Tax Resistance.

Glasgow.

Miss [Janet Legate] Bunten, the

hon. treasurer of the

Glasgow Branch of the Women’s Freedom League, has had some pictures seized by

the authorities in consequence of her refusal to pay taxes levied without her

consent. The date of the sale is not yet fixed. A protest meeting will be

held, at which Miss [Anna] Munro will speak.

St. Leonards.

One of the most successful and effective Suffrage demonstrations ever held

in St. Leonards was that

arranged jointly by the Women’s Tax Resistance League and the Hastings and

St. Leonards Women’s Suffrage

Propaganda League, on , on

the occasion of the sale of some family silver which had been seized at the

residence of Mrs. [Isabella] Darent Harrison for non-payment of Inhabited

House Duty. Certainly the most striking feature of this protest was the fact

that members of all societies in Hastings,

St. Leonards, Bexhill and

Winchelsea united in their effort to render the protest representative of all

shades of Suffrage opinion. Flags, banners, pennons and regalia of many

societies were seen in the procession. Not the least satisfactory feature

was the courtesy and respect shown by the authorities, the general public,

and the Press towards the demonstrators. The hearty response from the men to

Mrs. [Margaret] Kineton Parkes’s call for “three cheers for Mrs. Darent

Harrison” at the close of the proceedings in the auction room, came as

a surprise to the Suffragists themselves.

Some historical and global examples of tax resistance → women’s suffrage movements → British women’s suffrage movement → Janet Legate Bunten

The Men Who Govern Us.

Another Victory.

The release of Mr. Mark Wilks, under precisely the same circumstances as the release of Miss [Clemence] Housman — that is to say, after a futile imprisonment, a series of defiant suffrage demonstrations, and with no sort of official explanation — is a triumph for the Women’s Tax Resistance League, the W.F.L., and the various men’s association[s] that helped to conduct the protest campaign.

It is more than a triumph; it is an object lesson in how not to do things.

To incarcerate a helpless and innocent man for his wife’s principles, knowing that that wife was one of a movement that never strikes its colours, was foolish on the face of it.

(That it was also unjust is a matter which we recognise to be of little consequence in the eyes of those who make and administer our law).

But to let him out without rhyme or reason seems foolishness of so low a degree that it is only to be described as past all understanding.

One is reminded of the genial duffer who protested that he might be an ass, but he was not a silly ass.

Our highest authorities are not so particular about their reputations as the stage idiot.

The Pity of It.

Yet we are all set wondering what is behind it all.

Is it a contempt so great for the intelligence of the public on which they batten which makes our rulers so unconcerned about even the appearance of wisdom or consistency?

Or is it sheer contempt for women which makes them bully, badger, and torture in turns, and then dismiss the matter as of not sufficient importance to pursue?

It is too easy and flattering a solution to determine that ministers have been impressed by the women’s resolute defiance.

It hardly accounts for the milk in the cocoanut.

Nothing, for instance, would have been easier than to give Mrs. [Mary] Leigh and Miss Evans first-class treatment, and keep them in durance for months and years!

The release of the latter lady at the same time as Mr. Wilks points, we sadly fear, not to an intelligent appreciation of the gathering forces of progress and humanity, but a cruel and callous disregard of wisdom, righteousness, and decency.

If this be “representative” government, it is a sorry testimonial to the worth of the [sic] those represented.

Terminological…?

No tale appears too farcical to present to the tax-payers on behalf of the Government.

One explanation that has been seriously offered, with a view to relieving the Chancellor of the Exchequer from any odium that may be incurred by those responsible for the Wilks imbroglio, is as follows: “The Chancellor knew nothing of the case.

His official correspondence followed him during his recent Welsh peregrinations, missing him everywhere, and only catching him up on his return to London, where he at once ordered a meeting of the Board of Inland Revenue, on whose report (unpublished) he acted promptly.”

Now this is a little too thin.

Wanted, a Good Lie.

The political and militant organiser of the W.F.L., who pens these lines, has to confess with emotion that during recent wanderings in the fastnesses of the Land of George, certain correspondence, re-addressed to divers and sundry humble cottages in mean streets, did indubitably go astray.

But the political and militant organiser is not a world-renowned personage who on occasion has been reduced to the Royal necessity of travelling incognito.

The more than Royal progress of the Carsons and the Georges does not lend itself to these subterfuges; and we feel inclined to give the Chancellor the advice addressed by a too intelligent master to a schoolboy of our acquaintance, whose effort at explanatory romance was not convincing: “No, no, George, my lad; that doesn’t sound likely.

Run away and think of something better.”

C. Nina Boyle

Tax Resistance.

In consequence of the release of Mr. Mark Wilks, a sprightly account of which appeared in The Evening Standard, the proposed demonstration on Trafalgar-square was not held by the Women’s Tax-Resistance League .

The main issues which have been brought forward by this new phase of the struggle are:— “That the present irregular method of administering the Income-tax and Married Women’s Property Acts amount to a penalty on matrimony; that the relief afforded to persons of limited income is unjustly and illegally filched from them; and that the Tax Resistance campaign has for one of its objects the determination to secure to the public one million and a half of money which is at present improperly diverted from the pockets of the people to the Government coffers.

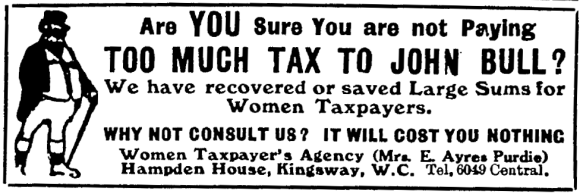

It took a woman expert — Mrs. [Ethel] Ayres Purdie — to fathom the real meaning of the law as it is administered to-day; and it is some considerable time since she expressed the opinion, and was laughed at by male legal experts for so doing, that the situation which actually arose was possible.

At Bolton.

A tax-resistance meeting was held at Bolton on , at which Mr. Isaac Edwards presided, the speakers being Miss Hicks and Mrs. Williamson-Forrestier.

The meeting was a public one, explaining the policy and principle of Tax Resistance, and was well attended.

The goods of Mrs. Fyffe, hon. treasurer of the Women’s Tax Resistance League, member of committee of the Horsham and South Kensington Branches of the National Union of Women’s Suffrage Societies, and hon. secretary of the London “Common Cause” Selling Corps, have been seized for tax resistance, and will be sold on , at Whiteley’s Auction Rooms, Westbourne-grove.

A procession will form up at Roxburghe Mansion, Kensington-court, at and start at going to the corner of Westbourne-grove and Chepstow-place, where a Protest Meeting will be held.

Mrs. [Anne] Cobden Sanderson, Mrs. [Caroline] Louis Fagan, Mrs. [Margaret] Kineton Parkes, and others will speak.

The procession will then go on to the sale.

It is hoped that as many members of the Freedom League and other Suffragists as can will support Mrs. Fyffe by walking in the procession and attending the sale.

Mrs. Fyffe, who is an ardent Tax Resister, was presiding at a meeting of the Kensington branch of the National Union (London Society) at her own house, when the bailiffs arrived to distrain on her goods.

It was a novel experience for the non-militant ladies!

Pleasant Amenities.

Mrs. Louis Fagan, summoned at West London Police-court for non-payment of taxes in respect of motor-car, man-servant, and armorial bearings, had quite a merry dialogue with the presiding genius, Mr. Fordham, who waxed — might one say waggish?

— during the encounter.

After refusing to discuss her “conscientious objections” — while in no way belittling them — he imposed a penalty of 20s. and 2s. costs in respect of the man-servant; £10 2s. costs in respect of the motor-car; and 2s. 6d. for the armorial bearings.

Mrs. Fagan represented that her conscientious objection included fines as well as taxes, and he expressed regret at having no alternative to offer save imprisonment.

“I shall sentence you to a month,” he said, “but you won’t do it, of course — you ladies never do.

If I really wanted you to have a month, I should have to call it five years!”

With such little pleasantries the affair passed off in the happiest manner; and Mr. Fordham was equally obliging in fixing the time for the distraint on Mrs. Fagan’s goods “at the earliest possible moment,” to suit the lady’s convenience.

The goods were seized on ; and all Women’s Freedom League members who know anything of the way in which the sister society organises these matters should attend the sale in the certainty of enjoying a really telling demonstration.

Mr. Lansbury’s Chivalry

At a meeting held in the Hackney Town Hall on to demand the release of Mr. Mark Wilks, Dr. Elizabeth Wilks and the Rev. Fleming Williams, who were received with enthusiasm, both addressed the audience, and a resolution of protest was carried unanimously.

The stirring speech given by Mr. [George] Lansbury contained valuable hints for Suffragists.

“Parliament,” he said, “did not do more for the cause of the women because the women did not make themselves felt sufficiently.

If, instead of remaining Liberal, Conservative, or Socialists, they went on strike against the politicians, they would get what they wanted.

“Many years ago, Mr. Lansbury continued, he had believed in the honesty of politicians, and in the sincerity of political warfare, but much water had flowed under the bridges since then, and many new ideas had gone through his head.

What was of most importance to the women of this country was not politics — whether Tory or Liberal — but the emancipation of their sex.

“The imprisonment of Mark Wilks, though it might be a laughing matter to the daily Press, was no laughing matter for the man imprisoned.

It was a jolly hard thing for Mr. Wilks.

He believed that if the working-class women of this country could be got to realise that his was no mere fight for a vote, but a fight for their complete emancipation, they would soon get this sort of thing altered.”

Resistance in Scotland

The Glasgow Herald tells us that:— “Dr. Grace Cadell, Leith, has, as a protest against the non-enfranchisement of women, refused to pay inhabited house duty on a property belonging to her in Edinburgh.

Several articles of her furniture have been poinded to meet the amount of the tax, about £2, but so far the authorities have not taken these away.”

We are also expecting news of the distraint on Miss Janet Bunten’s property for the same reason.

Miss Bunten, Hon. Sec. of the Glasgow Branch, has already lost goods in this manner, and has also been sentenced to imprisonment for refusal to pay dog license or fine in default.

The “Favouritism” of the Law.

The other day a woman, an utter stranger to me, came into the office to seek advice.

She was a pale, worried little creature, and had a little blind child.

Her trouble was that she had had to leave her husband on account of his brutality — he seemed to be a thoroughly bad lot — and had returned to her parents with the child.

She never saw her husband, nor received any money from him, but he was getting her Income-tax repaid to him.

Her income was very small, and she needed it all for herself and her child, and asked how this procedure could be stopped and the money obtained for her own wants.

I could only tell her that nothing could be done, as the law held that her income belonged to her husband, on hearing which, she broke down and sobbed bitterly, saying she had thought that women might be able to help her.

These are cases one hears of every week, but the Press remains conveniently silently about such, and reserves all its sympathies for the “wronged” husband.

These repayments often amount to quite respectable sums, perhaps as much as £40 or £50, for a three years claim.

I must say that personally it is terribly distasteful to me, when I have recovered tax deducted from a married woman’s income, to be obliged to draw the cheques in favour of her husband, though morally the money is hers.

Yet this is what I am forced to do for my own protection, as, if I handed the money to its real owner, I should still have to pay it to the husband in addition.

He could sue me in the County Court for it, or I might perhaps be charged with “feloniously misappropriating” his money, if I dared to hand it to the wife.

The isolated case of Mr. Wilks is a relatively small matter when compared with numerous cases of defrauded wives.

Mr. Wilks, being released, will have saved £40 by imprisonment, and lots of these wives would joyfully do a few weeks in Holloway, if thereby they could save their money.

What we want to do is to get the law altered, and the Married Women’s Property Act recognised by the Crown, so that marriage shall not involve the brand of “idiocy” and a financial penalty for a woman.

But there seems to be a general impression abroad that the only injustice lies in Mr. Wilks being imprisoned, and not in the law being as it is; and that as he has been got out, that will be the end of the whole thing, and nobody need trouble about it or make any further fuss, unless and until another husband finds himself held liable for tax on his wife’s income, and put in prison for not paying it.

Whether people are Suffragists or Anti’s or neutrals, it is equally to their interest to get the law brought up-to-date.

The Anti husband of an Anti wife might quite as easily find himself in Mr. Wilks’ position, and “tax-resistance” has nothing to do with it, because Income-tax on a wife’s income may be demanded from a husband quite without his wife’s knowledge.

There is a case going on at the present time where 2s. 8d. is being demanded from a man for Income-tax on some Consols which the authorities state are held by his wife.

She has never been asked to pay it, and is not even aware that it is being demanded from him.

He disputes paying it on the ground that he has no evidence that she possesses any Consols, as he has never asked her anything about her means and never intends to do so.

He has formally appealed against the charge, and at the hearing of the appeal his wife’s name was not mentioned, nor her existence even referred to, as the Consols in question are legally deemed to be in his possession.

This husband will doubtless be put in prison in due course.

He contends, quite logically, that if he is held liable for the tax on one of his wife’s investments, he ought to be held equally liable for the tax on all of her other investments, and while the whole position remains so unsatisfactory and anomalous he will pay nothing and do nothing, but will remain simply passive.

At the hearing of the appeal two highly-paid Special Commissioners, drawing, I believe, at least £1,000 a year each, sat to consider the matter.

There was also present a Surveyor of Taxes, who had come up on purpose from Brighton at the public expense, the appellant and his legal representative (myself).

This gentleman and I wasted our valuable time, and the three Revenue officials wasted their time (and the public’s money) for upwards of an hour, discussing a matter involving 2s. 8d., and the existence or non-existence of some Consols which none of the persons present knew anything about.

There were also one or two clerks who took everything down; and altogether it was a most amusing demonstration of the methods of the Circumlocution Office, and the sublime art of How Not To Do It.

Numbers of married women invest their money in order to escape from the anomalies of the Income-tax Act, so some day we may see an equal number of husbands being called upon to pay tax on these investments (which they know nothing about), and ultimately getting locked up sine die.

When men in considerable numbers begin to feel the shoe pinching, probably some serious effort will be made to amend the law.

Ethel Ayres Purdie

Tax Resistance.

Members of the Women’s Tax Resistance League attended the dinner of welcome held at the Hotel Cecil to the Men’s International Alliance for Women’s Suffrage, and the League was represented at the Congress by Mr. Laurence Housman.

Reception to Dr. and Mr. Mark Wilks.

The Women’s Tax Resistance League wish to announce that they have decided to hold a public reception to Dr. and Mr. Wilks on .

They trust that all Suffrage Societies will support this effort, because not only do they wish to do honour to those who have made such a brave stand for tax resistance, but to use the occasion, as one of many others, to keep before the public mind the necessity for the alteration of the laws which affect the taxation of married women until the reform promised by Mr. Lloyd George is debated in the House of Commons.

Amongst the speakers will be Mrs. [Charlotte] Despard, Dr. Elizabeth Wilks, Mr. George Lansbury, M.P., Mr. F. Pethick Lawrence, and Mr. Mark Wilks.

Tickets, 2s. each, including refreshments, may be had from all Suffrage Societies and from the office of the League, 10, Talbot House, St. Martin’s-lane.

The Case of the W.F.L. Hon. Treasurer.

On the hon. treasurer of the Women’s Freedom League was summoned to appear before the Hampstead Petty Sessions Court, at the instance of the London County Council, for refusing to contribute to taxation in the form of dog license.

Dr. Knight did not appear in person, and was represented by Miss Nina Boyle, of the Political and Militant Department, who was supported by Miss Andrews (National Executive Committee), Miss Hunt (assistant secretary to the League), Mrs. Spiller (hon. secretary of the Hampstead Branch), Miss Hicks, Mrs. Garrod, and other friends and supporters.

Mr. Dashwood Carter put the case for the London County Council, and Miss Boyle, invited by the chairman, Mr. Henry Clarke, to state Dr. Knight’s case, asserted that Dr. Knight was “not guilty,” as it was manifestly improper that she should be called upon to contribute to the upkeep of the Government when women were denied representation.

The chairman declared that those were considerations into which they could not go, as they were there to administer the law; whereupon Miss Boyle, expressing her desire to put her case “with the utmost courtesy,” contended that as women not only had to pay for the upkeep of the Government, but also for the upkeep of police-courts, they considered themselves fully entitled to make use of them for the ventilation of their grievance.

The Bench, after a period of indecision, suddenly remembered that the Council had not proved its case; and a witness was hurriedly summoned.

The prosecution incautiously admitted that since calling on Dr. Knight, a license had been taken out in respect of a dog, “but whether it was in respect of the dog at Hampstead, or another at Woodbridge (Suffolk), the prosecution could not say.”

Miss Boyle pointed out that if that were so, there was no proper case for the prosecution; and she would call attention to the grossly improper and slovenly fashion in which the case had been brought into court.

After much consultation, and on Miss Boyle stating that they were not there to contest the case, the Bench fined Dr. Knight £2, with 5s. costs, which, with extraordinary lack of understanding, the court then asked Miss Boyle to produce.

On the assurance that Dr. Knight had not the least intention of paying fines to the Government, the sentence was altered, after more deliberation, to “seven days.”

The prosecuting counsel then greatly improved his case by saying that more witnesses could have been brought from Suffolk, but he had not brought them “because of the expense.”

(Any law and any evidence, apparently, is good enough on which to convict voteless women.)

Dr. Knight’s friends were thereby enabled to leave the court with another emphatic protest against the slovenly and slip-shod procedure in bringing a case.

Dr. Knight has heard nothing further from the Arm of the Law, and is now awaiting developments with her well-known composure.

In Glasgow.

According to The Manchester Guardian, a Sheriff’s officer in Glasgow on , acting on behalf of the Crown, exposed to public sale a number of articles belonging to three women suffragists who as a protest had refused to pay their Imperial taxes.

Two are members of the Women’s Social and Political Union, and one is a member of the Women’s Freedom League.

A solid silver tea service, a gold watch and brooch, and a table and clock were sold.

They were bought on behalf of the parties concerned.

The women addressed the large crowd that assembled.

Miss Janet Bunten is, no doubt, our member referred to, and next week we hope to publish particulars.

A Red-Tape Comedy.

[Our readers will be specially interested in the following account by Mrs. Ayers Purdie of her successful appeal against the Inland Revenue authorities.]

I desire it to be clearly understood that the following narrative is not an extract from Alice in Wonderland, neither is it a scene out of a Gilbert and Sullivan comic opera.

It is a simple and faithful account of a successful Income-Tax appeal which was heard at Durham on .

The appellant was a Suffragist, belonging to the Women’s Tax-Resistance League and the Women’s Social and Political Union.

I was conducting the case for the appellant, which I am legally entitled to do under Section 13 of the Revenue Act, 1903.

Dramatis Personæ

The dramatis personæ are as follows: Two Commissioners of Taxes, elderly gentlemen, inclining, like all their kind, to baldness; spectacled of course; one of them wearing his spectacles high on his forehead, and looking out at me from under his eyebrows with a pair of piercing eyes.

These gentlemen hear appeals under the Income-Tax Acts, and are the judges therein.

Their decision is absolutely final, except on a point of law, in which case a further appeal may be made to the High Court.

To continue the list, there is also the Clerk to the Commissioners, who is a solicitor, member of a well-known North-country firm.

His business is to record everything, and to help the Commissioners on knotty legal questions; and, finally, the Surveyor of Taxes, who conducts the case for the Crown.

Opposed to all these learned gentlemen are my client and myself.

Unlike all other cases, in which the plaintiff or appellant has the opening and closing of the case, the procedure in these appeals is reversed; the Crown has the first and the last word, which puts a handicap on the appellant.

Accordingly the Surveyor of Taxes is invited to open the proceedings with a statement of his case; and he sets forth that Dr. Alice Burn, of Sunderland, Assistant Medical Inspector for the County of Durham, is receiving an official salary of so much per annum, and, though she has a husband, he lives in New Zealand, according to her own admission, so an assessment has been made on her salary and the Surveyor claims that he is fully entitled to do so.

Then it is my turn to put my case, and I freely admit all the facts as stated by the Surveyor, but challenge the conclusion he has drawn from them; my case being that by Section 45 of the Income-Tax Act of 1842 Dr. Burn cannot be held liable for the tax.

The solicitor reads this section aloud to the Commissioners.

Most women are familiar, since the famous [Elizabeth & Mark] Wilks episode, with the words on which I am relying.

They are, “the profits (i.e., income) of any married woman living with her husband shall be deemed the profits of the husband, and shall be charged in the name of the husband, and not in her name.”

One of the Commissioners asks in whose name was Dr. Burn’s salary assessed, and is told that it has been charged in her own name.

Geographical Separation.

The Surveyor, invited to offer any arguments or evidence to support his case, says that as Dr. Burn is here and Mr. Burn is in New Zealand, she cannot be living with him.

I argue, as against this, that the case really involves a point of law as to what is meant or implied by the words “living with her husband;” that these words must be interpreted strictly in accordance with their legal signification, and therefore I shall contend that my client lives with her husband in the legal sense, though I fully admit the geographical separation.

This term, “geographical separation,” seems to strike one of the Commissioners very forcibly; he repeats it with much relish, adding, “Yes, I can see what you mean, and I suppose you will say that the Crown cannot take any cognisance of a mere geographical separation.

Quite so.”

Apparently he thinks this is a good point, and he glances towards the solicitor, as if wondering how in the world they will get over it.

By this time both Commissioners, who started with the expression of men about to be frightfully bored, have become thoroughly alert and impressed; and the Surveyor appears to realise that his task will nt be such an easy one as he anticipated.

He becomes slightly nervous and confused, a little inclined to bluster, and to take the matter personally, which causes him sometimes to contradict himself and to refute his own arguments.

Being now invited to consider the point about “the geographical separation,” he declines to have anything to do with it, and strenuously denies that any point of law is involved.

He absolutely refuses to consider the matter from this standpoint, and declares that the Commissioners do not take the legal aspect into account in forming their decision.

According to him, this case is purely one of fact, and what the Commissioners have to do is to consider the actual fact, and nothing else.

He knows that if a woman’s husband is at the other side of the world she is not living with him in actual fact, and therefore cannot be said to be living with him at all.

Impertinent Questions

Asked by me to state on what authority he bases this last assertion, he says that he bases it on his own authority; and on his own common-sense.

This leads me to inquire how it happened that, being so fully convinced that my client was not living with her husband, he yet had written to her asking her to furnish him with her husband’s name, address, occupation, the amount of his income, &c. He begs this question by complaining that her reply had been that she could not tell him her husband’s address; and, of course, if a woman could not give her husband’s address it was perfectly plain that she could not be living with him.

I point out that this does not follow, and one of the Commissioners mildly suggests that my client shall explain why she made this reply.

She readily answers that her primary reason was indignation at his questions.

The Commissioner, who seems to be rather human, and quick at grasping things, remarks, “Ah, I see.

You thought he had asked you a lot of impertinent questions, and that was your method of showing your resentment.

Very natural, I’m sure.”

The Surveyor being apparently unprepared with any further argument or evidence beyond the assertion of his own common-sense, it is again my innings.

I take up the tale by reference to the decision in Shrewsbury v. Shrewsbury, which showed that the Crown can only claim to levy tax on spinsters, widows, or femes soles, and my client does not correspond to any one of these descriptions.

I quote precedents set by the Inland Revenue Department on other occasions; as witness the successful objection made to taxation by Miss Decima Moore, Miss Constance Collier, and sundry other ladies, whose circumstances were precisely the same as those of my client.

The Surveyor pretends to be too dense to understand how those ladies whose names I have mentioned could have husbands, and has to have it all minutely explained to him before he is convinced.

A Commissioner asks if I can give any other instances, and I reply, “I am an instance myself, if that will do.

My husband’s business compels him to live in Hampshire, while my own business equally compels me to live in London; but no Surveyor of Taxes has ever ventured to assess me, or to insinuate that I am a feme-sole.

Perhaps you will tell me that I do not live with my husband,” I gently suggest to the present Surveyor of Taxes, who looks as if nothing would give him greater satisfaction if he only dared, but he does not offer to accept this invitation, and the Commissioner hastily says, “I think we are now quite satisfied on the question of precedents.”

I am then proceeding to state that the Crown has itself embodied the correct attitude towards married women in one of the forms issues from Somerset House, in which reference is made to the treatment of “a married woman permanently separated from her husband,” when the Surveyor interrupts — “Are you giving that as evidence?”

“Yes, I am,” I reply.

“Then I shall object to it,” he says.

“I deny that there is any Revenue form having such words upon it, and I object to that statement being received as evidence.”

“As he repudiates the existence of this form, I fear we must uphold his objection,” says the Commissioner apologetically to me.

“Oh,” I exclaim, affecting to be greatly dismayed, “this really was my strongest point.

Do you mean to say you will not admit it because you have not this form before you?”

“I am afraid we cannot, if the Surveyor persists in his objection.

As you see, he is also making avery strong point of it,” is the reply.

The Surveyor intimates that he will persist.

“Very well,” I say, in a tone of resignation to the inevitable; and then there is a short and uncomfortable pause.

The Surveyor looks pleased, as though he fancies he has scored at last.

The other three appear to sympathise with me; even my client begins to look apprehensive, as if she fears I am done for.

Because (as she tells me subsequently) she also thinks I cannot produce this thing, and that I have only been bluffing.

Piece de Resistance

But I make a sudden dive down to my satchel, which lies open on the floor at my feet, and where, unseen by anybody else, the disputed form (No. 44A) has been lying in wait; my last act, before I left London, having been to equip myself with this most important document.

It is laid in front of the Commissioners, and they and the solicitor stare very hard at it, shake their heads over it, and murmur to one another, “Yes, it says so, right enough,” and “This settles it, don’t you think?”

When they have quite done with it, the Surveyor has his turn, and he pounces upon it, examines it intently, up and down, and all round, as if to convince himself that there is no deception, and that it is not a conjuring trick.

(I must do him the justice to say that I honesty believe he has never seen or heard of this form before, as it is very little used.)

It is now fairly evident that my pièce de résistance, No. 44A, has clinched the business, as I knew it must, and that my case is as good as won.

But the Surveyor starts off desperately on a fresh tack.

“Even if those words are on this form,” he says, in portentious tones, “it does not follow that what is stated on official forms is necessarily in accordance with law.”

“I quite agree with you there,” is my cordial reply.

“If everything that is contrary to law were to be eliminated from the form, there would be very little left.

But you may take it that the part I am relying on is perfectly good law,” and I glance toward the solicitor, who nods his assent.

“Then I shall maintain that you cannot reply upon what any form says, because the Board of Inland Revenue can at any moment alter the wording of a form,” says the Surveyor.

“Yes, the Board always have the power to vary the forms when they think fit,” echo the Commissioners.

“But they have not yet altered this one,” I object, “and you cannot raise a valid argument against it by simply saying that it might be something different if it did not happen to be what it is.

The Board have put these words on this form to serve some particular purpose of their own; and it so happens that it equally suits my purpose to make use of them here and now.

It is ‘up to you’ to decide this case in one way or the other; but the Crown is not going, as hitherto, to claim to have things both ways.”

“Both ways, indeed,” laughs one of the Commissioners.

“Why, the Crown will have it three ways, if it is possible.”

“And I am here to show the Crown that it is not possible,” I retort.

The Surveyor is disinclined further to contest the validity of Form No. 44A; but the solicitor seems to be uneasy, as if he feels that the Crown is losing prestige, and that somebody must make the running for it.

So he starts to read an obscure and wearisome section of the Income-Tax Act relating to “foreigners” coming to reside in this country!

Ethel Ayers Purdie.

(To be continued.)

I’ll post the second part of the above article on .

Tax Resistance.

Women’s Freedom League.

After inexplicable delays, the representatives of the Law have finally made up their minds to wrestle with the case of Dr. [Elizabeth] Knight.

On , the Hon. Treasurer of the League received a call from a gentleman who embodied in his person the might, majesty and power of the London County Council, and the Court of Petty Sessions, and showed a desire to annex Dr. Knight’s property in lieu of the £2 5s. which she declines to pay.

It is hardly necessary to tell readers of The Vote that he got very little satisfaction out of his visit, seeing that no fine was forthcoming, no property could be seized, and no information was vouchsafed.

After some slight altercation, and an almost pathetic attempt at persuasion, in neither of which was any advantage gained, the Law retired, to return at some future period (unstated) with a warrant for the arrest of the smiling culprit, who declined, in accordance with the attitude taken up by the Women’s Freedom League, to furnish any information or facilities to the agents of the Government.

Miss Janet Bunten, whose goods were seized in Glasgow at twenty-four hours’ notice, was absent from home with the women marchers at the time that the Government executed its mandate for the distraint.

We are glad to be able to say that a staunch friend of Miss Bunten’s, who belongs to the Women’s Social and Political Union — some of whose members were in the same plight — bought in the goods for her.

Women’s Tax Resistance League.

Last week Mrs. Kineton Parkes spoke at Manchester and Leeds, and on Mrs. [Caroline] Fagan spoke at Woking on the subject of Tax Resistance.

New members joined the League at each place.

On , a Tax Resistance meeting was held under the auspices of the Hampstead W.S.P.U., and was presided over by Mrs. [Myra Eleanor] Sadd Brown.

Mrs. Kineton Parkes and Mr. Mark Wilks were the speakers.

Particulars appear in another column [sic] of the Caxton Hall Reception, on , to Mr. Mark Wilks.

Great interest will also be attached to the account of the case of Dr. Alice Burn, Medical Officer of Health for the County of Durham.

Mrs. Ayers Purdie appeared for her in Durham, and won our case against the Inland Revenue — a notable triumph for the Cause.

The Women’s Tax Resistance will join the Marchers at Camden-town on and proceed with the John Hampden Banner to Trafalgar-square.

Enthusiastic Reception to Mr. Mark Wilks.

Two meetings; the same hall; the same man as the centre of interest; yet what a difference!

In , Mr. Mark Wilks was in prison, and the Caxton Hall rang with the indignant demand for his release.

In Mr. Mark Wilks was on the platform, and the Caxton Hall rang with enthusiastic appreciation of his service to the Woman’s Cause.

“It is fitting that on this memorable day, when the Government has been defeated in the House of Commons, that we should meet to celebrate the defeat of the Government by Mr. Mark Wilks,” said Mr. Pethick Lawrence.

One had only to scan the platform and glance round the hall on to note that the Women’s Tax Resistance League has the power to call together men and women determined to do and to suffer in order to win the legal badge of citizenship for women and the amending of unjust laws.

Mr. Wilks and his brave wife, Dr. Elizabeth Wilks, had a fine reception, and their speeches were clear, straight challenges to all to carry on the fight.

“We must never tire,” said Dr. Wilks, as she showed the injustice of the working of the income tax methods of collection, and told heartrending stories of the betrayal of young girls, “until we have won sex equality.”

“If anyone fears that he has not courage to go to prison he will soon find, when he is inside, that one of its peculiar characteristics is to produce a determination and courage undreamed of to resist, not its discipline, which is a farce, but its tyranny, which oppresses the weak, and vanishes like the mist before the strong.”

Thus, Mr. Mark Wilks; and, having been inside himself, he declared that he was most anxious that Captain Gonne should enjoy a similar experience, because he is resisting taxation, largely on account of the White Slave Traffic.

“They seized an obscure man; let the important ones be seized.

They did not know you were behind me; we will show the one or two men who really stand for the great scheme we call ‘Government,’ that we are behind Captain Gonne.

I have been inside and know how to do it.

Play the band and cheer.

The effect is electric!”

Mr. Robert Cholmely, M.P., from the chair, blessed the Tax Resistance movement; Mr. Pethick Lawrence acclaimed it as part of a militant policy against a Government which abandons its Liberal principles and finds itself defeated; Mrs. [Charlotte] Despard rejoiced that the best men were standing by the women; Mrs. Cobden Sanderson pleaded for more recruits for the League to help it to find more Mark Wilks; Miss Bensusan and Miss Decima Moore delighted and amused everyone by their recitations of imaginary Antis and real tax collectors.

A notable gathering on a notable day.

Imprisonment for Tax Resistance.

Early in its session the [National Executive] Committee [of the Women’s Freedom League] received the news from Miss Nina Boyle that Miss [Janet Legate] Bunten, the hon. treasurer of our Glasgow Branch, had refused to pay her fine for non-payment of taxes, and had been sentenced to ten days’ imprisonment.

A telegram was despatched offering the Committee’s heartiest congratulations to Miss Bunten, and urging her to press for first division treatment.…

Tax-Resistance in Scotland.

Miss Bunten was fined £1, with £2 costs, in the Court House at Glasgow, on , and made a brief but excellent speech, defining her position.

As a fully qualified Parliamentary voter, she is not allowed to vote because she is a women; therefore she resisted taxation.

Miss Bunten refused to pay, and was sentenced to ten days’ imprisonment, to take effect in ten days’ time if the fine is not paid.

The thanks of the League are due to our plucky colleague who dislikes publicity more than having to go to prison.

The First Scotch Tax Resister.

Miss Janet Legate Bunten, hon. treasurer of the Glasgow Branch, W.F.L., was charged on , in the small debtors’ court, before Justices of the Peace Martin and Cameron, with keeping a dog without a license.

She made a spirited defence, saying “Whatever custom may be enforced, I claim I am not in equity liable to taxation.

I protest against the unjust, illegal, and unconstitutional taxation of unrepresented women,” and quoted from Statute 25 of Edward Ⅰ. set forth in Mrs. C.C. Stopes’ valuable little book, “The Sphere of Man in the Constiution.” After consultation, £1 fine and 10s. costs was adjudged a punishment befitting the crime, ten days’ imprisonment in default.

Miss Bunten announced her intention of not paying, and was given ten days’ grace in which to alter her mind.

Her arrest will fall due on the date of the St. Rollox by-election.

The full penalty is £5 or thirty days.

The element of comedy was supplied by the fact that Justice of the Peace Mr.

William Martin, is a Suffragist, and has taken the chair at a local meeting.

Also by the alarm created at the arrival of the W.S.P.U.

dray and reinforcements. The court was twenty minutes late in taking its

seat, and it was freely rumoured that the reason of the delay was that more

police were sent for to be in attendance before the proceedings began! There

certainly was an unusual number present for so insignificant a court. A

meeting was held outside the court, at which Miss Boyle spoke. The police not

only allowed the demonstration, but were interested listeners. Meetings were

held by Miss Boyle during the lunch hour in the Royal Exchange-square and the

next afternoon in Partick.

Is It Illegal Distraint?

Goods were seized from Mrs. Tollemache, of Batheaston Villa, Bath, for refusal to pay Property Tax and Inhabited House duty.

The tax collector threatened to put a man in possession for five days, but this was quite easily circumvented by acting on the instructions of the League, and the goods were then promptly removed to the White Hart Hotel, where they will be sold by public auction .

For a tax amounting to £15, goods were seized far exceeding in value the required sum, and it is therefore hoped that this will afford an opportunity to sue for illegal distraint.

Also in that issue, the National Executive Committee of the Women’s Freedom League stated “the reasons which have led them to refrain from militant action at this juncture.” Leading up to their explanation, they reminded readers, among other things, that the W.F.L. “was the first Suffrage society to make tax resistance a part of its official programme.”

Another article covered an “At Home” meeting at which “Miss [Nina] Boyle gave a graphic account of the St. Rollox Division by-election at Glasgow, and of the spirited tax resistance protest by Miss [Janet Legate] Bunten, whose fine was paid without her consent.”

Tax Resistance.

An interesting sequel to the seizure of Mrs. Tollemache’s goods last week, and the ejection of the bailiff from her residence, Batheaston Villa, Bath, was the sale held , at the White Hart Hotel.

To cover a tax of only £15 and costs, goods were seized to the value of about £80, and it was at once decided by the Women’s Tax Resistance League and Mrs. Tollemache’s friends that such conduct on the part of the authorities must be circumvented and exposed.

The goods were on view the morning of the sale, and as there was much valuable old china, silver, and furniture, the dealers were early on the spot, and buzzing like flies around the articles they greatly desired to possess.

The first two pieces put up were, fortunately, quite inviting; £19 being bid for a chest of drawers worth about 50s. and £3 for an ordinary leather-top table, the requisite amount was realised, and the auctioneer was obliged to withdraw the remaining lots much to the disgust of the assembled dealers.

Mrs. [Margaret] Kineton Parkes, in her speech at the protest meeting, which followed the sale, explained to these irate gentlemen that women never took such steps unless compelled to do so, and that if the tax collector had seized a legitimate amount of goods to satisfy his claim, Mrs. Tollemache would willingly have allowed them to go.

Another note in the same issue mentioned that “the quarterly meeting of the Scottish Council of the Women’s Freedom League… expressed high appreciation of the splendid stand made by Miss [Janet Legate] Bunten, hon. treasurer of the Glasgow Branch, in defence of the principle that ‘taxation without representation is tyranny.’ Miss Bunten intimated her determination to continue this fight.”

When people are arrested, tried, or imprisoned for tax resistance, their comrades have sometimes used this as an occasion to hold rallies or other demonstrations. This shows support for the people being persecuted, demonstrates determination in the face of government reprisals, and can be a good opportunity for propaganda.

Here are some examples:

- When Russell Kanning was convicted for leafletting at the IRS office in Keene, New Hampshire, supporters demonstrated at the jail, holding up “Free Russell Kanning” signs.

- During the Dublin water charge strike, according to one organizer: “The campaign immediately took a decision that when any individual was summonsed to court, we would turn up and contest every case — and that we would turn up in force. … And when the first court appearances took place, over 500 people turned up outside Rathfarnham courthouse to support their neighbours. We marched to the courthouse, had stirring speeches, several songs including ‘You’ll never Walk Alone’ and ‘Bridge Over Troubled Water’ and an amazing sense of our unbeatability.”

- Sylvia Hardy, an elderly woman from Exeter, refused to pay her council tax, calling it highway robbery that the tax rates have risen by double-digits per year, while her pension rises at only 1.7% annually. When she was summonsed to court, she walked alongside banner-waving supporters and was met by a crowd of supporters outside the courthouse.

- Another pensioner who refused to pay his council tax bill for similar reasons, David Richardson, was taken to court in . About fifty supporters demonstrated outside, singing “For He’s a Jolly Good Fellow,” for Richardson.

- Brian Wright was the first person imprisoned for failure to pay Margaret Thatcher’s “Poll Tax” — 700 people held a rally outside the prison to show support. Other prisons holding poll tax resisters were later picketed by protesters.

- When J.J. Keon, a Socialist from Grafton, Illinois, was jailed for refusing to pay what he contended was an illegal poll tax in , Socialist Party spokesman Ralph Korngold came to town and gave a speech outside the prison urging people to join Keon in resisting and to ask why no rich tax dodgers were behind bars.

- Maurice McCrackin was jailed for war tax resistance in . While there, war tax resister Richard Fichter picketed the federal prison camp where he was held. Before that, he’d picketed the courthouse where McCracken was being tried.

- When the IRS took war tax resister Ed Hedemann to court in to try to force him to turn over financial documents to the agency, some 25 supporters, waving signs and handing out leaflets, joined him to demonstrate outside the courthouse before the hearing.

- Prior to war tax resister Frank Donnelly’s sentencing on tax evasion charges in , dozens of supporters rallied outside the courthouse. One supporter noted that “[i]n addition to showing up at his sentencing, Donnelly’s friends in Maine threw three ‘Going-Away-To-Jail Parties’ for Donnelly in the days leading up to his prison sentence. In one party surprise, Donnelly cut into a fresh Maine blueberry pie, and he found a file baked into the pie.”

The women’s suffrage movement in the United Kingdom was particularly noted for its courthouse and jailhouse rallies:

- When Clemence Housman was jailed for failure to pay about $1 of tax in — with the authorities telling her that they were authorized to keep her in jail until she paid up, however long that took — the Women’s Tax Resistance League held a protest outside the prison, and “gave three rousing cheers for Miss Housman, which… it is hoped reached the lonely prisoner in her cell.” The league then organized a procession to the prison gates. The four mile walk, over muddy streets on a rainy day, ended in a surprising victory, as the government had thrown in the towel and released Housman — without getting a penny from her — after five days.

- When a Women’s Suffrage wagon full of activists descended on the courthouse where Janet Legate Bunten was being charged with refusal to take out a license for her dog, the authorities panicked. “The court was twenty minutes late in taking its seat,” a sympathetic observer noted, “and it was freely rumoured that the reason of the delay was that more police were sent for to be in attendance before the proceedings began! There certainly was an unusual number present for so insignificant a court.”

- The Women’s Tax Resistance League organized “a great gathering” to support Kate Harvey who was charged with ten counts of failing to pay national insurance taxes on her gardener’s salary. Following the sentence, they shouted “Shame!” to the judge, then held a “poster parade” to the town square and held a mass meeting there.

Rallies outside the courthouse or prison are one way of supporting resisters who are looking at doing time for taking their stand (see The Picket Line for ), supporting their families while they’re being held captive is another (see The Picket Line for ), and accompanying resisters to and from prison and visiting them while inside is a third (see The Picket Line for ).

Another way to support tax resisters as they go up against the legal system is to attend their trials. I remember that when I attended the NWTRCC national gathering in Boston in , one resister there mentioned that when he went to court to be sentenced, the courtroom was packed with supporters who quietly stood up behind him when he stood to hear the judge pass sentence, and he told us how important that show of support had been to him.

Today I’ll give some additional examples.

Rebecca Riots

In the government finally managed to get its hands on some prosecutable suspects involved in the Welsh “Rebecca Riots” (which largely involved dismantling offensive tollbooths).

The prisoners, under strong guard, were marched to a hearing before a set of magistrates. “Vast crowds accompanied them, and in expectation of hearing the examination, rushed into the large hall, which in a few minutes was crammed.” The magistrates responded by banning the public — and even the prisoners’ attorneys — from the room.

Council tax rebels

Council tax refusers in today’s Britain can often count on packing the courtroom with sympathizers if they are summoned. In the case of retired vicar Alfred Ridley:

[H]is supporters, who had packed the courtroom, cried “Shame!” “It’s a disgrace!” and “Kangaroo court!” …

Mr Woollett [the magistrate] had to be escorted from the court complex by police after he was surrounded by booing protesters.

One supporter said: “People have come here from as far away as Sheffield, Blackpool and Cornwall to support Mr Ridley.”

When Sylvia Hardy, 73, was sentenced to jail time for refusing to pay her council tax, the courtroom erupted:

As Ms Hardy, from Barrack Road, Exeter, was led away the chairman of Devon Pensioners’ Action Forum, Albert Venison, shouted at the bench: “You are on a completely different planet you people.” There were other shouts of “pompous ass” and “shame” from other supporters of Ms Hardy who were packed into the small courtroom.

The British women’s suffrage movement

When Janet Legate Bunten was taken to court for refusing to pay a dog license tax, the number of supporters who rallied to her side alarmed the court. One wrote:

The element of comedy was supplied… [in part] by the alarm created at the arrival of the W.S.P.U. dray and reinforcements. The court was twenty minutes late in taking its seat, and it was freely rumoured that the reason of the delay was that more police were sent for to be in attendance before the proceedings began! There certainly was an unusual number present for so insignificant a court. A meeting was held outside the court, at which Miss [C. Nina] Boyle spoke. The police not only allowed the demonstration, but were interested listeners.

When Winifred Patch was subjected to bankruptcy proceedings by the Inland Revenue Department, “[t]he officials were astonished to see women bringing in extra benches and overflowing into the solicitors’ seats and the Press pen.” Patch refused to cooperate in any way with the court, and a second hearing was scheduled, at which “[t]he crowd of suffragist sympathisers was far larger than on the previous occasion” and included many of the more prominent members of the Women’s Tax Resistance League.

War tax resisters

When Vietnam War-era war tax resister Jack Malinowski was sentenced to three months of probation for his tax refusal, “[a] crowd of [approximately 175] supporters in the courtroom greeted the sentencing with a chorus of ‘Solidarity Forever’ and jubilant applause.”