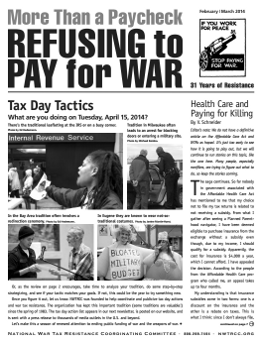

Some bits and pieces from here and there:

- A fellow named Kenneth O’Keefe has been making waves for his nicely seditious activities for some time now.

In a recent interview he also made a case for tax resistance:

When you look at citizenship, you have to understand that citizenship is a social contract between the state and the citizen. Under that contract you have, supposedly, rights and you also have obligations. Now, I look at the obligations of being a U.S. citizen and I realized I cannot pay into a tax system which is basically paying up debt to the bankers, but nonetheless, we pay into a tax system which is used to produce military capability that is also ultimately used in other parts of the world, which is ultimately killing my brothers and sisters in other parts of the world. I do not agree to contribute to a tax system that is being used to commit mass murder against people I consider to be my brothers and sisters halfway around the world. It’s violation of my ethics as a man, of someone who believes in justice for everyone and wants a better world for everyone. I cannot pay for the murder of my brothers and sisters — and that’s part of the contract of citizenship. So I said, which was to me a sensible thing and a moral thing to do, “Take my name off of that contract, because I do not agree to it and ultimately I will walk away.” I left a paradise life in Hawaii, had my own business, I was making money, lived on the beach, and did something I loved. I had a beautiful, beautiful life and I walked from that, because I absolutely, 100 percent disagree with the actions of my birth nation and I find them so criminal that I need my name taken off that list. I will enter into a contract again with the U.S. if indeed it carries itself with honor and will respect the US Constitution; if the U.S. Constitution is indeed made the supreme law of the United States, then I will happily come back to my nation and adhere to the contract.

It’s a difficult process. It’s costly, you have to leave the country, you have to swear under oath, you have to hand over your passport, you have to fill up the forms — I’ve done all that. I would argue that probably the reason why they have not honored my right of self-determination, a human right of self-determination, is because it could have set the precedent, which could spark an imaginative idea that people can look out around the world and say, “You know what? I don’t actually agree with this contract with my nation any longer, I want to enter into a new contract.” This is why I refer to myself as a world citizen, we’re all world citizens. My human family is where my allegiance goes; I don’t give my allegiance to one unit, one group, one nation, one religion. My whole human family is my brothers and sisters and ultimately I give my allegiance to them. That’s the contract I will honor and if any other contract, inferior to that one, will try to compel me to pay for the murder of my brothers and sisters — I will not partake in that contract. I’m living here in the U.K. and haven’t made enough money to even be taxable for the last 12 years, but I might make enough money this year to actually be taxable, and I’ll tell you what: I will not pay into the U.K. tax system and fund the murder of my brothers and sisters halfway around the world. I simply refuse to do it, and I would argue that other people should look at the contract like that and, maybe, if we all decide to enter into a new contract like that we can end war for good.

- Quaker war tax resister Joseph Olejak has joined the rare pantheon of American war tax resisters who have suffered criminal sanctions for their stand. he was sentenced to 26 weekends in jail and ordered to pay $240,000 in back taxes he had been evading out of repugnance for the government’s militarism.

- I’ve seen a couple of summaries of tax resistance in the American colonies pass through my feed reader in recent days:

- “Taxes, trade, and resistance” is part of an educational project meant to explain revolutionary-era North Carolina and is based on official government history (literally: it’s based on a report from the U.S. State Department’s “Office of the Historian”).

- “American Resistance to British Taxes ” by Sanderson Beck sketches out a chronological view on the various taxes imposed on the colonies and the resistance that followed.

Resistance tactics described include:

- intimidation of tax enforcement collaborators

- attacks on customs-enforcing ships

- attacks on tax offices

- petitions and legal challenges

- boycotts of British manufactures

- smuggling

- bribes of tax officials

- attacks on tax enforcers

- attacks on the homes of tax enforcers

- attacks on the homes of tax collaborators

- encouraging tax officials and enforcers to resign or desert

- humiliation attacks on tax officers (such as hanging in effigy, mock trials)

- creating a parallel government

- convincing the government to rescind the tax

- signing public pledges of tax resistance

- socially boycott taxpayers

- interfere with arrest attempts

![American Quaker War Tax Resistance (Second Edition) [Edited by David M. Gross. Picket Line Press, 2011. 574 pages. $25/paperback; $7.99/eBook] Gross has made a serious business of investigating and writing about not only the history of war tax resistance, but also tactics that can be used today. In American Quaker War Tax Resistance, Gross uses historical documents to trace the development of war tax resistance among Quakers, and how it was viewed by their contemporaries outside the Society of Friends. He includes writing by famous Friends such as William Penn and John Woolman, as well as individuals less known such as Moses Brown. In a subsequent book, 99 Tactics of Successful Tax Resistance, Gross lays out past campaigns to help war tax resisters of our own time choose from tactics that have already been used.](fjreview.png)