I’ve been slacking a bit in my reporting, but a lot has been coming across my screen in recent weeks:

War Tax Resistance News

- Erica Weiland penned a thoughtful piece on War Tax Resistance as Self-Care at NWTRCC’s blog.

Excerpt:

Some resisters describe war tax resistance as something they do so they can live with themselves, or something they do to assuage their conscience about where tax money goes. Being able to live in alignment with your beliefs is a profound form of self-care — think about the dis-ease you experience when you do something against your beliefs. War tax resistance not only brings you into alignment with your beliefs about war, it can also help you integrate your beliefs on other issues.

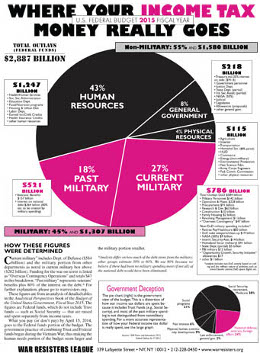

- The Global Day of Action on Military Spending is right around tax day () again this year, and the coalition is making plans for a variety of protest actions.

U.S. Tax Law News

- If you’re self-employed as a sole proprietorship in the U.S., you’re supposed to pay self-employment tax on all of your profits, just as though you were employed and it was your salary. But if you’ve organized yourself as an “S Corporation” — you can instead pay yourself a specific salary out of your profits and you’ll only owe self-employment tax on that. Seems an arbitrary and even sketchy loophole? Tax expert Peter J. Reilly says it’s “a valid self-employment tax avoidance strategy… organizing as an S Corporation and avoiding self-employment tax seems like a no-brainer for a sole proprietor” though he also warns that “you really should not use the strategy to avoid SE/payroll taxes entirely.”

- NPR looked into Why More Americans Are Renouncing U.S. Citizenship and concluded that there isn’t one single cause, but instead it is the result of “dominoes falling, one after another, leading to an unexpected outcome.” But all of the dominoes have to do with taxes, and how the U.S. tax system makes life difficult for citizens living overseas.

Tax Resistance in Spain

- Professor Roberto Centeno, writing at El Confidencial, made a bit of a stir by arguing that since much of the Spanish government debt is not legitimate, the people of Spain do not owe it and ought not to pay for it through their taxes.

Excerpts:

Following the marvelous example of civil dignity that Henry David Thoreau gave us with the practice of disobedience against unjust taxes, created and used against the interest of the citizens, now more than ever it has become indispensable to put an end to the particracy of lies and corruption. And to do this by means of an exemplary action of tax withholding against the enrichment without reason of the political and financial oligarchs, by means of those taxes created and a debt assumed to defend their interests, and so it will be them who reassume this debt or answer for the consequences of its nonpayment.

It is a debt of the regime, a personal debt of the government that contracted it, because it does not comply with the essential requirements of a legitimate debt, which would be that it was contracted for the exclusive benefit of the people.

- Meanwhile the number of towns in Catalonia that have stopped paying their taxes to the federal government, sending them to the regional government instead has risen to 54. This is currently only a sort of quasi-tax-resistance, as the regional government dutifully forwards these taxes to the central government, but it is part of a strategy of strengthening the regional tax agency in anticipation of eventually making the buck stop there in “the transition to statehood.”

Tax Resistance in France

- Yes, they’re still burning “ecotax” portals in Brittany. The latest one was partially burned on , which damaged it enough that the authorities ordered it to be removed.

A Look Back at the Poll Tax Resistance Campaign

- Chris Robinson has published a series of reminiscences of the campaign against the poll tax that brought down Thatcher’s reign in Great Britain:

- I also found some archives about the poll tax resistance effort at an Anarchist Communist Federation website.

Tax Resistance in Greece

- The Greek “Won’t Pay” movement won’t quit either. Thousands of Greeks marched at Afidnes and raised the toll gates there .

Tax Resistance in the Dominican Republic

- I feel like I have way too little context to make sense of all of this, but various industrial and commercial unions are squabbling over whether to support a business strike in the Dominican Republic over the expansion of a value-added tax there.

Tax Resistance in Argentina

- , twenty “productores, industriales forestales, empresas de servicios, y colonos” (roughly: “manufacturers, foresters, service businesses, and farmers,” I think) in Colonia Delicia decided to stop paying taxes in protest at the poor state of the government-maintained roads. The businesses say that the poor condition of the roads is making their businesses impossible to operate.