Vietnam by refusing to pay taxes that finance the war.

Such tax resistance is now gathering adherents outside traditional pacifist circles. Although it is still far from a major headache to the government, Internal Revenue Service men are being assigned to locate bank accounts of resisters and to seize the sums due — plus six per cent interest. Out of the frustration of the anti-Vietnam-war segment of the population, which is growing rapidly according to the polls; out of dashed hopes raised by peace promises and peace gestures from the Nixon and Johnson Administrations alike; and out of a feeling that orthodox democratic forms of protest — elections and demonstrations — have been ignored, an increasing number of otherwise law-abiding people are following their consciences into what Gandhi called the last stage of civil disobedience by openly refusing to pay part or all of their federal taxes.

The chief targets of the tax-resistance movement are the income tax, particularly the 10 per cent war surtax imposed last year, and the 10 per cent federal excise tax on telephone service. Other federal taxes have been rejected either as too complicated to resist, such as the liquor tax, which is collected at the wholesale level before individual purchase, or as earmarked for such non-war uses as highway construction. One pacifist, imprisoned for draft refusal and therefore lacking income to refuse taxes on, gave up smoking because the cigarette tax brings the government more revenue than any other single consumer-commodity tax.

The telephone tax is the most popular one to resist, partly because it was the first to be specifically linked to the war in Vietnam and partly because the American Telephone and Telegraph Company has proven courteous in its handling of tax resisters. The telephone tax was due to be reduced to three per cent in . In approving the White House request for its extension of the 10 per cent level, Chairman Wilbur Mills (D-Ark.) of the House Ways and Means Committee said: “It is clear that the Vietnam and only the Vietnam operation makes this bill necessary.”

Resistance to the telephone tax began soon afterward. Karl Meyer of Chicago, a former Congressman’s son and a free-lance writer immersed in pacifist causes, conceived the idea and proposed it to Maris Cakars of the War Resisters League in New York. Meyer drafted a pamphlet, “Hang Up On War!,” which has become a staple among the literature distributed by the War Resisters League through the mails and at peace booths. It explains the link between the telephone tax and the war, summarizes moral and legal objections to the war, and provides practical advice for resisters of the tax, including a candid assessment of the possible risks. Of the risks, it points out that under Section 7203 of the Internal Revenue Code, which covers both the telephone and the income tax, one who “willfully fails to pay” could be imprisoned for up to one year and fined up to $10,000. It adds that the experiences of tax resisters over the past several years show that the government is not willing to press criminal charges but, instead, acts to collect the taxes (with interest) directly, when and where it can.

AT&T records indicate that telephone tax resisters were relatively unmoved by President Johnson’s famous “abdication” speech on , but that about a quarter of them resumed payment of their telephone taxes at in the belief that President-elect Nixon would end the war. A table of the telephone company statistics follows, giving the number of telephone tax refusers at the end of each quarter :

Quarter No. of resisters to telephone tax 1,800 2,300 2,600 3,400 3,400 4,700 5,300 4,700 4,000 4,000 The figure for is not available yet, but the revived intensity of the anti-war movement, manifested in the national student moratorium on and the big demonstrations on , presage an increase.

Measured against the telephone company’s 43,459,000 residence customers, the percentage of tax resisters is minuscule. But in view of the seriousness of the act of tax resistance, the number of resisters is a source of satisfaction and encouragement to the leaders of the movement.

A spokeswoman for the telephone company told me its standing orders are to continue service to tax resisters so long as its own charges are paid. The company notifies the IRS of tax non-payments so it can do its own collecting. If a tax resister informs the local business office of the telephone company that he is deliberately omitting the tax from his payment, the office will not carry the tax charges forward to his next bill. “It would seem logical to assume that we don’t like to be a collecting agency,” she said, “but we do what we’re obliged to do.” She said that telephone tax resisters are located mainly in college communities.

Income tax resisters, although fewer than telephone tax resisters, appear to be a more stubborn breed, unmoved by political gestures and prepared to hold out until the war actually ends. An IRS spokesman in Washington gave me a statistical summary of the growth of such tax resistance. So far as he knew, it first became a public issue when Joan Baez, the singer, refused in to pay 60 per cent of her income tax in an act to dissociate herself from what she called the immoral, impractical, and stupid war in Vietnam. She refused the same proportion in and wrote the IRS: “This country has gone mad. But I will not go mad with it. I will not pay for organized murder. I will not pay for the war in Vietnam.” Joan Baez and a scattered handful of old-line pacifists, a few of whom had been refusing war taxes , were not worth keeping statistics on, so far as the IRS was concerned.

Then, in , a committee under the chairmanship of the Reverend A.J. Muste circulated a tax-refusal pledge among persons on the mailing lists of the Committee for Non-Violent Action and the War Resisters League. They obtained 370 signatures for an advertisement in The Washington Post that stated: “We believe that the ordinary channels of protest have been exhausted…” Joan Baez headed the list of signers. According to an IRS analysis, about one-quarter of the signers had no taxable income, about one-half cooperated with the IRS to the extent of telling the agent who called on them where their money could be seized, and about one-quarter put the IRS to the trouble of ferreting out their bank accounts. The number of actual resisters came to about 275.

the IRS began keeping a count of tax protesters. The number rose to 375. In there were 533 taxpayers who refused part or all of their income taxes and wrote the IRS that they were doing so in protest against the Vietnam war. there were 848 who set themselves against the law on grounds of conscientious objection to the war. The IRS spokesman told me that roughly three-quarters of the income-tax protesters live on the east and west coasts and that the same proportion held for persons refusing to pay the telephone tax.

IRS spokesmen emphasize that the number of refusers is only a tiny fraction of the total number of taxpayers. There were some 71 million returns filed in , about 73 million in , and 75 million in . But again, tax-resistance leaders find significance in the fact that the very idea of tax refusal was unthinkable to nearly all of the resisters until their consciences impelled them to it. Furthermore, although the numbers are small, the rate of increase of tax resisters is far greater than the annual increase in tax returns.

Fear of prosecution and jail is a deterrent to potential tax refusers. Many people fail to recognize the distinction between clandestine tax evasion and open tax refusal. The IRS makes the distinction, however, and has shown no inclination to prosecute persons refusing taxes because of the Vietnam war. An IRS spokesman said earlier this year: “Is IRS going to ask the Justice Department to go to a federal grand jury and get a jury trial to put a man in jail for a dollar, when all we have to do is go to his bank account?” Tax-resistance leaders believe also that the government wishes to avoid the publicity attendant on a prosecution, largely because a test case might produce a martyr and create sympathy for the movement. The few prosecutions in recent years have been for refusal to file returns or disclose information rather than for refusal to pay.

War tax refusal in this country is older than the United States itself. It began in when Mennonites and Quakers refused to pay taxes for the French and Indian wars. They refused again during the American Revolution and the Civil War. The most famous early instance was that of Henry David Thoreau, who spent a night in jail in for refusing taxes in protest against our invasion of Mexico. He explained in his essay on civil disobedience that he could not “without disgrace be associated with it” and added: “If a thousand men were not to pay their tax bills this year, that would not be a bloody and violent measure, as it would to pay them, and enable the State to commit violence and shed innocent blood.”

Gandhi, who was deeply influenced by Thoreau, wrote in that “civil non-payment of taxes is indeed the last stage in non-cooperation. …I know that the withholding of payment of taxes is one of the quickest methods of overthrowing a government.” He went on to say: “I am equally sure that we have not yet evolved that degree of strength and discipline which are necessary… Are the Indian peasantry prepared to remain absolutely non-violent, and see their cattle taken away from them to die of hunger and thirst? …I would urge the greatest caution before embarking upon the dangerous adventure.” But Lord Mountbatten said with relief after India became independent: “If they had started to refuse to pay their taxes, I don’t know what we could have done.”

The idea of modern, organized tax resistance in this country against armaments and war seems to have begun with the Peacemaker Movement, which was formed by 250 pacifists who met in Chicago early in . In , the Peacemaker Movement published the first edition of a mimeographed Handbook on Non-Payment of War Taxes, which contains practical advice and case histories. The handbook has now run to three editions and nearly 10,000 copies. It points out that since the bulk of the federal budget (estimates range from 66 to 80 per cent) goes to pay for past wars, finance the Vietnam war, and prepare for future wars, “it is apparent that the major business of the federal government is war… it is useless to act as if the major business of government is civil functions or peaceful pursuits.”

In , a little more than a year after A.J. Muste’s committee published its tax protest advertisement with 370 signers, Gerald Walker of The New York Times Magazine began to organize a Writers and Editors War Tax Protest, in which all the signatories pledged themselves flatly to refuse the then-proposed 10 per cent war surtax and possibly the 23 per cent of their income taxes allocated to the war effort as well. As was the case with the Reverend Muste’s advertisement, most daily newspapers that Walker approached refused to sell space to him. The New York Times was one that refused and so, this time, was The Washington Post. The New York Post printed Walker’s advertisement in , as did The New York Review of Books and Ramparts. In all, 528 writers and editors signed the pledge. Walker told me recently that about half of them, including himself, failed to carry out the tax-refusal pledge. “Johnson’s ‘abdication’ two weeks before the tax deadline convinced me that we had won,” he said.

I was myself among the other half of the signers who did refuse part of their taxes — 23 per cent in my case, the 10 per cent surtax not having gone into effect. Since my own hesitant involvement in war tax resistance seems typical among the non-pacifists now joining the movement, I will summarize it here as the case history I know best. With my part payment of my income tax, I wrote the IRS as follows:

Enclosed please find my check for $1,862.81, which is 77 per cent of the tax required. The 23 per cent unpaid is a protest against the government’s use of that proportion of its revenue for the war in Vietnam. My conscience revolts against the gross immorality of the war… There are also questions of law. The war violates the supreme law of our land, notably the Constitution (Art. Ⅰ, Sec. 8, clause 11), the United Nations Charter (Art. 51), and the Southeast Asia Treaty (Art. Ⅳ)… Responsible jurists and philosophers soberly accuse our government of crimes against international codes on human rights and the conduct of wars and the specific statutes created ex post facto to punish the Nazis…

The prodigal waste of our national energy and treasure in destroying the land and people of Vietnam is so weakening this nation that other powers may bring us to judgment as we once brought the Nazis to account at Nuremburg… It will then be no defense to plead, like the “good Germans,” that we had to obey our government and cannot be held responsible for what it did. By paying taxes which I know my government is using to kill a small nation I commit a greater and more violent breach of laws than I do by not paying…

I was a Navy pilot in World War Ⅱ. I would not serve in this war. If I could prevent my tax dollars from serving, I would do so. Unfortunately, I have not yet learned of a practical way to keep the government altogether from extracting financial support from me for the war. In the meantime, I balk at 23 per cent in token of my dissociation from the cruel injustice and bloodshed to poor and distant strangers being done under my flag, in my name, with my money.

The IRS reply did not come until after I had refused a similar amount of taxes . It was a form postcard saying: “Dear Taxpayer: Thank you for your letter. We are looking into the matter you brought up and should have the answer to you shortly… Thank you for your cooperation.” The answer, inevitably, was a series of printed forms, progressing from a “notice of tax due” to a “Final Notice Before Seizure.” The IRS had already seized telephone taxes, which I stopped paying in , from three bank accounts, patiently tracking down the bank to which I transferred my account after each seizure. The IRS obtained the unpaid part of my tax, plus six per cent interest, in . At this writing I am awaiting implementation of the Final Notice Before Seizure of the refused portion of my taxes. Banks are required by law to surrender private assets, including the contents of safe deposit boxes, to the IRS upon demand. Most banks surrender the levied amount immediately and the depositor is informed afterward.

This whole business of deliberately defying and harassing the government, even in a moral protest, is a heavy and anxious experience. When I first considered it in I was unaware that some hundreds of other people were already doing it. I was afraid of going to jail, which, among other things, would have prevented my fulfilling a contract to complete a book. I began refusing the telephone tax after obtaining the pamphlet “Hang Up On War!” from a pacifist in Princeton in . The Writers and Editors War Tax Protest, which came to my attention , gave me a sufficient sense of safety in numbers to begin income-tax resistance.

I am still troubled over possible consequences, particularly after the conspiracy convictions in the Dr. Spock trial, and I find it innately distasteful to resist paying my share of the general tax burden. But my revulsion against the war in Vietnam prevails over anxiety and civic reservations. And the Nixon Administration seems as unwilling or as unable as the Johnson Administration to make a significant and credible effort to end the war. In the country voted for Johnson and peace and got an escalation of the war. In , between Nixon and Humphrey, there was no real opportunity to vote for peace. Demonstrations have proven equally futile as a means of affecting war policy, so much so that the President declares that he will not be swayed by them. Under these circumstances, tax resistance, distasteful as it is, seems to more and more people to offer the most effective channel of protest.

I participated in the formation of War Tax Resistance, which is working to transform tax protests from essentially individual acts into an integrated political factor. The leading figure in the organization is Bradford Lyttle, a slim, earnest, no-nonsense pacifist who led a peace march across the United States and Europe to Moscow, urging unilateral disarmament on governments along the way and exhorting citizens toward non-cooperation with military service and war production. Its “Call to War Tax Resistance,” claiming the right of conscientious objection for taxpayers as well as draft-age men, says:

The first goal… is to convince as many people as possible to refuse at least $5 of some tax owed the government. Nearly everyone can do this by refusing their federal telephone tax or part of their income tax. If hundreds of thousands refuse to pay $5, they will establish mass tax refusal. Besides having the burden of collecting the unpaid amounts, the government will be faced with the political fact of massive non-cooperation with its war-making policies.

In a separate but related action, the poet Allen Ginsberg and I have obtained the backing of the National Emergency Civil Liberties Committee for a suit against the government to recover money that has been seized from us in enforcement of tax claims and also to enjoin further seizures. The main ground of our action, as it is now being prepared, is based on the historical equivalency between taxes and service (which is a kind of tax) and the claim that the right of conscientious objection is as inherent to taxpayers as it is to men liable for military service. Conscientious objectors cannot avoid service but they can earmark their service to the exclusion of warlike activity. In the same way, we claim, taxpayers should pay their full share but they should be able to earmark their taxes to the exclusion of war-like applications. In a time when weaponry has achieved the capacity to wipe out civilization, we believe, the people should be accorded a direct voice in deciding whether they shall make war. Since World War Ⅱ the decision has moved ever more into the hands of the executive despite the Constitutional stipulation that it is Congress which should declare war.

Meanwhile, until we are legally able to earmark our taxes for non-warlike applications, we feel conscience-bound to resist paying at least a part of them.

Let’s cast ourselves back, shall we, to , by which time the American anti-war movement had really hit its stride, and war tax resistance was prominently on the agenda.

From the Niagara Falls Gazette:

Day of Reckoning

Tax Revolt: Refusing to Pay for the War

(Newsweek Feature Service)

As approaches, most taxpayers are studiously calculating how much to turn over to the Internal Revenue Service. A small but growing group of citizens, however, is just as studiously determining how much they will refuse to pay the tax collector.

In the latest, and perhaps the ultimate, form of antiwar protest, hundreds and possibly thousands of taxpayers are preparing to hold back, or have already held back, anything from a symbolic few dollars to the 10 per cent war-born Federal surtax on their whole income tax for the year.

At the very least, these irate citizens hope their actions will register as formal protests against the Vietnam war. The more optimistic among them envision the war-effort’s being actually affected, should enough people hold back on their taxes.

It all began , with an organization of New Left and pacifist opponents of the war called War Tax Resistance. WTR’s headquarters is a littered office on Manhattan’s Lower East Side. The group also claims 62 resistance centers around the country, a number that has more than doubled . And it plans nationwide demonstrations at IRS offices on .

The group’s “coordinator” is Bradford Lyttle, a seasoned pacifist who led a peace march through the U.S. and Europe to Moscow a decade ago. WTR dispenses the usual paraphernalia of protest buttons, newsletters, and posters.

One poster shows a sprawl of dead children under the pronouncement “Your Tax Dollars at Work.” But mostly the propaganda treads a careful line between evangelic encouragement to defy the tax-coliector and occasional cautions that doing so could land the tax resister in a heap of trouble, perhaps jail.

The tax resisters also point to respectable historical precedents. Quakers and Mennonites refused to pay taxes for the French and Indian War and the Revolutionary War. And Henry David Thoreau is spiritually summoned forth from his night in jail in for refusing to pay taxes in protest against the U.S. invasion of Mexico.

“If a thousand men were not to pay their tax bills,” Thoreau said, “that would not be a bloody and violent measure, as it would to pay them and enable the State to commit violence and shed innocent blood.”

But tax resistance leaders warn that Thoreau’s imitators cannot be sure of getting off as lightly as he did.

“As we develop a broad movement of tax resistance,” cautions a Chicago-based WTR group, “we must anticipate a certain number of criminal prosecutions, and many merciless attempts to collect from tax resisters. Here is a good rule of thumb for all would-be resisters: if you can’t stand heat, don’t put your hand in the fire.”

Such warnings generally are played down in tax-resistance circles. Instead, there is a tendency to emphasize that the IRS so far has shied away from criminal action in favor of attaching salaries or seizing bank accounts.

There are, of course, other frustrations. WTR guidance on how to go about not paying taxes inevitably confronts the fact that a good many people already have — through payroll withholding taxes, and that getting tax money back is obviously a more difficult matter than not paying up to begin with.

One tax resistor from Minneapolis claims to have at least temporarily beaten the withholding system. He listed 40 million Vietnamese as dependents on his 1040 form; and the IRS, he says, has already sent him a refund.

He hopes this was one more example of the fallibility of computers, but tax resisters expect the human arithmeticians at IRS to be after the refundee soon enough. All the same, stretching the definition of dependents is one of the main tactics tax resisters are proposing.

“We must explicitly reject the standards defined by a blind bureaucracy and affirm instead definitions that spring from our own consciousness of human solidarity,” goes a bit of neo-Orwellianism from the Chicago WTR center.

The resisters are also zeroing in on other Federal taxes, most notably the 10 per cent Federal excise on telephone charges. According to telephone officials, many tax resisters have already begun subtracting the 10 per cent before paying their bills.

The telephone tax resisters evidently feel somewhat encouraged by telephone company policy: to accept the truncated payments, to continue service, and to leave the collection of the 10 per cent tax up to the IRS.

Income tax resisters have been a smaller band in recent years than telephone tax non-payers. But their numbers have been growing of late at a far greater rate.

In , when the IRS first began to keep tabs on tax protesters, some 375 were counted. In , there were 533, and , 848.

Resistance leaders feel that even if the amounts of nonpayment are small, symbolic sums, they could have significant impact by snarling the tax-collecting machinery. In a hand-lettered flier, titled, “No money, no war,” poet Allen Ginsberg asserts:

“If money talks, several hundred thousand citizens, refusing payments to our war government will short-circuit the nerve system of our electronic bureaucracy.”

The IRS has already formed a group of agents to go after conscientious non-payers, but an IRS spokesman stolidly denies that the electronics of the tax-collecting machinery can be jammed or ultimately evaded by the resisters. With the folk wisdom of civilization on his side, he says: “You can’t avoid your tax bill.”

To which WTR coordinator Lyttle, portentiously replies: “We’ll find out.”

Next, from the Daily Illini, :

War protesters plan action…

: Day to withhold taxes

by Steve Melshenker

Daily Illini Staff WriterThe government is a business proposition supported by a faith in its institutions which brings value to the dollar and the collection of dollars through taxes, which supports the government institutions.

Like any other business, the government is not pleased when its customers, the American people, do not pay their bills on time, and upset with some fail to pay at all.

However, there are those who believe the product for which they are paying is not up to company standards. That product is the Vietnam war. And so, these same people believe, if they don’t like the product, why should they pay for it?

Protest rekindled

On the war tax resistance moves en masse. All across the country protests are scheduled and various resistance groups are urging taxpayers to withhold part of all of their taxes in protest of the Vietnam war.

The war tax resistance groups do not oppose all taxes, just those going toward the war.

Various methods of resistance could be applied toward this purpose.

The method presently stressed by the resistance movement is refusing to pay at least $5 of some tax owed the government.

Or one might just refuse to pay part of his taxes, such as the additional income, the ten per cent surtax, or the telephone tax.

One might refuse to pay the percentage of his tax going toward the war. He could base his refusal on the percentage of the total national budget used for war, on the cost of the Vietnam war, or on other calculations.

Some people pay part of their tax and contribute the rest as a “peace tax” to the United Nations or some relief agency. Generally, these people contribute to organizations engaged in peaceful, constructive work.

But even though the government is not a profit making organization, it does not like to accumulate unpaid bills.

Don Werner, acting group supervisor of the Internal Revenue Service (IRS) explained a six per cent interest and six per cent penalty charge accompany that part of the taxes due to the government and withheld by the taxpayer.

Werner said IRS offers “every opportunity to pay” the tax and the first step toward collection takes the form of letters to the delinquent tax payer. A bill is sent out and if it is not paid within ten days, the task of collection is turned over to a collecting officer.

Extreme measure

The most extreme measure the internal revenue office can take is to levy on all property belonging to the individual. However, certain property items are exempt from this levy, such as tools and books necessary for the person’s trade, business, or profession. A complete list can be found in the internal revenue code.

Beyond all this, IRS can recommend the U.S. Attorney’s office take legal action against the delinquent taxpayer.

Richard Makarski, chief of the tax division for the U.S. Attorney’s office, said the maximum penalty for tax evasion is five years in prison and a $10,000 fine.

Before any penalty is handed out, he said, the case is reviewed by the tax division of the justice department and if felony is involved a grand jury indictment is issued.

Makarski said that cases of this type were rare and “I don’t see the government taking much action against war protesters.”

He said only major cases of evasion were prosecuted.

So the war tax resistance movement is not likely to cause much damage to the war process, but in the words of one member of the Vietnam Moratorium committee, “it will show the government people are willing to do something assertive to protest the war.”

Sylvia Kushner, executive secretary of the Chicago Peace Council said the withholding of the phone tax will cause no damage to the individual and at worst the government will take the tax out of that person’s bank account.

The nationwide protest on has as its theme, Who pays for the war? Who profits from the war? And in no small way the peace guys are focusing ’s protest on the answers to those questions.

From the Harvard Crimson:

Five Members of Faculty Will Withhold War Taxes To Voice Vietnam Dissent

By Scott W. Jacobs

Five Harvard faculty members and nine M.I.T. professors — including two Nobel prize-winners — have announced their intention to withhold portions of their taxes to protest the Vietnam War.

In identical letters appearing in the Crimson and the M.I.T. Tech this week, the professors said they will refuse to pay portions of the 10 per cent surtax or the telephone tax “as a sign of our personal opposition to the continuing Vietnam War.”

Salvador E. Luria, M.I.T.’s Nobel laureate, and George Wald, Higgins Professor of Biology and a Nobel winner, each signed the letters to their colleagues. Other Harvard signers are Harvey Cox, professor of Divinity; Everett I. Mendelsohn, professor of the History of Science; Herbert C. Kelman, Richard Clarke Cabot Professor of Social Ethies; and Mark Ptashne, lecturer in Biochemistry.

The signers asked other faculty members who have also decided to withhold their taxes to join them in a press release on — the same day that tax resistance rallies are scheduled around the country.

The Boston professors are among the first groups in the country to announce a systematic plan for withholding taxes. Several individuals — most notably Joan Baez — have withheld taxes to protest the war in the past.

In most cases the government has simply appropriated bank accounts or pay checks to get the revenue, although tax resisters are liable to jail sentences.

“Dragging One’s Feet”

“All of us confidently expect the government will collect the tax before this is through,” Wald said . “We are expressing our disapproval of what our country is doing and making it more expensive to collect these taxes and do it.

“You understand that one is essentially dragging one’s feet.” he added.

“We are clearly engaging in a conscious form of civil disobedience,” Mendelsohn said. “We are judging the war. We are saying it is wrong, and we are consciously cutting ourselves off from the war in the ways that we can.

Cox, who is now on sabbatical from the Divinity School, said the purpose of the action is to involve non-draft-age people in the anti-war movement.

“We’ve been asking young people to take a lot of risks — burning draft cards, resisting the draft, marching. I think it’s time to spread the risk through the whole life cycle,” he said .

The tax withholding is aimed primarity at the telephone tax and the 10 per cent surtax which were approved as means of financing the rising cost of the war.

Harvard is forced to deduct the surtax on salaries monthly, but taxes on royalties and honorariums must be assessed privately every year by the April 15 tax deadline.

From the Cornell Daily Sun:

Call Off the War

To the Editor: The undersigned members and wives of the staff at Cornell University declare their intention to refuse payment of the Federal excise tax on their telephone bills as a gesture of protest against our government’s policy in Vietnam. This tax was specifically retained by Congress as a revenue measure to provide funds for the war.

By our action, we signify our unwillingness to pay for that brutal, immoral war, one which has brought death and destruction to the Vietnamese, their land, and their culture. We refuse to sanction further waste of lives and treasure in defense of a corrupt and totalitarian regime in Saigon. The Vietnamese must be given true self-determination. American troops must be brought home. The War Must Be Stopped.

Andreas and Genia Albrecht, David and Carol Jasnow, Douglas and Marie Archibald, Jack Kiefer, Michael and Judy Balch, Jack and Mary Lewis, Father Daniel Berrigan, S.J., David Marr, David and Eloise Blanpied, Jim and Jean Matlack, Stephen Chase, Chandler and Katrina Morse, John and Sandra Condry, Reeve Parker, Robert Connelly, George and Julie Rinehart, Fred Cooper, Walter and Jane Slatoff, Vincent and Jill De Luca, Michael and Eve Stocker, Douglas Dowd, David Stroud, Daniel and Linda Finlay, Moss and Marilyn Sweedler, Bill and Maggie Goldsmith, Winthrop and Andrea Wetherbee, Neil and Louise Hertz, Tom and Carol Hill.

From the Cornell Daily Sun:

Anti-Tax Rallies At IRS Offices Protest Vietnam

By The Associated Press

Opponents of American policy in Vietnam massed in Boston and New York , while similar protest demonstrations — some objecting to the use of tax dollars to support the war — were staged in cities and towns across the country.

Crowds in Boston Common were estimated at 60,000, in New York’s Bryant Park, 20,000, but generally turnouts were below that of previous moratoriums. Tea was dumped into the Mississippi and Cedar rivers as reenactments of the Revolutionary era’s tax defiance — the Boston Tea Party.

Demonstrators at Internal Revenue Service sites numbered 4,000 in Chicago and in New York City, and ranged down to about 700 in Washington, D.C., 200 in Boston, 150 in White Plains, N.Y., and 16 in Oklahoma City.

Violence flared during demonstrations at the Berkeley campus of the University of California; demonstrators at Pennsylvania State University seized and damaged the administration building, and a brief melee erupted between police and protesters in Detroit.

In Washington, David Dellinger of the Chicago 7 urged a youthful, largely white crowd of 2,000 near the capitol to withhold their taxes as a means of forcing change in the United States.

“I advocate overthrowing the government by force but not by violence,” he told a rally, “and tax refusal is but one of the cutting edges and forces that are available to us.”

Young demonstrators burned two American flags during an earlier rally, drawing murmurs of disapproval from the rest of the crowd.

“We are going to make sure that this is a not so silent spring.” said Sam Brown, national coordinator of the Vietnam Moratorium Committee, one of several groups sponsoring the Boston rally. The crowd on the common was about 40,000 short of the 100,000 who gathered there .

In New York City, William Kunstler, a defense lawyer in the Chicago 7 conspiracy trial, told the Bryant Park gathering: “The time has come to resist illegitimate authority by any means necessary.”

I’m surprised I hadn’t come across this before. It comes from a back issue of The Thoreau Society Bulletin ():

Allen Ginsberg on Thoreau…

I recently wrote the poet Allen Ginsberg asking if I were correct in guessing from his writings and philosophy that he would feel a special affinity for Henry David Thoreau. His reply follows:

Dear Mr. [Walter] Harding

Thoreau set first classic US example of war resistance, back to nature, tax refusal. As at the moment I’m living in country without electric on commune using 19th century techne to move water (hydrolic ram) & we’re doing organic gardening, & I’m a member of the War Tax Refusal group. I find myself more & more indebted to Thoreau — particularly for his manner & remarks on being in jail — without, oddly, having very much read his texts.

My first association was Kerouacs association with Thoreau — both denizens of Merrimac river — & Kerouac’s individualistic Dharma Bums derives in part from his appreciation of Thoreau’s solitude. Kerouac was most near Thoreau when with knapsack he settled down by railroad bed or riverbottom under bridge & cooked himself some cornmeal fritters or soup.

Allen Ginsberg

R.D. 2 Cherry Valley

N.Y. 13320

from the edition of Cycle

The edition of Cycle, a student paper from Fitchburg (Massachusetts) State College, gives us a good peek into the rhetoric and tactics of the war tax resistance movement at that time:

Henry David Thoreau

A Call to War Tax Resistance

In , the United States government spend $103 billion to pay for present and past wars and to be prepared in case of future wars. This was 66% of the entire federal budget of $156 billion. One hundred and three billion dollars exceeds the gross national product of all but six nations.

Of this $103,198,100,000, $29 billion was spent on the Vietnam war, to continue a conflict whose brutality, immorality, and illegality have sickened most Americans and the vast majority of the people of the world. Already, this war has brought death to more than 42,000 Americans and more than two million Vietnamese. It is a spur to the arms race and continually threatens world peace.

Almost $20 billion will be invested this fiscal year in making more frightful our nuclear missile and bomber arsenal, weapons already so destructive that they can deliver ten tons of explosive power for every person on the globe.

$330 million will be spent on chemical and biological weapons that are polluting the environment and endangering the people in the United States and other countries without even being used; simply by being improperly stored.

$7.5 billion will go toward research on new and yet more fearful weapons.

$1.2 billion has been authorized for the Anti Ballistic Missile (ABM) system in .

$500 million to $1 billion is the estimated budget of the CIA.

Vast sums will be paid to the corporations and research institutes that design and build the weapons. In , the following companies, a handful of the biggest among thousands engaged in war production and research, enjoyed these military contracts:

General Dynamics $2.2 billion Lockheed Aircraft $1.8 billion General Electric $1.4 billion United Aircraft $1.3 billion McDonnell-Douglas $1.1 billion AT&T $777 million The following amounts were spent in for projects that seem to have little to do with primary human needs:

For moon and other space exploration $3.4 billion.

For farm subsidies to wealthy landowners $3.1 billion.

In comparison to the enormous expenditures for acts and instruments of military violence, luxury space programs, and subsidies to the wealthy, and at a time when city governments are crying for more funds, the United States government spent these sums on improving the health, education, and general welfare of the people within this country.

Slum rebuilding $1.9 billion.

Other poverty programs $7.2 billion.

Health programs $1.8 billion.

Educational programs and subsidies $3.7 billion.

Direct, nonmilitary foreign aid to underdeveloped countries totaled about $1.6 billion.

The U.S. appropriation to the United Nations was $109 million, about the cost of one Polaris submarine.

In , the total of all non-military expenditure was approximately 34% of the military expenses.

Throughout the United States, young people by the hundreds of thousands are rebelling in disgust and anger against this squandering of resources on war, and neglect of the day-to-day practical needs of the people. They are not alone in seeing only massive social disruption and probably nuclear war as eventual consequences. They are risking their freedom, careers, and often their lives to protest and resist what they see to be wrong.

In the face of this shameful and alarming situation and in solidarity with the youth resisting it, we, as participants in War Tax Resistance, are resolved to confront our own complicity in war, waste, and callousness. We resolve to end to the extent we can our cooperation in a federal tax program geared to death more than life. The least measure of our resistance will be not to pay voluntarily $5 of federal taxes due.

We are prepared to bear the consequences of our actions, be these criticism and unpopularity, financial penalties, confiscation of our bank accounts and property, and, perhaps, imprisonment. These seem to us small inconveniences beside the agony of those killed or bereft by war, and the numb hopelessness of those crippled by poverty.

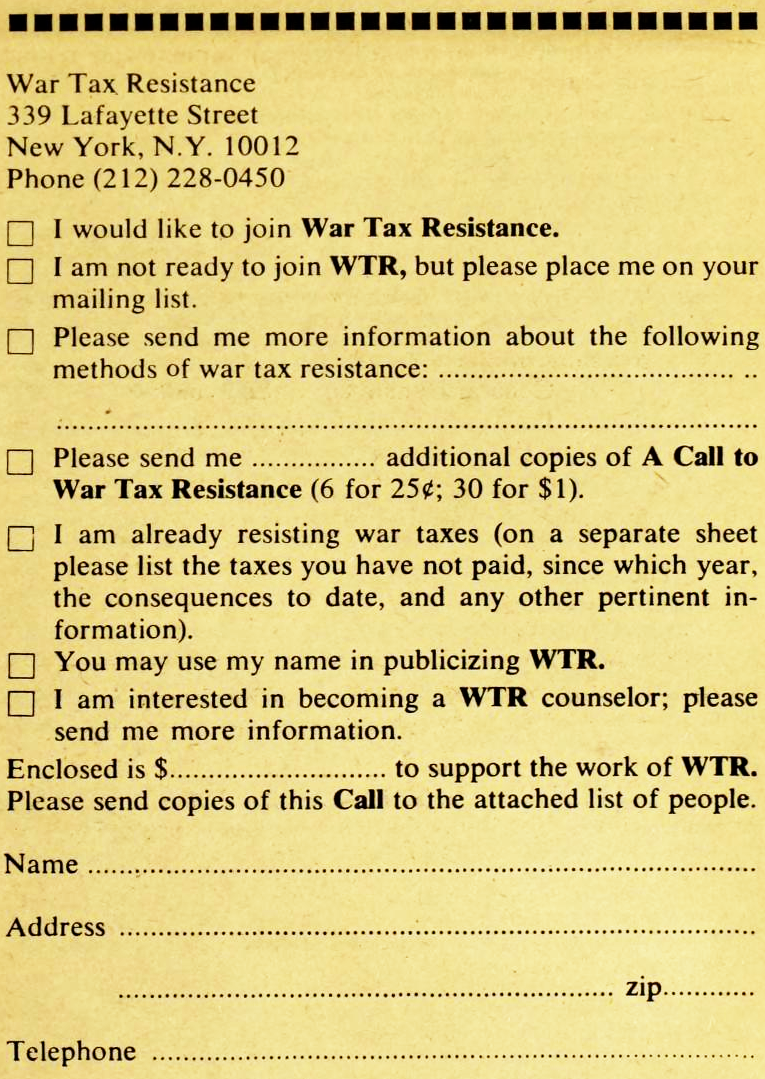

We invite all Americans to join us in some form of tax refusal. War tax resistance is not always easy, particularly for those whose taxes are withheld from their wages, but for most there is some variety of tax refusal that they can conscientiously adopt. It may be by not paying part or all of a balance “owed,” or by not paying federal telephone tax. War Tax Resistance has prepared literature and is setting up counseling services designed to help each individual find the best way of tax refusal and resistance for him. A list of Methods of War Tax Resistance follows this statement of purpose.

We also are developing a war tax resistance promotional program that will include advertisements, demonstrations, meetings, a bulletin, and other literature distribution. If you become a war tax resister, we hope you will allow yourself to be publicly identified with the movement and permit your name to be used on tax resistance literature.

War Tax Resistance will do more than concentrate on the weeks just before April 15. We are planning a year round educational and resistance program. If you agree with conscientious tax resistance as a means for opposing war, we hope you will communicate with us now. The included coupon is for your convenience.

Methods of Refusal

- Refuse to pay at least $5 of your tax

- The first goal of War Tax Resistance is to convince as many people as possible to refuse at least $5 of some tax owed the government. Nearly everyone can do this by refusing their federal telephone tax or part of their income tax. If hundreds of thousands refuse to pay $5, they will establish mass tax refusal. Besides having the burden of collecting the unpaid amounts, the government will be faced with the political fact of massive noncooperation with its warmaking policies.

- Better yet, refuse to pay all the taxes you can

- Even if some of your taxes are withheld, you can refuse to pay the balance and other taxes. These might include: taxes on additional income, the 10% surtax, and the telephone tax.

- You can refuse to pay that percentage of your tax that goes for war

- Two thirds or more of the federal budget pays for wars past, present, and future. To protest against war, a person can refuse that percentage of his tax. He can base his refusal on the percentage of the total national budget used for war, on the cost of the war in Vietnam, or on other calculations. Some people pay part of their tax and contribute the rest as a peace tax. Some give to the UN, or a relief agency, or some other organization engaged in peaceful, constructive work.

- You can refuse to pay the 10% surtax

- This surtax was imposed in to help pay for the war in Vietnam. Refusing to pay it is a direct protest against the war.

- You can refuse to pay the federal telephone tax

- The federal telephone tax was revived in to help pay for the war. Thousands are already not paying it. In all cases known to us but one, the telephone companies have continued service and referred the tax collection to IRS.

To Reduce or Eliminate the Withholding of Your Taxes You Can

- Claim additional dependents

If you claim a sufficient number of dependents on your W-4 form you can reduce the amount of taxes withheld from your salary to zero. The law reads that a dependent has to live in your household and be supported by you. The fact is that many people, particularly draft age young men and the Vietnamese, depend on you. So long as you declare at the end of the year that by the government’s standards you owe so much and are refusing to pay it, the moral point is made

The law reads that it is illegal — fraudulent — to state on a tax form that someone claimed as a dependent falls within that category, as defined by the IRS, when he does not. But no fraud appears to be involved if the people claimed as dependents are identified as being outside the IRS categories. The issue has not been tested in the courts.

- Make your employer an ally

- Although the law reads that it is illegal not to withhold taxes from an employee’s wages, your employer may be sympathetic to your protest and be willing to assist — and make a protest of his own — by not withholding from your salary. It is always valuable to raise the question.

- Organize an employment agency

- Have your agency hire you and then have your present employer hire the agency to supply him with you. Naturally, an agency that you control will not withhold taxes from its employees. Getting organized is complicated, but if you and a few friends get together you can work out the problem. Write us for information.

Also You Can

- Demand a refund

- There are four ways to do this:

- You may request a refund right on the 1040 form and stand a good chance of receiving it. Ask for a tax credit on Part Ⅴ of the form.

- You may file form 843 for a refund.

- If the above demands are refused, go to the Income Tax Board of Appeals. If the Board turns you down, sue.

- You can also sue the government to refund all your taxes on the grounds that the taxes have been used for illegal and immoral purposes.

- Protest by letter or in person

- Any protest to IRS or other government officials will help express opposition to the war and to militarism. If you are unable to refuse taxes, protest them as vigorously as you can.

Maximize the Impact

Talk about your tax refusal with friends, neighbors, co-workers. This sort of direct contact changes many minds. Distribute tax refusal literature.

Inform the newspapers and other mass media in your neighborhood that you are resisting war taxes and why. Start a war tax resistance group in your community.

Organize or join demonstrations at your local IRS office.

Inform yourself thoroughly and become a tax refusal counselor. Let your community know through ads, leaflets, etc. that a counseling service is available.

Keep the War Tax Resistance Clearinghouse informed by writing or phoning about your activities. Communication is the lifeblood of any movement.

We invite war tax resisters to send War Tax Resistance the first $5 or more refused the federal government. This money will be used to publicize and expand the war tax resistance movement.

Until now, the government has not imprisoned anyone for conscientious tax refusal. A few have been given short sentences for refusing to reveal information about their incomes. In general, the IRS has been content to take money from tax refusers’ bank accounts, garnishee part of their wages, or, on rare occasions, seize and auction property.

Sponsors of War Tax Resistance

- Winslow Ames

- Joan Baez

- Norma Becker

- James Bristol

- Prof. Noam Chomsky

- Prof. Frank Collins

- Tom Cornell

- Prof. William Davidon

- Dorothy Day

- Dave Dellinger

- Barbara Deming

- Ralph DiGia

- Prof. Douglas Dowd

- Prof. Margaret Eberbach

- Ruth Gage-Colby

- Allen Ginsberg

- Bob Haskell

- James Leo Herlihy

- Faye Knopp

- Kennett Love

- David McReynolds

- Stewart and Charlotte Meacham

- Rev. and Mrs. Arthur G. Melville

- Karl Meyer

- Jack Newfield

- Grace Paley

- Igal Roodenko

- Rev. Finley Schaef

- Dr. Benjamin Spock

- Marj and Bob Swann

- Arthur Waskow

- George and Lillian Willoughby

- Irma Zigas

Working Committee (in formation)

- Norma Becker

- Maris Cakars

- Frank Collins

- John Darr

- Jerry Dickinson

- Ralph DiGia

- Bob Haskell

- Neil Haworth

- Peter Kiger

- Kennett Love

- Bradford Lyttle

- Mark Morris

- Christopher Pollock

- Melinda Reed

- Kay Van Deurs

- Eric Weinberger

Here are some excerpts from The Catholic News Archive concerning tax resistance, from sources other than Catholic Worker, from the span:

First, a typed news dispatch from “M. Massiani,” Paris Correspondent for the National Catholic Welfare Council (U.S.) News Service, dated :

Priests and People of Vendee, France, Protest Tax on Christian Schools and Refusal of State Aid

Paris, . — A delegation of 20,000 citizens from various parts of the Department of Vendee, one of the most Catholic regions of France, appeared in the town of La Roche-sur-Yon, where a number of priests were on trial for refusing to pay a tax exacted on entertainments and theatrical productions given to aid in supporting the free Christian schools of the Department.

A large group of priests and directors of Christian schools purposely decided to refuse payment of this tax and made public announcement of the decision in order to protest what is regarded by the people of the Vendee as a highly inequitable situation; the state taxing the people to support unneeded public schools, refusing to grant a subsidy to aid in maintaining the Christian schools, and at the same time taxing entertainments held to raise money for support of the Christian schools.

It is pointed out that in Vendee public schools are practically empty. The Christian schools, on the other hand, are educating the vast majority of the children of the region, saving the state more than 200 million francs in school taxes annually. Yet whenever Catholics hold a festival to raise funds for support of their schools, the state intervenes to collect part of the receipts.

It is hoped that in refusing to pay this tax, public attention will be called to the injustice and the need of a state subsidy to help support the Christian schools, such as is granted in other countries, including Belgium and Holland.

Bishop Antoine Cazaux of Lucon, who went to La Roche-sur-Yon to testify in behalf of the defendants, stated that his priests are neither rebels nor evaders, and that the court, in order to judge equitably, should take into consideration the unjust situation that exists with regard to education. Many thousands of people were in the streets outside the courtroom.

Decisions were rendered in only two of the cases, the defendants being acquitted on procedural grounds. The other cases were postponed. The action of the court caused anti-religious groups and newspapers, particularly in Paris, to demand that new suits be instituted and that the law be applied with severity.

In the Diocese of Lucon, two-thirds of the children attend the 461 primary religious schools. In six large districts, 13,757 children out of 15,183 are enrolled at the Christian schools. In two other districts, the number of pupils in the public schools is only three per cent of the total. In 41 settlements in the Department, with a population of 40,000, there are no public schools.

A National Catholic Reporter editorial (signed by editor Robert C. Hoyt) in the issue recommended that men refuse military service, concluding that in Vietnam, “we are killing people and destroying a culture without adequate justification, without a rationale that meets the minimum requirements of morality. That imposes obligations on all of us. We believe that anyone who despairs of a political solution has a right and duty to search for more effective ways, including civil disobedience and tax refusal. We have a responsibility to the rest of the world, to history, to God that nobody else can bear.”

In its issue, that paper published a lengthy article on the war tax resistance movement:

Protesters turn to taxes to fight against the war

By Gary MacEoin

Special to the National Catholic Reporter, NEW YORK— Protesters against the Vietnam war are turning to the withholding of taxes as a way of fighting against the war.

A national campaign against the payment of taxes used for the war is being organized and its goal is to involve “tens and perhaps hundreds of thousands of people in conscientious tax refusal.”

The campaign is spearheaded by the War Tax Resistance, an organization founded which draws support from a broad spectrum of pacifist groups. Its headquarters is in New York and it has offices in Philadelphia and Chicago.

Resistance spokesmen say they hope to have “at least a phone, an address and a contact person” in each of the principal 50 to 100 cities in the nation by . Groups organized around such regional centers are to focus their tax resistance efforts on demonstrations on and .

“We picked the date more or less arbitrarily,” said Bradford Lyttle, clean-shaven and soft-spoken coordinator of War Tax Resistance. “That’s about the time that thousands of accountants all over the country hang out signs offering to help prepare tax returns. We want to provide an option for those who want not to pay.”

The choice of is more obvious, he said. “It is both the final day for filing tax returns and the start of the Spring offensive of the demonstrations against the war in Vietnam.”

Lyttle, 42, works out of an office in Lower Manhattan (339 Lafayette Street). It is also the home of the New York GI Coffeehouse, the Jewish Peace Fellowship, the Catholic Peace Fellowship, the War Resisters League, Win magazine (hippie-pacifist), and Liberation magazine (David Dellinger’s voice). Between them, they occupy the two top floors of a three-story cold-water walk-up not far from the Catholic Worker.

Organized resistance to paying war taxes is not new, dating from , Lyttle said. The War Tax Resistance is trying to give the idea broader appeal by modifying the totally pacifist position that its forerunners had adopted.

Lyttle, who himself is a pacifist, said the new approach was developed by a New York teacher, Norma Becker, who recruited a group of sponsors which included Joan Baez, Noam Chomsky, Tom Cornell, Dorothy Day, Dave Dellinger, Allen Ginsberg, Stewart and Charlotte Meacham, Grace Paley and Dr. Benjamin Spock.

“The result,” says Bradford Lyttle, “was a new emphasis. Instead of stressing the total pacifist tradition as the others had done, we decided to concentrate on two more immediate and obvious reasons: the horrors of the war in Vietnam, and the misuse of the taxpayers’ money by the government to the extent that it was neglecting national priorities.

“And instead of calling on sympathizers to pay no taxes whatever, we appealed to them to make a token withholding, if only $5, without of course ceasing to urge those who had the moral courage to go further.”

War Tax Resisters chose as their prime targets the 10 per cent surtax and the 10 per cent federal excise tax on telephone service — two taxes more clearly linked to Vietnam than any others.

Both War Tax Resistance and other organizations distribute literature explaining the various ways — some legal, some doubtful, some illegal — for nonpayment of federal taxes. The first War Tax Resistance leaflet was prepared for the antiwar demonstration in Washington, D.C., , and 10,000 copies were handed out there.

“The act of war tax resistance creates a confrontation between the government and the conscience of the citizens,” this pamphlet states. “We believe that the right of conscientious objection to war belongs to all people, not just to those of draft age… Do whatever makes sense to your conscience. But do it.”

Among the ways to avoid paying taxes, the first is to earn an income so low as not to be taxable. This means for the single person under 65, an earned income of less than $900 annually. Yet a considerable number of pacifists choose this method.

Another form of protest is to refuse to pay the percentage of the tax that goes for war. More than two-thirds of the federal budget pays for wars, past, present and future. This is the amount some withhold. Others refuse to pay the proportion of the federal budget (23 per cent) directly allocated to Vietnam, while others hold back a token amount.

According to Internal Revenue Service figures, 73 million Americans paid their income taxes in full , while 1,025 refused to pay all or part in protest against the Vietnam war. The 1,025 protesters was an increase from 592 .

IRS counted 10,511 cases of refusal to pay the telephone tax in , down from 14,396 in . Several factors combine to make the telephone tax the attractive target it has become.

For one thing, the American Telephone and Telegraph Co. has handled the situation with kid gloves. So long as the protester makes it clear to the company with each payment that the amount withheld is the tax portion, it will not cut off a phone. Printed forms are made available by the resistance groups to facilitate this notification. What the telephone company does is simply to report to IRS the fact of nonpayment and the amount.

IRS also is anxious to keep the situation as cool as possible, but it wants at the same time to maintain whatever pressure is necessary to dissuade the hesitant from joining the movement. Back in 1967, the first step was to send the defaulter a “notice of preliminary assessment” which enabled him to demand a hearing. Because of the number of cases involved and the small amount in each, the IRS quickly eliminated this step and moved immediately to Form 17-A or some other “notice of final assessment.” This notice contains a threat to seize property to collect a debt.

Ralph Di Gia of War Resisters League is one who has been through this process several times.

Early in , for example, the IRS computer at Andover, Mass., sent him Form 17 demanding payment of $2.25 owed as telephone tax. Next a New York agent wrote him, then called on him in his New York office. After checking with Di Gia’s landlord and the building superintendent to establish his political views, the agent tried to place a lien on his salary at the War Resisters League, but the League refused to cooperate.

After another confrontation with Di Gia, which merely established that it was “the principle,” not the $2.25, that was at issue on both sides, the agent located Di Gia’s bank account and collected the $2.25 plus 6 per cent interest. Under the IRS code, it can take money from a bank account without a court order in payment of taxes due by the account holder.

Apparently the discovered account was then fed into the computer, because another section of IRS moved quickly to seize the entire balance in payment of income tax. And as of , the IRS located a savings account recently opened by Di Gia in another bank and collected yet another telephone tax bill. But Di Gia insists that he doesn’t mind.

“The issue isn’t withholding money from the government,” he says. “They’re going to get it ultimately. But I made a few collection agents think about what their job’s about, and now IRS is going to have to realize that there are people who aren’t afraid to resist. They got the tax, but they had to come and get it, like when the agents had to go to the fields in France for collection.”

Unpaid taxes, whether telephone or income, can result not only in seizure from a bank account but also a lien on salary or the attachment and sale by auction of some property, usually an automobile.

In addition, some banks make a service charge — as high as $10, reportedly each time a lien is placed on an account, and the resisters suspect that IRS is pressuring banks to do this as a deterrent. Such a fee every month would make telephone tax refusal impractical for most people. But actually, the load on the IRS is such that it usually moves against any given individual only at much longer intervals.

Everyone who refuses to pay any taxes he owes is actually exposing himself to heavy penalties, and the resistance literature spells out this danger very openly. Simple “willful failure to pay” is punishable by fine up to $10,000 and a year in jail, plus the cost of prosecution. Similar or greater penalties are available for a variety of related offenses.

Although the offense of counseling or urging others not to pay taxes would seem greater than the simple act of withholding, the law on this point is somewhat ambiguous and apparently has never been tested in the courts.

There are few, if any, cases of conscientious tax refusers being jailed for not paying taxes or filing returns. Most of the small number of cases on record have resulted from related non-cooperation with the courts, such as ignoring a court order to disclose financial records.

In addition, it would appear that prosecutions have been initiated by local collectors who did not first check with headquarters. Current IRS policy on this issue apparently stops short of court action.

The most distinguished American to go to jail for refusal to pay taxes was Henry David Thoreau, the essayist, poet and naturalist. He spent only one night in confinement, because a neighbor paid the tax, but the experience inspired his essay on Civil Disobedience, espousing the doctrine of passive resistance. It deeply influenced Gandhi and has become the bible of the resistance movement. One passage is found to be particularly relevant by today’s resisters:

“When… a whole country is unjustly overrun and conquered by a foreign army, and subjected to military law, I think that it is not too soon for honest men to rebel and revolutionize. What makes this duty the more urgent is the fact that the Country to overrun is not our own, but ours is the invading army.” The reference is to the Mexican War of .

About half a dozen have been jailed in the past 20 years. Juanita Nelson was arrested in Philadelphia in , threatened with a year in jail and $1,000 fine if she did not disclose certain financial information, but in fact was held only some hours.

Maurice McCrackin, arrested in Cincinnati in , was given a mental test, imprisoned “indefinitely” on a contempt charge, then sentenced to six months and a $250 fine. James Otsuka got 90 days and a $140 fine in Indianapolis, in . Eroseanna Robinson, sentenced to a year and a day in Chicago in , was released unconditionally after 93 days. Walter Gormley got 7 days in Cedar Rapids in .

And in the first such imprisonment in several years, Neil Haworth of New London, Conn., got 60 days in for refusal to produce records. He had served six months in for “committing civil disobedience at a missile site” near Omaha. And in , he was a crew member of Everyman Ⅲ, a boat which sailed to Leningrad to protest the Russian nuclear tests.

Those who have refused to pay federal taxes and have got away with it include the Catholic Worker settlement houses and the settlement house of the New England Committee for Non-Violent Action. “We pay local taxes,” says Dorothy Day of the Catholic Worker, “and we let the IRS people examine our records, but we pay them nothing.” The New England group says that IRS has spent thousands of dollars going through their bills and receipts, without collecting a penny.

War Tax Resistance is now urging citizens “to sue the government to refund all your taxes on the grounds that the taxes have been used for illegal and immoral purposes.” The main value of such suits to date has been the publicity.

Professor Donald Kalish, chairman of the philosophy department at UCLA, filed a suit to recover his telephone tax but it was dismissed by the District Court. He appealed, and the appellate court has agreed to hear his appeal.

The most important case to date is that of Walter C. Pietsch, of Rego Park, N.Y., a 33-year-old administrative employee in a hospital. Last year, he instituted “a class action” for an injunction to enjoin IRS from collecting the 10 per cent surtax and all other taxes used to propagate the war, and also for a declaration that the Vietnam war was unconstitutional. A class action, if successful, would provide the same remedy for all taxpayers.

Pietsch, who served in Korea, “is not against all wars, just this one.” The surtax he withheld was $190.84. “The amount is insignificant,” he said, “It’s the principle I’m fighting for.” After a preliminary hearing in the Brooklyn federal district court on , written arguments were submitted on , and on the case was dismissed on a motion by the defendants. An appeal was filed immediately.

Although the Vietnam war is the direct issue on which tax resisters are concentrating, many of them insist that the campaign has escalated into something much bigger — the war mentality behind much of United States foreign policy. “Maybe it’s a hang-up,” says Ted Webster, administrator of the Roxbury War Tax Scholarship fund, “but I personally have a great feeling of urgency, it seems the logic behind bombing North Vietnam can be so easily applied to China. The influence of the Pentagon on policy, and the political expediency of yielding to it seems so obvious, I see the need to rapidly escalate resistance, or there will be a greatly expanded war — maybe with China — within one to three years.”

Another National Catholic Reporter article, from the issue, asked “In the name of God, how did Milwaukeeans get so radical?” A section of it covered tax resisters:

One area in which a number of community members are discussing is tax resistance. Some say they have claimed as many exemptions as were needed to keep from paying any federal taxes used to finance the war.

[Richard W.] Zipfel, who is defense committee chairman for the Chicago 15, Feit and Father Robert W. Dundon, a Jesuit, have sent a letter to the Wisconsin Telephone Co. stating they are refusing to pay the federal telephone tax on their phone bills because “we can no longer tolerate our nation spending more than $75 billion on the military while our cities die.”

The letter, dated , added that “even if the present war ended, our policies would quickly create another Vietnam.”

Their resistance gesture is significant, they said, because the tax was argued through Congress as a specifically Vietnam war tax. They have reserved a reply from the utility saying their letter was being forwarded to the government.

“I do believe in the legitimacy of the magistrates,” [Michael] Cullen said. “In paying property taxes, I believe in the state.

“I’ll render unto Caesar what is Caesar’s, but when Caesar decides to take what is God’s, or if Caesar decides to look like God or act like God, I won’t render to Caesar.

“You only render to what is legitimate and what is human, and what is for the common good. War destroys humans.”

Milwaukee’s Casa Maria Catholic Worker House still looks to be something like a hotbed of war tax resistance, at least relative to the current national lull. Lincoln Rice of Casa Maria is the current NWTRCC coordinator. I recognize the names of war tax resisters Roberta Thurstin and Don Timmerman among their volunteers as well.

From the Pittsburgh Catholic, :

Five say they won’t pay taxes

Five local clergymen handed in their income tax forms at the Federal Bldg. downtown on with the announcement they were withholding a portion in protest to the Vietnam War.

Joining them in the protest at the Internal Revenue Office there were several dozen local lay members of War Tax Resistance, an organization whose members carried out withholding actions in a number of cities , the last day for filing income tax returns. It is headquartered locally at 3601 Blvd. of the Allies.

The clergymen issued a statement denouncing the Vietnam war as immoral and stating other means of protest had been futile. “Now we must do more than talk. The time is now that we must act,” they said.

They included three priests active in civil rights causes here: Fr. Donald C. Fisher of St. Francis de Sales, McKees Rocks; Fr. Donald W. McIlvane, St. Richard’s, Hill District; and Fr. John O’Malley of St. Joseph’s, Manchester. Also taking part was Fr. Bernard Survil of St. Hedwig in Smock, Greensburg Diocese.

Protestant clergy included Rev. Oscar L. Arnall, a Lutheran, Rev. Thomas Whitcroft, an Episcopalian, and Rev. William S. Richard, a Presbyterian, signed the statement but weren’t present.

The clergymen announced they were withholding 25 per cent of their income tax, the proportion of the national tax that is estimated goes for the Vietnam war, they said. Some said they would pay the money into local community action programs suffering because of the amounts given to the Vietnam war.

“We are conscious of our obligation to pay taxes, but we are equally conscious of our obligation before God to refuse to cooperate with evil,” the clergymen said.

The National Catholic Reporter, in its issue, printed the following letter from Robert Calvert of War Tax Resistance:

Tax resisters suggest: “Stop paying for it”

To The Editors:

Vietnam, Cambodia, Laos… young people by the hundreds of thousands are rebelling in disgust and anger against the squandering of lives and resources in an immoral and illegal war. They are risking their freedom, careers and often their lives to protest and resist what they see to be wrong.

We, as participants in war tax resistance, are resolved to confront our own complicity in war, waste and callousness. We resolve to end to the extent possible our cooperation in a federal tax program geared to death more than life.

For every dollar which the administration expects to spend in , 64.8 per cent will go for wars — past, present and future. Of this amount, 48.4 per cent will go for current military expenditures, including Vietnam. (The administration has not revealed the exact costs of the Indochina war.) Another 17 per cent will go to health, education and welfare; 18.2 per cent for other expenditures.

The deadline for paying income taxes is close, . Many who read this letter will owe the federal government money. Don’t pay. War tax resistance is being supported by numerous civil rights, anti-poverty and peace organizations in our call to help end the war by widespread tax refusal. Widespread tax refusal does more than force the government to spend much money to try to collect unpaid taxes. It confronts the government with the political fact of massive non-cooperation with its war-making policies.

We need to dramatize war tax resistance and to expand it from an act of individual conscience to a nationwide demonstration of collective civil disobedience.

On , the People’s Coalition for Peace and Justice — which includes such groups as the Southern Christian Leadership Conference, the National Welfare Rights organization, the American Friends Service committee and the Fellowship of Resistance — is calling for a nationwide “Tribute in Action to Martin Luther King.” The theme is “Freedom from Hunger, War and Oppression”; the event will be observed by hunger marches, fasts, teachins, demonstrations and religious services.

War tax resisters will relate to these events in a real way. We are asking people to refuse to pay $10 to $50 or more of their federal income taxes, and to publicly turn this money over to a local community group on . We will thus take our tax money out of the hands of the government and put it into the hands of the people. If we work hard thousands of dollars can be rechanneled to the people. We can not wait for the government to change priorities. We must change them ourselves.

Find out what actions are being planned in your city or region and build a demonstration dramatizing the transfer of funds to useful community programs. A possible action: Rally at the IRS office where people put their tax money into a container of some sort. The money is then carried to the main event and is turned over to the designated local community group.